Inmobiliaria Colonial, Socimi, Sa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sigma Inv. House Eq. SPAIN -I

Sigma Inv. House Eq. SPAIN -I Key Figures Investment Growth vs Benchmark Name Sigma Inv. House FCP Eq Spain I Instl Time Period: 21/01/2015 to 30/06/2021 Domicile Luxembourg 130,0 Fund Legal Structure FCP Firm Name Andbank Asset Management Luxembourg 122,5 Fund Size 8.917.491 Base Currency Euro 115,0 Portfolio Manager Gonzalo Lardies NAV 109,48 107,5 100,0 Class ISIN I Inst LU1171803106 92,5 A ord LU1066281574 85,0 Investment Objective The Sub-Fund seeks to achieve long-term capital appreciation by actively 77,5 managing a diversified portfolio mainly made up of Spanish and Portuguese equities. There is however no guarantee that this objective will be achieved. 70,0 The Sub-Fund intends to achieve its objective mainly by the active management of a portfolio of eligible financial assets. The Sub-Fund will invest at least 80% of its assets in equities issued by companies domiciled 62,5 in Spain or Portugal or which are listed on the official stock exchanges of such countries. In cases where market liquidity for such equities does not 2015 2017 2019 2021 ensure optimal execution conditions, the Sub-Fund may exceptionally invest in other European markets where those equities may also be listed. There are no restrictions as to the market capitalization of the companies in which the Sub-Fund invests. Sigma Inv. House FCP Eq Spain I Instl BME IBEX 35 NR EUR 3 yr - Risk Ratios Returns per period Std Dev Beta Sharpe YTD 2020 2019 2018 3 yr Inception Sigma Inv. -

Inmobiliaria Colonial, SOCIMI, S.A. and Its Subsidiaries

Inmobiliaria Colonial, SOCIMI, S.A. and its subsidiaries Audit Report, Consolidated Annual Accounts as at 31 December 2020 Directors’ Report This version of our report is a free translation of the original, which will be prepared in Spanish. All possible care has been taken to ensure that the translation is an accurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation. Independent auditor´s report on the consolidated annual accounts To the shareholders of Inmobiliaria Colonial, SOCIMI, S.A.: Report on the consolidated annual accounts Opinion We have audited the consolidated annual accounts of Inmobiliaria Colonial, SOCIMI, S.A. (the Parent company) and its subsidiaries (the Group), which comprise the balance sheet as at 31 December 2020, and the income statement, statement of other comprehensive income, statement of changes in equity, cash flow statement and related notes, all consolidated, for the year then ended. In our opinion, the accompanying consolidated annual accounts present fairly, in all material respects, the equity and financial position of the Group as at 31 December 2020, as well as its financial performance and cash flows, all consolidated, for the year then ended, in accordance with International Financial Reporting Standards as adopted by the European Union (IFRS-EU) and other provisions of the financial reporting framework applicable in Spain. Basis for opinion We conducted our audit in accordance with legislation governing the audit practice in Spain. Our responsibilities under those standards are further described in the Auditor's responsibilities for the audit of the consolidated annual accounts section of our report. -

