FY 2015 Investor Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Registered Pawnshops & Msbs

LIST OF MONEY SERVICE BUSINESSES REGISTERED WITH THE AMLC AS OF SEPTEMBER 2020 INST CODE NAME OF MONEY SERVICE BUSINESSES 1 060000176 'ASMA MONEY CHANGER 2 060000233 0209 ROYAL STONES, INC. 3 060000234 101 FASTPAY, INC. 4 060000132 19TH MONEY CHANGER 5 060000587 5 SISTERS FOREIGN CURRENCY EXCHANGE CORP. 6 060000758 88 ARKADE INCORPORATED 7 060000743 8A8 MONEY CHANGER 8 060000825 A & V REMITTANCE CENTER 9 060000213 A STAR MONEY REMITTANCE 10 060000056 A.L. MONEY CHANGER 11 060000137 A.R.T. MONEY CHANGER 12 060000204 A.X. CURRENCY EXCHANGE 13 060000123 AAA MONEY CHANGER, REMITTANCE AND BILLS PAYMENT 14 060000777 ABA GLOBAL PHILIPPINES INC. 15 060000019 ABBA CURRENCY EXCHANGE, INC. 16 060000091 ABELEN'S MUSIC STORE AND GENERAL MERCHANDES 17 060000284 ABIGENCOUR CORP. 18 060000100 ACCE EASY REMIT & SERVICES 19 060000396 ACHIEVERS MONEY CHANGER 20 060000805 ACTION.ABLE INC. 21 060000515 ACURREX ENTERPRISE 22 060000429 ACYAO AND ACGALVEZ CURRENCY EXCHANGE INC. 23 060000386 ADA SINGAPORE 1 GIFTSHOP AND MONEYCHANGER ADVENTURE INTERNATIONAL TOURS, INC. DOING BUSINESS UNDER THE NAME AND 24 060000662 STYLE OF AMERICAN EXPRESS TRANSNATIONAL 25 060000659 AG & G MONEY EXCHANGE 26 060000784 AGOO MONEY CHANGER 27 060000620 AGPC MONEY CHANGER 28 060000510 AGUINALDO NETWORK INTERNATIONAL INC. 29 060000071 AIAH FOREIGN EXCHANGE DEALER 30 060000746 AIDA MONEY CHANGER 31 530013 AIRPAY TECHNOLOGIES PHILIPPINES INC Page 1 of 24 LIST OF MONEY SERVICE BUSINESSES REGISTERED WITH THE AMLC AS OF SEPTEMBER 2020 INST CODE NAME OF MONEY SERVICE BUSINESSES 32 060000329 AIRPORTVILLE CURRENCY TRADING 33 060000129 AKONG MONEY CHANGER 34 060000054 ALAINA JEM TRAVEL SERVICES 35 060000377 ALCHOR FOREX-MONEY CHANGER 36 060000796 ALCO AND LEE FOREIGN EXCHANGE, INC. -

SEVENTEENTH CONGRESS of the ) REPUBLIC of the PHILIPPINES ) First Regular Session ) ’16 SEP 20 P6:17

l3 of the SEVENTEENTH CONGRESS OF THE ) REPUBLIC OF THE PHILIPPINES ) First Regular Session ) ’16 SEP 20 P6:17 SENATE RITLI'. ^Y: S. B. NO. 1165 Introduced by SENATOR JOEL VILLANUEVA AN ACT REQUIRING PARKING SPACE FROM MOTOR VEHICLE BUYERS IN METROPOLITAN AREAS AS A PRE-REQUISITE FOR THE PURCHASE OF A MOTOR VEHICLE AND REGISTRATION WITH THE LAND TRANSPORTATION OFFICE (LTO) EXPLANATORY NOTE There are twelve metropolitan areas in the Philippines, which are identified by the National Economic Development Authority (NEDA); Metro Manila, Angeles, Bacolod, Baguio, Batangas, Cagayan de Oro, Cebu, Dagupan, Davao, Iloilo, Naga! and Olongapo. It is in these areas that traffic congestion is prevalent. According to the data released by the crowd-sourcing site Numbeo.com, the Philippines is the fifth country in the world with the worst traffic conditions and third in Asia1. The Metro Manila Development Authority (MMDA) claims that this traffic is expected to get worse in the next 15 years. The American Chamber of Commerce of the Philippines corroborated this claim saying that Metro Manila may become uninhabitable within four years if roads and other infrastructure are not upgraded immediately2. Furthermore, the Japan International Cooperation Agency (JICA) indicated in a study that the financial cost of traffic congestion is likely to increase to P6 billion a day by 2030 if the situation is not addressed3. 1 Gonzales, Yuji Vincent. “PH has S'*1 worst traffic in the world - survey”. 4 September 2014, http://newsinfo.inquirer.net/719261/ph-has-5th-worst-traffic-in-the-world-survey. Accessed 16 August 2016. Mercurio, Richmonde. -

