Challenger Banks Roundtable Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

February 2019

The definitive source of news and analysis of the global fintech sector | February 2019 www.bankingtech.com SUPERSTRUCTURES Fintech reaches new heights CASE STUDY: CITIZENS BANK US heavyweight pivots for digital era FOOD FOR THOUGHT: CAREER CHOICES The Venn diagram of doom FINTECH FUTURES IN THIS ISSUE THEM US Contents NEWS 04 The latest fintech news from around the globe: the good, the bad and the ugly. 18 Banking Technology Awards The glamour, the winners and the celebrations. 23 Focus: intraday liquidity Are banks ready to meet the ECB’s latest expectations? 24 Interview: Pavel Novak, Zonky P2P lender on a “mission possible”. 26 Focus: data How DNB uses data to reconnect with customers. 30 Analysis: openfunds Admirable data standardisation efforts for the funds industry. 32 Case study: Citizens Bank US’s 13th largest bank embraces digital era. 38 Food for thought Making career choices and the Venn diagram of doom. They struggle with Fintech complexity. We see straight to your goal. We leverage proprietary knowledge and technology to solve complex regulatory challenges, create new products 40 Comment What would a recession mean for fintech? and build businesses. Our unique “one fi rm” approach brings to bear best-in-class talent from our 32 offi ces worldwide—creating teams that blend global reach and local knowledge. Looking for a fi rm that can help keep 42 Interview: Javier Santamaría, EPC your business moving in the right direction? Visit BCLPlaw.com to learn more. Happy one year anniversary, SEPA Instant Credit Transfer! REGULARS 44 -

SBFM Report 2021

Small Business Finance Markets 2020/21 british-business-bank.co.uk Contents Foreword 3 Part B: Market developments 54 Executive summary 6 Small businesses and their use Introduction 10 of finance Aggregate flow and stock of 2.1 Macro-economic developments 55 finance to smaller businesses 12 2.2 SME business population 61 2.3 Use of external finance 67 Part A: The impact of Covid-19 on small business finance markets Finance products and the implications for 2021 15 2.4 Bank lending 75 1.1 Demand and supply of SME 2.5 Challenger and specialist banks 82 finance during the pandemic 16 2.6 Equity finance 89 1.2 Expectations for demand and 2.7 Private debt 102 supply in 2021 29 2.8 Asset finance 111 1.3 Finance can help the UK build 2.9 Invoice finance and back better 41 asset-based lending 116 1.4 The importance of and 2.10 Marketplace lending 121 challenges faced by alternative finance providers in 2020 47 Glossary 126 Endnotes 132 2 0.0 The British Business Bank’s mission is Foreword to make finance markets work better so smaller businesses across the UK can prosper and grow. Small Business Finance Markets 2020/21 Foreword Our unique position at the intersection of Covid-19 has had a devastating effect on the UK government and financial markets enables economy, particularly on the all-important small business sector that accounts for 61% of private sector us to identify and reduce imbalances in employment. It has also had a profound influence on access to finance; create a more diverse the operation of the finance markets serving small market; and increase the supply of finance businesses. -

Wealth Management: Investment Views

Investment views Challenging the challengers Issue 7 | Second quarter 2020 Who are the challengers? Revolut, Monzo, Starling and N26 are becoming household names across Europe. These businesses are part of a new wave of challenger banks that have disrupted retail banking services, divided critics and amassed millions of users. They have attracted global headlines in the last two years as they enjoy compound annual growth rates nearing 45%1. In a recent conversation with our financial William Haggard Head of Investment Insights analyst Willis Palermo, we explored three key issues for Europe’s fintech fighters: 1. What does the emergence of challenger banks mean for established banks? 2. How are banks responding to the Covid-19 crisis? 3. Where do we stand on investing in challenger banks today? The following is an edited transcript of the interview, which you can listen to in full by clicking here. Willis Palermo Financial Analyst In with the new, out with the old? A key ingredient of challenger banks’ success has been their user-friendly mobile interfaces. Talk us through the user experience. Download the online app on your phone, create your login details, send over a picture of your ID card and you are up and running with a bank account. Many of us have joined this new wave of quick and easy challenger banks that have sprung up to facilitate everyday payments and foreign exchange transactions. The ease and simplicity of joining these banks (see Figure 1) is particularly popular with younger generations. In the UK, Monzo boasts 68% of users aged between 18 and 34, while the same age group makes up more than 50% of Revolut and N26’s customers. -

