Infomemo Automatic

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Impatto COVID-19 Sui Primi Nove Mesi 2020 (Mnes Mondiali E FTSE MIB)

BRIEFING NOTE: IMPACTS OF COVID-19 PANDEMIC ON 9 MONTHS 2020 (MNES AND FTSE MIB) Area Studi Mediobanca Milan, 19 November 2020 1 ASM SHEDS LIGHT ON THE IMPACT OF PANDEMIC FOR 9M 2020 The survey analyses trends on results for 9M 2020 of: 1) Large industrial companies that have disclosed the results for the period January- September by November 16, 2020, sector by sector 2) 26 industrial and service companies listed on the FTSE MIB*: A2A, Amplifon, Atlantia, Buzzi Unicem, CNH Industrial, Davide Campari-Milano, DiaSorin, ENEL, ENI, FCA, Ferrari, Hera, Interpump Group, Inwit, Italgas, Leonardo, Moncler, Pirelli & C., Prysmian, Recordati, Saipem, Snam, STM, Telecom Italia, Tenaris, Terna That are 15 privately held and 11 state-owned companies, 16 manufacturing industry, 6 energy/utilities, 3 service companies and 1 oil and gas At the end of September 2020 the FTSE MIB companies analyzed were worth 318 €billion on the stock market and represented 76% of the total capitalization (excluding finance and insurance) 2 * Escluding Exor because does not publish quarterly reports SUMMARY 1. Impact on results for 9M 2020: Large industrial companies 2. Impact on results for 9M 2020: FTSE MIB (industry and services) 3. Overall look 3 IMPACT ON RESULTS FOR 9M 2020: LARGE INDUSTRIAL COMPANIES Section 1 4 REVENUES GROWTH IN 9M 2020/2019 Net sales 9M 2020/2019, percentage change – Multinational companies by sectors 18.4 8.8 5.7 3.7 3.1 0.3 -1.8 -5.4 -9.4 -17.4 -21.3 -30.6 -32.3 The world multinational companies average is equal to: -4.3% 5 REVENUES GROWTH IN DIFFERENT QUARTERS 2020 Net sales 9M 2020/2019, percentage change - Multinational companies by sectors 1Q 2020/2019 2Q 2020/2019 3Q 2020/2019 20.4 17.3 17.5 10.5 7.3 8.5 6.5 5.9 6.3 5.5 4.5 3.8 5.0 4.6 4.3 2.4 2.2 -0.2 -1.6 -0.8 -2.3 -2.5 -3.2 -3.0 -5.7 -9.2 -8.7 -9.8 -12.5 -13.1 -14.8 -21.7 -21.9 -28.0 -31.6 -40.5 -41.6 -42.1 -51.5 WebSoft, large-scale distribution, electronics and food are the only sectors to grow the net sales in all the different quarters of 2020. -

Mittel ITALY \ Holding

Mittel ITALY \ Holding New Coverage NEW AND DYNAMIC MANAGEMENT IN A SOLID INVESTMENT COMPANY BUY (n.a.) We initiate coverage with a BUY based on high discount to NAV (40%), solid financial structure, lower risk for banking activity than the other Target: € 4.0 (n.a.) banks and upside potential of recently acquired E.Capital and Hopa. Risk: High Target price € 4.0 PS, applying a 15% discount to NAV of € 4.7 PS (which implies a 43% upside). STOCK DATA Price € 2.8 Mittel (MIT) is an investment/merchant bank that is simultaneously and Bloomberg Code MIT IM complementarily active in: Market Cap. (€ mn) 198 • Private equity as an active shareholder in both listed and unlisted Free Float 32% companies Shares Out. (mn) 71 • Advisory services for extraordinary finance operations 52-week range 1.92 - 4.6 • Operating Finance Daily Volumes (mn) 0.03 • Investment Management Advisory concerning the creation of indexes and investments decisions via the application of ESG PERFORMANCE 1M 3M 12M (Environmental, Social and Governance) criteria Absolute -9.6% 12.9% -37.3% • Real estate investment typically in residential property development Rel. To Mibtel Index 1.1% 26.9% 7.0% The company’s main features are: MAIN METRICS 2008 2009E 2010E EPS 47.9 65.2 8.2 • A sound financial structure: holding system net cash at € 11 mn and DPS 15.0 15.0 15.0 over € 500 mn of available credit lines. • Much more diversified portfolio than other Italian holdings since NAV 2008 2009E 2010E no one of the assets worth more than 15% of NAV Nav ps ord - € 4.5 4.7 4.7 • Unusual prevalence of unlisted assets (76% of total asset) Listed assets 27% 24% 24% • High dividend yield (5.3%, to be paid this month and with good Controlling assets 39% 42% 42% visibility for the current year thanks to Moncler deal capital gain). -