Hotel Address Contact Number Email

HOTEL ADDRESS CONTACT NUMBER EMAIL Astoria Bohol Baranggay Taguihon, Baclayon, Bohol 335-1111 [email protected] 036-2881111/ Astoria Boracay Station 1, Boracay Island, Malay, Aklan [email protected] 036-2883536 Km 62 North National Highway, Brgy. San Rafael, Puerto Princesa Astoria Palawan 335-1111 [email protected] City, Palawan Astoria Plaza 15 J. Escriva Drive, Ortigas Business District, Pasig City 335-1131 to 35 [email protected] 2107 Prime Street, Madrigal Business Park, Ayala Alabang, B Hotel Alabang 828-8181 Muntinlupa City B Hotel Quezon City 14 Scout Rallos Street, Brgy. Laging Handa, Quezon City 990-5000 Chardonnay by Astoria 352 Captain Henry P. Javier, Brgy. Oranbo, Pasig City 335-1131 to 35 [email protected] Asean Avenue corner Roxas Boulevard, Entertainment City, City of Dreams Manila 800-8080 [email protected] Paranque Conrad Manila Seaside Boulevard, Coral Way, Pasay City 833-9999 Seascapes Resort Town, Soong, Lapu-Lapu City, Mactan Island, 032-4019999/ Crimson Resort & Spa Mactan [email protected] Cebu 239-3900 Ortigas Avenue corner Asian Development Bank Ave, Ortigas Crowne Plaza Manila Galleria 633-7222 Center, Quezon City Diamond Hotel Roxas Boulevard corner Dr. J. Quintos Street, Manila 528-3000/ 305-3000 [email protected] Discovery Suites 25 ADB Avenue, Ortigas Center, Pasig City 719-8888 [email protected] Dusit Thani Manila Ayala Center, Makati City 238-8888 [email protected] Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Bagumbayan, Quezon City 570-7777 [email protected] F1 Hotel Manila 32nd Street, Bonifacio Global City, Taguig City 928-9888 Fairmont Makati 1 Raffles Drive, Makati Avenue, Makati City 795-1888 [email protected] Las Casas Filipinas de Acuzar Brgy. -

Building a Strong Platform for Recovery, Renewed

2020 INTEGRATED REPORT BUILDING A STRONG PLATFORM FOR RECOVERY, RENEWED GROWTH, AND RESILIENCE Ayala Land’s various initiatives on stakeholder support, investment, and reinvention pave the way for recovery PAVING THE WAY FOR RECOVERY AND SUSTAINABLE GROWTH The ongoing COVID-19 pandemic and the natural calamities that of digital platforms to reach and engage buyers. Staff of APMC, struck the Philippines in 2020 are still being felt by Filipinos to this the company’s property management firm, stayed-in its managed day. Ayala Land’s swift response to face these challenges showed properties and communities while the enhanced community the resilience of both the company and its people. quarantine was enforced. In a strategic pivot, ALIzens executed a five-point action plan— Helping the Community protecting the workforce, financial sustainability, serving customers, Ayala Land employees raised PHP82.6 million under the Ayala helping the community, and thinking ahead towards recovery. Land Pays It Forward campaign to provide medical supplies and This action plan enabled Ayala Land, its employees, and its personal protective equipment to three COVID-19 designated communities to withstand the challenges and position for recovery. treatment hospitals. The company helped raise PHP425 million for Project Ugnayan and allocated PHP600 million in financial With the continued trust and confidence of its shareholders and assistance to more than 70 thousand “no work-no pay” contingent stakeholders, Ayala Land will count on bayanihan (community personnel during the critical first weeks of the quarantine. spirit) to move forward and pave the way for recovery and Recognizing the difficulties of its mall merchants, Ayala Land sustainable growth. -

Metropolitan Arrangements in the Philippines: Passing Fancy Or the Future Megatrend

