Client Profile: Gems N' Loans by Luis Rodríguez Martín

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Ordinance

MCO -09 - 2010 AN ORDINANCE AMENDING CHAPTER 31 ENTITLED, “BUSINESS LICENSING, REGULATION AND REGISTRATION” OF THE MUNICIPAL CODE OF THE CITY OF ELMHURST BY ADDING ARTICLE XVII ENTITLED “PAWNSHOPS AND PAWNBROKERS” WHEREAS, the City of Elmhurst is a home rule unit of government, pursuant to Article VII, Section 6 of the Illinois Constitution of 1970; and WHEREAS, as a home rule unit of government, the City is expressly authorized to exercise any power and perform any function pertaining to its government and affairs including, but not limited to, the power to regulate for the protection of the public health, safety, morals and welfare; and WHEREAS, the corporate authority of the City of Elmhurst has determined that it is proper, necessary and in the best interest of the City of Elmhurst to adopt this legislation regulating and licensing the business of Pawnshops and Pawnbrokers; and WHEREAS, this legislation is the act of the corporate authority of the City of Elmhurst, pursuant to his home rule powers as granted by Article VII, Section 6 of the Illinois Constitution of 1970. NOW, THEREFORE, BE IT ORDAINED, by the City Council of the City of Elmhurst, DuPage and Cook Counties, Illinois, as follows: Section 1. That the foregoing recitals are adopted as the findings of the corporate authority of the Village as if fully recited herein. Section 2. That Chapter 31, entitled “Business Licensing, Regulation and Registration” as amended, is further amended by adding thereto Article XVII, entitled, “Pawnshops and Pawnbrokers”, to read as follows: -

Pawnbroking and the Survival Strategies of the Urban Poor in 1770S York Alannah Tomkins

6 Pawnbroking and the survival strategies of the urban poor in 1770s York Alannah Tomkins The poor in England Pawnbroking and the urban poor Introduction On 9 June 1778 a woman called Ann Moyser visited George Fettes’s pawnbroker’s shop in York to pledge a checked apron, for which she received a shilling.1 On 14 October in the same year, the pawnbroker received a business call from the overseers of St Mary Castlegate parish in York. They claimed that the apron did not belong to Ann but to a parishioner of theirs called Sarah Wood. It is not clear whether the overseers considered the item to have been stolen, lent or pawned by Ann on Sarah’s behalf, but they redeemed the apron for Sarah’s use without producing the duplicate or ticket which had been issued to Ann in June. Despite this evidence and the sporadic entries in overseers’ ac- counts about pledges redeemed with parish money, pawning by paupers was the exception rather than the rule; the pawnshop was the resort of a large number of people in York, predominantly the labouring poor in times of difficulty, but was rarely used by paupers. Nevertheless a close examination of the pawning practices of customers in general, and a comparison of customer names with the identities of city paupers, illuminates the range of ways pawning was employed and the interplay between pawnshop credit and parish relief in poor household economies. The aims of the chapter are ambitious, particularly given the difficulty of defining or characterising ‘paupers’. The poor law might intervene at different points in the experience of households according to local custom, the economic conditions prevailing at different times, and 166 Alannah Tomkins - 9781526137869 Downloaded from manchesterhive.com at 10/03/2021 03:23:53AM via free access Pawnbroking and the urban poor 167 the persuasive powers of individuals seeking relief. -

University Microfilms International 300 North Zeeb Road Ann Arbor, Michigan 48106 USA St

INFORMATION TO USERS This material was produced from a microfilm copy of the original document. While the most advanced technological means to photograph and reproduce this document have been used, the quality is heavily dependent upon the quality of the original submitted. The following explanation of techniques is provided to help you understand markings or patterns which may appear on this reproduction. 1. The sign or "target" for pages apparently lacking from the document photographed is "Missing Page(s)". If it was possible to obtain the missing page(s) or section, they are spliced into the film along with adjacent pages. This may have necessitated cutting thru an image and duplicating adjacent pages to insure you complete continuity. 2. When an image on the film is obliterated with a large round black mark, it is an indication that the photographer suspected that the copy may have moved during exposure and thus cause a blurred image. You will find a good image of the page in the adjacent frame. 3. When a map, drawing or chart, etc., was part of the material being photographed the photographer followed a definite method in "sectioning" the material. It is customary to begin photoing at the upper left hand corner of a large sheet and to continue photoing from left to right in equal sections with a small overlap. If necessary, sectioning is continued again — beginning below the first row and continuing on until complete. 4. The majority of users indicate that the textual content is of greatest value, however, a somewhat higher quality reproduction could be made from "photographs" if essential to the understanding of the dissertation. -

