Social Media Usage by Digital Finance Consumers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strategies Adopted by Smep Deposit Taking Microfinance Limited to Gain a Sustainable Competitive Advantage by Simon Kamau

STRATEGIES ADOPTED BY SMEP DEPOSIT TAKING MICROFINANCE LIMITED TO GAIN A SUSTAINABLE COMPETITIVE ADVANTAGE BY SIMON KAMAU GATHECAH A MANAGEMENT RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION (MBA) OF THE SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI OCTOBER, 2015 DECLARATION I, the undersigned, declare that this research project is my own work and has never been presented in any other university or college for a degree or any other award. Signature: ___________________ Date: ___________________ STUDENT: SIMON KAMAU GATHECAH REG NO: D61/73342/2009 This research project report has been submitted for examination with my approval as the University Supervisor. Signature: ___________________ Date: ___________________ SUPERVISOR: DR. FLORENCE MUINDI SENIOR LECTURER SCHOOL OF BUSINESS UNIVERSITY OF NAIROBI ii DEDICATION To my father and mother, for their strong belief in me, To my lovely wife Jane, for her overwhelming support, To my beautiful angels Rehema and Tabitha, my family‟s hope for academic excellence. iii ACKNOWLEDGEMENTS My special thanks to the Almighty God for a fulfilled dream to pursue a degree course at The University of Nairobi. His grace was sufficient for provision the resources required and good health I enjoyed throughout my study. I acknowledge the exemplary guidance of my supervisor, Dr. Florence Muindi, whose priceless support and advice have made this project a success. I further thank her for setting time for me in the midst of many campus engagements to offer me the much needed guidance. I acknowledge the Department of Commerce, School of business for the structure and content of the MBA program. -

Equipment Leasing in Africa Handbook of Regional Statistics 2017 Including an Overview of 10 Years of IFC Leasing Intervention in the Region

AFRICA LEASING FACILITY II Equipment Leasing in Africa Handbook of Regional Statistics 2017 Including an overview of 10 years of IFC leasing intervention in the region © 2017 INTERNATIONAL FINANCE CORPORATION 2121 Pennsylvania Avenue, N.W., Washington, DC 20433 All rights reserved. First printing, March 2018. This document may not be reproduced in whole or in part without the written consent of the International Finance Corporation. This information, while based on sources that IFC considers to be reliable, is not guaranteed as to accuracy and does not purport to be complete. The conclusions and judgments contained in this handbook should not be attributed to, and do not necessarily represent the views of IFC, its partners, or the World Bank Group. IFC and the World Bank do not guarantee the accuracy of the data in this publication and accept no responsibility for any consequence of its use. Rights and Permissions Reference Section III. What is Leasing? and parts of Section IV. Value of Leasing in Emerging Economies are taken from IFC’s “Leasing in Development: Guidelines for Emerging Economies.” 2005, which draws upon: Halladay, Shawn D., and Sudhir P. Amembal. 1998. The Handbook of Equipment Leasing, Vol. I-II, P.R.E.P. Institute of America, Inc., New York, N.Y.: Available from Amembal, Deane & Associates. EQUIPMENT LEASING IN AFRICA: ACKNOWLEDGEMENT Acknowledgement This first edition of Equipment Leasing in Africa: A handbook of regional statistics, including an overview of 10 years of IFC leasing intervention in the region, is a collaborative efort between IFC’s Africa Leasing Facility team and the regional association of leasing practitioners, known as Africalease. -