FACTSHEET - AS of 23-Sep-2021 Solactive Spain 40 Price Return Index

FACTSHEET - AS OF 23-Sep-2021 Solactive Spain 40 Price Return Index HISTORICAL PERFORMANCE 120 110 100 90 80 70 60 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Solactive Spain 40 Price Return Index CHARACTERISTICS ISIN / WKN DE000SLA24C0 / SLA24B Base Value / Base Date 100 Points / 18.12.2009 Bloomberg / Reuters SOLSP40P Index / .SOLSP40P Last Price 115.98 Index Calculator Solactive AG Dividends Not included (Price index) Index Type Developed Markets Calculation 09:00am to 10:30pm (CET), every 15 seconds Index Currency EUR History Available daily back to 18.12.2009 Index Members 40 FACTSHEET - AS OF 23-Sep-2021 Solactive Spain 40 Price Return Index STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -1.56% -2.33% 6.64% 40.27% 12.92% 15.98% Performance (p.a.) - - - - - 1.27% Volatility (p.a.) 14.16% 15.53% 14.74% 19.65% 15.84% 23.02% High 118.32 118.74 120.31 120.31 120.31 123.40 Low 112.94 109.11 108.51 78.99 98.33 57.78 Sharpe Ratio -1.19 -0.55 0.98 2.11 1.18 0.08 Max. Drawdown -4.54% -8.11% -9.31% -9.31% -9.31% -45.37% VaR 95 \ 99 -27.4% \ -44.5% -35.7% \ -62.7% CVaR 95 \ 99 -36.7% \ -48.5% -54.7% \ -91.5% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES ES 96.1% EUR 100.0% LU 3.9% TOP COMPONENTS AS OF 23-Sep-2021 Company Ticker Country Currency Index Weight (%) IBERDROLA SA IBE SQ Equity ES EUR 13.67% BANCO SANTANDER SA SAN SQ Equity ES EUR 12.81% BANCO BILBAO VIZCAYA ARGENTARIA SA BBVA SQ Equity ES EUR 8.97% INDUSTRIA DE DISENO TEXTIL SA ITX SQ Equity ES EUR 8.60% CELLNEX TELECOM SA CLNX SQ Equity ES EUR 8.31% AMADEUS -

Integrated Annual Report 2018

2018 Integrated Annual Report 2018 Integrated Annual Report Main Figures 4 Colonial Integrated Annual Report 2018 Paris 20 ASSETS Madrid 43 ASSETS Barcelona 23 ASSETS Note: Logistics and other centres are not included. Main Figures 5 19% +17% 10,03€/share €5,051M Total Shareholder EPRA NVA - €/share EPRA NAV Market Return capitalization(1) €11,3 4 8 M 1,782,282sq m 4% +5% GAV s/above ground EPRA GRI var EPRA Group Vacancy Like-for-Like Specialists in prime offices A CBD portfolio 1% 91% 4% 3% 75% CBD(2) Offices Retail Logistic Others Prime CBD CBD BD Others Maximum energy efficiency Good diversification(3) Spain 42% France 91% 58% with energy certification Barcelona Madrid Paris Others Logistic (1) On 16 May 2019. (2) CBD Barcelona includes the assets of the 22@ market segment. (3) France = SFL shares valued at NAV. Spain = GAV directly held assets + NAV participation SPV TMN + Value JV Plaza Europa 34. 6 Colonial Integrated Annual Report 2018 EPRA Performance Measures Summary Table As at 31 December 12/2018 12/2017 €m € per share €m € per share EPRA Earnings 90 0.20 62 0.16 EPRA NAV 5,098 10.03 3,744 8.60 EPRA NNNAV 4,853 9.55 3,428 7.88 2018 2017 EPRA Net Initial Yield 3.0% 3.0% EPRA “topped-up” Net Initial Yield 3.3% 3.4% EPRA vacancy rate 4.1% 3.9% EPRA Cost ratio (including vacancy costs) 19.5% 18.4% EPRA Cost ratio (excluding vacancy costs) 17.9% 17.1% EPRA: European Public Real Estate Association: Association of listed European property companies that sets best market practices for the sector (www.epra.com) Summary Interview with the Chairman and CEO 8 01. -

Inmobiliaria Colonial, Socimi, S.A. Ordinary General Meeting of Shareholders (May 2018)

