Dear IP June 2017 – Issue No 77

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

All You Need to Know About Becoming an Insolvency Practitioner In

REMUNERATION OF INSOLVENCY PRACTITIONERS This time we bring you a real scoop. Insolvency law, legal status and remuneration of the insolvency practitioners, has completely changed in Poland! Judge Anna Hrycaj, who presented this subject at the ACC conference in Warsaw last year, and who was asked to adapt her presentation to the needs of our journal, was obliged to write a new article, because Poland was surprised a couple of weeks ago by a new law… So, we are proud to offer you an analysis of the new requirements for becoming an IP in Poland. If you have any questions, please write to [email protected] or [email protected] for further information. All you need to know about becoming an Insolvency Practitioner in Europe: Poland We have already looked at the legal status and remuneration of insolvency practitioners in France, Austria and Latvia. Here we discuss what happens in Poland The legal status of the Insolvency and the court does not deprive the • He/she has the full legal capacity to act; Practitioner (IP) in Poland is soon to be debtor of the right to administer the • He/she is under 65; regulated not only by the provisions of estate; • He/she received higher education the Bankruptcy and Rehabilitation Law, • The receiver ( zarz ądca ), who is qualifications and obtained an MA or 28 February 2003, but also by the appointed in the case of insolvency any other correspondent title in the provisions of the Polish law on IPs which with the possibility of making an member states mentioned above; was enacted by the Polish Parliament on arrangement with creditors, but the • He/she has an unblemished 9 May 2007. -

How to Become an Insolvency Practitioner In

REMUNERATION OF INSOLVENCY PRACTITIONERS The article is provided by Devorah Burns of the national organisation The Insolvency Service, based in London. The Insolvency Service operates under a statutory framework – mainly the Insolvency Acts 1986 and 2000, the Company Directors Disqualifications Act 1986 and the Employment Rights Act 1996. If you have any questions on this article, please send them to the author at Devorah.Burns @insolvency.gsi.gov.uk or [email protected] We welcome further contributions to this series, so if you would like to inform our readers of the regulations for becoming an IP in your jurisdiction, please contact the editors. All you need to know about becoming an Insolvency Practitioner: Great Britain The latest in our series of articles on the legal status and remuneration of insolvency practitioners examines the British rules and regulations Access to to pay an annual fee, which covers the costs Insolvency Practitioners in the profession associated with authorisation and England, Wales & Scotland. regulation. The Insolvency Service is responsible for The Secretary of State (SoS) may authorise EU Directive 2005/36 provides for the the regulation of insolvency practitioners insolvency practitioners, as may seven recognition of professional qualifications working in Great Britain (i.e. England, professional bodies (the RPBs). The RPBs throughout the relevant states and The Wales & Scotland) and the Department for represent accountants, lawyers and those European Communities (Recognition of Enterprise, Trade & Investment in Northern who only work as insolvency practitioners. Professional Qualifications) Regulations Ireland is responsible for the regulation Most insolvency practitioners are 2007 (The Regulations) make provision of insolvency practitioners who work in authorised by one of the RPBs. -

The Insolvency Service Annual Plan 2019-2020

Annual Plan 2019-2020 Contents Chief Executive’s Foreword .................................................... 5 Chair of the Board’s Foreword ................................................ 6 1. Delivery framework .............................................................. 8 1.1 Strategic delivery ..................................................................................................................8 2. Ministerial targets .............................................................. 13 3. Delivering economic confidence ...................................... 14 3.1 Objectives ...........................................................................................................................14 3.2 Targets ................................................................................................................................15 4. Supporting those in financial distress .............................. 16 4.1 Objectives ...........................................................................................................................16 4.2 Targets ................................................................................................................................17 4.3 Change portfolio milestones ..............................................................................................17 5. Tackling financial wrongdoing .......................................... 18 5.1 Objectives ...........................................................................................................................18 -

UK (England and Wales)

