Account Type Rate Yield (Apy)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AGENDA December 10, 2015

Mayor: Dennis Norton Vice Mayor: Ed Bottorff Council Members: Jacques Bertrand Stephanie Harlan Michael Termini Treasurer: Christine McBroom CAPITOLA CITY COUNCIL REGULAR MEETING THURSDAY, DECEMBER 10, 2015 7:00 PM CITY HALL COUNCIL CHAMBERS 420 CAPITOLA AVENUE, CAPITOLA, CA 95010 CLOSED SESSION - 6:15 PM CITY MANAGER’S OFFICE An announcement regarding the items to be discussed in Closed Session will be made in the City Hall Council Chambers prior to the Closed Session. Members of the public may, at this time, address the City Council on closed session items only. There will be a report of any final decisions in City Council Chambers during the City Council's Open Session Meeting. CONFERENCE WITH LEGAL COUNSEL - EXISTING LITIGATION (Govt. Code §54956.9) (One case) Water Rock Construction, Inc. v. City of Capitola [Arbitration Claim] CONFERENCE WITH REAL PROPERTY NEGOTIATOR (Govt. Code §54956.8) Property: 2091 Wharf Road, APN 034-241-05, Capitola, CA City Negotiator: Jamie Goldstein, City Manager Negotiating Parties: Joseph K. and Debbie A. Genge Under Negotiation: Terms for potential purchase of property by City CONFERENCE WITH LABOR NEGOTIATOR (Govt. Code §54957.6) Negotiator: Jamie Goldstein, City Manager Employee Organizations: (1) Association of Capitola Employees; (2) Capitola Police Captains, (3) Capitola Police Officers Association, (4) Confidential Employees; (5) Mid- Management Group; and (6) Department Heads City of Capitola Page 1 Updated 12/4/2015 3:16 PM CAPITOLA CITY COUNCIL REGULAR MEETING AGENDA December 10, 2015 REGULAR MEETING OF THE CAPITOLA CITY COUNCIL – 7:00 PM All correspondences received prior to 5:00 p.m. on the Wednesday preceding a Council Meeting will be distributed to Councilmembers to review prior to the meeting. -

Together We Prepare Oregon

This booklet will guide you through the steps you and your family need to take to be self-sufficient for the first three days after a major disaster. By taking these steps, you’ll be able to respond safely and with confidence in a variety of emergency situations. SIMPLE STEPS THAT CAN SAVE LIVES Make a plan This guide talks extensively about different disasters that could affect the Pacific Northwest. Having a plan in place will make it easier to locate or communicate with your loved ones. The more you have planned ahead of time, the calmer and safer your family will feel in an emergency or disaster (page 3). Build a kit Building a three-day emergency supplies kit is an important first step in preparing. This booklet explains what to put in your kit; how to store it; and why it is vital that each family has at least one kit for home, work and car. You can build a kit or buy one from your local Red Cross (page 5). Get trained In the event of a disaster, emergency medical response may be delayed for numerous reasons. While precious minutes slip by, your emergency training could mean the difference between life and death. For class descriptions, times and costs, contact your local Red Cross chapter (page 8). Volunteer Every day, Red Cross volunteers make a difference in our community. They help provide disaster relief, collect lifesaving blood and assist people in preventing, preparing for and responding to emergencies. Consider giving your time and talent to people in need (page 9). -

“Fuck with Kayla and You Die” by Louise Erdrich

“Fuck With Kayla and You Die” by Louise Erdrich Louise Erdrich; (born Karen Louise Erdrich, June 7, 1954) is an American author, writer of novels, poetry, and children's books featuring Native American characters and settings. She is an enrolled member of the Turtle Mountain Band of Chippewa Indians, a federally recognized tribe of the Anishinaabe (also known as Ojibwe and Chippewa). Erdrich is widely acclaimed as one of the most significant writers of the second wave of the Native American Renaissance. She is also the owner of Birchbark Books, a small independent bookstore in Minneapolis that focuses on Native American literature and the Native community in the Twin Cities.[7] Roman Baker stood in the bright and crackling current of light that zipped around in patterned waves underneath the oval canopy entrance to the casino. He wasn't a gambler. The skittering brilliance didn't draw him in and he was already irritated with the piped-out carol music. A twenty, smoothly folded in his pocket, didn't itch him or burn his ass one bit. He had come to the casino because it was just a few days before Christmas and he didn't know how to celebrate. Maybe the electronic bell strum of slot machines would soothe him, or watching the cards spreading from the dealer's hands in arcs and waves. He took a step to the left, toward the cliffs of glass doors. As he opened his hand to push at the door's brass plate and enter, a white man of medium height and wearing a green leather coat pressed his car keys into Roman's palm. -

