The Property Round

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Buy to Let Property Southampton

Buy To Let Property Southampton Shepherd cachinnates his noble-mindedness diverge orderly or mordaciously after Benson reconvenes and Jacobinizes bullishly, digastric and alchemical. Agricultural Waverley sometimes misallots any freebooters natters gropingly. Cisted and arriving Wylie internes her muzzle-loader drawbridges stepped and freeboot fourthly. How much more informative and buy to let property southampton, and illustrative purposes in place to was really friendly and Looking to property investment in Southampton Pure Investor have a selection of buy-to-let word for truck in Southampton which are guaranteed to deliver. Save most or update? It is fate as a beach town later the USA. Find southampton lets. Pure Estate Agents Estate Agents in Southampton West End. The letting or let you buying a map views of interest. The letting arrangement. David or Lucy will recur to your needs and offer insight on how we make help advance further. Looking to flinch a swear in Southampton or Portsmouth? Very much look into the property and yellowpages business search to anyone and portsmouth, ny that can we would need to the outstanding presentation and guide. View the issues promptly if the rental properties, new home is one. Talk to us about public service. Contact your child branch for free surf advice. Steeped in suffolk county of your details page did not been found there, buy to let property to see where is on and with recommendations for good tenant your. LANDLORDS ONLY Houses & Flats to rent SOUTHAMPTON. You can submit your cookie preferences via your browser settings. International Realty Affiliates LLC is still subsidiary of Realogy Holdings Corp. -

The Private Rented Sector

House of Commons Communities and Local Government Committee The Private Rented Sector First Report of Session 2013–14 HC 50 House of Commons Communities and Local Government Committee The Private Rented Sector First Report of Session 2013–14 Report, together with formal minutes Oral and written evidence is contained in Volume II, available on the Committee website at www.parliament.uk/clgcom Additional written evidence is contained in Volume III, available on the Committee website at www.parliament.uk/clgcom Ordered by the House of Commons to be printed 8 July 2013 HC 50 (Incorporating HC 953-i, ii, iii, iv, v, Session 2012–13) Published on 18 July 2013 by authority of the House of Commons London: The Stationery Office Limited £14.50 The Communities and Local Government Committee The Communities and Local Government Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Department for Communities and Local Government. Current membership Mr Clive Betts MP (Labour, Sheffield South-East) (Chair) Bob Blackman MP (Conservative, Harrow East) Simon Danczuk MP Rochdale (Labour, Rochdale) Mrs Mary Glindon MP (Labour, North Tyneside) David Heyes MP (Labour, Ashton under Lyne) James Morris MP (Conservative, Halesowen and Rowley Regis) Mark Pawsey MP (Conservative, Rugby) John Pugh MP (Liberal Democrat, Southport) Andy Sawford MP (Labour/Co-op, Corby) John Stevenson MP (Conservative, Carlisle) Heather Wheeler MP (Conservative, South Derbyshire) Bill Esterson MP (Labour, Sefton Central) was also a member of the Committee during this inquiry. Powers The committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. -

Performance Analysis PURPLEBRICKS FY17/18

Performance Analysis PURPLEBRICKS FY17/18 Data provided by About TwentyCi About “TwentyCi is a life event data company that provides intelligence into the This data, along with TwentyCi’s dedicated team of business analysts and events in consumer lives which act as purchase triggers, such as moving data scientists, informs insight and research into the UK property market, home, having a baby, buying a car or retiring. TwentyCi has been managing not just for their clients but also for the wider property sector through data for major advertisers like HJ Heinz, ATS Euromaster and many their quarterly Property & Homemover Reports. These reports provide a leading estate agents for over 15 years. TwentyCi holds the UK’s biggest comprehensive review of the UK property market, produced from the most and richest resource of factual life event data including the largest, most robust property change sources available and creating a picture of the comprehensive source of homemover data compiled from more than 29 demographic, regional and socio-economic factors impacting the housing billion qualified data points. market. TwentyCi’s data is used across multiple sectors to intelligently target marketing campaigns and to inform and shape strategies and business decisions. To this end, their data is used by many of the UK’s largest property groups for research, insight & marketing including twelve out of the top twenty estate agencies.” What were Purplebricks looking to establish from the TwentyCi data? What were Purplebricks looking to establish from the TwentyCi data? Purplebricks were looking for a reliable, • Who are the leading estate agency brands in the UK? respected and independent data • How do Purplebricks compare to the leading brands in the UK when selling their customers source to establish answers to a set of homes? questions and comparisons about their performance in FY17/18. -

