H1B Specialty Occupation Visa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Soaring Wings Vineyard Bluesfest

Volume FiFteen, number Six • June 2011 Soaring Wings Vineyard Bluesfest Saturday, June 4, 2011 17111 S 138th St • Springfield, NE 68059 5:30-6:30 Elwin James Band - 2012 Nebraska NBC finalist 7:00-8:00 Shannon & The Rhythm Kings Popular - KC Blues Band 8:30-9:30 The Candymakers - Winner of the Iowa Blues Challenge 9:30-10:00 JAM Session 2011 OutdOOr cOncerts at a glance Big James and The Chicago Playboys are 6/4.............................................................Soaring.Wings.Vineyard.Bluesfest confirmed to headline “The Blues Society of 6/4........................................................................ Lincoln.BBQ.and.Blues.Fest. Omaha presents The Aksarben Village BluesFest” 6/10...........................................................Big.Head.Todd.&.The.Monsters.w/ on Saturday, June 25th. The Fest will be held at . Toots.&.The.Maytals.at.STIR Stinson Park on 64th & Center. Opening the show 6/10-12..............................................................Omaha.Summer.Arts.Festival at 4pm will be (2) BluesEd Bands, Us & Them and 6/12............................................BluesEd.Benefit.at.Slattery.Vintage.Estates Mojo Bag, followed by Lou DeLuca and the R&M 6/19..................................................Blues.at.Bel.Air.(120th.&.W..Center.Rd.). Blues Band, and then Blue House with the 6/25..............................................BSO.presents.Aksarben.Village.BluesFest. Rent to Own Horns, prior to Big James’ set. 6/25.................................Carolyn.Wonderland.at.Glenwood.Amphitheater -

Son Sealsseals 1942-2004

January/February 2005 Issue 272 Free 30th Anniversary Year www.jazz-blues.com SonSon SealsSeals 1942-2004 INSIDE... CD REVIEWS FROM THE VAULT January/February 2005 • Issue 272 Son Seals 1942-2004 The blues world lost another star Son’s 1973 debut recording, “The when W.C. Handy Award-winning and Published by Martin Wahl Son Seals Blues Band,” on the fledging Communications Grammy-nominated master Chicago Alligator Records label, established him bluesman Son Seals, 62, died Mon- as a blazing, original blues performer and Editor & Founder Bill Wahl day, December 20 in Chicago, IL of composer. Son’s audience base grew as comlications with diabetes. The criti- he toured extensively, playing colleges, Layout & Design Bill Wahl cally acclaimed, younger generation clubs and festivals throughout the coun- guitarist, vocalist and songwriter – try. The New York Times called him “the Operations Jim Martin credited with redefining Chicago blues most exciting young blues guitarist and Pilar Martin for a new audience in the 1970s – was singer in years.” His 1977 follow-up, Contributors known for his intense, razor-sharp gui- “Midnight Son,” received widespread ac- Michael Braxton, Mark Cole, tar work, gruff singing style and his claim from every major music publica- Chris Hovan, Nancy Ann Lee, charismatic stage presence. Accord- tion. Rolling Stone called it ~one of the David McPherson, Tim Murrett, ing to Guitar World, most significant blues Peanuts, Mark Smith, Duane “Seals carves guitar albums of the decade.” Verh and Ron Weinstock. licks like a chain On the strength of saw through solid “Midnight Son,” Seals Check out our new, updated web oak and sings like began touring Europe page. -

LCBS Members Pack Limos to Kalona for a Night of Blues!

I read the news today, oh boy!I read the today, news Issue 164 The Publication of the Linn County Blues Society- lcbs.org March 2008 LCBS Members Pack Limos to Kalona for a 52406-2672 Cedar Rapids, IA Rapids, Cedar Night of Blues! PO Box 2672 Box PO Linn County Blues Society Blues County Linn A very special THANK YOU to these businesses who have signed up to help us kcck.org Keep the Blues Alive! • C.R. Bank & Trust • The Fifth Gear Friday Blues- • Chappy’s Safari • 16th Avenue Prod. • 6-10 PM - Da Friday Blues In this cool issue — • Chrome Horse • KCCK 88.3 • 10-11 PM - Backstage Blues • Longbranch • Checkers Tavern • 11 PM to midnight - KCCK Jams LCBS Blues Bash at Tuscan Moon! • Dudley Bros. Co. • Home Town Restyling • Midnight Blues CD Perry Weber Band at Checkers! • Cocktails & Co. • Next Door Saturday Blues - KUNI Blues Blowout photos • Ron Schantz Const. • Tomaso’s Pizza • 6-10 PM - Da Blues with Bobby D Big Mo’s CD Review • J.M. O’Malley’s • Mahoney’s Irish Pub • 10-11 PM - The Crawfish Circuit Francis Clay 1923-2008 More photos inside! • 11 PM -midnight - The Melting Pot Vinyl LPs From Blind Pig Records “I complained about the salt in her blackeyed peas, and she • Midnight Blues CD Local LIVE Music Schedules put her hand on her hip and she told me to leave” – Keb Mo ©2008-Linn County Blues Society ©2008-Linn County Blues Society The Linn County Blues Society is a way continued from page 4 cool, non-profit organization dedicated to we were both raised up in the same town tavern the preservation of Blues music in Eastern CEDAR RAPIDS,IA. -

