View Aerial Tour

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Phoenix Metro Area Trade an Icon in Valley

INDUSTRY UPDATE Biweekly Period Ending June 1, 2002 Phoenix Metro Area 20-screen Harkins Theater, plus as-yet-to- be-named sporting-goods, electronics, and Trade furniture stores. An icon in Valley and Arizona mall devel- RMB Enterprises plans to open about a opment was sold for nearly $1.5 billion in dozen Seattle’s Best Coffee locations in the late May. Macerich Co. of Santa Monica, Valley within the next year-and-a-half. A bit- Calif., purchased Westcor Realty, developer ter (not taste wise) rival of Starbucks, also and owner of eight malls throughout the state based in Seattle, the chain already has one (including recently opened Gateway Mall in store at the Chandler Fashion Center in Chan- Prescott and Chandler Fashion Center) and dler and will shortly open stores in Ahwa- dozens of Phoenix-area shopping centers. tukee, Mesa, and Gilbert. If coffee isn’t Westcor was formed more than three decades your cup of tea, the stores will also feature a ago by three local real estate developers who wide variety of pastries. have been able to create unique and highly Another hot, rather “cold” franchise, is Scotts- profitable properties that enjoy average-sales- per-square-foot rates much higher than the dale-based Cold Stone Creamery, which is national average. Macerich is one of the 10 eating its way into the hearts of customers largest owners of malls in the country. across the country. Now 250 franchise stores strong and projected to grow to 1,000 In related news, Westcor-owned Superstition stores by 2004, the 14-year-old chain’s 65 Springs Mall in east Mesa will undergo a administrative employees are currently $2.7 million make over and other searching for larger quarters than their changes, while Home Depot will open its current home at Scottsdale Airpark. -

20May200921180164

Exhibit 99.2 20MAY200921180164 Supplemental Financial Information For the three months ended March 31, 2010 The Macerich Company Supplemental Financial and Operating Information Table of Contents All information included in this supplemental financial package is unaudited, unless otherwise indicated. Page No. Corporate Overview ...................................................... 1-3 Overview .............................................................. 1 Capital information and market capitalization ................................... 2 Changes in total common and equivalent shares/units .............................. 3 Financial Data .......................................................... 4-5 Supplemental FFO information .............................................. 4 Capital expenditures ...................................................... 5 Operational Data ........................................................ 6-9 Sales per square foot ..................................................... 6 Occupancy ............................................................. 7 Rent................................................................. 8 Cost of occupancy ....................................................... 9 Balance Sheet Information ................................................. 10-13 Summarized balance sheet information ........................................ 10 Debt summary .......................................................... 11 Outstanding debt by maturity date ........................................... -

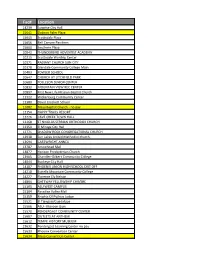

Fac# Location

Fac# Location 14239 Surprise City Hall 15641 Dobson Palm Plaza 15645 Scottsdale Plaza 15656 Bell Canyon Pavilions 15660 Southern Plaza 10042 THUNDERBIRD ADVENTIST ACADEMY 10215 Scottsdale Worship Center 10371 RADIANT CHURCH SUN CITY 10378 Glendale Community College Main 10403 FOWLER SCHOOL 10647 CHURCH AT LITCHFIELD PARK 10689 TOLLESON SENIOR CENTER 10830 MOUNTAIN VIEW REC CENTER 10897 First New Life Mission Baptist Church 11322 Wickenburg Community Center 11380 David Crockett School 12082 Mesa Baptist Church - no pay 12154 HAPPY TRAILS RESORT 12226 CAVE CREEK TOWN HALL 12268 ST NIKOLAS SERBIAN ORTHODOX CHURCH 12350 El Mirage City Hall 12771 SHADOW ROCK CONGREGATIONAL CHURCH 12938 Sun Lakes United Methodist church 13694 CARTWRIGHT ANNEX 13787 Arrowhead Mall 13877 Horizon Presbyterian Church 13905 Chandler-Gilbert Community College 14044 Buckeye City Hall 14187 PHOENIX UNION HIGH SCHOOL DIST OFF 14218 Estrella Mountain Community College 14227 Florence Ely Nelson 14864 GATEWAY FELLOWSHIP CHR/SBC 15105 ASU WEST CAMPUS 15164 Paradise Valley Mall 15359 Knights Of Pythias Lodge 15521 El Tianguis/Guadalupe 15566 ASU - Maroon Gym 15570 PENDERGAST COMMUNITY CENTER 15607 OUTLETS AT ANTHEM 15612 TEMPE HISTORY MUSEUM 15632 Pendergast Learning Center no pay 15633 Phoenix Convention Center 15634 Mesa Convention Center 15642 ASU Poly Campus 15646 Plaza Fountainside 15647 Signal Butte Marketplace 15649 Village Square 15650 Camelback Center 15658 Glendale Market Square 15659 McDowell Square 15661 Peoria Power Center 15663 Chandler Fashion Center 15664 -

