2019 Annual Financial Statements & Reports

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

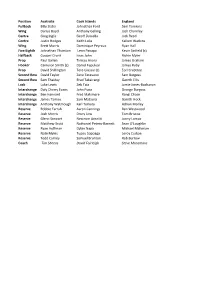

Position Australia Cook Islands England Fullback Billy Slater

Position Australia Cook Islands England Fullback Billy Slater Johnathan Ford Sam Tomkins Wing Darius Boyd Anthony Gelling Josh Charnley Centre Greg Inglis Geoff Daniella Jack Reed Centre Justin Hodges Keith Lulia Kallum Watkins Wing Brett Morris Dominique Peyroux Ryan Hall Five Eighth Johnathan Thurston Leon Panapa Kevin Sinfield (c) Halfback Cooper Cronk Issac John Richie Myler Prop Paul Gallen Tinirau Arona James Graham Hooker Cameron Smith (c) Daniel Fepuleai James Roby Prop David Shillington Tere Glassie (c) Eorl Crabtree Second Row David Taylor Zane Tetevano Sam Burgess Second Row Sam Thaiday Brad Takairangi Gareth Ellis Lock Luke Lewis Zeb Taia Jamie Jones-Buchanan Interchange Daly Cherry Evans John Puna George Burgess Interchange Ben Hannant Fred Makimare Rangi Chase Interchange James Tamou Sam Mataora Gareth Hock Interchange Anthony Watmough Karl Temata Adrian Morley Reserve Robbie Farrah Aaron Cannings Ben Westwood Reserve Josh Morris Drury Low Tom Briscoe Reserve Glenn Stewart Neccrom Areaiiti Jonny Lomax Reserve Matthew Scott Nathaniel Peteru-Barnett Sean O'Loughlin Reserve Ryan Hoffman Dylan Napa Michael Mcllorum Reserve Nate Myles Tupou Sopoaga Leroy Cudjoe Reserve Todd Carney Samuel Brunton Rob Burrow Coach Tim Sheens David Fairleigh Steve Mcnamara Fiji France Ireland Italy Jarryd Hayne Tony Gigot Greg McNally James Tedesco Lote Tuqiri Cyril Stacul John O’Donnell Anthony Minichello (c) Daryl Millard Clement Soubeyras Stuart Littler Dom Brunetta Wes Naiqama (c) Mathias Pala Joshua Toole Christophe Calegari Sisa Waqa Vincent -

Stars Shine at the Downer Nines! the Downer Rugby League World Cup 9S Was One of the Most 4 Exciting Weekends of Football in 2019

Issue 17 December 2019 PAGE Stars shine at the Downer Nines! The Downer Rugby League World Cup 9s was one of the most 4 exciting weekends of football in 2019. 2 Hydrogen: a key energy 7 Walkin’ in a ginger 8 Maryborough celebrates source of the future wonderland 150 golden years 2 Issue 17 December 2019 THOUGHT LEADERSHIP CONTRACT WINS Hydrogen can be a key energy source in a zero-emissions future There is no doubt that the power generation industry is the most disrupted of all industries. The unholy trinity of climate By Pat Burke change, perceived soaring energy prices and legislative Executive General Manager, uncertainty underlined by an ageing workforce, increasing Asset Services activism and changing market fundamentals have combined to create a sector facing considerable uncertainty. Many traditional energy sources are becoming clear example of the advancements being made And, perhaps most importantly, we need to unsustainable, not to mention unpopular in the development of these new technologies. convince a sceptical public it can be safely stored, among a growing section of the population. and used in their cars and in public transport. I also saw advances in retrofitting existing The energy market is changing quicker than plant to better cope with changed operating For Downer, a move towards hydrogen energy most expected. There are also conflicting parameters, improve efficiency, reduce would also present many opportunities. views on which decarbonisation technologies emissions or even convert gas turbines to We have a strong reputation for the provision will most likely progress, and what the current handle hydrogen. of safe and reliable operational services status and development roadmap of those across a diversified range of commodities These technologies are directly applicable to technologies actually looks like. -

