Q2 2021 Earnings Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 INTELSAT 20-F Printshop Copy

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2018 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 001-35878 INTELSAT S.A. (Exact name of Registrant as specified in its charter) N/A (Translation of Registrant’s name into English) Grand Duchy of Luxembourg (Jurisdiction of incorporation or organization) 4 rue Albert Borschette Luxembourg Grand-Duchy of Luxembourg L-1246 (Address of principal executive offices) Michelle V. Bryan, Esq. Executive Vice President, General Counsel and Chief Administrative Officer Intelsat S.A. 4, rue Albert Borschette L-1246 Luxembourg Telephone: +352 27-84-1600 Fax: +352 27-84-1690 (Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange On Which Registered Common Shares, nominal value $0.01 per share New York Stock Exchange Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report. -

Spectrum and the Technological Transformation of the Satellite Industry Prepared by Strand Consulting on Behalf of the Satellite Industry Association1

Spectrum & the Technological Transformation of the Satellite Industry Spectrum and the Technological Transformation of the Satellite Industry Prepared by Strand Consulting on behalf of the Satellite Industry Association1 1 AT&T, a member of SIA, does not necessarily endorse all conclusions of this study. Page 1 of 75 Spectrum & the Technological Transformation of the Satellite Industry 1. Table of Contents 1. Table of Contents ................................................................................................ 1 2. Executive Summary ............................................................................................. 4 2.1. What the satellite industry does for the U.S. today ............................................... 4 2.2. What the satellite industry offers going forward ................................................... 4 2.3. Innovation in the satellite industry ........................................................................ 5 3. Introduction ......................................................................................................... 7 3.1. Overview .................................................................................................................. 7 3.2. Spectrum Basics ...................................................................................................... 8 3.3. Satellite Industry Segments .................................................................................... 9 3.3.1. Satellite Communications .............................................................................. -

Letter to Our Shareholders 2020

Letter to Our Shareholders 2020 A backdrop of exciting opportunities – and complex challenges – provides the context for our 2019 shareholder update. These factors will drive Intelsat’s performance in 2020 and beyond. New space-based technologies – and recent investments – are lowering barriers to entry in the satellite communications sector, driving innovation, scale and potentially opening new applications for satellite solutions. Stephen Spengler At the same time, the global telecommunications ecosystem faces Director and Chief Executive Officer continual price pressure. This creates capital constraints which must be balanced with the need to invest heavily for the next generation “network of networks” known as 5G. Data traffic is expected to grow by a factor of 4 by 2025. Over this time, it is increasingly likely that telecom operators will create more value by analyzing the data carried by their networks than by transmitting this data. Thus, the tools required for success in the telecommunications sector are changing radically from those of just three years ago. This landscape of change and opportunity causes us to reassess Intelsat’s advantages and to challenge and refine our strategies to position our company for opportunity and success in the 5G era. Intelsat Advantage: the telecommunications growth drivers of 2020 and beyond align directly with the enduring strengths of our business. The network everywhere – Not only do people need connectivity every- where, and with the right economics that align to developed and developing world realities, but now machines and devices need connectivity as well. Intelsat’s vast global network, with the ability to connect 99 percent of the world’s populated regions, is unmatched in its reach and reliability. -

Since Our Last SIA Member News Summary, Press Releases and Posts

SIA PRESIDENT’S REPORT – MEMBER NEWS FOR AUG 2020 Since our last SIA Member News Summary, press releases and posts from many SIA Members including Amazon, Boeing, Hughes, Inmarsat, Intelsat, Iridium, Kymeta, Planet, SES, SpaceX, Spire and Viasat have released news. Please see the summary of stories and postings below and click on the COMPANY LINK for more details. SPACEX On Aug 2nd, SpaceX announced that 63 days after being launched from Cape Canaveral, FL, Crew Dragon undocked from the International Space Station (ISS) before successfully splashing down in the Gulf of Mexico off the coast of Pensacola, FL. The flight marked the return of human spaceflight to the U.S. and the first-time in history a commercial company successfully took astronauts to orbit and back. The Demo-2 mission was also the final major test milestone for SpaceX’s human spaceflight system to be certified by NASA for operational crew missions to and from the ISS. (photo credit: SpaceX) SPIRE On Aug 27th, Spire posted the following. “The summer of 2020 has had its fair share of out of the ordinary weather events. From thunderstorms and lightning to cyclones, most parts of the world are experiencing extreme weather conditions. Storm forecasts are one way to mitigate the impact a storm has on an area both in the form of human safety and economics. Storms cause damage to an area’s vital infrastructure, they disrupt supply chains, cost billions of dollars each year in structural damages, and most importantly, lives are lost. Forecasting a storm allows for measures to be put in place to lessen the impact of these extreme storms and save lives. -

