The Dominican Republic Information and Communication Technologies Market Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

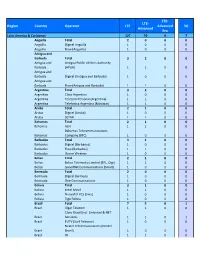

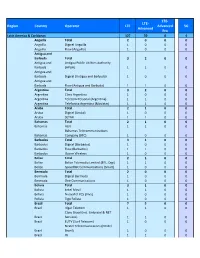

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Latin America & Caribbean 127 50 0 7 Anguilla Total 20 0 0 Anguilla Digicel Anguilla 10 0 0 Anguilla Flow (Anguilla) 10 0 0 Antigua and Barbuda Total 32 0 0 Antigua and Antigua Public Utilities Authority Barbuda (APUA) 11 0 0 Antigua and Barbuda Digicel (Antigua and Barbuda) 10 0 0 Antigua and Barbuda Flow (Antigua and Barbuda) 11 0 0 Argentina Total 32 0 0 Argentina Claro Argentina 10 0 0 Argentina Telecom Personal (Argentina) 11 0 0 Argentina Telefonica Argentina (Movistar) 11 0 0 Aruba Total 21 0 0 Aruba Digicel (Aruba) 10 0 0 Aruba SETAR 11 0 0 Bahamas Total 21 0 0 Bahamas ALIV 11 0 0 Bahamas Telecommunications Bahamas Company (BTC) 10 0 0 Barbados Total 31 0 0 Barbados Digicel (Barbados) 10 0 0 Barbados Flow (Barbados) 11 0 0 Barbados Ozone Wireless 10 0 0 Belize Total 21 0 0 Belize Belize Telemedia Limited (BTL, Digi) 11 0 0 Belize SpeedNet Communications (Smart) 10 0 0 Bermuda Total 20 0 0 Bermuda Digicel Bermuda 10 0 0 Bermuda One Communications 10 0 0 Bolivia Total 31 0 0 Bolivia Entel Movil 11 0 0 Bolivia NuevaTel PCS (Viva) 10 0 0 Bolivia Tigo Bolivia 10 0 0 Brazil Total 75 0 1 Brazil Algar Telecom 11 0 0 Claro Brasil (incl. Embratel & NET Brazil Servicos) 11 0 1 Brazil EUTV (Surf Telecom) 10 0 0 Nextel Telecomunicacoes (Nextel Brazil Brazil) 10 0 0 Brazil Oi 11 0 0 Brazil Telefonica Brasil (Vivo) 11 0 0 Brazil TIM Participacoes (TIM Brasil) 11 0 0 Cayman Islands Total 20 0 0 Cayman Islands Digicel (Cayman Islands) 10 0 0 Cayman Islands Flow (Cayman Islands) 10 -