MS Pawnbroker License New Application Checklist (Company)

MS Pawnbroker License New Application Checklist (Company) CHECKLIST SECTIONS General Information License Fees Requirements Completed in NMLS Requirements/Documents Uploaded in NMLS Requirements Submitted Outside of NMLS GENERAL INFORMATION Who Is Required to Have This License? "Pawnbroker" means any person engaged in whole or in part in the business of lending money on the security of pledged goods left in pawn, or in the business of purchasing tangible personal property to be left in pawn on the condition that it may be redeemed or repurchased by the seller for a fixed price within a fixed period of time; provided, however, that the following are exempt from the definition of "pawnbroker" and from the provisions of this act: any bank which is regulated by the State Department of Banking and Consumer Finance, the Comptroller of the Currency of the United States, the Federal Deposit Insurance Corporation, the Board of Governors of the Federal Reserve System or any other federal or state authority and all affiliates of such bank, and additionally any bank or savings and loan association whose deposits or accounts are eligible for insurance by the Bank Insurance Fund or the Savings Association Insurance Fund or other fund administered by Federal Deposit Insurance Corporation or any successor thereto, and all affiliates of such banks and savings and loan associations, any state or federally chartered credit union and any finance company subject to licensing and regulation by the State Department of Banking and Consumer Finance. 75-67-321 authorizes the Department to license and regulate this activity. Activities Authorized Under This License This license authorizes the following activities… o Pawn Brokering Pre-Requisites for License Applications None The Mississippi Department of Banking and Consumer Finance does not issue paper licenses for this license type. -

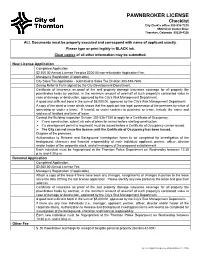

Pawnbroker Licensing Application

PAWNBROKER LICENSE Checklist City Clerk’s office 303-538-7230 9500 Civic Center Drive Thornton, Colorado 80229-4326 ALL Documents must be properly executed and correspond with name of applicant exactly. Please type or print legibly in BLACK ink. Clear copies of all other information may be submitted. New License Application Completed Application. $2,500.00 Annual License Fee plus $200.00 non-refundable Application Fee. Manager’s Registration (if applicable). City Sales Tax Application - submitted to Sales Tax Division 303-538-7400. Zoning Referral Form signed by the City Development Department. Certificate of Insurance as proof of fire and property damage insurance coverage for all property the pawnbroker holds by contract, in the minimum amount of one-half of such property's contracted value in case of damage or destruction, approved by the City's Risk Management Department. A good and sufficient bond in the sum of $5,000.00, approved by the City's Risk Management Department. A copy of the deed or lease which shows that the applicant has legal possession of the premises by virtue of ownership or under a lease. If leased, or under contract to purchase or lease, include the name and address of landlord and term of lease. Contact the Building Inspection Division 303-538-7250 to apply for a Certificate of Occupancy. If new construction, submit six sets of plans for review before starting construction. If a development permit is required it must be issued before a Certificate of Occupancy can be issued. The City can not issue the license until the Certificate of Occupancy has been issued. -

