CHAPTER–II Performance Audit Relating to Government Companies and Statutory Corporations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

District Population Statistics, 4-Meerut, Uttar Pradesh

I Census of India, 195 1 DISTRICT POPULATION STATISTICS UTTAR PRADESH 4-MEEl{UT DISTRICT 315.42 ALLAHABAD: TING AND STATIONERY, UTTAR PRADESH, INDIA 1951 1952 MEE DPS Price, Re.1-S. FOREWORD THE Uttar Pradesh Government asked me in March. 1952, (0 'supply them for the purposes of elections to local bodies population statistics with ,separation for scheduled castes (i) mohalla/ward-wise for urban areas, and (ii) village-wise for rural areas. The Census Tabulation Plan did nbt provide for sorting of scheduled cast<;s population for areas smaller than a tehsil or urban tract and the request from the Uttar Pradesh Government came when the slip sorting had been finished and (he Tabulation Offices closed. As the census slips are mixed up for the purposes of sorting in one lot for a tehsil or urban tract, collection of data regarding scheduled castes population by moh'allas/wards and villages would have involved enormous labour and expense if sorting of the slips had been taken up afresh. Fortunately, however, a secondary census record, viz. the National Citizens' Register, in which each slip has been copied, was available. By singular foresight it had been pre pared mohalla/ward-wise for urban areas and village-wise for rural areas. Th e required information has, therefore. been extracted from. this record, 2. In the above circumstances there is a slight difference in the figures of population as arrived at by an earlier sorting of the slips and as now determined by counting from the National Citizens' Register. This difference has been accen mated by an order passed by me during the later coum from the National Register of Citizens as follows:- (i) Count Ahirwars of Farrukhabad District, Raidas and Bhagar as ·Chamars'. -

Bagpat Page:- 1 Cent-Code & Name Exam Sch-Status School Code & Name #School-Allot Sex Part Group 1001 Janta Inter College Palari Bagpat Brm

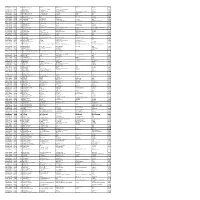

DATE:27-02-2021 BHS&IE, UP EXAM YEAR-2021 **** FINAL CENTRE ALLOTMENT REPORT **** DIST-CD & NAME :- 13 BAGPAT PAGE:- 1 CENT-CODE & NAME EXAM SCH-STATUS SCHOOL CODE & NAME #SCHOOL-ALLOT SEX PART GROUP 1001 JANTA INTER COLLEGE PALARI BAGPAT BRM HIGH BRM 1001 JANTA INTER COLLEGE PALARI BAGPAT 61 F HIGH BRM 1005 J K INTER COLLEGE DHANOURA TIKRI BAGPAT 45 M HIGH BRM 1010 J S INTER COLLEGE NIRPUDA BAGPAT 41 M HIGH BRM 1012 HARCHANDMAL JAIN INT COLL TIKRI BAGPAT 140 M HIGH CRM 1015 A V INT COLL JEBABAD KHAPRANA BAGPAT 102 F HIGH CRM 1135 O B S HR SEC SCHOOL BARNAWA BAGPAT 164 M - 553 INTER BRM 1001 JANTA INTER COLLEGE PALARI BAGPAT 71 F ALL GROUP INTER BRM 1005 J K INTER COLLEGE DHANOURA TIKRI BAGPAT 3 M OTHER THAN SCICNCE INTER BRM 1005 J K INTER COLLEGE DHANOURA TIKRI BAGPAT 11 F OTHER THAN SCICNCE INTER BRM 1009 SHRI JAWAHAR INT COLL BAMNOLI BAGPAT 30 M OTHER THAN SCICNCE INTER BRM 1012 HARCHANDMAL JAIN INT COLL TIKRI BAGPAT 63 M OTHER THAN SCICNCE INTER BRM 1012 HARCHANDMAL JAIN INT COLL TIKRI BAGPAT 163 M SCIENCE INTER CRM 1015 A V INT COLL JEBABAD KHAPRANA BAGPAT 26 F OTHER THAN SCICNCE INTER CRM 1015 A V INT COLL JEBABAD KHAPRANA BAGPAT 71 F SCIENCE INTER CRM 1126 N S C BOSS MEMO I C TAVELAGARHI BAGPAT 34 F ALL GROUP INTER CRM 1135 O B S HR SEC SCHOOL BARNAWA BAGPAT 14 F OTHER THAN SCICNCE INTER ARF 5003 GOVT GIRLS INTER COLLEGE DAHA BAGPAT 59 M ALL GROUP 545 CENTRE TOTAL >>>>>> 1098 1002 ARYA VIDYALAYA INTER COLLEGE TERA BAGPAT BRM HIGH BRM 1002 ARYA VIDYALAYA INTER COLLEGE TERA BAGPAT 29 F HIGH BRM 1013 S A V INTER COLLEGE KAMALA JUR -

