2020 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SCHEDULE 14A Proxy Statement Pursuant to Section 14(A) of the Securities Exchange Act of 1934 (Amendment No

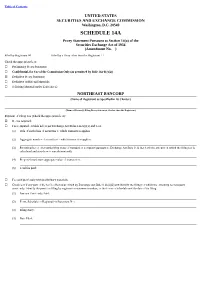

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material under §240.14a-12 NORTHEAST BANCORP (Name of Registrant as Specified in Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: Table of Contents October 24, 2011 Dear Northeast Bancorp Shareholders: You are cordially invited to attend the 2011 annual meeting of shareholders of Northeast Bancorp. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 Or 15

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): October 20, 2005 NORTHEAST BANCORP (Exact Name of Registrant as Specified in its Charter) Maine 1-14588 01-0425066 (State or Other Jurisdiction Incorporation) (Commission File Number) (IRS Employer Identification Number) 500 Canal Street, Lewiston, Maine 04240 (Address of Principal Executive Offices) (Zip Code) Registrant's telephone number, including area code: (207) 786-3245 Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions. Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. Rule 13e-4(c)). Item 9.01 Financial Statements and Exhibits. (c)Exhibits. Exhibit No. Description 99.1 Press Release, dated October 20, 2005 regarding first quarter 2005 earnings and the declaration of a dividend. Item 7.01 Regulation FD Disclosure. On October 20, 2005, Northeast Bancorp, a Maine corporation (the "Company"), issued a press release announcing it's earnings for the first quarter ended September 30, 2005 and declaring the payment of a dividend. The full text of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. -

Page 1 FORM 10-K SECURITIES

Page 1 FORM 10-K SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 (Mark One) [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For fiscal year ended June 30, 2001 [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number (1-14588) NORTHEAST BANCORP (Exact name of registrant as specified in its charter) Maine 01-0425066 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 232 Center Street, Auburn, Maine 04210 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (207) 777-6411 Securities registered pursuant to Section 12(b) of the Act: Title of each class: Name of each exchange on which registered: Common Stock, $1.00 par value American Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

Investor Presentation: Common Stock Offering

Filed Pursuant to Rule 433 Registration No. 333-180215 Issuer Free Writing Prospectus dated May 3, 2012 Relating to Preliminary Prospectus dated May 3, 2012 Investor Presentation: Common Stock Offering NASDAQ: NBN May 2012 DISCLAIMER SafeHarborRegardingForward-LookingStatements This presentation contains certain “forward-looking statements” about Northeast Bancorp (the “Company”) within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, such as statements relating to use of proceeds including the redemption of Series A preferred stock. Forward-looking statements, which are based on various assumptions (some of which are beyond the Company’s control), may be identified by reference to a future period or periods, or by the use of forward-looking terminology such as “believe,” “expect,” “estimate,” “anticipate,” “continue,” “plan,” “approximately,” “intend,” “objective,” “goal,” “project,” or other similar terms or variations on those terms, or the future or conditional verbs such as “will,” “may,” “should,” “could,” and “would.” Actual results could differ materially from those expressed or implied by such forward-looking statements as a result of, among other factors, the factors referenced in the Registration Statement under the heading “Risk Factors”; changes in interest rates and real estate values; competitive pressures from other financial institutions; the effects of a continuing deterioration in general economic conditions on a national basis -

1 As Filed with the Securities And

1 AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON NOVEMBER 5, 1999 REGISTRATION STATEMENT NOS. 333-88853 AND 333-88853-01 - -------------------------------------------------------------------------------- - -------------------------------------------------------------------------------- SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 --------------------- AMENDMENT NO. 2 TO FORM S-2 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 --------------------- NBN CAPITAL TRUST NORTHEAST BANCORP (Exact Name of Registrants as Specified in Their Charters) DELAWARE 01-6156013 MAINE 65-0624640 (States or Other Jurisdictions of (I.R.S. Employer Incorporation or Organization) Identification Nos.) 232 CENTER STREET AUBURN, MAINE 04210 (207) 777-6411 (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrants' Principal Executive Offices) --------------------- JAMES D. DELAMATER, PRESIDENT NORTHEAST BANCORP 232 CENTER STREET AUBURN, MAINE 04210 (207) 777-6411 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) --------------------- COPIES TO: RICHARD A. DENMON, ESQ. WILLIAM W. BOUTON, III, ESQ. CARLTON, FIELDS, WARD, EMMANUEL, TYLER COOPER & ALCORN, LLP SMITH & CUTLER, P.A. CITY PLACE - 35TH FLOOR 777 SOUTH HARBOUR ISLAND BOULEVARD HARTFORD, CONNECTICUT 06103 TAMPA, FLORIDA 33602 --------------------- APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after this Registration Statement becomes effective. If any of -