FOR INFORMATION PURPOSES ONLY. SPANISH VERSION PREVAILS INMOBILIARIA COLONIAL, SOCIMI, S.A. ORDINARY GENERAL MEETING OF SHAREHOLDERS (MAY 2018) REPORT BY THE BOARD OF DIRECTORS ON PROPOSED RESOLUTIONS FOR THE APPOINTMENT OR RE- ELECTION OF DIRECTORS (ITEM NINE ON THE AGENDA) 1. Purpose of the report This report has been awn up by the Board of Directors of Inmobiliaria Colonial, SOCIMI, S.A. (“Colonial” or the “Company”) in connection with the appointment or re-election, for the statutory period of 4 years, of Directors of the Company, in accordance with the Director Recruitment Policy of the Company. Pursuant to the provisions of Article 529 decies of the Spanish Limited Liability Companies Law approved by Royal Legislative Decree 1/2010 of 2 July (the “Spanish Limited Liability Companies Law”), this motion subject to the General Meeting requires the Board of Directors to draw up this report in order to assess the skills, experience and merits of the proposed candidate. 2. Justification of the proposal 2.1. Appointment of Mr Javier López Casado In order to submit the proposal for appointment of Mr Javier López Casado, the Board of Directors has examined the favorable report issued by the Appointments and Remuneration Committee, pursuant to the provisions of section 6 of Article 529 decies of the Spanish Limited Liability Companies Law, upon an evaluation of the current list of members of the Board, the needs of the Board and the shareholding structure of the Company. The Appointments and Remuneration Committee has also appraised the conditions that must be met by Directors for the exercise of their functions and the dedication required to enable them to carry out their duties properly. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327 -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe ex UK ex 19 August 2021 Controversies ex CW Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.02 GERMANY BMW 0.41 GERMANY Engie 0.27 FRANCE A P Moller - Maersk A 0.14 DENMARK BMW AG Pref 0.06 GERMANY Eni 0.37 ITALY A P Moller - Maersk B 0.2 DENMARK BNP Paribas 0.81 FRANCE Epiroc A 0.17 SWEDEN A2A 0.04 ITALY Boliden 0.13 SWEDEN Epiroc B 0.09 SWEDEN Aalberts NV 0.06 NETHERLANDS Bollore 0.06 FRANCE EQT Partners AB 0.1 SWEDEN ABB 0.69 SWITZERLAND Bouygues 0.09 FRANCE Equinor ASA 0.24 NORWAY ABN AMRO Bank NV 0.06 NETHERLANDS Brenntag AG 0.17 GERMANY Ericsson A 0.01 SWEDEN Acciona S.A. 0.04 SPAIN Bureau Veritas S.A. 0.11 FRANCE Ericsson B 0.45 SWEDEN Accor 0.08 FRANCE Buzzi Unicem 0.03 ITALY Erste Group Bank 0.12 AUSTRIA Ackermans & Van Haaren 0.04 BELGIUM CaixaBank 0.16 SPAIN EssilorLuxottica 0.65 FRANCE ACS Actividades Cons y Serv 0.08 SPAIN Campari 0.08 ITALY Essity Aktiebolag B 0.24 SWEDEN Adecco Group AG 0.12 SWITZERLAND Capgemini SE 0.36 FRANCE Eurazeo 0.05 FRANCE Adevinta 0.05 NORWAY Carl Zeiss Meditec 0.08 GERMANY Eurofins Scienti 0.17 FRANCE Adidas 0.85 GERMANY Carlsberg (B) 0.22 DENMARK Euronext 0.11 FRANCE Adyen 0.84 NETHERLANDS Carrefour 0.14 FRANCE Evolution AB 0.3 SWEDEN Aegon NV 0.09 NETHERLANDS Casino Guichard Perrachon 0.02 FRANCE Evonik Industries AG 0.08 GERMANY Aena SME SA 0.14 SPAIN Castellum 0.08 SWEDEN Evotec 0.08 GERMANY Aeroports de Paris 0.04 FRANCE CD Projekt SA 0.04 POLAND Exor NV 0.1 ITALY Ageas 0.12 BELGIUM Cellnex Telecom SAU 0.46 SPAIN Fastighets AB Balder B 0.08 SWEDEN Ahold Delhaize 0.35 NETHERLANDS Chr. -

