Ramco Cements (RAMCEM)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Ramco Cements Limited Capacity Additions and Efficiencies to Drive Profitable Growth

The Ramco Cements Limited Capacity additions and efficiencies to drive profitable growth Powered by the Sharekhan 3R Research Philosophy Cement Sharekhan code: RAMCOCEM Result Update Update Stock 3R MATRIX + = - Summary We maintain Buy The Ramco Cements Limited (Ramco) with a revised PT of Rs. 1,250, Right Sector (RS) ü factoring upwardly revised estimates and strong earnings growth outlook. In Q4FY2021, the company reported marginally lower-than-expected operational Right Quality (RQ) ü performance owing to clinker capacity constraints, while net earnings were lower on account of higher tax outgo. Right Valuation (RV) ü The commissioning of 3.75MT clinker capacities in FY2022 would ease clinker capacity constraints, aiding in capturing pent-up demand as COVID-led restrictions + Positive = Neutral - Negative are reversed. The company would unveil the next round of capacity expansion plans, balancing What has changed in 3R MATRIX leverage and growth opportunities. Old New For Q4FY2021, The Ramco Cements Limited (Ramco) reported marginally lower-than-expected operational performance, owing to clinker capacity constraints, while net earnings were lower on RS account of a higher effective tax rate (ETR). Standalone revenue rose by 17.3% y-o-y (up 21.8% q-o-q) to Rs. 1,631 crore, led by a 9.5% y-o-y rise in cement volumes, while blended realisations were up 7.5% y-o-y (almost flat q-o-q). The company witnessed a strong demand environment RQ during Q4FY2021, in line with the industry, which led to 92% utilisation rate based on clinker capacity for Q4FY2021 (March 2021 witnessing 100% utilisation based on clinker capacity). -

The Ramco Cements Estimate Change CMP: INR802 TP: INR750 (-6%) Neutral

3 November 2020 2QFY21 Results Update | Sector: Cement The Ramco Cements Estimate change CMP: INR802 TP: INR750 (-6%) Neutral TP change Beneficiary of South production discipline Rating change Retain Neutral on valuation pricing in strong EPS growth Bloomberg TRCL IN The Ramco Cements’ (TRCL) 2QFY21 results highlight the benefits of high Equity Shares (m) 236 cement prices in South India, which led to the highest ever cement EBITDA/t M.Cap.(INRb)/(USDb) 189.1 / 2.5 at INR1,895 (+94% YoY). Volumes, however, declined 19% YoY due to weak 52-Week Range (INR) 883 / 457 cement demand in South India. 1, 6, 12 Rel. Per (%) 5/27/1 We raise our FY21/FY22E EPS by 26%/5%, factoring in a strong realization 12M Avg Val (INR M) 513 outlook on the back of a strong production discipline in South. However, we retain our Neutral rating on 12.7x FY22E EV/EBITDA pricing in growth. Financial Snapshot (INR bn) Y/E Mar 2020 2021E 2022E Strong realization leads to EBITDA beat despite weak volumes Sales 53.4 54.5 63.2 Revenue/EBITDA/PAT stood at -4%/+52%/+40% YoY to EBITDA 11.1 15.9 16.6 Adj. PAT 6.0 8.5 8.3 INR12.6b/INR4.4b/INR2.4b, v/s our estimate of -3%/ +28%/ +28%. The beat EBITDA Margin (%) 20.8 29.2 26.3 was led by higher-than-expected realization at INR5,558/t (est. INR5,514/t). Adj. EPS (INR) 25.5 35.9 35.0 Sales volumes declined 19% YoY to 2.21mt (v/s est. -

