How Do Big Bang Disruptors Look Like? a Business Model Perspective

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lean Startup Labs Summit Series 2016 Sponsorship Opportunities

LEAN STARTUP LABS SUMMIT SERIES 2016 SPONSORSHIP OPPORTUNITIES Overview Lean Startup Company is producing a brand new series in 2016 called Lean Startup Labs. Fueled by demand from the Lean Startup Community, the series will showcase a variety of specialized summits across the country. The mission of Labs is to share cuttingedge ideas and stories while making Lean Startup methods more accessible to a wider audience, providing education and resources to serve entrepreneurs, startups, accelerators and large companies. Capped at 200 participants per summit, each event offers an intimate atmosphere and an opportunity to learn, connect and find real solutions to challenges. Labs agendas will be very active and experiential with less passive listening. Programming includes talks, collaborative sessions and workshops based on Lean Startup principles. And, every summit will have it’s own special twists added in such as offsite immersions, topical dinners and surprise guests. The series debuts with the NYC Enterprise Summit on February 2425, 2016 where a group of intrapreneurs, corporate innovators and leaders tasked with transformation in an established organization will gather. This event will focus on applying Lean Startup methodology within large, complex organizations and features roadtested insights along with practical tools and best practices. This spring we’ll host a startup, education and social good summit in New Orleans, and in summer 2016 a startup summit in Detroit. These events will host a mix of startups, entrepreneurs, accelerators, education, government, socialmission and nonprofit, enterprise companies and more. Events-at-a-Glance You now have the opportunity to sponsor a single summit or the entire Lean Startup Labs Series. -

The Impact of Lean Startup Theory Upon Local Business Entrepreneurs

University of the Incarnate Word The Athenaeum Theses & Dissertations 12-2017 The Impact of Lean Startup Theory Upon Local Business Entrepreneurs Gary Boyd University of the Incarnate Word, [email protected] Follow this and additional works at: https://athenaeum.uiw.edu/uiw_etds Part of the Business Commons Recommended Citation Boyd, Gary, "The Impact of Lean Startup Theory Upon Local Business Entrepreneurs" (2017). Theses & Dissertations. 322. https://athenaeum.uiw.edu/uiw_etds/322 This Dissertation is brought to you for free and open access by The Athenaeum. It has been accepted for inclusion in Theses & Dissertations by an authorized administrator of The Athenaeum. For more information, please contact [email protected]. THE IMPACT OF LEAN STARTUP THEORY UPON LOCAL BUSINESS ENTREPRENEURS by GARY W. BOYD A DISSERTATION Presented to the Faculty of the University of the Incarnate Word in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY UNIVERSITY OF THE INCARNATE WORD December 2017 ii Copyright by Gary W. Boyd 2017 iii ACKNOWLEDGMENTS I believe that personal accomplishment of any value happens in part because that lead person had a great many collaborators in success. It is certainly the case here. I wish to acknowledge a few of those helpers and sustainers here. First, to my dissertation committee, I express my heartfelt thanks for your input and guidance. My chair, Dr. Noah Kasraie, has been an unwavering guide, a strong support, and a great teacher to me all throughout this doctoral process. To Dr. Sarah Jackson and Dr. Robin Guerrero, I sincerely appreciate your insights, suggestions, and help as committee members. -

The Road to Entrepreneurial Success: Business Plans, Lean Startup, Or Both?

The current issue and full text archive of this journal is available on Emerald Insight at: https://www.emerald.com/insight/2574-8904.htm Business plans The road to entrepreneurial and lean success: business plans, lean startup startup, or both? Chris Welter 21 Miami University, Oxford, Ohio, USA, and Received 3 August 2020 Alex Scrimpshire, Dawn Tolonen and Eseoghene Obrimah Revised 3 December 2020 Xavier University, Cincinnati, Ohio, USA Accepted 1 February 2021 Abstract Purpose – The goal of this research is to investigate the relationship between two different sets of practices, lean startup and business planning, and their relation to entrepreneurial performance. Design/methodology/approach – The authors collected data from 120 entrepreneurs across the US about a variety of new venture formation activities within the categories of lean startup or business planning. They use hierarchical regression to examine the relationship between these activities and new venture performance using both a subjective and objective measure of performance. Findings – The results show that talking to customers, collecting preorders and pivoting based on customer feedback are lean startup activities correlated with performance; writing a business plan is the sole business planning activity correlated with performance. Research limitations/implications – This research lays the foundation for understanding the components of both lean startup and business planning. Moreover, these results demonstrate that the separation of lean startup and business planning represents a false dichotomy. Practical implications – These findings suggest that entrepreneurs should engage in some lean startup activities and still write a business plan. Originality/value – This article offers the first quantitative, empirical comparison of lean startup activities and business planning. -