Fashion Center Chandler Viridian

CHANDLER VIRIDIAN PRIMEGATE AT FASHION CENTER A SPECIALTY EXPERIENCE CHANDLER’S FIRST MIXED-USE RESTAURANT & RETAIL VENUE AND THE CENTRAL BUSINESS DISTRICT OF THE SOUTHEAST VALLEY PRIMEGATE is the ±24,000 square foot Restaurant & Retail component of the $150,000,000 Mixed-Use Chandler Viridian Development in conjunction with Hines, Alliance Residential & WinLee Development. The ±26-Acre project features 330 Broadstone Fashion Center luxury multi-family units; a ±250,000 square foot Class-A, LEED designed 6-story office building; and a 138-room Cambria Hotel. The project represents the first truly mixed-use development in Chandler Arizona with all components being linked together with extensive pedestrian esplanades and jogging paths and is integrated with the Super Regional Luxury Mall Chandler Fashion Center (Nordstrom’s, Macy’s, Dillard’s, Apple, Lululemon, Dick’s, Pottery Barn, Lego, Microsoft, etc.). It is also flanked by both the Super Target-anchored Chandler Festival power center and the Chandler Costco adjacent to the west and southwest respectively. LEASING CONTACTS Carol Schillne +1 602 735 5680 [email protected] Kerry Linthicum +1 602 735 1764 [email protected] 17 10 CHANDLER BLVD. 10 17 N CHANDLER VIRIDIAN PRIMEGATE NOT TO SCALE SWC FRYE ROAD AND PRICE ROAD, CHANDLER, AZ 10 101 CHANDLER BLVD. W FRYE RD CHANDLER VIRIDIAN 10 D A O S GALLERIA WAY R E CHANDLER VIRIDIAN C I R PRIMEGATE P AT FASHION CENTER 202 PRICE FWY 110,400 VPD WY E F RIC P SANTAN FWY 105,000 VPD N TRAFFIC COUNTS: CITY OF CHANDLER SITE PLAN NOT -

Macerich Shopping Centers & Fashion Outlets

Macerich Shopping Centers & Fashion Outlets Tourism Fact Sheet Overview Experience the top two activities when traveling in the US – shopping and dining – at our premier shopping destinations located in major cities across the country. A unique blend of MACERICH RETAIL BRANDS INCLUDE: stores, restaurants, and entertainment – many of which are exclusives – as well as unparalleled guest services create the ultimate experience for visitors. Tourism programs benefit travel trade AMERICAN GIRL professionals and welcome both individuals and groups including: commissionable, experiential APPLE shopping packages; visitor savings; motorcoach meet-and-greet plus driver and guide incentives; resort and hotel partnerships; group programs, and dedicated marketing campaigns. BARNEYS NEW YORK Shopping Centers & Fashion Outlets BLOOMINGDALE’S Shopping in major destinations include Santa Monica Place in Santa Monica, California; Scottsdale BURBERRY Fashion Square in Scottsdale, Arizona; The Shops at North Bridge and Fashion Outlets Chicago in COACH Chicago, Illinois; Fashion Outlets Niagara Falls in Niagara Falls, New York; Tysons Corner Center in the Washington DC area; and the soon-to-open Fashion District Philadelphia in Pennsylvania. DISNEY ARIZONA 1 Scottsdale Fashion Square* Scottsdale GAP 2 Biltmore Fashion Park Phoenix GUCCI 3 Chandler Fashion Center Chandler 4 Kierland Commons Scottsdale H&M 5 La Encantada Tucson LOUIS VUITTON CALIFORNIA 6 Santa Monica Place* Santa Monica 7 La Cumbre Plaza Santa Barbara KATE SPADE NEW YORK 8 Broadway Plaza Walnut -

