Mathematical Economics and Control Theory: Studies in Policy Optimisation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Keynes's Investment Theory As a Micro-Foundation for His Grandchildren

Vol. 14, 2020-24 | July 03, 2020 | http://dx.doi.org/10.5018/economics-ejournal.ja.2020-24 Keynes's investment theory as a micro-foundation for his grandchildren Sergio Nisticò Abstract In contrast with the ‘missing micro-foundations’ argument against Keynes’s macro- economics, the paper argues that it is the present state of microeconomics that needs more solid ‘Keynesian foundations’. It is in particular Keynes’s understanding of investors’ behaviour that can be fruitfully extended to consumption theory, in a context in which consumers are considered as entrepreneurs, buying goods and services to engage in time- consuming activities. The paper emphasizes that the outcome in terms of enjoyment is particularly uncertain for those innovative and path-breaking activities, which Keynes discussed in his 1930 prophetic essay about us, the grandchildren of his contemporaries. Moreover, the Keynes-inspired microeconomics suggested in the paper provides an explanation of why Keynes’s prophecy about his grandchildren possibly expanding leisure did not materialize yet. The paper finally points at the need for appropriate economic policies supporting consumers’ propensity to enforce innovative forms of time use. JEL B41 D11 D81 Keywords Keynesian microeconomics; consumption; time use; uncertainty; Keynes’s grandchildren Authors Sergio Nisticò, Creativity and Motivations Economic Research Center, Department of Economics and Law, University of Cassino and Southern Lazio, Italy, [email protected] Citation Sergio Nisticò (2020). Keynes's investment theory as a micro-foundation for his grandchildren. Economics: The Open-Access, Open-Assessment E-Journal, 14 (2020-24): 1–15. http://dx.doi.org/10.5018/economics-ejournal.ja.2020-24 Received January 22, 2020 Published as Economics Discussion Paper February 14, 2020 Revised June 8, 2020 Accepted June 18, 2020 Published July 3, 2020 © Author(s) 2020. -

Lucas on the Relationship Between Theory and Ideology

Discussion Paper No. 2010-28 | November 17, 2010 | http://www.economics-ejournal.org/economics/discussionpapers/2010-28 Lucas on the Relationship between Theory and Ideology Michel De Vroey IRES, University of Louvain Please cite the corresponding journal article: http://dx.doi.org/10.5018/economics-ejournal.ja.2011-4 Abstract This paper concerns a neglected aspect of Lucas’s work: his methodological writings, published and unpublished. Particular attention is paid to his views on the relationship between theory and ideology. I start by setting out Lucas’s non-standard conception of theory: to him, a theory and a model are the same thing. I also explore the different facets and implications of this conception. In the next two sections, I debate whether Lucas adheres to two methodological principles that I dub the ‘non-interference’ precept (the proposition that ideological viewpoints should not influence theory), and the ‘non-exploitation’ precept (that the models’ conclusions should not be transposed into policy recommendations, in so far as these conclusions are built into the models’ premises). The last part of the paper contains my assessment of Lucas’s ideas. First, I bring out the extent to which Lucas departs from the view held by most specialized methodologists. Second, I wonder whether the new classical revolution resulted from a political agenda. Third and finally, I claim that the tensions characterizing Lucas’s conception of theory follow from his having one foot in the neo- Walrasian and the other in the Marshallian–Friedmanian universe. JEL B22, B31, B41, E30 Keywords Lucas; new classical macroeconomics; methodology Correspondence Michel De Vroey, IRES, University of Louvain, Place Montesquieu 3, B- 3458 Louvain-la-Neuve, Belgium: e-mail: [email protected] A first version of this paper was presented at seminars given at the University of Toronto and the University of British Columbia. -

Propt Product Sheet

PROPT - The world’s fastest Optimal Control platform for MATLAB. PROPT - ONE OF A KIND, LIGHTNING FAST SOLUTIONS TO YOUR OPTIMAL CONTROL PROBLEMS! NOW WITH WELL OVER 100 TEST CASES! The PROPT software package is intended to When using PROPT, optimally coded analytical solve dynamic optimization problems. Such first and second order derivatives, including problems are usually described by: problem sparsity patterns are automatically generated, thereby making it the first MATLAB • A state-space model of package to be able to fully utilize a system. This can be NLP (and QP) solvers such as: either a set of ordinary KNITRO, CONOPT, SNOPT and differential equations CPLEX. (ODE) or differential PROPT currently uses Gauss or algebraic equations (PAE). Chebyshev-point collocation • Initial and/or final for solving optimal control conditions (sometimes problems. However, the code is also conditions at other written in a more general way, points). allowing for a DAE rather than an ODE formulation. Parameter • A cost functional, i.e. a estimation problems are also scalar value that depends possible to solve. on the state trajectories and the control function. PROPT has three main functions: • Sometimes, additional equations and variables • Computation of the that, for example, relate constant matrices used for the the initial and final differentiation and integration conditions to each other. of the polynomials used to approximate the solution to the trajectory optimization problem. The goal of PROPT is to make it possible to input such problem • Source transformation to turn descriptions as simply as user-supplied expressions into possible, without having to worry optimized MATLAB code for the about the mathematics of the cost function f and constraint actual solver. -

