Mexico Food Processing Ingredients

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Profile Local Character

strategy execution sustainability leadership strength discipline flexibility Global profile local character 2009 Annual Report 1 Central America Region America Central Headquartered in San José, Costa Rica. Countries included: Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua and Panama. Principal brands are Bimbo, Breddy, Europa, Ideal, Lido, La Mejor, Marinela, Milpa Real, Monarca, Pix and Ricolino. Latin America Organizacion Latinoamerica Headquartered in Buenos Aires, Argentina. Countries included: Argentina, Brazil, Chile, Colombia, Paraguay, Peru, Uruguay and Venezuela. Principal brands are Agua de Piedra, Ana Maria, Bimbo, Cena, Firenze, Fuchs, Holsum, Ideal, Lagos del Sur, Lalo, Laura, Los Sorchantes, Maestro Cubano, Mama Ines, Marinela, Nutrella, Oroweat, Plucky, Plus Vita, Pullman, Pyc, Ricard, Ricolino and Trigoro. China Organizacion Asia Headquartered in Beijing, China with the Bimbo and Million Land brands. One of the leading manufacturers of bakery products and prepared foods, with distribution in cities north of Beijing as well. Main products are biscuits; packaged bread in such varieties as white, whole wheat, milk and corn; pastries; and prepared foods like sandwiches and hamburgers. 98 plants 2 Mexico Organizacion Barcel S.A. de C.V. Headquartered in Lerma, Mexico. Principal brands are Barcel, Grupo Bimbo Coronado, Juicee Gummee, La Corona and Ricolino. today Mexico Advanced Gastronomy and Pastries Headquartered in Mexico City and located in 18 states throughout the country. Its principal brands are El Globo, with 125 years of history; La Balance with 25 years; and El Molino with 80 years. Fine traditional Mexican pastries. Mexico Bimbo S.A. de C.V. Headquartered in Mexico City. Principal brands are Bimbo, Del Hogar, Gabi, Lara, Lonchibon, Marinela, Milpa Real, Oroweat, Saníssimo, Suandy, Tía Rosa and Wonder. -

Grupo Comercial Chedraui, S.A.B. De C.V

GRUPO COMERCIAL CHEDRAUI, S.A.B. DE C.V. Av. Constituyentes No. 1150, Lomas Altas Delegación Miguel Hidalgo C.P. 11950 México, D. F. www.chedraui.com.mx Características de las acciones representativas del capital social de GRUPO COMERCIAL CHEDRAUI, S.A.B. DE C.V. Nominativas Sin valor nominal Íntegramente suscritas y pagadas Serie B Clase I Capital mínimo fijo sin derecho a retiro. Clave de Cotización en la Bolsa Mexicana de Valores, S.A.B. de C.V.: CHDRAUI Los valores emitidos por Grupo Comercial Chedraui, S.A.B. de C.V. se encuentran inscritos en el Registro Nacional de Valores y se cotizan en la Bolsa Mexicana de Valores, S.A.B. de C.V. La inscripción en el Registro Nacional de Valores no implica certificación sobre la bondad de los valores, la solvencia de la emisora o la exactitud o veracidad de la información contenida en el reporte anual, ni convalida los actos que, en su caso, se hubieren realizado en contravención de las leyes. Reporte anual que se presenta de acuerdo con las disposiciones de carácter general aplicables a las Emisoras de valores y a otros participantes del mercado, por el año terminado el 31 de diciembre de 2015. México, D.F. a 30 de abril de 2016 ÍNDICE 1. INFORMACIÓN GENERAL ........................................................................................... 4 a) Glosario de Términos y Definiciones ......................................................................... 4 b) Resumen Ejecutivo ................................................................................................. 6 c) Factores -