The UK's Leading Pawnbroker

H&T Group plc H&T Group The UK’s leading pawnbroker Annual Report and Accounts 2012 ReportAnnual and Building value in our local communities H&T Group plc Times House Throwley Way Sutton Surrey SM1 4AF Tel: 0870 9022 600 H&T Group plc www.handtgroup.co.uk ANNUAL REPORT and ACCOUNTS 2012 H &T provides a range of simple and accessible financial products tailored for a customer base who have limited access to, or are excluded from, the traditional banking and finance sector. KEY PERFORMANCE INDICATORS FINANCIAL HIGHLIGHTS 2012 Pledge book (£m) Redemption (%) Retail sales (£m) Gross profit EBITDA* £62.3m £21.3m 76.6 76.4 51.6 20.1 20.0 76.1 75.5 19.6 46.6 16.4 39.5 38.2 (2011: £27.4m) * Earnings Before Interest Tax (2011: £65.4m) Depreciation and Amortisation 2009 2010 2011 2012 2009 2010 2011 2012 2009 2010 2011 2012 Profit before tax Diluted EPS Up 10.7% to £51.6m 76.6% in 2012 £20.1m in 2012 in 2012 (2011: £46.6m) (2011: 76.4%) (2011: £20.0m) £17.0m 33.9p Retail margin (%) Gold purchase No. of Pawnbroking margin (%) stores (2011: £23.5m) (2011: 48.4p) 186 49.5 39.9 49.2 49.0 44.9 36.1 160 31.4 135 Proposed dividend Proposed final 122 per share dividend 23.3 11.85p 8.05p 2009 2010 2011 2012 2009 2010 2011 2012 2009 2010 2011 2012 49.0% in 2012 23.3% in 2012 186 stores in 2012 (2011: 49.2%) (2011: 31.4%) (2011: 160 stores) (2011: 10.75p) (2011: 7.00p) Customer Satisfaction Over 86% of customers surveyed rated their satisfaction 8 or more out of 10 Employee Satisfaction Cautionary statement Over 92% of employees stated they enjoyed working for H&T Group This annual report of H&T Group plc (“H&T”, “the Group”, “the Company”) contains some forward-looking information and statements that involve known and unknown risks and uncertainties, including statements about the Group’s plans, objectives and intentions. -

The UK's Leading Pawnbroker

H&T Group plc Annual Report and Accounts 2009 The UK’s leading pawnbroker Appreciating the value for over 100 years Financial and Operational Highlights Gross profit EBITDA* Operating profit (£m) (£m) (£m) 60 24 24 23.1 21.0 51.2 14.9 35.7 30 12 12 13.3 11.4 27.7 10.0 23.3 7.5 6.1 0 0 0 2006 2007 2008 2009 2006 2007 2008 2009 2006 2007 2008 2009 up 43.2% up 55.2% up 58.4% to £51.2m (2008: £35.7m) to £23.1m (2008: £14.9m) to £21.0m (2008: £13.3m) *Earnings before Interest, Tax, Depreciation, Amortisation as defined in note 3 of the consolidated financial statements Basic EPS Pledge book Profit before tax (p) (£m) (£m) 40 40 20 37.9 37.75 18.5 32.0 27.8 20 20 25.2 10 20.27 10.1 15.17 7.4 3.65 2.0 0 0 0 2006 2007 2008 2009 2006 2007 2008 2009 2006 2007 2008 2009 up 86.2% up 18.4% up 83.9% to 37.75p (2008: 20.27p) to £37.9m (2008: £32.0m) to £18.5m (2008: £10.1m) Proposed final dividend up 24.4% to 5.6p (2008: 4.5p) s The national footprint reached 122 stores at 31 December 2009 (2008:105) with 17 new stores opened during 2009 (2008:16) s In addition the Group operated 54 Retail Mall Units at 31 December 2009 (2008: nil) s In store gold purchasing volumes near tripled year on year s Scrap margins increased to 39.0% benefiting from the prevailing price of gold (£4.3 million contribution) s The Group expanded its debt facilities securing a £50 million, four year term facility H&T provides a range of simple and Highlights ////////////////////////////////////// IFC Chairman’s Statement ///////////////////////// 3 Business at a glance /////////////////////////// 4 OVERVIEW REVIEW OF THE BUSINESS GOVERNANCE FINANCIAL STATEMENTS accessible financial products tailored What is Pawnbroking? ///////////////////////// 6 Valuations, how H&T manage for a customer base who have limited the process /////////////////////////////////////// 7 Our customers /////////////////////////////////// 8 access to, or are excluded from, the Our people /////////////////////////////////////// 9 traditional banking and finance sector. -

Pauli, Markus (2019). Market for 33 Percent Interest Loans- Financial Inclusion and Microfinance in India