Market Update

Market Update April 2021 The markets ended the month of March 2021 with minor gains of 1.1%. Pan-India Covid-19 Forecasted Trends However, the volatility during the month continued to be high. 120000 Concerns of “taper tantrum” and a 2nd wave of Covid-19 cases in 100000 India led to cautiousness and bouts of selloffs. However, economic 80000 indicators and economic recovery enthused investors, leading to 60000 investment interest at every reaction. Broader markets were also 40000 flattish with the BSE Mid-cap and BSE Small-cap 250 indices gaining 1% 20000 and 0.7% respectively. 0 The financial year 2021 turned out to be one of the most eventful year. 02 Mar-20 31 May-21 Starting with Covid-19 related scare and one of the sharpest Daily New Cases Predicted path (27-Oct to 22-Dec) Predicted path (2-Mar to 26-Oct) corrections in recent times, markets ended with a lot of hope, Predicted path (15-Feb to 23-Mar) 7 per, Mov, Avg (Daily Cases) optimism and spectacular gains. Nifty 50 gained a superb 71% for Source: SBI Report FY21, with the broader markets doing much better. The month started on a positive note as after two quarters of Injection to Infection Ratio 7.0 6.1 6.3 6.5 contraction, 3QFY21 GDP grew at 0.4% and vaccination drive gained 6.0 steam. However, the rapid spurt in Covid-19 cases, imposition of 5.0 4.3 3.9 4.0 2.8 lockdowns, night curfews in some parts of India, elevated crude prices 3.0 2.3 2.8 and jump in bond yields weighed on sentiments. -

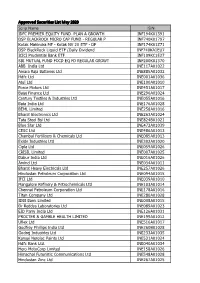

Group1 MAY-2020 APPROVED LIST

Approved Securities List May 2020 Scrip Name ISIN IDFC PREMIER EQUITY FUND PLAN A GROWTH INF194K01391 DSP BLACKROCK MICRO CAP FUND - REGULAR P INF740K01797 KotAk MAhindrA MF - KotAk NV 20 ETF - DP INF174K01Z71 DSP BlAckRock Liquid ETF (Daily Dividend INF740KA1EU7 ICICI PrudentiAl BAnk ETF INF109KC1E27 SBI MUTUAL FUND FOCD EQ FD REGULAR GROWT INF200K01370 ABB IndiA Ltd INE117A01022 AmArA RAjA BAtteries Ltd INE885A01032 Hdfc Ltd INE001A01036 Atul Ltd INE100A01010 Force Motors Ltd INE451A01017 BajAj FinAnce Ltd INE296A01024 Century Textiles & Industries Ltd INE055A01016 BatA IndiA Ltd INE176A01028 BEML Limited INE258A01016 BhArAt Electronics Ltd INE263A01024 Tata Steel Bsl Ltd INE824B01021 Blue StAr Ltd INE472A01039 CESC Ltd INE486A01013 ChAmbAl Fertilisers & ChemicAls Ltd INE085A01013 Exide Industries Ltd INE302A01020 CiplA Ltd INE059A01026 CRISIL Limited INE007A01025 Dabur IndiA Ltd INE016A01026 Arvind Ltd INE034A01011 BhArAt HeAvy ElectricAls Ltd INE257A01026 HindustAn Petroleum CorporAtion Ltd INE094A01015 IFCI Ltd INE039A01010 MangAlore Refinery & PetrochemicAls Ltd INE103A01014 ChennAi Petroleum CorporAtion Ltd INE178A01016 Titan CompAny Ltd INE280A01028 IDBI BAnk Limited INE008A01015 Dr Reddys LAborAtories Ltd INE089A01023 EID PArry IndiA Ltd INE126A01031 PROCTER & GAMBLE HEALTH LIMITED INE199A01012 Uflex Ltd INE516A01017 Godfrey Phillips IndiA Ltd INE260B01028 Godrej Industries Ltd INE233A01035 KansAi NerolAc PAints Ltd INE531A01024 Hdfc BAnk Ltd. INE040A01034 Hero MotoCorp Limited INE158A01026 HimAchAl Futuristic CommunicAtions Ltd -