Restructuring and Insolvency 2006/07 Country Q&A UK (England and Wales) UK (England and Wales) Lyndon Norley, Partha Kar and Graham Lane, Kirkland and Ellis International LLP www.practicallaw.com/2-202-0910 SECURITY AND PRIORITIES ■ Floating charge. A floating charge can be taken over a variety of assets (both existing and future), which fluctuate from 1. What are the most common forms of security taken in rela- day to day. It is usually taken over a debtor's whole business tion to immovable and movable property? Are any specific and undertaking. formalities required for the creation of security by compa- nies? Unlike a fixed charge, a floating charge does not attach to a particular asset, but rather "floats" above one or more assets. During this time, the debtor is free to sell or dispose of the Immovable property assets without the creditor's consent. However, if a default specified in the charge document occurs, the floating charge The most common types of security for immovable property are: will "crystallise" into a fixed charge, which attaches to and encumbers specific assets. ■ Mortgage. A legal mortgage is the main form of security interest over real property. It historically involved legal title If a floating charge over all or substantially all of a com- to a debtor's property being transferred to the creditor as pany's assets has been created before 15 September 2003, security for a claim. The debtor retained possession of the it can be enforced by appointing an administrative receiver. property, but only recovered legal ownership when it repaid On default, the administrative receiver takes control of the the secured debt in full. -

Department for Business, Enterprise and Regulatory Reform (BERR) and the Department for Innovation, Universities and Skills (DIUS)

James Davies Clerk of the Committee Business Innovation and Skills Committee House of Commons 7 Millbank London SW1P 3JA 7 July 2010 Dear James Main Estimates Memorandum 2010-11 I am enclosing the Department for Business Innovation and Skills (BIS’s) Memorandum for the forthcoming Main Estimate. This Memorandum has been prepared in accordance with the “Guide to Preparing Estimate Memoranda” and has been approved by the Departmental Accounting Officer. Presentation and publication of the Main Estimate was made on 21 June 2010. I recognise that, as this is a new Committee, some of this information may require fuller explanation to bring members fully up to speed with the Department’s activities and funding. I will be happy to provide any additional information which may be required. Yours sincerely Howard Orme Director General, Finance and Commercial Finance and Commercial, 1 Victoria Street, London SW1H 0ET www.bis.gov.uk Direct Line +44 (0)20 7215 5936 | Fax +44 (0)20 7215 3248 | Mincom +44 (0)020 7215 6740 Enquiries +44 (0)20 7215 5000 | Email [email protected] 1 Department for Business Innovation and Skills Main Estimate 2010-11 Select Committee Memorandum 1. This is the first Main Estimate for the Department for Business Innovation and Skills (BIS). The principal activities of the Department relate to the funding, policy and support of Innovation, Business and Enterprise; Further and Higher education and Skills; and Science and Research. 2. The Main Estimate for 2010-11 seeks the necessary resources and cash to support the functions of the Department and its Non Departmental Public Bodies (NDPBs). -

Insolvency Review Insolvency Review

the Insolvency Review Insolvency Insolvency Review Sixth Edition Editor Donald S Bernstein Sixth Edition Sixth lawreviews © 2018 Law Business Research Ltd Insolvency Review Sixth Edition Reproduced with permission from Law Business Research Ltd This article was first published in November 2018 For further information please contact [email protected] Editor Donald S Bernstein lawreviews © 2018 Law Business Research Ltd PUBLISHER Tom Barnes SENIOR BUSINESS DEVELOPMENT MANAGER Nick Barette BUSINESS DEVELOPMENT MANAGERS Thomas Lee, Joel Woods SENIOR ACCOUNT MANAGER Pere Aspinall ACCOUNT MANAGERS Jack Bagnall, Sophie Emberson, Katie Hodgetts PRODUCT MARKETING EXECUTIVE Rebecca Mogridge RESEARCHER Keavy Hunnigal-Gaw EDITORIAL COORDINATOR Gavin Jordan HEAD OF PRODUCTION Adam Myers PRODUCTION EDITOR Martin Roach SUBEDITOR Helen Smith CHIEF EXECUTIVE OFFICER Paul Howarth Published in the United Kingdom by Law Business Research Ltd, London 87 Lancaster Road, London, W11 1QQ, UK © 2018 Law Business Research Ltd www.TheLawReviews.co.uk No photocopying: copyright licences do not apply. The information provided in this publication is general and may not apply in a specific situation, nor does it necessarily represent the views of authors’ firms or their clients. Legal advice should always be sought before taking any legal action based on the information provided. The publishers accept no responsibility for any acts or omissions contained herein. Although the information provided is accurate as of September 2018, be advised that this is -

