Monthly Economic Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Exchange Indices

Global Exchange Indices Country Exchange Index Argentina Buenos MERVAL, BURCAP Aires Stock Exchange Australia Australian S&P/ASX All Ordinaries, S&P/ASX Small Ordinaries, Stock S&P/ASX Small Resources, S&P/ASX Small Exchange Industriials, S&P/ASX 20, S&P/ASX 50, S&P/ASX MIDCAP 50, S&P/ASX MIDCAP 50 Resources, S&P/ASX MIDCAP 50 Industrials, S&P/ASX All Australian 50, S&P/ASX 100, S&P/ASX 100 Resources, S&P/ASX 100 Industrials, S&P/ASX 200, S&P/ASX All Australian 200, S&P/ASX 200 Industrials, S&P/ASX 200 Resources, S&P/ASX 300, S&P/ASX 300 Industrials, S&P/ASX 300 Resources Austria Vienna Stock ATX, ATX Five, ATX Prime, Austrian Traded Index, CECE Exchange Overall Index, CECExt Index, Chinese Traded Index, Czech Traded Index, Hungarian Traded Index, Immobilien ATX, New Europe Blue Chip Index, Polish Traded Index, Romanian Traded Index, Russian Depository Extended Index, Russian Depository Index, Russian Traded Index, SE Europe Traded Index, Serbian Traded Index, Vienna Dynamic Index, Weiner Boerse Index Belgium Euronext Belgium All Share, Belgium BEL20, Belgium Brussels Continuous, Belgium Mid Cap, Belgium Small Cap Brazil Sao Paulo IBOVESPA Stock Exchange Canada Toronto S&P/TSX Capped Equity Index, S&P/TSX Completion Stock Index, S&P/TSX Composite Index, S&P/TSX Equity 60 Exchange Index S&P/TSX 60 Index, S&P/TSX Equity Completion Index, S&P/TSX Equity SmallCap Index, S&P/TSX Global Gold Index, S&P/TSX Global Mining Index, S&P/TSX Income Trust Index, S&P/TSX Preferred Share Index, S&P/TSX SmallCap Index, S&P/TSX Composite GICS Sector Indexes -

Monthly Economic Update

In this month’s recap: Stocks moved higher as investors looked past accelerating inflation and the Fed’s pivot on monetary policy. Monthly Economic Update Presented by Ray Lazcano, July 2021 U.S. Markets Stocks moved higher last month as investors looked past accelerating inflation and the Fed’s pivot on monetary policy. The Dow Jones Industrial Average slipped 0.07 percent, but the Standard & Poor’s 500 Index rose 2.22 percent. The Nasdaq Composite led, gaining 5.49 percent.1 Inflation Report The May Consumer Price Index came in above expectations. Prices increased by 5 percent for the year-over-year period—the fastest rate in nearly 13 years. Despite the surprise, markets rallied on the news, sending the S&P 500 to a new record close and the technology-heavy Nasdaq Composite higher.2 Fed Pivot The Fed indicated that two interest rate hikes in 2023 were likely, despite signals as recently as March 2021 that rates would remain unchanged until 2024. The Fed also raised its inflation expectations to 3.4 percent, up from its March projection of 2.4 percent. This news unsettled 3 the markets, but the shock was short-lived. News-Driven Rally In the final full week of trading, stocks rallied on the news of an agreement regarding the $1 trillion infrastructure bill and reports that banks had passed the latest Federal Reserve stress tests. Sector Scorecard 07072021-WR-3766 Industry sector performance was mixed. Gains were realized in Communication Services (+2.96 percent), Consumer Discretionary (+3.22 percent), Energy (+1.92 percent), Health Care (+1.97 percent), Real Estate (+3.28 percent), and Technology (+6.81 percent). -

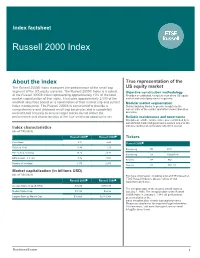

Russell 2000® Index Measures the Performance of the Small-Cap US Equity Market Segment of the US Equity Universe

