Appendix: Some Source Codes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

On the Optionality and Fairness of Atomic Swaps

On the optionality and fairness of Atomic Swaps Runchao Han Haoyu Lin Jiangshan Yu Monash University and CSIRO-Data61 [email protected] Monash University [email protected] [email protected] ABSTRACT happened on centralised exchanges. To date, the DEX market volume Atomic Swap enables two parties to atomically exchange their own has reached approximately 50,000 ETH [2]. More specifically, there cryptocurrencies without trusted third parties. This paper provides are more than 250 DEXes [3], more than 30 DEX protocols [4], and the first quantitative analysis on the fairness of the Atomic Swap more than 4,000 active traders in all DEXes [2]. protocol, and proposes the first fair Atomic Swap protocol with However, being atomic does not indicate the Atomic Swap is fair. implementations. In an Atomic Swap, the swap initiator can decide whether to proceed In particular, we model the Atomic Swap as the American Call or abort the swap, and the default maximum time for him to decide is Option, and prove that an Atomic Swap is equivalent to an Amer- 24 hours [5]. This enables the the swap initiator to speculate without ican Call Option without the premium. Thus, the Atomic Swap is any penalty. More specifically, the swap initiator can keep waiting unfair to the swap participant. Then, we quantify the fairness of before the timelock expires. If the price of the swap participant’s the Atomic Swap and compare it with that of conventional financial asset rises, the swap initiator will proceed the swap so that he will assets (stocks and fiat currencies). -

FINANCIAL DERIVATIVES SAMPLE QUESTIONS Q1. a Strangle Is an Investment Strategy That Combines A. a Call and a Put for the Same

FINANCIAL DERIVATIVES SAMPLE QUESTIONS Q1. A strangle is an investment strategy that combines a. A call and a put for the same expiry date but at different strike prices b. Two puts and one call with the same expiry date c. Two calls and one put with the same expiry dates d. A call and a put at the same strike price and expiry date Answer: a. Q2. A trader buys 2 June expiry call options each at a strike price of Rs. 200 and Rs. 220 and sells two call options with a strike price of Rs. 210, this strategy is a a. Bull Spread b. Bear call spread c. Butterfly spread d. Calendar spread Answer c. Q3. The option price will ceteris paribus be negatively related to the volatility of the cash price of the underlying. a. The statement is true b. The statement is false c. The statement is partially true d. The statement is partially false Answer: b. Q 4. A put option with a strike price of Rs. 1176 is selling at a premium of Rs. 36. What will be the price at which it will break even for the buyer of the option a. Rs. 1870 b. Rs. 1194 c. Rs. 1140 d. Rs. 1940 Answer b. Q5 A put option should always be exercised _______ if it is deep in the money a. early b. never c. at the beginning of the trading period d. at the end of the trading period Answer a. Q6. Bermudan options can only be exercised at maturity a. -

Here We Go Again

2015, 2016 MDDC News Organization of the Year! Celebrating 161 years of service! Vol. 163, No. 3 • 50¢ SINCE 1855 July 13 - July 19, 2017 TODAY’S GAS Here we go again . PRICE Rockville political differences rise to the surface in routine commission appointment $2.28 per gallon Last Week pointee to the City’s Historic District the three members of “Team him from serving on the HDC. $2.26 per gallon By Neal Earley @neal_earley Commission turned into a heated de- Rockville,” a Rockville political- The HDC is responsible for re- bate highlighting the City’s main po- block made up of Council members viewing applications for modification A month ago ROCKVILLE – In most jurisdic- litical division. Julie Palakovich Carr, Mark Pierzcha- to the exteriors of historic buildings, $2.36 per gallon tions, board and commission appoint- Mayor Bridget Donnell Newton la and Virginia Onley who ran on the as well as recommending boundaries A year ago ments are usually toward the bottom called the City Council’s rejection of same platform with mayoral candi- for the City’s historic districts. If ap- $2.28 per gallon of the list in terms of public interest her pick for Historic District Commis- date Sima Osdoby and city council proved Giammo, would have re- and controversy -- but not in sion – former three-term Rockville candidate Clark Reed. placed Matthew Goguen, whose term AVERAGE PRICE PER GALLON OF Rockville. UNLEADED REGULAR GAS IN Mayor Larry Giammo – political. While Onley and Palakovich expired in May. MARYLAND/D.C. METRO AREA For many municipalities, may- “I find it absolutely disappoint- Carr said they opposed Giammo’s ap- Giammo previously endorsed ACCORDING TO AAA oral appointments are a formality of- ing that politics has entered into the pointment based on his lack of qualifi- Newton in her campaign against ten given rubberstamped approval by boards and commission nomination cations, Giammo said it was his polit- INSIDE the city council, but in Rockville what process once again,” Newton said. -

