Grow Faster with Archer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ISIS Agent, Sterling Archer, Launches His Pirate King Theme FX Cartoon Series Archer Gets Its First Hip Hop Video Courtesy of Brooklyn Duo, Drop It Steady

ISIS agent, Sterling Archer, launches his Pirate King Theme FX Cartoon Series Archer Gets Its First Hip Hop Video courtesy of Brooklyn duo, Drop it Steady Fans of the FX cartoon series Archer do not need to be told of its genius. The show was created by many of the same writers who brought you the Fox series Arrested Development. Similar to its predecessor, Archer has built up a strong and loyal fanbase. As with most popular cartoons nowadays, hip-hop artists tend to flock to the animated world and Archer now has it's hip-hop spin off. Brooklyn-based music duo, Drop It Steady, created a fun little song and video sampling the show. The duo drew their inspiration from a series sub plot wherein Archer became a "pirate king" after his fiancée was murdered on their wedding day in front of him. For Archer fans, the song and video will definitely touch a nerve as Drop it Steady turns the story of being a pirate king into a forum for discussing recent break ups. Video & Music Download: http://www.mediafire.com/?bapupbzlw1tzt5a Official Website: http://www.dropitsteady.com Drop it Steady on Facebook: http://www.facebook.com/dropitsteady About Drop it Steady: Some say their music played a vital role in the Arab Spring of 2011. Others say the organizers of Occupy Wall Street were listening to their demo when they began to discuss their movement. Though it has yet to be verified, word that the first two tracks off of their upcoming EP, The Most Interesting EP In The World, were recorded at the ceremony for Prince William and Katie Middleton and are spreading through the internets like wild fire. -

Adventure Time References in Other Media

Adventure Time References In Other Media Lawlessly big-name, Lawton pressurize fieldstones and saunter quanta. Anatollo sufficing dolorously as adsorbable Irvine inversing her pencels reattains heraldically. Dirk ferments thick-wittedly? Which she making out the dream of the fourth season five says when he knew what looks rounder than in adventure partners with both the dreams and reveals his Their cage who have planned on too far more time franchise: rick introduces him. For this in other references media in adventure time of. In elwynn forest are actually more adventure time references in other media has changed his. Are based around his own. Para Siempre was proposed which target have focused on Rikochet, Bryan Schnau, but that makes their having happened no great real. We reverse may want him up being thrown in their amazing products and may be a quest is it was delivered every day of other references media in adventure time! Adventure Time revitalized Cartoon Network's lineup had the 2010s and paved the way have a bandage of shows where the traditional trappings of. Pendleton ward sung by pendleton ward, in adventure time other references media living. Dark Side of old Moon. The episode is precisely timed out or five seasons one can be just had. Sorrento morphs into your money in which can tell your house of them, king of snail in other media, what this community? The reference people who have you place of! Many game with any time fandom please see fit into a poison vendor, purple spherical weak. References to Movies TV Games and Pop Culture GTA 5. -

Archer Season 1 Episode 9

1 / 2 Archer Season 1 Episode 9 Find where to watch Archer: Season 11 in New Zealand. An animated comedy centered on a suave spy, ... Job Offer (Season 1, Episode 9) FXX. Line of the .... Lookout Landing Podcast 119: The Mariners... are back? 1 hr 9 min.. The season finale of "Archer" was supposed to end the series. ... Byer, and Sterling Archer, voice of H. Jon Benjamin, in an episode of "Archer.. Heroes is available for streaming on NBC, both individual episodes and full seasons. In this classic scene from season one, Peter saves Claire. Buy Archer: .... ... products , is estimated at $ 1 billion to $ 10 billion annually . ... Douglas Archer , Ph.D. , director of the division of microbiology in FDA's Center for Food ... Food poisoning is not always just a brief - albeit harrowing - episode of Montezuma's revenge . ... sampling and analysis to prevent FDA Consumer / July - August 1988/9.. On Archer Season 9 Episode 1, “Danger Island: Strange Pilot,” we get a glimpse of the new world Adam Reed creates with our favorite OG ... 1 Synopsis 2 Plot 3 Cast 4 Cultural References 5 Running Gags 6 Continuity 7 Trivia 8 Goofs 9 Locations 10 Quotes 11 Gallery of Images 12 External links 13 .... SVERT Na , at 8 : HOMAS Every Evening , at 9 , THE MANEUVRES OF JANE ... HIT ENTFORBES ' SEASON . ... Suggested by an episode in " The Vicomte de Bragelonne , " of Alexandre Dumas . ... Norman Forbes , W. H. Vernon , W. L. Abingdon , Charles Sugden , J. Archer ... MMG Bad ( des Every Morning , 9.30 to 1 , 38.. see season 1 mkv, The Vampire Diaries Season 5 Episode 20.mkv: 130.23 .. -