Nebraska Bankers

NEBRASKA BLUEPRINT NOVEMBER/DECEMBERSEPTEMBER/OCTOBERMAY/JUNE 2015 20182017 Focused on serving you, Nebraska bankers For more than 50 years, Kutak Rock has provided high-quality, personal legal service to the Nebraska business community. Our Banking Group, made up of attorneys from a Bank regulatory Mortgage banking litigation variety of business transaction, litigation and Retail banking and operations Financial services litigation Commercial and agricultural lending Governance Mergers and acquisitions Internal and government investigations regulatory practices, has the experience you Securitizations Bankruptcy and restructuring Structured finance Equipment leasing and finance FinTech Intellectual property need and bench strength you want to remain Derivatives and swaps Privacy and data security competitive in the banking arena. Kutak Rock LLP Omaha 1650 Farnam Street, The Omaha Building, Omaha, NE 68102 | 402.346.6000 | www.kutakrock.com CONTENTS 7 PRESIDENT’S MESSAGE – LAUNCHING BLUEPRINT NEBRASKA 8 Nebraska’s statewide initiative has begun the research phase for collective input and data to best “Blueprint” the state’s future economic growth, prosperity and quality of life. Richard J. Baier, President & CEO, Nebraska Bankers Association 8 WASHINGTON UPDATE – NEW BANKS AS BELLWETHERS New ABA chief policy officer weighs in on why new bank charters are indicators of economic vitality and the ABA De Novo Task Force. Naomi Camper, Chief Policy Officer, American Bankers Association 12 COUNSELOR’S CORNER – COMMUNITY REINVESTMENT ACT MODERNIZATION: A TOUCH UP OR A TOTAL OVERHAUL? Twenty-five pages published on August 28th by the Office of the Comptroller of the Currency (OCC) may finally kick-off what bankers and regulators have been anticipating since early last year: Modernizing the Community Reinvestment Act of 1977 (CRA). -

![[X] ANNUAL REPORT PURSUANT to SECTION 13 OR 15(D) of the SECURITIES EXCHANGE ACT of 1934](https://docslib.b-cdn.net/cover/3009/x-annual-report-pursuant-to-section-13-or-15-d-of-the-securities-exchange-act-of-1934-12193009.webp)

[X] ANNUAL REPORT PURSUANT to SECTION 13 OR 15(D) of the SECURITIES EXCHANGE ACT of 1934

FORM 10-K SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 (Mark One) [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For fiscal year ended June 30, 2003 [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number (1-14588) NORTHEAST BANCORP (Exact name of registrant as specified in its charter) Maine 01-0425066 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 158 Court Street, Auburn, Maine 04210 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (207) 777-6411 Securities registered pursuant to Section 12(b) of the Act: Title of each class: Name of each exchange on which registered: Common Stock, $1.00 par value American Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

Access to Financial Services in Brazil

DIRECTIONSDIRECTIONS ININ DEVELOPMENTDEVELOPMENT Access to Financial Public Disclosure Authorized Services in Brazil A STUDY LED BY ANJALI KUMAR Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized DIRECTIONS IN DEVELOPMENT Access to Financial Services in Brazil DIRECTIONS IN DEVELOPMENT Access to Financial Services in Brazil A study led by Anjali Kumar THE WORLD BANK Washington, D.C. © 2005 The International Bank for Reconstruction and Development / The World Bank 1818 H Street, NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org E-mail: [email protected] All rights reserved 1 2 3 4 07 06 05 04 The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the Board of Executive Directors of the World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of the World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this work is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The World Bank encourages dissemination of its work and will normally grant permission promptly. For permission to photocopy or reprint any part of this work, please send a request with complete information to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers MA 01923, USA; telephone: 978-750-8400; fax: 978-750-4470; www.