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Manasan, Rosario G.; Mercado, Ruben G. Working Paper Metropolitan Arrangements in the Philippines: Passing Fancy or the Future Megatrend PIDS Discussion Paper Series, No. 1998-31 Provided in Cooperation with: Philippine Institute for Development Studies (PIDS), Philippines Suggested Citation: Manasan, Rosario G.; Mercado, Ruben G. (1998) : Metropolitan Arrangements in the Philippines: Passing Fancy or the Future Megatrend, PIDS Discussion Paper Series, No. 1998-31, Philippine Institute for Development Studies (PIDS), Makati City This Version is available at: http://hdl.handle.net/10419/187373 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Philippine Institute for Development Studies Metropolitan Arrangements in the Philippines: Passing Fancy or the Future Megatrend? Ruben G. -

With Every Step the Mcmicking Memorial

WITH EVERY STEP THE MCMICKING MEMORIAL Located at the eponymous McMicking Courtyard of the Ayala Triangle Gardens, the McMicking Memorial was inaugurated on October 2, 2017. Designed by Leandro V. Locsin Partners in collaboration with Ayala Land and the Zobel family, the memorial’s portal and water elements represent the union of Colonel Joseph McMicking and Mrs. Mercedes Zobel McMicking. Colonel McMicking was widely recognized as the visionary of Makati’s urban development while Mrs. McMicking was the quiet force behind the growth of Ayala in the 20th century. AYALA LAND IS MOVING TO PROVIDE MORE FILIPINOS WITH A BRIGHTER FUTURE With each community we develop, we enrich lives and enable relationships to flourish. With each new estate we build, we enhance land for future generations to enjoy. With every step, we provide more Filipinos with a brighter future. Integrated Report 2017 2017 Theme: In Motion About this Report The Ayala group is moving closer to its Ayala Land’s annual report is released We present our corporate governance 2020 goals, as captured in the cover to stockholders and other stakeholders practices based on metrics defined images of the 2017 Integrated Reports on the day of the Annual Stockholders’ by the ASEAN Corporate Governance of the various Ayala companies. Meeting which takes place in the month Scorecard (ACGS) to provide of April every year. The 2016 report was shareholders with an organized and The McMicking Memorial, unveiled at released on April 19, 2017. detailed reference that is aligned and the Ayala Triangle Gardens in October consistent with ASEAN standards. 2017, provides an eloquent backdrop to This current report was made available the strides that Ayala Land is currently to the public on April 18, 2018. -

Growth, Demographic Trends, and Physical Characteristics

Overlay of Economic Growth, Demographic Trends, and Physical 03 Characteristics Chapter 3 Overlay of Economic Growth, Demographic Trends, and Physical Characteristics | 29 30 | Philippine Development Plan 2017-2022 Chapter 3 Overlay of Economic Growth, Demographic Trends, and Physical Characteristics The Philippine Development Plan (PDP) 2017-2022, which takes off from the current Administration’s 0+10 Socioeconomic Agenda, pursues the realization of inclusive development, anchored on the Long-Term Vision or AmBisyon Natin 2040: matatag, maginhawa, at panatag na buhay. It defines the desired spatial distribution of human activity in the country based on economic, social, institutional, and environmental conditions. The Plan espouses a national spatial strategy (NSS) that describes the geographic development challenges and opportunities in population and economic growth. The NSS provides the basis for policies on urban development, infrastructure development, disaster mitigation, and environmental resource protection and conservation. It recommends sustainable human settlements, efficient production, and effective service delivery systems. The key principles of spatial development are as follows: • Integration of leading and lagging areas and urban-rural linkages through transportation networks • Improvement of access to social services • Identification of locations of major infrastructure to maximize their benefits • Improvement of local, national, and international connectivity • Promotion of sustainable development and resiliency Economic and Demographic Trends The spatial distribution of population • Regions with established and large cities reflects the structure of the economy, (regional centers) are growing the fastest. characterized by varying concentrations of Notably, while the regional centers production and consumption in cities and are growing much faster than other municipalities, and in their respective host cities and municipalities, the National regions. -