Queensland Women's Representative Player Numbers 1. Karyn Murphy 2

Queensland Women’s Representative Player Numbers 1. Karyn Murphy 31. Tracy Bailey 61. Tammy Cole 91. Tui Cope 2. Erica Ross 32. Raylee Taka 62. Anne Marie Burki 92. Natasha Baggow 3. Teresa Anderson 33. Selena Barry 63. Jasmine Green 93. Natalie Gala 4. Karen Shaw 34. Lisa Elkins 64. Casey Watkins 94. Kaitlin Moss 5. Tammy Pohatu 35. Neena Fraser 65. Suzanne Johnson 95. Amber Saltner 6. Tracey Thompson 36. Erin Elliot 66. Rachele Whelan 96. Jenni-Sue Hoepper 7. Annie Banks 37. Jaye Christensen 67. Bianca Ambrum 97. Nicole Richards 8. Debbie Merritt 38. Tracey Musgrove 68. Hayley Vankempen 98. Talia Poutini-Lawrence 9. Karen Stuart 39. Michelle Mercy 69. Alisha Creed 99. Kellye Hodges 10. Kellie Batchelor 40. Rebecca Tavo 70. Tania Davis 100. Annette Brander 11. Kirsty Taylor 41. Tarah Westera 71. Alex Robertson 101. Kady Tinker 12. Veronica White 42. Leah Williams 72. Tegan Rolfe 102. Brittany Breayley 13. Jodie Billing 43. Joanne Barrett 73. Amie Solomona 103. Teri Nukunuku 14. Kerri Shiplock 44. Steph Hancock 74. Renae Kunst 104. Jazmyn Taumafai 15. Megan Stiffler 45. Rosie Su’emalo Aleki 75. Deanna Turner 105. Aleasha Brider 16. Gina Sterling 46. Kirisitina Bethell 76. Naomi Bobongie 106. Chelsea Baker 17. Debbie Mulhern 47. Rebecca Jones 77. Ashley Oberleuter 107. Kody House 18. Sharon Mitchell-Cowan 48. Caroline White 78. Nive MoeFaauo 108. Latoya Billy 19. Kellie O'Doherty 49. Cindy Reid 79. Latisha Gary 109. Courtney Lockwood 20. Yvonne O'Neil 50. Aimee Gilbert 80. Heather Ballinger 110. Carly Bell 21. Liz Ryan 51. Claudia Kumeroa 81. -

Round 232021

FRONTTHE ROW ROUND 23 2021 VOLUME 2 · ISSUE 24 PARTY AT THE BACK Backs and halves dominate the Run rabbit run rookie class of 2021 TheBiggestTiger zones in on a South Sydney superstar! INSIDE: ROUND 23 PROGRAM - SQUAD LISTS, PREVIEWS & HEAD TO HEAD STATS, R22 REVIEWED LEAGUEUNLIMITED.COM AUSTRALIA’S LEADING INDEPENDENT RUGBY LEAGUE WEBSITE THERE IS NO OFF-SEASON 2 | LEAGUEUNLIMITED.COM | THE FRONT ROW | VOL 2 ISSUE 24 What’s inside From the editor THE FRONT ROW - VOL 2 ISSUE 24 Tim Costello From the editor 3 It's been an interesting year for break-out stars. Were painfully aware of the lack of lower-grade rugby league that's been able Feature Rookie Class of 2021 4-5 to be played in the last 18 months, and the impact that's going to have on development pathways in all states - particularly in History Tommy Anderson 6-7 New South Wales. The results seems to be that we're getting a lot more athletic, backline-suited players coming through, with Feature The Run Home 8 new battle-hardened forwards making the grade few and far between. Over the page Rob Crosby highlights the Rookie Class Feature 'Trell' 9 of 2021 - well worth a read. NRL Ladder, Stats Leaders 10 Also this week thanks to Andrew Ferguson, we have a footy history piece on Tommy Anderson - an inaugural South Sydney GAME DAY · NRL Round 23 11-27 player who was 'never the same' after facing off against Dally Messenger. The BiggestTiger's weekly illustration shows off the LU Team Tips 11 speed and skill of Latrell Mitchell, and we update the run home to the finals with just three games left til the September action THU Gold Coast v Melbourne 12-13 kicks off. -

