FORM SD Specialized Disclosure Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States Securities and Exchange Commission Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM SD SPECIALIZED DISCLOSURE REPORT RIBBON COMMUNICATIONS INC. (Exact Name of Registrant as Specified in its Charter) DELAWARE 001-38267 82-1669692 (State or Other Jurisdiction (Commission File Number) (IRS Employer of Incorporation) Identification No.) 4 TECHNOLOGY PARK DRIVE, WESTFORD, MASSACHUSETTS 01886 (Address of Principal Executive Offices) (Zip Code) Justin K. Ferguson, Executive Vice President, General Counsel and Secretary (978) 614-8100 (Name and telephone number, including area code, of the person to contact in connection with this report) Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies: ☒ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2019. Section 1 — Conflict Minerals Disclosure Item 1.01. Conflict Minerals Disclosure and Report Ribbon Communications Inc. (the “Company” or “Ribbon”) has determined that some of the products that it manufactured or contracted to manufacture through the end of reporting year 2019 (“Ribbon Products”), include gold, columbite-tantalite (coltan), cassiterite and wolframite, including their derivatives, tantalum, tin and tungsten (collectively, “Conflict Minerals”). The Company has further determined that these Conflict Minerals are necessary to the functionality or production of the Ribbon Products. The Company conducted a Reasonable Country of Origin Inquiry (“RCOI”) to determine whether any of the Conflict Minerals in the Ribbon Products originated in the Democratic Republic of the Congo or an adjoining country (“Covered Country”) and whether the Conflict Minerals are from recycled or scrap sources. -

The Mineral Industry of China in 2016

2016 Minerals Yearbook CHINA [ADVANCE RELEASE] U.S. Department of the Interior December 2018 U.S. Geological Survey The Mineral Industry of China By Sean Xun In China, unprecedented economic growth since the late of the country’s total nonagricultural employment. In 2016, 20th century had resulted in large increases in the country’s the total investment in fixed assets (excluding that by rural production of and demand for mineral commodities. These households; see reference at the end of the paragraph for a changes were dominating factors in the development of the detailed definition) was $8.78 trillion, of which $2.72 trillion global mineral industry during the past two decades. In more was invested in the manufacturing sector and $149 billion was recent years, owing to the country’s economic slowdown invested in the mining sector (National Bureau of Statistics of and to stricter environmental regulations in place by the China, 2017b, sec. 3–1, 3–3, 3–6, 4–5, 10–6). Government since late 2012, the mineral industry in China had In 2016, the foreign direct investment (FDI) actually used faced some challenges, such as underutilization of production in China was $126 billion, which was the same as in 2015. capacity, slow demand growth, and low profitability. To In 2016, about 0.08% of the FDI was directed to the mining address these challenges, the Government had implemented sector compared with 0.2% in 2015, and 27% was directed to policies of capacity control (to restrict the addition of new the manufacturing sector compared with 31% in 2015. -

China Weigao Reducer Success Case (Large Enterprise Version) Serial Company Name Serial Company Name

China Weigao reducer success case (large enterprise version) serial Company Name serial Company Name 1 Shanghai Automobile Group Co., Ltd. 231 Chongqing Textile Holding (Group) Company 2 Dongfeng Motor Corporation 232 Aoyang Group Co., Ltd. 3 Huawei Investment Holdings Co., Ltd. 233 Guangxi Shenglong Metallurgy Co., Ltd. 4 China Ordnance Equipment Group Corporation 234 Lingyuan Iron and Steel Group Co., Ltd. 5 China Minmetals Corporation 235 Futong Group Co., Ltd. 6 China FAW Group Corporation 236 Yongfeng Group Co., Ltd. 7 China Ordnance Industry Corporation 237 Shandong Taishan Iron and Steel Group Co., Ltd. 8 Beijing Automobile Group Co., Ltd. 238 Xinjiang Zhongtai (Group) Co., Ltd. 9 Shandong Weiqiao Venture Group Co., Ltd. 239 Guangdong Haida Group Co., Ltd. 10 China Aviation Industry Corporation 240 Jiangsu Yangzijiang Shipbuilding Group Corporation 11 Zhengwei International Group Co., Ltd. 241 Shenzhen Oufeiguang Technology Co., Ltd. 12 China Baowu Iron and Steel Group Co., Ltd. 242 Dongchen Holding Group Co., Ltd. 13 Lenovo Holdings Co., Ltd. 243 Xinjiang Goldwind Technology Co., Ltd. 14 China National Chemical Corporation 244 Wanji Holding Group Co., Ltd. 15 Hegang Group Co., Ltd. 245 Tsingtao Brewery Co., Ltd. 16 China Shipbuilding Industry Corporation 246 Tasly Holding Group Co., Ltd. 17 Guangzhou Automobile Industry Group Co., Ltd. 247 Wanfeng Auto Holding Group Co., Ltd. 18 Aluminum Corporation of China 248 Wuhan Institute of Posts and Telecommunications 19 China National Building Material Group Co., Ltd. 249 Red Lion Holdings Group Co., Ltd. 20 Hengli Group Co., Ltd. 250 Xinjiang Tianye (Group) Co., Ltd. 21 CRRC Corporation Limited 251 Juhua Group Company 22 Xinxing Jihua Group Co., Ltd. -