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by DCU Online Research Access Service Pauli 2019 Market for 33 percent interest loans. India Review (Accepted Manuscript – AM) Citation: Pauli, Markus (2019). Market for 33 percent interest loans- Financial inclusion and microfinance in India. India Review, 18(1), 88-111. Note: This is the accepted manuscript – before final copy editing & formatting by the publisher. Free online version of journal article (50 in total) – Please copy and paste into your browser: www.tandfonline.com/eprint/bKJ2hIR8GdumAdFGeFbp/full?target=10.1080/14736489.2019.1576988 Article DOI: https://doi.org/10.1080/14736489.2019.1576988 Author Email: [email protected] Author ORCID ID: https://orcid.org/0000-0003-0799-280X The Market for 33 Percent Interest Loans. Financial Inclusion and Microfinance in India Markus Pauli* Abstract Financial inclusion is the process of building viable institutions that provide financial services to those hitherto excluded. These may include savings, insurances, remittances, and credit. Microfinance became the most dominant method for achieving financial inclusion. However, different microfinance schools of thought recommend opposite ways for attaining financial integration. India is a particularly insightful case study due to the sheer number of people excluded from formal financial services, as well as the spectrum of actors and approaches. The aim of this article is threefold. First, defining financial inclusion, depicting its status quo in India and comparing it to its South Asian and BRICS peers using recently released data from the Global Findex database. Second, focusing on microfinance as the dominant vehicle for achieving financial inclusion by scrutinizing its definitions, contrasting its two leading "schools of thought" and analyzing the central role of its dominant group-based approach. -

Pawnbroking in Limerick

Pawnbroking i hen "Pashie" Browne's, the last of a long line of pawnbrokers'shops, closed its doors about a decade wago, another link with Limerick's poverty-stricken past was severed. In the first half of the present cen- tury, pawnbrokers' signs could be seen hanging outside their shops in nearly MacL all the poorer parts of the city. At least ten of these will be remembered by many readers: Pashie Browne's, "Dot" was sold to a third party, who then of Limerick. Clifford's and O'Dowd's, all in Broad became the owner of the goods. The Rev. Thomas Enright, CC., St. Street, O'Brien's, (later Carmello's), in Since goods on which the debts Mary's, stated in a public letter that not High Street, Parker's in Parnell Street, were not discharged or redeemed less than 25 families were living in one Jackson's in Denmark Street, Kear- could be sold after 12 months, a wide house in his parish, where misery and ney's in Mary Street, Guerin's in Bridge variety of articles were always on show destitution prevailed to a woeful ex- Street and Johnston's in Nicholas in the pawnbroker's window: watches, tent. In the same year (1834), a visitor Street. There were probably some clocks, boots and shoes, articles of to the city, H.D. Inglis, stated "that other pawnshops not mentioned in this jewellery, including wedding rings, nowhere did I meet with more destitu- list. tradesmen't tools, war medals, etc. In tion. I entered forty abodes of poverty Many amusing stories are told about the dim recesses of the shop and on and to the last hour of my existence I "Uncle", as the pawnbrokers were the broad shelves various articles of never will forget the scenes of utter jocosely called. -

540845 Fremont County Ordinance No

540845 FREMONT COUNTY ORDINANCE NO. 301Q. - o^ AN ORDINANCE ESTABLISHING THE REQUIREMENTS FOR THE OPERATION OF PAWNBROKER SERVICES, PROVIDING OR THE REQUIREMENTS FOR RECORD MAINTENANCE; PROVIDING FOR GENERAL PROVISIONS OF PAWNBROKER SERVICES; PROVIDING FOR A PENALTY FOR THE VIOLATION OF THE PROVISIONS OF THIS ORDINANCE; REPEALING ALL ORDINANCES AND PARTS OF ORDINANCES IN CONFLICT HEREWITH; AND PROVIDING WHEN SAID ORDINANCE SHALL BECOME EFFECTIVE. BE IT ORDAINED BY THE BOARD OF COUNTY COMMISSIONERS OF FREMONT COUNTY, IDAHO: I. PAWNBROKER BUSINESS The doing of any single act listed below shall constitute the carrying on of a pawn broker’s business. 1. Loaning or advancing money, whether in the form of cash, credit or draft, to any person on the deposit, pledge, or bailment of personal property of any kind as security for such loan or advancement when the personal property may be repurchased by the party upon paying a sum of money; 2. Loaning or advancing money, whether in the form of cash, check, or draft upon a chattel mortgage(s) on personal property where said property is taken into the possession of the lender as security for the advancement or loan upon any assignment(s), pledge(s) of earned or unearned salary, wages, or earnings; 3. Loaning or advancing money, whether in the form of cash, check, or draft, u pon any contract or agreement which assigns, pledges, or binds the earned or unearned salary, wages, or earnings of the borrower as security for the loan or advancement. 4. Purchasing previously owned or used personal property on the condition that it may be repurchased by the seller within a fixed period of time for a fixed sum of money. -

