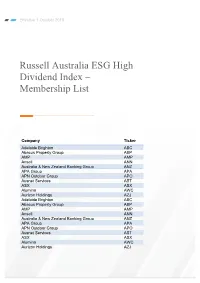

Russell Australia ESG High Dividend Index – Membership List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Quarterly Investment Update Antares High Growth Shares Fund – June 2021

Quarterly Investment Update Antares High Growth Shares Fund – June 2021 For adviser use only Highlights for the quarter Performance: The Fund returned 9.6% (net of fees) for the June quarter, outperforming its benchmark by 1.3%. Contributors to performance: Positive contributors – Aristocrat Leisure, Telix Pharmaceuticals, Megaport, Boral, Woodside (not owned); Negative contributors – Incitec Pivot, Qantas, ANZ, Resmed (not owned) and Altium (not owned). Stock activity: Buys/additions – Ansell, Downer and TPG Telecom ; Sells/reductions – BlueScope Steel, Boral, Endeavour Group and Worley Fund snapshot Inception date 7 December 1999 Benchmark S&P/ASX 200 Total Return Index To outperform the benchmark (after fees) over rolling Investment objective 5-year periods Investment returns as at 30 June 20211 Period 3 months 1 year 3 years pa 5 years pa 10 years pa Since inception pa Net return2 % 9.6 39.9 9.2 12.6 10.0 11.0 Gross return3 % 9.9 41.9 10.5 13.9 11.2 12.5 Benchmark return % 8.3 27.8 9.6 11.2 9.3 8.5 Net excess return % 1.3 12.1 -0.4 1.4 0.7 2.5 Gross excess return % 1.6 14.1 0.9 2.7 1.9 4.0 1 Past performance is not a reliable indicator of future performance. Returns are not guaranteed and actual returns may vary from any target returns described in this document. 2 Investment returns are based on exit prices, and are net of management fees and assume reinvestment of all distributions. Contributors to performance Pleasingly the Fund enjoyed another strong quarter, returning 9.6% (net of fees) vs the benchmark return of 8.3%. -

Getting Things Done

Incitec Pivot Limited Pivot Incitec ® Getting ® Annual Report 2006 Report Annual things done. ® ® ® ® Incitec Pivot Limited ABN 42 004 080 264 70 Southbank Boulevard, ™ Southbank Victoria 3006, Australia Postal address Incitec Pivot Limited GPO Box 1322 Melbourne Victoria 3001, Australia T. + 61 3 8695 4400 F. + 61 3 8695 4419 www.incitecpivot.com.au Annual Report 2006 ® Incitec Pivot Limited ABN 42 004 080 264 Shareholder Information Annual General Meeting 2.00 pm Wednesday 20 December 2006 at The Arts Centre, 100 St Kilda Road, Melbourne Victoria 3000, Australia, in the ANZ Pavilion Stock Exchange Listing Incitec Pivot’s shares are listed on the Australian Stock Exchange (ASX) and are traded under the code IPL Share Registry Link Market Services Level 12, 680 George Street, Sydney New South Wales 2000, Australia Locked Bag A14 Sydney South New South Wales 1235 Telephone: 1300 554 474 (for callers within Australia) International: +61 2 8280 7111 General Facsimile: +61 2 9287 0303 Proxy Facsimile: +61 2 9287 0309 Email: [email protected] Website: www.linkmarketservices.com.au Auditor KPMG 147 Collins Street, Melbourne Victoria 3000, Australia Incitec Pivot Limited Registered address and head office: 70 Southbank Boulevard, Southbank Victoria 3006, Australia GPO Box 1322 Melbourne Victoria 3001, Australia Telephone: +61 3 8695 4400 Facsimile: +61 3 8695 4419 www.incitecpivot.com.au SuPerfect, Easy Liquids, Green Urea and FertTerms Plus are registered trade marks of Incitec Pivot Limited. Cal Gran is a trade mark of Incitec Pivot Limited. The BIG N logo, Nutrient Advantage, Granulock, GranAm and Liquifert are registered trade marks of Incitec Fertilizers Limited. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Dow Jones Sustainability Australia Index