Index factsheet Russell 2000 Index About the index True representation of the The Russell 2000® Index measures the performance of the small-cap US equity market segment of the US equity universe. The Russell 2000® Index is a subset Objective construction methodology of the Russell 3000® Index representing approximately 10% of the total Provides an unbiased, complete view of the US equity market capitalization of that index. It includes approximately 2,000 of the market and underlying market segments smallest securities based on a combination of their market cap and current Modular market segmentation index membership. The Russell 2000® is constructed to provide a Distinct building blocks to provide insight into the comprehensive and unbiased small-cap barometer and is completely current state of the market and inform asset allocation reconstituted annually to ensure larger stocks do not distort the decisions performance and characteristics of the true small-cap opportunity set. Reliable maintenance and governance Disciplined, reliable maintenance process backed by a well-defined, balanced governance system ensures the Index characteristics indexes continue to accurately reflect the market (As of 7/31/2021) Russell 2000® Russell 3000® Tickers Price/Book 2.71 4.46 Russell 2000® Dividend Yield 0.99 1.26 Bloomberg PR RTY P/E Ex-Neg Earnings 19.25 24.71 Bloomberg TR RU20INTR EPS Growth - 5 Years 9.76 17.01 Reuters PR .RUT Number of Holdings 1,975 2,997 Reuters TR .RUTTU Market capitalization (in billions USD) (As of 7/31/2021) For more information, including a list of ETFs based on FTSE Russell Indexes, please call us or visit Russell 2000® Russell 3000® www.ftserussell.com Average Market Cap ($-WTD) $3.274 $478.338 The inception date of the Russell 2000® Index is Median Market Cap $1.193 $2.636 January 1, 1984. -

Small Cap Is Active Management's Rightful Home

SMALL CAP IS ACTIVE MANAGEMENT’S RIGHTFUL HOME Recent trends show a growing willingness among investors to apply indexing’s logic farther down the market-cap ladder. But, when it comes to smaller companies, the indexing argument isn’t very convincing. Maintaining exposure to the small-cap “category” through an index-based product eliminates the chance to benefit in an area that, we contend, offers active managers with fundamentals-based strategies the most consistent and pronounced opportunity to generate excess return. PASSIVE INFLUX: FUNDS FORM THE FOUNDATION WHILE ETFS KEEP PILING ON… The Vanguard Group introduced the first index fund at the end of 1975 as a low-cost way for investors to gain exposure to the companies of the S&P 500 Index, which account for roughly 80 percent of the stock market’s total capitalization. The strategy initially attracted $11 million in assets under management. According to S&P Dow Jones Indices, more than $7.8 trillion is currently benchmarked to the S&P 500 Index, “with index assets comprising approximately $2.2 trillion of this total.” Other estimates put indexing’s reach at more than one out of every three shares outstanding among the index’s component companies. The emergence of exchange-traded funds (ETFs), the first of which was launched in 1993 to track the S&P 500 Index, only adds momentum to passive investing’s growing presence within the equity market. Since 2008, when the SEC broadened the scope of allowable ETF strategies, the number of ETFs more than doubled to 1,594 through the end of 2015. -

Weekly Economic Update

Electronic News That You Can Use! ONTHLY CONOMIC PDATE M E U October 2018 THIS MONTH’S THE MONTH IN BRIEF Wall Street maintained its optimism in September. While trade worries were top of HIGHLIGHT IS mind for economists and investors overseas, bulls largely shrugged at the prospect of tariffs and the probability of another interest rate hike. The S&P 500 rose 0.43% SOCIAL SECURITY for the month. On the whole, U.S. economic indicators were quite good, and some offered pleasant surprises. Social Security benefits can be a DOMESTIC ECONOMIC HEALTH As many analysts expected, the Federal Reserve raised the main interest rate by critical part of your 0.25% on September 26 to a target range of 2.00-2.25%. The word “accommodative” retirement was absent from its latest policy statement, distinctly hinting at a shift in U.S. income. It’s monetary policy. As September ended, the CME Group’s FedWatch Tool had the odds of a quarter-point December rate hike at 76.5%. important to understand how it On the last day of September, Canada joined the U.S. and Mexico in a new proposed works and trade pact representing an evolution of the existing North American Free Trade Agreement (NAFTA). The new accord, if approved by the governments of Canada, consider carefully Mexico, and the U.S., would toughen intellectual property and trade secret when to claim regulations, require 75% of autos made in North America to use parts from North American manufacturers, stipulate new labor requirements for Mexican industry, your benefits. -

Calamos Small Cap Market Snapshot

DATA AS OF 6/30/2021 WHAT’S NEW MARKET PULSE A little early…Last month, I made the bold prediction that the small cap MONTH-TO-DATE RETURNS correction was over. However, in June, they lagged by another 57 basis points R 2000 VALUE RUSSELL 2000 R 2000 GROWTH (Russell 2000 less Russell 1000). Falling 10-year Treasury yields during the last few weeks spooked many investors into rotating away from small caps. -0.61 1.94 4.69 R MICROCAP VALUE RUSSELL MICROCAP R MICROCAP GROWTH Even so, I’m not wavering. Small cap fundamentals continue to be rock-solid -0.63 2.19 6.36 and valuations versus large caps continue to look inexpensive, sitting at the 22nd percentile. In each of the past three small cap cycle peaks, valuations versus YEAR-TO-DATE RETURNS large caps surpassed the 83rd percentile. Small caps have a long way to go. I R 2000 VALUE RUSSELL 2000 R 2000 GROWTH conclude with an amazing small cap fact: since 1989, when small caps were up 26.69 17.54 8.98 more than 10% during the first six months of the year (the Russell 2000 was up R MICROCAP VALUE RUSSELL MICROCAP R MICROCAP GROWTH 17.5% in 1H 21), they continued to rise in the second half of the year, on average by another 12%. Buy the dip! 35.65 29.02 20.57 Brandon M. Nelson, CFA, Calamos Senior Portfolio Manager RUSSELL 2000 GROWTH VS. RUSSELL 1000 GROWTH RUSSELL 2000 GROWTH VS. S&P 500 GROWTH 300-DAY PERFORMANCE GICS SECTOR ALLOCATIONS (NET) 60% 50% Russell 2000 Growth 50% 40% S&P 500 Growth 40% 30% 30% 20% 20% 10% 10% 0% 0% -10% -20% -30% -40% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Past performance is not indicative of future results. -