Mergers and Acquisitions - Collar Contracts

Mergers and Acquisitions - Collar Contracts An Chen University of Bonn joint with Christian Hilpert (University of Bonn) Seminar at the Institute of Financial Studies Chengdu, June 2012 Introduction Model setup and valuation Value change through WA Welfare analysis Traditional M&A deals Traditional M&A deals: two main payment methods to the target all cash deals: fixed price deal stock-for-stock exchange: fixed ratio deal Risks involved in traditional M&A transactions: Pre-closing risk: the possibility that fluctuations of bidder and target stock prices will affect the terms of the deal and reduce the likelihood the deal closes. Post-closing risk: after the closing the possible failure of the target to perform up to expectations, thus resulting in overpayment ⇒ major risk for the shareholders of the bidder An Chen Mergers and Acquisitions - Collar Contracts 2 Introduction Model setup and valuation Value change through WA Welfare analysis Pre-closing instruments: Collars Collars were introduced to protect against extreme price fluctuations in the share prices of bidder and target: Fixed price collars and fixed ratio collars Collar-tailored M&A deals have both characteristics of traditional all-cash or stock-for-stock deals. Collars can be used by bidders to cap the payout to selling shareholders An Chen Mergers and Acquisitions - Collar Contracts 3 Introduction Model setup and valuation Value change through WA Welfare analysis Fixed price collar (taken from Officer (2004)) First Community Banccorp Inc. - Banc One Corp., 1994, with K = 31.96$, U = 51$, L = 47$, a = 0.6267, and b = 0.68. 34 33 32 Payoff 31 30 29 44 46 48 50 52 54 Bidder stock price An Chen Mergers and Acquisitions - Collar Contracts 4 Introduction Model setup and valuation Value change through WA Welfare analysis Fixed ratio collar (taken from Officer (2004)) BancFlorida Financial Corp. -

Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces

DEGREE PROJECT IN MATHEMATICS, SECOND CYCLE, 30 CREDITS STOCKHOLM, SWEDEN 2020 Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON KTH ROYAL INSTITUTE OF TECHNOLOGY SCHOOL OF ENGINEERING SCIENCES Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON Degree Projects in Mathematical Statistics (30 ECTS credits) Master's Programme in Applied and Computational Mathematics (120 credits) KTH Royal Institute of Technology year 2020 Supervisor at Nasdaq Technology AB: Sebastian Lindberg Supervisor at KTH: Fredrik Viklund Examiner at KTH: Fredrik Viklund TRITA-SCI-GRU 2020:081 MAT-E 2020:044 Royal Institute of Technology School of Engineering Sciences KTH SCI SE-100 44 Stockholm, Sweden URL: www.kth.se/sci Abstract The implied volatility surface plays an important role for Front office and Risk Manage- ment functions at Nasdaq and other financial institutions which require mark-to-market of derivative books intraday in order to properly value their instruments and measure risk in trading activities. Based on the aforementioned business needs, being able to calibrate an end of day implied volatility surface based on new market information is a sought after trait. In this thesis a statistical learning approach is used to calibrate the implied volatility surface intraday. This is done by using OMXS30-2019 implied volatil- ity surface data in combination with market information from close to at the money options and feeding it into 3 Machine Learning models. The models, including Feed For- ward Neural Network, Recurrent Neural Network and Gaussian Process, were compared based on optimal input and data preprocessing steps. -

A Tree-Based Method to Price American Options in the Heston Model

The Journal of Computational Finance (1–21) Volume 13/Number 1, Fall 2009 A tree-based method to price American options in the Heston model Michel Vellekoop Financial Engineering Laboratory, University of Twente, PO Box 217, 7500 AE Enschede, The Netherlands; email: [email protected] Hans Nieuwenhuis University of Groningen, Faculty of Economics, PO Box 800, 9700 AV Groningen, The Netherlands; email: [email protected] We develop an algorithm to price American options on assets that follow the stochastic volatility model defined by Heston. We use an approach which is based on a modification of a combined tree for stock prices and volatilities, where the number of nodes grows quadratically in the number of time steps. We show in a number of numerical tests that we get accurate results in a fast manner, and that features which are essential for the practical use of stock option pricing algorithms, such as the incorporation of cash dividends and a term structure of interest rates, can easily be incorporated. 1 INTRODUCTION One of the most popular models for equity option pricing under stochastic volatility is the one defined by Heston (1993): 1 dSt = µSt dt + Vt St dW (1.1) t = − + 2 dVt κ(θ Vt ) dt ω Vt dWt (1.2) In this model for the stock price process S and squared volatility process V the processes W 1 and W 2 are standard Brownian motions that may have a non-zero correlation coefficient ρ, while µ, κ, θ and ω are known strictly positive parameters. -

