GAIN Report Global Agriculture Information Network

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Building a Trusted and Connected Customer Experience in China

Customer first Building a trusted and connected customer experience in China KPMG China Customer Experience Excellence report kpmg.com/cn ¥ ¥ ¥ Foreword In our first KPMG China Customer Experience Excellence report, we look in detail at the state of customer experience in China to understand what market leaders are doing to drive success. Many of our clients prioritise customer centricity While technology has played a pivotal role in and are continuously looking to improve customer reducing time and effort, and improving convenience experience. In order to accomplish this, organisations for customers, creating a personalised offering, need to have an up-to-date understanding of their engendering trust and delivering a brand promise customers and readily adjust their operations to that resonates with customers are also shown to be meet customers‘ needs. immensely important. The KPMG China Customer Experience Excellence Looking ahead, the Greater Bay Area (GBA) initiative report focuses on mainland China and Hong Kong will be the next force of change for customers customers to find out what they value most when in mainland China and Hong Kong. Improved interacting with brands, and understand what infrastructure and transport connectivity means that other factors are important for organisations to companies which optimise their customer strategy successfully deliver a market-leading customer accordingly will be better positioned to maximise the experience. To explore the topic, KPMG China took new business opportunities available. part in a survey of over 5,000 customers, who were asked questions about more than 200 brands across We hope our insights provide you with a more mainland China and Hong Kong. -

Hotel Restaurant Institutional HRI Food Service Sector

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 9/1/2010 GAIN Report Number: HK0012 Hong Kong Food Service - Hotel Restaurant Institutional HRI Food Service Sector Approved By: Erich Kuss Prepared By: Chris Li Report Highlights: U.S. exports of high value food products and seafood to Hong Kong are expected to reach a record level at over US$2 billion in 2010, making it our 4th largest market for these products after Canada, Mexico and Japan. The global financial crisis did not have a significant impact on Hong Kong’s food & beverage imports and spending on food. Economic growth in Hong Kong is expected to be around 5% in 2010, benefitting from the continued economic growth in Mainland China. In addition, it is expected that Hong Kong will remain as one of the top 5 markets for U.S. consumer ready food products in 2011, continuing to be a major buying center and transshipment point for China and Southeast Asia. However, rents and wages are on the rise in Hong Kong and inflation may limit Hong Kong’s future economic growth. In addition, Mainland China is expected to take austerity measures to cool down its economy in late 2010 and 2011 and these measures could also impact Hong Kong’s economic growth. Even with lower economic growth, post expects that U.S. products will continue to fair well due to competitive prices and consumer confidence in the quality and safety of U.S. -

A Magazine for the Women of Hong Kong T May 2014

".BHB[JOFGPSUIF8PNFOPG)POH,POHt.BZ CCWM AWA Half Jan 2014 Horizontal.pdf 1 3/12/2014 5:02:32 PM MAY 2014 The American Women’s Association of Hong Kong, Limited. Established in 1956 A volunteer organization of international women supporting Hong Kong charities and schools through community service and monetary grants, while providing educational and social activities for members. 12 AWARE PRODUCTION STAFF EDITOR Joy Murray Tel: 6773 7036 [email protected] Membership Information 3 ASSISTANT EDITORS Carole Atkin WOW Update 4 Laura Metoudi AWA Enjoys 6 Lori DiCarlo Angela Bellas 10 ConLove at First Sight tents 8 Rachel Bourke Exploring Chinese Culture 10 ADVERTISING MANAGER Tsim Sha Tsui 12 [email protected] Asia Tour - Tibet 16 PUBLISHED & PRINTED BY Giving New Hope 18 R&R Publishing Ltd. Local Tours and Activities 20 2126 7812 [email protected] On-going Activities 27 www.rrpublishing.com.hk Sporting Activities 30 Contact Information 33 16 Office is open from Monday-Thursday 9:30am-3:30pm. The AWA office will be closed for Easter on Monday 21 April 2014 VISIT THE AWA WEBSITE: www.awa.org.hk FIND US ON FACEBOOK: www.facebook.com/awahk Any opinions expressed in this publication are those of the author only and do not represent the opinion of the American Women’s Association. Any reliance by the reader upon any recommendation or opinion in this publication is at the reader’s own risk. The AWA accepts no responsibility for any loss which may result from such reliance. Copyright 2014. The content of the Aware publication is the property of the American Women's Association Reproduction in whole or part without permission is strictly prohibited. -

