Somerset Ballpark Somerville, New Jersey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Somerset Patriots (41-26) @ Lancaster Barnstormers (36-30)

SOMERSET PATRIOTS SIX-TIME ATLANTIC LEAGUE CHAMPIONS 1 Patriots Park * Bridgewater, NJ 08807 * 908.252.0700 www.somersetpatriots.com Somerset Patriots (41-26) @ Lancaster Barnstormers (36-30) Game #68 Friday, June 30th * 6:30 pm ET * Clipper Magazine Stadium * Lancaster, Pennsylvania On The Air: WCTC-AM 1450; WCTCam.com Twitter: @SOMPatriots @MarcSchwartz26 @ChrisDrabik PATRIOTS BREAKDOWN Series at a Glance Home Road Overall Friday (6:30 pm) SOM [RHP] Will Oliver (3-0, 3.25 ERA) vs LAN [RHP] Brad Bergesen (4-5, 4.26 ERA) Season: 25-12 16-14 41-26 Saturday (6:30 pm) SOM [LHP] Logan Darnell (3-2, 4.34 ERA) vs LAN [LHP] Tommy Shirley (0-1, 13.50 ERA) Day: 9-2 6-4 15-6 Sunday (2:00 pm) SOM [RHP] David Kubiak (3-6, 3.37 ERA) vs LAN [RHP] Bryan Evans (5-2, 5.13 ERA) Night: 16-10 10-10 26-20 1-Run Gm: 8-3 2-5 10-8 2-Run Gm: 1-3 4-3 5-6 3-Run Gm: 2-4 1-1 3-5 PROMOTION-A-PALOOZA: 2017 has featured three different Somerset Patriots vs. Barnstormers 4+Run Gm: 13-2 9-5 22-7 Patriots earning a promotion to Major League clubs, tying a franchise record set in in 2017 Extras: 6-3 1-0 7-3 2008: OF Chris Marrero (SFG), RHP Tyler Cloyd (SEA) and LHP Nik Turley (MIN). Date SITE RESULT Hit a HR: 10-4 9-4 19-8 Marrero played in 37 games here in 2015, Turley appeared in 10 games (8 GS) in 04/21 vs LAN W, 2-1 (10) 04/22 vs LAN W, 5-4 No HR: 14-8 7-9 21-17 2016 and Cloyd made three starts with the Patriots in 2017, earning his call-up 04/22 vs LAN W, 5-2 0 Errors: 14-4 12-7 26-11 just 27 days after his last appearance in Somerset. -

New Jersey Institute of Technology Athletics Visiting Team Guide

New Jersey Institute of Technology Athletics Visiting Team Guide NJIT Department of Athletics 80 Lock Street Newark, NJ 07102 Phone: (973) 596-5730 Fax: (973) 596-8295 www.njithighlanders.com/@njithighlanders General Information Nickname:……………………………………………………………………………………………………………………………………………………………..……Highlanders Colors:…………………………………………………………………………………………………………………………………………..…………...………….Red and White Affiliation:…………………………………………………………………………………………………………………………….……..……………….………NCAA Division I Conference:………………………………………………………………………………………………………………………………………………………………..Atlantic Sun Mailing Address:………………………………………………………………………………………………………….…..……….80 Lock Street, Newark, NJ 07102 Athletic Department Phone Number:……………………………………………………………………….……..……………….…………………(973) 596-5730 Athletic Department Fax Number:…………………………………………………………………………….………..……………….……………..(973) 596-8295 Athletic Website:……………………………………………………………………………………………………….………..……….…….www.njithighlanders.com Twitter:……………………………………………………………………………………………………………………….…………..…….………………….@njithighlanders Administration All phone numbers are 973-area code Lenny Kaplan Director of Athletics [email protected] 596-3638 Andrew Schwartz Senior Associate Athletic Director [email protected] 642-7224 Stephanie Pillari Interim Senior Women Administrator [email protected] 596-8324 Tim Camp Assistant Athletic Director for Sports Information [email protected] 596-8461 Jayson Smikle Assistant Athletic Director for Compliance [email protected] 596-5278 Kerry Feder Administrative Assistant for the Director of Athletics 596-3636 Michael -