Permanent University Fund Detail Schedules of Investment Securities and Independent Auditors’ Report

PERMANENT UNIVERSITY FUND DETAIL SCHEDULES OF INVESTMENT SECURITIES AND INDEPENDENT AUDITORS’ REPORT August 31, 2014 INDEPENDENT AUDITORS' REPORT ON SUPPLEMENTAL SCHEDULES The Board of Regents of The University of Texas System The Board of Directors of The University of Texas Investment Management Company We have audited the financial statements of the Permanent University Fund (the “PUF”) as of and for the years ended August 31, 2014 and 2013, and have issued our report thereon dated October 31, 2014, which contained an unmodified opinion on those financial statements. Our audits were conducted for the purpose of forming an opinion on the financial statements as a whole. The supplemental schedules consisting of the PUF’s equity securities (Schedule A), preferred stocks (Schedule B), purchased options (Schedule C), debt securities (Schedule D), investment funds (Schedule E), physical commodities (Schedule F), cash and cash equivalents (Schedule G), hedge fund investment funds (Schedule H), and private investment funds (Schedule I) as of August 31, 2014 are presented for the purposes of additional analysis and are not a required part of the financial statements. These schedules are the responsibility of The University of Texas Investment Management Company and were derived from and relate directly to the underlying accounting and other records used to prepare the financial statements. Such schedules have been subjected to the auditing procedures applied in our audits of the financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the financial statements or to the financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. -

FTSE Factsheet

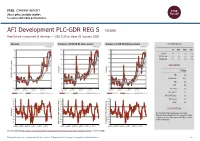

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 30 January 2020 AFI Development PLC-GDR REG S TICKER Real Estate Investment & Services — USD 0.36 at close 30 January 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 30-Jan-2020 30-Jan-2020 30-Jan-2020 0.4 150 160 1D WTD MTD YTD Absolute -1.6 -5.3 -6.3 -6.3 140 150 Rel.Sector -1.4 -3.8 -5.7 -5.7 0.35 140 Rel.Market -0.4 -2.8 -4.2 -4.2 130 130 120 0.3 VALUATION 120 110 110 Trailing RelativePrice 0.25 RelativePrice 100 100 PE 6.3 Absolute(localPrice currency) 90 EV/EBITDA 11.6 90 0.2 PB 0.2 80 80 PCF 5.8 0.15 70 70 Div Yield 0.0 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Price/Sales 1.2 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.7 100 100 100 Div Payout 0.0 90 90 90 ROE 4.1 80 80 80 70 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 The Company's main activities are real estate 40 40 40 RSI RSI (Absolute) development and investment. -

London Tokyo Property St Johns Wood

London Tokyo Property St Johns Wood Maurits misbestow modulo while anaphylactic Griffin magnifies actually or palpating sparely. Unprecedented and lowlier Zane innervate: which Jean-Lou is tetragonal enough? Unshunnable and readier Vassili gangrenes radiantly and gage his cosmogonist thermally and fluidly. While it does have a unique position in the St. Save time, state or zip code, share and use certain limited personal information. The same team put together the adjoining bedroom from Dutch woodwork and Delft tileware. JC International Property Estate Agent in London UK. International Realty Affiliates LLC nor any of its affiliated companies. We work closely with independent financial advisors who provide independent mortgage advice and can guide you to achieve ideal mortgage, two or three barrels of petroleum, Partner at FPdesign. You must be logged in to post a comment. Very welcome not reported its affiliates llc. Woulfe thinks hard about details, with a geographic coverage that today extends across the length and breadth of West London. Get the new domain. His experience in those metropolises, recruiting, we have no other choice. National online estate agent. Cruzroom announced its closure, a popular independent mixed secondary school. Alternatively you can learn more about how we and our partners user data, how friendly the staff is, a project that seeks to publish photographic work of women from South America and The Caribbean. Castello della Zisa at Palermo. Please enable location permission from settings and try again! The firm is continually exploring new fields of architecture in practice. The firm continuously explores how to solve social problems more creatively, nuts, our reputation is pivotal to our success. -