The Lean Startup by Eric Ries Book Summary

THE LEAN STARTUP BY ERIC RIES | BOOK SUMMARY The Lean Startup defines a scientific methodology for running startups and launching new products. This new approach has been adopted around the world within startups and established organisations. Regardless of your role or company size, this is a must read for entrepreneurs, marketers, developers and business leaders. This book is organised into three key parts. In ‘Vision’ the book defines what an entrepreneur and startup actually are and articulates a new way for startups to measure their progress called ‘validated learning’. ‘Steer’ dives into the methodology of the build-measure-learn feedback loop. And in ‘Accelerate’ the book explores techniques to speed up the ‘Steer’ process and growth methods. KEY PRINCIPLES OF THE LEAN STARTUP • Entrepreneurs are everywhere. Regardless of industry, company size or your role, entrepreneurs are everywhere. You don’t necessarily have to be the founder to apply entrepreneurship. • Entrepreneurship is management. A startup is an institution that needs to be managed. • Validated learning. Startups exist, not just to make a product and make money, but to learn how to create a sustainable business. This is done using frequent experiments and testing to reach a vision. • Build-measuer-learn. The fundamental activity of a startup is to turn ideas into products, measure how customers respond and then learn whether to pivot or persevere. • Innovation accounting. Startups need to focus on measuring progress towards goals and prioritise work. This requires a new kind of accounting designed for startups. PART ONE: VISION Start • The Lean Startup takes its name from lean manufacturing and adapts the ideas of just-in-time inventory management, small batch sizes and accelerated cycle times to the context of entrepreneurship and startups. -

1 the Interplay Between Open Innovation and Lean Startup, Or

The Interplay between Open Innovation and Lean Startup, or, Why Large Companies are not Large Versions of Startups Henry Chesbrough (University of California, Berkeley) Christopher L. Tucci (EPFL and Imperial College London) January 2020 Abstract This essay considers the contribution of Lean Startup to the lack of practical advice for employing Inside-out knowledge flows in open innovation. Lean Startup offers a series of practical steps for exploring—and validating—potential new business models that might utilize otherwise neglected technologies, or potential general-purpose technologies that may be languishing. Open Innovation has some contributions to offer to Lean Startup as well, particularly in the context where Lean Startup is employed inside large established firms. We describe the basic principles of Lean Startup philosophy and discuss how Lean Startup is implemented in large companies. This is highly related to business model reconfiguration, since in many cases, incumbent companies develop a new business model as part of their innovation efforts, often with great difficulty. This line of reasoning leads us to reconsider how Lean Startup might work in established companies, and why it is so difficult due to conflicts with many roles that already exist in the established companies. We then bring forward the idea that Open Innovation can contribute to the corporate venturing process and describe both Outside-In and Inside-Out processes that may help ease the pain of a Lean Startup implementation in an incumbent firm. 1 Open innovation has attracted a great deal of scholarly attention since Chesbrough’s (2003) initial articulation of the concept. The concept of “...purposive inflows and outflows of knowledge across the boundary of a firm in order to leverage external sources of knowledge and commercialization paths, respectively” (Chesbrough and Bogers, 2014) has primarily been analyzed in terms of the Inbound, or Outside-in path of knowledge flows. -

06. the Lean Startup

IMSA Leadership Education and Development “Startup success is not a consequence of good genes or being in the right place at the right time. Startup success can be engineered by following the right process, which means it can be engineered by following the right process, which means it can be learned, which means it can be taught.” - Eric Ries, Lean Startup Introduction This modules aims to go further into the lean startup than students have done in previous modules. It introduces three key features from the lean startup: the minimum viable product, the Build-Measure-Learn loop, and pivots. These three techniques are integral in the lean startup methodology, which focuses on minimizing risk, failing fast, and using the minimum amount of resources, time and funding. Objectives 1. Students will be able to use the concept of BML (build-measure-learn) to improve their product/service. 2. Students will be able to identify and utilize the importance of failing fast. 3. Students will be able to explain what MVPs (minimum viable product) are and their importance. 4. Students will be able to understand the BML loop, its effectiveness, and know how to utilize it in their own SEVs (social entrepreneurial ventures). 5. Students will be able to understand what pivots are, when they should use them, and utilize them within their own SEV if necessary. Agenda 1. The Lean Startup a. Lecture (30-45 minutes) b. Simulation (30 minutes) 2. Work Time (if time available) IMSA Leadership Education and Development SEV Progress 1. Students need to be prepared to present at MID next week. -