The Sustainability Yearbook 2020

The Sustainability Yearbook 2020 Perceiving risks, measuring impact, and disclosing results – critical steps for propelling corporate sustainability into the future The Sustainability Yearbook 2020 January 2020 S&P Global and RobecoSAM AG yearbook.robecosam.com Now a Part of 2 The Sustainability Yearbook 2020 2019 Annual Corporate Sustainability Assessment 61 4,710 Industries Companies assessed* *As of November 30th 2019 227,316 2,657,822 Documents uploaded Data points collected The Sustainability Yearbook 2020 3 Foreword Dear Reader, There’s no question the theme of sustainability is increasingly on the minds of investors, business leaders and policy makers. It’s moved to the top of the agenda at The World Economic Forum. Sustainable investing assets are growing. And you see more CEOs and corporate policy experts advocating long-term thinking. Virtually everywhere I go there are discussions about the role asset owners and the world’s largest businesses have in society, and how we all should be measuring their performance in that context. Just a few years ago these topics didn’t really resonate beyond Scandinavia, parts of Asia and segments of the investment community. Now they’re pervasive. The rising prominence of environmental, social and governance, or ESG, issues and the market demand for greater insights about these matters make this Sustainability Yearbook more important than ever. This Yearbook stands out for another reason. It’s the first one published by S&P Global. 4 The Sustainability Yearbook 2020 We’re incredibly proud to have acquired We thank everyone who participates in RobecoSAM’s ESG Ratings and the CSA for their continued partnership. -

DEA CAPITAL OUTPERFORM SECTOR: Holdings & RE Price (Eu): 1.10 Alberto Villa +39-02-77115.431 E-Mail: [email protected] Target Price (Eu): 1.55

Italian Research 4Q19 Results Milan, April 16, 2020 DEA CAPITAL OUTPERFORM SECTOR: Holdings & RE Price (Eu): 1.10 Alberto Villa +39-02-77115.431 e-mail: [email protected] Target Price (Eu): 1.55 AAM Transformation Continued in 2019. Net Cash Helps in Uncertain Times FY19 results confirmed ongoing trends. In 2019, DeA Capital increased total AuM to over DEA CAPITAL - 12m Performance Eu22bn, completing its transformation from an investment company to one of the most important Italian Alternative Asset Management operators, with a wide range of 02 investment solutions, ranging from Real Estate to Private Equity to Non-Performing 02 Exposure, including some of the most innovative proposals available on the Italian 01 market. As for FY19 financial results, the alternative asset management (AAM) platform 01 reported management fees at Eu65mn (+2.5% YoY) and a slightly lower operating result 01 at Eu14.6mn, as last year benefited from some extraordinary positive items (real estate 01 01 45% / investment solutions 33%, NPE 14% and private equity 8%). Net profit came to 01 Eu12mn, up 10% YoY, with a Eu0.12ps extraordinary dividend, flat YoY and in line with a-19 g-19 a-19 o-19 d-19 f-20 a-20 expectations; net cash was broadly stable at Eu65.8mn thanks to some asset disposals DEA CAPITAL DEA CAPITAL Rel. to FTSE All Shares (Reb.) and the cash-in of investments compensating investment activity and the Eu31mn dividend payout. NAVps was Eu1.76, up slightly YoY confirming the stable nature of the assets – management companies and investments – included in the portfolio. -

MONCLER S.P.A. Directors' Illustrative Report on First Item on the Agenda of the Extraordinary Shareholders' Meeting Called