Update from the Insolvency Service

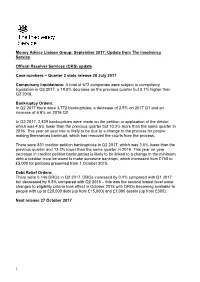

Money Advice Liaison Group: September 2017: Update from The Insolvency Service Official Receiver Services (ORS) update Case numbers – Quarter 2 stats release 28 July 2017 Compulsory liquidations: A total of 672 companies were subject to compulsory liquidation in Q2 2017, a 19.8% decrease on the previous quarter but 0.1% higher than Q2 2016. Bankruptcy Orders: In Q2 2017 there were 3,772 bankruptcies, a decrease of 2.5% on 2017 Q1 and an increase of 4.6% on 2016 Q2. In Q2 2017, 2,839 bankruptcies were made on the petition or application of the debtor, which was 4.6% lower than the previous quarter but 10.3% more than the same quarter in 2016. This year on year rise is likely to be due to a change to the process for people making themselves bankrupt, which has removed the courts from the process. There were 831 creditor petition bankruptcies in Q2 2017, which was 3.6% lower than the previous quarter and 13.3% lower than the same quarter in 2016. This year on year decrease in creditor petition bankruptcies is likely to be linked to a change in the minimum debt a creditor must be owed to make someone bankrupt, which increased from £750 to £5,000 for petitions presented from 1 October 2015. Debt Relief Orders: There were 6,146 DROs in Q2 2017. DROs increased by 0.4% compared with Q1 2017 but decreased by 8.8% compared with Q2 2016 – this was the second lowest level since changes to eligibility criteria took effect in October 2015 with DROs becoming available to people with up to £20,000 debt (up from £15,000) and £1,000 assets (up from £300). -

Department for Business, Enterprise and Regulatory Reform Annual Report and Accounts 2007-08

Department for Business, Enterprise and Regulatory Reform Annual Report and Accounts 2007-08 Including the Annual Departmental Report and Consolidated Resource Accounts for the year ended 31 March 2008 Presented to Parliament pursuant to the Government Resources and Accounts Act 2000 c.20, s.6 (4) Ordered by the House of Commons to be printed 21 July 2008 London: The Stationery Office HC 757 £33.45 © Crown Copyright 2008 The text in this document (excluding the Royal Arms and other departmental or agency logos) may be reproduced free of charge in any format or medium providing it is reproduced accurately and not used in a misleading context. The material must be acknowledged as Crown copyright and the title of the document specified. Where we have identified any third party copyright material you will need to obtain permission from the copyright holders concerned. For any other use of this material please write to Office of Public Sector Information, Information Policy Team, Kew, Richmond, Surrey TW9 4DU or e-mail: [email protected] ISBN: 978 0 10295 7112 3 Contents Foreword from the Secretary of State 5 Executive Summary 7 About this report 9 Chapter 1: Introducing the Department 1.1 The Department for Business, Enterprise and Regulatory Reform 11 1.2 Structure and Ministerial responsibilities 12 1.3 Strategy and objectives 13 1.4 Being the Voice for Business across Government 16 Chapter 2: Performance Report 2.1 Introduction 19 2.2 Summary of performance 21 2.3 Raising the productivity of the UK economy 25 2.4 Promoting the creation -

Insolvency Statistics, Q3 July to September 2020

Quarterly Company Insolvency Statistics, Q3 July to September 2020 Released Next released 9.30am, 30th October 2020 9.30am, 29th January 2021 Media enquiries Statistical enquiries Michael Gibbs Michael McDaid (author) +44 (0)300 304 8506 [email protected] Kate Palmer (responsible statistician) . 1 Contents 1. Main messages for England and Wales ............................................................................... 3 2. Things you need to know about this release......................................................................... 4 3. Company insolvency in England and Wales ......................................................................... 5 3.1. Company insolvency decreased in comparison to Q3 2019 and Q2 2020 ......................... 5 3.2. The company liquidation rate fell in the 12 months ending Q2 2020 .................................. 6 3.3. All major industry groupings saw a decline in insolvency in the 12 months ending Q2 2020 ................................................................................................................................................ 8 4. Company insolvency in Scotland ........................................................................................ 10 5. Company insolvency in Northern Ireland ............................................................................ 11 6. Data and Methodology ....................................................................................................... 12 7. Glossary ............................................................................................................................ -