Building Better Vismin Metro Davao

Key business highlights Contact us www.pwc.com/ph/vismin 600 Alex B. Cabrera 118 No. of primary and +63 (2) 845 2728 Ext. 2002 No. of banks secondary schools [email protected] 36,950 Aldie P. Garcia Building Better No. of business establishments +63 (2) 845 2728 Ext. 3078/3118 [email protected] VisMin 11 No. of ecozonesg Brando C. Cabalsi 8 IT Parks and Center Ops +63 (2) 845 2728 Ext. 3060 Metro Davao 2 Agro-industrial [email protected] 1 Manufacturing Rose Dale M. Ando +63 (32) 233 5020 1.7m Tourist arrivals [email protected] 92% Local tourists Karen Patricia A. Rogacion 0.1% Foreign tourists +63 (2) 845 2728 Ext. 3089 [email protected] Tourist destinations • Malagos Garden Resort Shalla Anne Deymos-Quiling • Davao Riverfront Complex +63 (2) 845 2728 Ext. 2061 • Philippine Eagle Center • Deca Wakeboard Park [email protected] • Davao Wild Water Adventure • People’s Park • Eden Nature Park • Davao Museum Eloisa Fe J. Lusotan +63 (2) 845 2728 Ext. 3021 [email protected] Luzon * Data pertains to Davao Region Sources • Businesslist.ph • Commission on Audit • Davao City Investment Promotion Center Visayas • Davao City Official Government Website • Philippine Economic Zone © 2016 Isla Lipana & Co. All rights reserved. Authority • Philippine Statistics Authority Isla Lipana & Co. helps organisations and individuals create the value 2010 they’re looking for. We’re a member of the PwC network of firms in • Philippine Statistics Authority Mindanao 157 countries with more than 223,000 people who are committed to 2015 delivering quality in assurance, tax and advisory services. -

As of 21 December 2020 FACILITIES SUITABLE for STRINGENT QUARANTINE (TI=I989 Fasilili98 Af9-A189 8Wil951 Fqr MJ!.NQA:Rory

• FAC!! 'TIES AS OF Bece,""er J.;ink: https"/IglJarantjne dob 9Q'a'.j3R}facililies-i. ispected-as-of deeefTlger 21 aQ2fJe. As of 21 December 2020 FACILITIES SUITABLE FOR STRINGENT QUARANTINE (TI=I989 fasilili98 aF9-a189 8wil951 fQr MJ!.NQA:rORY 1. Manila Hotel 33. Conrad Hotel 2. Manila Prince Hotel 34. Networld Hotel 3. Go Hotel Ermita 35. Hotel Jen 4. Manila Grand Opera Hotel 36. The Courtyard Hotel Pasay 5. Red Planet Mabini 37. Seda BGC 6. Rizal Park Hotel 38. Go Hotels Timog 7. Go Hotel, Otis 39. Go Hotels North, Edsa 8. Eurotel, Pedro Gil 40. Park Inn by Radisson North 9. Amelie Hotel Manila Edsa 10. Hotel Kimberly Manila 41. Sequioa Hotel Manila Bay 11. Ramada Manila Central 42. Sequioa Hotel QC 12. Best Western Hotel La 43. Hotel Rembrandt QC Corona 44. Summit Hotel, QC 13. Aloha Hotel 45. Hive Hotel, QC 14. The Bayleaf, Intramuros 46. Cocoon Hotel QC 15. Bayview Park Hotel Manila 47. Privata Hotel, QC 16. 1898 Hotel Colonia - Makati 48. Novotel Cubao 17. The Sphere Residences- 49. Wow Hotel Aurora Cubao Makati 50. F1 Hotel BGC 18. The Charter House -Makati 51. Somerset Olympia Makati 19. Royal Bellagio Hotel - 52. Cabin by Eco Hotels Makati 53. Container by Eco Hotels 20. Nest Nano Suites - Makati 54. Diamond Hotel Manila 21. Ritz Astor Hotel - Makati 55. Oyo Nano Suites Fort 55 22. Crown Regency Hotel 56. Asiatel Makati 57. Elan Hotel Annapolis 23. Privata Hotel, Makati 58. E-Hotel Makati 24. Hotel Celeste, Makati 59. Pearl Blossom, Manila 25. -