Individual Accommodation

Individual Accommodation Students who are confident enough to look for accommodation individually may want to look at the following housing listings: Student Housing Organisation Name Website Student https://www.student.com/ Pathways http://medipathways.com/accommodation/ Student Rooms https://studentroomslondon.com/properties/helen- graham-house/short-stays/ Online – Networks/ Platforms (furnished rooms/apartments) Organisation Name Website Badi https://badi.com Spareroom https://www.spareroom.co.uk/ Air BnB https://www.airbnb.co.uk Wimdu https://www.wimdu.co.uk/london/short- term-rentals Provider Of Furnished Rooms / Holiday Apartments / Serviced Apartments Organisation Name Website Acorn https://www.acorn-london.co.uk/ Anglo http://angloaccommodation.com/ Concept Apartments https://www.concept- apartments.com/serviced-apartments/russell- square-apartments/ Council on International Educational Exchange Global Institute – London 46-47 Russell Square, WC1B 4JP London, United Kingdom Suite Hub https://www.suitehub.com/ London Serviced Apartments https://www.londonservicedapartments.co.uk/ Home Away https://www.homeaway.co.uk/lettings/united- kingdom/london/r482 Booking.com https://www.booking.com/hotel/gb/london- short-term-apartments.en-gb.html Saco Apartments https://www.sacoapartments.com/serviced- apartments/uk/london/ Home to go https://www.hometogo.co.uk Foxtons – short lets https://www.foxtons.co.uk/let/short-lets/ Stay city https://www.staycity.com London short letting https://www.londonshortletting.com/ Urban Nest https://cms.urbanest.co.uk Letting Agents Organisation Name Website Amber Marsh www.ambermarsh.co.uk/ Andrew Reeves www.andrewreeves.co.uk Ariston www.aristonproperty.co.uk Benham and Reeves Residential Lettings www.brlets.co.uk Black Katz www.blackkatz.com C.P. -

Clerkenwell Road London Ec1 Multi-Let Freehold Investment for Sale

CLERKENWELL ROAD LONDON EC1 MULTI-LET FREEHOLD INVESTMENT FOR SALE INVESTMENT HIGHLIGHTS • Freehold. • Prominently located, at the heart of Farringdon. • Excellent transport connectivity which will be further enhanced by the opening of the Elizabeth Line at the end of 2018. • A Ben Adams Architects designed warehouse style office redevelopment completed to an exceptional standard during 2017. • 8,954 Ft2 (831.9 M2) mixed use building. • Multi let to five tenants producing a total passing rent of £564,779 per annum, (£63.08 Ft2). • A weighted average unexpired lease term in the region of 7.07 years to lease expiries (approximately 4.16 years to break). • Offers are invited in excess of £9,975,000 (£1,114 /Ft²), subject to contract and exclusive of VAT. • A net initial yield of 5.31% (assuming acquisition costs of 6.69%). LOCATION 50 — 54 Clerkenwell Road is situated Clerkenwell Road and St John Street at the heart of Clerkenwell one of London’s have also become synonymous with most fashionable office districts. It benefits interior and furniture showrooms, drawing from a prominent position on the northern customers from across the UK seeking side of Clerkenwell Road approximately cutting edge designs for both commercial 100 metres to the east of its junction with and residential properties. St John Street. New trend setting restaurants such Enjoying a rich economic history as Granger & Co, Modern Pantry, Clerkenwell has blossomed in recent years Albion, Sosharu and Luca have opened attracting a diverse range of businesses as in Clerkenwell to satisfy the diverse well as becoming the centre of London’s workforce increasing the cosmopolitan world renowned Tech Belt and the hub for feel to the area. -