Effective as of 23 November 2020 Dow Jones Sustainability Australia Index Company Country Industry Group Comment Australia and New Zealand Banking Group Limited Australia Banks National Australia Bank Limited Australia Banks Westpac Banking Corporation Australia Banks CIMIC Group Limited Australia Capital Goods Brambles Limited Australia Commercial & Professional Services Downer EDI Limited Australia Commercial & Professional Services Tabcorp Holdings Limited Australia Consumer Services The Star Entertainment Group Limited Australia Consumer Services Janus Henderson Group plc United Kingdom Diversified Financials Oil Search Limited Papua New Guinea Energy Woodside Petroleum Ltd Australia Energy Coles Group Limited Australia Food & Staples Retailing Fisher & Paykel Healthcare Corporation Limited New Zealand Health Care Equipment & Services Asaleo Care Limited Australia Household & Personal Products Insurance Australia Group Limited Australia Insurance QBE Insurance Group Limited Australia Insurance Suncorp Group Limited Australia Insurance Addition Amcor plc Switzerland Materials Addition BHP Group Australia Materials Boral Limited Australia Materials Evolution Mining Limited Australia Materials Fletcher Building Limited New Zealand Materials Fortescue Metals Group Limited Australia Materials IGO Limited Australia Materials Iluka Resources Limited Australia Materials Incitec Pivot Limited Australia Materials Newcrest Mining Limited Australia Materials Orocobre Limited Australia Materials Rio Tinto Ltd Australia Materials South32 Limited -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 04 December 2020 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 13.48 -3.02 2.04 -24.57 -5.73 13.14 21.69 66.61 - - ABC Adelaide Brighton 3.23 2.22 3.19 -2.46 -0.08 -18.14 -17.52 -1.18 4.55 98 ABP Abacus Property Grp 3.15 -0.63 6.42 21.82 -10.83 4.23 -3.52 6.74 8.37 69 AFI Australian Foundat 7.22 -0.82 8.41 17.95 9.38 13.38 9.55 8.04 7.01 75 AGL AGL Energy Limited 13.52 -1.46 5.54 -20.24 -27.72 -9.15 -12.47 1.87 3.88 102 AIA Auckland Internation 7.32 -0.41 8.77 11.76 -12.65 5.08 9.74 10.98 18.12 22 ALD Ampol Limited 30.77 0.46 21.00 9.73 -8.08 8.66 -1.78 0.93 10.77 56 ALL Aristocrat Leisure 31.84 -3.74 3.67 17.51 -3.91 17.25 14.09 28.04 29.23 7 ALQ ALS Limited 9.52 -2.36 -0.98 31.69 7.40 14.26 14.25 21.73 5.54 90 ALU Altium Limited 35.72 2.09 -5.53 -1.48 2.44 24.33 41.36 50.26 71.58 1 ALX Atlas Arteria 6.48 -1.22 8.91 -2.66 -11.90 3.02 5.85 12.80 18.17 21 AMC Amcor PLC 15.34 -0.84 0.16 3.68 8.49 11.97 3.36 6.80 13.24 39 AMP AMP Limited 1.72 -1.15 3.30 2.84 0.04 -12.32 -25.31 -14.07 -2.03 121 ANN Ansell Limited 35.68 -5.06 -14.07 0.81 26.57 27.11 14.59 12.75 11.78 48 ANZ ANZ Banking Grp Ltd 23.30 0.91 22.54 24.41 -1.20 -1.64 -1.47 2.25 5.11 94 APA APA Group 10.18 -3.69 -6.86 -9.84 -0.47 13.21 7.59 8.16 14.00 36 APE AP Eagers Limited 13.25 -0.53 14.13 81.51 37.33 41.67 21.54 5.80 20.09 20 APT Afterpay Touch 94.50 -0.21 -6.20 81.03 224.97 -