Allot Communications Ltd

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 __________________ Form SD __________________ Specialized Disclosure Report Allot Communications Ltd. Israel 001-33129 N/A (State or other jurisdiction of incorporation) (Commission File Number) (I.R.S. Employer Identification No.) 22 Hanagar Street Neve Ne’eman Industrial Zone B Hod-Hasharon 4501317 Israel Rael Kolevsohn General Counsel Tel +972-9-7619200 Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies: ☒ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2015. SECTION 1 – CONFLICT MINERALS DISCLOSURE Item 1.01 Conflict Minerals Disclosure and Report Introduction This Specialized Disclosure Form (“Form SD”) of Allot Communications Ltd. (the “Company,” “we,” or “us”) is filed pursuant to Rule 13p-1 (the “Rule”) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the reporting period from January 1, 2015 to December 31, 2015. The Rule requires disclosure of certain information when a company manufactures or contracts to manufacture products for which the minerals specified in the Rule are necessary to the functionality or production of those products. The specified minerals are gold, columbite-tantalite (coltan), cassiterite and wolframite, including their derivatives, which are limited to tantalum, tin and tungsten (collectively, the “Conflict Minerals”), -

DIGITAL ECONOMY GROWTH and MINERAL RESOURCES Implications for Developing Countries

DIGITAL ECONOMY GROWTH AND MINERAL RESOURCES Implications for Developing Countries No16 UNCTAD, DIVISION ON TECHNOLOGY AND LOGISTICS SCIENCE, TECHNOLOGY AND ICT BRANCH ICT POLICY SECTION TECHNICAL NOTE NO16 UNEDITED TN/UNCTAD/ICT4D/16 DECEMBER 2020 Digital economy growth and mineral resources: 1 implications for developing countries Abstract: This technical note examines the link between growing digitalization of the world economy and the demand for various elements. It feeds into the overall research work of the UNCTAD E- commerce and Digital Economy (ECDE) work programme. The study focuses on the following issues in view of the growing use of digital technologies: What metals/minerals will be more demanded as a result?; What changes in demand can be expected compared with today's situation?; Which mineral-rich developing countries are likely to be most affected by the growth in demand of different metals and minerals?; Which are the main actors (including possibly new actors such as digital companies) involved in the extraction, smelting and refining of these minerals and metals?; and How recyclable will these "new" metals be and to what extent may they be adding to the problem of "e-waste"? Based primarily on desk top research, complemented by a few interviews with representatives from industry and academia, the study deals primarily with the functional parts of computers and other devices, which are at the core of the digital economy. Demands for raw materials from the structural parts of the devices and the networks necessary as well as their energy supply and the consequences of the transition to a fossil free world are not covered. -