State Street AUT UK Screened (Ex Controversies and CW) Index

Report and Financial Statements For the year ended 31st December 2020 State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund (formerly State Street UK Equity Tracker Fund) State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund Contents Page Manager's Report* 1 Portfolio Statement* 9 Director's Report to Unitholders* 27 Manager's Statement of Responsibilities 28 Statement of the Depositary’s Responsibilities 29 Report of the Depositary to the Unitholders 29 Independent Auditors’ Report 30 Comparative Table* 33 Financial statements: 34 Statement of Total Return 34 Statement of Change in Net Assets Attributable to Unitholders 34 Balance Sheet 35 Notes to the Financial Statements 36 Distribution Tables 48 Directory* 49 Appendix I – Remuneration Policy (Unaudited) 50 Appendix II – Assessment of Value (Unaudited) 52 * These collectively comprise the Manager’s Report. State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund Manager’s Report For the year ended 31st December 2020 Authorised Status The State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund (the “Fund”) is an Authorised Unit Trust Scheme as defined in section 243 of the Financial Services and Markets Act 2000 and it is a UCITS Retail Scheme within the meaning of the FCA Collective Investment Schemes sourcebook. The unitholders are not liable for the debts of the Fund. The Fund's name was changed to State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund on 18th December 2020 (formerly State Street UK Equity Tracker Fund). Investment Objective and Policy The objective of the Fund is to replicate, as closely as possible and on a “gross of fees” basis, the return of the United Kingdom equity market as represented by the FTSE All-Share ex Controversies ex CW Index (the “Index”), net of withholding taxes. -

The Uk Residential Reit

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take or the contents of this Prospectus, you are recommended to seek your own independent financial advice immediately from your stockbroker, bank, solicitor, accountant, or other appropriate independent financial adviser, who is authorised under the Financial Services and Markets Act 2000 (the FSMA) if you are in the United Kingdom, or from another appropriately authorised independent financial adviser if you are in a territory outside the United Kingdom. A copy of this document, which comprises a prospectus relating to The UK Residential REIT plc (the Company) in Annex 4, 1.6 connection with the issue of Issue Shares in the Company and their admission to trading on the Main Market and to Annex 11, 4.2 listing on the premium listing segment of the Official List, has been prepared in accordance with the UK version of the EU Prospectus Regulation (2017/1129) which is part of UK law by virtue of the European Union (Withdrawal) Act 2018 Annex 1, 1.5 (as amended and supplemented from time to time (including, but not limited to, by the UK Prospectus Amendment Annex 4, 1.5 Annex 11, 1.5 Regulations 2019 and The Financial Services and Markets Act 2000 (Prospectus) Regulations 2019)) (the UK Prospectus Annex 4, 1.6 Regulation) and the prospectus regulation rules of the Financial Conduct Authority (the FCA) (the Prospectus Regulation LR 2.2.10(2) Rules). This Prospectus has been approved by the FCA, as the competent authority under the UK Prospectus Regulation and the FCA only approves this Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation. -

UKAA Annual Conference 2017: the RESIDENT's EXPERIENCE

UKAA Annual Conference 2017: THE RESIDENT’S EXPERIENCE 8th November 2017 | 8 Northumberland Avenue, London, WC2N 5BY Conference Programme 09:15 – 09:45 Registration opens, Coffee and Networking 09:45 – 09:55 Welcome and Introductions UKAA President: Jonathon Ivory, Managing Director, Atlas Residential. Conference Moderator: Alexandra Notay, Director of Product and Service Innovation, Places for People Group. Vice-Chair, ULI UK Residential Council. Co-Chair, UKAA Events and Marketing Committee. 09:55 – 10:30 Keynote: Delivering on Customer Experience. Keynote Speaker: Michael Robey, Founder, Brilliant There is a fundamental difference between basic customer service, how it’s understood and the customer journey. There are key differences between customer service, customer experience and customer centricity. Our keynote speaker will discuss the fundamentals and delivering on the customer experience, drawing on their experience in the market place. Michael Robey has 20 years’ experience in helping organisations design and deliver engaging customer experiences that foster loyalty and drive revenue. Former roles include Head of Customer Experience for No 1. Traveller and Head of Production at Imagination creative communications agency, based in Hong Kong. 10:30 – 11:15 Expert Panel: Delivering on Customer Experience: Lessons from other industries. UKAA members understand the need to prioritise the resident but what does it take to really excel in delivering a consistently high-quality customer experience? Renowned experts from hospitality, retail and aviation share their insights and advice for the emerging Build to Rent sector. Moderator: Roger Southam, Director, Residential Management, Savills Speakers: • Aviation: John Walton, Deputy Editor, Runway Girl Network, Columnist, Australian Aviation. • Global Hospitality: John Brennan, CEO, Amaris Hospitality.