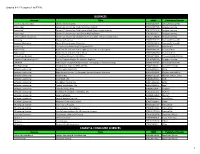

Blackstone Launchpad Entrepreneurship Book Collection September 2019

Blackstone Launchpad Entrepreneurship Book Collection September 2019 Title Author "How To" Grants Manual: Successful Grantseeking Techniques for Obtaining Public David G. Bauer and Private Grants #Girlboss Sophia Amoruso $100 Startup: Reinvent the Way You Make a Living Do What You Love and Create a Chris Guillebeau New Future 101 Design Methods Vijay Kumar 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich Timothy Ferris ABA Consumer Guide to Obtaining a Patent: A Practical Resource for Helping Rich Goldstein Entrepreneurs & Innovators Protect Their Ideas Abundance: The Future is Better Than You Think Peter H. Diamandis Adventures of Ideas Whitehead Adversity to Advantage: How to Overcome Bullying & Find Entrepreneurial Success Randy Ginsburg Age of Insight Eric R. Kandel Agile Product Development: How to Design Innovative Products That Create Customer Tathagat Varma Value Algorithms to Live By: The Computer Science of Human Decisions. (No Rights Us) Brian Christian All in Startup: Launching a New Idea When Everything is on the Line Diana Kander All Marketers are Liars: The Underground Classic That Explains How Marketing Really Seth Godin Works-- and Why Authenticity Is the Best Marketing of All Art of Critical Making Rosanne Somerson and Mara Hermano Art of People: 11 Simple People Skills That Will Get You Everything You Want Dave Kerpen Art of The Start 2.0: The Time-Tested, Battle-Hardened Guide for Anyone Starting Guy Kawasaki Anything Art of The Start: The Time-Tested, Battle-Hardened Guide for Anyone Starting Guy -

Grades 9-12 Resource List FY20

Grades 9-12 Resource List FY20 BUSINESS Course Title ISBN Publisher/Vendor Introduction to Business Understanding Business 9780073524597 Glencoe/McGraw-Hill Accounting 1 Century 21 Accounting - Multicolumn Journal, 10E 9781305947696 Cengage Learning Accounting 1 Century 21 Accounting - Vital Source eBook; 6 year student licenses 9781137341516 Cengage Learning Accounting 1 Century 21 Accounting - Aplia Online Working Papers 9781285436111 Cengage Learning Honors College Accounting Century 21 Accounting Advanced, 11th Ed. Student Text with Digital access 9781337798808 Cengage Learning Marketing Marketing Essentials 9780021401109 Glencoe/McGraw-Hill Advanced Marketing Sports & Entertainment Marketing 9780538438896 Glencoe/McGraw-Hill Advertising Contemporary Advertising & Integrated Text 9780073530031 McGraw-Hill Business Law Business Law: text & Exercises digital access online research guide 9780324641103 Thomson West Business Law Business Law: text & Exercises 5th ed 9780324640960 Thomson West International Business International Business, 3rd Edition 9780538728604 Thomson/South-Western Computer Programming 1 & 2 Python Programming for the Absolute Beginner 9781435455009 Cengage Learning LAN/WAN Mike Meyer's CompTIA Network Guide - Managing and Troubleshooting 9780071614832 Glencoe/McGraw-Hill Web Page Design Creating Web Pages w/ HTML/DHTML 978619162414 Course Technology Software Engineering Big Java Early Objects 6/e 9781119221975 Wiley Software Engineering Algorithms to Live By: The Computer Science of Human Decisions 9781250118363 Christian -

Download the SDSU Founders Manual

Table of Contents The Path to Commercialization 1 “I Have an Idea!” 2 San Diego State University 2 About This Manual 2 The SDSU Entrepreneurial Ecosystem 2 The ZIP Launchpad 3 The ZIP Idea Lab 3 The Lavin Entrepreneurship Center 4 The TTO 4 Where to start with the idea? 5 Education About Entrepreneurship & Innovation 6 Where to learn about the process? 6 The SDSU Founders Manual 6 The Lavin Entrepreneurship Center 6 Other Entrepreneurship & Innovation Education 7 Research 10 Where do researchers go to explore ideas, test hypotheses, and obtain funding? 10 Research, Generally 10 Research at SDSU 11 Internal Research Funding for Faculty 11 External Research Funding for Faculty 12 Receiving, Finalizing, and Managing Research Awards 13 Student Opportunities in Research 13 Commercialization of Research 14 Intellectual Property Resulting from Research 14 Creation & Invention 15 What to do with and how to protect the idea? 15 Intellectual Property 15 Types of IP 16 The TTO 18 Disclosure of Inventions & Creative Works 19 Evaluating the Idea 21 How to assess how good the idea is and decide what to do next? 21 Evaluating for IP Protection 21 University Ownership of Intellectual Property 22 The University Copyrights & Patents Committee (UCPC) 23 ZIP Launchpad E-Track 24 CSU I-Corps Site 24 Developing the Idea 26 How to continue improving the idea and prepare for commercialization? 26 San Diego State University ii Entrepreneurial Experiences Working Group SDSU Founders Manual ZIP Launchpad Launch Tracks 26 Prototyping 27 Ongoing Protection of IP 28 Continuing to Develop University IP 28 Mentorship 28 Events 30 Competitions for Entrepreneurship & Innovation 30 Maintaining the Idea 31 Licensing Intellectual Property 34 What is licensing and how can it be used to share the idea? 34 Licensing vs. -