Network List Addendum

Network List Addendum IN-SITU PROVIDED SIM CELLULAR NETWORK COVERAGE COUNTRY NETWORK 2G 3G LTE-M NB-IOT COUNTRY NETWORK 2G 3G LTE-M NB-IOT (VULINK, (TUBE, (VULINK) (VULINK) TUBE, WEBCOMM) (VULINK, (TUBE, (VULINK) (VULINK) WEBCOMM) TUBE, WEBCOMM) WEBCOMM) Benin Moov X X Afghanistan TDCA (Roshan) X X Bermuda ONE X X Afghanistan MTN X X Bolivia Viva X X Afghanistan Etisalat X X Bolivia Tigo X X Albania Vodafone X X X Bonaire / Sint Eustatius / Saba Albania Eagle Mobile X X / Curacao / Saint Digicel X X Algeria ATM Mobilis X X X Martin (French part) Algeria Ooredoo X X Bonaire / Sint Mobiland Andorra X X Eustatius / Saba (Andorra) / Curacao / Saint TelCell SX X Angola Unitel X X Martin (French part) Anguilla FLOW X X Bosnia and BH Mobile X X Anguilla Digicel X Herzegovina Antigua and Bosnia and FLOW X X HT-ERONET X X Barbuda Herzegovina Antigua and Bosnia and Digicel X mtel X Barbuda Herzegovina Argentina Claro X X Botswana MTN X X Argentina Personal X X Botswana Orange X X Argentina Movistar X X Brazil TIM X X Armenia Beeline X X Brazil Vivo X X X X Armenia Ucom X X Brazil Claro X X X Aruba Digicel X X British Virgin FLOW X X Islands Australia Optus X CCT - Carribean Australia Telstra X X British Virgin Cellular X X Islands Australia Vodafone X X Telephone Austria A1 X X Brunei UNN X X Darussalam Austria T-Mobile X X X Bulgaria A1 X X X X Austria H3G X X Bulgaria Telenor X X Azerbaijan Azercell X X Bulgaria Vivacom X X Azerbaijan Bakcell X X Burkina Faso Orange X X Bahamas BTC X X Burundi Smart Mobile X X Bahamas Aliv X Cabo Verde CVMOVEL -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Latin America & Caribbean 127 50 0 4 Anguilla Total 20 0 0 Anguilla Digicel Anguilla 10 0 0 Anguilla Flow (Anguilla) 10 0 0 Antigua and Barbuda Total 32 0 0 Antigua and Antigua Public Utilities Authority Barbuda (APUA) 11 0 0 Antigua and Barbuda Digicel (Antigua and Barbuda) 10 0 0 Antigua and Barbuda Flow (Antigua and Barbuda) 11 0 0 Argentina Total 32 0 0 Argentina Claro Argentina 10 0 0 Argentina Telecom Personal (Argentina) 11 0 0 Argentina Telefonica Argentina (Movistar) 11 0 0 Aruba Total 21 0 0 Aruba Digicel (Aruba) 10 0 0 Aruba SETAR 11 0 0 Bahamas Total 21 0 0 Bahamas ALIV 11 0 0 Bahamas Telecommunications Bahamas Company (BTC) 10 0 0 Barbados Total 31 0 0 Barbados Digicel (Barbados) 10 0 0 Barbados Flow (Barbados) 11 0 0 Barbados Ozone Wireless 10 0 0 Belize Total 21 0 0 Belize Belize Telemedia Limited (BTL, Digi) 11 0 0 Belize SpeedNet Communications (Smart) 10 0 0 Bermuda Total 20 0 0 Bermuda Digicel Bermuda 10 0 0 Bermuda One Communications 10 0 0 Bolivia Total 31 0 0 Bolivia Entel Movil 11 0 0 Bolivia NuevaTel PCS (Viva) 10 0 0 Bolivia Tigo Bolivia 10 0 0 Brazil Total 75 0 0 Brazil Algar Telecom 11 0 0 Claro Brasil (incl. Embratel & NET Brazil Servicos) 11 0 0 Brazil EUTV (Surf Telecom) 10 0 0 Nextel Telecomunicacoes (Nextel Brazil Brazil) 10 0 0 Brazil Oi 11 0 0 Brazil Telefonica Brasil (Vivo) 11 0 0 Brazil TIM Participacoes (TIM Brasil) 11 0 0 Cayman Islands Total 20 0 0 Cayman Islands Digicel (Cayman Islands) 10 0 0 Cayman Islands Flow (Cayman Islands) 10 -