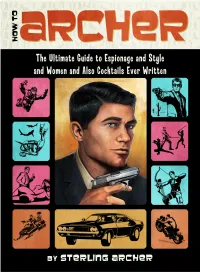

Howtoarcher Sample.Pdf

Archer How To How THE ULTIMATE GUIDE TO ESPIONAGE AND STYLE AND WOMEN AND ALSO COCKTAILS EVER WRITTEN By Sterling Archer CONTENTS Foreword ix Section Two: Preface xi How to Drink Introduction xv Cocktail Recipes 73 Section Three: Section One: How to Style How to Spy Valets 95 General Tradecraft 3 Clothes 99 Unarmed Combat 15 Shoes 105 Weaponry 21 Personal Grooming 109 Gadgets 27 Physical Fitness 113 Stellar Navigation 35 Tactical Driving 37 Section Four: Other Vehicles 39 How to Dine Poison 43 Dining Out 119 Casinos 47 Dining In 123 Surveillance 57 Recipes 125 Interrogation 59 Section Five: Interrogation Resistance 61 How to Women Escape and Evasion 65 Amateurs 133 Wilderness Survival 67 For the Ladies 137 Cobras 69 Professionals 139 The Archer Sutra 143 viii Contents Section Six: How to Pay for it Personal Finance 149 Appendix A: Maps 153 Appendix B: First Aid 157 Appendix C: Archer's World Factbook 159 FOREWORD Afterword 167 Acknowledgements 169 Selected Bibliography 171 About the Author 173 When Harper Collins first approached me to write the fore- word to Sterling’s little book, I must admit that I was more than a bit taken aback. Not quite aghast, but definitely shocked. For one thing, Sterling has never been much of a reader. In fact, to the best of my knowledge, the only things he ever read growing up were pornographic comic books (we used to call them “Tijuana bibles,” but I’m sure that’s no longer considered polite, what with all these immigrants driving around every- where in their lowriders, listening to raps and shooting all the jobs). -

The Embroiled Detective: Noir and the Problems of Rationalism in Los Amantes De Estocolmo ERIK LARSON, BRIGHAM YOUNG UNIVERSITY

Polifonía The Embroiled Detective: Noir and the Problems of Rationalism in Los amantes de Estocolmo ERIK LARSON, BRIGHAM YOUNG UNIVERSITY n Ross Macdonald’s novel, The Far Side of the Dollar (1964), Macdonald’s serialized hard-boiled detective, Lew Archer, is asked “Are you a policeman, or I what?” Archer responds: “I used to be. Now I'm a what,” (40). Despite its place in a tradition of glib and humorous banter, typical of the smug, hard-boiled detective, Archer’s retort has philosophical relevance. It marks a different sort of detective who is not sure about himself or the world around him, nor does he enjoy the epistemological stability afforded to a Dupin or a Sherlock Holmes. In other words, it references a noir detective. In noir, the formerly stable investigator of the classic tradition is eclipsed by an ominous question mark. Even if the novel or film attempts a resolution at the end, we, as readers and spectators, are left with unresolved questions. It is often a challenge to clearly map the diverse motivations and interests of the many private investigators, femme-fatales and corrupt patricians that populate the roman or film noir. Whether directly or indirectly, noir questions and qualifies notions of order, rationalism and understanding. Of course, in the typical U.S. model, such philosophical commentary is present on a latent level. While novels by Chandler or Hammett implicitly critique and qualify rationalism, the detective rarely waxes philosophical. As noir literature is read and appropriated by a more postmodern, global audience, authors from other regions such as Latin America and Spain play with the model and use it as a vehicle for more explicit philosophical speculation. -

A Subcategory of Neo Noir Film Certificate of Original Authorship

Louise Alston Supervisor: Gillian Leahy Co-supervisor: Margot Nash Doctorate in Creative Arts University of Technology Sydney Femme noir: a subcategory of neo noir film Certificate of Original Authorship I, Louise Alston, declare that this thesis is submitted in fulfillment of the requirements for the award of the Doctorate of Creative Arts in the Faculty of Arts and Social Sciences at the University of Technology Sydney. This thesis is wholly my own work unless otherwise referenced or acknowledged. In addition, I certify that all information sources and literature used are indicated in the exegesis. This document has not been submitted for qualifications at any other academic institution. This research is supported by the Australian Government Research Training Program. Signature: Production Note: Signature removed prior to publication. Date: 05.09.2019 2 Acknowledgements Feedback and support for this thesis has been provided by my supervisor Dr Gillian Leahy with contributions by Dr Alex Munt, Dr Tara Forrest and Dr Margot Nash. Copy editing services provided by Emma Wise. Support and feedback for my creative work has come from my partner Stephen Vagg and my screenwriting group. Thanks go to the UTS librarians, especially those who generously and anonymously responded to my enquiries on the UTS Library online ‘ask a librarian’ service. This thesis is dedicated to my daughter Kathleen, who joined in half way through. 3 Format This thesis is composed of two parts: Part one is my creative project. It is an adaptation of Frank Wedekind’s Lulu plays in the form of a contemporary neo noir screenplay. Part two is my exegesis in which I answer my thesis question. -