Applied Investment Management (AIM) Program

Applied Investment Management (AIM) Program AIM Class of 2014 Equity Fund Reports Spring 2014 Date: February 28th | Time: 12-1 p.m. | Location: AIM Research Room (488) Join us in person Student Presenter Company Name Ticker Price Page No. Rocio Maria Diaz Grupo Bimbo, S.A.B.de C.V. GRBMF 2.56 2 The student presentations are an important element of the applied learning experience in the AIM program. The students conduct fundamental equity research and present their recommendations in written and oral format – with the goal of adding their stock to the AIM Equity Fund. Your comments and advice add considerably to their educational experience and is greatly appreciated. Each student will spend about 5-7 minutes presenting their formal recommendation, which is then followed by about 8-10 minutes of Q & A. For more information about AIM please contact: David S. Krause, PhD Director, Applied Investment Management Program Marquette University College of Business Administration, Department of Finance 436 Straz Hall, PO Box 1881 Milwaukee, WI 53201-1881 mailto: [email protected] Website: MarquetteBuz/AIM AIM Blog: AIM Program Blog Twitter: Marquette AIM Facebook: Marquette AIM Marquette University AIM Class 2014 Equity Reports Spring 2014 Page 1 Grupo Bimbo, S.A.B de C.V. (GRBMF) February 28, 2014 Rocio Maria Diaz International Consumer Staples Grupo Bimbo S.A.B de C.V. (GRBMF) is one of the leading baking companies in the world. It carries out the production, distribution, and marketing of more than 10,000 products including packaged bread, salted snacks, confectionary, tortillas, and packaged foods. -

Panorama Bursátil. Voto De Confianza En Enero

15 de f ebrero de 2019 Octav io García Williams González Mesa de Análisis Ext. 10717 [email protected] Panorama Bursátil. Voto de confianza en enero Nuestra lectura del mercado ─ Optimismo en los mercados de EUA tras avances en las negociaciones comerciales con China. Las pláticas continuarán la próxima semana en Washington. En EUA el S&P 500 subió 2.3% y el DJIA 2.8%; mientras que México se ajustó 0.4% en pesos (-1.4% en dólares; el peso se depreció 0.9%). ¿Bolsa atractiva?…La renta fija dice que todavía no ─ Se comparó el rendimiento desde 2008 de las utilidades de la Bolsa en México (earnings yield o inverso del múltiplo P/U) contra el rendimiento o yield del Bono M a 10 años. El difícil entorno del mercado global en términos comerciales, las dudas en cuanto al crecimiento económico global, la política monetaria restrictiva la Fed, la incertidumbre interna, entre otros factores, hacen que rendimiento de las utilidades de la Bolsa en México no luzca su mejor versión, al ubicarse en 5.9% vs. ~8.5% del bono M a 10 años, aunque se reconoce que el diferencial entre ambos se ha recortado ~100pb en los últimos cinco meses. Flujos de extranjeros a la renta variable nacional ─ Tras el fuerte ajuste del mercado en 2018 (-15.6%), y apoyados por una menor aversión al riesgo en mercados emergentes, los extranjeros dieron el voto de confianza al mercado local al traer flujos por más de US$500 millones en enero que ayudaron al índice a subir 5.6% en el primer mes del año. -