Single Sector Funds Portfolio Holdings

! Mercer Funds Single Sector Funds Portfolio Holdings December 2020 welcome to brighter Mercer Australian Shares Fund Asset Name 4D MEDICAL LTD ECLIPX GROUP LIMITED OOH MEDIA LIMITED A2 MILK COMPANY ELDERS LTD OPTHEA LIMITED ABACUS PROPERTY GROUP ELECTRO OPTIC SYSTEMS HOLDINGS LTD ORICA LTD ACCENT GROUP LTD ELMO SOFTWARE LIMITED ORIGIN ENERGY LTD ADBRI LTD EMECO HOLDINGS LTD OROCOBRE LTD ADORE BEAUTY GROUP LTD EML PAYMENTS LTD ORORA LTD AFTERPAY LTD ESTIA HEALTH LIMITED OZ MINERALS LTD AGL ENERGY LTD EVENT HOSPITALITY AND ENTERTAINMENT PACT GROUP HOLDINGS LTD ALKANE RESOURCES LTD EVOLUTION MINING LTD PARADIGM BIOPHARMACEUTICALS LTD ALS LIMITED FISHER & PAYKEL HEALTHCARE CORP LTD PENDAL GROUP LTD ALTIUM LTD FLETCHER BUILDING LTD PERENTI GLOBAL LTD ALUMINA LTD FLIGHT CENTRE TRAVEL GROUP LTD PERPETUAL LTD AMA GROUP LTD FORTESCUE METALS GROUP LTD PERSEUS MINING LTD AMCOR PLC FREEDOM FOODS GROUP LIMITED PHOSLOCK ENVIRONMENTAL TECHNOLOGIES AMP LTD G8 EDUCATION LTD PILBARA MINERALS LTD AMPOL LTD GALAXY RESOURCES LTD PINNACLE INVESTMENT MANAGEMENT GRP LTD ANSELL LTD GDI PROPERTY GROUP PLATINUM INVESTMENT MANAGEMENT LTD APA GROUP GENWORTH MORTGAGE INSRNC AUSTRALIA LTD POINTSBET HOLDINGS LTD APPEN LIMITED GOLD ROAD RESOURCES LTD POLYNOVO LIMITED ARB CORPORATION GOODMAN GROUP PTY LTD PREMIER INVESTMENTS LTD ARDENT LEISURE GROUP GPT GROUP PRO MEDICUS LTD ARENA REIT GRAINCORP LTD QANTAS AIRWAYS LTD ARISTOCRAT LEISURE LTD GROWTHPOINT PROPERTIES AUSTRALIA LTD QBE INSURANCE GROUP LTD ASALEO CARE LIMITED GUD HOLDINGS LTD QUBE HOLDINGS LIMITED ASX LTD -

View Annual Report

Nufarm Limited Annual Report 2015 ANNUAL REPORT 2015 Building a better Nufarm The company is making changes and improvements that will help Nufarm become a better, more successful business. While we have continued to grow in recent years, we must ensure that we are generating the level of profitability that we need to fund future growth opportunities and reward our shareholders with a suitable return on their investment. We are lowering our cost base and putting systems and processes in place that help us become more efficient and more competitive. And we’ve set some ambitious targets to achieve over the next three years, with the aim of generating significant cost savings and a return on funds employed (ROFE) of 16 per cent by the end of our 2018 financial year. Nufarm has a strong global distribution platform; a broad product portfolio; a respected brand; and talented, committed employees who will continue to contribute to the success of the company. It’s a challenging, but exciting time to be part of a business where things are changing for the better. CONTENTS 01 About Nufarm 02 Key events 03 Facts in brief 04 Managing director’s review ER AND M 10 Business review M AR TO K S E U T 14 Sustainability C We understand our 16 Board of directors customers and markets. V E Our people, systems and A 18 Executive management R processes make us easy L U to deal with. U 20 Information on the company T L E 22 Corporate governance S U 36 Financial report C WE BUILD 37 Directors’ report VALUE FOR CUSTOMERS 57 Lead auditor’s independence declaration We safely AND NUFARM manufacture high We create unique E P quality products 58 Income statement C O value propositions and we deliver N R for our customers 59 Statement of comprehensive income those products in E T across our range L F full and on time O of high quality L 60 Balance sheet at the lowest E L products. -