Uttar Pradesh

Uttar Pradesh RPS ITC UPZJ7C Name Ram Piyare Singh Industrial Training Centre Address Maharwa Gola , , , Ambedkar Nagar - File Nos. DGET-6/24/16/2003-TC Govt. ITI UPZJ8C Name Govt. Industrial Training Institute, Tanda Address Tanda , , , Ambedkar Nagar - File Nos. DGET-6/24/7/2001-TC Chandra Audyogik UPZLPX Name Chandra Audyogik Prashikshan Kendra Address Dhaurhara, Sinjhauli , , , Ambedkar Nagar - File Nos. DGET-6/24/152/2009-TC WITS ITC UPZLQ4 Name WITS ITC Address Patel Nagar Akbarpur , , , Ambedkar Nagar - 224122 File Nos. DGET-6/24/160/2009-TC Kamla Devi Memorial Voc. UPZLT9 Name Kamla Devi Memorial Vocational Training Institute Address Pura Baksaray, Barua Jalaki, Tanda , , , Ambedkar Nagar - File Nos. DGET-6/24/235/2009-TC Hazi Abdullah ITC UPZLTK Name Hazi Abdullah ITC Address Sultanpur Kabirpur, Baskhari , , , Ambedkar Nagar - File Nos. DGET-6/24/238/2009-TC K.B.R ITC UPZM02 Name K.B.R ITC Address Shastri Nagar, Akbarpur , , , Ambedkar Nagar - File Nos. DGET-6/24/236/2009-TC Govt.ITI (W) Agra UP1750 Name Govt. Industrial Training Institute (Women Branch) Address , , , Agra - 0 File Nos. 0 Women Govt ITI, Agra UP1751 Name Govt. Industrial Training Institute for Women (WB) Address Vishwa Bank , , , Agra - 0 File Nos. DGET-6/24/16/2000-TC Govt ITI Agra UP1754 Name Govt Industrial Training Institute Address , , , Agra - 282001 File Nos. DGET-6/24/20/92 - TC Fine Arts Photography Tra UP2394 Name Fine Arts Photography Training Institute Address Baba Bldg. Ashok Nagar , , , Agra - 282001 File Nos. DGET-6/21/1/88 - TC National Instt of Tech Ed UPZJZ2 Name National Institute of Tech Educational Vijay Nagar Colony Address North Vijay Nagar Colony , , , Agra - 282004 File Nos. -

Outcome Budget 2015

GOVERNMENT OF INDIA OUTCOME BUDGET 2015 - 2016 MINISTRY OF WATER RESOURCES, RIVER DEVELOPMENT & GANGA REJUVENATION CONTENTS Chapter/Para Aspect Page(s) No. EXECUTIVE SUMMARY I BRIEF INTRODUCTORY NOTE ON THE 1-14 FUNCTIONS OF THE MINISTRY / DEPARTMENT, ORGANIZATIONAL SET UP, LIST OF MAJOR PROGRAMMES / SCHEMES IMPLEMENTED BY THE MINISTRY / DEPARTMENT, ITS MANDATE, GOALS AND POLICY FRAMEWORK II STATEMENT OF OUTLAYS AND 15-29 OUTCOMES/ TARGETS: ANNUAL PLAN 2015-16 III REFORM MEASURES AND POLICY 30-38 INITIATIVES IV REVIEW OF PAST PERFORMANCE 39 V OVERALL FINANCIAL REVIEW 40-50 Trend of expenditure in FY 2014-15 40-41 Budget at a Glance 42-49 Utilization Certificates 50 VI REVIEW OF PERFORMANCE OF STATUTORY /AUTONOMOUS ORGANISATIONS AND PUBLIC SECTOR UNDERTAKINGS Statutory Bodies: 6.1.1-6.1.2 Brahmaputra Board 51-54 6.2 Ravi and Beas Waters Tribunal 54 6.3 Cauvery Water Disputes Tribunal 55-56 6.4 Krishna Water Disputes Tribunal 56-57 6.5 Vansadhara Water Disputes Tribunal 57-58 6.6 Mahadayi Water Disputes Tribunal 58-60 6.7 Godavari and Krishna River Management Boards 60-61 Autonomous Bodies (Societies): 6.8 National Water Development Agency 61-63 i 6.9 National Institute of Hydrology 63-65 Public Sector Undertakings: 6.10 Water and Power Consultancy Services (India) 65-67 Limited 6.11 National Projects Construction Corporation Limited 67-69 ANNEXURE I Performance of 2013-14 70-95 II Performance of 2014-15 96-138 III Information regarding Accelerated Irrigation 139-146 Benefits Programme & National Project IV Statement showing details of Ministry of Water 147 Resources budget vis-a-vis XI Plan Outlay V Statement showing details of Ministry of Resources 148-149 Budget vis-à-vis XII Plan Outlay. -