Bolsas Y Mercados Argentinos Indices Methodology Consultation

Bolsas y Mercados Argentinos Indices Methodology Consultation BUENOS AIRES, NOVEMBER 5, 2018: In March 2018, Bolsas y Mercados Argentinos (“BYMA”) and S&P Dow Jones Indices (“S&P DJI”) signed an Index Operation and License Agreement. The partnership between BYMA and S&P DJI, the world’s leading provider of index-based concepts, data and research, includes the adoption of international index methodology standards and the integration of operational processes and business strategies and enhances the visibility, governance, and transparency of the existing indices. The agreement also enables the development, licensing, distribution and management of current and future indices which will be designed to serve as innovative and practical tools for local and global investors. The new and existing BYMA indices will be co- branded under the “S&P/MERVAL” and “S&P/BYMA” names (the “Indices”) that can be used to underlie liquid financial products, expanding the breadth and depth of the Argentine capital market. As part of this transition, S&P DJI and BYMA are conducting a consultation with members of the investment community on potential changes to the following BYMA indices to ensure that they continue to meet their objectives and are aligned with the needs of local and international market participants. BYMA Argentina General Index (Also known as Índice General de la Bolsa de Comercio de Buenos Aires) MERVAL Index MERVAL Argentina Index S&P DJI SUPPORTING DOCUMENTS This consultation is meant to be read in conjunction with supporting documents providing greater detail with respect to the S&P DJI policies, procedures and calculations described herein. -

Investing in the Marketplace

Investing in the Marketplace Prudential Retirement When you hear people talk about “the market,” you might think Did you know... we agree on what that means. Truth is, there are many indexes that represent differing segments of the market. And these …there is even indexes don’t always move in tandem. Understanding some of an index that the key ones can help you diversify your investments to better represent the economy as a whole. purports to track The Dow Jones Industrial Average (The Dow) is one of the oldest, most investor anxiety? well-know indexes and is often used to represent the economy as a Dubbed “The Fear whole. Truth is, though, The Dow only includes 30 stocks of the world’s largest, most influential companies. Why is it called an “average?” Index,” the proper Originally, it was computed by adding up the per-share price of its stocks, and dividing by the number of companies. name of the Chicago The Standard & Poor’s 500 Index (made up of 500 of the most widely- Board Options traded U.S. stocks) is larger and more diverse than The Dow. Because it represents about 70% of the total value of the U.S. stock market, the Exchange’s index is S&P 500 is a better indication of how the U.S. marketplace is moving as a whole. the VIX Index, Sometimes referred to as the “total stock market index,” the Wilshire and measures the 5000 Index includes about 7,000 of the more than 10,000 publicly traded companies with headquarters in the U.S. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

Morningstar Indexes Correlation

Morningstar Indexes Correlation Learn More Morningstar Indexes capture a complete set of global investment opportunities, as demonstrated by their high degree indexes.morningstar.com of correlation to the industry’s major indexes. Each Morningstar Index can be used as discrete building blocks for Contact Us asset allocation and portfolio construction analysis. [email protected] North America +1 312 384 3735 EMEA +44 20 3194 1082 Morningstar Index 3rd Party Index Correlation Australia +61 2 9276 4446 Hong Kong +65 6340 1285 Equity Japan +813 5511 7580 US Style 10 yr Korea +82 2 3771 0721 Morningstar US Large Core MSCI US Large Cap 300 0.98 Singapore +65 6340 1285 Russell 1000 TR USD 0.98 S&P 500 TR USD 0.99 Morningstar US Large Growth MSCI US Large Cap Growth 0.99 S&P 500 Growth TR USD 0.98 Russell 1000 Growth TR USD 0.99 Morningstar US Large Value MSCI US Large Cap Value 0.99 Russell 1000 Value TR USD 0.98 S&P 500 Value TR USD 0.98 Morningstar US Mid Core MSCI US Mid Cap 450 1.00 Russell Mid Cap TR USD 0.99 S&P Mid Cap 400 0.99 Morningstar US Mid Growth MSCI US Mid Cap Growth 0.99 S&P Mid Cap 400 Growth 0.98 Russell Mid Cap Growth TR USD 0.99 Morningstar US Mid Value MSCI US Mid Cap Value 0.99 S&P MidCap 400 Value TR USD 0.97 Russell Mid Cap Value TR USD 0.99 Morningstar US Small Core MSCI US Small Cap 1750 1.00 Russell 2000 0.99 S&P SmallCap 600 TR USD 0.98 Morningstar US Small Growth MSCI US Small Cap Growth 0.99 S&P SmallCap 600 Growth 0.99 Russell 2000 Growth TR USD 0.99 Morningstar US Small Value MSCI US Small Cap Value 0.99 Russell 2000 Value TR USD 0.98 S&P SmallCap 600 Value TR USD 0.97 Morningstar US Core Russell 3000 0.99 S&P 500 0.99 Morningstar US Growth Russell 3000 Growth 0.99 S&P United States BMI Growth TR USD 0.99 Morningstar US Value Russell 3000 Value 0.99 S&P United States BMI Value TR USD 0.99 ©2019 Morningstar, Inc. -

