Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strategic Use of the Internet and E-Commerce: Cisco Systems

Journal of Strategic Information Systems 11 (2002) 5±29 www.elsevier.com/locate/jsis Strategic use of the Internet and e-commerce: Cisco Systems Kenneth L. Kraemer*, Jason Dedrick Graduate School of Management and Center for Research on Information Technology and Organizations, University of California, Irvine, 3200 Berkeley Place, Irvine, CA 92697-4650, USA Accepted 3October 2001 Abstract Information systems are strategic to the extent that they support a ®rm's business strategy. Cisco Systems has used the Internet and its own information systems to support its strategy in several ways: (1) to create a business ecology around its technology standards; (2) to coordinate a virtual organiza- tion that allows it to concentrate on product innovation while outsourcing other functions; (3) to showcase its own use of the Internet as a marketing tool. Cisco's strategy and execution enabled it to dominate key networking standards and sustain high growth rates throughout the 1990s. In late 2000, however, Cisco's market collapsed and the company was left with billions of dollars in unsold inventory, calling into question the ability of its information systems to help it anticipate and respond effectively to a decline in demand. q 2002 Elsevier Science B.V. All rights reserved. Keywords: Internet; e-commerce; Cisco Systems; Virtual Organization; Business Ecology 1. Introduction Information systems are strategic to the extent that they are used to support or enable different elements of a ®rm's business strategy (Porter and Millar, 1985). Cisco Systems, the world's largest networking equipment company, has used the Internet, electronic commerce (e-commerce), and information systems as part of its broad strategy of estab- lishing a dominant technology standard in the Internet era. -

Juniper Networks Investor Relations May 2021

Juniper Networks Investor Relations May 2021 1 © 2021 Juniper Networks Juniper Public Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve substantial risks and uncertainties. Except for historical information contained herein, all statements could be deemed forward-looking statement, including, without limitation, Juniper Networks’ views concerning our business outlook; economic and market outlook; our future financial and operating results (including our financial model); the expected impact of network transitions and timing of deployments with large customers; our capital return program; our expectations with respect to market trends; our future strategy; the strength of certain use-cases and customer segments; our ability to expand business opportunities (including in software, security, hyperscale-switching, 5G buildouts and with enterprise customers); our expectations with respect to revenue growth, gross margin or operating costs or our ability to improve profitability and make necessary investments; the introduction of future products; the strength of our solution portfolio; the timing of recovery from COVID-19 on customer demand; and overall future prospects. Actual results or events could differ materially from those anticipated in those forward-looking statements as a result of several factors, including: general economic and political -

Juniper Networks J-Series Services Routers: J2320, J2350, J4350, and J6350

Datasheet Juniper Networks J-series Services Routers: J2320, J2350, J4350, and J6350 Product Description Enterprises are faced with a number of challenges and opportunities by converging voice, video and data to one network. This consolidation of network elements reduces cost by easing deployment of SIP enabled voice over IP (VoIP), real-time high-definition Telepresence and standardizing on a consistent infrastructure network operating system like JUNOS software. These new technologies improve; customer relations, interactions with suppliers, and employee productivity. This mission-critical multi-media network must be always on and always available. To accomplish this, fully integrated stateful security is a key requirement, not merely forwarding packets without regard to the intended application or individual user session. JUNOS software with enhanced services provides the high-performance networking infrastructure that helps enterprises Juniper Networks J-series services routers extend implement key initiatives that: • Secure critical information and protect the network from vulnerabilities and attacks. Enterprise applications and deliver reliable Enterprises need to protect confidential information from external and internal connectivity to remote offices with a powerful attacks as they connect with their customers and suppliers. The inseparable routing and firewall offered by JUNOS software with enhanced services secures every location blend of high-performance network protection in the network and allows departmental segmentation out to remote locations of the network. Implementing IPSec VPNs with firewalls at remote sites allows for flexible and advanced services. J-series services routers network connectivity with security for split tunneling configurations. leverage the modular JUNOS® software operating • Minimize the cost of installing and operating the network. -

The Great Telecom Meltdown for a Listing of Recent Titles in the Artech House Telecommunications Library, Turn to the Back of This Book