ITI Code ITI Name ITI Category Address State District Phone Number Email Name of FLC Name of Bank Name of FLC Mobile No

ITI Code ITI Name ITI Category Address State District Phone Number Email Name of FLC Name of Bank Name of FLC Mobile No. Of Landline of Address Manager FLC Manager FLC GR09000145 Karpoori Thakur P VILL POST GANDHI Uttar Ballia 9651744234 karpoorithakur1691 Ballia Central Bank N N Kunwar 9415450332 05498- Haldi Kothi,Ballia Dhanushdhari NAGAR TELMA Pradesh @gmail.com of India 225647 Private ITC - JAMALUDDINPUR DISTT Ballia B GR09000192 Sar Sayed School P OHDARIPUR, Uttar Azamgarh 9026699883 govindazm@gmail. Azamgarh Union Bank of Shri R A Singh 9415835509 5462246390 TAMSA F.L.C.C. of Technology RAJAPURSIKRAUR, Pradesh com India Azamgarh, Collectorate, Private ITC - BEENAPARA, Azamgarh, 276001 Binapara - AZAMGARH Azamgarh GR09000314 Sant Kabir Private P Sant Kabir ITI, Salarpur, Uttar Varanasi 7376470615 [email protected] Varanasi Union Bank of Shri Nirmal 9415359661 5422370377 House No: 241G, ITC - Varanasi Rasulgarh,Varanasi Pradesh m India Kumar Ledhupur, Sarnath, Varanasi GR09000426 A.H. Private ITC - P A H ITI SIDHARI Uttar Azamgarh 9919554681 abdulhameeditc@g Azamgarh Union Bank of Shri R A Singh 9415835509 5462246390 TAMSA F.L.C.C. Azamgarh AZAMGARH Pradesh mail.com India Azamgarh, Collectorate, Azamgarh, 276001 GR09001146 Ramnath Munshi P SADAT GHAZIPUR Uttar Ghazipur 9415838111 rmiti2014@rediffm Ghazipur Union Bank of Shri B N R 9415889739 5482226630 UNION BANK OF INDIA Private Itc - Pradesh ail.com India Gupta FLC CENTER Ghazipur DADRIGHAT GHAZIPUR GR09001184 The IETE Private P 248, Uttar Varanasi 9454234449 ietevaranasi@rediff Varanasi Union Bank of Shri Nirmal 9415359661 5422370377 House No: 241G, ITI - Varanasi Maheshpur,Industrial Pradesh mail.com India Kumar Ledhupur, Sarnath, Area Post : Industrial Varanasi GR09001243 Dr. -