Efectos De La Ley Fintech México En La Apertura De Instituciones De

962 Efectos de la Ley Fintech México en la apertura de Instituciones de Tecnología Financiera (ITF) García-Cañedo, Alma Iliana1, Quiroz-Gálvez, Sergio2 & Jiménez-García, Carlos3 1Universidad de Sonora, Departamento de Administración Hermosillo, Sonora, México, [email protected], Luis Encinas y Rosales S/N Col. Centro, (+52) 662 2 59 21 29; 2Universidad de Sonora, Departamento de Administración Hermosillo, Sonora, México, [email protected], Luis Encinas y Rosales S/N Col. Centro, (+52) 662 2 59 21 29; 3Universidad de Sonora, Departamento de Contabilidad Hermosillo, Sonora, México, [email protected], Luis Encinas y Rosales S/N Col. Centro, (+52) 662 2 59 21 29; Información del artículo arbitrado e indexado en Latindex: Revisión por pares Fecha de publicación: Julio 2019 Resumen Abstract El corto plazo de la proliferación de las empresas FinTech The short term of the proliferation of FinTech companies en México y en el mundo, es debido al impulso recibido por in Mexico and in the world, is due to the impulse received la combinación de varios factores: Técnicas novedosas de by the combination of several factors: innovative desarrollo, expectativas de innovación empresarial, ahorro development techniques, expectations of business en los costos, etcétera. Esta expectativa tan dramáticamente innovation, cost savings, and so on. This expectation, so amplia en el uso de las FinTech mexicanas, está a la dramatically wide in the use of the Mexican FinTech, is in expectativa de cómo funcionará la nueva Ley que para tal expectation of how the new Law will work, for that purpose efecto se aprobó en marzo de 2018, y las Leyes secundarias was approved in March 2018, and secondary laws in en noviembre del mismo año. -

Gruma, S.A.B. De C.V

GRUMA, S.A.B. DE C.V. San Pedro Garza García, N.L. April 7, 2021. In relation to the First Notice to the Annual General Ordinary Shareholders Meeting of GRUMA, S.A.B de C.V. (the “Company” or “GRUMA”) to be held on April 23, 2021 at 11:00 (eleven) hours, the shareholders are hereby informed of the details of the proposals to be discussed during said Shareholders’ Meeting regarding the items on the Agenda. The corresponding documentation will be available to the Shareholders in the Company’s offices, at least 15 days prior to the date on which said Shareholders’ Meeting will take place: ANNUAL GENERAL ORDINARY SHAREHOLDERS’ MEETING I. Presentation, discussion and, as the case may be, approval of the reports referred to in article 28, Section IV of the Securities Market Law (Ley del Mercado de Valores) and article 19, Section IV of the Company´s Bylaws, for the fiscal year ended December 31, 2020, including the Financial Statements of GRUMA, S.A.B. DE C.V. for the fiscal year commencing on January 1 ending December 31, 2020. First point.- The shareholders will be presented, for their approval, with the Financial Statements of GRUMA, S.A.B. DE C.V. for the fiscal year commencing January 1 ending December 31, 2020, the Chief Executive Officer’s Annual Report, as well as the following reports and opinions: • Report on the Individual and Consolidated Financial Statements issued by the independent auditors firm PriceWaterhouseCoopers. • Report Regarding the main Policies and Accounting Guidelines used for the preparation of the Financial Statements. -

Risk Factors

RISK FACTORS The following risks factors described may adversely affect the Company’s development, financial status and/or operating results, as well as affect the price of any securities of the Company. Risks Related to the Business, Industry and Supply Increases in prices and shortages of raw materials, fuels and utilities could cause costs to increase Grupo Bimbo purchases large quantities of commodities, including wheat flour, edible oils and fats, sugar, eggs and plastic to package its products, the prices of which are volatile. The Group is also exposed to changes in oil prices, which impact both its packaging and transportation costs. Prices for commodities, other supplies and energy fluctuate due to conditions that are difficult to predict, including global competition for resources, currency fluctuations, severe weather conditions (including the effects of global climate change), consumer, industrial or commodity investment demand, changes in governmental regulation and trade, alternative energy sources and government-sponsored agricultural programs. The prices of the Group’s raw materials normally fluctuate due to market conditions and currency fluctuations. Grupo Bimbo cannot assure that these fluctuations will not have an adverse effect on its financial performance or that it will be able to pass along the effect of increased costs to consumers. The Group also relies on fuels and utilities to operate its business. For example, its bakeries and other facilities use natural gas, liquefied petroleum gas and electricity to operate. In addition, its distribution operations use gasoline and diesel fuel and electricity to deliver the products. These fuels and utilities are subject to price volatility. For these reasons, substantial future increases in prices for, or shortages of, these fuels or electricity could adversely affect Grupo Bimbo. -