TD Ameritrade Spanish Financial Transactional Tax Impacted

TD Ameritrade Spanish Financial Transactional Tax-Impacted Securities PO Box 2760 Omaha, NE 68103-2760 Fax: 866-468-6268 Cusip Symbol Description Cusip Symbol Description E7390Z100 MRPRF MERLIN PROPERTIES E7366C101 SMIZF MELIA HOTELS SOCIMI S.A. EUR1 INTERNATIONAL SA COM E0304S106 CDNIF LOGISTA HOLDINGS COM E67674106 BABWF INTL CONSOL AIRLINES E526K0106 ANNSF AENA SME S.A. COM GRP SA COM E2R41M104 CLNXF CELLNEX TELECOM SAU 879382109 TEFOF TELEFONICA SA COM COM E97579192 VSCFF VISCOFAN SA COM E5R71W108 GMPUF GESTAMP AUTOMOCION E9853W160 ZRDZF ZARDOYA-OTIS COM COM 00089H106 ACSAY ACS ACTIVIDADES DE E8S56X108 PGUUF PROSEGUR CASH COM CONSTRUCCIO ADR E04648114 AMADF AMADEUS IT GROUP SA UNSPONSORED COM 00444E103 ANIOY ACERINOX SA ADR E38028135 EBRPF EBRO FOODS SA COM UNSPONSORED E11805103 BBVXF BANCO BILBAO VIZCAYA 00774W103 ANYYY AENA SME S.A. ADR ARGENTARI COM 02263T104 AMADY AMADEUS IT GROUP SA E2R23Z164 BNKXF BANKIA S.A. COM ADR UNSPONSORED E2116H880 BKIMF BANKINTER SA COM 05946K101 BBVA BANCO BILBAO VIZCAYA E15819191 BNDSF BANCO DE SABADELL SA ARGENTARI ADR COM SPONSORED E19790109 BCDRF BANCO SANTANDER SA 059568105 BNDSY BANCO DE SABADELL SA COM ADR UNSPONSORED E7S90S109 GASNF NATURGY ENERGY GROUP 05964H105 SAN BANCO SANTANDER SA S.A. COM ADR SPONSORED E5701Q116 GCNJF GRUPO CATALANA 066449109 BNKXY BANKIA S.A. ADR OCCIDENTE SA COM UNSPONSORED E6271Z155 ISMAF INDRA SISTEMAS S.A COM 066460304 BKNIY BANKINTER SA ADR E49512119 FRRVF FERROVIAL SA COM SPONSORED E52236143 FMOCF FOM CONST Y CONTRA 12803K109 CAIXY CAIXABANK SA ADR COM UNSPONSORED -

Eurex Circular 113/17

eurex circular 113/17 Date: 20 October 2017 Recipients: All Trading Participants of Eurex Deutschland and Eurex Zürich and Vendors Authorized by: Mehtap Dinc Action required Single Stock Futures: Introduction of 25 SSFs Contact: Derivatives Trading Operations, T +49-69-211-1 12 10, Nicolae Raulet, T +44-207-8 62 72 74 Content may be most important for: Attachment: Ü All departments Updated Annex A of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland and Eurex Zürich Summary: The Management Board of Eurex Deutschland and the Executive Board of Eurex Zürich AG took the following decisions with effect from 25 October 2017: 1. Introduction of 25 Single Stock Futures pursuant to Annex A of the attachment. Eurex Deutschland Internet: Management Board: Börsenplatz 4 www.eurexchange.com Thomas Book, 60313 Frankfurt/Main Mehtap Dinc, Erik Tim Müller, Mailing address: Michael Peters, Randolf Roth 60485 Frankfurt/Main Germany ARBN: 101 013 361 eurex circular 113/17 Single Stock Futures: Introduction of 25 SSFs 1. Product overview Eurex Future/Dividend Future Underlying ISIN Eurex Product Product ISIN product on group ID currency code ABEP Abertis Infraestructuras ES0111845014 ES02 EUR DE000A2G9TW1 S.A. AENP Aena S.A. ES0105046009 ES02 EUR DE000A2G9TY7 AI3P Amadeus IT Group S.A. ES0109067019 ES02 EUR DE000A2G9TZ4 ANAP Acciona S.A. ES0125220311 ES02 EUR DE000A2G9TX9 BAKP Bankinter S.A. ES0113679I37 ES02 EUR DE000A2G9T28 BDSP Banco de Sabadell S.A. ES0113860A34 ES02 EUR DE000A2G9UK4 CLNP Cellnex Telecom S.A. ES0105066007 ES02 EUR DE000A2G9T44 CMAP Mapfre S.A. ES0124244E34 ES02 EUR DE000A2G9UG2 COLP Inmobiliaria Colonial S.A. -

