Modern Chinese Tourists

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Actos De BARCELONA Del BORME Núm. 17 De 2010

BOLETÍN OFICIAL DEL REGISTRO MERCANTIL Núm. 17 Miércoles 27 de enero de 2010 Pág. 4633 SECCIÓN PRIMERA Empresarios Otros actos publicados en el Registro Mercantil BARCELONA Cuentas consolidadas (Diciembre de 2009) 57274 - CAIXA D'ESTALVIS COMARCAL DE MANLLEU(2005). 57275 - CULTIVAR GRUP SL(2005). 57276 - CAIXA D'ESTALVIS COMARCAL DE MANLLEU(2006). 57277 - CULTIVAR GRUP SL(2006). 57278 - METALDYNE ENGINE HOLDINGS SL(2006). 57279 - TUBSA AUTOMOCION SL(2006). 57280 - CAIXA D'ESTALVIS COMARCAL DE MANLLEU(2007). 57281 - ESTABANELL Y PAHISA SA(2007). 57282 - GRUP LASEM GESTIO SL(2007). 57283 - LANXESS HOLDING HISPANIA SL(2007). 57284 - MULLOR SA(2007). 57285 - TECSIDEL SA(2007). 57286 - TUBSA AUTOMOCION SL(2007). 57287 - AFFINITY PETCARE SA(2008). 57288 - AUTOMOBIL CLUB ASSISTENCIA SA(2008). 57289 - BAGLEY LATINOAMERICA SA(2008). 57290 - BKB ELECTRONICA SA(2008). 57291 - CAIXA D'ESTALVIS COMARCAL DE MANLLEU(2008). 57292 - CATALANA D'INFRAESTRUCTURES PORTUARIES SL(2008). 57293 - CERAMIQUES ESTRUCTURALS DEL PENEDES SA(2008). 57294 - CHIMIGRAF HOLDING SL(2008). 57295 - CINFROMAS SL(2008). 57296 - CONEI CORPORACION S XXI SL(2008). 57297 - CONSTRUCCIONS TORCA SA(2008). 57298 - COPCISA CORP SL(2008). 57299 - COPCISA ELECTRICA SL(2008). 57300 - COPCISA GEST SL(2008). 57301 - COPCISA PROMO SL(2008). 57302 - CREDITS AND PARTNERS ESPAÑOLA SA(2008). 57303 - DOGI INTERNATIONAL FABRICS SA(2008). 57304 - EDICIONS 62 SA(2008). 57305 - ENVASES DEL VALLES SA(2008). 57306 - EPLER INVEST SL(2008). 57307 - ESBELT SA(2008). 57308 - EXPERTUS WORLDWIDE SL(2008). 57309 - FRUIT MARKET INVESTMENT SL(2008). 57310 - GRUP LASEM GESTIO SL(2008). 57311 - GRUPO G56 HOLDING SL(2008). 57312 - GRUPO INMOBILIARIO CASTELLVI SL(2008). 57313 - GRUPO ZETA SA(2008). 57314 - INDUSTRIAL QUIMICA LASEM SA(2008). -

The Use of Smart Technology in Tourism: Evidence from Wearable Devices∗

Journal of Tourism and Hospitality Management, December 2015, Vol. 3, No. 11-12, 224-234 doi: 10.17265/2328-2169/2015.12.002 D DAVID PUBLISHING The Use of Smart Technology in Tourism: Evidence From Wearable Devices∗ Roland Atembe University of Innsbruck, Republic of Austria The emergence of wearable devices has shifted internet from the conventional cyber space to becoming wearable on the body. This new paradigm shift has precipitated a lot of speculations about its impact on the tourism industry. Access to wearable web is predicted to drastically streamline the way tourists connect with stakeholders and the environment around them. Although it is relatively new, wearable technological devices are predicted to have a significant effect on people’s interaction. However, research describing the application of wearable devices in tourism is relatively lacking in academic literature. This paper examines the usage of wearable devices in tourism. The essay aims at contributing to the literature of wearable device and tourism. It also aims at providing an insight of the influence of wearable devices on tourists’ behavior. The paper provides an overview of wearable device functionalities and presents an insight of used cases in the tourism context. Keywords: wearable device, smart technology, tourism Introduction Information and communication technologies (ICTs) have substantially influenced the tourism industry, and they continue to serve as the main drivers for tourism innovations. We see evidence in literature that ICTs have drastically transformed the way tourism products are developed, presented, and offered (Buhalis, 2003; Buhalis & Law, 2008). The technological influence in the tourism industry does not only impact the suppliers, but also the consumers. -