Perfil Global Carácter Local

estrategia ejecución sustentabilidad liderazgo fuerza disciplina flexibilidad Perfil global carácter local Informe Anual 2009 1 Centroamérica Región América Central Tiene su sede en San José, Costa Rica. Los países que la integran son: Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua y Panamá. Sus principales marcas son Bimbo, Breddy, Europa, Ideal, Lido, La Mejor, Marinela, Milpa Real, Monarca, Pix y Ricolino. Latinoamérica Organización Latinoamérica Tiene su sede en Buenos Aires, Argentina. Los países que la integran son: Argentina, Brasil, Chile, Colombia, Paraguay, Perú, Uruguay y Venezuela. Sus principales marcas son Agua de Piedra, Ana Maria, Bimbo, Cena, Firenze, Fuchs, Holsum, Ideal, Lagos del Sur, Lalo, Laura, Los Sorchantes, Maestro Cubano, Mama Ines, Marinela, Nutrella, Oroweat, Plucky, Plus Vita, Pullman, Pyc, Ricard, Ricolino y Trigoro. China Organización Asia Tiene su sede en Beijing, China con las marcas Bimbo y Million Land. Es uno de los principales fabricantes de productos panificados y alimentos preparados, con distribución además en ciudades al norte de Beijing. Sus principales productos son pastelitos, pan de caja en variedades como pan blanco, pan integral, pan de leche y pan de maíz; pan dulce además de alimentos preparados como sándwiches y hamburguesas. 98 plantas 2 México Organización Barcel S.A. de C.V. Tiene su sede en Lerma, Estado de México. Entre sus principales marcas Grupo Bimbo se encuentran Barcel, Coronado, Juicee Gummee, La Corona y Ricolino. hoy México Gastronomía Avanzada y Pastelerías Tiene su sede en la Cd. de México y presencia en 18 estados de la República Mexicana. Sus marcas principales son Pastelerías El Globo, con 125 años de vida; La Balance con 25 años y El Molino con 80 años. -