Cau 5141 CITY CAB Chinee Reds Report Chan News on Yanks

■ -• ■ ■ X. ^ i m TnuasniA^, Aritxij 18,1948 ‘ Avetace Dally drcalatlon The Weather Foroeoat of D. K' W eathar ifiattrljMter lEpgntng fgrato For tlm MobUi of March. 104a I the youhtiT Clear and colder tonight with light froot In Interior aectton; Sat N Services Tonight To Attend C onccriffM.... —___ ; S______ 7 . rappear . min • acon-x^ conS^ s 9 ,0 4 2 ^ ' cert at the famous Carnegie Hall. urday fair and warmer followiad tty Tomorrow, Good Friday, with Meniber of the AadHR Herald P u b l i s h e r I* ChaniTei^ed to W ork These Uavs Communion In the German O f GrandtIawEghier She la m pupil of Professor Andor laereaaing dondlneoe. it Town At the Concordia lage only, preparatory serv- Scheon, famous music teacher Bnreaa of CIrealatlon \ ___ Will begin at 9:16 and the from Austria. UfancbeafFr— 4 City o f Village Charm Sir and Stn.'^altar B. Joynei*. legular„ ---- service, ------- at 9:30 a. ni. Mr; and Mf*. Anthony George Mr. and M rf. George will spend . : s . f t W tl HoH atiadtshave , <:oncordla Luthe>an cb»irch Elaater weekend with their fami ^ ikon a f«w days ap^^ in Atlantic | choir will meet tniflthis CVfniTiKevfnUi^g EL,at Inin iiicthe cvt;iiiii*;evening at i 7:30.uv mvthe ,*•«- In- »»•••will .1..loav^-f»y . w plane -Friday---- —^ after---- (SIXTEEN PAGES) PRICE THREE CENTS . A ^ A > _____ a ___________ . I l f g ^ J lL a f f m n / 1 ly in New Y o rk and return b5r (ClaeaUed Advertlalag en Page l4> MANCHESTER, CONN., FRIDAY, APRIL 19,1946 & City. -

NFL 1926 in Theory & Practice

THE COFFIN CORNER: Vol. 24, No. 3 (2002) One division, no playoffs, no championship game. Was there ANY organization to pro football before 1933? Forget the official history for a moment, put on your leather thinking cap, and consider the possibilities of NFL 1926 in Theory and Practice By Mark L. Ford 1926 and 2001 The year 1926 makes an interesting study. For one thing, it was 75 years earlier than the just completed season. More importantly, 1926, like 2001, saw thirty-one pro football teams in competition. The NFL had a record 22 clubs, and Red Grange’s manager had organized the new 9 team American Football League. Besides the Chicago Bears, Green Bay Packers and New York Giants, and the Cardinals (who would not move from Chicago until 1959), there were other team names that would be familiar today – Buccaneers (Los Angeles), Lions (Brooklyn), Cowboys (Kansas City) and Panthers (Detroit). The AFL created rivals in major cities, with American League Yankees to match the National League Giants, a pre-NBA Chicago Bulls to match the Bears, Philadelphia Quakers against the Philly-suburb Frankford Yellowjackets, a Brooklyn rival formed around the two of the Four Horsemen turned pro, and another “Los Angeles” team. The official summary of 1926 might look chaotic and unorganized – 22 teams grouped in one division in a hodgepodge of large cities and small towns, and is summarized as “Frankford, Chicago Bears, Pottsville, Kansas City, Green Bay, Los Angeles, New York, Duluth, Buffalo, Chicago Cardinals, Providence, Detroit, Hartford, Brooklyn, Milwaukee, Akron, Dayton, Racine, Columbus, Canton, Hammond, Louisville”. -