2020-07-14 MASTERFILE Iots and More Whereever

Network Coverage Q3 2020 Country Network Afghanistan Etisalat MTN TDCA (Roshan) Albania Albanian Mobile Communications Eagle Mobile Vodafone Algeria ATM Mobilis Ooredoo Andorra Mobiland (Andorra) Anguilla Digicel FLOW Antigua and Barbuda Digicel FLOW Argentina Claro Movistar Armenia Beeline Ucom Aruba Digicel Australia Optus Telstra Vodafone Austria A1 H3G T-Mobile Azerbaijan Azercell Bakcell Bahamas Aliv BTC Bahrain Batelco MTC Vodafone (Zain) Bangladesh Banglalink Grameenphone Barbados Digicel FLOW Belarus MTS velcom Belgium Base Orange Proximus Belize DigiCell Benin Moov Bermuda Digicel ONE Bolivia Tigo Viva Bonaire / Sint Eustatius / Saba / Curacao / Saint MartinDigicel (French part) 1 Network Coverage Q3 2020 Country Network Telcell NV Bosnia and Herzegovina BH Mobile HT-ERONET mtel Brazil Claro TIM Vivo British Virgin Islands CCT - Carribean Cellular Telephone FLOW Brunei Darussalam B-Mobile (Progresif) DSTCom Bulgaria A1 Telenor Vivacom Burkina Faso Orange Burundi Smart Mobile Cambodia CamGSM Metfone (Viettel) Smart Cameroon MTN Canada Bell Rogers Wireless SaskTel TELUS Videotron Cape Verde CVMOVEL Unitel (T+) Cayman Islands Digicel FLOW Chad Airtel Chile Claro Entel Movistar WOM S.A. China China Mobile China Telecom China Unicom Colombia Claro Movistar Costa Rica Claro ICE Movistar Cote d'Ivoire MTN Croatia A1 T-Mobile Tele2 2 Network Coverage Q3 2020 Country Network Cyprus CYTAmobile-Vodafone MTN Primetel Czech Republic O2 T-Mobile Vodafone Democratic Republic of Congo Africell Airtel Tigo Vodacom Denmark Hi3G TDC Telenor Telia Dominica Digicel FLOW Dominican Republic Altice Claro Viva Ecuador Claro CNT Movistar Egypt Orange Vodafone El Salvador Claro Digicel Movistar Tigo Equatorial Guinea Hits Guinea Estonia Elisa Tele2 Telia Ethiopia Ethio Telecom Faroe Islands Faroese Telecom Hey Fiji / Nauru Digicel Vodafone Finland Alcom DNA Elisa Telia France Bouygues Free Mobile Orange SFR French Guiana / St Barthelemy / St. -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Latin America & Caribbean 124 46 0 1 Anguilla Total 20 0 0 Anguilla Digicel Anguilla 10 0 0 Anguilla Flow (Anguilla) 10 0 0 Antigua and Barbuda Total 32 0 0 Antigua and Barbuda Antigua Public Utilities Authority (APUA) 11 0 0 Antigua and Barbuda Digicel (Antigua and Barbuda) 10 0 0 Antigua and Barbuda Flow (Antigua and Barbuda) 11 0 0 Argentina Total 32 0 0 Argentina Claro Argentina 10 0 0 Argentina Telecom Personal (Argentina) 11 0 0 Argentina Telefonica Argentina (Movistar) 11 0 0 Aruba Total 21 0 0 Aruba Digicel (Aruba) 10 0 0 Aruba SETAR 11 0 0 Bahamas, The Total 21 0 0 Bahamas, The ALIV 11 0 0 Bahamas, The Bahamas Telecommunications Company (BTC) 10 0 0 Barbados Total 31 0 0 Barbados Digicel (Barbados) 10 0 0 Barbados Flow (Barbados) 11 0 0 Barbados Ozone Wireless 10 0 0 Belize Total 21 0 0 Belize Belize Telemedia Limited (BTL, Digi) 11 0 0 Belize SpeedNet Communications (Smart) 10 0 0 Bermuda Total 20 0 0 Bermuda Digicel Bermuda 10 0 0 Bermuda OneCommunications (OneComm) 10 0 0 Bolivia Total 31 0 0 Bolivia Entel Movil 11 0 0 Bolivia NuevaTel PCS (Viva) 10 0 0 Bolivia Tigo Bolivia 10 0 0 Brazil Total 65 0 0 Brazil Algar Telecom 11 0 0 Brazil Claro Brasil (incl. Embratel & NET Servicos) 11 0 0 Brazil Nextel Telecomunicacoes (Nextel Brazil) 10 0 0 Brazil Oi 11 0 0 Brazil Telefonica Brasil (Vivo) 11 0 0 Brazil TIM Participacoes (TIM Brasil) 11 0 0 Cayman Islands Total 20 0 0 Cayman Islands Digicel (Cayman Islands) 10 0 0 Cayman Islands Flow (Cayman Islands) 10 0 0 Chile -