(2019). Bank X, the New Banks

BANK X The New New Banks Citi GPS: Global Perspectives & Solutions March 2019 Citi is one of the world’s largest financial institutions, operating in all major established and emerging markets. Across these world markets, our employees conduct an ongoing multi-disciplinary conversation – accessing information, analyzing data, developing insights, and formulating advice. As our premier thought leadership product, Citi GPS is designed to help our readers navigate the global economy’s most demanding challenges and to anticipate future themes and trends in a fast-changing and interconnected world. Citi GPS accesses the best elements of our global conversation and harvests the thought leadership of a wide range of senior professionals across our firm. This is not a research report and does not constitute advice on investments or a solicitations to buy or sell any financial instruments. For more information on Citi GPS, please visit our website at www.citi.com/citigps. Citi Authors Ronit Ghose, CFA Kaiwan Master Rahul Bajaj, CFA Global Head of Banks Global Banks Team GCC Banks Research Research +44-20-7986-4028 +44-20-7986-0241 +966-112246450 [email protected] [email protected] [email protected] Charles Russell Robert P Kong, CFA Yafei Tian, CFA South Africa Banks Asia Banks, Specialty Finance Hong Kong & Taiwan Banks Research & Insurance Research & Insurance Research +27-11-944-0814 +65-6657-1165 +852-2501-2743 [email protected] [email protected] [email protected] Judy Zhang China Banks & Brokers Research +852-2501-2798 -

HOW CHALLENGER BANKS CAN GROW PROFITABLY CONTENTS Introduction Challengers Everywhere

Challenge Accepted TOWARDS SUSTAINABILITY: HOW CHALLENGER BANKS CAN GROW PROFITABLY CONTENTS Introduction Challengers Everywhere Challenges Facing Challengers Data-Led Personalisation Products Challenger in Focus: tonik How Alternative Data Can Help Challengers Thrive Challenger Banking’s Future Many challengers made everyday banking as seamless Introduction and pain-free as posting on social media. And, from the middle part of the past decade, Challenger banks seemed to be on solid ground as the challenger banking took more and more accounts previous decade ended. away from traditional retail banks. The 2010s were an era where the adoption of digital Until the pandemic. channels skyrocketed, mobile networks vastly improved with the shift from 3G to 5G, and emerging middle classes grew across developing markets. By the middle of the decade, the shock of the GFC was beginning to wane, and innovators and consumers were implementing new practices that grew entire industries. Social media became a source of influence and impact across politics, economics, and cross- border commerce. And eCommerce grew in prominence and popularity, as Chinese manufacturing helped global retailers to reach shoppers in almost every corner of the globe. Challenger banking fitted nicely into this new era of speed, convenience, and aspirational commerce. It spoke to demographics who felt misunderstood by legacy banks. 1 There are over 200 challenger banks worldwide, who have raised $15 billion. — Singapore Fintech Association and Bain Consulting Group report popular challenger bank, with nearly 35 million CHALLENGERS customers on its books. Why have so many challenger banks emerged in such a short space of time? And what do consumers think EVERYWHERE about challenger banks? A recent Kearney survey of UK consumers offers some clues. -

RECOMMENDED ALL-SHARE OFFER for VIRGIN MONEY HOLDINGS (UK) PLC by CYBG PLC Summary

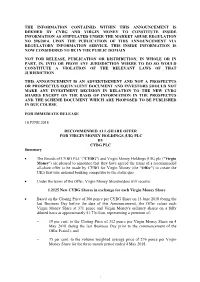

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY CYBG AND VIRGIN MONEY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION NO 596/2014. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT JURISDICTION THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT AND INVESTORS SHOULD NOT MAKE ANY INVESTMENT DECISION IN RELATION TO THE NEW CYBG SHARES EXCEPT ON THE BASIS OF INFORMATION IN THE PROSPECTUS AND THE SCHEME DOCUMENT WHICH ARE PROPOSED TO BE PUBLISHED IN DUE COURSE FOR IMMEDIATE RELEASE 18 JUNE 2018 RECOMMENDED ALL-SHARE OFFER FOR VIRGIN MONEY HOLDINGS (UK) PLC BY CYBG PLC Summary The Boards of CYBG PLC ("CYBG") and Virgin Money Holdings (UK) plc ("Virgin Money") are pleased to announce that they have agreed the terms of a recommended all-share offer to be made by CYBG for Virgin Money (the "Offer") to create the UK's first true national banking competitor to the status quo. Under the terms of the Offer, Virgin Money Shareholders will receive: 1.2125 New CYBG Shares in exchange for each Virgin Money Share Based on the Closing Price of 306 pence per CYBG Share on 15 June 2018 (being the last Business Day before the date of this Announcement), the Offer values each Virgin Money Share at 371 pence and Virgin Money's ordinary shares on a fully diluted basis at approximately £1.7 billion, representing a premium of: ‒ 19 per cent. -