Hong Kong Food Service

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 9/19/2018 GAIN Report Number: HK1824 Hong Kong Food Service - Hotel Restaurant Institutional Food Service - Hotel Restaurant Institutional Approved By: Alicia Hernandez Prepared By: Chris Li, Annie Lai Report Highlights: Hong Kong is the 4th largest export market for U.S. consumer-oriented agricultural products, by value. With a dynamic food culture, sophisticated buyers, and world class logistical infrastructure, Hong Kong is a market to promote high-quality, innovative U.S. food and beverage products as well as a gateway to the region. As hotel and restaurant expansions continue, demand for high-quality U.S. food and beverage products by the Hotel, Restaurant, and Institutional food service sector in Hong Kong is expected to remain strong. Post: Hong Kong Market Fact Sheet: Hong Kong Executive Summary Quick Facts CY 2017 Hong Kong has a population of 7.39 million and its per capita GDP was over Imports of Consumer-Oriented Ag. Products US$46,000 in 2017, more than the U.S. and one of the highest in Asia. Hong US$20.4 billion Kong is a vibrant city, and a major gateway to Asia. Consumers are sophisticated and enjoy cosmopolitan food tastes. Due to limited arable land, around 95 Top 10 Consumer-Oriented Ag. Imports percent of foods in Hong Kong are imported. In 2017, imports of agricultural and Fish, beef, fresh fruit, pork, dairy products, food preparations, poultry, related products reached US$27.6 billion. -

Chartered Secretaries American Express Credit Cards

Chartered Secretaries American Express Credit Cards Chartered Secretaries American Express® Platinum Credit Card and Chartered Secretaries American Express®Gold Credit Card are two co-branded cards that have been created in collaboration with The Hong Kong Institute of Chartered Secretaries (HKICS) and have been specifically designed to recognise and benefit our members. As a Member/Graduate/Student of HKICS, you are cordially invited to become a Chartered Secretaries American Express Platinum or Gold Card Cardmember. This card provides a highly convenient way to pay for HKICS membership fees, CPD events and seminars, examination fees and other fees. Application forms Exclusive privileges Merchants List Application forms Chartered Secretaries American Express Platinum Credit Card application form Chartered Secretaries American Express Gold Credit Card application form Application with required documents should be sent to: American Express International Inc Attn: New Accounts GPO Box 11250 Hong Kong Note: 1. Terms and conditions apply to the above offers and privileges. Please visit www.americanexpress.com.hk to learn more. 2. The Chartered Secretaries American Express co-branded Card is a privilege from HKICS. All Credit Card applicationapprovals will be at the sole discretion of American Express International Inc 3. For any enquiries, please call 2277 1370 Back to top Exclusive privileges: Chartered Secretaries American Express® Platinum Credit Card Half annualfee waiver saving you HK$800 a year Generous welcome offers including HK$500 Lane Crawford or Esso Synergy Fuel Cash Voucher, plus 10X Membership Rewards points in the first 3 months, up to 300,000 points Up to HK$500 travel package discount coupon when you purchasing travel packages from Farrington American Express Travel Services Ltd. -

Oasis Hong Kong, 1, 31

18_078334 bindex.qxp 1/19/07 11:09 PM Page 302 Index See also Accommodations and Restaurant indexes, below. GENERAL INDEX Airport Express Line, 33–34 Books, recommended, 37–38 Airport Shuttle, 34 British Airways, 30 Air Tickets Direct, 31 Buddha’s Birthday, 20 AARP, 25 Al’s Diner, 230 Bulldog’s Bar & Grill, 230 Aberdeen, 42, 52, 169 A-Ma, 193 Business hours, 62 restaurants, 154–155 Temple of (Macau), 283–284 Bus travel, 57–58 Accommodations, 70–105. See American Express Macau, 267–268 also Accommodations Index Macau, 268 best, 7–8, 72, 74, 76 offices, 62 Causeway Bay and Wan Chai traveler’s checks, 18 alendar of events, 19–21 expensive, 89–90 C American Foundation for the California, 230 inexpensive, 102–103 Blind, 25 Cantonese food, 115–116 moderate, 95–98 Amusement parks, 174–176 Captain’s Bar, 230–231 very expensive, 82 Antiques and collectibles, Carpets, 211 Central District 10, 208–210 Car travel, 61 expensive, 88–89 Ap Lei Chau, 208 Casa Museu da Taipa, 284–285 very expensive, 79–82 Apliu Street, 215 Casinos, Macau, 286–287 expensive, 82–90 Aqua Spirit, 228 Cathay Pacific Airways, 30, 31 family-friendly, 83 Arch Angel Antiques, 209 Cathay Pacific Holidays, 36 guesthouses and youth Area code, Macau, 268 Cat Street, 42, 194–195 hostels, 103–105 Art, Museum of shopping, 208 inexpensive, 98–103 Hong Kong, 39, 166, 198–199 Cat Street Galleries, 209 Kowloon Macau, 282 Causeway Bay, 52 expensive, 83–88 Art galleries, 210–211 accommodations inexpensive, 98–102 Asian Artefacts (Macau), 287 expensive, 89–90 moderate, 91–94 ATMs (automated -