Capital Blues Messenger

Capital Blues Messenger Celebrating the Blues in the District of Columbia, Maryland and Virginia January 2016 Volume 10, Issue 1 Good Luck to DCBS Reps at International Blues Challenge by Pat Bransford (Australia, Israel, Philippines, etc.). The Baltimore Blues Society does not have an IBC Update: The 32nd International Blues Challenge entry this year. (IBC) is set for Jan. 26–30, at numerous Reggie Wayne Morris’ CD, Don’t Bring Me venues in the Beale Street Historic District However, the River City Blues Society of Daylight, last week advanced to Round 2 of Memphis, TN. It is five days filled with Virginia, Richmond, is sponsoring The of the competition, joining 27 other self- music and music competitions involving (at Forrest McDonald Band and in the Solo/ produced domestic and international CDs. last count) 120 bands and 94 solo/duo acts, Duo category, Root2 Music. Unfortunately, Don’t Bring Me Daylight did plus 41 Youth Showcase entries. The largest not make the cut to be part of the final five. The Central Virginia Blues Society is being increase from last year’s entry is in the Youth represented by Vintage #18, a band known Duke and Theresa Richmond in the Solo/ Showcase, which jumped from 31 entries in to many DCBS members, and by Adrian Duo category. 2015 to 41 this year—a good sign that more continued page 6 youth are getting involved in the Blues? This year’s IBC begins Tuesday, Jan. 26 with the International Showcase. Quarter Finals DC Blues Society: 2015—A Year at a Glance are Wednesday and Thursday, Jan. -

(KBA) Award Page 1 of 11

2011 Keeping the Blues Alive (KBA) Award Page 1 of 11 2011 Keeping the Blues Alive (KBA) Award The Blues Foundation Press Release The Blues Foundation Keeps the Blues Alive With Its 30th Annual Awards Ceremony in Memphis this February Honorees Include Key Movers from Around the Globe [For Immediate Release November 9, 2011] Memphis, TN - On the heels of achieving its all- time high membership (quickly approaching 4,000 total), The Blues Foundation will honor 21 individuals and organizations with its 2011 Keeping the Blues Alive (KBA) Award during a recognition brunch on Saturday, February 5, 2011, in Memphis, Tennessee. Each year, The Blues Foundation presents the KBA Awards to individuals and organizations that have made significant contributions to the blues music world. The KBA ceremony begins at 10:00 A.M. and will be held in conjunction with the 27th International Blues Challenge (IBC) weekend of events that will feature the final rounds of the world's most prestigious blues competition and largest gathering of blues acts, as well as seminars, showcases, and receptions for blues societies, fans, and professionals on February 1-5. The KBAs are awarded strictly on the basis of merit by a select panel of blues professionals to those working to actively promote and document the music. Nominations are accepted from affiliated blues societies, past KBA recipients and current members of The Blues Foundation's Board of Directors. "The recipients of this year's awards - as with every year - are people and organizations who are an integral part of not only promoting blues music, but of preserving it as well. -

