JOHCM UK Equity Income Fund Monthly Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Company Date Type Resid Proposal Vote Rescode CARR's GROUP

Company Date Type ResId Proposal Vote ResCode CARR'S GROUP PLC 07/01/2020 AGM 1 Receive the Annual Report Abstain 201 CARR'S GROUP PLC 07/01/2020 AGM 2 Approve the Dividend For 401 CARR'S GROUP PLC 07/01/2020 AGM 3 Elect Peter Page Oppose 301 CARR'S GROUP PLC 07/01/2020 AGM 4 Re-elect Tim Davies For 301 CARR'S GROUP PLC 07/01/2020 AGM 5 Re-elect Neil Austin For 301 CARR'S GROUP PLC 07/01/2020 AGM 6 Re-elect Alistair Wannop Oppose 301 CARR'S GROUP PLC 07/01/2020 AGM 7 Re-elect John Worby Oppose 301 CARR'S GROUP PLC 07/01/2020 AGM 8 Re-elect Ian Wood Oppose 301 CARR'S GROUP PLC 07/01/2020 AGM 9 Appoint the Auditors For 501 CARR'S GROUP PLC 07/01/2020 AGM 10 Allow the Board to Determine the Auditor's Remuneration For 503 CARR'S GROUP PLC 07/01/2020 AGM 11 Approve the Remuneration Report Oppose 202 CARR'S GROUP PLC 07/01/2020 AGM 12 Issue Shares with Pre-emption Rights For 601 CARR'S GROUP PLC 07/01/2020 AGM 13 Issue Shares for Cash For 602 CARR'S GROUP PLC 07/01/2020 AGM 14 Authorise Share Repurchase Oppose 607 CARR'S GROUP PLC 07/01/2020 AGM 15 Meeting Notification-related Proposal For 1511 DIPLOMA PLC 15/01/2020 AGM 1 Receive the Annual Report Oppose 201 DIPLOMA PLC 15/01/2020 AGM 2 Approve the Dividend For 401 DIPLOMA PLC 15/01/2020 AGM 3 Re-elect John Nicholas Oppose 301 DIPLOMA PLC 15/01/2020 AGM 4 Elect Johnny Thomson For 301 DIPLOMA PLC 15/01/2020 AGM 5 Re-elect Nigel Lingwood For 301 DIPLOMA PLC 15/01/2020 AGM 6 Re-elect Charles Packshaw For 301 DIPLOMA PLC 15/01/2020 AGM 7 Re-elect Andy Smith For 301 DIPLOMA PLC 15/01/2020 AGM 8 -

Fiscal Quarter-End Holdings (Pdf)

Quarterly Schedules of Portfolio Holdings International & Global Funds July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class Harbor Diversified International All Cap Fund HNIDX HAIDX HRIDX HIIDX Harbor Emerging Markets Equity Fund HNEMX HAEMX HREMX HIEEX Harbor Focused International Fund HNFRX HNFSX HNFDX HNFIX Harbor Global Leaders Fund HNGIX HGGAX HRGAX HGGIX Harbor International Fund HNINX HAINX HRINX HIINX Harbor International Growth Fund HNGFX HAIGX HRIGX HIIGX Harbor International Small Cap Fund HNISX HAISX HRISX HIISX Harbor Overseas Fund HAORX HAOSX HAOAX HAONX Table of Contents Portfolios of Investments HARBOR DIVERSIFIED INTERNATIONAL ALL CAP FUND. ..... 1 HARBOR EMERGING MARKETS EQUITY FUND . .......... 8 HARBOR FOCUSED INTERNATIONAL FUND. ................................. 11 HARBOR GLOBAL LEADERS FUND. ................. 13 HARBOR INTERNATIONAL FUND . 15 HARBOR INTERNATIONAL GROWTH FUND . ........................ 21 HARBOR INTERNATIONAL SMALL CAP FUND. ................. 24 HARBOR OVERSEAS FUND . ............................................ 26 Notes to Portfolios of Investments ..................................... 31 Harbor Diversified International All Cap Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost, and Principal Amounts in Thousands COMMON STOCKS—96.4% COMMON STOCKS—Continued Shares Value Shares Value AEROSPACE & DEFENSE—0.7% BANKS—Continued 28,553 Airbus SE (France)* .............................. $ 2,090 236,142 Svenska Handelsbanken AB (Sweden) ............... $ -