Consumer Perceived Risk of Internet Banking in Kenya

CONSUMER PERCEIVED RISK OF INTERNET BANKING IN KENYA: A SURVEY OF THREE SELECTED BANKS IN NAIROBI COUNTY ORUCHO DANIEL OKARI FACULTY OF INFORMATION SCIENCE AND TECHNOLOGY A Research Thesis Submitted to the Graduate School in Partial Fulfillment of the Requirements for the Award of the Degree of Masters in Information Systems KISII UNIVERSITY February, 2017 DECLARATION BY STUDENT Declaration by candidate This is my original work and has not been presented for any degree award in this or any university. Orucho Daniel Okari Signature: …………………..Date: ………………… Registration Number: MIN 14/20189/14 Declaration by the Supervisors This thesis research has been submitted for examination with our approval as university supervisors. Dr. Elisha Ondieki Makori Lecturer, Faculty of Information Science and Technology University of Nairobi Signature: ……………. Date: …………….. Dr. Festus Ngetich Lecturer, Faculty of Information Science and Technology Kabianga University Signature………………. Date: ……………. ii DECLARATION OF NUMBER OF WORDS This form should be signed by the candidate and the candidate‟s supervisor (s) and returned to Director of Postgraduate Studies at the same time as you copies of your thesis/project. Please note at Kisii University Masters and PhD thesis shall comprise a piece of scholarly writing of not less than 20,000 words for the Masters degree and 50 000 words for the PhD degree. In both cases this length includes references, but excludes the bibliography and any appendices. Where a candidate wishes to exceed or reduce the word limit for a thesis specified in the regulations, the candidate must enquire with the Director of Postgraduate about the procedures to be followed. Any such enquiries must be made at least 2 months before the submission of the thesis. -

CBL Annual Report 2019

Central Bank of Liberia Annual Report 2019 Central Bank of Liberia Annual Report January 1 to December 31, 2019 © Central Bank of Liberia 2019 This Annual Report is in line with part XI Section 49 (1) of the Central Bank of Liberia (CBL) Act of 1999. The contents include: (a) report on the Bank’s operations and affairs during the year; and (b) report on the state of the economy, which includes information on the financial sector, the growth of monetary aggregates, financial markets developments, and balance of payments performance. i | P a g e Central Bank of Liberia Annual Report 2019 CENTRAL BANK OF LIBERIA Office of the Executive Governor January 27, 2020 His Excellency Dr. George Manneh Weah PRESIDENT Republic of Liberia Executive Mansion Capitol Hill Monrovia, Liberia Dear President Weah: In accordance with part XI Section 49(1) of the Central Bank of Liberia (CBL) Act of 1999, I have the honor on behalf of the Board of Governors and Management of the Bank to submit, herewith, the Annual Report of the CBL to the Government of Liberia for the period January 1 to December 31, 2019. Please accept, Mr. President, the assurances of my highest esteem. Respectfully yours, J. Aloysius Tarlue, Jr. EXECUTIVE GOVERNOR P.O. BOX 2048, LYNCH & ASHMUN STREETS, MONROVIA, LIBERIA Tel.: (231) 555 960 556 Website: www.cbl.org.lr ii | P a g e Central Bank of Liberia Annual Report 2019 Table of Contents ACRONYMS ............................................................................................................................. ix FORWARD ..................................................................................................................................1 The Central Bank of Liberia’s Vision, Mission and Objectives, Function and Autonomy ……4 EXECUTIVE SUMMARY………………………………………………..……….………………6 HIGHLIGHTS ......................................................................................................................... -

Public Notice

PUBLIC NOTICE PROVISIONAL LIST OF TAXPAYERS EXEMPTED FROM 6% WITHHOLDING TAX FOR JANUARY – JUNE 2016 Section 119 (5) (f) (ii) of the Income Tax Act, Cap. 340 Uganda Revenue Authority hereby notifies the public that the list of taxpayers below, having satisfactorily fulfilled the requirements for this facility; will be exempted from 6% withholding tax for the period 1st January 2016 to 30th June 2016 PROVISIONAL WITHHOLDING TAX LIST FOR THE PERIOD JANUARY - JUNE 2016 SN TIN TAXPAYER NAME 1 1000380928 3R AGRO INDUSTRIES LIMITED 2 1000049868 3-Z FOUNDATION (U) LTD 3 1000024265 ABC CAPITAL BANK LIMITED 4 1000033223 AFRICA POLYSACK INDUSTRIES LIMITED 5 1000482081 AFRICAN FIELD EPIDEMIOLOGY NETWORK LTD 6 1000134272 AFRICAN FINE COFFEES ASSOCIATION 7 1000034607 AFRICAN QUEEN LIMITED 8 1000025846 APPLIANCE WORLD LIMITED 9 1000317043 BALYA STINT HARDWARE LIMITED 10 1000025663 BANK OF AFRICA - UGANDA LTD 11 1000025701 BANK OF BARODA (U) LIMITED 12 1000028435 BANK OF UGANDA 13 1000027755 BARCLAYS BANK (U) LTD. BAYLOR COLLEGE OF MEDICINE CHILDRENS FOUNDATION 14 1000098610 UGANDA 15 1000026105 BIDCO UGANDA LIMITED 16 1000026050 BOLLORE AFRICA LOGISTICS UGANDA LIMITED 17 1000038228 BRITISH AIRWAYS 18 1000124037 BYANSI FISHERIES LTD 19 1000024548 CENTENARY RURAL DEVELOPMENT BANK LIMITED 20 1000024303 CENTURY BOTTLING CO. LTD. 21 1001017514 CHILDREN AT RISK ACTION NETWORK 22 1000691587 CHIMPANZEE SANCTUARY & WILDLIFE 23 1000028566 CITIBANK UGANDA LIMITED 24 1000026312 CITY OIL (U) LIMITED 25 1000024410 CIVICON LIMITED 26 1000023516 CIVIL AVIATION AUTHORITY -