Day Month Year

Quarterly Commentary Third Quarter 2019 July 1, 2019 - September 30, 2019 October 29, 2019 Third Quarter 2019 Performance Summary Our third quarter in 2019 featured a successful satellite launch and the continued expansion of our managed services strategy. We saw improving trends with respect to new business for wireless infrastructure applications on several continents, including developing and developed regions, gaining success with our new AgileCore products designed to provide cost-effective point-to-point services. Our media business provided a solution for a global broadcast, demonstrating the capabilities of our cloud- based content distribution solution, IronRoute. Our government business advanced its managed services strategy using its new FlexGround service to provide critical restoration services in the Bahamas. Our cost profile has increased over the course of the year, generally as expected, reflecting our decision to fund certain satellite programs with operating expense agreements instead of capital expenditures. Overall, we are taking the right measures to allow us to implement our strategies to build stability in our business while also executing on our C-band spectrum opportunity. Total revenue was $507 million in the third quarter of 2019, a decrease of $30 million, or 6 percent as compared to the third quarter of 2018. Net loss attributable to Intelsat S.A. was $148 million for the third quarter of 2019, as compared to net loss attributable of $375 million in the third quarter of 2018. The greater loss in the prior year period reflects a loss on early extinguishment of debt of $204 million incurred in the third quarter of 2018. -

Quarterly Commentary Quarterly Total Revenue And

Quarterly Commentary First Quarter 2018 January 1, 2018 - March 31, 2018 May 1, 2018 First Quarter 2018 Performance Summary Our performance in the first quarter of 2018 includes many examples of the benefits of our global scale, regional expertise and technology. In the first quarter, we advanced our operating priorities, gaining new Intelsat EpicNG contracts with wireless operators in Asia and Africa and winning a new hosted payload for a government customer that will ride on one of our planned North America replacement satellites. On January 1, 2018, we adopted the provisions of the Financial Accounting Standards Board Accounting Standards Codification Topic 606, Revenue from Contracts with Customers (“ASC 606”). The most significant adjustments to our reported results were related to contracts with a significant financing component, typically with respect to our long-term media and government contracts for which a prepayment was received, which resulted in an increase in revenue and an increase in interest expense, both of which are non-cash. Only a small portion of our total contracts required accounting changes as a result of implementing ASC 606. This change further aligns Intelsat with international accounting practices consistent with our peer group. Quarterly Total Revenue and Adjusted AEBITDA $600 $544 $500 $539 $538 $538 $533 $519 $419 $400 $410 $418 $420 $416 $392 Revenue Millions $300 AEBITDA $200 $100 $- 1Q17 2Q17 3Q17 4Q17 1Q18 Total revenue was $544 million in the first quarter of 2018, an increase of $5 million or 1 percent as compared to the first quarter of 2017. Total revenue excluding the effects of ASC 606 was $519 million for the first quarter of 2018, a decline of $20 million or 4 percent as compared to the first quarter of 2017. -

Changes to the Database for May 1, 2021 Release This Version of the Database Includes Launches Through April 30, 2021