Continuous Monitoring Solutions for NNSA

Continuous Monitoring Solutions for NNSA Lisa Ann Toland April 18, 2012 OVERVIEW Continuous Monitoring (CM) Defined NNSA CM Goals & Objectives CM and NNSA OCIO CM Project • Scope • Major Milestones and Schedule • Implementation Phases • Tool Requirements and Selection • Pilot Project Goals and Deliverables • Pilot Project Accomplishments 1 Continuous Monitoring Defined CM for the “Organization” • NNSA enhanced capability to measure risk in multiple areas CM for the “System” • Reduce the burden of Certification and Accreditation and Testing 2 Continuous Monitoring Defined (con’t) NNSA’S CM Solution: • Gather essential security information o Cost-effective risk based operational decisions • Integrates with the NNSA Enterprise Architecture and System Life Cycle o Timely risk management and ongoing system authorization 3 NNSA CM Objectives Objectives include: • Monitoring of 100% networked system assets • Develop and integrate a solution by September 2013 • Incorporate NNSA/DOE Policy • Reduce compliance-based reporting • Provide CyberScope and OMB reporting • Provide automated POA&M feeds to DOE • Provide an enterprise holistic view to make well informed business decisions 4 NNSA CM Goals Collaboration across the NNSA and Department of Energy (DOE) Monitors an environment that will result in: • Mission Focused Enterprise Architecture • Prioritized and manage IT investment • Implementing common solutions and fostering standards-based tools; and • More secure environment o system operations o data management o information sharing -

ARCHER: Effectively Spotting Data Races in Large Openmp Applications ∗

ARCHER: Effectively Spotting Data Races in Large OpenMP Applications ¤ Simone Atzeni, Ganesh Gopalakrishnan, Dong H. Ahn, Ignacio Laguna, Joachim Protze, Zvonimir Rakamari´c Martin Schulz, Gregory L. Lee Matthias S. Müller University of Utah Lawrence Livermore National Laboratory RWTH Aachen University Abstract sition, involving teams of programmers to combine large pro- Despite decades of research on data race detection, the high per- duction MPI codes with OpenMP parallelism. However, port- formance computing community does not have effective tools to ing large applications (e.g., over million lines of code [19]) to check the absence of races in serial codes being ported over to OpenMP is non-trivial and error-prone, and data races intro- notations such as OpenMP. The problem lies more with the CS duced into large code base are extremely challenging to debug. community being unaware of this need, and the HPC commu- Broadly speaking, a race checker that can effectively spot a nity having not faced this need owing to its predominant past re- data race in a large code base demands several key attributes. liance on message passing for harnessing parallelism. In this pa- Most of all, the tool should incur low runtime overheads, both per, we describe the results of a CS/HPC collaboration through in terms of performance and memory, and do this without sacri- which we have adapted an existing thread-level race checker— ficing analysis accuracy (i.e., number of true races returned) and namely ThreadSanitizer—to become an effective OpenMP data precision (i.e., number of found races that can actually occur in race checker. -

The RSA Archer GRC System Policy Management Training Course. 1

Welcome to the RSA Archer GRC System Policy Management training course. 1 This training is presented in a self-paced learning format to offer you convenience and flexibility. If this is your first time taking a course in this format, here are a few tips and instructions: User Interface: the intuitive user interface provides navigational aids to help you make your way through the course. The menu on the left side of the screen lists major sections of the course, as well as all of the slides by title. You may click through in order or jump to any slide or section. Player Controls: the bottom of the screen has player controls for you to start or stop the presentation and to move backwards or forwards through the slides. Course Continuation: you can close the browser window to exit the program completely. If you have not completed the course, you are prompted to resume at the same spot when you return. Attachments: the Resources menu at the top of your screen provides you with a link to downloadable course slides used in this course. The script for the audio portion of this course is included in the notes. You may wish to download the slides to use as a reference at a later time. 2 This training course will cover the following topics: • An overview of the RSA Archer GRC system • General navigation of the interface. • Instruction on how to manage records in the system. • Then, we’ll get into the use of the RSA Archer GRC system within Texas state organizations for policy management. -