Cement Update

Monthly Report - DECEMber 2020 Cement Update Monthly Report December 2020 | 1 TABLE OF CONTENTS JSW owned Shiva Cement to invest Rs 1,500 crore on clinker facility in Odisha .................. 07 UltraTech to invest Rs 5,477 crore towards 12.8 mtpa capacity expansion .................. 09 ACC and Ambuja Cement to invest Rs 780 crore to set up waste heat recovery .................. 10 power plants Southern India sees boost in cement prices .................. 11 Disclaimer: The information contained in this market update is drawn from wide range of newspapers, business and trade magazines, government, company and industry association websites. While all possible care is taken to verify the correctness and authenticity of information contained in this compilation, no claim to independent authorship of articles is implied or intended. Readers are expected to make their own independent evaluation and verification of information for their use. While all information contained in this report are believed to be correct, the editors of this compilation or J.M.Baxi & Co. do not guarantee the quotes or other data Monthly Report December 2020 | 2 PORT ANALYSIS Cement Traffic at Indian Ports (Qty in Millions Tonnes) Monthly Report December 2020 | 3 CEMENT TRAFFIC AT INDIAN PORTS (QTY IN MILLION TONNES) Port Name Apr-Oct 2020 Apr-Oct 2019 Variance Y-o-Y BEDI 0.048 0 0.048 COCHIN 0.634 0.775 -0.141 DHAMRA 0 0.213 -0.213 DHARAMTAR 0.057 0.148 -0.091 GANGAVARAM 0 0.157 -0.157 GOPALPUR 0.025 0.075 -0.05 HALDIA 0.162 0.38 -0.218 JNPT 0.309 0.522 -0.212 KANDLA 0.008 0 0.008 KAKINADA 0.224 0.128 0.096 KARAIKAL 0 0.101 -0.101 KRISHNAPATNAM 0.571 0.415 0.156 MANGALORE 0.204 0.12 0.085 MUMBAI 0.024 0.006 0.018 MUNDRA 0 0.028 -0.028 PIPAVAV 1.397 1.578 -0.181 PORBANDAR 0.033 0.054 -0.021 PORT BLAIR 0.001 0.012 -0.011 TUTICORIN 0.125 0.103 0.022 Grand Total 3.822 4.812 -0.99 Monthly Report December 2020 | 4 CEMENT IMPORTS - APR - OCT 2020 (QTY IN MILLION TONNES) SRI LAN- IMPORTER BANGLADESH COASTAL IRAN OMAN U.A.E. -

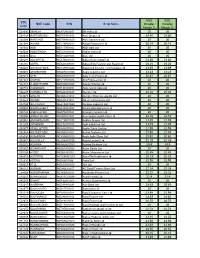

BSE Code NSE Code ISIN Scrip Name NSE Intraday Margin % BSE

NSE BSE BSE NSE Code ISIN Scrip Name Intraday Intraday Code Margin % Margin % 523395 3MINDIA INE470A01017 3M India Ltd 20 20 524348 AARTIDRUGS INE767A01016 Aarti Drugs Ltd 24.86 24.86 524208 AARTIIND INE769A01020 Aarti Industries Ltd 20 20 541988 AAVAS INE216P01012 Aavas Financiers Ltd 20.14 20.14 500002 ABB INE117A01022 ABB India Ltd 20 20 500488 ABBOTINDIA INE358A01014 Abbott India Ltd 20 20 500410 ACC INE012A01025 ACC Ltd 20 20 540691 ABCAPITAL INE674K01013 Aditya Birla Capital Ltd 23.86 23.86 535755 ABFRL INE647O01011 Aditya Birla Fashion and Retail Ltd 20.25 20.25 540025 ADVENZYMES INE837H01020 Advanced Enzyme Technologies Ltd 23.89 23.89 500003 AEGISCHEM INE208C01025 Aegis Logistics Ltd 23.23 23.23 500215 ATFL INE209A01019 Agro Tech Foods Ltd 20.87 20.87 532683 AIAENG INE212H01026 AIA Engineering Ltd 20 20 532331 AJANTPHARM INE031B01049 Ajanta Pharma Ltd 20 20 500710 AKZOINDIA INE133A01011 Akzo Nobel India Ltd 20 20 506235 ALEMBICLTD INE426A01027 Alembic Ltd 25.32 25.32 533573 APLLTD INE901L01018 Alembic Pharmaceuticals Ltd 20 20 539523 ALKEM INE540L01014 Alkem Laboratories Ltd 20 20 532749 ALLCARGO INE418H01029 Allcargo Logistics Ltd 20 20 500008 AMARAJABAT INE885A01032 Amara Raja Batteries Ltd 20 20 500425 AMBUJACEM INE079A01024 Ambuja Cements Ltd 20 20 590006 AMRUTANJAN INE098F01031 Amrutanjan Health Care Ltd 22.16 22.16 590062 ANDHRSUGAR INE715B01013 Andhra Sugars Ltd 24.09 24.09 532259 APARINDS INE372A01015 Apar Industries Ltd 21.08 21.08 500877 APOLLOTYRE INE438A01022 Apollo Tyres Limited 22.55 22.55 542484 ARVINDFASN INE955V01021 -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd. -