C:\Users\DELL\Desktop\Prashant

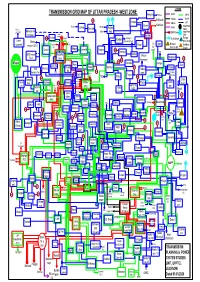

LEGEND TRANSMISSION GRID MAP OF UTTAR PRADESH -WEST ZONE Manglore Roorkee HVDC 220 kV 38 765 kV 132 kV 54 5 Rishikesh Kiratpur 400 kV U/C Morna Kashipur Solar Plant Roorkee Laksar Kotdwar Najiba 66 kV Roorkee Chandok 132kV 220/132kV Mawana Rd. Chilla bad 132kV C0-Gen Solar Plant Vishnu 33kV Hastinapur prayag. Nehtaur 48 Purkazi Alaknanda Kalagarh 33 kV C0-Gen Flue gas Hydro Afzalgarh Laxmi Bhag Ramganga G.S. base Co-gen To C.B Lalpur Biomass sugarmill wanpur (U.K.) Roorkee Srinagar Bijnor Coal Base PG Ganj base Co-gen Co-gen Charla Bhopa Janseth Nagina 29 220kV Dhampur TSS SRE Ambala Muzaffar Sherkot Mahua Rd.-II nagar Roorkee Shahabad 51 67 Kheraganj 21 Chandpur Rampur Khara Pura Bilari Jolly Rd. Bhopa Nara Nehtaur 27 Bilaspur SRE Ramraj Thakurd TSS Rd 31 C.B Ganj Ambala Rd.-I Bareilly wara 10 Baghra (PG) Tajpur TSS 220/132kV TSS Jalilpur 56 58 Rampur Gangal 14 Moga Chan Chutmal Koteshwar Mataur Gulab heri Sarsawa 20 Khatauli Mandola Tanda duasi Roorkee (PG) Kanth Rd. pur Saharan (PG) bari PG Avas MBD Bisauli pur Khodri Lalu Bhivani Vikas 62 59 Saharanpur Kheri Salava Kankar Kundarkhi khera-II (PG) (Kapsad) Modi Agwanpur TSS Gajraula Kashipur Moradabad Babrala Nakur Kota puram Sardhana Jhinjana Mawana 40 India 49 TSS 8 Garhmuk Designco Glycols 24 Amroha Behjoi Rampur 13 Ganganagar Gajraula teshwar Amroha 1MW Deoband Kankar Bachraun Bareilly Maniharan 41 42 khera 37 (PG) Sahas Behat Thanabhawan 33 wan Chan Gangoh Medical Col. Kothi (Kalsia) (Jalalabad) 17 duasi Budhana Vedvyas khidmatpur Nagli 3 Badaun puri kithore Simbholi Sambhal Nanuta 63 Sambhal Bannat Shamli Shatabdi B B Nagar 72 To Shamli Shyamla Nagar Saidnagli Dehradun Mundali Jagritivihar TSS Hapur Siyana Kharad Asmauli 57 Nirpura Kaniyan Hapur Rd. -

MEERUT: 111111111111'1111111111111111111111111111 Gfpe-PUNE-017942 a GAZETTEER

Dhauanjayarao Gadgii LibRaRy MEERUT: 111111111111'1111111111111111111111111111 GfPE-PUNE-017942 A GAZETTEER, llEING VOLUME IV OF THE DISTRICT GAZETTEERS OF THE UNITEll PROVINCES OF AGRA AND OUDH. COMPILED A.ND EDITED :BY H. R. N E V ILL, 1. C. S. ALLAHABAD: PRINTED :BY F. LUKER, SUl/DT., GOVT. PRESS, UNiTED PnOTINCES. 1904. Price Rs. 3 (48.). GAZETTEER OF MEERU~i .CONTENTS.,. PAGE, .,~AGE, Occupp.tions ••• 101 Boundaries and Area 1 Villages and houses , . 102 Topography ... 2 Contlition of the people 105 },akes · . .. 18 Proprietor~· ••• . ., 107 Tenants; ... , 108 Waste lands •· · ... ', 1' ... 19 ... Groves 21 Rents . ... 109 Minerals ~··... 22 Language and Literature •• , 109 }'auna 24 Edu<(ation : .. , ... 110 Cattle 26 ~· Climate and Rainfall 29 CRAPTEB IV. Medical Aspects ... ... 31 District Sta:ff ... J.I5 CH!PT~]I1I• . Garrison ... 116' Subdivisions 116 Cultivation .. •.. 35 .... Fiscal History ' ... 119 ~oils .. .... 37'' Police' 136 Harvests · ;.. ••.•. 38 Crime 138 Crops .: •. •··· 3~ ,Jail' , '. ·140 .., .. 47 .. l~ri~atiol\ and Cana~s. ~- '·"' 140 .... 57• :Excise ..•. ... }amines ., ·•'• .~ Registratj.on .... ~· .... 142 J>rices andWag~8' .~ •. ·::..~·· 60 .Stamps .. ... ·Ha:. Trade .. • , .. ..... 61 lncome-tax . ' 143 }'airs . •.. .. .... 63 Post-offi!leS . '143 Weights and Mej;\sures 63 Municipalities ... ']44. ]nterest · ·: ~ :' :.,: l.. 64 Act XX towns ... ' ... 145 Manufactures ;,,.' .• · · ":· 65 District Board· ... ... 145 <:ommunicati~n{ .".:... ·:.· :·: ;1 ... 67 _l)i s pensarie s ••• 141i . ... C:S:Al'TEB ·ll[ ' ' ·. CriPTER V. ; '75 Population •. ·.. ~-.~~ r~'. '·•·•"' ~l'l. • ··41 . '147 .. , . 78. Uis~ory ··~... ...... '• , ... 78 -~ J~,·li:;-ions- · ' ... ,, 79 ~ 187 (.'bri~~ianity __:' . ~. ~ . Directory ... ... ,....._...:... '"· Arya Sam~j . · .... ' ,,, 82;. <'' .hins .... .... .,, 82 Appen<U~ ... ·t. .. ·i-ilviii .. I • ,...___ ?\I u sal uia D.~ : ... ..... 83 lliuJue ... ... 88 Index~ ••• ,.... i...;.vii PREFACE. -