MONCLER S.P.A. Registered office at Via Stendhal 47, Milan – share capital Euro 51,670,524.80 fully paid-in Milan Companies Register, tax code and VAT no. 04642290961 - REA no. 1763158 Directors’ illustrative report on first item on the agenda of the extraordinary Shareholders’ Meeting called on March, 25th 2021, in single call. This document does not constitute or constitute a part of any offer or solicitation to purchase or subscribe for any securities in the United States. The securities referred to herein have not been, and will not be, registered under the United States Securities Act of 1933 (the "Securities Act"). The securities referred to herein may not be offered or sold in the United States except as exempted from registration under the Securities Act. There will be no public offering of securities in the United States. Distribution of this document in certain Countries may be forbidden by law. The information contained in this document is not intended for distribution or publication in Canada, Japan or Australia and does not constitute an offer to sell in Canada, Japan or Australia. 1 EXTRAORDINARY SHAREHOLDERS’ MEETING Item no. 1 on the agenda – Proposal to increase the share capital against payment in divisible form, with exclusion of pre-emptive right pursuant to Article 2441, par. 5 and 6, of the Italian Civil Code, for a total maximum amount of Euro 575,000,800.2948 (fivehundredseventyfivemillioneighthundred/2948), of which maximum Euro 3,066,033.2 (threemillionsixtysixthousandthirtythree/2) to be allocated to share capital and maximum Euro 571,934,767.0948 (fivehundredseventyonemillionninehundredthirtyfourthousandsevenhundredsixtyseven/0948) to be charged as a premium, through the issue of a maximum total of no. -

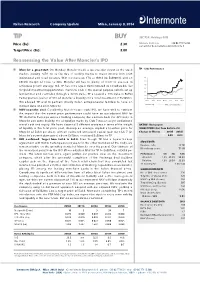

TIP BUY SECTOR: Holdings & RE Price (Eu): 2.30 Michele Ballatore +39-02-77115.252 E-Mail: [email protected] Target Price (Eu): 2.80

Italian Research Company Update Milan, January 9, 2014 TIP BUY SECTOR: Holdings & RE Price (Eu): 2.30 Michele Ballatore +39-02-77115.252 e-mail: [email protected] Target Price (Eu): 2.80 Reassessing the Value After Moncler’s IPO Moncler: a great start. On Monday Moncler made a spectacular debut on the stock TIP - 12m Performance market, posting +47% on its first day of trading thanks to major interest from both institutional and retail investors. With revenues up 17% at 9M13 (to Eu390mn) and an 2.4 EBITDA margin of close to 30%, Moncler still has lot plenty of room to execute its 2.2 ambitious growth strategy. Still, TIP has once again demonstrated its considerable flair 2.0 1.8 for good investment opportunities. Thanks to Club 7, the special purpose vehicle set up 1.6 last summer and controlled through a 52.5% stake, TIP acquired a 14% stake in Ruffini 1.4 Partecipazioni (owner of 32% of Moncler + liquidity) for a total investment of Eu103mn. 1.2 N-12 J-13 M-13 M-13 J-13 S-13 N-13 This allowed TIP and its partners (mainly Italian entrepreneurial families) to have an indirect stake of 4.4% in Moncler. TIP TIP Rel. to BCI Index (Reb.) NAV-accretive deal. Considering Moncler’s successful IPO, we have tried to estimate the impact that the current price performance could have on our adjusted NAV for TIP. As Ruffini Partecipazioni is a holding company that contains both the 32% stake in Moncler and some liquidity, the acquisition made by Club 7 was an as yet undisclosed mix of cash and equity. -

Elisabetta Franchi

Elisabetta Franchi 02 December 2019 Branded Goods Chiara Rotelli In the Instagram age Cinderella is a fashion designer Equity Analyst +39 02 8829 931 Once upon a time, an influencer designer built an accessible luxury brand… [email protected] Elisabetta Franchi is a leading Italian player in the accessible luxury industry, a market worth €114bn in 2018 and estimated to grow 4-5% annually in the next 6 Gilles Errico years. This segment is more fragmented than high-end luxury. Many players have Equity Analyst a strong regional presence, but only a few have experienced growth in retail and +39 02 8829 558 wholesale globally. Elisabetta Franchi, with c.€116m revenues in FY18, growing [email protected] 6.5% annually since 2016, has outperformed its reference market, leveraging a strong wholesale business and taking the initial steps of an internationalization journey that still has to express its full potential. …blending the codes of luxury, Made in Italy and fast fashion… Elisabetta Franchi’s business model is based on a lean operational structure. The company controls the supply chain and relies on valuable partners for production and distribution. Manufacturing - fully outsourced, based on "cut, trim and make" approach - has unique flexibility. It allows for 3-4 weeks lead times for re- assortment of best-selling items, which, in turn, maximizes full-price sell-through for retail and wholesale partners. To support traffic, the brand launches six collections per year, with Pre, Main and Catwalk for S/S and F/W seasons. Elisabetta Franchi leverages an innovative approach to digital: the designer is a powerful influencer. -