Inner 25 Resources & Energy Fund

Modera erate tely Mod High to H w te ig o ra h L de o M V e r y w H Tata Resources & Energy Fund o i L g (An open ended equity scheme investing in Resources and Energy Sector) h Riskometer Investors understand that their principal As on 30th April 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily focuses on investment in at least 80% of its net Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets assets in equity/equity related instruments of the companies in the Resources & Energy sectors in India. Equity & Equity Related Total 8050.68 99.20 Vedanta Ltd. 170000 437.33 5.39 Cement National Aluminium Co. Ltd. 510000 329.72 4.06 INVESTMENT OBJECTIVE Ultratech Cement Ltd. 7500 470.92 5.80 Pesticides The investment objective of the scheme is to provide long term capital appreciation by investing atleast 80% Grasim Industries Ltd. 28500 399.50 4.92 Upl Ltd. 35000 212.42 2.62 of it’s net assets in equity/equity related instruments of the companies in the Resources& Energy sectors in Ambuja Cements Ltd. 75000 231.79 2.86 Bayer Cropscience Ltd. 3000 160.41 1.98 India.However, there is no assurance or guarantee that ACC Ltd. 12000 225.93 2.78 Pi Industries Ltd. 3800 95.44 1.18 the investment objective of the Scheme will be achieved.The Scheme does not assure or guarantee any Heidelberg Cement India Ltd. -

Corporate Action Tracker

Corporate Action Tracker st nd Corporate Action a nd Result Calendar May 21 – Jun 02 , 2018 Bonus Company Ratio Ex-Date G.M.Breweries 1:4 21-May-18 Coastal Corporation 3:1 23-May-18 Split Company Ratio Ex-Date Gaekwar Mills 100:10 31-May-18 Right N.A. Buyback Company Ex Date Start Date End Date Offer Price Smartlink Holdings 17-May-18 -- -- 120.00 Netlink Solutions (India) 18-May-18 -- -- 17.00 Open Offer Company Start Date End Date Offer Price Envair Electrodyne 11-May-18 25-May-18 32.50 Rajputana Investment and Finance 15-May-18 28-May-18 11.50 Econo Trade (India) 16-May-18 29-May-18 20.00 HK Trade International 17-May-18 30-May-18 20.00 Xchanging Solutions 18-May-18 31-May-18 55.22 Dividend for May 21st – Jun 02nd, 2018 Dividend Company Type (In Rs) Ex-Date Merck Dividend 15.00 21-May-18 Mold-Tek Technologies Interim Dividend 0.30 21-May-18 Mold-Tek Packaging Interim Dividend 2.00 21-May-18 Raymond Dividend 3.00 22-May-18 R Systems International Interim Dividend 0.60 22-May-18 Gateway Distriparks Interim Dividend 4.00 23-May-18 GHCL Dividend 5.00 23-May-18 DCB Bank Dividend 0.75 24-May-18 Ingersoll-Rand (India) Interim Dividend 202.00 24-May-18 Trident Final Dividend 0.30 24-May-18 ITC Dividend 5.15 25-May-18 Colgate-Palmolive (India) Interim Dividend -- 29-May-18 Manappuram Finance Interim Dividend 0.50 29-May-18 Suyog Telematics Interim Dividend 1.00 29-May-18 Oberoi Realty Dividend 2.00 31-May-18 Page Industries Interim Dividend -- 31-May-18 Responsive Industries Dividend 0.10 31-May-18 1 Corporate Action Result Calendar for May 21st – Jun 02nd, 2018 Date: 21-May-18 63 moons Technologies AstraZeneca Pharma India CCL Products (India) Colgate Palmolive (India) DLF Dhunseri Petrochem Dhunseri Tea & Industries Future Retail GSPL IL&FS Transportation IMFA Just Dial Mahanagar Gas Motilal Oswal Fin Services Navkar Corporation Petronet LNG Redington (India) Timken India TTK Prestige Date: 22-May-18 Andhra Bank Bata India Bharat Forge Bosch Capital Trust CARE Ratings Cipla Dr. -