MI Chelverton UK Equity Income Fund

MI Chelverton UK Equity Income Fund Investment Objective and Policy Monthly Fact Sheet The objective of the Fund is to provide a progressive income stream and achieve long-term capital growth by investing primarily in a portfolio of fully listed and AIM traded UK equities. The Fund will 31 May 2021 invest in UK companies which aim to provide a high initial dividend, progressive dividend payments and long term capital appreciation. Launch Date 4 December 2006 Monthly Manager Commentary Fund Size £527m A relatively quiet month in terms of corporate results and news flow was dominated by Q1 trading Historic Yield 2.32% updates. Pleasingly these were generally positive and have served to underpin the ‘recovery’ trade in a wide range of our holdings. Having been overly pessimistic a year or so ago, analysts are firmly in ‘upgrade’ The historic yield reflects distributions over the mode as profit expectations are being revised upwards, generating positive share price momentum. We past 12 months as a percentage of the price of the B share class as at the date shown. It does hope to see this bounce in current earnings gradually start to be reflected in improving dividend payments not include any initial charge and investors may as Boards confidence in their trading outlook starts to improve. For the moment investors are happy to be subject to tax on their distributions. look through any potential changes in the government’s roadmap back to normality and appear sanguine about any short term volatility in domestic macro numbers. The consensus is still that any pick up in inflation will only be temporary although we are less convinced on this front and will be looking for any Share Price (as at 31.05.21) signs of sustained wage inflation which may undermine this view. -

Schroder UK Mid Cap Fund Plc Unaudited Portfolio Holdings at 31St July 2020

Schroder UK Mid Cap Fund plc Unaudited portfolio holdings at 31st July 2020 The investments listed below have been valued on a fair value basis using closing bid prices. Market Nominal value Investment SEDOL ISIN holding £ 4Imprint Group Ord GBP0.385 664097 GB0006640972 105,000 2,493,750 A G Barr Ord GBP0.04167 B6XZKY7 GB00B6XZKY75 700,000 2,999,500 Anglo Pacific Group Ord GBP0.02 644936 GB0006449366 2,050,000 2,423,100 Bodycote PLC Ord GBP0.173 B3FLWH9 GB00B3FLWH99 800,000 4,504,000 Brewin Dolphin Ord GBP0.01 176581 GB0001765816 1,610,000 4,218,200 Cairn Energy Ord GBP0.0136686 B74CDH8 GB00B74CDH82 2,300,000 2,748,500 Capita Plc B23K0M2 GB00B23K0M20 2,700,000 924,210 CLS Holdings Plc Ord GBP0.025 BF04459 GB00BF044593 1,749,950 3,415,902 Computacenter Plc Ord 0.075555 BV9FP30 GB00BV9FP302 300,000 5,943,000 Cranswick Ord GBP0.10 231888 GB0002318888 114,000 4,078,920 Crest Nicholson Holdings Ltd Ord GBP0.05 B8VZXT9 GB00B8VZXT93 800,000 1,496,000 Dechra Pharmaceuticals Ord GBP0.01 963318 GB0009633180 143,310 4,087,201 Diploma Ord GBP0.05 182663 GB0001826634 320,000 5,801,600 Dunelm Group GBP.01 B1CKQ73 GB00B1CKQ739 790,000 9,709,100 Fisher (James) Ord GBP0.25 339500 GB0003395000 266,000 3,037,720 Future PLC Ord GBP0.15 BYZN904 GB00BYZN9041 212,000 2,925,600 Games Workshop Ord GBP0.05 371847 GB0003718474 80,000 7,024,000 Gamesys Group Plc Ord NPV BZ14BX5 GB00BZ14BX56 132,072 1,226,949 Genus Ord GBP0.10 207458 GB0002074580 80,000 2,716,800 Grafton Group New Units B00MZ44 IE00B00MZ448 530,000 3,407,900 Grainger Ord GBP0.05 B04V127 GB00B04V1276 -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