Lecture Notes1 Mathematical Ecnomics

Lecture Notes1 Mathematical Ecnomics Guoqiang TIAN Department of Economics Texas A&M University College Station, Texas 77843 ([email protected]) This version: August, 2020 1The most materials of this lecture notes are drawn from Chiang’s classic textbook Fundamental Methods of Mathematical Economics, which are used for my teaching and con- venience of my students in class. Please not distribute it to any others. Contents 1 The Nature of Mathematical Economics 1 1.1 Economics and Mathematical Economics . 1 1.2 Advantages of Mathematical Approach . 3 2 Economic Models 5 2.1 Ingredients of a Mathematical Model . 5 2.2 The Real-Number System . 5 2.3 The Concept of Sets . 6 2.4 Relations and Functions . 9 2.5 Types of Function . 11 2.6 Functions of Two or More Independent Variables . 12 2.7 Levels of Generality . 13 3 Equilibrium Analysis in Economics 15 3.1 The Meaning of Equilibrium . 15 3.2 Partial Market Equilibrium - A Linear Model . 16 3.3 Partial Market Equilibrium - A Nonlinear Model . 18 3.4 General Market Equilibrium . 19 3.5 Equilibrium in National-Income Analysis . 23 4 Linear Models and Matrix Algebra 25 4.1 Matrix and Vectors . 26 i ii CONTENTS 4.2 Matrix Operations . 29 4.3 Linear Dependance of Vectors . 32 4.4 Commutative, Associative, and Distributive Laws . 33 4.5 Identity Matrices and Null Matrices . 34 4.6 Transposes and Inverses . 36 5 Linear Models and Matrix Algebra (Continued) 41 5.1 Conditions for Nonsingularity of a Matrix . 41 5.2 Test of Nonsingularity by Use of Determinant . -

Optimal Control Theory Version 0.2

An Introduction to Mathematical Optimal Control Theory Version 0.2 By Lawrence C. Evans Department of Mathematics University of California, Berkeley Chapter 1: Introduction Chapter 2: Controllability, bang-bang principle Chapter 3: Linear time-optimal control Chapter 4: The Pontryagin Maximum Principle Chapter 5: Dynamic programming Chapter 6: Game theory Chapter 7: Introduction to stochastic control theory Appendix: Proofs of the Pontryagin Maximum Principle Exercises References 1 PREFACE These notes build upon a course I taught at the University of Maryland during the fall of 1983. My great thanks go to Martino Bardi, who took careful notes, saved them all these years and recently mailed them to me. Faye Yeager typed up his notes into a first draft of these lectures as they now appear. Scott Armstrong read over the notes and suggested many improvements: thanks, Scott. Stephen Moye of the American Math Society helped me a lot with AMSTeX versus LaTeX issues. My thanks also to Atilla Yilmaz for spotting lots of typos and errors, which I have corrected. I have radically modified much of the notation (to be consistent with my other writings), updated the references, added several new examples, and provided a proof of the Pontryagin Maximum Principle. As this is a course for undergraduates, I have dispensed in certain proofs with various measurability and continuity issues, and as compensation have added various critiques as to the lack of total rigor. This current version of the notes is not yet complete, but meets I think the usual high standards for material posted on the internet. Please email me at [email protected] with any corrections or comments. -

Mathematical Economics - B.S

College of Mathematical Economics - B.S. Arts and Sciences The mathematical economics major offers students a degree program that combines College Requirements mathematics, statistics, and economics. In today’s increasingly complicated international I. Foreign Language (placement exam recommended) ........................................... 0-14 business world, a strong preparation in the fundamentals of both economics and II. Disciplinary Requirements mathematics is crucial to success. This degree program is designed to prepare a student a. Natural Science .............................................................................................3 to go directly into the business world with skills that are in high demand, or to go on b. Social Science (completed by Major Requirements) to graduate study in economics or finance. A degree in mathematical economics would, c. Humanities ....................................................................................................3 for example, prepare a student for the beginning of a career in operations research or III. Laboratory or Field Work........................................................................................1 actuarial science. IV. Electives ..................................................................................................................6 120 hours (minimum) College Requirement hours: ..........................................................13-27 Any student earning a Bachelor of Science (BS) degree must complete a minimum of 60 hours in natural, -