Pawn Broker Regulations

PUBLIC NOTICE OF INTENT TO ADOPT PAWNBROKER BUSINESS LICENSE REGULATIONS, pursuant to 4 CMC S 5651 CONTENTS: PROPOSED PAWNBROKER BUSINESS *LICENSE REGULATIONS PAWNBROKER BUSINESS LICENSE REGULATIONS (see attached proposed regulation) COPIES OF REGULATIONS: The proposed Pawnbroker Business License Regulations are published in the Commonwealth Register. Copies of the proposed regulation may be obtained from the Department of Commerce, Caller Box 10007, Donni Hill Complex, Capitol Hill, Saipan, MP 96950. PUBLIC COMMENTS: All interested persons may submit written data, views, or arguments about the proposed regulation to the Secretary, Department of Commerce, Caller Box 10007, Donni Hill Complex, Capitol Hill, Saipan, MP 96950, not later than thirty (30) days from the date'of this publication in the Comrnonwealth Register. AUTHORITY: The Department of Commerce is authorized to promulgate regulations pursuant.to 1 CMC §§ 2454, 9104, 4 CMC § 5651. A -- f Commerce pursuant toLl CMC § 2153, the rules and regulations attached hereto have been reviewed as to form and sufficiency and approved by the CNMI Attorney General's Off ice. Dated &&%\ Recorded by: [I"v-7v n. H3.9 ~homabA. /~ebuteb Date COMMONWEALTH REGISTER VOLUME 26 NUMBER 01 January 22,2004 PAGE [?2 fj2 3 PROPOSED PAWNBROKER BUSINESS LICENSE REGULATIONS, pursuant to 4 CMC S 5651 Citation of Statutory Authority: 1 CMC § 2454 modified by Exec. Order-. 94-3 (effective 8/23/94] authorizes the Secretary of the Department of Commerce to promulgate regulations over matters which the Department has jurisdiction. Statement of Goals/Objectives: The purpose of the new proposed regulation is to provide for the regulation of Pawnbroker Business Licenses which is specifically provided for in 4 CMC 5 5651. -

New Application

PAWNBROKER MAIN OFFICE APPLICATION Ohio Pawnbroker Act Ohio Revised Code Sections 1321.21; 4727.01 to 4727.22 and 4727.99 Ohio Administrative Code Chapter 1301:8-5 Ohio Department of Commerce Division of Financial Institutions 77 South High Street, 21st Floor Columbus, OH 43215-6120 Telephone: (614) 728-8400 www.com.ohio.gov/fiin WARNING: It is a crime to provide a false statement to a government official or public agency. R.C. 2921.13. "An Equal Opportunity Employer and Service Provider" PAWNBROKER MAIN OFFICE APPLICATION CHECKLIST The Application submission must include the following: Fee o $500 per location if license is issued between 1/1 and 6/30 of even-numbered year; or, o $800 per location if license is issued any other time o Make check payable to Ohio Division of Financial Institutions Application – Starts on Page 2 o Submit Document Samples with the Application. Application Attestation – Page 12 Company Resolution – (not required for Sole Proprietors) Sample Form on Page 13 Schedule A Forms for Each Required Individual – Instructions on Page 14 o Disclosure Form o Schedule A: Residential & Employment History o Schedule A: Attestation Ownership Disclosure – Page 20 o Identify persons that own or control, directly or indirectly, 5% or more of the applicant Management Disclosure – Page 20 o Identify the senior managers/officers of the applicant Financial Statement: Dated within 90 days prior to the application submission – Page 22 Consent to Service and Jurisdiction – Page 23 Office Manager Statement – Page 24 Background Check – Instructions on Page 25 Criminal History Statement – Page 27 PB App 1 7/2020 PAWNBROKER LICENSE APPLICATION The Company Application is the licensing form used by companies and sole proprietors to apply for any non-depository, financial services license authority with Ohio.