BLUES-A-THON 2017-Description And

BLUES-A-THON 2017-Description and Rules What is the Blues-A-Thon? The Blues-A-Thon is a fundraising event intended to raise money to support the Uptown Music Collective, a 501(c)(3) nonprofit school of music. All funds raised will go directly to the school’s free class and workshop initiative. The fundraising goal for this ninth annual event is $5,000. The Blues-A-Thon will take place at multiple locations during the 24hr period: 6pm to 8pm - First Friday on Pine St. (420 Pine St. Williamsport, Pa) 8pm to 10pm – Pine Square Stage (343 Pine St. Williamsport, Pa) 10pm to 12pm - Uptown Music Collective (144 West Third St. (2nd Floor) Williamsport, Pa) 12pm to 6pm – The Mid-Town Landing (behind the Uptown Music Collective) & Pine Square Stage 6pm – The Michael Ross Event Center (144 West Third St. (3rd Floor) Williamsport, Pa) The public is welcome throughout the event, and is encouraged to make donations to help the organization. The event will feature international blues recording artist Bob Margolin, who will perform with the participants and solo during the opening ceremonies and closing concert. All participants must pledge a number of hours that they intend to perform and seek donations from individuals and companies for each hour pledged. A minimum of $25 in sponsor pledges is required for each participant. Rules of Participation 1. The number of hours each participant pledges to perform and what times they plan to play must be turned into Brendan Mondell, [email protected] by June 2nd. 2. Participants must turn in a completed registration form with a sponsor sheet and envelope with a minimum of $25 in pledges by 5:00 pm on Friday, June 2nd to participate. -

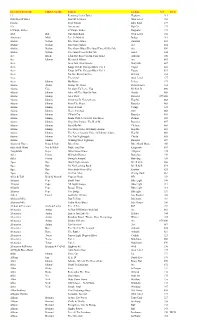

Band/Surname First Name Title Label No

BAND/SURNAME FIRST NAME TITLE LABEL NO DVD 13 Featuring Lester Butler Hightone 115 2000 Lbs Of Blues Soul Of A Sinner Own Label 162 4 Jacks Deal With It Eller Soul 177 44s Americana Rip Cat 173 67 Purple Fishes 67 Purple Fishes Doghowl 173 Abel Bill One-Man Band Own Label 156 Abrahams Mick Live In Madrid Indigo 118 Abshire Nathan Pine Grove Blues Swallow 033 Abshire Nathan Pine Grove Blues Ace 084 Abshire Nathan Pine Grove Blues/The Good Times Killin' Me Ace 096 Abshire Nathan The Good Times Killin' Me Sonet 044 Ace Black I Am The Boss Card In Your Hand Arhoolie 100 Ace Johnny Memorial Album Ace 063 Aces Aces And Their Guests Storyville 037 Aces Kings Of The Chicago Blues Vol. 1 Vogue 022 Aces Kings Of The Chicago Blues Vol. 1 Vogue 033 Aces No One Rides For Free El Toro 163 Aces The Crawl Own Label 177 Acey Johnny My Home Li-Jan 173 Adams Arthur Stomp The Floor Delta Groove 163 Adams Faye I'm Goin' To Leave You Mr R & B 090 Adams Johnny After All The Good Is Gone Ariola 068 Adams Johnny After Dark Rounder 079/080 Adams Johnny Christmas In New Orleans Hep Me 068 Adams Johnny From The Heart Rounder 068 Adams Johnny Heart & Soul Vampi 145 Adams Johnny Heart And Soul SSS 068 Adams Johnny I Won't Cry Rounder 098 Adams Johnny Room With A View Of The Blues Demon 082 Adams Johnny Sings Doc Pomus: The Real Me Rounder 097 Adams Johnny Stand By Me Chelsea 068 Adams Johnny The Many Sides Of Johnny Adams Hep Me 068 Adams Johnny The Sweet Country Voice Of Johnny Adams Hep Me 068 Adams Johnny The Tan Nighinggale Charly 068 Adams Johnny Walking On A Tightrope Rounder 089 Adamz & Hayes Doug & Dan Blues Duo Blue Skunk Music 166 Adderly & Watts Nat & Noble Noble And Nat Kingsnake 093 Adegbalola Gaye Bitter Sweet Blues Alligator 124 Adler Jimmy Midnight Rooster Bonedog 170 Adler Jimmy Swing It Around Bonedog 158 Agee Ray Black Night is Gone Mr. -