Microfinance Sector Report 4Th Edition 2017

ASSOCIATION OF MICROFINANCE INSTITUTIONS (AMFI) MICROFINANCE SECTOR REPORT 4TH EDITION 2018 EXECUTIVE SUMMARY (Ag. CEO) n behalf of the Association of Microfinance Institutions (AMFI) Kenya Board and Secretariat, I am proud to present the 4th edition sector report on the Microfinance Sector in Kenya. This publication comprises a section on the Kenyan microfinance sector trends as at 30th June 2017, displaying business information such as portfolio, delivery methods, different target Ogroups, branch network, sectors as well as a list of the microfinance institutions that participated. This publication is part of AMFI-Kenya’s role to foster transparency in the microfinance sector as the national professional association aiming at building the capacity of the sector to ensure the provision of high quality financial services to the low-income people. This publication is also intended to allow the Kenyan microfinance sector to benefit from increased visibility on domestic and international capital markets, besides providing individual microfinance institutions (MFIs) with benchmarks to set their standards and strategic goals. AMFI would like to gratefully and sincerely thank all participants who made the issue and the relevance of the publication possible. This publication indeed raised significant interest among MFIs and in total, we were able to count on the participation of 30 institutions from the AMFI membership comprising; 8 microfinance banks, 1 Sacco and 21 retail credit only microfinance institutions. The data was collected, analyzed and compared between two periods ending 31st December 2016 and 30th June 2017 where applicable. We believe that the publication of this report is a very positive step towards enhancing transparency in the sector. -

Covert Capital the Kabila Family’S Secret Investment Bank

Covert Capital The Kabila Family’s Secret Investment Bank May 2019 Cover photo: The Sentry. The Sentry • TheSentry.org Covert Capital: The Kabila Family’s Secret Investment Bank May 2019 Executive Summary It would have been hard to understand the significance of Kwanza Capital just by looking at the company’s headquarters in a commercial garage in Kinshasa’s business district. No sign marked its presence. There was nothing to indicate the company was shuffling over one hundred million dollars through accounts held at a bank linked to the family of Joseph Kabila, who served as president of the Democratic Republic of Congo (Congo) from 2001 to January 2019. Nor would onlookers have had reason to suspect that the company was controlled by members of Congo’s former first family and its close allies. Individuals with knowledge of the company’s activities told The Sentry it maintained a low profile by design and the individuals behind Kwanza Capital apparently sought to minimize their public association with the company. Kwanza Capital, which is now reportedly under liquidation, gained only fleeting public notice as it made unusual maneuvers in the country’s banking sector, but its story is more expansive than the public record would suggest. An investigation by The Sentry into Kwanza Capital’s activities provides a new glimpse into how members of Kabila’s family and inner circle have done business. The Sentry examined the firm’s operations, finances, apparent beneficiaries, business partners, and relationships with government agencies and officials. In addition to maintaining extensive links to a bank run by members of Kabila’s family, Kwanza Capital participated in multiple acquisition attempts in the Congolese banking sector. -