Details of Unpaid Dividend As on September 2

JUBILANT INDUSTRIES LIMITED (CIN: L24100UP2007PLC032909) STATUS OF UNPAID DIVIDEND DATA AS ON SEPTEMBER 2, 2014 Proposed date Folio No/DP id/Client Amount of transfer of Sr. No. id Name Father's Name Address Country State District Pincode Investment Type due IEPF 1 1201060000468701 LATA MEHROTRA MR RAM KRISHNA MEHROTRA 520-A NEHRU NAGATR MEERAPUR ALLAHABAD 211003 INDIA UTTAR PRADESH ALLAHABAD 211003 Amount for unclaimed and unpaid dividend 15.00 24-SEP-2018 2 1201060001473242 PHANIRAJ KATTA BADARINATH BADARINATH KATTA NARAYANAIAH S/O K N BADARINATH NO 4 412 GANDHI MADAKASIRA TQ ANANTHPUR DIST 515301 INDIA ANDHRA PRADESH ANANTHAPUR 515301 Amount for unclaimed and unpaid dividend 3.00 24-SEP-2018 3 1201060001588511 P MOHANAVELU PARAMASIVAM NO:950 BAJANAI KOIL STREET VANIYAMBADI VELLORE 635751 INDIA TAMIL NADU VELLORE 635751 Amount for unclaimed and unpaid dividend 3.00 24-SEP-2018 4 1201060100148944 CHANDRAKANTA SHARMA MURLIMANOHAR BAZAR ROAD CHANDAMETA TEH.PARASIA CHHINDWARA 480449 INDIA MADHYA PRADESH CHHINDWARA 480449 Amount for unclaimed and unpaid dividend 3.00 24-SEP-2018 5 1201060100173162 AJAY KUMAR VYAS MADHAV RAO VYAS NEAR VIJAY STAMBH WARD NO. 03 JUNNARDEO CHHINDWARA 480551 INDIA MADHYA PRADESH CHHINDWARA 480551 Amount for unclaimed and unpaid dividend 15.00 24-SEP-2018 6 1201060500129536 KULDEEP SINGH CHHABRA SH. GURUBACHAN SINGH CHHABRA FRONT OF GURUDWARA BHAWANIMANDI BHAWANIMANDI 326502 INDIA RAJASTHAN BARAN 326502 Amount for unclaimed and unpaid dividend 45.00 24-SEP-2018 7 1201060500476332 VARUN VYAS CHANDRA SHEKHAR VYAS -