Foreign Investment in Latin America and the Caribbean

(FRQRPLF&RPPLVVLRQIRU/DWLQ$PHULFDDQGWKH&DULEEHDQ (&/$& )RUHLJQ,QYHVWPHQWLQ/DWLQ$PHULFDDQGWKH&DULEEHDQLVWKHODWHVWHGLWLRQRIDVHULHVSXEOLVKHGDQQXDOO\E\WKH 8QLWRQ,QYHVWPHQWDQG&RUSRUDWH6WUDWHJLHVRIWKH(&/$&'LYLVLRQRI3URGXFWLRQ3URGXFWLYLW\DQG0DQDJHPHQW ,WZDVSUHSDUHGE\ÈOYDUR&DOGHUyQ3DEOR&DUYDOOR0LFKDHO0RUWLPRUHDQG0iUFLD7DYDUHVZLWKWKHDVVLVWDQFHRI $GULDQ1\JDDUG/HPD1LFRODV&KDKLQH3KLOOLS0OOHU$OLVRQ&ROZHOO%U\DQW,YHVDQG&DUO1LVV)DKODQGHQDQG FRQWULEXWLRQVIURPWKHFRQVXOWDQWV*HUPDQR0HQGHVGH3DXOD*XVWDYR%DUXM'DYLG7UDYHVVR&HOVR*DUULGR3DWULFLR <ixH]DQG1LFROR*OLJR&KDSWHU9ZDVSUHSDUHGMRLQWO\E\WKH8QLWRQ,QYHVWPHQWDQG&RUSRUDWH6WUDWHJLHVDQGWKH $JULFXOWXUDO'HYHORSPHQW8QLWERWKSDUWRIWKH&RPPLVVLRQ¶V'LYLVLRQRI3URGXFWLRQ3URGXFWLYLW\DQG0DQDJHPHQW ,QSXWVIRUWKLVFKDSWHUZHUHSURYLGHGE\WKHFRQVXOWDQWV0DUF6FKHLQPDQDQG-RKQ:LONLQVRQDPRQJRWKHUVLQWKH IUDPHZRUNRIWKHSURMHFWHQWLWOHG³$JULFXOWXUDOGHYHORSPHQWSROLFLHVDQGWUDQVQDWLRQDOFRUSRUDWLRQV¶VWUDWHJLHVLQWKH DJULIRRGVHFWRU´RIWKH*RYHUQPHQWRIWKH1HWKHUODQGV,QWKLVUHJDUGWKHFRQWULEXWLRQVRI0{QLFD5RGULJXHVDQG 6RItD$VWHWH0LOOHUDUHJUDWHIXOO\DFNQRZOHGJHG7KDQNVDUHDOVRGXHWRWKHFRUSRUDWHH[HFXWLYHVZKRDJUHHGWRWDNH SDUWLQWKHLQWHUYLHZVFRQGXFWHGGXULQJWKHSUHSDUDWLRQRIFKDSWHUV,,,WR9, 7KHLQIRUPDWLRQXVHGLQWKLVUHSRUWKDVEHHQGUDZQIURPDQXPEHURILQWHUQDWLRQDODJHQFLHVLQFOXGLQJWKH,QWHUQDWLRQDO 0RQHWDU\)XQGWKH8QLWHG1DWLRQV&RQIHUHQFHRQ7UDGHDQG'HYHORSPHQWDQGWKH2UJDQLVDWLRQIRU(FRQRPLF&R RSHUDWLRQDQG'HYHORSPHQWDVZHOODVDKRVWRIQDWLRQDOLQVWLWXWLRQVVXFKDVFHQWUDOEDQNVDQGLQYHVWPHQWSURPRWLRQ DJHQFLHVLQ/DWLQ$PHULFDDQGWKH&DULEEHDQDQGVSHFLDOL]HGSUHVV$FUXFLDOLQSXWIRUWKLVUHSRUW±±WKHGDWDUHODWLQJ -

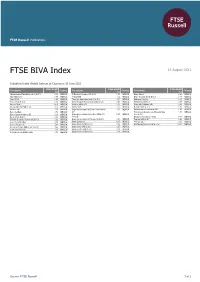

FTSE BIVA Index

2 FTSE Russell Publications 19 August 2021 FTSE BIVA Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Administradora Fibra Danhos S.A. de C.V. 0.15 MEXICO El Puerto de Liverpool SA de CV 0.53 MEXICO Grupo Mexico 8.89 MEXICO Alfa SAB de CV 0.89 MEXICO Femsa UBD 9.2 MEXICO Grupo Rotoplas S.A.B. de C.V. 0.17 MEXICO Alpek S.A.B. 0.28 MEXICO Fibra Uno Administracion S.A. de C.V. 1.91 MEXICO Industrias Penoles 1.02 MEXICO Alsea S.A.B. de C.V. 0.56 MEXICO Genomma Lab Internacional S.A.B. de C.V. 0.46 MEXICO Kimberly Clark Mex A 0.88 MEXICO America Movil L 13.59 MEXICO Gentera SAB de CV 0.35 MEXICO Megacable Holdings SAB 0.64 MEXICO Arca Continental SAB de CV 1.53 MEXICO Gruma SA B 1.37 MEXICO Nemak S.A.B. de C.V. 0.16 MEXICO Bachoco Ubl 0.36 MEXICO Grupo Aeroportuario del Centro Norte Sab de 1.31 MEXICO Orbia Advance Corporation SAB 1.59 MEXICO Banco del Bajio 0.76 MEXICO CV Promotora y Operadora de Infraestructura 1.05 MEXICO Banco Santander Mexico (B) 0.43 MEXICO Grupo Aeroportuario del Pacifico SAB de CV 2.27 MEXICO S.A. de C.V. Becle S.A.B. de C.V. 0.86 MEXICO Series B Qualitas Controladora y Vesta 0.48 MEXICO Bolsa Mexicana de Valores SAB de CV 0.62 MEXICO Grupo Aeroportuario del Sureste SA de CV 2.21 MEXICO Regional SAB de CV 0.83 MEXICO Cementos Chihuahua 0.79 MEXICO Grupo Banorte O 11.15 MEXICO Televisa 'Cpo' 4.38 MEXICO Cemex Sa Cpo Line 7.43 MEXICO Grupo Bimbo S.A.B. -