Tracking and Trading Volatility 155

ffirs.qxd 9/12/06 2:37 PM Page i The Index Trading Course Workbook www.rasabourse.com ffirs.qxd 9/12/06 2:37 PM Page ii Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Aus- tralia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers’ professional and personal knowledge and understanding. The Wiley Trading series features books by traders who have survived the market’s ever changing temperament and have prospered—some by reinventing systems, others by getting back to basics. Whether a novice trader, professional, or somewhere in-between, these books will provide the advice and strategies needed to prosper today and well into the future. For a list of available titles, visit our web site at www.WileyFinance.com. www.rasabourse.com ffirs.qxd 9/12/06 2:37 PM Page iii The Index Trading Course Workbook Step-by-Step Exercises and Tests to Help You Master The Index Trading Course GEORGE A. FONTANILLS TOM GENTILE John Wiley & Sons, Inc. www.rasabourse.com ffirs.qxd 9/12/06 2:37 PM Page iv Copyright © 2006 by George A. Fontanills, Tom Gentile, and Richard Cawood. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the web at www.copyright.com. -

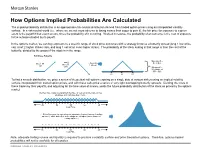

How Options Implied Probabilities Are Calculated

No content left No content right of this line of this line How Options Implied Probabilities Are Calculated The implied probability distribution is an approximate risk-neutral distribution derived from traded option prices using an interpolated volatility surface. In a risk-neutral world (i.e., where we are not more adverse to losing money than eager to gain it), the fair price for exposure to a given event is the payoff if that event occurs, times the probability of it occurring. Worked in reverse, the probability of an outcome is the cost of exposure Place content to the outcome divided by its payoff. Place content below this line below this line In the options market, we can buy exposure to a specific range of stock price outcomes with a strategy know as a butterfly spread (long 1 low strike call, short 2 higher strikes calls, and long 1 call at an even higher strike). The probability of the stock ending in that range is then the cost of the butterfly, divided by the payout if the stock is in the range. Building a Butterfly: Max payoff = …add 2 …then Buy $5 at $55 Buy 1 50 short 55 call 1 60 call calls Min payoff = $0 outside of $50 - $60 50 55 60 To find a smooth distribution, we price a series of theoretical call options expiring on a single date at various strikes using an implied volatility surface interpolated from traded option prices, and with these calls price a series of very tight overlapping butterfly spreads. Dividing the costs of these trades by their payoffs, and adjusting for the time value of money, yields the future probability distribution of the stock as priced by the options market. -

THE BLACK-SCHOLES EQUATION in STOCHASTIC VOLATILITY MODELS 1. Introduction in Financial Mathematics There Are Two Main Approache

THE BLACK-SCHOLES EQUATION IN STOCHASTIC VOLATILITY MODELS ERIK EKSTROM¨ 1,2 AND JOHAN TYSK2 Abstract. We study the Black-Scholes equation in stochastic volatility models. In particular, we show that the option price is the unique classi- cal solution to a parabolic differential equation with a certain boundary behaviour for vanishing values of the volatility. If the boundary is at- tainable, then this boundary behaviour serves as a boundary condition and guarantees uniqueness in appropriate function spaces. On the other hand, if the boundary is non-attainable, then the boundary behaviour is not needed to guarantee uniqueness, but is nevertheless very useful for instance from a numerical perspective. 1. Introduction In financial mathematics there are two main approaches to the calculation of option prices. Either the price of an option is viewed as a risk-neutral expected value, or it is obtained by solving the Black-Scholes partial differ- ential equation. The connection between these approaches is furnished by the classical Feynman-Kac theorem, which states that a classical solution to a linear parabolic PDE has a stochastic representation in terms of an ex- pected value. In the standard Black-Scholes model, a standard logarithmic change of variables transforms the Black-Scholes equation into an equation with constant coefficients. Since such an equation is covered by standard PDE theory, the existence of a unique classical solution is guaranteed. Con- sequently, the option price given by the risk-neutral expected value is the unique classical solution to the Black-Scholes equation. However, in many situations outside the standard Black-Scholes setting, the pricing equation has degenerate, or too fast growing, coefficients and standard PDE theory does not apply. -