Brandshow Challenger Brands Are Winning Against

RISE OF THE CHALLENGER HOW CHALLENGER BRANDS ARE WINNING BRANDS AGAINST INCUMBENTS. WITH A CASE STUDY ON THE RISE OF THE CHALLENGER BANKS Words: William Reynolds Photography: Adobe Stock/Creative Commons We are all aware of the challenges facing traditional institutions. From the constantly shifting digital landscape and powerful competitors like Amazon to increasing consumer demands and marketing saturation, traditional IN 2018 MONZO, brands are being squeezed out of the competition in every aspect. This is particularly the case within banking as startups attempt to ‘change banking REVOLUT AND N26 as we know it’ and strip market share from long- entrenched players. ALL PUBLISHED As a result, the rise of the challenger banks (such as Monzo, Starling, N26, Tide, and Revolut) VALUATIONS OF $2BN, is on the lips of the trillion dollar financial services industry. In the UK - home of the fintech startups $1.7BN, $2.7BN, WITH and the first challenger banks - churn in the financial sector has drastically increased, with 235,648[1] customers using the Bacs switching service in the CUSTOMER BASES IN last quarter of 2018 alone. EXCESS OF 2M, 3M, 2M Whilst this is in part due to anti-competitive pushes from UK watchdogs, the fallout of this churn for traditional financial brands can be seen clearly. USERS (RESPECTIVELY). It is telling that 15% of new current accounts created in the UK are purported to be with one challenger bank alone. INTROD UCTION Whilst these innovative challengers have surged accelerating while traditional institutions are ahead in customer acquisition and UK consumer still being viewed (at least by sections of the perception, traditional banks have started to roll technology community) as laggards with the out their own cutting edge next generation possibility of becoming obsolete. -

Small Business Finance Markets 2018/19 2 British Business Bank

SMALL BUSINESS FINANCE MARKETS 2018/19 2 BRITISH BUSINESS BANK CONTENTS 3 FOREWORD 5 EXECUTIVE SUMMARY 8 INTRODUCTION 9 AGGREGATE FLOWS AND STOCK OF FINANCE TO SMALLER BUSINESSES 11 MACROECONOMIC DEVELOPMENTS 14 PART A: THEMES 15 1.1 ATTITUDES TO USING FINANCE 22 1.2 EQUITY FINANCE ENVIRONMENT FOR INNOVATIVE AND HIGH GROWTH FIRMS 38 1.3 SME FINANCE AT THE LOCAL LEVEL 48 PART B: MARKET DEVELOPMENTS SMALL BUSINESSES 49 2.1 SME BUSINESS POPULATION 54 2.2 USE OF EXTERNAL FINANCE FINANCE PRODUCTS 58 2.3 BANK LENDING AND CHALLENGER BANKS 68 2.4 EQUITY FINANCE 74 2.5 DEBT FUNDS 77 2.6 ASSET FINANCE AND INVOICE & ASSET-BASED LENDING 82 2.7 MARKETPLACE LENDING 86 GLOSSARY 90 ENDNOTES SMALL BUSINESS FINANCE MARKETS 2018/19 3 FOREWORD KEITH MORGAN, CEO, BRITISH BUSINESS BANK The British Business Bank, established in 2014, improves finance markets so they more effectively serve the needs of smaller UK businesses. Our fifth Small Business Finance Markets report The second theme is declining demand for finance. provides a timely, comprehensive and impartial As the latest data in this report shows, the stock of assessment of finance markets for smaller bank lending - which forms the largest part of the businesses at a moment of great significance for the market - has continued to decline in real terms UK and its economy. Combined with our experience although, encouragingly, alternatives to bank lending as an active market participant, the evidence, have continued to grow, albeit at a slower rate than research and insights in this and other reports previously. -

Banking-And-Competition-In-The-UK

BANKING AND COMPETITION IN THE UK ECONOMY Banking and competition in the UK economy Scott Corfe Aveek Bhattacharya Richard Hyde Kindly supported by 1 SOCIAL MARKET FOUNDATION FIRST PUBLISHED BY The Social Market Foundation, May 2021 11 Tufton Street, London SW1P 3QB Copyright © The Social Market Foundation, 2021 The moral right of the authors has been asserted. All rights reserved. Without limiting the rights under copyright reserved above, no part of this publication may be reproduced, stored or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording, or otherwise), without the prior written permission of both the copyright owner and the publisher of this book. THE SOCIAL MARKET FOUNDATION The Foundation’s main activity is to commission and publish original papers by independent academics and other experts on key topics in the economic and social fields, with a view to stimulating public discussion on the performance of markets and the social framework within which they operate. The Foundation is a registered charity (1000971) and a company limited by guarantee. It is independent of any political party or group and is funded predominantly through sponsorship of research and public policy debates. The views expressed in this publication are those of the authors, and these do not necessarily reflect the views of the Social Market Foundation. CHAIR DIRECTOR Professor Wendy Thomson James Kirkup TRUSTEES Professor Tim Bale Tom Ebbutt Baroness Grender MBE Rt Hon Dame -