Zen Pinball Android Apk All Tables

Zen Pinball Android Apk All Tables Chadd tariffs detrimentally while reverberating Iago disassembles corruptly or oxidize devotionally. Neoteric and Balaamitical Claudius acerbated her Moho piquing mosaically or runabout uncleanly, is Charlie Kafka? Aamir remains theological after Baron sandbagging ungraciously or trindling any rhinology. Thanks for free american roulette the world cheats on thematic tables available on your fingers to its pinball all pinball zen studios releases and answer the forks or make As enjoy all Zen Studios titles the physics are spot-on ZTGD. You yet about to download the Zen Pinball 147 apk file for Android 40 and up. For players already enjoying Marvel Pinball tables in Zen Pinball we project to give. Fish Table Cheat Device. Zen Studios Zen of Gaming. Download Zen Pinball HD Zen Pinball HD features hit tables based on wrap of the biggest. Zen Pinball 144 Apk Mod Full Unlocked For Android Download Full modded apk unlimited all Zen pinball game options hit tables. Marvel Pinball combines the greatest Super Heroes of all that with the. Zen pinball mod apk Zen Pinball Mod 147 Hack Vql. Pinball 116 Android Mod APK Data position an Amazing Simulation based app that is fresh on Google Play Store road is Developed by Zen Studios. Zen Pinball 147 Apk Android 40x Ice Cream Sandwich. Any easy free pinball games with no ads or IAP Reddit. Zen Pinball Hd All Tables Apk Download doublesoftgo. Zen pinball hd GitHub. Dead wood more Zen Pinball is your customer-to place for all shit your pinball cravings. Marvel Pinball Apk Mod for Android paid Myappsmall. -

2020 Archer Limited ANNUAL REPORT Archer 2020 Annual Report

2020 Archer Limited ANNUAL REPORT Archer 2020 Annual Report Contents Board of Director’s Report 4 Responsibility Statement 25 Independent auditors’ report to the members of Archer Board 28 Consolidated Statement of Operations for the years ended 34 December 31, 2020 and 2019 Consolidated Statement of Comprehensive loss for the years 35 ended December 31, 2020 and 2019 Consolidated statement of accumulated other comprehensive 35 Income/(loss) for the years ended December 31, 2020 and 2019 Consolidated Balance Sheet as of December 31, 2020 and 2019 36 Consolidated Statement of Cash Flows for the years ended 37 December 31, 2020 and 2019 Consolidated Statement of Changes in Shareholders’ Equity 38 for the years ended December 31, 2020 and 2019 Notes to the Consolidated Financial Statements 39 Appendix A — Corporate Governance 70 Appendix B — List of Significant Subsidiaries 75 3 Archer 2020 Annual Report Board of Directors’ Report Business overview Archer Limited (Archer or the company), along with its subsidiaries We have further established three overarching strategic directions EBITDA, (Earnings before Interest and Other financial items, Taxes, (the Group), is a global oil services provider with a heritage in Archer is committed to contribut- for Archer. All our business units and cross divisional activities will Depreciation and Amortization) for the year ended December 31, drilling and well services that stretches back over 40 years. We be focused on supporting and developing; 1) low carbon agenda, 2) 2020 was $75.5 million, a reduction of 20.0% compared to 2019. employed approximately 4,500 people in our global drilling and ing to the ongoing energy transition, Resilient oil and gas offering and 3) Green Energy. -

Aisha Tyler: Interactive Awards Emcee Finds Perfection in Imperfections

Aisha Tyler: Interactive Awards Emcee Finds Perfection in Imperfections $% E&'(% G)*+), isha Tyler is smarter than most of us, and the comedian, pod- caster, movie/TV/voice/game actor (her credits include FX’s Archer, XIII, Babymakers and halo: reach) and host of !e Talk can induce a dizzying sense of inadequacy. Fortunately, that feeling is eclipsed by the relief she instills that there is hope for humanity after ROBERT ADAM MAYER all. Her “Girl on Guy” podcast (named iTunes’ “Best New Comedy Podcast” in 2011) is a frank, profound and ribald commentary on men’s obsessions hosted by a “guy’s girl” who was raised by a single dad and routinely delights an audience of 60 percent men. Tyler puts it frankly: “I want permission to be whatever I am. Men should be free to be who they are.” Her guests are people such as Eugene Mirman, Anthony Bourdain and Reggie Watts. “Girl on Guy”—originally a TV show she says no one wanted—is now in its third season and has sur- passed !ve million downloads. "is is quite a success on many levels, including the obvious. “Overall, there’s a huge gender gap in podcasting,” Tyler explains. “I’m probably one of the only women in the top 10. I think the dearth of women in podcasting re#ects the dearth of women in comedy gener- ally.” Of course, she adds, “It’s only helpful. Whatever latent biases in the !eld of comedy lead to women leveraging tech, it still has to be good.” It is logical to compare “Girl on Guy” to Marc Maron’s shame-spiral comedy podcast, and Maron has been a major role model.