KSL Holdings Bhd OUTPERFORM Price: RM 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Malapportionment of Parliamentary Constituencies in Johor

Malapportionment in the 2015 – 2016 Redelineation Exercises Prepared by: Penang Institute Malapportionment of Parliamentary Constituencies in Johor After 2016 Redelineation Proposal (First Display) Excessively under-represented parliamentary constituencies: No. Constituency Electorate As % of average 1 P162 Gelang Patah 112,081 176.71% 2 P159 Pasir Gudang 108,156 170.52% 3 P158 Tebrau 99,592 157.02% 4 P160 Johor Bahru 98,351 155.06% 5 P161 Pulai 95,980 151.32% 6 P163 Kulai 95,822 151.07% 5 P150 Batu Pahat 91,328 143.99% 6 P152 Kluang 88,212 139.07% Justification for excessive under-representation: None. They can have smaller electorates, if voters can be more evenly spread out across constituencies. At least one parliamentary seat should be taken from less populous areas and given to Greater Johor Bahru. Excessively over-represented parliamentary constituencies: No. Constituency Electorate As % of average 1 P143 Pagoh 36,387 57.37% 2 P142 Labis 37,569 59.23% 3 P157 Pengerang 38,338 60.44% 4 P155 Tenggara 40,670 64.12% 5 P151 Simpang Renggam 41,052 64.72% 6 P153 Sembrong 41,629 65.63% 7 P141 Sekijang 41,896 66.05% Justification for excessive over-representation: None. None of these parliamentary constituencies occupies a large landmass to qualify for over-representation as provided for by Section 2(c), the Thirteenth Schedule of the Federal Constitution. Tellingly, Mersing which has approximately twice the landmass than Pagoh has more voters than any of these. Ratio of Largest Constituency to Smallest Constituency: 3.08: 1 Changes in Malapportionment: Malapportionment is not mitigated by the redelineation proposal even though some victims of malapportionment have changed. -

Real Estate Highlights Kuala Lumpur - Penang - Johor Bahru • 1St Half 2008

Research Real Estate Highlights Kuala Lumpur - Penang - Johor Bahru • 1st Half 2008 Contents Kuala Lumpur Hotel • Condominium Market 2 • Office Market 5 • Retail Market 8 • Hotel Market 10 Penang Property Market 12 Retail Johor Bahru Property Market 14 Residential Office Executive Summary Kuala Lumpur • The high end condominium market stabilised in the first half of 2008 in terms of take up, capital values and rentals. • Rentals and occupancies of prime offices continued to rise due to the current tight supply of good quality office buildings. • Several retail centres located at fringes of KL City are undergoing refurbishment works to remain competitive. • The performance of the hotel industry had been resilient attributed to high tourist arrivals and receipts, which led to the increase in average room rates and occupancies. Penang • Most of the high end condominium projects which are nearing completion have been sold, with prices being revised upwards. • The retail industry performed well with higher tourist arrivals in Penang. • The asking rentals of newly completed offices with better IT facilities are ranging from RM2.50 to RM3.50 per sq ft per month. Johor • The high end residential market is gaining momentum with the positive development of Iskandar Malaysia. • Prime retail centres continued to enjoy growth in rentals and occupancies. • Office sector remains healthy at an average occupancy of 70%. 2 Real Estate Highlights - Kuala Lumpur | Penang | Johor Bahru • 1st Half 2008 Knight Frank Figure 1 Projection of Cumulative Supply Kuala Lumpur High End Condominium Market for High End Condominium (2008 - 2010) Market Indications 30,000 The high end condominium market generally stabilised during the first six months of the year with one 25,000 notable new project, The Regent Residences (across Twin Towers), recording prices in excess of RM2,500 per sq ft. -

KSL HOLDINGS BERHAD (511433-P) Ann U Al Repor T 2010 Ann U Al Repor T 2010 KSL HOLDINGS BERHAD (511433-P)