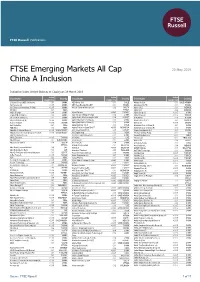

FTSE Emerging Markets All Cap China a Inclusion

FTSE Russell Publications FTSE Emerging Markets All Cap 20 May 2019 China A Inclusion Indicative Index Weight Data as at Closing on 29 March 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 21Vianet Group (ADS) (N Shares) 0.01 CHINA AES Gener S.A. 0.01 CHILE Almarai Co Ltd 0.01 SAUDI ARABIA 360 Security (A) <0.005 CHINA AES Tiete Energia SA UNIT 0.01 BRAZIL Alpargatas SA PN 0.01 BRAZIL 361 Degrees International (P Chip) <0.005 CHINA African Rainbow Minerals Ltd 0.02 SOUTH Alpek S.A.B. 0.01 MEXICO 3M India 0.01 INDIA AFRICA Alpha Bank 0.04 GREECE 3SBio (P Chip) 0.04 CHINA Afyon Cimento <0.005 TURKEY Alpha Group (A) <0.005 CHINA 51job ADR (N Shares) 0.03 CHINA Agile Group Holdings (P Chip) 0.04 CHINA Alpha Networks <0.005 TAIWAN 58.com ADS (N Shares) 0.12 CHINA Agility Public Warehousing Co KSC 0.04 KUWAIT ALROSA ao 0.06 RUSSIA 5I5j Holding Group (A) <0.005 CHINA Agricultural Bank of China (A) 0.06 CHINA Alsea S.A.B. de C.V. 0.02 MEXICO A.G.V. Products <0.005 TAIWAN Agricultural Bank of China (H) 0.26 CHINA Altek Corp <0.005 TAIWAN Aarti Industries 0.01 INDIA Aguas Andinas S.A. A 0.03 CHILE Aluminum Corp of China (A) 0.01 CHINA ABB India 0.02 INDIA Agung Podomoro Land Tbk PT <0.005 INDONESIA Aluminum Corp of China (H) 0.03 CHINA Abdullah Al Othaim Markets <0.005 SAUDI ARABIA Ahli United Bank B.S.C. -

1994, the Communist Party Emphasized the Theme but These Taxes Would Eventually Be Brought in Line with the of Stability Rather Than Reform in a Resolute Way

THE MINERAL INDUSTRY OF CHINA By Pui-Kwan Tse1 China, the most populous country in the world, faced dwindling share of revenues. A uniform 33% tax rate on all enormous challenges in managing its transition from a central enterprises replaced the 55% tax levied on large- and planning system to a market oriented system. At the fourth medium-size enterprises. Preferential taxes on foreign plenary session of the 14th central committee held in enterprises and joint ventures would not be affected initially, September 1994, the Communist Party emphasized the theme but these taxes would eventually be brought in line with the of stability rather than reform in a resolute way. The rate of those levied on domestic enterprises. A value-added- Government expressed concerns about rising prices, unrest tax (VAT) would be applied at an uniform rate of 17% on all among the unemployed, agitation by peasants whose incomes goods in circulation, but an additional excise tax would be have been squeezed by rising costs, and the greater incidence levied on such luxury items as cigarettes, alcohol, cosmetic of crime across the country. products, gas, and petroleum. A mineral resource fee, or a In 1994, China's gross domestic product (GDP) grew tax from 1% to 4%, would be levied on each mining 11.8%, the cost of living increased by 24.1%, and retail operator. Also, China replaced its official two-tiered prices rose by 21.7% compared with those of previous year.2 exchange rate with a single unified rate. The Government also found the task of reforming state- An important legal framework, the Company Law, was owned enterprises more challenging and politically riskier passed in 1994. -

This “Report”) for the Year Ended December 31, 2015 Is Presented by Merit Medical Systems, Inc

CONFLICT MINERALS REPORT MERIT MEDICAL SYSTEMS, INC. YEAR ENDED DECEMBER 31, 2015 This Conflict Minerals Report (this “Report”) for the year ended December 31, 2015 is presented by Merit Medical Systems, Inc. (“Merit”) to comply with Rule 13p-1 under the Securities Exchange Act of 1934 (the “Rule”). The Rule was adopted by the Securities and Exchange Commission (“SEC”) to implement reporting and disclosure requirements related to conflict minerals as directed by the Dodd- Frank Wall Street Reform and Consumer Protection Act of 2010. The Rule imposes certain reporting obligations on SEC registrants whose manufactured products contain conflict minerals which are necessary to the functionality or production of their products. Conflict minerals are defined as cassiterite, columbite-tantalite, gold, wolframite, and their derivatives, which are limited to tin, tantalum, tungsten, and gold (“3TG”). COMPANY OVERVIEW Founded in 1987, Merit set out to build the world’s most customer-focused healthcare company by understanding customers’ needs, and innovating and delivering a diverse range of products that improve the lives of people, families, and communities throughout the world. Merit’s primary products consist of inflation devices used in angioplasty and stent placement; diagnostic and therapeutic catheters used for various procedures in cardiology and radiology; diagnostic and hydrophilic products used to manage and monitor the administration of contrast media and other fluid solutions; thrombolytic catheters and fluid dispensing systems; embolotherapeutic -

Semi-Annual Report DBX ETF Trust

November 30, 2020 Semi-Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Portfolio Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 3 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 4 Xtrackers MSCI All China Equity ETF .................................................... 5 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 6 Fees and Expenses ....................................................................... 7 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 8 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 13 Xtrackers MSCI All China Equity ETF .................................................... 21 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 26 Statements of Assets and Liabilities ........................................................ 34 Statements of Operations ................................................................. 35 Statements of Changes in Net Assets ....................................................... 36 Financial Highlights -