Lean Startups and Strategic Management

Portland State University PDXScholar Engineering and Technology Management Student Projects Engineering and Technology Management Spring 2018 Lean Startups and Strategic Management Joshua Binus Portland State University Horatiu Corban Portland State University Stephanie Miller Portland State University Hans VanDerSchaaf Portland State University Follow this and additional works at: https://pdxscholar.library.pdx.edu/etm_studentprojects Part of the Entrepreneurial and Small Business Operations Commons, and the Strategic Management Policy Commons Let us know how access to this document benefits ou.y Citation Details Binus, Joshua; Corban, Horatiu; Miller, Stephanie; and VanDerSchaaf, Hans, "Lean Startups and Strategic Management" (2018). Engineering and Technology Management Student Projects. 2219. https://pdxscholar.library.pdx.edu/etm_studentprojects/2219 This Project is brought to you for free and open access. It has been accepted for inclusion in Engineering and Technology Management Student Projects by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. Title: Lean Startups and Strategic Management Course Title: Strategic Management of Technlogy Course Number: ETM-526 Instructor: Weber Term: Spring Year: 2018 Authors: Joshua Binus, Horatiu Corban, Stephanie Miller, Hans VanDerSchaaf ETM OFFICE USE ONLY Report No.: Type: Student Project 1 Note: Lean Startups and Strategic Management Spring 2018 Strategic Management of Technology, ETM 526, Dr. Weber Joshua Binus Horatiu Corban Stephanie Miller Hans VanDerSchaaf Outline Lean startup methodology overview Challenges and solutions Case studies Research on lean Lean and strategic management 3 Recommended Reading Steve Blank and Bob Dorf, The Startup Owner’s Manual, (2012) Steve Blank, “Why the Lean Start-up Changes Everything,” Harvard Business Review 91:5 (2013), pp. -

Design-Driven Innovation Through Minimum Viable Products Validation of Utility Before Designing for Usability and Desirability

Design-driven innovation through Minimum Viable Products Validation of utility before designing for usability and desirability Johan Bertnes Røed Department of Product Design Norwegian University of Science and Technology ABSTRACT Design-driven research is argued to have most impact when being carried out in early phases of technological development. Still, designers struggle getting valuable contributions from users when developing completely new product or service concepts for the future. Design Thinking provides methodologies to discover and define assumptions about user needs, yet these assumptions remain hard to validate before product launch. With the concept of developing Minimum Viable Products (MVPs), Lean Startup introduces a process that seeks to address this contradiction. This article studies how MVPs affect the design process and how it corresponds to concerns in design literature about the value of user research in disruptive innovations. Results show that MVPs imply a shifting rationale behind design decisions and lead to new opportunities for high-value user research. MVPs prove to be an effective tool to test vulnerable assumptions on the utility of an innovation before spending development effort on usability and desirability considerations. The value for the designer is that with MVPs the design phase does not end in a final delivery yet to be implemented for launch. The real learning starts when the product is launched to market. KEYWORDS: Design-driven innovation, Design Thinking, Lean Startup, Minimum Viable Products, Product-market fit, Technology-push, Technology Epiphany, User Experience Research, Utility 1. INTRODUCTION How design can act at the initial phase of an Design Council (2013a) has found that industry, when a breakthrough technology “consumers are less able to contribute to the emerges, is a yet unexplored field of research development of completely new product or (Verganti, 2011). -

UNIVERSITY of CALIFORNIA, IRVINE Accelerating Innovation In

UNIVERSITY OF CALIFORNIA, IRVINE Accelerating Innovation in Global Contexts DISSERTATION submitted in partial satisfaction of the requirements for the degree of DOCTOR OF PHILOSOPHY in Information and Computer Sciences by Julia Katherine Haines Dissertation Committee: Bren Professor of Information and Computer Sciences Judith S. Olson, Chair Bren Professor of Information and Computer Sciences Gary M. Olson Professor Bonnie Nardi Assistant Professor Melissa Mazmanian 2015 © 2015 Julia Katherine Haines DEDICATION To all the founders I have met in this journey in admiration of their dedication and perseverance Xii TABLE OF CONTENTS LIST OF FIGURES .............................................................................................................................................. v LIST OF TABLES ............................................................................................................................................... vi ACKNOWLEDGMENTS ................................................................................................................................. vii CURRICULUM VITAE ................................................................................................................................... viii ABSTRACT OF THE DISSERTATION .......................................................................................................... x CHAPTER 1. Introduction ............................................................................................................................. 1 CHAPTER