Moncler (MONC.MI) 21St February 2018

CFA Institute Research Challenge Hosted in Italy Team DOTH 1 Moncler (MONC.MI) 21st February 2018 Recommendation SELL Price (19th Feb 18 h 17:30) €28,08 Target Price €19,1 Expected share price return -31,98% Moncler Expected dividend yield 1,05% Expected total return -31,27% Company description Market Cap (€ mln) 4.601 Moncler is a leading luxury player in the outwear market, which has experienced a remarkable growth from the Ruffini’s ownership. The company has successfully Moncler's Ownership expanded outside Italy, reaching every luxury shopping area in almost all over the world, 29.42% 15.26% through both retail and wholesale shops. Moncler is based in Italy, while the production 20.20% is externalized to Eastern Europe countries. 35.12% Top 10 Other Inst. Inv. Investment strategy Insider Owner. Unknown We focused our attention on a SELL rating; Moncler has experienced a very important growth in the last years (IPO price (16/12/2013) = €10.2), but in our analysis we took SOURCE: BLOOMBERG into account the fact that now Moncler is present almost in every country, so the new MONCLER HISTORICAL openings rate will be lower than the one of last years. Moreover, Moncler is mainly a PRICE 30 “fashion trend”, also because it doesn’t have the same features as brand like Gucci, Louis 20 Vuitton or the other most important Italian luxury brands; this will bring to the risk that a new competitor will take Moncler’s place (or, at least, some of the Moncler’s market 10 share). Last but not least, even if Moncler has a negative financial position and positive 0 growth perspectives, we think that it is overvalued, which will bring the stock price to an unavoidable correction (with a P/E of ca. -

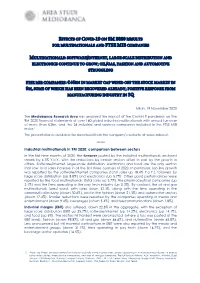

Effects of Covid-19 on 9M 2020 Results

EFFECTS OF COVID -19 ON 9M 2020 RESULTS FOR MULTINATIONALS A ND FTSE MIB COMPANIES MULTINAT IONAL S: SOFTWARE /INTERNET , LARGE -SCALE DISTRIBUTION A ND ELECTRONICS CONTINUE TO GROW ; OIL /GAS , FASHION AND A UTOMOTIVE STRUGGLING FTSE MIB COMPANIES : €46 BN IN MARKET CAP WIPED OFF THE STOCK MARKET IN 9M, SOME OF WHICH HAS BEEN RECOVERED ALREADY ; POSITIVE RESPONSE FR OM MANUFACTURING INDUST RY IN 3Q Milan, 19 November 2020 The Mediobanca Research Area has analysed the impact of the Covid-19 pandemic on the 9M 2020 financial statements of over 160 global industrial multinationals with annual turnover of more than €3bn, and the 26 industrial and services companies included in the FTSE MIB index. 1 The presentation is available for download from the company’s website at www.mbres.it. ****** Industrial multinationals in 9M 2020: comparison between sectors In the first nine months of 2020, the turnover posted by the industrial multinationals analysed shrank by 4.3% Y.o.Y., with the reductions by certain sectors offset in part by the growth in others. Software/internet, large-scale distribution, electronics and food are the only sectors that saw total sales increase in all the first three quarters of 2020. In particular, top-line growth was reported by the software/internet companies (total sales up 18.4% Y.o.Y.), followed by large-scale distribution (up 8.8%) and electronics (up 5.7%). Other good performances were reported by the food multinationals (total sales up 3.7%), the pharmaceutical companies (up 3.1%) and the firms operating in the pay tech industry (up 0.3%). -

360Entrepreneurial Index

Press release AppQuality closes a €3.5 million investment round with P101 Milan, 28th May 2020 - AppQuality, the leading Italian Crowd testing platform, owned by Digital360 S.p.A., a company listed on AIM Italia - Mercato Alternativo del Capitale (Alternative Investment Market), organised and managed by Borsa Italiana S.p.A., concluded a 3.5 million euro investment round led by the Venture Capital company P101 SGR, by means of a dedicated capital increase, through its second company P102 and ITA500 (a co- investment fund promoted together with Azimut). Italian Angels for Growth (IAG), Club degli Investitori and Club Italia Investimenti 2, already company shareholders together with Digital360, were participants in the round. Founded in 2015 at the Cremona Campus of the Politecnico di Milano by Luca Manara (CEO), Edoardo Vannutelli and Filippo Renga (co-founder of the Digital Innovation Observatories), and developed in PoliHub, the certified incubator of the Politecnico di Milano, the start-up created a platform which helps companies to develop "bug” search/identification systems (i.e. the defects of digital services) and to optimise the User Experience of apps, websites, chatbots, Internet of Things devices, e-commerce, through crowd testing. This technique is able to place end users and bug seekers directly within the design, development and evolution of a digital product. AppQuality has tripled its turnover from 2017 to date (from 290,000 Euro in 2017 to 1 million Euro in 2019), expanding its market and product portfolio and creating partnerships with qualified professionals. Today it has a worldwide community of 14,000 qualified and certified testers and a clientele of over 100 corporate companies of the calibre of Pirelli, BMW, Bending Spoons, UniCredit, Moncler, Allianz, Enel, Vodafone, Dyson, etc. -