Phoenix, PHOENIX Obviously, Is Blessed in the Sunshine Department

SEASONS Mother Nature smiles on some cities more than others. Phoenix, PHOENIX obviously, is blessed in the sunshine department. Phoenix basks in sunshine more than any other major metropolitan area in the U.S. — during 85 percent of its daylight hours. And the cliché ARIZONA that “it’s a dry heat” rings true, too: Humidity levels are pleasantly low, even in summer. The bottom line: Any time is a good time to visit the Sonoran Desert. WINTER During the winter months Greater Phoenix enjoys blue skies and highs in the 60s and 70s. Winter nights in the desert can get chilly, though the temperature rarely dips below freezing. SPRING Phoenix’s weather is consistently perfect during springtime. Daytime temperatures loll around 80 degrees, while evenings are comfortably cool. Spring is when hikers hit the trails to see blooming cactuses and wildflowers, and baseball fans flock to stadiums across the metro area for Cactus League Spring Training. SUMMER Summertime temps routinely reach triple digits in summer, but a 100-degree day in the desert actually feels much more pleasant than Average Temperatures in Phoenix an 85-degree day in a locale with heavy humidity. The best thing about summer in Phoenix: It’s value season. Prices at resorts, hotels and golf courses plunge as much as 30 percent. HIGH LOW (° F/ °C) (° F/ °C) FALL January 67/19 44/7 Autumn days in Phoenix are warm, sunny and exceedingly pleasant. It’s a great time for recreational pursuits, off-season sunbathing and serious February 71/22 48/9 shopping. Nights can get cool, but patio dining and outdoor events are March 76/24 52/11 still comfortable. -

CEM-March 08

www.CEM-AZ.com Issue 3 Arizona’s Trade Publication for the Commercial Real Estate Industry TOP PRODUCERS 2007 ld Eric Wichterman Brent Moser David Fogler Steve Nicoluzakis Overall Top Producer Top Land Producer Top Multi Housing Producers Top Investment Producer Mike Haenel Jeff Wentworth Jack Wilson Justin Himelstein Top Industrial Producer Top Office Producer Top Retail Producer Rookie of the Year Don Mudd John Bonnell Jason Moore Brett Abramson Iain Vasey Top Leasing Team - Office Division Independently Owned and Operated 2375 East Camelback Road, Suite 300 • Phoenix, Arizona 85016 • 602.954.9000 • Fax 602.468.8588 • www.brephoenix.com Passion for Integrity My father, Charles J. Coles, founded our company on one simple premise: integrity. Integrityisreflectedinwhatwedo and how we do it. Living this passion is the cornerstone of MortgagesLtd.Whenitcomestoprotectingandmanaging your wealth, especially in a highly competitive and volatile marketplace, integrity is the only asset that matters. Scott M. Coles CEO/Chairman ww.mtgltd.com w Mortgage Banking | Securities | Title | Real Estate | Insurance Moving Early 2008 4455 E. Camelback Rd. 55 East Thomas Road Phone: 602.277.5626 Phoenix, Arizona 85018 Phoenix, Arizona 85012 www.mtgltd.com Mortgages Ltd. Securities, LLC is a Licensed Broker Dealer and member of FINRA. Contents Issue 3 2008 6 13 21 29 Pete Bolton Tyler Anderson & Sean Cunningham Young Leaders Red Rock Business Plaza 6 Cover Story Executive Publisher Mandy McCullough Purcell Pete Bolton Publisher/Editor 10 People & Properties Christina O’Callaghan Creative Director 13 Featured Brokers Samantha Ponce Tyler Anderson & Writers Sean Cunningham Dana Bos Christia Gibbons 18 Executive Q&A Photography with John Kross Kay & Co. -