Adb Sme Development Ta

ADB SME DEVELOPMENT TA BACKGROUND REPORT INSTITUTIONAL SET-UP FOR SME POLICY DESIGN AND IMPLEMENTATION CASE STUDY UNITED KINGDOM ROB HITCHINS JULY 2001 Published by: ADB Technical Assistance SME Development State Ministry for Cooperatives & SME Jalan H.R. Rasuna Said Kav.3 Jakarta 12940 Tel: ++62 21 520 15 40 Fax: ++62 21 527 94 82 e-mail: [email protected] ADB SME DEVELOPMENTTA I. TABLE OF CONTENTS I. TABLE OF CONTENTS ..........................................................................................3 II. TABLE OF ABBREVIATIONS.................................................................................5 III. TABLE OF FIGURES..............................................................................................6 IV. TABLE OF REFERENCES......................................................................................7 V. EXECUTIVE SUMMARY ENGLISH ........................................................................8 VI. EXECUTIVE SUMMARY BAHASA INDONESIA..................................................10 1 INTRODUCTION....................................................................................................12 1.1 Objectives of the case study ..................................................................................12 1.2 Structure of the case study ....................................................................................12 1.3 Country comparisons .............................................................................................12 1.4 Overview of UK economic performance.................................................................14 -

Irish Examinership: Post-Eircom a Look at Ireland's Fastest and Largest

A look at Ireland’s fastest and largest restructuring through examinership and the implications for the process Irish examinership: post-eircom A look at Ireland’s fastest and largest restructuring through examinership and the implications for the process* David Baxter Tanya Sheridan A&L Goodbody, Dublin A&L Goodbody [email protected] The Irish telecommunications company eircom recently successfully concluded its restructuring through the Irish examinership process. This examinership is both the largest in terms of the overall quantum of debt that was restructured and also the largest successful restructuring through examinership in Ireland to date. The speed with which the restructuring of this strategically important company was concluded was due in large part to the degree of pre-negotiation between the company and its lenders before the process commenced. The eircom examinership demonstrated the degree to which an element of pre-negotiation can compliment the process. The advantages of the process, having been highlighted through the eircom examinership, might attract distressed companies from other EU jurisdictions to undertake a COMI shift to Ireland in order to avail of this process. he eircom examinership was notable for both the Irish High Court just 54 days after the companies Tsize of this debt restructuring and the speed in entered examinership. which the process was successfully concluded. In all, This restructuring also demonstrates the advantages €1.4bn of a total debt of approximately €4bn was of examinership as a ‘one-stop shop’: a flexible process written off the balance sheets of the eircom operating that allows for both the write-off of debt and the change companies. -

Summary Rescue Process”

COMPANY LAW REVIEW GROUP REPORT ADVISING ON A LEGAL STRUCTURE FOR THE RESCUE OF SMALL COMPANIES 22 OCTOBER 2020 1 | P a g e Contents Chairperson’s Letter to the Minister for Business, Enterprise and Innovation 4 1. Introduction to the Report 5 1.1. The Company Law Review Group ................................................................... 5 1.2 The Role of the CLRG ...................................................................................... 5 1.3 Policy Development........................................................................................ 5 1.4 Contact information ....................................................................................... 5 2. The Company Law Review Group Membership…………………………………………….….6 2.1 Membership of the Company Law Review Group ............................................ 6 3. The Work Programme ............................................................................................. 8 3.1 Introduction to the Work Programme ............................................................ 8 3.2 Company Law Review Group Work Programme 2018-2020 .............................. 8 3.3 Additional item to the Work Programme ........................................................ 9 3.4 Decision making process of the Company Law Review Group……………… ... ……..9 3.5 Committees of the Company Law Review Group ..... ….………………………………..…9 4. A Rescue Plan for SMEs ............................................................................................... 10 4.1 Introduction ................................................................................................