Risk-Adjusted Return Monitor Summary & Views

a global macro investment newsletter by Neil Azous Morning Edition | October 12, 2018 Risk-Adjusted Return Monitor CROSS-ASSET FOREX FIXED INCOME EQUITIES COMMODITIES THEMATIC PAIRS India SENSEX EUR/CNY UK 5-Yr Gilt India SENSEX Soybean China Exposure EU Cyclicals vs Defensives Saudi Tadawul USD/TWD South Korea 10-Yr Saudi Tadawul Gold None EU Domestic vs EM Exposure * Highlights the largest overnight positive and negative risk-adjusted returns across 160+ market proxies Summary & Views Contents These Are Not The Droids You Are Looking For Summary & Views Top Observations . The Pedestrian View Tracking Portfolio . Our View – Mutual Funds Economic Data . Our View – Hedge Funds . Our View – Global Macro . Financial Conditions Tracking Portfolio Admin – Schedule Tracking Portfolio Twitter @sbstimestamp The next edition of Sight Beyond Sight will be delivered on Monday. Bloomberg MCRO <go> Any updates to the tracking portfolio will be sent via Twitter (@sbstimestamp) or Bloomberg (MCRO<go>). Links Subscribe Now! Newsroom View Archive Permissions/Reprints Connect Twitter @neilazous These Are Not The Droids You Are Looking For The Pedestrian View This is the 23rd correction greater than 5% in the S&P 500 Index (SPX) since the March 2009 low. The average correction is -9.3% and the median correction is -8.4%. The average VIX peak is 32.1 and median peak is 30.3. From the high-to-low, the S&P 500 fell 7.8%, and the VIX peaked at 28.84. Add in the drawdowns in other benchmarks – Russell 2000 Index (RTY) -11.29% and NASDAQ-100 Index (NDX) - 10.49% – and the dozens of intra-day indicators showing extremes, and it is easier to understand that the correction is largely complete. -

The Pricing of Stock Index Futures During the Asian Financial Crisis: Evidence from Four Asian Index Futures Markets”

“The Pricing of Stock Index Futures During the Asian Financial Crisis: Evidence from Four Asian Index Futures Markets” AUTHORS Janchung Wang Janchung Wang (2007). The Pricing of Stock Index Futures During the Asian ARTICLE INFO Financial Crisis: Evidence from Four Asian Index Futures Markets. Investment Management and Financial Innovations, 4(2) RELEASED ON Saturday, 23 June 2007 JOURNAL "Investment Management and Financial Innovations" FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 0 0 0 © The author(s) 2021. This publication is an open access article. businessperspectives.org Investment Management and Financial Innovations, Volume 4, Issue 2, 2007 77 THE PRICING OF STOCK INDEX FUTURES DURING THE ASIAN FINANCIAL CRISIS: EVIDENCE FROM FOUR ASIAN INDEX FUTURES MARKETS Janchung Wang* Abstract Market imperfections are traditionally measured individually. Hsu and Wang (2004) and Wang and Hsu (2006) recently proposed the concept of the degree of market imperfections, which reflects the total effects of all market imperfections between the stock index futures market and its underlying index market when implementing arbitrage activities. This study discusses some useful applications of this concept. Furthermore, Hsu and Wang (2004) developed an imperfect market model for pricing stock index futures. This study further compares the relative pricing perform- ance of the cost of carry and the imperfect market models for four Asian index futures markets (particularly for the Asian crisis period). The evidence indicates that market imperfections are im- portant in determining the stock index futures prices for immature markets and turbulent periods with high market imperfections. Nevertheless, market imperfections are excluded from the cost of carry model.