Civeo Corporation (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM SD/A SPECIALIZED DISCLOSURE REPORT (Amendment No. 1) Civeo Corporation (Exact name of registrant as specified in its charter) British Columbia, Canada 001-36246 98-1253716 (State or Other Jurisdiction (Commission (IRS Employer of Incorporation) File Number) Identification No.) Three Allen Center, 333 Clay Street, Suite 4980 77002 Houston, Texas (Address of Principal Executive Offices) (Zip Code) Frank C. Steininger (713) 510-2400 (Name and telephone number, including area code, of the person to contact in connection with this report.) Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies: ☒ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2016. Explanatory Note This Amendment No. 1 on Form SD/A to the Special Disclosure Report on Form SD of Civeo Corporation for the reporting period from January 1 to December 31, 2016, which was filed with the Securities and Exchange Commission on May 25, 2017 (the “Original Form SD Report”), is being filed solely for purposes of 1) amending and restating in its entirety Section 3, including the chart of smelters and refiners listed therein, of the Conflict Minerals Report filed as an exhibit to the Original Form SD Report, and 2) amending and restating in its entirety Section 4 of the Conflict Minerals Report filed as an exhibit to the Original Form SD Report. Section 1 – Conflict Minerals Disclosure Item 1.01 Conflict Minerals Disclosure and Report 1. -

Asia Satellite Telecommunications Holdings Limited 亞洲衛星控股有限

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this Circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Asia Satellite Telecommunications Holdings Limited, you should at once forward this Circular with the enclosed proxy form to the purchaser or transferee or to the stockbroker, bank or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this Circular, make no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Circular. Asia Satellite Telecommunications Holdings Limited 亞 洲 衛 星 控 股 有 限 公 司* (Incorporated in Bermuda with limited liability) (Stock Code: 1135) PROPOSED GRANT OF GENERAL MANDATES TO ISSUE SHARES AND REPURCHASE SHARES AND RE-ELECTION OF RETIRING DIRECTORS AND NOTICE OF ANNUAL GENERAL MEETING A notice convening the annual general meeting of Asia Satellite Telecommunications Holdings Limited to be held at 12th Floor, Harbour Centre, 25 Harbour Road, Wanchai, Hong Kong on 14 June 2019 at 10:00 a.m. is set out on pages 10 to 20 of this Circular. If you are not able to attend and/or vote at the annual general meeting in person, you are requested to complete the accompanying proxy form in accordance with the instructions printed thereon and return thesametotheCompany’s share registrar in Hong Kong, Computershare Hong Kong Investor Services Limited at 17M Floor, Hopewell Centre, 183 Queen’s Road East, Wanchai, Hong Kong as soon as possible and in any event not less than 48 hours before the time appointed for holding the meeting or any adjournment thereof. -

The Next Chapter of Chinese Outbound M&A

Emerging from the twilight: the next chapter of Chinese outbound M&A October 2010 Chinese Services Group Emerging from the twilight: the next chapter of Chinese outbound M&A Foreword 4 Executive summary 5 Methodology 7 China outbound M&A overview 9 Northern China outbound M&A brief 11 Eastern China outbound M&A brief 15 Southern China outbound M&A brief 19 Sector spotlights Automotive 21 Financial Services 27 Mining 35 Oil & Gas 44 China's M&A investments into Brazil, India, and Russia 51 Introducing Deloitte's Chinese Services Group 64 China outbound historical data 67 Deloitte contacts 78 Emerging from the twilight: the next chapter of Chinese outbound M&A 3 Foreword: Emerging from the twilight Last year’s report on Chinese outbound M&A Looking forward, industry practitioners are activity begun by noting that China has truly broadly bullish on growth prospects, suggesting stepped onto the world stage. If that was that as China continues to play an increasingly true, then Emerging from the twilight: the next important role within the global economy, chapter of Chinese outbound M&A should outbound acquisitions will be conducted more really begin with a glowing reflection of China’s frequently as corporate players look to expand performance in what is almost certainly the market share overseas. Brand acquisitions, as well opening act of a long chronicle. as the purchase of advanced technologies are also crucial drivers of outbound M&A, while on What a glowing rendition it is. From the the Energy and Oil & Gas front, Chinese miners beginning of the third quarter of 2009 to the and power generators are almost universally end of the second quarter of 2010, Chinese scouring the globe for controlling stakes in businesses undertook 143 transactions abroad, mineral extractors.