UNPAID SHAREHOLDERS LIST AS on 30-06-2021.Xlsx

KEY-DEMAT ID DWNO NETDIV NAME ADDRESS 1 ADDRESS 2 ADDRESS 3 City PIN 1203340000044106 1414298 7200.00 VIRENDER KUMAR MADAN B-140 MALVIYA NAGAR NEW DELHI 110017 1204720000676855 1414460 1.00 MD FIRDAUS ALAM HOUSE NO 32 3RD FLOOR AMI CHAND KHAND GIRINAGAR KALKAJI NEW DELHI 110019 1201910100595770 1414972 90.00 BRIJ MOHAN 171, MAIN BAZAR BUS STAND BAWANA DELHI 110039 1304140007221019 1415020 158.00 RISHIKESH TIWARI H. NO-136 GALI. NO.S-54. E-BLOCK MOLAR BAND EXT NEAR PARASAR PUBLIC SCHOOL BADARPUR 110044 IN30072410162523 1415351 45.00 VINOD KUMAR 182-WZ BLOCK GALI NO-4 VIRENDER NAGAR NEW DELHI 110058 IN30167010089828 1416100 225.00 PAVNEET KAUR NARANG J - 3, FINE HOME APPTS MAYUR VIHAR PHASE - I DELHI 110091 IN30023913906396 1413801 45.00 EBI ELDHO JACOB AL GURG CONSULTANT P B NO 810 DUBAI UAE 100000 IN30223610157507 1413979 45.00 RAJEEV SETHI 14 A/3 W E A KAROL BAGH NEW DELHI 110005 1202060000069367 1414047 45.00 INDERA DEVI 7232 ROOP NAGAR NEW DELHI 110007 IN30021410363033 1414548 3600.00 SURENDER KUMAR HOODA H 304 SOM VIHAR R K PURAM NEW DELHI 110022 IN30223611465946 1414963 2250.00 VIVEK SHARMA 2991, GALI NO-222 CHANDER NAGAR TRI NAGAR DELHI 110035 IN30154915352663 1415029 194.00 G JAYAKUMAR HR 132 GALI NO 6 NEAR SURAJKUND MODH PULPHELADPURI BADARPUR PO NEW DELHI 110044 001221 1400048 180000.00 DWARKA NATH ACHARYA RETAINABLE CASE 700007 IN30281412100767 1414994 454.00 Rajeev Kumar Mittal D 51 B Yadav Nagar Samay Pur Delhi 110042 IN30223610002208 1415035 5.00 SRIVALSAN PILLAI 219 B POCKET-C SIDDHARTH EXTN NEW DELHI 110044 IN30223612200785 -

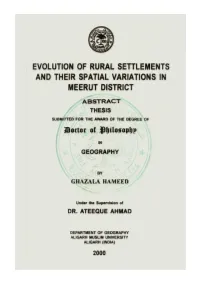

Evolution of Rural Settlements and Their Spatial Variations in Meerut District

EVOLUTION OF RURAL SETTLEMENTS AND THEIR SPATIAL VARIATIONS IN MEERUT DISTRICT 5^BSTRACT ^ 0 THESIS •\. f*f i;,-^-- SUBMITTED FOR THE AWARD OF THE DEGREE OF Bottar of ^iitloifoplip \ I 'Zy- •.'.•.•"•.. IN -I , ^ I <:•*- ^^-X. - •^<:<« A ..^.,^^^BV GHAZALA HAiMEED Under the Supervision of DR. ATEEQUE AHMAD DEPARTMENT OF GEOGRAPHY ALIGARH MUSLIM UNIVERSITY ALIGARH (INDIA) 2000 ABSTRACT Settlement has occupied an important place among the visual imprints made by man upon physical landscape, through the process of cultural occupancy since the dawn of civilization. The evolution and growth of settlement in an area is a result of interplay of the prevailing ecological conditions, cultural and social values of the residents, technology, management system and the settling process through time spans settlement refers to an organized colony of human beings ranging from a simple farmstead to a highly complex city and from a temporary camp of hunters or miners to more sedentary houses of farmers and city dwellers. Settlement includes not only the various kinds of buildings put to a variety of uses but also lanes, streets, roads, parks, places of worship and play grounds etc. In the initial stages settlement features bear simple forms and have close relationship with the environment. However, the growth of knowledge and spread of civilization increases the degree of variability in their form and size. The problem of human settlements has emerged as one of the most challenging issues particularly in the under developed countries of the world. About 65 per cent of the world's population still lives in rural areas. Since the country is dominated by agrarian economy and most of the population is concentrated in villages, the study of rural settlements in India should be given prime importance. -