Changes to the Database for May 1, 2021 Release This version of the Database includes launches through April 30, 2021. There are currently 4,084 active satellites in the database. The changes to this version of the database include: • The addition of 836 satellites • The deletion of 124 satellites • The addition of and corrections to some satellite data Satellites Deleted from Database for May 1, 2021 Release Quetzal-1 – 1998-057RK ChubuSat 1 – 2014-070C Lacrosse/Onyx 3 (USA 133) – 1997-064A TSUBAME – 2014-070E Diwata-1 – 1998-067HT GRIFEX – 2015-003D HaloSat – 1998-067NX Tianwang 1C – 2015-051B UiTMSAT-1 – 1998-067PD Fox-1A – 2015-058D Maya-1 -- 1998-067PE ChubuSat 2 – 2016-012B Tanyusha No. 3 – 1998-067PJ ChubuSat 3 – 2016-012C Tanyusha No. 4 – 1998-067PK AIST-2D – 2016-026B Catsat-2 -- 1998-067PV ÑuSat-1 – 2016-033B Delphini – 1998-067PW ÑuSat-2 – 2016-033C Catsat-1 – 1998-067PZ Dove 2p-6 – 2016-040H IOD-1 GEMS – 1998-067QK Dove 2p-10 – 2016-040P SWIATOWID – 1998-067QM Dove 2p-12 – 2016-040R NARSSCUBE-1 – 1998-067QX Beesat-4 – 2016-040W TechEdSat-10 – 1998-067RQ Dove 3p-51 – 2017-008E Radsat-U – 1998-067RF Dove 3p-79 – 2017-008AN ABS-7 – 1999-046A Dove 3p-86 – 2017-008AP Nimiq-2 – 2002-062A Dove 3p-35 – 2017-008AT DirecTV-7S – 2004-016A Dove 3p-68 – 2017-008BH Apstar-6 – 2005-012A Dove 3p-14 – 2017-008BS Sinah-1 – 2005-043D Dove 3p-20 – 2017-008C MTSAT-2 – 2006-004A Dove 3p-77 – 2017-008CF INSAT-4CR – 2007-037A Dove 3p-47 – 2017-008CN Yubileiny – 2008-025A Dove 3p-81 – 2017-008CZ AIST-2 – 2013-015D Dove 3p-87 – 2017-008DA Yaogan-18 -

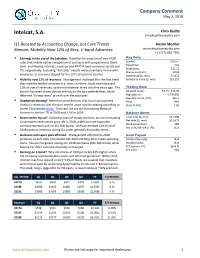

Intelsat, S.A. [email protected]

Company Comment May 2, 2018 Chris Quilty Intelsat, S.A. [email protected] Q1 Boosted by Accounting Change, but Core Trends Austin Moeller Remain; Mobility Now 12% of Revs, C-band Advances [email protected] +1 (727)-828-7601 • Earnings in the eye of the beholder. Aided by the adoption of new FASB Key Data rules that enable earlier recognition of contracts with prepayments (think Symbol: EXCH: I Govt. and Media), Intelsat’s revenue and EBITDA beat consensus by 5% and Fiscal Year: Dec Stock price: $12.31 7%, respectively. Excluding “ASC 606,” results were essentially in-line with th Shares out (mm): 119.9 consensus as revenues dipped for the 19 consecutive quarter Market cap ($, mm) $1,476 • Mobility now 12% of revenues. Management disclosed (for the first time) Enterprise value ($, mm) $15,153 that mobility-related revenues (i.e. aero, maritime, land) now represent 12% of overall revenues, up from immaterial levels only five years ago. This Trading Data growth has been driven almost entirely by the Epic satellite fleet, which 52-week range: $2.44 - $13.86 delivered “strong teens” growth over the past year. Avg daily vol: 3,776,000 Avg daily vol ($, mm): $46.5 • Headwinds abating? Relentless price declines that that have battered Float: 30% Intelsat’s revenues over the past several years may be abating according to Short % float 11% recent Euroconsult study. That said, we are still forecasting Network Services to decline 7% in 2018 and 3.5% in 2019. Balance Sheet • Government leg up? Following years of steady declines, we are forecasting Total debt ($, mm): $14,188 Government revenues to grow 4% in 2018, aided by more favorable Net debt ($, mm): $13,677 Book value/share: NM contract renewals and an ASC 606 bump. -