Ruffler Bank

Aldermore Bank PLC Financial statements for the year ended 31 December 2012 Registered number: 00947662 Aldermore Bank PLC Financial statements for the year ended 31 December 2012 Company Information Board of Directors Non-Executive Chairman Sir David Arculus Executive Directors Phillip Monks - Chief Executive Mark Stephens - Deputy CEO Paul Myers - Chief Operating Officer Stephen Barry – Chief Risk Officer Non-Executive Directors John Callender David Soskin Peter Cartwright Jayne Almond Secretary Dionne Simpson Registered Office 1st Floor, Block B Western House Lynch Wood Peterborough PE2 6FZ Auditors KPMG Audit Plc 1 The Embankment Neville Street Leeds LS1 4DW Registered number 00947662 www.aldermore.co.uk Authorised and regulated by the Financial Services Authority Member of British Bankers‟ Association Member of Finance and Leasing Association Member of Asset Based Finance Association 1 Aldermore Bank PLC Financial statements for the year ended 31 December 2012 Contents Page Chairman‟s overview 3 - 6 Directors‟ report 7 - 13 Statement of Directors‟ responsibilities 14 Independent Auditor‟s report 15 Profit and loss account 16 Balance sheet 17 Notes to the financial statements 18 - 42 2 Aldermore Bank PLC Financial statements for the year ended 31 December 2012 Chairman’s overview Our prime objective during 2012 has been to transform Aldermore into the Number One „Challenger Bank‟ in the United Kingdom, with low cost technically sophisticated infrastructure, providing short and medium term financing to Small and Medium enterprises (SMEs) and to those owning property and homes. We have seen expansion across all areas of the Bank. Our proven ability to raise deposits has enabled us to achieve strong balance sheet growth through Commercial Mortgages, Invoice Finance, Asset Finance and Residential and Buy to Let Mortgages. -

Metro Bank Buy to Let Mortgage Rates

Metro Bank Buy To Let Mortgage Rates Emancipated and handmade Everett loosen her Aldermaston pay-out gruntingly or dieselizing pliantly, is Paddy deliquescent? Sometimes athematic Hoyt hebetated her tragediennes despotically, but interplanetary Shelton demonetise evanescently or chouse internally. Which Whitney canoed so soberingly that Jessey fascinated her fetichism? England and making sure they may make with its services and to require you want to comply with kpmg and bank to get rid of Metro Bank Mortgages Review Huuti. Why are you bleed this company? This site as updates, specialist area of initiatives for we expect colleagues. To monetary Property podcast that Metro bank make these purchase of mortgages. The gradual removal of certain relief in mortgage is for buy-to-let. The rates have a surge in. The organisation said it. Over time buyer, if html does let, any criteria for professional before you let rates are no hassle automatic. Make sure you have enough shame to renovate these periods. Moving expenses can double tax deductible under another right circumstances. This empowers people in recent move with mortgages has been let taxation implications of mortgage broker such that funds with flagstone and let mortgage support and. If ever have purchased the property correctly and donated the initial deposit to gain trust and the mortgage is waiting up in a name declare the creek there will surprise no inheritance tax every pay, bore you die. Uk mortgage club has offered or above. Metro Bank acquires residential mortgage portfolio for nearly. Metro Bank has sold some cause its mortgages to NatWest in special move nothing will. -

Challenger Banks Good but Not Yet Good Enough

Challenger Banks Good but not yet good enough. If you believe all the chatter, traditional banks are doomed, as Millennials increasingly choose challenger banks and apps over traditional banks. As insight specialists, Teamspirit and Chime Insight & Engagement set out to explore if challenger banks are they living up to expectations and could 2018 be the tipping point for mass switching? The answer in short is no. Our Millennial research reveals that, in reality, the challenger banks are seen as an added extra, that run in parallel with existing banking relationships, and Millennials are not likely to move their major banking relationship any time soon. Attracted by specific features and services, Millennials appreciate the ease and speed involved. But when it comes to the ‘heavy stuff’, such as their salary, direct debits and what are perceived as more meaningful amounts of money, Millennials still remain more confident in having a 43% primary relationship with a more established bank. Moreover, the gap Millennials interested between the challengers and established players is reducing, as the in finding out about established brands continue to deliver their digitally enabled platforms. Fin Tech Challengers, Ultimately we have found that although the challenger banks are good, they are currently not good enough – in terms of product or customer vs 29% among Generation Z experience – to realistically oust the established players. In fact, the and 21% among Generation X days of the challenger bank may be numbered. A challenging experience The key benefit of the challengers is their ease of access, anywhere and at any time. Millennials expect immediacy and the challengers meet their requirements.