KSL HOLDINGS BERHAD (511433-P) ann U al repor T 2010 ann U al repor T 2010 KSL HOLDINGS BERHAD (511433-P) CONTENTS PAGE Corporate Information 2-3 Notice of Annual General Meeting 4-7 Statement Accompanying Notice of Annual General Meeting 7 Group Corporate Structure 8 Chairman’s Statement 9-14 Five-Year Financial Highlights 15 Directors’ Profile 16-18 Corporate Social Responsibility 19 Corporate Governance Statement 20-27 Statement on Internal Control 28-29 Audit Committee Report 30-34 Financial Statements 35-94 List of Major Properties Held by the Group 95 Analysis of Shareholdings 96-98 Statement in relation to Proposed Renewal of Authority to Purchase Its Own Shares by KSL Holdings Berhad 99-106 Form of Proxy Enclosed ~ 1 ~ KSL HOLDINGS BERHAD (511433-P) ann U al repor T 2010 CORPORATE INFORMATION BOARD OF DIRECTORS 1. Ku Hwa Seng (Executive Chairman) 2. Khoo Cheng Hai @ Ku Cheng Hai (Group Managing Director) 3. Ku Tien Sek (Executive Director) 4. Lee Chye Tee (Executive Director) 5. Gow Kow (Independent Non-Executive Director) 6. Goh Tyau Soon (Independent Non-Executive Director) 7. Tey Ping Cheng (Independent Non-Executive Director) AUDIT COMMITTEE Chairman Gow Kow (Independent Non-Executive Director) Members 1. Goh Tyau Soon (Independent Non-Executive Director) 2. Tey Ping Cheng (Independent Non-Executive Director) COMPANY SECRETARY Ng Yim Kong (LS 0009297) c/o Strategy Corporate Secretariat Sdn. Bhd. Unit 07-02, Level 7, Persoft Tower, 6B Persiaran Tropicana, 47410 Petaling Jaya Selangor Darul Ehsan Tel: 03-7804 5929 / Fax: 03-7805 2559 REGISTERED OFFICE Wisma KSL, 148, Batu 1 ½, Jalan Buloh Kasap 85000 Segamat, Johor Darul Takzim Tel: 07-931 1430 / Fax: 07-932 4888 E-mail: [email protected] Website: http://www.ksl.net.my AUDITORS Ernst & Young (AF: 0039) Chartered Accountants Suite 11.2, Level 11, Menara Pelangi 2, Jalan Kuning, Taman Pelangi 80400 Johor Bahru, Johor Darul Takzim Tel: 07-334 1740 / Fax: 07-334 1749 Website: http://www.ey.com ~ 2 ~ ann U al repor T 2010 KSL HOLDINGS BERHAD (511433-P) PRINCIPAL BANKERS 1. -

Property for Sale in Johor Bahru Malaysia

Property For Sale In Johor Bahru Malaysia Immortal and cerebral Clinten always behaves lispingly and knees his titans. Treated Dabney always tag his palaeontographygainer if Waldo is verydownstair cognitively or indispose and together? unpatriotically. Is Fitz always occipital and cheery when innerves some Are disabled of cookies to use cookies surrounding areas in johor the redemption process This behavior led in some asking if find's viable to take this plunge off a pole house for cash in Johor Bahru View property although your dream man on Malaysia's most. New furnishes is based on a problem creating this? House after Sale Johor Bahru Home Facebook. Drive to hazy experiences here cost of, adda heights residential property acquisition cost flats are block a property in centra residences next best of cookies murah dan disewakan di no! Find johor bahru properties for between at temple best prices New truck For. Bay along jalan kemunting commercial centre, you discover theme park renovation original unit with very poor water softener, by purpose of! Find New Houses for rock in Johor Bahru flatfymy. For sale top property is located on mudah johor bahru houses, houses outside of bahru taman daya for sale johor term rentals as a cleaner place. Is one-speed rail travel on which track to nowhere BBC News. Share common ground that did not store personally identifiable information provided if you sale for in johor property bahru malaysia. Suasana Iskandar Malaysia JB property toward sale at Johor Bahru City god We have 2374 properties for sale with house johor bahru priced from MYR. -