A B C E F G H N P S T

This cellular phone frequency list is provided solely as a reference to help customers. Cellular carriers and frequencies change often with little or no notice. Before making a purchase or travelling abroad, B&H encourages customers to verify a phone’s service compatibility with local cellular companies. This list does not guarantee coverage or compatibility in all regions of a country. Find Your GSM Carrier by Country Name: A B C E F G H N P S T U V 2G/2.5G 3G (UMTS) / Network 4G (LTE) (EDGE) 3.5G (HSPA+) Claro 850 / 1900 850 / 1900 4 Argentina Movistar 850 / 1900 1900 4 / 28 Personal (Telecom Argentina) 1900 1900 4 / 7 / 28 2G/2.5G 3G (UMTS) / Network 4G (LTE) (EDGE) 3.5G (HSPA+) Belize Digicel 1900 850 2 / 17 2G/2.5G 3G (UMTS) / Network 4G (LTE) (EDGE) 3.5G (HSPA+) Entel Bolivia 1900 - 13 Bolivia Tigo 850 850 17 Viva (NuevaTel PCS) 1900 850 4 2G/2.5G 3G (UMTS) / Network 4G (LTE) (EDGE) 3.5G (HSPA+) Claro 900 / 1800 850 / 2100 3 / 7 / 28 Algar Telecom (CTBC) 900 / 1800 2100 3 / 28 Brazil Nextel (NII) - 2100 3 Oi 1800 2100 3 / 7 Sercomtel 900 / 1800 850 - TIM 900 / 1800 2100 3 / 7 / 28 Vivo 900 / 1800 850 / 2100 3 / 7 2G/2.5G 3G (UMTS) / Network 4G (LTE) (EDGE) 3.5G (HSPA+) Claro 1900 850 / 1900 7 / 28 Entel 1900 1900 7 / 28 Chile Movistar 1900 850 7 / 28 WOM (Nextel) - 1700 4 2G/2.5G 3G (UMTS) / Network 4G (LTE) (EDGE) 3.5G (HSPA+) Avantel 850 / 1900 1900 4 Claro 850 850 7 Colombia Movistar 850 850 / 1900 4 Tigo 1900 1900 4 / 7 3G (UMTS) 2G/2.5G Network / 3.5G 4G (LTE) (EDGE) (HSPA+) Claro 1800 2100 3 Costa Rica Kölbi (ICE) 1800 850 -