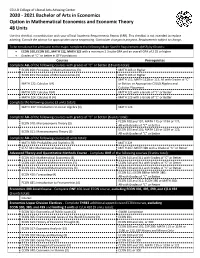

2020-2021 Bachelor of Arts in Economics Option in Mathematical

CSULB College of Liberal Arts Advising Center 2020 - 2021 Bachelor of Arts in Economics Option in Mathematical Economics and Economic Theory 48 Units Use this checklist in combination with your official Academic Requirements Report (ARR). This checklist is not intended to replace advising. Consult the advisor for appropriate course sequencing. Curriculum changes in progress. Requirements subject to change. To be considered for admission to the major, complete the following Major Specific Requirements (MSR) by 60 units: • ECON 100, ECON 101, MATH 122, MATH 123 with a minimum 2.3 suite GPA and an overall GPA of 2.25 or higher • Grades of “C” or better in GE Foundations Courses Prerequisites Complete ALL of the following courses with grades of “C” or better (18 units total): ECON 100: Principles of Macroeconomics (3) MATH 103 or Higher ECON 101: Principles of Microeconomics (3) MATH 103 or Higher MATH 111; MATH 112B or 113; All with Grades of “C” MATH 122: Calculus I (4) or Better; or Appropriate CSULB Algebra and Calculus Placement MATH 123: Calculus II (4) MATH 122 with a Grade of “C” or Better MATH 224: Calculus III (4) MATH 123 with a Grade of “C” or Better Complete the following course (3 units total): MATH 247: Introduction to Linear Algebra (3) MATH 123 Complete ALL of the following courses with grades of “C” or better (6 units total): ECON 100 and 101; MATH 115 or 119A or 122; ECON 310: Microeconomic Theory (3) All with Grades of “C” or Better ECON 100 and 101; MATH 115 or 119A or 122; ECON 311: Macroeconomic Theory (3) All with -

The Neglect of the French Liberal School in Anglo-American Economics: a Critique of Received Explanations

The Neglect of the French Liberal School in Anglo-American Economics: A Critique of Received Explanations Joseph T. Salerno or roughly the first three quarters of the nineteenth century, the "liberal school" thoroughly dominated economic thinking and teaching in F France.1 Adherents of the school were also to be found in the United States and Italy, and liberal doctrines exercised a profound influence on prominent German and British economists. Although its numbers and au- thority began to dwindle after the 1870s, the school remained active and influential in France well into the 1920s. Even after World War II, there were a few noteworthy French economists who could be considered intellectual descendants of the liberal tradition. Despite its great longevity and wide-ranging influence, the scientific con- tributions of the liberal school and their impact on the development of Eu- ropean and U.S. economic thought—particularly on those economists who are today recognized as the forerunners, founders, and early exponents of marginalist economics—have been belittled or simply ignored by most twen- tieth-century Anglo-American economists and historians of thought. A number of doctrinal scholars, including Joseph Schumpeter, have noted and attempted to explain the curious neglect of the school in the En- glish-language literature. In citing the school's "analytical sterility" or "indif- ference to pure theory" as a main cause of its neglect, however, their expla- nations have overlooked a salient fact: that many prominent contributors to economic analysis throughout the nineteenth and early twentieth centuries expressed strong appreciation of or weighty intellectual debts to the purely theoretical contributions of the liberal school. -

Firmin Oulès and the “New Lausanne School”

Firmin Oulès and the "New Lausanne School" David Sarech (University of Lausanne, Ph.D. Student) In this paper I will present Firmin Oulès’ “harmonized economics” and interrogate the relationship between state and market in his thought. “Harmonized economics” were conceived as the continuation of Léon Walras’ theory. The key concept of the first Lausanne school is the notion of equilibrium. Indeed, Walras forged it in order to “scientifically” demonstrate the superiority of a competition-based economy. However, the mathematical approach he chose, as well as his disdain for the orthodox economy of his time, led him to be misunderstood and he did not receive the recognition he was expecting. Thus the concept of general equilibrium would be forgotten until the mid 1950’s when it would become the core of microeconomics. However, as recent studies in history of economic thought have shown, the concept of equilibrium in Walras’ thought has to be understood in a broader context than a purely economical one. Indeed, the main goal of Walras was to bring an answer to “the social question”. Contrary to Marx, he did not think of it as being a problem of profit distribution between labor and capital. Instead he thought the goal of the economist was to create an economic system were everyone would be able to exert its inner abilities and in which inequalities would be based solely on merit. The incentive created by private property and profit-seeking being the groundwork of a flourishing economy, the equilibrium had to be understood as a tool to establish this idealistic society. -