Fidelity UCITS ICAV

Interim Report and Condensed Unaudited Financial Statements For the six month period ended 31 July 2020 Fidelity UCITS ICAV (An Irish collective asset-management vehicle constituted as an umbrella fund with segregated liability between sub-funds) Fidelity UCITS ICAV TABLE OF CONTENTS Page GENERAL INFORMATION 2 INVESTMENT MANAGERS’ REPORT 6 SCHEDULES OF INVESTMENTS: Fidelity Global Quality Income UCITS ETF 9 Fidelity US Quality Income UCITS ETF 21 Fidelity Emerging Markets Quality Income UCITS ETF 25 Fidelity Europe Quality Income UCITS ETF 30 Fidelity Sustainable Research Enhanced Europe Equity UCITS ETF 34 Fidelity Sustainable Research Enhanced US Equity UCITS ETF 40 Fidelity Sustainable Research Enhanced Global Equity UCITS ETF 48 CONDENSED STATEMENT OF FINANCIAL POSITION 58 CONDENSED STATEMENT OF COMPREHENSIVE INCOME 62 CONDENSED STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO HOLDERS OF REDEEMABLE PARTICIPATING SHARES 65 CONDENSED STATEMENT OF CASH FLOWS 66 NOTES TO THE CONDENSED FINANCIAL STATEMENTS 69 DIRECTORY 91 APPENDIX 1 - STATEMENT OF SIGNIFICANT CHANGES IN THE COMPOSITION OF PORTFOLIO 92 APPENDIX 2 – TRACKING ERROR 102 APPENDIX 3 – SECURITIES FINANCING TRANSACTIONS 103 Fidelity UCITS ICAV GENERAL INFORMATION Fidelity UCITS ICAV (the “Fund”) was registered in Ireland pursuant to the Irish Collective Asset-management Vehicles Act 2015 (as amended) on 19 August 2016 under registration number C158668 and is authorised by the Central Bank of Ireland (the “Central Bank”) under the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (as amended) (the “UCITS Regulations”). Except where the context otherwise requires, defined terms shall bear the meaning given to them in the Prospectus of the Fund. The Fund is organised in the form of an umbrella fund with segregated liability between sub-funds. -