Blues Notes November 2013

VOLUME EIGHTEEN, NUMBER ELEVEN • NOVEMBER 2013 Sunday Dec. 8th BSO HOLIDAY PARTY to benefit TOY DRIVE FOR PINE RIDGE Sokol Auditorium @ 2:30 p.m. Featuring INDIGENOUS PLUS 3 OTHER BANDS Also on P.S. Blues 9 a.m. to 12 p.m. You can also donate at www.toydriveforpineridge.com Full info with details inside SHAWN HOLT and the TEARDROPS Blind Pig Records CD Release Party! Tuesday, December 10th THURSDAY BLUES SERIES The 21st Saloon at 6:00pm 4727 S 96th Plaza BSO member discounts on admission and CD’s! All Shows 6:00pm unless noted After twenty-four years and ten releases as Magic Slim’s label, Blind Pig Records is very proud to announce the November 7th .................. Rockin’ Johnny Burgin w/JW Jones ($10) debut recording by Shawn Holt & the Teardrops, “Daddy November 14th .......................................................The Bel Airs ($8) Told Me.” Shawn’s booming vocal presence is more than November 21st ............................................................... Harper ($8) a little reminiscent of his father’s, and his guitar playing November 27th (WEDS) ..........................The Todd Wolfe Band ($8) while similar to Slim’s exhibits a broader mix of classic and contemporary influences. Combining a couple of his December 5th ............................... Davina and the Vagabonds ($10) Dad’s songs and other songs associated with him with December 12th .........................................The Ori Naftaly Band ($8) five of his own originals, Shawn shows himself more December 19th ...........................................................Nikki Hill ($10) than capable of leading the Teardrops into a new era. December 26th ...........................................................................TBA PAGE 2 BLUES NEWS • BLUES SOCIETY OF OMAHA Why donate to The Blues Society of Omaha? The Blues Society of Omaha, Inc is a 501C3 Non-Profit Organization that was formed in 1998. -

Muziek Voor Volwassenen / Johan Derksen Woensdag 26 December 2018, Tweede Kerstdag

Muziek voor Volwassenen / Johan Derksen Woensdag 26 december 2018, Tweede Kerstdag TITEL ARTIEST COMPONIST TIJD PLATENLABEL LABELNO CD TITEL 09.00 - 10.00 uur 1 Christmas fais do do Marcia Ball Ball 3:15 Alligator Records XMAS 9202 Genuine houserockin' Christmas 2 Sunshine after the rain Elkie Brooks Greenwich 3:20 Sony Music 8875051792 A natural woman 3 Santa claus do you ever get the blues Roomful of Blues Vachon 3:23 Alligator Records XMAS 9202 Genuine houserockin' Christmas 4 Nights on broadway Candi Staton Gibb, Gibb, Gibb 3:31 Sony Music 8875051792 A natural woman 5 Really been good this year Saffire Rabson 3:28 Alligator Records XMAS 9202 Genuine houserockin' Christmas 6 Mr. big stuff Jean Knight Broussard, Williams 2:25 Sony Music 8875051792 A natural woman 7 All i want for christmas Lonnie Brooks L. Brooks, R.B. Brooks 4:55 Alligator Records XMAS 9202 Genuine houserockin' Christmas 8 I'm gonna tear your playhouse down Ann Peebles Randle 2:41 Sony Music 8875051792 A natural woman 9 A bluesman's christmas Coco Montoya Steen 4:28 Alligator Records XMAS 9202 Genuine houserockin' Christmas 10 I don't want to be right Millie Jackson Banks, Hampton 3:26 Sony Music 8875051792 A natural woman 11 Fattening up the turkey Dave Hole Dave Hole 3:42 Alligator Records XMAS 9202 Genuine houserockin' Christmas 12 Something tells me Cilla Black Cook, Greenaway 2:25 Sony Music 8875051792 A natural woman 13 Christmas time Billy Boy Arnold Jimmy McCracklin 5:26 Stoney Plain SPCD 1269 Stoney Plain's Christmas blues 14 Christmas 9-1-1 Sonny Rhodes Sonny Rhodes 6:05 Stoney Plain SPCD 1269 Stoney Plain's Christmas blues 10.00 - 11.00 uur 1 Do you hear what I hear Carrie Underwood N. -