Jhgjhgjhgjhgwrtwerwerkjhefwer

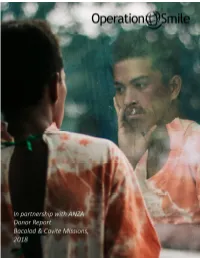

jhgjhgjhgjhgwrtwerwerkjhefwer Since January 2018, Operation Smile Philippines has conducted 6 surgical missions, treating a total of 452 patients. Over the last 36 years, Operation Smile has developed a comprehensive model for patient care and safety to ensure safe and highly effective surgical care is given to each and every patient. Beyond providing surgery, we also conduct medical consultations and evaluations through our screening process, which gives access to multidisciplinary specialties of surgery, anaesthesia, paediatrics, dentistry, speech therapy and nursing. As of August 2018, we have screened 748 cleft patients and operated on 452 of them across three international missions, three local missions and in our three cleft care centers. We conducted the international missions in three sites nationwide: Cebu City, Cebu; Bacolod, Negros Occidental; Dasmariñas, Cavite. Our three local missions took place in Laginayen, Pangasinan; Davao City, Davao; Aborlan, Palawan. A total of 255 volunteer cleft care professionals took part in those 6 missions. They came from more than 10 countries, including: Australia, Brazil, Canada, China, Mexico, South Africa, Sweden, USA, Venezuela, and the Philippines. In addition to the missions, we also provided treatment in our three cleft centers in Manila at the Sta. Ana Hospital, in Bacolor, Pampanga at the Jose A. Datu Medical Center and in Davao City at the Metro Davao Research and Medical Center. ANZA-Sponsored Patients We applied the funds raised by ANZA totalling 2,698,200 PHP, to two international missions: Bacolod, Negros Occidental held from May 17-25; Dasmariñas, Cavite held from June 8-16. A total of 189 patients received surgery as a direct result of ANZA’s fundraising efforts. -

Earthquake Atlas for Building Resiliency in Metro Davao Launched

Republic of the Philippines DEPARTMENT OF SCIENCE AND TECHNOLOGY PHILIPPINE INSTITUTE OF VOLCANOLOGY AND SEISMOLOGY PRESS RELEASE EARTHQUAKE ATLAS FOR BUILDING RESILIENCY IN METRO DAVAO LAUNCHED The Department of Science and Technology – Philippine Institute of Volcanology and Seismology (DOST – PHIVOLCS) reiterates the importance of structurally-sound buildings as part of earthquake preparedness through the launch of the Metro Davao Earthquake Model (MDEM) Atlas on September 4, 2019 at the Grand Regal Hotel in Lanang, Davao City. “Metro Davao is traversed by the Central Davao Fault System composed of Tamugan Fault, Lacson Fault, Dacudao Fault, Pangyan-Biao Escuela Fault and New Carmen Fault, which may produce earthquakes greater than magnitude 6.5,” says DOST Undersecretary Renato Solidum, Jr., Officer-In-Charge of PHIVOLCS. “The MDEM Atlas can be used as reference for engineers in the seismic design of buildings and structures, and will help minimize the impact of very destructive ground shaking and prevent casualties.” The Atlas is a compilation of maps showing seismic ground motion hazard assessment from various earthquake sources. Among the maps are Peak Ground Acceleration (PGA) and Spectral Acceleration (SA), which were modelled using Probabilistic Seismic Hazard Analysis (PSHA) through the collaborative efforts and expertise of engineers, seismologists, geologists and researchers from DOST – PHIVOLCS in consultation with various local stakeholders such as the Regional Development Council (RDC) XI, Association of Regional Executives of National Agencies (ARENA) XI, Department of Public Works and Highways (DPWH) XI, Philippine Institute of Civil Engineers (PICE) XI, Association of Structural Engineers of the Philippines - Regional Coordinating Council (ASEP-RCC), Association of Structural Engineers of Davao, Inc. -

The French Touch

HOTELS EN JVD CATALOGUE • 2020 THE FRENCH TOUCH Asia-Pacific/Middle-east JVD HOTELS P1 THE HOSPITALITY EXPERIENCE In JVDs Hotels universe, accessories make each room unique and transform a hotel stay into a delightful experience in itself. Every day, we innovate to provide hotel guests with accessories that combine functionality, safety and ergonomics. JVD’s Hotels accessories have become a delight for hotels and travellers around the world. Visit our website for more information General Disclaimer Reasonable efforts are used to include accurate and up-to date information in this catalogue. They may contain technical inaccuracies or typographical errors. We do reserve the rights to change the information without prior notification or any obligation. In no event will JVD or its As part of our environment friendly approach, JVD would like to invite all subsidiaries be liable to any part for any damages whether direct or indirect, consequential, our partners and customers to ensure we have their e-mail address to send punitive or others for use of its contents. this directly in electronic format. P2 JVD HOTELS INNOVATION IN THE SERVICE OF WELL-BEING The strength of JVD resides in our provision of accessories adorning hotel rooms around the world for more than 30 years. JVD accessories help to personalize hotel rooms, giving them the final touch to ensure guests’ well-being. Accessories are what truly At JVD, there is no room for boredom. make a difference. We are proud to present our catalogue of 2020 collections to you, just brimming with new items: JVD does not believe in simply copying and pasting! Our team have been working tirelessly in Nantes, Singapore, Alicante and Mexico City to offer you and your customers enhanced well-being.