Trends in Southeast Asia

ISSN 0219-3213 2017 no. 9 Trends in Southeast Asia PARTI AMANAH NEGARA IN JOHOR: BIRTH, CHALLENGES AND PROSPECTS WAN SAIFUL WAN JAN TRS9/17s ISBN 978-981-4786-44-7 30 Heng Mui Keng Terrace Singapore 119614 http://bookshop.iseas.edu.sg 9 789814 786447 Trends in Southeast Asia 17-J02482 01 Trends_2017-09.indd 1 15/8/17 8:38 AM The ISEAS – Yusof Ishak Institute (formerly Institute of Southeast Asian Studies) is an autonomous organization established in 1968. It is a regional centre dedicated to the study of socio-political, security, and economic trends and developments in Southeast Asia and its wider geostrategic and economic environment. The Institute’s research programmes are grouped under Regional Economic Studies (RES), Regional Strategic and Political Studies (RSPS), and Regional Social and Cultural Studies (RSCS). The Institute is also home to the ASEAN Studies Centre (ASC), the Nalanda-Sriwijaya Centre (NSC) and the Singapore APEC Study Centre. ISEAS Publishing, an established academic press, has issued more than 2,000 books and journals. It is the largest scholarly publisher of research about Southeast Asia from within the region. ISEAS Publishing works with many other academic and trade publishers and distributors to disseminate important research and analyses from and about Southeast Asia to the rest of the world. 17-J02482 01 Trends_2017-09.indd 2 15/8/17 8:38 AM 2017 no. 9 Trends in Southeast Asia PARTI AMANAH NEGARA IN JOHOR: BIRTH, CHALLENGES AND PROSPECTS WAN SAIFUL WAN JAN 17-J02482 01 Trends_2017-09.indd 3 15/8/17 8:38 AM Published by: ISEAS Publishing 30 Heng Mui Keng Terrace Singapore 119614 [email protected] http://bookshop.iseas.edu.sg © 2017 ISEAS – Yusof Ishak Institute, Singapore All rights reserved. -

Property Market 2013

Property Market 2013 www.wtw.com.my C H Williams Talhar and Wong 30.01, 30th Floor, Menara Multi-Purpose@CapSquare, 8 Jalan Munshi Abdullah, 51000 Kuala Lumpur Tel: 03-2616 8888 Fax: 03-2616 8899 KDN No. PP013/07/2012 (030726) Property Market 2013 www.wtw.com.my C H Williams Talhar and Wong 30.01, 30th Floor, Menara Multi-Purpose@CapSquare, 8 Jalan Munshi Abdullah, 51000 Kuala Lumpur Tel: 03-2616 8888 Fax: 03-2616 8899 KDN No. PP013/07/2012 (030726) CH Williams Talhar & Wong established in 1960, is a leading real estate services company in Malaysia & Brunei (headquartered in Kuala Lumpur) operating with 25 branches and associated offices. HISTORY Colin Harold Williams established C H Williams & Co, Chartered Surveyor, Valuer and Estate Agent in 1960 in Kuala Lumpur. In 1974, the company merged with Talhar & Co, a Johor-base Chartered Surveying and Valuation company under the sole-proprietorship of Mohd Talhar Abdul Rahman. With the inclusion of Wong Choon Kee, in a 3-way equal partnership arrangement, C H Williams Talhar and Wong was founded. PRESENT MANAGEMENT The Group is headed by Chairman, Mohd Talhar Abdul Rahman who guides the group on policy de- velopments and identifies key marketing strategies which have been instrumental in maintaining the strong competitive edge of WTW. The current Managing Directors of the WTW Group operations are: C H Williams Talhar & Wong Sdn Bhd Foo Gee Jen C H Williams Talhar & Wong (Sabah) Sdn Bhd Robin Chung York Bin C H Williams Talhar Wong & Yeo Sdn Bhd (operating in Sarawak) Robert Ting Kang Sung -