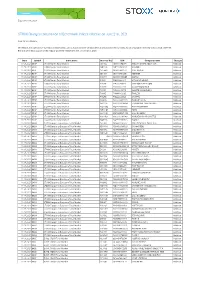

STOXX Changes Composition of Benchmark Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Benchmark Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Benchmark Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXP STOXX Nordic Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. SDR Addition 11.06.2021 BDXP STOXX Nordic Total Market NO112F NO0010823131 KAHOOT! Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10W3 SE0015483276 CINT GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10X4 SE0015671995 HEMNET Addition 11.06.2021 BDXP STOXX Nordic Total Market DK3011 DK0060497295 MATAS Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10JH FI4000480215 SITOWISE GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10HF FI4000049812 VERKKOKAUPPA COM Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10FD FI0009001127 ALANDSBANKEN B Addition 11.06.2021 BDXP STOXX Nordic Total Market FI6036 FI4000048418 AHLSTROM-MUNKSJO Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10IG FI4000062195 TAALERI Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10GE FI4000029905 SCANFIL Addition 11.06.2021 BDXP STOXX Nordic Total Market NO90I2 NO0010861115 NORSKE SKOG Addition 11.06.2021 BDXP STOXX Nordic Total Market NO111E NO0010029804 SPAREBANK 1 HELGELAND Addition 11.06.2021 BDXP STOXX Nordic Total Market NO113G NO0010886625 AKER BIOMARINE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO114H NO0010936792 FROY Addition 11.06.2021 BDXP STOXX Nordic Total Market NO110D BMG9156K1018 2020 BULKERS Addition 11.06.2021 BDXP STOXX Nordic Total Market NO10R3 NO0010196140 NORWEGIAN AIR SHUTTLE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO809S NO0010792625 FJORD1 Deletion 11.06.2021 BKXA STOXX Europe ex Eurozone Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. -

ACXW Avantis International Small Cap Value

American Century Investments® Quarterly Portfolio Holdings Avantis® International Small Cap Value ETF (AVDV) May 28, 2021 Avantis International Small Cap Value ETF - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 99.4% Australia — 8.0% Adairs Ltd. 64,691 233,414 Adbri Ltd. 444,216 1,141,164 Aeris Resources Ltd.(1) 238,800 31,179 Alkane Resources Ltd.(1)(2) 152,741 103,278 Alliance Aviation Services Ltd.(1) 50,306 171,065 Asaleo Care Ltd. 212,115 229,790 Aurelia Metals Ltd. 716,008 245,064 Austal Ltd. 283,491 520,718 Australian Finance Group Ltd. 186,297 400,567 Australian Pharmaceutical Industries Ltd. 419,111 373,258 Bank of Queensland Ltd. 555,800 3,869,929 Beach Energy Ltd. 2,204,143 2,167,414 Bendigo & Adelaide Bank Ltd. 252,445 2,042,517 Boral Ltd.(1) 116,988 619,401 Calix Ltd.(1) 39,671 84,060 Cedar Woods Properties Ltd. 8,294 45,011 Champion Iron Ltd.(1) 492,380 2,502,893 Collins Foods Ltd. 16,697 160,894 Coronado Global Resources, Inc.(1) 453,537 242,887 CSR Ltd. 651,143 2,799,491 Dacian Gold Ltd.(1) 129,467 28,363 Deterra Royalties Ltd. 179,435 579,460 Eclipx Group Ltd.(1) 432,641 710,525 Emeco Holdings Ltd.(1) 476,645 332,757 EML Payments Ltd.(1) 327,130 862,970 Galaxy Resources Ltd.(1) 3,318 9,808 Genworth Mortgage Insurance Australia Ltd.(1) 442,504 945,096 Gold Road Resources Ltd. 660,222 763,347 GrainCorp Ltd., A Shares 347,275 1,343,019 Grange Resources Ltd. -

MI Chelverton UK Equity Income Fund

MI Chelverton UK Equity Income Fund Monthly Manager Commentary Monthly Fact Sheet As investors look through lockdown to a period of economic recovery, the debate has moved increasingly to one of ‘value’ versus ‘growth’. It is well documented that growth as a style performed relatively well 28 February 2021 through the pandemic and commentators have been searching for a catalyst that may start to close the performance gap moving forward. To this end all eyes are now firmly on the recent increase in the US long bond yield, a lead indicator of rising inflation, and something that has historically provided a tail wind to Launch Date 4 December 2006 ‘value’ investors. Over the coming months we expect an increase in inflationary pressures at home after Fund Size £464m the effects of the rise in the oil price and a ‘re-opening’ bounce in domestic consumer spending start to be reflected in macro data. We have seen the first signs of increased investor interest in our investible Historic Yield* 2.24% universe and this will hopefully be sustained moving forward as the recent build up in the domestic savings ratio starts to be run down. The busy results season has started well with most numbers coming Share Price (as at 28.02.21) in at least in line with expectations, although some momentum has been lost in US Dollar earners as the Shares Income Accumulation relative strength of Sterling is holding back this year’s earnings progress. The lack of downgrades in these B Shares 109.84p 232.42p stocks however does reassure us that generally analyst estimates remain conservative. -