THE MACERICH COMPANY (Exact Name of Registrant As Specified in Its Charter) MARYLAND 95-4448705 (State Or Other Jurisdiction (I.R.S

Macerich Wrap 09 Proof 7 | 03.24.10 Page MacerichMacerich Wrap Wrap09 09Proof Proof 7 | 03.24.10 7 | 03.24.10 Page Page MacerichMacerich Wrap Wrap 09 09 CoverProof Art 7 || 03.24.1003.24.10 BackPage MacerichMacerich Wrap Wrap 09 09 ProofCover 7 Art| 03.24.10 | 03.24.10 Page Page This will be the inside back cover. ThisThis is is the the back back cover cover >> Spine is set at 0.375” wide. CoverThis Pageis the front cover. b 1 5 PBCover a PB Macerich 2009 Annual Report Financial Highlights Corporate Information (all amounts in thousands, except per share and per square foot amounts) 2009 2008 2007 2006 2005 Principal Outside Counsel Macerich Website Stock Exchange Listing Operating Data O’Melveny & Myers LLP For an electronic version of this New York Stock Exchange Los Angeles, California annual report, our SEC filings Symbol: MAC Total revenues $ 805,654 $ 880,871 $ 800,842 $ 737,311 $ 648,636 and documents relating to The common stock of the Company is listed Shopping center and operating expenses $ 258,174 $ 281,613 $ 253,258 $ 230,463 $ 200,305 Independent Auditor corporate governance, please and traded on the New York Stock Exchange Management companies’ operating expenses $ 79,305 $ 77,072 $ 73,761 $ 56,673 $ 52,840 visit www.macerich.com. Deloitte & Touche LLP under the symbol “MAC.” The common stock REIT general and administrative expenses $ 25,933 $ 16,520 $ 16,600 $ 13,532 $ 12,106 Los Angeles, California Corporate Headquarters began trading on March 10, 1994, at a price of Net income (loss) available to common stockholders $ 120,742 $ 161,925 $ 64,131 $ 217,404 $ (93,614) $19 per share. -

5Mar200719253705

Exhibit 99.2 5MAR200719253705 Supplemental Financial Information For the three and twelve months ended December 31, 2008 The Macerich Company Supplemental Financial and Operating Information Table of Contents All information included in this supplemental financial package is unaudited, unless otherwise indicated. Page No. Corporate overview ....................................................... 1-3 Overview .............................................................. 1 Capital information and market capitalization ................................... 2 Changes in total common and equivalent shares/units .............................. 3 Financial data .......................................................... 4-5 Supplemental FFO information .............................................. 4 Capital expenditures ...................................................... 5 Operational data ........................................................ 6-9 Sales per square foot ..................................................... 6 Occupancy ............................................................. 7 Rent................................................................. 8 Cost of occupancy ....................................................... 9 Balance sheet information ................................................. 10-13 Summarized balance sheet information ........................................ 10 Debt summary .......................................................... 11 Outstanding debt by maturity date ........................................... -

Development Pipeline 2008 and Beyond

Development Pipeline 2008 and Beyond Tom O’Hern - EVP and CFO, Macerich Randy Brant - EVP, Real Estate, Macerich Scott Nelson - VP, Development, Macerich Bobby Williams - SVP, Development Leasing, Macerich Garrett Newland - VP, Development, Macerich 30 Development Pipeline 2008 and Beyond 2008 Guidance FFO per share range $5.00 - $5.15 – 10% increase at midpoint v. 2007 Same center NOI growth forecast 3.5% - 4.0% – Increased from 2.4% in 2007 Capital events factored in: – 43 Mervyn’s stores – Redemption of 2.9 million MAC OP units for 4 Rochester assets Occupancy neutral v. 2007 Development Pipeline 2008 and Beyond MAC Balance Sheet Total debt $7.5 billion Total equity at $61 per share $5.4 billion Total market cap $12.9 billion Debt/market cap 57% Variable debt/total market cap 15% 2008 debt maturities $527 million 2009 debt maturities $728 million 4Q07 interest service coverage 2.4X Development Pipeline 2008 and Beyond 2008 Debt Maturities 2007 Current Debt Est. New Debt Asset SPSF $ Int. Rate (millions) Fresno Fashion Fair 545 63.5 6.52 200 Westside Pavilion 481 92.0 6.74 180 Broadway Plaza 768 30.0 6.68 50 South Towne Center 433 64.0 6.66 150 SanTan Village A 0.0 0 170 The Oaks 549 B 0.0 0 200 Mall at Victor Valley 480 51.2 4.69 110 Total 1,060 Total 2008 Maturities 520 Estimated LTV 50-55% A Center opened in Oct 2007. B SPSF is 2006 figure; redevelopment began in 2007. 33 Development Pipeline 2008 and Beyond Project SF Pro Rata Project 2007 2008 2009 2010 Property % Owned Completion (millions) Cost (millions) Cost Cost Cost -