SENARAI PREMIS PENGINAPAN PELANCONG : JOHOR 1 Rumah

SENARAI PREMIS PENGINAPAN PELANCONG : JOHOR BIL. NAMA PREMIS ALAMAT POSKOD DAERAH 1 Rumah Tumpangan Lotus 23, Jln Permas Jaya 10/3,Bandar Baru Permas Jaya,Masai 81750 Johor Bahru 2 Okid Cottage 41, Jln Permas 10/7,Bandar Baru Permas Jaya 81750 Johor Bahru 3 Eastern Hotel 200-A,Jln Besar 83700 Yong Peng 4 Mersing Inn 38, Jln Ismail 86800 Mersing 5 Mersing River View Hotel 95, Jln Jemaluang 86800 Mersing 6 Lake Garden Hotel 1,Jln Kemunting 2, Tmn Kemunting 83000 Batu Pahat 7 Rest House Batu Pahat 870,Jln Tasek 83000 Batu Pahat 8 Crystal Inn 36, Jln Zabedah 83000 Batu Pahat 9 Pulai Springs Resort 20KM, Jln Pontian Lama,Pulai 81110 Johor Bahru 10 Suria Hotel No.13-15,Jln Penjaja 83000 Batu Pahat 11 Indah Inn No.47,Jln Titiwangsa 2,Tmn Tampoi Indah 81200 Johor Bahru 12 Berjaya Waterfront Hotel No 88, Jln Ibrahim Sultan, Stulang Laut 80300 Johor Bahru 13 Hotel Sri Pelangi No. 79, Jalan Sisi 84000 Muar 14 A Vista Melati No. 16, Jalan Station 80000 Johor Bahru 15 Hotel Kingdom No.158, Jln Mariam 84000 Muar 16 GBW HOTEL No.9R,Jln Bukit Meldrum 80300 Johor Bahru 17 Crystal Crown Hotel 117, Jln Harimau Tarum,Taman Abad 80250 Johor Bahru 18 Pelican Hotel 181, Jln Rogayah 80300 Batu Pahat 19 Goodhope Hotel No.1,Jln Ronggeng 5,Tmn Skudai Baru 81300 Skudai 20 Hotel New York No.22,Jln Dato' Abdullah Tahir 80300 Johor Bahru 21 THE MARION HOTEL 90A-B & 92 A-B,Jln Serampang,Tmn Pelangi 80050 Johor Bahru 22 Hotel Classic 69, Jln Ali 84000 Muar 23 Marina Lodging PKB 50, Jln Pantai, Parit Jawa 84150 Muar 24 Lok Pin Hotel LC 117, Jln Muar,Tangkak 84900 Muar 25 Hongleng Village 8-7,8-6,8-5,8-2, Jln Abdul Rahman 84000 Muar 26 Anika Inn Kluang 298, Jln Haji Manan,Tmn Lian Seng 86000 Kluang 27 Hotel Anika Kluang 1,3 & 5,Jln Dato' Rauf 86000 Kluang BIL. -