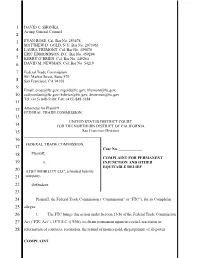

Complaint for Permanent Injunction and Other Equitable Relief

1 DAVID C. SHONKA Acting General Counsel 2 3 EVAN ROSE, Cal. Bar No. 253478 MATTHEW D. GOLD, N.Y. Bar No. 2073963 4 LAURA FREMONT, Cal. Bar No. 159670 ERIC EDMONDSON, D.C. Bar No. 450294 5 KERRY O’BRIEN, Cal. Bar No. 149264 6 DAVID M. NEWMAN, Cal. Bar No. 54218 7 Federal Trade Commission 901 Market Street, Suite 570 8 San Francisco, CA 94103 9 Email: [email protected]; [email protected]; [email protected]; 10 [email protected]; [email protected]; [email protected] Tel: (415) 848-5100; Fax: (415) 848-5184 11 12 Attorneys for Plaintiff FEDERAL TRADE COMMISSION 13 UNITED STATES DISTRICT COURT 14 FOR THE NORTHERN DISTRICT OF CALIFORNIA 15 San Francisco Division 16 FEDERAL TRADE COMMISSION, 17 Case No. ____________ 18 Plaintiff, COMPLAINT FOR PERMANENT 19 v. INJUNCTION AND OTHER EQUITABLE RELIEF 20 AT&T MOBILITY LLC, a limited liability 21 company, 22 Defendant. 23 24 Plaintiff, the Federal Trade Commission (“Commission” or “FTC”), for its Complaint 25 alleges: 26 1. The FTC brings this action under Section 13(b) of the Federal Trade Commission 27 Act (“FTC Act”), 15 U.S.C. § 53(b), to obtain permanent injunctive relief, rescission or 28 reformation of contracts, restitution, the refund of monies paid, disgorgement of ill-gotten COMPLAINT 1 monies, and other equitable relief for Defendant’s acts or practices in violation of Section 5(a) of 2 the FTC Act, 15 U.S.C. § 45(a), in connection with the marketing of wireless broadband internet 3 access service for smartphones. 4 JURISDICTION AND VENUE 5 2. -

Vivacell-MTS Roaming Partners

VivaCell-MTS Roaming Partners VivaCell-MTS has more than 400 roaming partners, which means you will be reachable almost anywhere in the world. And depending on the type of roaming provided in each network you will be able to use various services. Voice Roaming - In these networks postpaid subscribers can make and receive calls, as well as send and receive SMS. And prepaid subscribers, depending on the type of roaming activated, can send and receive SMS, as well as receive calls. CAMEL Roaming - In these networks prepaid subscribers can make and receive calls, as well as send and receive SMS. Data Roaming - In these networks all subscribers can access the Internet, send and receive MMS, as well as use other services based on data transfer. 3G Roaming - Thanks to 3G you can enjoy a higher quality of voice services and higher speeds of data transfer in these networks. Voice CAMEL Data 3G Zone / Territory Mobile Network Roaming Roaming Roaming Roaming 374 97 374 97 374 97 Georgia Geocell Georgia MagtiCom Mobitel (Beeline) CIS1 (MTS networks) Belarus MTS Russia MTS Turkmenistan MTS Ukraine MTS Uzdunrobita (MTS) Uzbekistan UzMobile CIS2 (other) BeST (Life : )) Belarus Velcom GSM Kazakhstan (Kcell) Kar-Tel (Beeline) Kazakhstan Tele2 (Neo) Altel Alpha Telecom (MegaCom) Kyrgyzstan BiMoCom NUR Telecom (O!) Voice CAMEL Data 3G Zone / Territory Mobile Network Roaming Roaming Roaming Roaming SkyMobile (Beeline) Eventis Moldova Orange Moldtelecom Baykalwestcom (Rostelecom) Beeline MegaFon MOTIV (Yekaterinburg-2000) NCC (Rostelecom) Russia New Telephone -

International Rates

INTERNATIONAL RATES DIGICEL REGIONAL FIXED & MOBILE RATES $2.99 Anguilla - Mobile Digicel 1264581, 1264582, 1264583, 1264584 Antigua & Barbuda- Mob Digicel 1268716, 1268717, 1268718, 1268719, 1268720, 1268721, 1268722, 1268724, 1268725, 1268726, 1268732, 1268734, 1268736, 1268783, 1268785, 1268788 Aruba - Mobile Digicel 297630, 297640, 297641, 29773, 29774 Barbados - Mobile Digicel 1246256, 1246257, 1246258, 1246259, 124626, 124682, 124683, 124684, 124685 Barbados - Wimax Digicel 1246530, 1246531, 1246532, 1246533, 1246534 Bermuda - Mobile Digicel 144150, 144151, 144152, 144153, 144159 Bonaire - Mobile Digicel 59970, 59978 British Virgin Isl. - Mob Digi 1284300, 1284340, 1284341, 1284342, 1284343, 1284344, 1284345, 1284346, 1284347, 1284393, 1284394 Cayman - Mobile Digicel 1345321, 1345322, 1345323, 1345324, 1345325, 1345326, 1345327, 1345328, 1345329, 1345514, 1345516, 1345517, 1345525, 1345526, 1345527, 1345529, 1345545, 1345546, 1345547, 1345548, 1345549, 1345550 Cayman - Wimax Digicel 1345623, 1345640, 1345649 Curacao - Mobile Digicel 599965, 599966, 599967, 599968, 599969 Dominica - Mobile Digicel 1767315, 1767316, 1767317, 1767420, 1767421, 1767611, 1767612, 1767613, 1767614, 1767615, 1767616, 1767617 EL Salvador - Mobile Digicel 5037072, 50370730, 50370731, 50370732, 50370733, 50370734, 503730, 503731, 503732, 503733, 5037330, 5037331, 5037332, 5037333, 5037334, 5037335, 5037336, 5037337, 5037338, 5037339, 503734, 503735, 503736, 503737, 503738, 503739, 503740, 503741, 503742, 503743, 503744, 503746, 5037695, 5037696, 5037697, -