UNIVERSITY of CALIFORNIA SANTA CRUZ EVERYDAY IMAGININGS UNDER the LION ROCK: an ANALYSIS of IDENTITY FORMATION in HONG KONG a Di

UNIVERSITY OF CALIFORNIA SANTA CRUZ EVERYDAY IMAGININGS UNDER THE LION ROCK: AN ANALYSIS OF IDENTITY FORMATION IN HONG KONG A dissertation submitted in partial satisfaction of the requirements for the degree of DOCTOR OF PHILOSOPHY in POLITICS by Sarah Y.T. Mak March 2013 The Dissertation of Sarah Y.T. Mak is approved: _______________________________ Professor Megan Thomas, Chair ________________________________ Professor Ben Read ________________________________ Professor Michael Urban ________________________________ Professor Lisa Rofel ______________________________________ Tyrus Miller Vice Provost and Dean of Graduate Studies Copyright © by Sarah Y.T. Mak 2013 TABLE OF CONTENTS List of Figures ..................................................................................................................... v Abstract ...............................................................................................................................vi Acknowledgments.........................................................................................................viii CHAPTER ONE: INTRODUCTION ..............................................................................................1 I. SETTING THE SCENE .......................................................................................................1 II. THE HONG KONG CASE ............................................................................................. 15 III. THEORETICAL STARTING POINTS ........................................................................... -

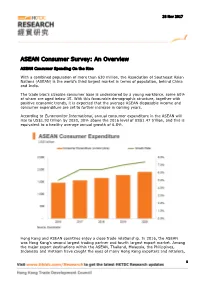

ASEAN Consumer Survey: an Overview

28 Nov 2017 ASEAN Consumer Survey: An Overview ASEAN Consumer Spending On the Rise With a combined population of more than 630 million, the Association of Southeast Asian Nations (ASEAN) is the world’s third largest market in terms of population, behind China and India. The trade bloc’s sizeable consumer base is underscored by a young workforce, some 60% of whom are aged below 35. With this favourable demographic structure, together with positive economic trends, it is expected that the average ASEAN disposable income and consumer expenditure are set to further increase in coming years. According to Euromonitor International, annual consumer expenditure in the ASEAN will rise to US$1.92 trillion by 2020, 30% above the 2016 level of US$1.47 trillion, and this is equivalent to a healthy average annual growth of 6.8%. Hong Kong and ASEAN countries enjoy a close trade relationship. In 2016, the ASEAN was Hong Kong’s second largest trading partner and fourth largest export market. Among the major export destinations within the ASEAN, Thailand, Malaysia, the Philippines, Indonesia and Vietnam have caught the eyes of many Hong Kong exporters and retailers, 1 ASEAN Consumer Survey: An Overview thanks to their economic vigour, strong purchasing power, and in particular a fast expanding middle class. To better understand the spending patterns of the middle class consumers in these five countries, including their shopping motivations and channels, as well as their receptiveness of Hong Kong’s brand products and services, HKTDC Research carried out a consumer survey (the Survey) in the second quarter of 2017 to gather first-hand information. -