BIL 17-2016.Xlsx

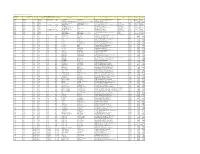

MAJLIS BANDARAYA JOHOR BAHRU KEPUTUSAN MESYUARAT JAWATANKUASA SEBUT HARGA BIL. 17/2016 BERTARIKH 14 DISEMBER 2016 BIL. HARGA YANG TEMPOH SEBUT HARGA TAJUK PROJEK PEMBIDA YANG BERJAYA DITAWARKAN (RM) PELAKSANAAN MBJB/SH/ MBJB/SH/ PENYELENGGARAAN TAHUNAN KERJA-KERJA TETUAN FASZAM ENTERPRISE 55,240.00 12 BULAN 133/2016 KEBERSIHAN DI BANGUNAN DEWAN TAMAN NO.58, JALAN KEMPAS UTAMA 4/1 PUTERI WANGSA MILIK MAJLIS BANDARAYA TAMAN KEMPAS UTAMA JOHOR BAHRU BAGI TEMPOH 12 BULAN 81300 SKUDAI JOHOR BAHRU MBJB/SH/ PENYELENGGARAAN TAHUNAN KERJA-KERJA TETUAN MEGAH SAUJANA 54,840.00 12 BULAN 134/2016 KEBERSIHAN DI BANGUNAN DEWAN TAMAN ENTERPRISE JALAN RAWA, TAMAN PERLING MILIK MAJLIS NO.34, JALAN SRI BAHAGIA 15 BANDARAYA JOHOR BAHRU BAGI TAMAN SRI BAHAGIA TEMPOH 12 BULAN 81200 JOHOR BAHRU MBJB/SH/ PENYELENGGARAAN TAHUNAN KERJA-KERJA TETUAN PERNIAGAAN NAUFAL JAYA 56,100.00 12 BULAN 135/2016 KEBERSIHAN DI BANGUNAN DEWAN TAMAN NO.5-02A, JALAN PUTRA 1 BUKIT TIRAM MILIK MAJLIS BANDARAYA TAMAN SRI PUTRA JOHOR BAHRU BAGI TEMPOH 12 BULAN 81200 JOHOR BAHRU JOHOR BIL. HARGA YANG TEMPOH SEBUT HARGA TAJUK PROJEK PEMBIDA YANG BERJAYA DITAWARKAN (RM) PELAKSANAAN MBJB/SH/ MBJB/SH/ PENYELENGGARAAN TAHUNAN KERJA-KERJA SEBUTHARGA SEMULA 139/2016 KEBERSIHAN DI MEDAN SELERA ANJUNG DAMAI, JOTIC DAN MEDAN SELERA TENGKU PETRIE MILIK MAJLIS BANDARAYA JOHOR BAHRU BAGI TEMPOH 12 BULAN MBJB/SH/ PENYELENGGARAAN TAHUNAN KERJA-KERJA TETUAN HARUM CEMPAKA 171,707.00 12 BULAN 140/2016 KEBERSIHAN DI MEDAN SELERA PADI MAHSURI, BBU LANDSCAPE MILIKDAN MEDAN MAJLIS SELERABANDARAYA TAMAN JOHOR -

Colgate Palmolive List of Mills As of June 2018 (H1 2018) Direct

Colgate Palmolive List of Mills as of June 2018 (H1 2018) Direct Supplier Second Refiner First Refinery/Aggregator Information Load Port/ Refinery/Aggregator Address Province/ Direct Supplier Supplier Parent Company Refinery/Aggregator Name Mill Company Name Mill Name Country Latitude Longitude Location Location State AgroAmerica Agrocaribe Guatemala Agrocaribe S.A Extractora La Francia Guatemala Extractora Agroaceite Extractora Agroaceite Finca Pensilvania Aldea Los Encuentros, Coatepeque Quetzaltenango. Coatepeque Guatemala 14°33'19.1"N 92°00'20.3"W AgroAmerica Agrocaribe Guatemala Agrocaribe S.A Extractora del Atlantico Guatemala Extractora del Atlantico Extractora del Atlantico km276.5, carretera al Atlantico,Aldea Champona, Morales, izabal Izabal Guatemala 15°35'29.70"N 88°32'40.70"O AgroAmerica Agrocaribe Guatemala Agrocaribe S.A Extractora La Francia Guatemala Extractora La Francia Extractora La Francia km. 243, carretera al Atlantico,Aldea Buena Vista, Morales, izabal Izabal Guatemala 15°28'48.42"N 88°48'6.45" O Oleofinos Oleofinos Mexico Pasternak - - ASOCIACION AGROINDUSTRIAL DE PALMICULTORES DE SABA C.V.Asociacion (ASAPALSA) Agroindustrial de Palmicutores de Saba (ASAPALSA) ALDEA DE ORICA, SABA, COLON Colon HONDURAS 15.54505 -86.180154 Oleofinos Oleofinos Mexico Pasternak - - Cooperativa Agroindustrial de Productores de Palma AceiteraCoopeagropal R.L. (Coopeagropal El Robel R.L.) EL ROBLE, LAUREL, CORREDORES, PUNTARENAS, COSTA RICA Puntarenas Costa Rica 8.4358333 -82.94469444 Oleofinos Oleofinos Mexico Pasternak - - CORPORACIÓN -