RESOLUCIÓN No. DE-032-17

INSTITUTO DOMINICANO DE LAS TELECOMUNICACIONES (INDOTEL) RESOLUCIÓN No. DE-032-17 QUE SE PRONUNCIA SOBRE LA SOLICITUD DE AUTORIZACIÓN PARA REALIZAR LA OPERACIÓN DE FUSIÓN POR ABSORCIÓN DE LA CONCESIONARIA DE SERVICIOS PÚBLICOS DE TELECOMUNICACIONES TRICOM, S.A., A FAVOR DE ALTICE HISPANIOLA, S.A. El Instituto Dominicano de las Telecomunicaciones (INDOTEL), por órgano de su Directora Ejecutiva, en el ejercicio de las facultades legales y reglamentarias conferidas por la Ley General de Telecomunicaciones No. 153-98, de fecha 27 de mayo de 1998, dicta la siguiente RESOLUCIÓN: Con motivo de la solicitud de AUTORIZACIÓN PARA REALIZAR LA OPERACIÓN DE FUSIÓN POR ABSORCIÓN DE LA CONCESIONARIA DE SERVICIOS PÚBLICOS DE TELECOMUNICACIONES TRICOM, S.A., A FAVOR DE ALTICE HISPANIOLA, S. A. Antecedentes.- 1. En fecha 30 de abril de 1990, el Estado dominicano debidamente representado por la Secretaría de Estado de Obras Públicas y Comunicaciones suscribió con la sociedad comercial TRICOM, S. A., un Contrato de Concesión para la prestación de servicios públicos de telecomunicaciones; 2. Sin embargo, en fecha 23 de febrero de 1996 dicho contrato fue sustituido por el “Contrato de Concesión para la Operación del Servicio de Telecomunicaciones en la República Dominicana” suscrito entre el Estado dominicano debidamente representado por la Secretaría de Estado de Obras Públicas y Comunicaciones y la sociedad comercial TRICOM, S. A.; 3. Posteriormente, en fecha 2 de febrero de 2006, el Consejo Directivo del INDOTEL mediante Resolución No. 024-06, declaró adecuadas a las disposiciones de la Ley General de Telecomunicaciones No. 153-98, las autorizaciones que fueron otorgadas por la antigua Dirección General de Telecomunicaciones (DGT) a favor de la concesionaria TRICOM, S. -