Annex List of Signatories of the Charter on External Lighting 1. 168

Annex List of Signatories of the Charter on External Lighting 1. 168 Queen's Road Central Management Office 2. 360 Series (7 shops) 3. 3D-GOLD Jewellery (HK) Limited (4 shops) 4. 759 Store (119 shops) 5. Aberdeen Kai-fong Welfare Association Social Service (7 service units) 6. Aberdeen Restaurant Enterprises Ltd 7. adidas Hong Kong Limited (3 shops) 8. Aesop Hong Kong Limited 9. Alliance Primary School, Whampoa 10. Aluminium Ltd 11. Apex Estate Agents Limited 12. Apple Shop Limited (2 shops) 13. ARA Asset Management (Fortune) Limited (11 properties) 14. ARA Asset Management (Prosperity) Limited (2 properties) 15. Auberge Discovery Bay Hong Kong 16. AX 21 (HK) Ltd 17. Baleno Kingdom Ltd. 18. Bank of China (Hong Kong) Limited (43 branches / properties) 19. Bank of Communications Co., Ltd. Hong Kong Branch (2 branches) 20. Bayshore Development Group Limited 21. Beijing Tong Ren Tang HK Mod. Mgt. Ltd. (23 shops) 22. BELPORT Limited 23. Billion Power Development Limited (3 shops) 24. Blackwell Global Precious Metals Limited 25. Bonjour Cosmetic Wholesale Centre Limited (39 shops) 26. BOSE 27. Broadway Photo Supply Ltd. (9 shops) 28. Burberry Asia Limited (3 shops) 29. Business Environment Council 30. Butterfly Hotel and Serviced Apartment Group Limited (6 hotels) 31. Café de Coral Fast Food (107 shops) 32. Caritas - Hong Kong (13 service units) 33. Causeway Corner 34. Cayley Property Management Limited (4 properties) 35. CBRE Limited 36. Centaline Property Agency Ltd. (256 branches) 37. Chan Sui Ki (La Salle) College 38. Cheung Kong Property Holdings Limited (5 properties) 39. China Construction Bank (Asia) Corporation Limited (41 branches and 2 billboards) 40. -

COPYRIGHTED MATERIAL N D D

passports, 329 Australia Index visitor information in, 330 Consulate, 326 Amusement parks, 183–184 customs regulations, 33 See also Accommodations and Antiques and collectibles, Macau Tourist Office, 285 Restaurant indexes, below. 224–226 passports, 329 Ap Lei Chau, 224 visitor information in, 330 Apliu Street, 232 Avenida Almeida Ribeiro Aqualuna, 187 (Macau), 320 General Index Aqua Spirit, 246 Avian flu, 21, 47 A Arch Angel Antiques, 225 Architecture, 22–25 Aberdeen, 62, 175 B Area codes, 325 restaurants, 156–157 Bahama Mama’s, 246 GENERAL INDEX Macau, 291–292 Accommodations, 70–105. See Ballet, 243 Art galleries, 226–227 also Accommodations Index Bank of China Tower, 196 Art museums best, 4–6, 72, 74, 76 Bargaining, 221 Handover Gifts Museum of Causeway Bay & Wan Chai Bars, pubs and lounges Macao (Macau), 309 expensive, 88 Central District, 248–252 Hong Kong Museum of Art, inexpensive, 102–103 Kowloon, 246–248 170–171, 211 moderate, 96–98 Beaches, 190 Macao Museum of Art, 309 very expensive, 83–84 Cheung Chau, 271 Asian Artefacts (Macau), 324 Central District Lamma, 273–274 ATMs (automated-teller expensive, 87–88 Macau, 314 machines), 46 inexpensive, 102 Beer, 117 Attractions, 164–217 moderate, 95 Big Bus Company, 40 Aberdeen, 175 very expensive, 81–83 Bird Garden, Yuen Po Street, Hong Kong Island, 172–175, family-friendly, 85 181–182 182–183 guesthouses, 104–105 Blanc de, 233 museums and galleries. See Kowloon Boat travel and tours, 186–187 Museums and galleries expensive, 84–86 Aberdeen, 175 organized tours and cultural inexpensive, -