Striving to Overcome the Economic Crisis: Progress and Diversification of Mexican Multinationals’ Export of Capital

Striving to overcome the economic crisis: Progress and diversification of Mexican multinationals’ export of capital Report dated December 28, 2011 EMBARGO: The contents of this report cannot be quoted or summarized in any print or electronic media before December 28, 2011, 7:00 a.m. Mexico City; 8:00 a.m. NewYork; and 1 p.m. GMT. Mexico City and New York, December 28, 2011: The Institute for Economic Research (IIEc) of the National Autonomous University of Mexico (UNAM) and the Vale Columbia Center on Sustainable International Investment (VCC), a joint initiative of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their third survey of Mexican multinationals today. 1 The survey is part of a long-term study of the rapid global expansion of multinational enterprises 2 (MNEs) from emerging markets. The present report focuses on data for the year 2010. Highlights In 2010, the top 20 Mexican MNEs had foreign assets of USDD 123 billion (table 1 below), foreign sales of USDD 71 billion, and employed 255,340 people abroad (see annex table 1 in annex I). The top two firms, America Movil and CEMEX, together controlled USDD 85 billion in foreign assets, accounting for nearly 70% of the assets on the list. The top four firms (including FEMSA and Grupo Mexico) jointly held USDD 104 billion, which represents almost 85% of the list’s foreign assets. Leading industries in this ranking, by numbers of MNEs, are non-metallic minerals (four companies) and food and beverages (another four companies). -

06/03/2015 I. Eventos Relevantes De Las Principales Emisoras

Fecha de Elaboración: 06/03/2015 I. Eventos Relevantes De Las Principales Emisoras (S.A.B’s) RAZÓN SOCIAL EVENTOS RELEVANTES (clave de pizarra) ARCA CONTINENTAL, S.A.B DE Sin publicación C.V (AC) ALFA, S.A.B DE C.V Sin publicación (ALFA) ALPEK, S.A.B de C.V Sin publicación (ALPEK) ALSEA, S.A.B DE C.V (ALSEA) b)De acue Ley del Mercado de Valores) con el 6 siguiente, por este mismo medio y conforme lo estable el marco normativo. General aplicables a las emisoras de valores y a otros participantes del mercado de valores. AMERICA MOVIL, S.A.B DE C.V Sin publicación (AMX) GRUPO AEROPORTUARIO DEL SURESTE, S.A.B DE C.V (ASUR) GRUPO BIMBO, S.A.B DE C.V Sin publicación (BIMBO) BOLSA MEXICANA DE Sin publicación VALORES, S.A.B DE C.V (BOLSA) CEMEX, S.A.B DE CV MONTERREY, MEXICO. 2 de Marzo de - (CEMEX) convocada para celebrarse el 26 de marzo de 2015. GRUPO CARSO, S.A.B DE C.V 2 (GCARSO) Sin publicación CONTROLADORA COMERCIAL MEXICANA, S.A.B DE C.V Cont (COMERCI) CCM se mantienen sin camb Adicionalmente, en es En 2015 se proyecta la apertura de cinco nuevas tiendas, de las cuales una corresp con Centros comerciales y mantenimiento operativo 1 $ 685 CEDIS Vallejo 1 $ 50 y Fresko. lo que 3 crezcan un 2.0% a unidades iguales y 1.8% a tiendas totales - esto debido el efecto de la venta de Restaurantes California. control de gastos administrativos y de operaciones.