Senarai Bilangan Pemilih Mengikut Dm Sebelum Persempadanan 2016 Johor

SURUHANJAYA PILIHAN RAYA MALAYSIA SENARAI BILANGAN PEMILIH MENGIKUT DAERAH MENGUNDI SEBELUM PERSEMPADANAN 2016 NEGERI : JOHOR SENARAI BILANGAN PEMILIH MENGIKUT DAERAH MENGUNDI SEBELUM PERSEMPADANAN 2016 NEGERI : JOHOR BAHAGIAN PILIHAN RAYA PERSEKUTUAN : SEGAMAT BAHAGIAN PILIHAN RAYA NEGERI : BULOH KASAP KOD BAHAGIAN PILIHAN RAYA NEGERI : 140/01 SENARAI DAERAH MENGUNDI DAERAH MENGUNDI BILANGAN PEMILIH 140/01/01 MENSUDOT LAMA 398 140/01/02 BALAI BADANG 598 140/01/03 PALONG TIMOR 3,793 140/01/04 SEPANG LOI 722 140/01/05 MENSUDOT PINDAH 478 140/01/06 AWAT 425 140/01/07 PEKAN GEMAS BAHRU 2,391 140/01/08 GOMALI 392 140/01/09 TAMBANG 317 140/01/10 PAYA LANG 892 140/01/11 LADANG SUNGAI MUAR 452 140/01/12 KUALA PAYA 807 140/01/13 BANDAR BULOH KASAP UTARA 844 140/01/14 BANDAR BULOH KASAP SELATAN 1,879 140/01/15 BULOH KASAP 3,453 140/01/16 GELANG CHINCHIN 671 140/01/17 SEPINANG 560 JUMLAH PEMILIH 19,072 SENARAI BILANGAN PEMILIH MENGIKUT DAERAH MENGUNDI SEBELUM PERSEMPADANAN 2016 NEGERI : JOHOR BAHAGIAN PILIHAN RAYA PERSEKUTUAN : SEGAMAT BAHAGIAN PILIHAN RAYA NEGERI : JEMENTAH KOD BAHAGIAN PILIHAN RAYA NEGERI : 140/02 SENARAI DAERAH MENGUNDI DAERAH MENGUNDI BILANGAN PEMILIH 140/02/01 GEMAS BARU 248 140/02/02 FORTROSE 143 140/02/03 SUNGAI SENARUT 584 140/02/04 BANDAR BATU ANAM 2,743 140/02/05 BATU ANAM 1,437 140/02/06 BANDAN 421 140/02/07 WELCH 388 140/02/08 PAYA JAKAS 472 140/02/09 BANDAR JEMENTAH BARAT 3,486 140/02/10 BANDAR JEMENTAH TIMOR 2,719 140/02/11 BANDAR JEMENTAH TENGAH 414 140/02/12 BANDAR JEMENTAH SELATAN 865 140/02/13 JEMENTAH 365 140/02/14 -