Fall 2010 E-News-FINAL

Ottawa BLUES Society Got Blues? Join the Club! Road to the IBC in Memphis—Feb 1-5, 2011 Fall 2010 Al Wood & the Woodsmen join Brandon Agnew & Benny Gutman on the ‘Road to Inside the e-news Memphis’. Brandon & Benny were the successful Solo/Duo competitors at the ♫ Road to Memphis Ottawa Blues Society’s first ever Solo/Duo ♫ OBS Update blues challenge held on Wednesday, ♫ September 8. Al Wood & the Woodsmen Blues Summit & Maple Blues advanced to the finals from the 3rd Band Awards Qualifying Round, held Wednesday, September 22. Friday, September 24, six ♫ Blues Foundation News finalist bands played smokin’ sets at Tucson’s, and Al & his Woodsmen got the ♫ Blues News & Random nod from the finals judges. The other finalists included Bluestone, Lil’ Al’s Notes Combo, Steve Groves & the Wit Shifters, the Brothers Chaffey and Jeff Rogers ♫ Summer Festival Photos & the All Day Daddies. Throughout the ♫ DVD Review competitions, each ♫ Amanda’s Rollercoaster performance was judged by the same criteria as is used at the International Blues Challenge in Memphis. Bands played for 25 minutes, solos & duos for 20 minutes. Cover charges and impressive raffle draws raised a total of $5,200 as financial support for travel and accommodation expenses for the winners. The Ottawa Blues Society extends a special thank you to the following who contributed hugely to the success of the 2010 Road to Memphis: ♪ from the OBS - our volunteers, and our corporate sponsors, for their donations and support; ♪ from Tucson’s - Steve Ross, Jim Jones, our hostess Jennifer -

Blueink Newsletter DEC 2013

BLUE INK www.BLUSD.org DEC 2013 Vol 15- Issue 12 IBC Sendoff Party... Help Fuzzy Rankin’s Band get to Memphis ~ Two Women Burn The Blues & more IBC Sendoff Party 2014 January 11 ~ Tio Leo’s et’s send our winners off in style! The BLUSD’s official IBC Send- LOff Party will be January 11 at Tio Leo’s (Napa/Moreno) starring the Lenny “Fuzzy” Rankins Band & Friends, 1-4 pm. Proceeds and donations will help get the band to Memphis. The Blues Foundation's 30th IBC is set to begin Tuesday, January 21, 2014 and conclude on Saturday January 25, 2014. The competition will be held in Memphis, TN in the Beale Street entertainment district. Known as the largest “Battle of Blues Bands in the World,” acts compete for wider recognition and a coveted spot performing on the Legendary Rhythm & Blues Cruise. If you want to go to Memphis to root the band on, tickets are available online from the Blues Foundation at www.blues.org. They also have special prices and direct lines and links to a number of Downtown Memphis hotels for the 2014 International Blues Challenge. Reserve your room early to get what you want--best price, closest to Beale. Beale Street comes alive with the best regional acts from around the globe plus there’s the Keeping the Blues Alive KBA luncheon and thousands of blues industry people and fans. If you’d like to make a donation to help get Fuzzy Rankins Blues Band to Memphis, please contact us at [email protected] Two Women Burn The Blues Cee Cee James & Michele Lundeen riday December 20, “Two Women Burn The Blues,” at the House of Blues San Diego from 7-11pm. -

Finding Aid for the Blues Archive Poster Collection (MUM01783)

University of Mississippi eGrove Archives & Special Collections: Finding Aids Library April 2020 Finding Aid for the Blues Archive Poster Collection (MUM01783) Follow this and additional works at: https://egrove.olemiss.edu/finding_aids Part of the African American Studies Commons, American Material Culture Commons, American Popular Culture Commons, and the Other Music Commons Recommended Citation Blues Archive Poster Collection (MUM01783), Archives and Special Collections, J.D. Williams Library, The University of Mississippi This Finding Aid is brought to you for free and open access by the Library at eGrove. It has been accepted for inclusion in Archives & Special Collections: Finding Aids by an authorized administrator of eGrove. For more information, please contact [email protected]. University of Mississippi Libraries Finding Aid for the Blues Archive Poster Collection MUM01783 TABLE OF CONTENTS SUMMARY INFORMATION Summary Information Repository University of Mississippi Libraries Scope and Content Creator - Collector Arrangement Cole, Dick "Cane"; King, B. B.; Living Blues Administrative Information (Magazine); Malaco Records; University of Mississippi; Miller, Betty V. Related Materials Controlled Access Headings Title Blues Archive Poster Collection Collection Inventory ID Series 1: General Posters MUM01783 Series 2: B. B. King Posters Date [inclusive] 1926-2012 Series 3: Malaco Records Posters Date [bulk] Series 4: Living Blues Bulk, 1970-2012 Posters Extent Series 5: Dick “Cane” 3.0 Poster cases (16 drawers) Cole Collection Location Series 6: Betty V. Miller Blues Archive Collection Series 7: Southern Language of Materials Ontario Blues Association English Broadsides Abstract Series 8: Oversize These blues posters, broadsides, and oversize Periodicals printings, collected by various individuals and Series 9: Blues Bank institutions, document the world of blues advertising.