Acc Shares 30 June 2021

QPR.en.xx.20210630.GB00B88V3X40.pdf For Investment Professionals Only FIDELITY INVESTMENT FUNDS QUARTERLY PERFORMANCE REVIEW SPECIAL SITUATIONS FUND W - ACC SHARES 30 JUNE 2021 Portfolio manager: Alex Wright, Jonathan Winton Performance over quarter in GBP (%) Performance for 12 month periods in GBP (%) Fund 6.3 Market index 5.6 FTSE All Share Index Market index is for comparative purposes only. Source of fund performance is Fidelity. Basis: bid-bid with income reinvested, in GBP, net of fees. Other share classes may be available. Please refer to the prospectus for more details. Fund Index Market Environment UK equities rose over the second quarter. Markets started on a strong note on increasing optimism around the prospects of a reopening given an acceleration in vaccination rollouts. A sharp pick-up in corporate earnings and continued strength in economic data boosted investor sentiment. However, a pick-up in inflation readings led to some concerns. While the Bank of England (BoE) continues to see the current inflation pressures as transitory, the US Federal Reserve’s (Fed) more aggressive tone temporarily unsettled markets. Meanwhile, worries about the spread of a more transmissible COVID-19 variant led to a more cautious stance. For the most part, vaccines appear to be keeping hospitalisation rates under control, but virus concerns remain a source of worry going forward. In this environment, most sectors reported flat to positive returns, with the decline in bond yields helping growth stocks and bond proxies outperform. Health care and utilities were among the biggest gainers, while more cyclical sectors such as financials and consumer discretionary underperformed. -

The Henderson Smaller Companies Investment Trust Plc

The Henderson Smaller Companies Investment Trust plc Update for the half-year ended 30 November 2020 0009960_H047066_Smaller Companies_Interim_V8a.indd 1 30/01/2021 00:07 The Henderson Smaller Companies Investment Trust plc Investment objective The Company aims to maximise shareholders’ total returns (capital and income) by investing in smaller companies that are quoted in the United Kingdom. This update contains material extracted from the unaudited half-year results of the Company for the six months ended 30 November 2020. The unabridged results for the half-year are available on the Company’s website: www.hendersonsmallercompanies.com 0009960_H047066_Smaller Companies_Interim_V8a.indd 102 29/01/2021 07:11 Update for the half-year ended 30 November 2020 Performance Performance for the six months to 30 November 2020 NAV1 Benchmark2 Share price3 Interim dividend4 20.6% 20.8% 27.7% 7.0p NAV per share at period end Share price at period end 30 Nov 2020 30 Nov 2020 1,017.4p 972.0p 31 May 2020 31 May 2020 859.1p 777.0p Net Assets 30 Nov 2020 31 May 2020 £760.0m £641.8m Total return performance (including dividends reinvested) 6 months 1 year 3 years 5 years 10 years % % % % % NAV¹ 20.6 3.1 13.6 55.4 278.9 Benchmark² 20.8 -3.1 -1.7 26.7 143.3 Share price3 27.7 2.4 26.6 66.4 354.5 Average sector NAV5 14.3 -0.5 -0.7 36.4 176.4 Average sector share price6 10.6 -8.5 -8.2 9.5 163.2 FTSE All-Share Index 6.9 -10.3 -1.9 22.1 77.3 Sources: Morningstar for the AIC, Janus Henderson, Refinitiv Datastream 1 Net asset value (‘NAV’) per ordinary share total -

Premium Listed Companies Are Subject to the UK's Super-Equivalent Rules Which Are Higher Than the EU Minimum "Standard Listing" Requirements

List of Premium Equity Comercial Companies - 29th April 2020 Definition: Premium listed companies are subject to the UK's super-equivalent rules which are higher than the EU minimum "standard listing" requirements. Company Name Country of Inc. Description of Listed Security Listing Category Market Status Trading Venue Home Member State ISIN(S) 4IMPRINT GROUP PLC United Kingdom Ordinary Shares of 38 6/13p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB0006640972 888 Holdings Plc Gibraltar Ordinary Shares of 0.5p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GI000A0F6407 AA plc United Kingdom Ordinary Shares of 0.1p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BMSKPJ95 Admiral Group PLC United Kingdom Ordinary Shares of 0.1p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00B02J6398 AGGREKO PLC United Kingdom Ordinary Shares of 4 329/395p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BK1PTB77 AIB Group Plc Ireland Ordinary Shares of EUR0.625 each; fully paid Premium Equity Commercial Companies RM LSE Ireland IE00BF0L3536 Air Partner PLC United Kingdom Ordinary Shares of 1p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BD736828 Airtel Africa plc United Kingdom Ordinary Shares of USD0.50 each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BKDRYJ47 AJ Bell plc United Kingdom Ordinary Shares of GBP0.000125 each; fully paid Premium