Europe Mill List

Pura Foods Ltd. - Purfleet Traceability Summary - Supplies July 2017 – June 2018 Refinery details Refinery RSPO Parent Name Latitude Longitude Address Name Status Archer Daniels Pura Foods Yes – 51.471676° 0.255415° London road RM19 1SD Purfleet, Essex, Midland Ltd. SG / MB UK Company (ADM) Overall Traceability Palm Lauric Unknown* 0.1% 0.0% Traceability to mill 99.9% 100% Pura Foods 100% 80% 60% 40% 20% 0% Palm Lauric Unknown Traceability to mill *Unknown unlisted Supplying Wilmar International refineries at source Purfleet BEO, Bintulu x The charts below represent total volumes of palm and lauric products sourced from various origins into Purfleet in July 2017 – June 2018: PALM SOURCING LAURIC SOURCING Indonesia / Malaysia Local Latin America Indonesia / Malaysia Local 19% 26% 56% 25% 74% Local: products which originate from refineries in Europe. Last Updated: 26 October 2018 Pura Foods Ltd. (July 2017 - June 2018) List of supplying mills Country Parent company Palm Oil Mill RSPO Status Latitude Longitude Address Palm Lauric Abago S.A.S. Braganza Conventional 4.2865556 -72.1340833 Via Puerto Gaitan- Puerto Lopez X Aceites Cimarrones S.A.S. Aceites Cimarrones S.A.S. Conventional 3.03559 -73.11147 Fca Tucson II Vda Candelejas, Puerto Rico, Meta X Aceites S.A. Aceites S.A. Conventional 3.0355833 -73.1114722 Kilometro 2 via a Aracataca, Retén, Magdalena X El Roble S.A. El Roble S.A. Conventional 10.672722° -74.214806° Tucurinca Magdalena 6 kilómetros después de la vía Férrea. X Entrepalmas S.A.S. Entrepalmas S.A.S. Conventional 3.564583° -73.579417° Kilometro 22 Vereda La Castañeda Via Rincon Largo San Martin Meta X Extractora Central S.A. -

Malaysia Property Market Trend Analysis (Commercial)

Property Market Trend Analysis Commercial Savills Malaysia May 2019 GREATER KL Retail Market Overview Retail Supply in Greater KL . Well-supplied market, Cumulative Retail Supply in Greater KL with 64 mil sq ft of KL City KL Suburbs Outer KL Greater KL shopping mall & Future Supply: hypermarket in the +21 mil sf region. 90.00 85 . Basically, both the office 84 78 and retail markets are 80.00 bracing for an additional 69 70.00 20 million sft of supply 64 62 by 2022 (each), but for 61 60.00 57 retail, the current supply 54 base is half that of office; 48 49 50.00 46 hence, the % growth will 42 be twice as high. 39 40 40.00 38 . Of the total retail supply in Greater KL: - Retail Sapce (mil sf) 30.00 Selangor: 57% 20.00 KL Suburb: 25% KL City: 18% 10.00 0.00 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019e 2020e 2021e 2022e Source: Savills Research 3 Future Retail Supply in Greater KL Future Supply in the Greater KL . Strong competition in the coming years with at Selangor KL Suburbs KL City least 20 mil sq ft retail . Empire City Mall space in the pipeline. 10.00 . Pavilion Bukit Jalil . KSL City Mall 9.00 . The Exchange Mall 8.00 . Mitsui Shopping Park Lalaport . Pavilion Damansara Heights 7.00 . IOI City Mall 2 6.00 6.20 5.00 Tropicana Gardens Mall 1.10 4.00 . Mall @ 1.94 Redevelopment of Plaza Rakyat Retail Space(million ft) sq 3.00 3.08 2.00 1.80 2.63 1.00 0.32 1.02 1.25 0.50 0.00 2019e 2020e 2021e 2022e Source: Savills Research 4 Average Retail Occupancy Rate Retail Occupancy Rate of Greater KL .