Australian Capital Territory Listed Company Shareholdings As at 31 March 2021

? i Australian Capital Territory Listed Company Shareholdings at 31 March 2021 Publication Date: April 2021 Page | 1 10X Genomics Inc Airbus SE 3i Group PLC Aisin Corp 3M Co Ajinomoto Co Inc A O Smith Corp Akamai Technologies Inc a2 Milk Co Ltd/The Akzo Nobel NV ABB Ltd Albemarle Corp Abbott Laboratories Alcon Inc AbbVie Inc Alexandria Real Estate Equities Inc ABC-Mart Inc Alexion Pharmaceuticals Inc ABIOMED Inc Alfa Laval AB Accent Group Ltd Algonquin Power & Utilities Corp Accenture PLC Align Technology Inc Accor SA Alimentation Couche-Tard Inc Acom Co Ltd Alkane Resources Ltd ACS Actividades de Construccion y Servic Alleghany Corp Activision Blizzard Inc Allegion plc Adbri Ltd Allianz SE Adecco Group AG Allstate Corp/The adidas AG Ally Financial Inc Admiral Group PLC Alnylam Pharmaceuticals Inc Adobe Inc Alphabet Inc Advance Auto Parts Inc ALS Ltd Advanced Micro Devices Inc Alstom SA Advantest Corp AltaGas Ltd Adyen NV Altice USA Inc Aegon NV Altium Ltd Aeon Co Ltd Alumina Ltd Aflac Inc Amada Co Ltd Afterpay Ltd Amadeus IT Group SA AGC Inc Amazon.com Inc Ageas SA/NV Ambu A/S Agilent Technologies Inc Amcor PLC Agnaten SE AMERCO AGNC Investment Corp American Express Co Agnico Eagle Mines Ltd American Financial Group Inc/OH AIA Group Ltd American International Group Inc Air Canada American Tower Corp Air Liquide SA American Water Works Co Inc Air Products and Chemicals Inc Ameriprise Financial Inc Air Water Inc AmerisourceBergen Corp Airbnb Inc AMETEK Inc Page | 2 Amgen Inc Assicurazioni Generali SpA AMP Ltd Assurant Inc Amphenol Corp -

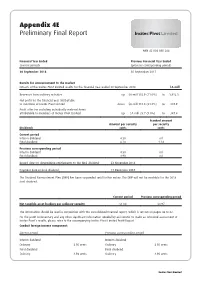

Appendix 4E Preliminary Final Report

Appendix 4E Preliminary Final Report ABN 42 004 080 264 Financial Year Ended Previous Financial Year Ended (current period) (previous corresponding period) 30 September 2018 30 September 2017 Results for announcement to the market Extracts of the Incitec Pivot Limited results for the financial year ended 30 September 2018 $A mill Revenues from ordinary activities up $A mill 382.9 (11.0%) to 3,856.3 Net profit for the financial year attributable to members of Incitec Pivot Limited down $A mill 110.8 (34.8%) to 207.9 Profit after tax excluding individually material items attributable to members of Incitec Pivot Limited up $A mill 28.7 (9.0%) to 347.4 Franked amount Amount per security per security Dividends cents cents Current period Interim dividend 4.50 nil Final dividend 6.20 1.24 Previous corresponding period Interim dividend 4.50 nil Final dividend 4.90 nil Record date for determining entitlements to the final dividend: 23 November 2018 Payment date of final dividend: 17 December 2018 The Dividend Reinvestment Plan (DRP) has been suspended until further notice. The DRP will not be available for the 2018 final dividend. Current period Previous corresponding period Net tangible asset backing per ordinary security $1.04 $0.97 The information should be read in conjunction with the consolidated financial report, which is set out on pages 46 to 82. For the profit commentary and any other significant information needed by an investor to make an informed assessment of Incitec Pivot’s results, please refer to the accompanying Incitec Pivot Limited Profit Report. -