Engineering Statement

Engineering Statement 1 Introduction Intelsat License LLC, as debtor in possession (“Intelsat”), seeks authority in this application to modify the Galaxy 30 (formally known as Galaxy 14R) satellite license to launch and operate at the 125.0° W.L. (235.0° E.L.) orbital location. The characteristics of Galaxy 30, as well as its compliance with the various provisions of Part 25 of the Federal Communications Commission’s (“FCC or “Commission”) rules,1 are provided in this Engineering Statement. 2 Spacecraft Overview Galaxy 30 is an Orbital ATK GeoStar-2 spacecraft capable of operating in the L-, C-, Ku-, and Ka-band frequencies listed in the table below. Direction Frequency 6425-6725 MHz2 5925-6425 MHz Uplink 12750-13250 MHz 13750-14500 MHz3 27600-28600 MHz4 1 Unless otherwise stated, all references to rule sections in this document refer to sections in Title 47 of the Code of Federal Regulations. 2 This frequency band includes two Wide Area Augmentation System (“WAAS”) uplink frequency bands: 6598.58-6618.58 MHz and 6649.73-6669.73 MHz. 3 Galaxy 30 has the capability to operate in the 14000-14500 MHz band, but Intelsat is not seeking authority to operate in this band at 125.0° W.L. 4 Intelsat is aware that geostationary satellite orbit (“GSO”) fixed satellite services (“FSS”) operations in the 27500-28350 MHz band are secondary to the Upper Microwave Flexible Use Service, except for FSS operations associated with earth stations authorized pursuant to §25.136. See 47 C.F.R. § 25.202(a)(1)(i). Page 1 of 26 Direction Frequency 29000-29100 MHz5 29100-29250 MHz6 29250-30000 MHz7 1166.45-1186.45 MHz 1565.42-1585.42 MHz 3700-4200 MHz 10700-10950 MHz 10950-11200 MHz 11200-11450 MHz Downlink 11450-11700 MHz 17800-18800 MHz8 19200-19300 MHz9 19300-19400 MHz 19400-19600 MHz10 19600-20200 MHz 5 Intelsat is aware that GSO FSS operations in the 29000-29100 MHz band are secondary to non-geostationary orbit FSS. -

Read More Stories in Space Business Review December 2020

Space Business Review Special Edition – Top Ten Space Business Stories of 2020 December 2020 Contact | Dara A. Panahy, +1 202.835.7521, [email protected] | Bijan Ganji, +1 202.835.7543, [email protected] #1 – COVID-19 Pandemic: Scourge and Silver Linings #6 – SpaceX Reaches New Heights The pandemic rattles the space industry, creating challenges – SpaceX in 2020: achieves 100-launch milestone for Falcon 9 with in-flight connectivity in a holding pattern, leisure industry and sets new high marks for first stage reusability; debuts the connectivity on a prolonged siesta and launch providers and manned Crew Dragon capsule, with two successful missions to satellite manufacturers suffering shut-downs and delays – yet the ISS; nears 1,000 satellites on-orbit for Starlink, with public causing an explosion in demand for remote connectivity. Along beta testing underway; receives a contract from NASA to the way, industry leaders aid the fight against the virus, with transport cargo to and from the lunar Gateway; raises almost Virgin Orbit building ventilators, DISH Network contributing $2b in new equity funding; and scores $885.5m from the FCC’s spectrum, and Airbus, ULA and Virgin Galactic making PPE. Rural Digital Opportunity Fund to bridge the digital divide. #2 – Financial Markets Prove Resilient and Responsive #7 – LEO Constellation Shakeout Capital markets recover and private equity and venture The clouds continue to disperse in 2020, with the finalist track investments abound, with significant fundraising activity by for LEO broadband constellations shaping up: SpaceX’s Astranis, Astroscale, ICEYE, Kymeta, Ligado, Relativity, Starlink, Amazon’s Kuiper, Telesat LEO and restructured SpaceX, Spire Global, DISH Network and Viasat. -