Interest-Rate Caps, Collars, and Floors

November 1989 Interest-Rate Caps, Collars, and Floors Peter A. Abken As some of the newest interest-rate risk management instruments, caps, collars, and floors are the subject of increasing attention among both investors and analysts. This article explains how such instruments are constructed, discusses their credit risks, and presents a new approach for valuing caps, collars, and floors subject to default risk. 2 ECONOMIC REVIEW, NOVEMBER/DECEMBER 1989 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis November 1989 ince the late 1970s interest rates on all types of fixed-income securities have What Is an Interest-Rate Cap? Sbecome more volatile, spawning a va- riety of methods to mitigate the costs associ- An interest-rate cap, sometimes called a ceil- ated with interest-rate fluctuations. Managing ing, is a financial instrument that effectively interest-rate risk has become big business and places a maximum amount on the interest pay- an exceedingly complicated activity. One facet ment made on floating-rate debt. Many busi- of this type of risk management involves buying nesses borrow funds through loans or bonds on and selling "derivative" assets, which can be which the periodic interest payment varies used to offset or hedge changes in asset or according to a prespecified short-term interest liability values caused by interest-rate move- rate. The most widely used rate in both the caps ments. As its name implies, the value of a de- and swaps markets is the London Interbank rivative asset depends on the value of another Offered Rate (LIBOR), which is the rate offered asset or assets. -

Are Defensive Stocks Expensive? a Closer Look at Value Spreads

Are Defensive Stocks Expensive? A Closer Look at Value Spreads Antti Ilmanen, Ph.D. November 2015 Principal For several years, many investors have been concerned about the apparent rich valuation of Lars N. Nielsen defensive stocks. We analyze the prices of these Principal stocks using value spreads and find that they are not particularly expensive today. Swati Chandra, CFA Vice President Moreover, valuations may have limited efficacy in predicting strategy returns. This piece lends insight into possible reasons by focusing on the contemporaneous relation (i.e., how changes in value spreads are related to returns over the same period). We highlight a puzzling case where a defensive long/short strategy performed well during a recent two- year period when its value spread normalized from abnormally rich levels. For most asset classes, cheapening valuations coincide with poor performance. However, this relationship turns out to be weaker for long/short factor portfolios where several mechanisms can loosen the presumed strong link between value spread changes and strategy returns. Such wedges include changing fundamentals, evolving positions, carry and beta mismatches. Overall, investors should be cognizant of the tenuous link between value spreads and returns. We thank Gregor Andrade, Cliff Asness, Jordan Brooks, Andrea Frazzini, Jacques Friedman, Jeremy Getson, Ronen Israel, Sarah Jiang, David Kabiller, Michael Katz, AQR Capital Management, LLC Hoon Kim, John Liew, Thomas Maloney, Lasse Pedersen, Lukasz Pomorski, Scott Two Greenwich Plaza Richardson, Rodney Sullivan, Ashwin Thapar and David Zhang for helpful discussions Greenwich, CT 06830 and comments. p: +1.203.742.3600 f: +1.203.742.3100 w: aqr.com Are Defensive Stocks Expensive? A Closer Look at Value Spreads 1 Introduction puzzling result — buying a rich investment, seeing it cheapen, and yet making money — in Are defensive stocks expensive? Yes, mildly, more detail below. -

307439 Ferdig Master Thesis

Master's Thesis Using Derivatives And Structured Products To Enhance Investment Performance In A Low-Yielding Environment - COPENHAGEN BUSINESS SCHOOL - MSc Finance And Investments Maria Gjelsvik Berg P˚al-AndreasIversen Supervisor: Søren Plesner Date Of Submission: 28.04.2017 Characters (Ink. Space): 189.349 Pages: 114 ABSTRACT This paper provides an investigation of retail investors' possibility to enhance their investment performance in a low-yielding environment by using derivatives. The current low-yielding financial market makes safe investments in traditional vehicles, such as money market funds and safe bonds, close to zero- or even negative-yielding. Some retail investors are therefore in need of alternative investment vehicles that can enhance their performance. By conducting Monte Carlo simulations and difference in mean testing, we test for enhancement in performance for investors using option strategies, relative to investors investing in the S&P 500 index. This paper contributes to previous papers by emphasizing the downside risk and asymmetry in return distributions to a larger extent. We find several option strategies to outperform the benchmark, implying that performance enhancement is achievable by trading derivatives. The result is however strongly dependent on the investors' ability to choose the right option strategy, both in terms of correctly anticipated market movements and the net premium received or paid to enter the strategy. 1 Contents Chapter 1 - Introduction4 Problem Statement................................6 Methodology...................................7 Limitations....................................7 Literature Review.................................8 Structure..................................... 12 Chapter 2 - Theory 14 Low-Yielding Environment............................ 14 How Are People Affected By A Low-Yield Environment?........ 16 Low-Yield Environment's Impact On The Stock Market........