Consolidating Strengths. Ready for Future

ANNUAL REPORT 2020-21 Consolidating Strengths. Ready for Future. Contents Corporate overview 01 Introduction to theme GUIDED BY HIS VALUES 02 Company overview 04 Manufacturing facilities 06 Geographic presence 08 Product suite 10 Quarterly highlights 12 Key performance indicators 16 Chairman’s message 18 CEO’s message 20 Corporate strengths 22 Capacity expansion 26 Product diversity 28 Innovation 32 Technology 34 Sustainability Shri. P.A.C. Ramasamy Raja 36 Sustainability – Environment Founder 38 Sustainability – Social 1894-1962 44 Biodiversity 46 Sustainability – Governance 48 Board of Directors 50 Leadership team BUilt BY HIS VISION 51 Senior executive team 52 Awards and accolades 54 15-year highlights 55 Corporate information Statutory reports 56 Notice to the Members 64 Board’s Report 116 Business Responsibility Report Financial statements 125 Separate financial statements 203 Consolidated financial statements “Gurubakthamani” Shri. P. R. Ramasubrahmaneya Rajha 10 Sridharmarakshakar - Former Chairman Cement manufacturing 1935-2017 facilities Lives of great men all remind 1 us, we can make our lives R&D centre sublime, and, departing, leave behind us, footprints on More than 6 decades the sands of time of experience Read online or download this report at www.ramcocements.in Consolidating strengths. Ready for future. We believe that the key to achieving long-term growth and be future-ready remains in our ability to strategically leverage our strengths and seize opportunities. At Ramco Cements, this is what we Our scale, integrated and responsible have been doing with single-minded operations, innovation capabilities and and unwavering focus. We have been network, reinforces our confidence continually augmenting capacities in in a growing Indian economy where new strategic locations with increased the rapid infrastructure creation and emphasis on integration for logistics and the reviving real estate demand are cost efficiencies and on sustainability bound to unleash mega opportunities. -

Portfolio Scanner – December 2018

Portfolio Scanner – December 2018 Portfolio Data as on December 31, 2018 1 Investment Approach & Portfolio Details Top 10 Count of Debt / Scheme Name Stock Picking Approach Benchmark Index Holdings (%) Stocks Cash (%) L&T Equity Fund No bias, go-anywhere strategy S&P BSE 500 TRI 40.30 61 2.9 L&T India Large Cap Fund Bottom-up with focus on largecap stocks S&P BSE 100 TRI 48.52 53 2.6 L&T Large and Midcap Invest in a mix of large and midcap stocks S&P BSE 200 TRI 35.78 58 3.4 Fund with portfolio tilt towards midcap. L&T Midcap Fund Bottom-up with focus on midcap stocks Nifty Midcap 100 TRI 22.52 77 13.7 L&T Emerging Businesses Focus on investing in emerging S&P BSE Smallcap 21.73 86 7.5 Fund businesses TRI L&T India Value Fund Bottom-up with a value bias S&P BSE 200 TRI 38.67 81 2.6 Cyclical / Defensive stocks based on the L&T Business Cycles Fund S&P BSE 200 TRI 33.46 62 1.4 business cycle Invest in 30 high conviction stocks by L&T Focused Equity Fund Nifty500 TRI 44.55 26 15.8 taking a concentrated position. Stocks related to, or benefiting from L&T Infrastructure Fund Nifty Infrastructure TRI 45.22 48 1.8 growth in Infrastructure sector Focus on companies with strong balance L&T Tax Advantage Fund S&P BSE 200 TRI 35.15 63 3.4 sheet. 2 For product labeling please refer to the last page.