A Cultural Tourism Plan for the Maitland and Dungog Districts, Nsw 2

TABLE OF CONTENTS EXECUTIVE SUMMARY OF RECOMMENDATIONS 4 1. INTRODUCTION 18 A CULTURAL TOURISM PLAN FOR THE MAITLAND AND DUNGOG DISTRICTS, NSW 2. BACKGROUND AND RATIONALE 20 2.1: Project Background 2.2: Project Rationale December 2001 3. THE OPERATIONAL PHILOSOPHY OF CULTURAL TOURISM 24 3.1: What is Cultural Tourism? 3.2: Why Regional Cultural Tourism? 3.3: Cultural Tourism in the Hunter 4. THE RESEARCH PROCESS 28 4.1: Research Phases and Methods 5. SUMMARY OF VISITOR AND RESIDENT SURVEY 32 5.1: Maitland City Council Area 5.1.1 Discussion of Results 5.2: Dungog Shire Council Area Project Team: 5.2.1 Discussion of Results Associate Professor David Rowe, Dr John Jenkins, Dr Kevin Markwell, Ms Georgia Paton and Dr Deborah Stevenson 6. STRENGTHS, WEAKNESSES, OPPORTUNITIES AND THREATS 43 6.1: Maitland District 6.2: Dungog Shire 6.3: Maitland and Dungog Region 7. STRATEGIC DIRECTIONS AND ACTIONS: MAITLAND CITY COUNCIL 46 7.1: Cultural Tourism in Maitland Strategic Opportunities 7.2: Extend the Scope of the Tourism Community 7.3: Mindaribba Aboriginal Council Museum and Community Project Funded by: Centre, Metford The Commonwealth Department of Transportation and Regional Services under 7.4: Events its Understanding Rural Australia Programme. 7.5: Local Education Campaign 7.6: Accommodation 7.7: The Hunter River 7.8: Maitland Heritage Architecture 7.9: Innovative Marketing 7.10: Improving Basic Amenity: Parks, Grounds and Surrounds 7.11: Morpeth 7.12: Walka Water Works 7.13: Maitland Heritage Mall 7.14: Maitland Gaol 1 2 EXECUTIVE SUMMARY OF RECOMMENDATIONS 8. STRATEGIC DIRECTIONS AND ACTIONS: DUNGOG SHIRE 70 8.1: Cultural Tourism in Dungog Shire This tourism strategy for the Maitland and Dungog local government areas sets out to identify the cultural richness and diversity of the two areas from the standpoints Strategic Opportunities of local tourism authorities, stakeholders, residents, and visitors. -

Nebraska Tourism Study Appendix 3

Nebraska Tourism Industry Strategic Plan Appendices Presented to the: Nebraska Tourism Commission August 27, 2012 List of Appendices Appendix 1. Addressing Board Rules, Responsibilities and Policies Appendix 2. Equation Research, Nebraska Tourism Study Appendix 3. Colorado Tourism Impact Case Study Appendix 4. Michigan Tourism Impact Case Study Strategic Plan for the Nebraska Tourism Industry Appendix 1. Addressing Board Rules, Responsibilities and Policies Strategic Plan for the Nebraska Tourism Industry Appendix 1 - Addressing Board Rules, Responsibilities and Policies As of July of 2012, the Nebraska Tourism Division became the Nebraska Tourism Commission, a semi- autonomous organization led by industry, to direct the strategic tourism efforts of the state. A new board for the Commission has been appointed, and efforts are underway to formulate the “rules of the road” for the organization. In this section, we include specific comment on organizational issues that can impact the Nebraska Tourism Commission, followed by a more general set of ideas and comments as to initiatives important to a highly functional and strategic tourism board. With respect to Board structure and makeup for the Commission, we recommend that over time, the board member skill sets be clearly defined to include representatives from traditional local/regional destination marketing organizations (CVB’s), as well as from private businesses operating in the tourism industry. These private businesses provide a real-world perspective on how tourism in Nebraska is trending, and what initiatives could best support entrepreneurs critical to growing the industry. Also, high level executives in non-tourism industries should be included in order to introduce high quality business practices into the organizations. -