12-Weequahic Newsletter Spring

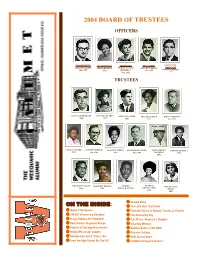

2004 BOARD OF TRUSTEES OFFICERS CO-PRESIDENT CO-PRESIDENT SECRETARY TREASURER EXECUTIVE HAROLD BRAFF JUDY BENNETT MYRNA JELLING SHELDON BROSS DIRECTOR June 1952 1972 WEISSMAN Jan. 1955 PHILIP YOURISH Jan. 1953 1964 TRUSTEES DAVID LIEBERFARB YVONNE CAUSBEY ARTHUR LUTZKE ADILAH QUDDUS BERT MANHOFF 1965 1977 1963 1971 Jan. 1938 FAITH HOWARD SAM WEINSTOCK LORAINE WHITE DAVID SCHECHNER MARY BROWN GERALD RUSSELL 1982 Jan. 1955 1964 June 1946 DAWKINS 1974 1971 CHARLES TALLEY MARJORIE BROWN Principal SHARON VIVIAN ELLIS 1966 1985 RONALD STONE PRICE-CATES SIMON 1972 1959 Newark News ON THE INSIDE: The Little Shul That Could Behind The Scenes From the Voices of Alumni, Faculty, & Friends $40,000 Scholarship Donation You Ruined My Day Hisani Dubose, NJ Filmmaker Carl Prince: Brooklyn’s Dodgers Herb Schon's Rugelach Recipe In Loving Memory Profiles of Distinguished Alumni Sheldon Belfer’s POP QUIZ Waldo Winchester Column Reunion Listings Scholarships Are A “Class” Act WHS Alumni Store From the High School On The Hill Football Fantasy Fundraiser 2004 BOARD OF TRUSTEES OFFICERS CO-PRESIDENT CO-PRESIDENT SECRETARY TREASURER EXECUTIVE HAROLD BRAFF JUDY BENNETT MYRNA JELLING SHELDON BROSS DIRECTOR June 1952 1972 WEISSMAN Jan. 1955 PHILIP YOURISH Jan. 1953 1964 TRUSTEES DAVID LIEBERFARB YVONNE CAUSBEY ARTHUR LUTZKE ADILAH QUDDUS BERT MANHOFF 1965 1977 1963 1971 Jan. 1938 FAITH HOWARD SAM WEINSTOCK LORAINE WHITE DAVID SCHECHNER MARY BROWN GERALD RUSSELL 1982 Jan. 1955 1964 June 1946 DAWKINS 1974 1971 CHARLES TALLEY MARJORIE BROWN Principal -

Experience the First Class Difference • Plumbing • Heating • Air Conditioning • Well Pumps & Water Conditioners

8 Special Publication by Kapp Advertising - 2016 Season Make Homemade Ice Cream Baseball Anyone? Milk can become homemade ice cream in five minutes by using a bag! This homemade, creamy treat is a summertime delight for kids and adults alike. It’s the bottom of the ninth....your team is rallying to pull out the big win...and it’s a long fly ball...Did you remember the peanuts and cracker jacks? Check out some of these What you’ll need: local home games or create your own version of backyard baseball with your friends. 1 tablespoon sugar 1/2 cup milk or half & half Frederick Keys – Home Games York Revolution – Home Games 1/4 teaspoon vanilla May 13-16 Myrtle Beach Pelicans May 13-15 Sugar Land Skeeters 6 tablespoons rock salt May 20-23 Potomac Nationals May 24-26 Southern Maryland Blue Crabs 1 pint-size plastic food storage bag (e.g., Ziploc) June 1-3 Potomac Nationals May 27-30 Somerset Patriots 1 gallon-size plastic food storage bag June 3-5 Lancaster Barnstormers Ice cubes June 4-7 Carolina Mudcats June 16-19 Lynchburg Hillcats June 7-9 Long Island Ducks How to make it: June 27-29 Carolina Mudcats June 17-19 Bridgeport Bluefish Fill the large bag half full of ice, and add the rock salt. Seal the bag. June 30 - July 3 Salem Red Sox June 20-22 Long Island Ducks Put milk, vanilla, and sugar into the small bag, and seal it. July 8-11 Winston-Salem Dash July 1-3 Lancaster Barnstormers Place the small bag inside the large one, and seal it again carefully. -