Absa Bank 22

Uganda Bankers’ Association Annual Report 2020 Promoting Partnerships Transforming Banking Uganda Bankers’ Association Annual Report 3 Content About Uganda 6 Bankers' Association UBA Structure and 9 Governance UBA Member 10 Bank CEOs 15 UBA Executive Committee 2020 16 UBA Secretariat Management Team UBA Committee 17 Representatives 2020 Content Message from the 20 UBA Chairman Message from the 40 Executive Director UBA Activities 42 2020 CSR & UBA Member 62 Bank Activities Financial Statements for the Year Ended 31 70 December 2020 5 About Uganda Bankers' Association Commercial 25 banks Development 02 Banks Tier 2 & 3 Financial 09 Institutions ganda Bankers’ Association (UBA) is a membership based organization for financial institutions licensed and supervised by Bank of Uganda. Established in 1981, UBA is currently made up of 25 commercial banks, 2 development Banks (Uganda Development Bank and East African Development Bank) and 9 Tier 2 & Tier 3 Financial Institutions (FINCA, Pride Microfinance Limited, Post Bank, Top Finance , Yako Microfinance, UGAFODE, UEFC, Brac Uganda Bank and Mercantile Credit Bank). 6 • Promote and represent the interests of the The UBA’s member banks, • Develop and maintain a code of ethics and best banking practices among its mandate membership. • Encourage & undertake high quality policy is to; development initiatives and research on the banking sector, including trends, key issues & drivers impacting on or influencing the industry and national development processes therein through partnerships in banking & finance, in collaboration with other agencies (local, regional, international including academia) and research networks to generate new and original policy insights. • Develop and deliver advocacy strategies to influence relevant stakeholders and achieve policy changes at industry and national level. -

Annual Report

2017/18 ANNUAL REPORT RESILIENCE AND RECOVERY ABOUT US New Vision Printing & Publishing Company Limited started business in March 1986. It is a multimedia business housing newspapers, magazines, internet publishing, televisions, radios, commercial printing, advertising and distribution services. The Company is listed on the Uganda Securities Exchange. Our Vision A globally respected African media powerhouse that advances society Mission To be a market-focused, performance-driven organisation, managed on global standards of operational and financial efficiency Values • Honesty • Innovation • Fairness • Courage • Excellence • Zero tolerance to corruption • Social responsibility 2 VISION GROUP ANNUAL REPORT 2017/18 INTRODUCTION This is the Annual Report of New Vision Printing & Publishing Company Limited trading as Vision Group for the year ended June 30, 2018. This Annual Report includes financial and non-financial information. It sets out the Company’s strategy, financial, operational, governance, social and environmental performance. The Annual Report also contains the risks and opportunities affecting the Company. The purpose of producing an Annual Report is to give the shareholders an annual view of how the Company has performed and what the Board is striving to do on behalf of the shareholders. 1 TABLE OF contENT Notice of Annual General Meeting 4 Company Profile 5 Business Review 15 Board of Directors 19 Chairperson’s Statement 21 Executive Committee 26 CEO’s Statement 27 Corporate Governance Statement 31 Shareholder Information 42 Proxy Card 47 Sustainability Report 50 Accolades 80 Financial Statements 82 2 VISION GROUP ANNUAL REPORT 2017/18 LIST OF AcronYMS AGM - Annual General Meeting Annual Report - An annual report is a comprehensive report on a company’s activities including the financial performance throughout the year. -

Notes to the Financial Statements 34

Secure Online Payments Open your online store to international customers by accepting & payments. Transactions are settled NO FOREX UGX USD in both UGX and USD EXPOSURE Powered by for more Information 0417 719229 [email protected] XpressPay is a registered TradeMark Secure Online Payments 2016 ANNUAL REPORT Open your online store to international customers by accepting & payments. Transactions are settled NO FOREX UGX USD in both UGX and USD EXPOSURE Powered by for more Information 0417 719229 [email protected] XpressPay is a registered TradeMark ENJOY INTEREST OF UP TO 7% P.A. WITH OUR PREMIUM CURRENT ACCOUNT INTEREST IS CALCULATED DAILY AND PAID MONTHLY. CONTENTS Overview About Us 6 Our Branch Network 7 Our Corporate Social Responsibility 8 Corporate Information 11 Governance Chairman’s Statement 12 Managing Director/CEO’s Statement 14 Board of Directors’ Profiles 18 Executive Committee 20 Directors’ Report 21 Statement of Directors’ Responsibilities 23 Report of the Independent Auditors 24 Orient Bank Limited Annual Report and Consolidated 04 Financial Statements For the year ended 31 December 2016 OVERVIEW GOVERNANCE FINANCIAL STATEMENTS Financial Statements Consolidated Statement of Comprehensive Income 26 Bank Statement of Comprehensive Income 27 Consolidated Statement of Financial Position 28 Bank Statement of Financial Position 29 Consolidated Statement of Changes in Equity 30 Bank Statement of Changes in Equity 31 Consolidated Statement of Cash flows 32 Bank Statement of Cash flows 33 Notes to the Financial Statements 34 Orient Bank Limited Annual Report and Consolidated Financial Statements For the year ended 31 December 2016 05 ...Think Possibilities ABOUT US Orient Bank is a leading private sector commercial Bank in Uganda. -