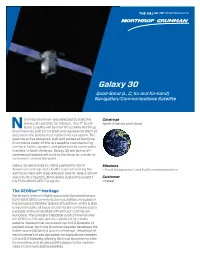

Galaxy 30 Quad-Band (L, C, Ku and Ka-Band) Navigation/Communications Satellite

Galaxy 30 Quad-Band (L, C, Ku and Ka-band) Navigation/Communications Satellite orthrop Grumman was selected to build the Coverage Galaxy 30 satellite for Intelsat. This 1st Quad- North America and Global Band satellite will be the 11th satellite Northrop NGrumman has built for Intelsat and represents the first satellite in the Galaxy fleet replacement program. The satellite will be designed, built and tested at Northrop Grumman’s state-of-the-art satellite manufacturing facility in Dulles, Virginia, and will primarily serve video markets in North America. Galaxy 30 will be the 41st commercial spacecraft built by Northrop Grumman for customers around the world. Galaxy 30 will include a C-band payload for North Missions American coverage and a Ku/Ka payload covering the L-Band Navigation, C and Ku/Ka communications earth's surface with steerable spot beams. Galaxy 30 will also include a hosted L-Band global payload to support Customer the FAA’s WAAS GEO 7 program. Intelsat The GEOStar™ Heritage Northrop Grumman’s highly successful Geosynchronous Earth Orbit (GEO) communications satellites are based on the company’s GEOStar spacecraft platform, which is able to accommodate all types of commercial communications payloads and is compatible with all major commercial launchers. The company’s GEOStar product line includes the GEOStar-2 design, which is optimized for smaller satellite missions that can support up to 5.0 kilowatts of payload power. Northrop Grumman has also developed the higher-power GEOStar-3 spacecraft design, delivering the next increment of payload power for applications between 5.0 and 8.0 kilowatts, allowing Northrop Grumman to offer its innovative and reliable satellite design to the medium- class of communications satellites. -

PUBLIC NOTICE FEDERAL COMMUNICATIONS COMMISSION 445 12Th STREET S.W

PUBLIC NOTICE FEDERAL COMMUNICATIONS COMMISSION 445 12th STREET S.W. WASHINGTON D.C. 20554 News media information 202-418-0500 Internet: http://www.fcc.gov (or ftp.fcc.gov) TTY (202) 418-2555 Report No. SES-02169 Wednesday June 5, 2019 Satellite Communications Services Information re: Actions Taken The Commission, by its International Bureau, took the following actions pursuant to delegated authority. The effective dates of the actions are the dates specified. SES-ASG-20190520-00596 E E181930 WLEX Communications, LLC Application for Consent to Assignment Consummated Date Effective: 05/20/2019 Current Licensee: WLEX Communications, LLC FROM: WLEX COMMUNICATIONS, LLC TO: Scripps Broadcasting Holdings LLC No. of Station(s) listed: 1 SES-ASG-20190520-00597 E E182011 KPAX Communications, LLC Application for Consent to Assignment Consummated Date Effective: 05/20/2019 Current Licensee: KPAX Communications, LLC FROM: KPAX COMMUNICATIONS, LLC TO: Scripps Broadcasting Holdings LLC No. of Station(s) listed: 1 SES-ASG-20190520-00598 E E181725 KXLF Communications, LLC Application for Consent to Assignment Consummated Date Effective: 05/20/2019 Current Licensee: KXLF Communications, LLC FROM: KXLF Communications, LLC TO: Scripps Broadcasting Holdings LLC No. of Station(s) listed: 1 Page 1 of 33 SES-ASG-20190520-00599 E E181721 KRTV Communications, LLC Application for Consent to Assignment Consummated Date Effective: 05/20/2019 Current Licensee: KRTV Communications, LLC FROM: KRTV Communications, LLC TO: Scripps Broadcasting Holdings LLC No. of Station(s) listed: 1 SES-ASG-20190520-00600 E E050213 KATC Communications, LLC Application for Consent to Assignment Consummated Date Effective: 05/20/2019 Current Licensee: KATC Communications, LLC FROM: KATC Communications, LLC TO: Scripps Broadcasting Holdings LLC No.