Directory of Destination Services

DIRECTORY OF DESTINATION SERVICES DO ATLANTIC CITY.COM MARKETING PARTNERSHIP DIRECTORY Published by the Casino Reinvestment Development Authority – Convention Center Division 2314 Pacific Ave. Atlantic City, NJ 08401 Phone: 609-449-7100, 1-888-AC-VISIT www.DoAtlanticCity.com INTRODUCTION We are pleased to present the CRDA Partnership Directory. Within its pages you will find reference to suppliers who can provide everything from accommodations to trolley tours. Please use this book for quick reference to our Atlantic City Marketing Partners. The Directory of Destination Services Guide lists a variety of hospitality industry related businesses that offer support services to all groups holding conventions, trade shows, meetings and public events in the Atlantic City and Southern New Jersey region. Information for this directory has been solicited from authority partners. Every effort has been made to assure accuracy. Corrections are welcome; please write to the address shown above or reach out to Doreen Prinzo, Manager, Marketing Partnership at [email protected] or 609-449-7156. Directory of Destination Services TABLE OF CONTENTS Page # Business Category Page # Business Category 1 .... Accommodations:Bed & Breakfast 40 .... Candy, Peanuts, Taffy & Other 1 .... Accommodations:Hotels Specialties 41 .... Canoe, Kayak & Boat Rentals 6 .... Accommodations:Motels 41 .... Cape May/Wildwood 9 .... Accommodations:Resorts 42 .... Casino Hotels & Resorts 10 .... Adult Entertainment 43 .... Casino Restaurants 11 .... Advertising 51 .... Casual Dining 13 .... Advertising Specialties/Promotional Items 56 .... Catering 13 .... Aerial Advertising & Photography 57 .... Child Care Services 14 .... Air Transportation 57 .... Chinese 14 .... Airport Limousine/Transportation 57 .... Clothing Stores 16 .... American 58 .... Communications 18 .... Amusement Parks & Arcades 59 .... Community, Business & Trade 19 .... Antiques & Atlantic City Organizations Memorabilia 62 ... -

Fall 2010 a Publication of the University of Bridgeport

U B KNIGHTLINES FALL 2010 A PUBLICATION OF THE UNIVERSITY OF BRIDGEPORT FALL 2010 Out of the Box For more than 40 years, Thomas Mezzanotte has taken breathtaking photographs with cameras dating back to the Civil War and equipment made from cardboard boxes. Just named “Artist of the Year” by the Fairfield Arts Council, UB’s maverick photography alum suddenly finds himself in everybody’s focus. ALSO INSIDE Remembering Manute Bol • Patching Up the Bluefish • UB’s Poet Laureate 1 President’s Line Dear Friends: As I walk through campus on these beautiful fall days, it gives me great pleasure to see so many familiar faces—upper-classmen, professors, and staff—and also the hundreds of new students who these days crowd the PedMall. More than 5,100 students from 80 nations have chosen UB as the place where they will enrich their minds, pursue their dreams, and forge friendships that will last a lifetime. Together, we make UB a truly vibrant and exciting community. The beginning of every academic year brings excitement, but in 2010-2011 we have several new initiatives and programs to celebrate. The Physician Assistant Institute and the Pre-Pharmacy partnership with the University of Connecticut have added energy to the already-lively Health Sciences Division. Even before their courses began, these two new programs had a waiting list of eager applicants. Students at the Shintaro Akatsu School of Design (SASD) will be opening a storefront in downtown Bridgeport, providing local businesses and individuals the opportunity to commission graphic design projects that will benefit the Neil Albert Salonen local business community as well as providing invaluable experience for our students. -