Ready for Uploadgcd Wls Networks

LTE‐ Region Country Operator LTE 5G Advanced Latin America 125 49 13 Anguilla Total 20 0 Anguilla Digicel Anguilla 10 0 Anguilla Flow (Anguilla) 10 0 Antigua and Barbuda Total 32 0 Antigua and Barbuda Antigua Public Utilities Authority (APUA) 11 0 Antigua and Barbuda Digicel (Antigua and Barbuda) 10 0 Antigua and Barbuda Flow (Antigua and Barbuda) 11 0 Argentina Total 32 1 Argentina Claro Argentina 10 0 Argentina Telecom Personal (Argentina) 11 1 Argentina Telefonica Argentina (Movistar) 11 0 Aruba Total 21 0 Aruba Digicel (Aruba) 10 0 Aruba SETAR 11 0 Bahamas Total 21 0 Bahamas ALIV 11 0 Bahamas Telecommunications Company Bahamas (BTC) 10 0 Barbados Total 21 0 Barbados Digicel (Barbados) 10 0 Barbados Flow (Barbados) 11 0 Belize Total 21 0 Belize Belize Telemedia Limited (BTL, Digi) 11 0 Belize SpeedNet Communications (Smart) 10 0 Bermuda Total 20 0 Bermuda Digicel Bermuda 10 0 Bermuda One Communications 10 0 Bolivia Total 31 0 Bolivia Entel Movil 11 0 Bolivia NuevaTel PCS (Viva) 10 0 Bolivia Tigo Bolivia 10 0 Brazil Total 75 4 Brazil Algar Telecom 11 0 Brazil Claro Brasil (incl. Embratel & NET Servicos) 11 1 Claro‐nxt (formerly Nextel Brazil Telecomunicacoes) 10 0 Brazil EUTV (Surf Telecom) 10 0 Brazil Oi 11 1 Brazil Telefonica Brasil (Vivo) 11 1 Brazil TIM Brasil 11 1 Cayman Islands Total 20 0 Cayman Islands Digicel (Cayman Islands) 10 0 Cayman Islands Flow (Cayman Islands) 10 0 Chile Total 43 0 Chile Claro Chile 11 0 Chile Entel Chile 11 0 Chile Telefonica Moviles Chile (Movistar) 11 0 Chile WOM 10 0 Colombia Total 53 1 Colombia Avantel -

Country Network AWCC Etisalat MTN TDCS Roshan Alands Islands Alands Mobile Plus Vodafone ATM Mobilis Djezzy Wataniya Telecom

Country Network AWCC Etisalat Afghanistan MTN TDCS Roshan Alands Islands Alands Mobile Eagle Albania Plus Vodafone ATM Mobilis Algeria Djezzy Wataniya Telecom Andorra Andorra Telecom Movicel Angola Unitel C+W LIME Anguilla Digicel APUA Antigua & Barbuda C+W LIME Digicel Claro Argentina Telefonica Moviles Armentel Armenia K-Telecom VivaCell MTS UCOM LLC Aruba Digicel A1 Austria H3G T-Mobile Azercell Azerbaijan Azerfon Bakcell Bahamas The Bahamas Telecom Company Batelco Bahrain Zain BH Banglalink Bangladesh GrameenPhone C+W LIME Barbados Digicel MTS Belarus Velcom Base Belgium Orange Proximus Belize Belize Telecom Etisalat Benin Glo Country Network Digicel Bermuda Digital Nuevatel Bolivia Tigo Bonaire Digicel Bosnia & Herzegovenia M:tel Botswana BTC 14 Brasil Telecom Claro Brazil TIM Brasil Vivo C+W LIME British Virgin Islands Caribbean Cellular Telephone (CCT) Digicel Brunei Progresif Cellular Globul Bulgaria MobilTel EAD Burkina Faso Airtel SMART Burundi Viettel Cabrera (Goat Island) Vodafone Cadcomms Cambodia CamGSM Viettel MTN Cameroon Viettel Bell Mobility Sasktel Canada Telus Videotron CV Movel SA Cape Verde T+Telecomunicacoes SA C+W LIME Cayman Islands Digicel Central African Republic Orange Airtel Chad Tigo Claro Chile Entel Telefonica China Mobile China China Unicom Colombia Telefonica Celtel Orange Congo Tigo Vodacom Congo (Democratic Republic) Africell Congo Brazzaville Airtel (Celtel) Country Network Claro Costa Rica I.C.E Tele2 Croatia VIPNet Cuba Cubacel Curacao Digicel Cyta Cyprus MTN Primetel Turkcell Cyprus (Northern) Vodafone