The Great Telecom Meltdown For a listing of recent titles in the Artech House Telecommunications Library, turn to the back of this book. The Great Telecom Meltdown Fred R. Goldstein a r techhouse. com Library of Congress Cataloging-in-Publication Data A catalog record for this book is available from the U.S. Library of Congress. British Library Cataloguing in Publication Data Goldstein, Fred R. The great telecom meltdown.—(Artech House telecommunications Library) 1. Telecommunication—History 2. Telecommunciation—Technological innovations— History 3. Telecommunication—Finance—History I. Title 384’.09 ISBN 1-58053-939-4 Cover design by Leslie Genser © 2005 ARTECH HOUSE, INC. 685 Canton Street Norwood, MA 02062 All rights reserved. Printed and bound in the United States of America. No part of this book may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without permission in writing from the publisher. All terms mentioned in this book that are known to be trademarks or service marks have been appropriately capitalized. Artech House cannot attest to the accuracy of this information. Use of a term in this book should not be regarded as affecting the validity of any trademark or service mark. International Standard Book Number: 1-58053-939-4 10987654321 Contents ix Hybrid Fiber-Coax (HFC) Gave Cable Providers an Advantage on “Triple Play” 122 RBOCs Took the Threat Seriously 123 Hybrid Fiber-Coax Is Developed 123 Cable Modems -

The World Needs Network Innovation. Juniper Is Here to Help

The world needs network innovation. Juniper is here to help. In a world where the pace of change is accelerating at an unprecedented rate the network has taken on a new level of importance as the vehicle for pulling together our best people, best thinking, and best hope for addressing the critical challenges we face as a global community. The JUNIPER BY THE macro-trends of cloud computing and the mobile Internet NUMBERS hold the potential to expand the reach and power of the network—while creating an explosion of new subscribers, • The world’s top five social media properties new traffic, and new content. In the face of such intense are supported by Juniper demand, this potential cannot be realized with legacy Networks. thinking. Juniper Networks stands as a response and a • The top 10 telecom companies challenge to the traditional approach to the network. in the world run on Juniper Networks. • Juniper Networks is deployed in more than 1,400 national Our Vision government organizations We believe the network is the single greatest vehicle for knowledge, collaboration, and around the world. human advancement that the world has ever known. Now more than ever, the world relies on high-performance networks. And now more than ever, the world needs network • Juniper has over 8,700 innovation to unleash our full potential. employees in 46 worldwide offices, serving over 100 The network plays a central role in addressing the critical challenges we face as a global countries. community. Consider the healthcare industry, where the network is the foundation for new models of mobile affordable care for underserved communities. -

Juniper Networks Junos Space Network Management Platform, with Or Without Network Director and with Or Without Security Director in JA2500

Juniper Networks Junos Space Network Management Platform, with or without Network Director and with or without Security Director in JA2500 Firmware: Junos Space 19.1R1_FIPS, Network-Director.3.6R3.15 and Security-Director-19.1R1.23 Non-Proprietary FIPS 140-2 Cryptographic Module Security Policy Document Version: 1.0 Date: December 14, 2020 Juniper Networks, Inc. 1133 Innovation Way Sunnyvale, California 94089 USA 408.745.2000 1.888 JUNIPER www.juniper.net Copyright Juniper, 2020 Document Version 1.0 Page 1 of 40 Juniper Networks Public Material – May be reproduced only in its original entirety (without revision). Table of Contents 1 Introduction .................................................................................................................... 4 1.1 Cryptographic Boundary ..............................................................................................................6 1.2 Modes of Operation .....................................................................................................................8 1.2.1 FIPS Approved Mode ..........................................................................................................8 1.2.2 Non-Approved Mode ..........................................................................................................8 1.3 Zeroization ....................................................................................................................................9 2 Cryptographic Functionality .......................................................................................... -

Ericsson.Com/ Networks

ericsson.com/ networks End-to-end network capabilities simplify the journey to 5G for Swisscom 2 Ericsson | End-to-end network capabilities simplify the journey to 5G for Swisscom Wanting to ensure its consumers would reap the benefits of 5G at an early stage, Swiss operator Swisscom was looking for a vendor that could act as a one-stop shop in managing and maintaining its entire IP transport network. Our product portfolio and subsequent partnership with Juniper Networks made us the perfect choice. In November 2017, Swisscom was discussing how In the first end-to-end 5G transport network deal in the upcoming introduction of 5G would greatly the industry, Ericsson is delivering Swisscom’s new increase complexity in its IP transport network. end-to-end 5G IP transport network with Router Swisscom wanted to be early in the market with 5G 6672 as the site router, Router 6675 as the C-RAN technologies, and it was looking for a single vendor router, Router 6274 as the edge router and Juniper able to take full end-to-end responsibility for its MX 10008 as the core router. The architecture meets complete IP transport network from the radio site up scalability, availability, performance, latency and to the data center. synchronization demands, and it is functionally aligned end-to-end. All of the routers are managed Key characteristics of the network were the support by one single operations support system (OSS), for slicing, low latency, time/phase synchronization namely Ericsson Network Manager. and high performance, and the complete transport network had to be managed by one management Heinz Herren, CIO and CTO at Swisscom says: “We system. -