Historic Atlantic League Baseball Makes Way to Hall of Fame

Historic Atlantic League Baseball makes way to Hall of Fame Posted by tbnBBM On 02/02/2016 Cooperstown, NY - The distinctive red and blue stitched official baseball used by the Atlantic League of Professional Baseball has been added to the permanent collection at the National Baseball Hall of Fame and Museum in Cooperstown, N.Y. In addition, the ball is currently on display as part of the “This Year in Baseball” exhibition. “It is an incredible honor to have a piece of league and professional baseball history as part of the Hall of Fame’s collection,” says Atlantic League President Rick White. “We are profoundly appreciative of the Hall’s consideration and encourage all of our fans to pay a visit to Cooperstown.” The baseball represents the first artifact from the Atlantic League to be place in the Hall of Fame. It was debuted on July 8, 2015 at the league’s 18th Annual All-Star Game, held at The Ballpark at Harbor Yard in Bridgeport, Connecticut. Bridgeport Bluefish pitcher D.J. Mitchell, who was representing the Liberty Division, delivered the ball to York Revolution outfielder Brandon Boggs before the ball was removed from play. The Atlantic League adopted the red and blue stitched baseball as a way to honor baseball’s rich heritage as America’s pastime. The baseballs are a tribute to the original baseballs used by the American League until 1934, when Major League Baseball adopted red stitched baseballs in both leagues. Each baseball is created by Rawlings Sporting Goods, the Atlantic League’s official supplier of baseballs since its founding in 1998. -

Bridgeport Bluefish Game Information

2016 JULY 1 2 schedule SP SP HOME 3 4 5 6 7 8 9 SP yk YK YK NB NB NB AWAY 4:12 7:12 7:12 10 11 15 16 ALL-STAR GAME april NB LANCASTER, PA SL SL 7:12 6:12 17 18 19 20 21 22 23 17 18 19 20 21 22 23 sl sl sl SL SL LI LI LI NB NB 1:12 7:12 7:12 6:12 24 25 26 27 DH 28 29 30 24 25 26 27 28 29 30 sl md md nb nb nb NB MD MD MD SP SP SP 7:12 7:12 1:12 1:12 7:12 11:12am 7:12 MAY AUGUST 1 2 3 4 DH 5 6 7 JULY 31 1 2 3 4 5 6 nb yk yk yk LI LI SP SL SL SL LI LI 1:12 7:12 6:12 7:12 11:12am 7:12 7:12 6:12 8 9 10 11 12 13 14 7 8 9 10 11 12 13 LI SL SL SL YK YK li1:12 sl sl sl nb nb 1:12 7:12 7:12 7:12 15 16 17 18 DH 19 20 21 14 15 16 17 18 19 20 YK MD MD MD MD SP SP nb sp7:12 10:35a/7:12psp sp7:12 SL SL 7:12 6:12 22 23 24 25 26 27 28 21 22 23 24 25 26 27 SP NB NB NB LA LA SL LI LI LI MD7:12 MD6:12 1:12 29 30 31 28 29 30 31 LA YK YK YK MD1:12 MD1:12 yk7:12 7:12 7:12 7:12 JUNE SEPTEMBER 1 2 3 4 1 2 3 YK7:12 YK7:12 SP SP YK7:12 MD7:12 MD6:12 5 6 7 8 9 10 11 4 5 6 7 8 9 10 SP LA7:12 10:LA35am LA7:12 NB7:12 NB6:12 MD1:12 LI LI LI LI LA LA 12 13 14 15 16 17 18 11 12 13 DH 14 15 16 17 NB1:12 MD MD MD YK YK LA 10:35a/7:12pSP SP7:12 la7:12 la7:12 la6:12 19 20 21 22 23 24 25 18 19 20 divisional series YK LA7:12 LA7:12 LA7:12 LI7:12 LI7:12 LI6:12 la1:12 SEPTEMBER 21–24 26 27 28 29 30 25 26 27 CHAMPIONSHIP series LI1:12 LA LA LA LA SEPTEMBER 28–OCTOBER 1 *DH - Double Header FREEDOM DIVISION LIBERTY DIVISION HARBOR CLUB LA Lancaster Barnstormers BP Bridgeport Bluefish GATE D MD Southern Maryland Blue Crabs LI Long Island Ducks GATE C SL Sugar Land Skeeters NB New Britain Bees YK York Revolution SP Somerset Patriots 1 2 3 4 5 6 3 1 2 4 7 5 6 8 TICKETS: 203.210.BLUE 9 7 8 10 INFORMATION 11 10 12 9 GATE B BRIDGEPORTBLUEFISH.COM 14 13 11 12 GEAR SHOP 13 14 15 16 The Bridgeport Bluefish are members of the Atlantic League of Professional Baseball and 17 18 GATE A play their home games at The Ballpark at 19 20 Harbor Yard. -