Russell Australia ESG High Dividend Index – Membership List

Effective 1 October 2018 Russell Australia ESG High Dividend Index – Membership List Company Ticker Adelaide Brighton ABC Abacus Property Group ABP AMP AMP Ansell ANN Australia & New Zealand Banking Group ANZ APA Group APA APN Outdoor Group APO Ausnet Services AST ASX ASX Alumina AWC Aurizon Holdings AZJ Adelaide Brighton ABC Abacus Property Group ABP AMP AMP Ansell ANN Australia & New Zealand Banking Group ANZ APA Group APA APN Outdoor Group APO Ausnet Services AST ASX ASX Alumina AWC Aurizon Holdings AZJ Company Ticker Bendigo and Adelaide Bank BEN Bega Cheese BGA Boral BLD Bank of Queensland Ltd. BOQ Beach Energy BPT Bluescope Steel BSL Brambles BXB Commonwealth Bank of Australia CBA Coca-Cola Amatil CCL Challenger CGF Charter Hall Group CHC CIMIC Group CIM Cromwell Property Group CMW Cochlear COH Computershare CPU Charter Hall Retail REIT CQR CSL CSL CSR CSR Caltex Australia CTX Cleanaway Waste Management CWY DuluxGroup DLX Downer Group DOW Dexus Property Group DXS Evolution Mining EVN Fortescue Metals Group FMG Genworth Mortgage Insurance Australia GMA Goodman Group GMG Graincorp GNC Growthpoint Properties Australia GOZ GPT Group GPT Healthscope HSO Insurance Australia Group IAG IOOF Holdings IFL Infigen Energy IFN Independence Group NL IGO Iluka Resources ILU Investa Office Fund IOF Incitec Pivot Ltd IPL Lend Lease Group LLC Magellan Financial Group MFG Mirvac Group MGR Medibank Private MPL Macquarie Group MQG National Australia Bank NAB Company Ticker Scentre Group SCG Shopping Centres Australasia Property Group SCP Sandfire Resources NL SFR Stockland SGP Sonic Healthcare SHL Santos STO Super Retail Group SUL Suncorp Group SUN Sydney Airport SYD Transurban Group TCL Tassal Group TGR Telstra Corp TLS Vicinity Centers VCX Westpac Banking Corp WBC Wesfarmers WES WorleyParsons Ltd. -

Dow Jones Sustainability Australia Index

Effective as of 23 September 2019 Dow Jones Sustainability Australia Index Company Country Industry Group Comment Australia & New Zealand Banking Group Ltd Australia Banks National Australia Bank Ltd Australia Banks Westpac Banking Corp Australia Banks CIMIC Group Ltd Australia Capital Goods Brambles Ltd Australia Commercial & Professional Services Downer EDI Ltd Australia Commercial & Professional Services Addition Star Entertainment Grp Ltd Australia Consumer Services Tabcorp Holdings Ltd Australia Consumer Services Janus Henderson Group PLC United Kingdom Diversified Financials Macquarie Group Ltd Australia Diversified Financials Oil Search Ltd Australia Energy Woodside Petroleum Ltd Australia Energy Coles Group Ltd Australia Food & Staples Retailing Fisher & Paykel Healthcare Corp Ltd New Zealand Health Care Equipment & Services Asaleo Care Ltd Australia Household & Personal Products Insurance Australia Group Ltd Australia Insurance QBE Insurance Group Ltd Australia Insurance BHP Group Ltd Australia Materials Boral Ltd Australia Materials Addition Evolution Mining Ltd Australia Materials Addition Fletcher Building Ltd New Zealand Materials Addition Fortescue Metals Group Ltd Australia Materials Iluka Resources Ltd Australia Materials Incitec Pivot Ltd Australia Materials Independence Group NL Australia Materials Addition Newcrest Mining Ltd Australia Materials Orica Ltd Australia Materials Orocobre Ltd Australia Materials Rio Tinto Ltd Australia Materials Sims Metal Management Ltd Australia Materials South32 Ltd Australia Materials