May 28, 2021 Submitted Via ECFS

May 28, 2021 Submitted via ECFS Marlene H. Dortch Federal Communications Commission Page | 1 45 L Street NE Washington, D.C., 20554 Re: Reply Comments of the Open RAN Policy Coalition on Promoting the Deployment of 5G Open Radio Access Networks, GN Docket No. 21-63. Dear Ms. Dortch, The Open RAN Policy Coalition (“ORPC” or “Coalition”)1 appreciates the opportunity to provide additional input to the Federal Communications Commission (“Commission”) on its Notice of Inquiry (“NOI”) Promoting the Deployment of 5G Open Radio Access Networks. Initial comments in this landmark proceeding provide a robust foundational record regarding the growing Open RAN market, show widespread consensus about the potential public benefits Open RAN can produce, and coalescence around several key steps the Commission and other policymakers can take to support these outcomes. Commenters also express consensus that policies supporting industry innovation and carrier choice – not government mandates or legal preferences – will enable the market to realize the benefits of Open RAN.2 Commenters describe active and diverse engagement in industry organizations that are driving standardization, testing, and other real-world advancement toward open and interoperable interfaces in the RAN.3 1 See https://www.openranpolicy.org/. As of this filing, the Coalition includes 60 members, including: Airspan, Altiostar, American Tower, Analog Devices, Arm, AT&T, AWS, Benetel, Bharti Airtel, Broadcom, Ciena, Cisco, Cohere Technologies, CommScope, Crown Castle, DeepSig, Dell Technologies, Deutsche Telekom, DISH Network, Facebook, Fujitsu, GigaTera Communications, Google, Hewlett Packard Enterprise, IBM, Inseego, Intel, JMA Wireless, Juniper Networks, Ligado Networks, Marvell, Mavenir, Microsoft, NEC Corporation, NewEdge Signal Solutions, Nokia, NTT, Nvidia, Oracle, Palo Alto Networks, Pivotal Commware, Qualcomm, Quanta Cloud Technology, Radisys, Rakuten Mobile, Reliance Jio, Rift, Robin, Samsung Electronics America, STL Tech, Telefónica, Texas Instruments, U.S. -

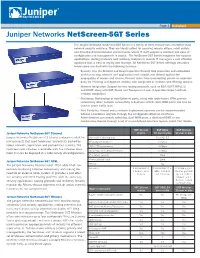

Juniper Networks Netscreen-5GT Series Datasheet

Page Datasheet Juniper Networks NetScreen-5GT Series The Juniper Networks NetScreen-5GT Series is a family of three feature-rich, enterprise-class network security solutions. They are ideally suited for securing remote offices, retail outlets and broadband telecommuter environments, where IT staff support is minimal and ease of configuration and management is crucial. The NetScreen-5GT Series integrates key security applications, routing protocols and resiliency features to provide IT managers a cost effective appliance that is easy to deploy and manage. All NetScreen-5GT Series offerings described below come standard with the following features: • Security: Use the Stateful and Deep Inspection firewall, DoS protection and embedded antivirus to stop network and application level attacks and defend against the propagation of worms and viruses. Prevent users from transmitting private or corporate data, via Phishing and Spyware attacks, with integrated or re-direct web filtering options. • Network integration: Support for key routing protocols, such as BGP, OSPF, RIPv1/2 and ECMP along with NAT, Route and Transparent Layer 2 operation helps facilitate network integration. • Resiliency: Dial-backup or dual Ethernet ports, along with route-based VPNs provide redundancy when network connectivity is business critical. Dual WAN ports can also be used to share traffic load. • Port Flexibility: Almost every network deployment scenario can be accommodated without a hardware upgrade through five configurable Ethernet interfaces. Administrators can enable switching, dual WAN ports, a dedicated DMZ or any combination thereof through a set of six predefined interface layouts called Port Modes. 5GT 10 user 5GT ADSL 5GT Wireless Juniper Networks NetScreen-5GT Ethernet or plus 10 user or plus 10 user or plus Juniper Networks NetScreen-5GT Ethernet solution is ideal for ScreenOS version support ScreenOS 5.3 environments that need hardwired connectivity backed by Firewall performance(1) 75 Mbps robust network, application and payload level security. -