MAJOR LEAGUE BASEBALL Name PGCBL Team (Year)

The Perfect Game Collegiate Baseball League (PGCBL), upstate New York’s premier summer wood bat league, played its seventh season in 2017. Every year since its inception in 2011, the PGCBL has sent players to the pros and has had several alumni selected in the MLB Draft with each year. Here is a list of former PGCBL players that are currently in professional baseball, listed by their current level. MAJOR LEAGUE BASEBALL Name PGCBL Team (Year) MLB Team Hunter Pence Schenectady Mohawks* (2002) San Francisco Giants Shae Simmons Watertown Wizards (2010) Seattle Mariners J.D. Martinez Saratoga Phillies+ (2009) Detroit Tigers Mike Fiers Saratoga Phillies+ (2009) Houston Astros Luke Maile Amsterdam Mohawks (2010-11) Toronto Blue Jays Tom Murphy Oneonta Outlaws (2010) Colorado Rockies James Hoyt Little Falls Miners^ (2008) Houston Astros Nick Pivetta Glens Falls Golden Eagles# (2012) Philadelphia Phillies Mark Leiter Jr. Amsterdam Mohawks (2011-12) Philadelphia Phillies Jimmy Yacabonis Elmira Pioneers (2012) Baltimore Orioles Carlos Asuaje Oneonta Outlaws (2011) San Diego Padres Tim Locastro Newark Pilots (2013) Los Angeles (NL) Two former PGCBL pitchers made their MLB debuts with the Philadelphia Phillies in 2017. Nick Pivetta (L), a former Glens Falls Golden Eagle, was called up on April 30 to face the Dodgers in Los Angeles and struck out five in 5.0 innings in his first start. He would pick up his first major league victory on June 5 in Atlanta. Mark Leiter Jr. (R), a member of the Amsterdam Mohawks Hall of Fame, also made his MLB debut in Los Angeles out of the bullpen on April 28. -

1. Executive Summary 2. Client

1 Hunter Davis Natalie Kates Sharnequa Steed COM5338- Assignment 8 and 9 CONTENT OUTLINE AND FUNCTIONAL SPECIFICATION 1. Executive Summary This document contains the content outline combined with the functional specification of the redesigned website for the New Jersey Jackals. This functional specification provides information on the client – the New Jersey Jackals, including the team’s purpose, history, and accolades. The site was found to be in need of improvement in terms of design, content, and features. These are important aspects that drive the site’s use among its targeted audience. The most frequent users were found to be those interested in family outings and die- hard sports enthusiasts. These users typically access the site from their homes where Internet Explorer is the dominant web browser. The site’s simple design requires only a minimum of technical knowledge, hardware, and software from the user. Technical requirements must meet the high demands of peak seasons throughout the year. With the redesign, it is important that we confirm our presumptions with usability testing that will ensure that the website meets the needs and expectations of its users. 2. Client Who is the client? The New Jersey Jackals are an independent minor league baseball team within the Canadian American Association of Professional Baseball (CANAM). The Jackals find their home in Yogi Berra Stadium, located in Montclair, New Jersey. On an average night the stadium may house upwards of 4,500 fans that come to watch the Jackals take on numerous competitors including: the Atlantic City Surf, the Brockton Rox, the American Defenders of New Hampshire, the Quebec Capitales, the Sussex Skyhawks, and the Worcester Tornadoes.