A Timeline of Michigan Tourism Alyssa Peterson and Dr

A Timeline of Michigan Tourism Alyssa Peterson and Dr. Sarah Nicholls Department of Community, Agriculture, Recreation & Resource Studies Michigan State University March 2012 *** This timeline is a work in progress. Please send suggested edits or additions to Sarah Nicholls at [email protected]. *** 1815 Detroit incorporated as a city th 1837 Michigan became the 26 state of the United States The beginning of smooth transportation between Lakes Superior and Huron 1855 is marked by a steam engine boat crossing through the Sault Ste. Marie Locks 1887 The Grand Hotel opened on Mackinac Island 1895 Michigan’s first state park, Detroit CVB opened as the Mackinac Island State Park, opened first CVB in the U.S. 1896 First gas-powered automobile in Golf courses began being Michigan tested designed in Michigan 1898 Wawashkamo Golf Course founded on Mackinac Island 1901 The world’s first concrete road built in Detroit OrganiZed skiing in the U.S. began in Ishpeming, MI, MI Hotel, Motel and Resort 1905 where the National Skiing Association was founded Association (MHMRA) formed 1909 Huron and Hiawatha National Forests established 1915 First stop sign invented and installed in Detroit 1917 Michigan Tourism and Resort Association (MTRA) formed (later renamed West Michigan Tourism Association) First commercial flight (from Michigan’s state park system 1919 Paris to London) established 1928 Tunnel and bridge access to Canada commences with the opening of Interlochen Center for the the Detroit-Windsor Tunnel and the Ambassador Bridge Arts founded Hugh Gray of MTRA led the movement to secure the first state appropriations for tourist advertising after showing the state legislature the value in the tourism industry, gaining $100,000/year for 2 years 1929 Black Tuesday, October 29, Dr. -

OAO JSFC OAO Shareholders “22” May 2009 Minutes “__” _____ 2009 of Meeting No

Preliminarily approved by Approved by the Annual the Board of Directors of General Meeting of Sistema Sistema JSFC OAO JSFC OAO Shareholders “22” May 2009 Minutes “__” _____ 2009 of Meeting No. 04-09 Minutes of Meeting No. __ SISTEMA Joint-Stock Financial Corporation Public Joint-Stock Company [OAO] ANNUAL REPORT for 2008 Completed in accordance with requirements of the “Regulation for disclosure of information by issuers of issuable securities” (Order of the Federal Service for Financial Markets of 10 October 2006 N 06-117/pz-n). The financial information presented in this Annual Report is based on data of the accounting statements compiled in accordance with Russian legislation and also contains elements from the consolidated financial statements compiled in accordance with international standards. All data presented in this Report are fixed as of 31 December 2008. Moscow, 2009 1 TABLE OF CONTENTS 1. Company’s positioning in the sector 4 1.1 Profile of Sistema JSFC OAO operations 4 1.2 Sistema JSFC OAO assets 4 2. Priority directions of the activity 7 2.1 Sistema JSFC OAO strategy 7 2.2 Determining the strategy and principles for asset portfolio management 7 3. Report of the Company’s Board of Directors on results of the 8 Company’s development 8 3.1 Key events of 2008 11 3.2 Financial results of activities according to the RBAS 13 3.3 Financial results of activities under the US GAAP 16 3.4 Sistema JSFC OAO credit ratings 16 3.5 Dividend policy, report on payment of declared (paid) dividends on Sistema JSFC OAO shares 4. -

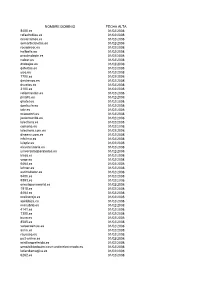

Febrero (Ver Pdf)

NOMBRE DOMINIO FECHA ALTA 8400.es 01/02/2008 rafaelrobles.es 01/02/2008 cesarramos.es 01/02/2008 semarbicicletas.es 01/02/2008 rocadecor.es 01/02/2008 hellbells.es 01/02/2008 proximobote.es 01/02/2008 calzar.es 01/02/2008 drebajas.es 01/02/2008 qofertas.es 01/02/2008 yico.es 01/02/2008 7700.es 01/02/2008 destrenos.es 01/02/2008 dvuelos.es 01/02/2008 3100.es 01/02/2008 reformasclic.es 01/02/2008 pinalfo.es 01/02/2008 qhotel.es 01/02/2008 dpelicula.es 01/02/2008 iatv.es 01/02/2008 mapsport.es 01/02/2008 javiermorilla.es 01/02/2008 lalechera.es 01/02/2008 comono.es 01/02/2008 lalechera.com.es 01/02/2008 disseny.com.es 01/02/2008 infclima.es 01/02/2008 luisplz.es 01/02/2008 elxveterinaria.es 01/02/2008 universidadparatodos.es 01/02/2008 kissa.es 01/02/2008 yoge.es 01/02/2008 6464.es 01/02/2008 lehner.es 01/02/2008 estimulador.es 01/02/2008 5400.es 01/02/2008 9393.es 01/02/2008 onesteponeworld.es 01/02/2008 1818.es 01/02/2008 8484.es 01/02/2008 molinorojo.es 01/02/2008 spiritibiza.es 01/02/2008 manubrio.es 01/02/2008 4141.es 01/02/2008 7300.es 01/02/2008 buya.es 01/02/2008 8585.es 01/02/2008 votoerasmus.es 01/02/2008 arnm.es 01/02/2008 rauesso.es 01/02/2008 ps3-online.es 01/02/2008 misillonpreferido.es 01/02/2008 sensibilidadquimicaymundorelacionado.es 01/02/2008 latiendamagica.es 01/02/2008 6262.es 01/02/2008 1700.es 01/02/2008 2121.es 01/02/2008 5151.es 01/02/2008 eachooser.es 01/02/2008 ekito.es 01/02/2008 pbi-dansensor.es 01/02/2008 fitotecnologia.es 01/02/2008 6565.es 01/02/2008 historiasdelatele.es 01/02/2008 2300.es 01/02/2008 yubi.es -