Nozzom Newsletter Issue

NOZZOM NEWSLETTER ISSUE #29 - December 2017 Moving… Foreword Contents Welcome to our new issue of Nozzom, where we share with you our events and projects as well as our future plans and outlook on happenings and opportunities. Maturity does not necessarily come with age, but with experience. As is the case with sentient beings, organizations have a lifecycle in 04 which they themselves experience various stages of learning, developing, adapting, and striving towards being better. With maturity comes NOZZOM NEWSLETTER ISSUE #29 responsibility: the responsibility to look inwards, at the way business is done and how it can develop itself to improve; and outwards, at how Agility in ENAL the organization can support and further contribute to the development of the society in which it finds itself. Chairman Recognizing where we are currently at, Giza Systems’ goal is to self-develop, learn from our experiences, and mature as a whole, with reference Shehab ElNawawi to our business and our community alike. We are entering a ‘regeneration’ phase that surpasses adapting to our surroundings. Quintessentially, it is about striving to do better and be better. Managing Editor Just a few highlights on what you can expect in this issue of Nozzom: Lara Shawky New Leaps • Giza Systems Implements 50,000 Smart Meters in North Cairo Zone in Saudi 15 • Fire Alarm and Detection Systems Implementation in Al Masah Capital Complex, New Cairo Internatinal Convention and Exhibition Center, Mzizima Tower Complex, Meliá Hotels International Creative & Art Director -

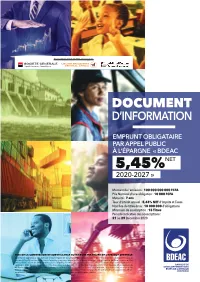

Document Dinformation BDEAC OK OK

Consortium Chef de File, Arrangeurs DOCUMENT D’INFORMATION EMPRUNT OBLIGATAIRE PAR APPEL PUBLIC À L’ÉPARGNE « BDEAC 5,45%NET 2020-2027 » Montant de l’émission : 100 000 000 000 FCFA Prix Nominal d’une obligation : 10 000 FCFA Maturité : 7 ans Taux d’intérêt annuel : 5,45% NET d’Impôts et Taxes Nombre de titres émis : 10 000 000 d’obligations Minimum de souscription : 15 Titres Période indicative des souscriptions : 21 au 29 Décembre 2020 VISA DE LA COMMISSION DE SURVEILLANCE DU MARCHÉ FINANCIER DE L’AFRIQUE CENTRALE La présente opération a été visée par la Commission de Surveillance du Marché Financier de l’Afrique Centrale (COSUMAF) sous le numéro APE---/20 conformément aux dispositions régissant l’appel public à l’épargne sur le Marché Financier Régional, notamment les articles 90 et suivants de l’Acte Uniforme sur le Droit des Sociétés Commerciales et du GIE, 12, alinéa (iv) du Règlement n°06/03 du 12 novembre 2003 portant Organisation, Fonctionnement et Surveillance du Marché Financier de l’Afrique Centrale, 25 et suivants du Règlement Général de la COSUMAF, 1 alinéa (1) de l’Instruction n°2006-01 du 3 mars 2006 relative au document d’information exigé dans le cadre d’un appel public à l’épargne. Le visa de la Commission ne porte pas sur l’opportunité de l’opération envisagée, mais atteste simplement que la COSUMAF a vérifié la pertinence et la cohérence de l’information publiée. I. Sommaire I. SOMMAIRE 02 II. CONDITIONS DE DIFFUSION DU PRESENT DOCUMENT D’INFORMATION 03 III. SIGLES ET ABREVIATIONS 05 IV.