Global Powers of Luxury Goods 2020 the New Age of Fashion and Luxury Contents

Global Powers of Luxury Goods 2020 The new age of fashion and luxury Contents Foreword 3 Quick statistics 4 The new age of fashion and luxury 5 Top 10 highlights 17 Top 100 24 Geographic analysis 31 Product sector analysis 37 New entrants 42 Fastest 20 43 Study methodology and data sources 45 Endnotes 47 Contacts 50 Foreword Welcome to the seventh edition of Global Powers of Luxury Goods. At the time of writing, the COVID-19 pandemic has inflicted many losses: human, social and economic. What we are now experiencing is an unprecedented moment of crisis in modern history. However, it is during uncertain times that companies often come up with new ideas, converting the crisis into an opportunity, and adopting a long-term vision of future challenges. This prolonged disruptive situation is creating profound changes in consumer behavior and how companies are responding to these changes—prompting a debate about the future of the fashion and luxury industry. There is a general feeling of rethinking luxury and driving it in new directions, considering which business models will be feasible and more relevant in the new normal. Tradition and responsiveness, two elements that have always characterized luxury companies, will both be required to face great challenges in the post-COVID environment. We see the pandemic acting as a divider between the old way of doing business and the new scenario that is taking shape, characterized by changing consumer behavior. Hence, in this report, we talk about a new age for fashion and luxury and will explore the main trends that will drive the industry in the coming months. -

Yoox Net-A-Porter Group

PRESS RELEASE 9 NOVEMBER 2016 YOOX NET-A-PORTER GROUP: Trading Statement for the first nine months to 30 September 2016 ORGANIC1 NET REVENUE GROWTH ACCELERATES TO 19% IN THE THIRD QUARTER • Third-quarter net revenue organic1 growth of 19% at Euro 435 million (+17% at constant FX and +12% reported1), with growth accelerating on the first half of the year – Acceleration in net revenue growth in the third quarter driven by the US and Asia Pacific – Strong organic1 performance across all business lines: Multi-brand In-Season net revenues up 19%, Multi- brand Off-Season net revenues up 19%, Gross Merchandise Value of Online Flagship Stores (GMV2) up 26% • Nine-month net revenue organic1 growth of 17% at Euro 1,332 million (+16% at constant FX and +13% reported1) • Key Performance Indicators: – 27.5 million average monthly unique visitors, compared with 25.93 million in the first nine months of 2015 – 5.9 million orders, compared with 5.0 million in the first nine months of 2015 – Euro 331 AOV (Average Order Value), compared with Euro 354 in the first nine months of 2015, reflecting a different business-line mix and unfavourable exchange rate movements – 2.8 million active customers, compared with 2.3 million in the first nine months of 2015 3Q 2015 CHANGE % € million 3Q 2016 % PRO-FORMA % REPORTED CONSTANT ORGANIC1 Multi-brand In-Season 215.1 49.4% 200.6 51.4% +7.2% +14.7% +19.1% Multi-brand Off-Season 178.0 40.9% 152.4 39.1% +16.8% +19.5% +19.5% Online Flagship Stores 42.4 9.7% 36.9 9.5% +14.7% +16.8% +25.7%* Total YOOX NET-A-PORTER-GROUP 435.4 100.0% 389.9 100.0% +11.7% +16.8% +19.0% * Relates to Gross Merchandise Value (GMV3) growth at constant exchange rates and at a comparable perimeter 3Q 2015 CHANGE % € million 3Q 2016 % PRO-FORMA % REPORTED CONSTANT Italy 29.9 6.9% 26.8 6.9% +11.4% +11.6% UK 56.5 13.0% 59.7 15.3% -5.4% +13.5% Europe (excl.