Good Practices in Tourism Awareness Programmes – Raising the Tourism Sector’S Profile and Status in Caribbean Countries

COMPETING WITH THE BEST Good Practices in Tourism Awareness Programmes – Raising the Tourism Sector’s Profile and Status in Caribbean Countries - TABLE OF CONTENTS Good Practices in Tourism Awareness Programmes Introduction.............................................................................................................1 Rationale .................................................................................................................1 The Process .............................................................................................................1 A Summary of Results – Country Information & Results.............................................3 Country Profiles Antigua & Barbuda.................................................................................................6 Aruba.......................................................................................................................8 The Bahamas.........................................................................................................11 Barbados ...............................................................................................................14 Belize.....................................................................................................................17 Bonaire..................................................................................................................19 British Virgin Islands ............................................................................................21 -

A Timeline of Michigan Tourism Alyssa Peterson and Dr

A Timeline of Michigan Tourism Alyssa Peterson and Dr. Sarah Nicholls Department of Community, Agriculture, Recreation & Resource Studies Michigan State University March 2012 1815 Detroit incorporated as a city th 1837 Michigan became the 26 state of the United States The beginning of smooth transportation between LaKes Superior and Huron 1855 is marKed by a steam engine boat crossing through the Sault Ste. Marie LocKs 1887 The Grand Hotel opened on MacKinac Island 1895 Michigan’s first state parK, Detroit CVB opened as the MacKinac Island State ParK, opened first CVB in the U.S. 1896 First gas-powered automobile in Golf courses began being Michigan tested designed in Michigan 1898 WawashKamo Golf Course founded on MacKinac Island 1901 The world’s first concrete road built in Detroit Organized sKiing in the U.S. began in Ishpeming, MI, MI Hotel, Motel and Resort 1905 where the National SKiing Association was founded Association (MHMRA) formed 1909 Huron and Hiawatha National Forests established 1915 First stop sign invented and installed in Detroit 1917 Michigan Tourism and Resort Association (MTRA) formed (later renamed West Michigan Tourism Association) First commercial flight (from Michigan’s state parK system 1919 Paris to London) established 1928 Tunnel and bridge access to Canada commences with the opening of Interlochen Center for the the Detroit-Windsor Tunnel and the Ambassador Bridge Arts founded Hugh Gray of MTRA led the movement to secure the first state appropriations for tourist advertising after showing the state legislature the value in the tourism industry, gaining $100,000/year for 2 years 1929 BlacK Tuesday, October 29, Dr. -

Crash Risk of International Visitors to Victoria May 2014

Crash Risk of International Visitors to Victoria May 2014 RACV Research Report 14/02 Royal Automobile Club of Victoria (RACV) Ltd Report No. Date ISBN Pages 14/02 May 2014 978-0-9804913-5-7 94 Title Crash Risk of International Visitors to Victoria Authors Acknowledgements John Catchpole Elle Towner Kate Pratt Melinda Spiteri Victoria Pyta Performing Organisation ARRB Group Ltd 500 Burwood Highway Vermont South VICTORIA 3133 Abstract This study investigated the involvement of international visitors in road crashes in Victoria. The project aimed to determine whether a comprehensive communication plan was needed to inform targeted groups of international visitors of particular road safety issues in Victoria. The report examined available literature, analysed trends and crash data, and involved consultation with stakeholders. It was found that approximately 0.7% of all road users killed in Victoria between 2002 and 2011 were international visitors. The number of short-term visitors is forecast to steadily grow by 5–6% per annum so the number of visitors killed on Victoria is also likely to increase. The overall recommendations relate to recognition of overseas licences, communication with international visitors and institutional arrangements. Key Words Crash risk; international drivers; visitors; Victoria; Road safety Disclaimer This report is based upon work supported by ARRB Group Ltd. Any opinions expressed during the interviews were those of individual interviewees and do not represent the official policy of the organisations to which they belong. The research presented in this report has been funded by RACV and is released in the public interest. The views expressed and recommendations made are those of the authors and do not necessarily reflect RACV policy. -