Get More Data, Look More Smarter

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll SPORT McCrone a Roo in the making Faith in Moses to deliver title New rules to end mass debates NEWS Canberra coach Ricky Stuart dangled a big, fat MOSES Wigness has taken over the reins again at MANLY coach Geoff Toovey says captain Jamie Lyon representative jersey carrot in front of Josh McCrone Brothers Rugby League club for the 2014 season. won’t have to change his on-field approach to when convincing him to switch to hooker full-time. Wigness, who coached the club for three years and referees despite recent NRL rule changes. Lyon and Stuart, who left Parramatta to coach the Raiders won the 2010 and 2011 premierships, replaces Canterbury’s Michael Ennis are seen as two of the after the sacking of David Furner, has wasted no time Anthoiny Castro who had held the position for the game’s leading debaters when it comes to arguing stamping his authority on his new team, training past two seasons. The club’s seniors sign-on day is at with match officials. But they are set to be stymied them in 40C heat and sending them to a week-long Airport Tavern today from 1pm. Brothers spokesman by a new law that limits where and when captains elite training camp. The former NSW and Australia John Adams said the club wanted to regain the can speak to refs. Under new rules captains will only coach has seen big potential for McCrone at hooker. premiership that they lost to Palmerston last year. be able to speak to refs during a stoppage in play. -

Special NRL Grand Final Wrap-Around

South Sydney supporters talk of their love for the red and green Dream come true! Compiled by Renee Louise Azzopardi Laura Buzo, Mascot the game. I guess growing What are three qualities you field with Greg Inglis. No up in the Souths region had think make a true souths fan? team would measure up! a great influence on me. Loyalty. Support. Never- say-die attitude. Where will you be on grand Who is your favourite player final day and how will you and why? Where will you be on grand celebrate? Sam Burgess, because he final day and how will you This year I will be watching George Burgess (or is it Tom?), Kirisome Auva’a and Joel Reddy at Redfern Oval Photo: Kat Hines uses his full ability during celebrate? the grand final with my mum, an 80-minute game and is an If not at the game, I will grandma and friends. My inspiration to the rest of the gather some family and friends and I will get dressed team by leading the charge. friends to my place, have a up with red and green wigs Building up to JOEL BoRG, 14 large TV screen viewing of and face paint and we will What do you think Russell the game and when Souths jump up with joy when What does being a souths fan Crowe and Michael Maguire win I will enjoy the evening Souths win. I will re-watch something special mean to you? have brought to the club? celebrating with a party – I’ll the highlights after the grand I look forward to games Russell Crowe was able to bring out my very best scotch! final is played. -

Dejosh Addo-Carr and Ash Taylor Want to Inspire

TEAM LISTS STAT ATTACK SCORES AROUND THE COUNTRY + ALEX JOHNSTON ENNIS ON RAIDERS RIVALRY BULLDOGS TEAM POSTER ROUND 10 Volume 99. No.10. May 10-16 2018 Twitter & Facebook: @bigleaguemag STATISTICAL FORM GUIDE Our algorithm reveals surprise Origin teams DEJosh Addo-Carr and Ash Taylor want to inspire the next wave of Indigenous stars Join the Ultimate Team on Game Day Live Across Australia Head to NRL Nation Radio for where you can hear all the action Brett Brenton Renee Kimmorley Speed Gartner Gary Russell Belcher Barwick Brent Luke Chris Tate Lewis Warren Scott Sattler Scott Prince Laurie Steve ‘Blocker’ Daley Roach The NRL Nation team brings you closer to all the league action 4 games per round, as well as Join the conversation 1300 94 93 95 KICKING PAMELA OFF WHALEY EW things make me prouder to be an FNRL supporter than Indigenous Round. Ilovethewaywe’reabletoembrace everything that makes the game we love sospecial–ourdiversity.Someofthe bestplayerstoeverlaceonaboothave beenIndigenousandtheycontinuetobe, even this weekend. But more than being able to celebrate our amazing athletes and their culture, this week is about showing Indigenous communities that they’re important, we appreciate them and we acknowledge their struggles. This yeareachplayerandofficialwillbewearing Indigenous inspired jerseys – many of which have been designed with the help of some past and present Indigenous players. E all know the brilliant work that WAboriginal champions Johnathan ThurstonandGregInglisdofortheir communities and cultures, but the two young men on our cover are the next generation of leaders ready to step up to theplate.JoshAddo-CarrandAshTaylor bothidolised‘JT’and‘GI’whentheywere growingup,andtheiraimistoberole models for a new wave of Indigenous youthwhoneedsomeonetolookupto. -