Euro Stoxx® Residual Momentum Premium Index

EURO STOXX® RESIDUAL MOMENTUM PREMIUM INDEX Components1 Company Supersector Country Weight (%) HENKEL PREF Personal & Household Goods DE 3.94 KERRY GRP Food & Beverage IE 3.71 HERA Utilities IT 2.87 HANNOVER RUECK Insurance DE 2.32 MUENCHENER RUECK Insurance DE 2.07 INGENICO Technology FR 1.96 AMPLIFON Health Care IT 1.91 CELLNEX TELECOM Telecommunications ES 1.87 ILIAD Telecommunications FR 1.77 FERROVIAL Construction & Materials ES 1.73 ESSILORLUXOTTICA Health Care FR 1.72 LEGRAND Industrial Goods & Services FR 1.69 ZALANDO Retail DE 1.56 ORION B Health Care FI 1.53 ENAGAS Oil & Gas ES 1.52 BECHTLE Technology DE 1.51 SCHNEIDER ELECTRIC Industrial Goods & Services FR 1.44 ASM INTERNATIONAL Technology NL 1.41 GEA GRP Industrial Goods & Services DE 1.37 ALSTRIA OFFICE REIT Real Estate DE 1.36 MERCK Health Care DE 1.35 Industria de Diseno Textil SA Retail ES 1.32 AMUNDI Financial Services FR 1.28 BRENNTAG Chemicals DE 1.28 CTS EVENTIM Media DE 1.26 ICADE Real Estate FR 1.25 EUROFINS SCIENTIFIC Health Care FR 1.24 INMOBILIARIA COLONIAL SOCIMI Real Estate ES 1.21 ASML HLDG Technology NL 1.18 AIR LIQUIDE Chemicals FR 1.17 SIEMENS Industrial Goods & Services DE 1.15 BOUYGUES Construction & Materials FR 1.12 HUHTAMAKI Industrial Goods & Services FI 1.11 INTESA SANPAOLO Banks IT 1.10 BAYER Health Care DE 1.07 CREDIT AGRICOLE Banks FR 1.06 COFINIMMO Real Estate BE 1.06 BNP PARIBAS Banks FR 1.05 ATOS Technology FR 1.03 SIEMENS GAMESA Oil & Gas ES 1.03 GECINA Real Estate FR 1.02 AALBERTS Industrial Goods & Services NL 1.02 GRIFOLS Health Care ES -

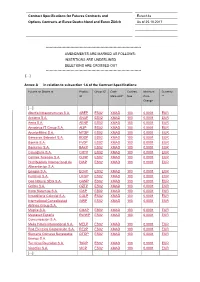

Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 25.10.2017

Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 25.10.2017 ************************************************************************* AMENDMENTS ARE MARKED AS FOLLOWS: INSERTIONS ARE UNDERLINED DELETIONS ARE CROSSED OUT ************************************************************************* […] Annex A in relation to subsection 1.6 of the Contract Specifications: Futures on Shares of Product Group ID* Cash Contract Minimum Currency ID Market-ID* Size Price ** Change […] Abertis Infraestructuras S.A. ABEP ES02 XMAD 100 0.0001 EUR Acciona S.A. ANAP ES02 XMAD 100 0.0001 EUR Aena S.A. AENP ES02 XMAD 100 0.0001 EUR Amadeus IT Group S.A. AI3P ES02 XMAD 100 0.0001 EUR ArcelorMittal S.A. MTSP ES02 XMAD 100 0.0001 EUR Banco de Sabadell S.A. BDSP ES02 XMAD 100 0.0001 EUR Bankia S.A. FV0P ES02 XMAD 100 0.0001 EUR Bankinter S.A. BAKP ES02 XMAD 100 0.0001 EUR CaixaBank S.A. CRTP ES02 XMAD 100 0.0001 EUR Cellnex Telecom S.A. CLNP ES02 XMAD 100 0.0001 EUR Distribuidora Internacional de DIAP ES02 XMAD 100 0.0001 EUR Alimentacion S.A. Enagas S.A. EG4P ES02 XMAD 100 0.0001 EUR Ferrovial S.A. UFGP ES02 XMAD 100 0.0001 EUR Gas Natural SDG S.A. GANP ES02 XMAD 100 0.0001 EUR Grifols S.A. OZTP ES02 XMAD 100 0.0001 EUR Indra Sistemas S.A. IDAP ES02 XMAD 100 0.0001 EUR Inmobiliaria Colonial S.A. COLP ES02 XMAD 100 0.0001 EUR International Consolidated INRP ES02 XMAD 100 0.0001 EUR Airlines Group S.A. Mapfre S.A.