Juniper Networks J4350/J6350 Services Routers Data Sheet

Datasheet Juniper Networks J4350/J6350 Services Routers Product Description Juniper J4350 and J6350 routers are ideal for branch offices connected directly to a traditional private network such as leased lines, Frame Relay, ATM or MPLS, or for branch offices where the public Internet is being used as an alternative to a traditional private WAN. Because the J4350 and J6350 offer superior performance while running services Juniper Networks J4350 and J6350 routers such as stateful firewall, Network Address Translation (NAT), and IPSec, they are also provide up to Gigabit Ethernet performance for ideally suited for Metro Ethernet deployments. enterprise remote, branch, and regional offices. The Juniper J4350 and J6350 are modular routers that support Juniper Physical Interface Modules (PIMs) which provide a wide variety of common WAN and LAN interfaces, They run modular JUNOS software which offers including Gigabit Ethernet. Both models offer hardware encryption acceleration (optional on the J4350), and are available in DC and Network Equipment Building System (NEBS) advanced services (MPLS, IPv6, quality of service versions. Additionally, the J6350 offers redundant AC or DC power supplies. The following (QoS), multicast) and security (stateful firewall table outlines key hardware features: and IPSec VPN) at no additional charge. The Product Description J4350 • Support for T1, E1, Fast Ethernet, Serial, ISDN BRI, ADSL/2/2+, G.SHDSL, J4350 and J6350 Services Routers support DS3, E3, Gigabit Ethernet Interfaces • Support for integrated IP Telephony using the Avaya IG550 Integrated Gateway integrated IP Telephony using the Avaya IG500 • 4 fixed GE LAN ports, 4 PIM slots, and 2 EPIM/PIM slots Integrated Gateway. -

Vmx Virtual Router on Microsoft Azure

vMX Virtual Router on Microsoft Azure Seamlessly extend your enterprise network into the cloud with Juniper Networks® vMX Virtual Router, a full- featured cloud-grade virtual router. The vMX enables secure migration of IT infrastructure and apps to the cloud with routing protocols, VPN support, and IPsec. Additionally, vMX provides sophisticated routing services that support provider edge, broadband network gateway, and route reflector solutions for service providers leveraging cloud infrastructure. WHAT WE OFFER Seamless integration Secure migration Easy deployment Efficient scalability Enjoy seamless, easy, and Supports sophisticated routing Is easily deployed in the public Allows users to efficiently immediate integration with the services with IPsec, including cloud using automation for scale, on demand, routing current Juniper solution. vPE, and as a Cloud Gateway, rapid deployment, eliminating and forwarding capacity to is suited for rapid service the time-consuming facility accommodate deployment in all Runs the Junos operating scale out and agile service and platform qualifications sizes. Is scalable up to 2.5 Gbps system with a vTrio forwarding introduction and modification associated with physical IPsec performance. engine to manage existing and for both service providers and routers. cloud networks in the same enterprise. manner. What our customers are saying Learn More “Juniper vMX leverages OTS hardware and supports For more information, visitAzure and Juniper or open APIs, reinforcing programming tools such as Ruby, E-mail: [email protected] Python, Ansible, Puppet, and Chef. This will allow us to spend less time manipulating the platform and more time creating innovative solutions with our clients.” Frank Jadevaia, President, Intercloud Systems Azure is the Microsoft application platform for the public cloud. -

IP/MPLS Router Module for the CBX 500 Multiservice WAN Switch Quick

IP/MPLS Router Module for the CBX 500 Multiservice WAN Switch Quick Start Lucent Technologies InterNetworking Systems Data Networking 1 Robbins Road Westford, MA 01886 http://www.lucent.com/support Part Number: 530-011610-01, Revision 1; Lucent comcode: 300730959 This Quick Start contains information you need to install and configure the Lucent Technologies IP/MPLS Router Module quickly. For complete installation instructions, see the IP/MPLS Router Module Hardware Guide at www.lucent.com. WARNING: This Quick Start contains a summary of safety warnings on page 10. For a complete list of warnings for this router module, including translations, see the IP/MPLS Router Module Hardware Guide at www.lucent.com. The router module is a complete routing system that provides ATM, Ethernet, and IP services for large networks and network applications, such as those supported by Internet service providers (ISPs). Application-specific integrated circuits (ASICs), which are a definitive part of the router module design, let the router module forward data at the high speeds that current network media demand. The router module is designed exclusively for installation in the Lucent Technologies CBX 500 Multiservice WAN Switch. The router module is 2.1 in. (5.3 cm) wide, which enables side-by-side installation of six IP/MPLS router modules in a single CBX 500 switch. You can install a router module in any two adjacent CBX 500 slots except the leftmost slot (slot 3). The router module is shipped in a cardboard carton (on an optional pallet). The carton contains the following items: One accessory kit (a box that contains this document, two SFPs, and other items) One router module Table of Contents Step 1: Preparing the Site......................................................................................