36 Years Old 2018 KING GAL and Still the NRLCEO MVP

SEASON GUIDE 36 years old 2018 KING GAL and still the NRLCEO MVP... 500+ Player Stats Team Previews Top 100 from 2017 Ask The Experts Rookie Watch Super League Scouting NRLCEO.com.au - $10.00 25 METRE EATERS INTRODUCTION Welcome CEOs, Table of Contents Broncos........................................ 14 2018 marks the sixth year of producing ‘The Bible’ – we can’t believe it! What started off as a bit of office procrastination over the Christmas period has now (Click on any link below to go straight to the page) Bulldogs....................................... 16 blossomed into what you see before you here – the ultimate asset for success in NRLCEO! We have been busy this off-season scouring news articles, blogs and forums Tips From The Board Room.............................. 3 Cowboys...................................... 18 for any ‘gold’ that can be used in the draft. After all, knowledge is power and in purchasing this Guide, you have made the first step towards NRLCEO success! Steve Menzies Stole Our Name......................... 4 Dragons........................................ 20 We can’t wait for the NRL season to kick off and as loyal NRLCEO fans, we are certain that you can’t wait for your respective drafts – arguably the best time Eels............................................... 22 of the year! Interview with the Champion............................. 5 A big thank you goes to the small NRLCEO Crew that helps put this Guide Knights......................................... 24 together – there’s only four of us! Our graphic designer, Scott is the master Supporters League............................................ 6 of the pixel. He’s given the Season Guide a real professional look. If you like his work and want to hire him for some design services, then check out Panthers...................................... -

August 16 2018.Pdf

INSIDE ❘ TEAM LISTS ❘ STAT ATTACK ❘ NRL FANTASY ❘ CLUB NEWS DYLANWALKER ❘ DEANWHARE❘ BEN HUNT ❘ TRYLESSTRADITIONS❘PANTHERSPOSTER+MORE ROUND 23 Volume 99. No.23. August 16-22 2018 Twitter & Facebook: @bigleaguemag o ex ONE OF .. Makeshift e a Wests Tigers.. the back in .... game.. of the season.. KICKIN DID On-fireRoostershave OFF PIEPERS room to improve PAREathoughtforDragonsfansatthis Stime of year – they must currently be HE Roostersmaybesittingatthe that’s disappointing, but it’s something having the least-enjoyable déjà vu in the topofthetableafteragrittywin tobecomebetterat,sothat’sastart.” NRLcommunity.Justwhenitseemedlike Tover fellow minor premiership One area the team have been they’dshakenoffthescarsoflastyear’s contenders the Rabbitohs, but injured focused on is improving their final-day heartbreak and secured their spot propJaredWaerea-Hargreavesadmits defence and this was evident in in the finals, they’ve now lost five of their theteamaren’tattheirbestyet. Friday’s match. Waerea-Hargreaves last six, lost both the leader of their forward “Obviouslywe’vebeenplaying racked up 33 tackles, which was more packandtheircaptainandkeyplaymaker some good footy, but we know we’ve thanhisoppositionpropsThomasand toinjury,andfacewhatcouldbeatricky stillgotalottoimproveon.Thelast GeorgeBurgess,whomade22and runhomeagainstsidesthathaveregularly threeweekswe’veconceded14or By DARCIE 24 tackles respectively. causedthemtroublenomatterwhere 20points,sowe’vegottocontinueto McDONALD “Inthepastthreeweekswe’ve theysitontheladder.Shouldtheyloseto @DarcieMcDonald -