2018 Revenue Budget General Fund 001

CITY OF OTHELLO 2018 Revenue Budget General Fund 001 2013 2014 2015 2016 2017 2018 Actual Actual Actual Actual Actual Budget Proposal GENERAL FUND REVENUES BEGINNING FUND BALANCE 1,102,786 674,919 942,630 750,942 766,391 509,187 TAXES: Real/Personal Property Tax 1,439,840 1,535,342 1,537,110 1,565,368 1,596,826 1,640,000 Local Retail Sales Tax (50% split with Street) 645,962 669,988 683,932 725,102 767,660 775,000 B & O Natural Gas 384,568 Criminal Justice - Local 103,460 112,468 103,711 112,394 117,235 115,000 Electricity 556,018 Natural Gas 110,000 Cable Telephone 180,000 Water 10% 270,300 Sewer 15% 270,000 Gambling Taxes - Pull Tabs 929 605 424 1,129 243 400 Amusement Games 898 740 1,033 296 27 300 Leasehold Excise Tax 73 2,498 994 1,565 3,034 2,200 Total Taxes 2,191,162 2,321,642 2,327,204 2,405,854 2,485,025 4,303,786 PERMITS & LICENSES: Dance Permits 300 50 900 0 900 700 Cabaret Licenses 575 975 50 450 900 1,500 Franchise Fees 5,467 12,727 12,413 11,112 9,009 10,000 Cable TV Franchise Fee 6,141 0 0 Business License - General 36,615 50,241 49,185 53,375 51,950 54,000 Solicitor Permit 2,900 1,900 900 100 100 Building Permits 134,439 132,718 169,690 154,639 74,409 85,000 Placement Permits Animal License 4,726 6,538 6,736 5,705 4,795 0 Chicken License 10 20 20 20 Commercial Kennel Permit Gun Permits 5,111 3,902 4,218 3,948 4,284 4,700 Yard Sale Permits 1,428 1,266 1,296 1,458 1,227 1,200 Display on Public Property 25 25 25 25 25 Business License - Penalties 1,840 222 2,009 1,279 1,269 1,260 Total Permits & Licenses 199,567 210,564 247,431 232,010 148,887 158,480 U:\Budgets\2018 Budget\2018 Council Budget Docs\01 - 2018 General Fund Page 1 of 5 4/23/2018 2:22 PM CITY OF OTHELLO 2018 Revenue Budget General Fund 001 2013 2014 2015 2016 2017 2018 Actual Actual Actual Actual Actual Budget Proposal GENERAL FUND REVENUES INTERGOVENMENTAL: Federal Direct & Indirect CDBG - Police Computers 0 0 0 US Dep of Justice 3,949 1,886 HUD - Planning Only (Comp Plan/ Crit Areas) 24,000 19,297 4,703 WASPC - Equipment Grant 0 0 0 DOJ/DOComm. -

Operating Budget Operating Budget

CityCity ofof LewisvilleLewisville OperatingOperating BudgetBudget FiscalFiscal YearYear 2007-20082007-2008 HOW TO USE THIS BUDGET The City's budget is a planning and financial guide for citizens, staff, and Council members. The purpose of this document is to communicate the initiatives authorized by the City Council and enacted by City management. This guide details key revenue sources (e.g. property tax, water sales, etc.) and their planned use for the fiscal year. Readers will find a breakdown of costs, how the organization is structured, goals, objectives, accomplishments, performance measures for each department, and other pertinent statistical data about Lewisville. The budget document contains the following information: Introduction: This section contains the City Manager’s transmittal letter to the Mayor, Council, and citizens of Lewisville. The letter provides a brief overview of the most important modifications to the approved budget, including a discussion of the tax rate, any changes to utility rates, and significant service improvements for the upcoming year. Strategic Planning: The City’s strategic planning initiatives are described as a foundation on which the City Council and staff operate to conduct municipal business. The City’s primary 5-year planning documents are also included in this section. Budget Overview: The overview is the executive summary, providing detailed analysis of revenues and expenditures for all funds and management’s response to the growing demands of the City. Fund Summaries: This section contains financial summary information for each of the operating funds. Debt Summary: The Debt Summary itemizes Lewisville’s annual principal and interest costs, purposes, and lengths of all issued General Obligation and Revenue Bonds.