List of JEECUP Institutes

Code Institute Name Type 101 GOVERNMENT POLYTECHNIC, GHAZIABAD Government 102 KM MAYAWATI GOVERNMENT GIRLS POLYTECHNIC, BADALPUR, GAUTAMBUDDHA NAGAR Government 103 SETH GANGASAGAR JATIA POLYTECHNIC, KHURJA, BULANDSHAHAR Government 104 GOVERNMENT POLYTECHNIC, SAHARANPUR Government 105 SAVITRIBAI PHULE GOVERNMENT GIRLS POLYTECHNIC, KUMARHERA, SAHARANPUR Government 106 GOVERNMENT POLYTECHNIC, MORADABAD Government 107 GOVERNMENT GIRLS POLYTECHNIC, MORADABAD Government 108GOVERNMENT POLYTECHNIC, BIJNORE Government 109GOVERNMENT POLYTECHNIC, RAMPUR Government 110GOVERNMENT POLYTECHNIC, MAINPURI Government 111 GOVERNMENT POLYTECHNIC, SORON, KASGANJ Government 112 GOVERNMENT GIRLS POLYTECHNIC, SHAMLI Government 113 GOVERNMENT LEATHER INSTITUTE, AGRA Government 114 GOVERNMENT POLYTECHNIC, FIROZABAD Government 133 CH. MUKHTAR SINGH GOVERNMENT GIRLS POLYTECHNIC DAURALA, MEERUT Government 137 MAHAMAYA POLYTECHNIC OF INFORMATION TECHNOLOGY, MAHAMAYA NAGAR, HATHRAS Government 138 MAHAMAYA POLYTECHNIC OF INFORMATION TECHNOLOGY, AMROHA Government 200 GOVERNMENT GIRLS POLYTECHNIC, LUCKNOW Government 201GOVERNMENT POLYTECHNIC, LUCKNOW Government 203G B PANT POLYTECHNIC, LUCKNOW Government 204 AERONAUTICAL TRAINING INSTITUTE, LUCKNOW Government 205GOVERNMENT POLYTECHNIC, FAIZABAD Government 206 GOVERNMENT GIRLS POLYTECHNIC, FAIZABAD Government 207 CHHATRAPATI SHAHUJI MAHARAJ GOVERNMENTPOLY. AMBEDKARNAGAR Government 208 GOVERNMENT POLYTECHNIC, BARABANKI Government 209GOVERNMENT POLYTECHNIC, GONDA Government 210GOVERNMENT POLYTECHNIC, BAHRAICH Government 211 -

List of Existing Institutes Required to Upload ONLY Affidavit-2 As Per the Format Given in APH-2020-21

List of Existing Institutes Required to Upload ONLY Affidavit-2 As per the Format Given in APH-2020-21 Categories: Change in Minority Status/Change in Name of Bank/Change in Name of Trust/Extended EoA NOTE: The applications of the Institutes mentioned in this list will be Processed Only for EOA Now and After July 2020, the processing for the categories will be done. Application Region State Institute Name Document Required Number_2020-21 1-7001602693 Central Chhattisgarh SHRI SHANKARACHARYA INSTITUTE OF FINE ARTS AND Affidavit-2 As per the format provided in APH 2020-21 COMMUNICATION 1-7012593354 Central Chhattisgarh S.O.S IN ELECTRONICS AND PHOTONICS Affidavit-2 As per the format provided in APH 2020-21 1-7013852647 Central Chhattisgarh GOVERNMENT POLYTECHNIC COLLEGE,SURAJPUR Affidavit-2 As per the format provided in APH 2020-21 1-7002184712 Central Gujarat B. PHARMACY COLLEGE, RAMPURA-KAKANPUR Affidavit-2 As per the format provided in APH 2020-21 1-7002266051 Central Gujarat SMT.CHANDABEN MOHANBHAI PATEL INSTITUTE OF Affidavit-2 As per the format provided in APH 2020-21 COMPUTER APPLICATIONS CMPICA 1-7003279531 Central Gujarat CHRIST INSTITUTE OF MANAGEMENT Affidavit-2 As per the format provided in APH 2020-21 1-7003586097 Central Gujarat D. L. PATEL INSTITUTE OF MANAGEMENT & TECHNOLOGY, Affidavit-2 As per the format provided in APH 2020-21 MBA COLLEGE 1-7003788395 Central Gujarat VIDHYADEEP INSTITUTE OF ENGINEERING AND TECHNOLOGY Affidavit-2 As per the format provided in APH 2020-21 1-7003976264 Central Gujarat D.L.PATEL INSTITUTE