Download the Trophy Cabinet

ACT Heritage Library Heritage ACT Captain of the Canberra Raiders Mal Meninga holding up the Winfield Cup to proud fans after the team won the club’s first premiership against Balmain, 1989. The Trophy CabINeT Guy Hansen Rugby league is a game that teaches you lessons. My big lesson Looking back to those days I realise that football was very much came in 1976 when the mighty Parramatta Eels were moving in part of the fabric of the Sydney in which I grew up. The possibility a seemingly unstoppable march towards premiership glory. As of grand final glory provided an opportunity for communities to a 12-year-old, the transformation of Parramatta from perennial take pride in the achievements of the local warriors who went cellar-dwellers was a formative event. I had paid my dues with into battle each weekend. Winning the premiership for the first fortnightly visits to Cumberland Oval and was confident that a time signalled the coming of age for a locality and caused scenes Parramatta premiership victory was just around the corner. In the of wild celebration. Parramatta’s victory over Newtown in 1981 week before the grand final I found myself sitting on a railway saw residents of Sydney’s western city spill onto the streets in bridge above Church Street, Parramatta, watching Ray Higgs, a spontaneous outpouring of joy. Children waved flags from the the legendary tackling machine and Parramatta captain, lead family car while Dad honked the horn. Some over-exuberant fans the first-grade team on a parade through the city. -

Beyond the Broncos Leadership Camp Act for Kids Indigenous Round Beyond the Broncos Leadership Camp

ISSUE 11 inBRONCOS the community BEYOND THE BRONCOS LEADERSHIP CAMP ACT FOR KIDS INDIGENOUS ROUND BEYOND THE BRONCOS LEADERSHIP CAMP OVER 50 STUDENTS TOOK PART IN THE BIGGEST BEYOND THE BRONCOS LEADERSHIP CAMP TO DATE. Participants travelled from all over Queensland and northern New South Wales to join program ambassadors Scott Prince, Justin Hodges and Ali Brigginshaw as they explored the 2020 theme Your Voice, Your Story. The program included a host of activities, with students visiting the Queensland Art Gallery, a theatre sport component with Grin & Tonic and an Aboriginal Astrology session with Krystal De Napoli a local Cultural Astronomer. Students were also treated to guest speakers including recently retired Broncos player Darius Boyd, as well as a welcome from Ann Keep of the University of Queensland ATSIS Unit, Karla Hume from Kmart and a special video message from elder Aunty Ruth Hegarty. 2 BRONCOS IN THE COMMUNITY it was a life-changing experience for all involved, not just the students SCOTT PRINCE Broncos Ambassador The experience proved to be extremely emotional and inspiring for the students, with all going home with a renewed sense of pride in their culture and excitement for what their future holds. “I met so many new friends and have a new found confidence in myself.” said student Shayla McGill. The Beyond the Broncos program is proudly supported by the Federal Government. BRONCOS IN THE COMMUNITY 3 PARLIAMENTARY SHOWCASE Broncos CEO, Paul White, former club greats and current Brisbane Broncos NRWL stars hosted a special meet and greet at Parliament House to showcase the impact of the work the Broncos do off the field. -

Sir Peter Leitch Club at MT SMART STADIUM, HOME of the MIGHTY VODAFONE WARRIORS

Sir Peter Leitch Club AT MT SMART STADIUM, HOME OF THE MIGHTY VODAFONE WARRIORS 5th September 2018 Newsletter #233 Congratulations to the Vodafone Warriors on making the 2018 NRL Finals Congratulations Simon on playing your 300th game for the Vodafone Warriors we hope you enjoyed the night as we all did. Photos courtesy of www.photosport.nz Bloody, Penrith, Dragons and Broncos...give me a break By David Kemeys Former Sunday Star-Times Editor, Former Editor-in-Chief Suburban Newspapers, Long Suffering Warriors Fan HIS IS why I am not an NRL tipster. TLast week I boldly opined that to get a home game we would need to beat the Raiders – which happened – and have results go our way – which didn’t. The Storm did not beat the Panthers and blew the Minor Premiership, buggering everything. The Roosters, as predicted, were way too good for the Eels and snatched the Minor Premiership. Souths ended their slump by beating a Tigers side that barely looked interested to finish third. The Sharks at least made me look semi-competent, beating the Dogs to go fourth. The Panthers, as mentioned, pulled off an upset no-one saw coming, and that left them in fifth. The Broncos crushed Manly and rose to sixth, only failing to edge the Panthers – having finished on the same points and differential – because they had more points conceded. The Dragons beat Newcastle yet dropped to seventh. All of which saw us, despite our win over Canberra, at an almost disappointing eighth. Being there is the only thing, and our last finals experience in 2011 took us all the way to the final from the same spot, so why not again? It’s doubtful even if I wish I could say differently, but I cannot see it happening.