Food Wise Hong Kong Campaign 惜食香港運動

Food Wise Hong Kong Campaign 惜食香港運動 Signees of the Food Wise Charter (1056 signees (as at 15 September 2021)) 已簽惜食約章機構及企業 (1056 簽署者 (截至2021年9月15日)) Business Sectors 工商界 Business and Professional Associations 商企及專業協會 Hong Kong Association of Property Management Companies 香港物業管理公司協會 Hong Kong Federation of Restaurants and Related Trades 香港餐飲聯業協會 Hong Kong Food Council 香港食品委員會 Hong Kong Green Building Council Limited 香港綠色建築議會有限公司 Hong Kong Hotels Association 香港酒店業協會 Hong Kong Institute of Qualified Environmental Professionals Limited 香港合資格環保專業人員學會有限公司 Hong Kong Waste Disposal Industry Association 香港廢物處理業協會 Hong Kong WEEE Recycling Association 香港電器及電子設備回收協會 Institution of Dining Art 稻苗學會 The Hong Kong Institution of Engineers 香港工程師學會 The Hong Kong Institute of Housing 香港房屋經理學會 Food and Beverage Sector (incl. also food markets and supermarkets, etc.) 飲食業界 (亦包括食物市場和超級市場等) Aeon Stores (Hong Kong) Company Limited 永旺(香港)百貨有限公司 Alize Noire de Nova Limited Asia Pacific Catering Corporation Limited 泛亞飲食有限公司 Asia Pacific Catering Corporation Limited - Luncheon Star 泛亞飲食有限公司 - 活力午餐 Bijas Company Limited Catering Services Contractor 膳食承辦商 Cathay Pacific Catering Services (H.K.) Limited 國泰航空飲食服務(香港)有限公司 Compass Group Hong Kong Limited 金巴斯集團香港有限公司 Crystal Jade La Mian Xiao Long Bao(TM) Limited 翡翠拉麵小籠包(屯門)有限公司 Cuisine Continental (HK) Limited - Alfafa Cuisine Continental (HK) Limited - Chatterbox Daikiya Catering Group 大喜屋飲食集團 Daliang Vegetarian Kitchen 滋味齋素食餐廳 Delicious Chef King Catering Limited 美味王餐飲管理有限公司 Delifrance (HK) Limited Dutch Kitchen Limited -

Featured Merchants for Quickpass Acceptance Convenience Stores: 7-Eleven, Circle K, VANGO Super Market: City Super, Market Pl

Featured Merchants for QuickPass Acceptance Convenience Stores: 7-Eleven, Circle K, VANGO Super Market: City Super, Market Place by Jasons, Three Sixty, U select, UNY, Vanguard, Wellcome, YATA Bakeries: Arome Bakery, COVA, ITALIAN TOMATO, Kee Wah Bakery, Maxim's Cakes, Orchid Padaria Bakery, SIFT Food Stores: Aji Ichiban, Best Mart 360 ゚, Hung Fook Tong, Pappagallo, Venchi Restaurants: Agnes B Café, Ajisen Ramen, Chee Kee, Genki Sushi, Ho Hung Kee, Hong Kong Day, IPPUDO, KFC, Mövenpick, MX, Pacific Coffee, Pizza Hut, Saboten, Sen-Ryo, Starbucks, TamJai Samgor, Tao Heung, Teawood, Tsui Wah Restaurant, Uo-Show, Xi Chu Fan Tang Pharmacies/Health Products: Catalo, CR Care, eCosway, GNC, HERBALIFE, Mannings Beauty /Cosmetic Stores: 3CE, Benefit, Choi Fung Hong, Bonjour, Colourmix, Facesss, fresh, Make Up Forever, MORIMOR, Sa Sa, Sweetmay Book/CD Stores: Bookazine, CD Warehouse, Chung Hwa Book Co., Eslite, HMV, Joint Publishing, The Commercial Press Electronics & Appliance Stores: Apple Store, Broadway, Fortress , Suning Toy Stores: Toys "R" Us Department Stores: Lane Crawford, Muji, Sogo, Sincere, Wing On, YATA, Yue Wah Chinese Products Furniture/Lifestyle Stores: IKEA, Japan Home Centre, Pricerite Clothing Stores: Aape, AIGLE, b+ab, Baleno, BSX, Calzedonia, CHOCOOLATE, COTTON ON, D-MOP, double-park, ESPRIT, EXI.T, Fred Perry, GIORDANO, GU, H&M, http://www.izzue.com, i.t, MAX & CO, Monki, NAUTICA, The North Face, Toonsland , UNIQLO , VANS , ZAXY Luxury/Leather Goods/Accessories/Shoe Stores: Alexander Wang, Burberry, GIVENCHY, HERMES, ISA, Kenzo, LAVENGI, Marc Jacobs , Max Mara , Tommy Hilfiger, Timberland Jewelry/Watch Stores: Audemars Piguet, Chow Sang Sang, Emphasis, Harry Winston, Lao Feng Xiang, Longines, Luk Fook, Prince Jewellery & Watch, Swatch Opticians: Lenscrafters Other Services: Chu Kong Shipping, Madame Tussaud, SKY 100 Updated on:April, 2017 *All the POS terminals with "QuickPass" signage are supporting mobile QuickPass.