Macerich Announces Completion of $1.475 Billion Acquisition of Westcor

Macerich Announces Completion of $1.475 Billion Acquisition of Westcor July 29, 2002 SANTA MONICA, Calif., Jul 29, 2002 /PRNewswire-FirstCall via COMTEX/ -- The Macerich Partnership L.P., the operating partnership of The Macerich Company (NYSE: MAC), today announced that it has completed its acquisition of Westcor Realty Limited Partnership and its affiliated companies ("Westcor"). Westcor is the dominant owner, operator and developer of regional malls and specialty retail assets in the greater Phoenix area. The total purchase price was approximately $1.475 billion including the assumption of $733 million in existing debt and the issuance of approximately $72 million of convertible preferred operating partnership units at a price of $36.55 per unit. Each preferred operating partnership unit is convertible into a common operating partnership unit. The balance of the purchase price was paid in cash which was provided primarily from a $380 million interim loan with a term of up to 18 months bearing interest at an average rate of LIBOR plus 3.25% and a $250 million term loan with a maturity of up to five years with an interest rate ranging from LIBOR plus 2.75% to LIBOR plus 3.00% depending on the Company's overall leverage. Concurrent with the closing the Company also replaced its $200 million line of credit with a new $425 million revolving line of credit. This increased line of credit has a three-year term plus a one-year extension. The interest rate fluctuates from LIBOR plus 1.75% to LIBOR plus 3.00% depending on the Company's overall leverage level. -

FOR IMMEDIATE RELEASE Media Contact: Kimberly Hastings, Westcor, 602-953-6563, [email protected] SCOTTSDALE FASHION

FOR IMMEDIATE RELEASE Media Contact: Kimberly Hastings, Westcor, 602-953-6563, [email protected] SCOTTSDALE FASHION SQUARE ANNOUNCES COLLECTION OF NINE ADDITIONAL RETAILERS TO JOIN BARNEYS NEW YORK EXPANSION PROJECT THIS FALL -- One of 2009’s Few, High-Profile Retail Project Openings Highlights Ongoing Appeal of Arizona’s Top Retail Property -- SCOTTSDALE, Ariz. ― July 29, 2009 ― Scottsdale Fashion Square today announced nine retailers that will join its 100,000-square-foot expansion and Arizona’s first Barneys New York department store opening on Oct. 15, 2009. Maintaining its position as the market’s dominant house of fashion, Scottsdale Fashion Square continues to serve up exciting retail bringing the center’s roster of “first-to-market” retailers to 50. The expansion's retail roster will include Love Culture, the new concept for young women and teens from the founders of Forever 21; Pandora, offering unique, handcrafted Danish designs in charm bracelets, necklaces, earrings and more; 7 for All Mankind, the premium denim retailer synonymous with fashion; Vans, an action-sports-lifestyle fashion source for men and women; and an Aveda Lifestyle Salon, featuring the brand's famous botanically-based beauty products. Also joining the expansion are Aqua Beachwear, the swimwear and resort wear brand that underscores selection and ease of shopping; Paris Optique, an Arizona-based purveyor of fine fashion eyewear and optical services; and Perfume Gallery, home to exciting recreations of original fragrances. Footwear and accessories leader Kenneth Cole will take a new space in the expansion, moving from an existing location at the center. “Retail openings of this magnitude are few and far between in 2009,” said Steve Helm, assistant vice president, property management, Westcor.