Marginal Revolution

MARGINAL REVOLUTION It took place in the later half of the 19th century Stanley Jevons in England, Carl Menger in Austria and Leon walras at Lausanne, are generally regarded as the founders of marginalist school Hermann Heinrich Gossen of Germany is considered to be the anticipator of the marginalist school The term ‘Marginal Revolution’ is applied to the writings of the above economists because they made fundamental changes in the apparatus of economic analysis They started looking at some of the important economic problems from an altogether new angle different from that of classical economists Marginal economists has been used to analyse the single firm and its behavior, the market for a single product and the formation of individual prices Marginalism dominated Western economic thought for nearly a century until it was challenged by Keynesian attack in 1936 (keynesian economics shifted the sphere of enquiry from micro economics to macro economics where the problems of the economy as a whole are analysed) The provocation for the emergence of marginalist school was provided by the interpretation of classical doctrines especially the labour theory of value and ricardian theory of rent by the socialists Socialists made use of classical theories to say things which were not the intention of the creators of those theories So the leading early marginalists felt the need for thoroughly revising the classical doctrines especially the theory of value They thought by rejecting the labour theory of value and by advocating the marginal utility theory of value, they could strike at the theoretical basis of socialism Economic Ideas of Marginalist School This school concentrated on the ‘margin’ to explain economic phenomena. -

Adam Smith and the Austrian School of Economics: the Problem of Diamonds and Water

Stefan Poier 1st year Part-time Doctoral Studies Adam Smith and the Austrian School of Economics: The Problem of Diamonds and Water Keywords: Adam Smith, Austrian School of Economics, Value Paradox, Marginal Utility, Decision Making Introduction When end of 2017 Leonardo da Vinci's painting "Salvator Mundi" was auctioned off for over $450 million, it was nearly three times as expensive as the second most expensive painting, a Picasso, and it could have compensated for the state deficit of Lithuania. An absurdly high sum for a piece of wood and oil paint. How do you explain such a price? Neither the amount of time spent working on it, nor the benefits from this work alone could justify it. Why do we often pay high prices for goods with little use, but low prices for things that are sometimes partially vital? Generations of economists and philosophers have tried to resolve this apparent paradox. An explanation for this price is - quite simply - an individual’s willingness to pay this price. The prestige gain of owning one of only fifteen paintings of the probably most important artist and universal scholar of all time can already provide an enormous increase in status. It is the scarcity, the uniqueness of the artwork, which justified the high increase in utility or satisfaction. If there were any number of similar works, no one would pay more than the utility value for it. This – today rational – economic inference was not always granted. It is based on the recognition that the benefits of consumption of a good decreases with the amount consumed (and thus with the saturation of the consumer). -

Evolution and Refinement of the Concept of Supply and Demand from Cournot to Marshall Ray Mcdermott

Evolution and Refinement of the Concept of Supply and Demand from Cournot to Marshall Ray McDermott Table of Contents Page Introduction 1 John Stuart Mill 2 Augustin Cournot 5 J. H. von Thunen 7 Hermann Heinrich Gossen 8 Fleeming Jenkin 10 William Stanley Jevons 13 Carl Menger 19 Leon Walras 21 Aspects of Marginal Theory as set by Jevons, Menger and Walras 28 Rudolf Auspitz and Richard Lieben 47 Alfred Marshall 52 Conclusion 66 Bibliography 67 ALUMNI MEMORIAL LIBRARY Creighton University Omaha; Nebraika 65178 fc v 385843 “ *** '••v.i-fii. Evolution and Refinement of the Concept of Supply and Demand from Cournot to Marshall The law of supply and demand can be restated in mathematical language. Fleeming Jenkin did this. As one looks at the correspondence between the economists of an eighty year period (Cournot to Marshall), thinking can be clarified on the discussion of supply and demand. Relationships are shown between these economists. There are similar ities as well as differences in their thinking. Disagreements on terminology pertaining to utility theory is evident between Jevons, Walras, and Menger. Priority on thoughts about utility was claimed and disputed between Jevons and Walras. Marshall was annoyed by Jevons* theory. Marshall, Walras, and Mill were all directed by their fathers in the classics. Lecturing at various universities was common for Jevons, Marshall, Walras, and Menger. Some however were not trained economists. Examples of these were Jenkin, Cournot, and von Thunen. Jevons, Menger, and Walras were the founders of the Marginal Utility School. The economists are not discussed according to the chronological time in which they lived.