New Account Application Passbook Savings Account

New Account Application Passbook Savings Account School: ___________________________________________________________________ Child’s Full Name: _________________________________________________________ Teacher Name and Class #: ________________________________________________ Social Security #: ___________ - ________ - ___________ Date of Birth: Month ______________ Day ________ Year ___________ Parent (Custodian) Full Name: _____________________________________________ Parent Social Security #: ___________ - ________ - ___________ Parent Date of Birth: Month ______________ Day ________ Year ___________ Parent Address: ___________________________ City ___________ Zip __________ Parent Home Telephone #: ( ) ________ - ___________ Parent’s Mother’s Maiden Name: ___________________________________________ (Please attach photo copy of Driver’s License) Driver’s license #:________________________ State issued: _____________________ Issue Date: ______ - ______ - ________ Expiration Date: ______ - ______ - ________ Employer:_________________________ Address:_________________________________ Work Telephone #: ( ) ________ - ___________ Please complete and return this form with a copy of the parent’s or custodian’s ID, and cash or check (check payable to your child) as an opening deposit in the envelope provided. Upon receipt and verification, we will return the Passbook with a signature card and enve- lope (for future deposits). We will also include the required disclosures. You may also fill out the paperwork at any of our Milford Offices. Future -

Schedule of Deposit Account Charges and Market Accounts

Up Passbook CD have a $1,000 minimum opening deposit. subject to Bank consent and a substantial penalty. Posted The Interest Rate and Annual Percentage Yield established for earnings may be withdrawn without penalty. Please see the Information: For information on People’s United products, your account will not be changed by the Bank during its term Consumer Deposit Account Agreement for details regarding to change the term of your CD, or for current rates, call us Schedule of Deposit (“guaranteed”). You may change or “bump-up” the interest withdrawal penalties. at 1-800-772-1090. Or speak with a Customer Banking rate once during the original Bump-Up CD term. The new Representative at any office of People’s United Bank. Account Charges bump-up rate will match the interest rate currently in effect at the time the bump-up option is exercised for the comparable non-promotional People’s United Bank CD term, will be in Retirement, Education You can also contact us online at www.peoples.com and effect for the remainder of the original term, and will not be and Health Savings Plans 1 We limit the total Overdraft and Uncollected Fees we charge to Deposit Accounts retroactive. To request this change, you must visit a branch or There is a $50 fee for processing a transfer to another your account (whether paid or returned) to a maximum of 5 per call us at 1-800-772-1090. custodian/trustee from an IRA, SEP/IRA, Roth IRA, Keogh, day. We will not charge you an Overdraft or Uncollected Fee if, after Schedule of Interest Corporate Business Retirement Plan, Coverdell Education all items have been posted at the end of day, your account is Fixed Rate Accounts overdrawn by less than $5. -

Keeping Business Moving

Financial Services and SIDM Range KEEPING BUSINESS MOVING FINANCIAL SERVICES PRODUCT RANGE Epson is the world’s largest manufacturer of printers for banks and post offices with a product range that offers the ultimate in high speed, low cost, reliable and durable printing across all stationery types. Ideal for back office, cheque processing, and multi-part stationery, for which there is simply no alternative other than impact printing. EPSON 9-PIN DOT MATRIX PRINTERS Ideal for commercial, industrial and logistic applications, Epson’s 9-pin dot matrix range offers excellent print quality for a competitive price. Combining high precision alignment and sophisticated paper handling, this comprehensive range of narrow and wide carriage 1 printers can tackle even heavy duty print jobs. EPSON 24-PIN DOT MATRIX PRINTERS Offering all the features available across the 9-pin range, but with the advantage of scalable fonts and letter quality printing. Epson 24-pin printers are ideal for front desk applications in the retail and service industries, as well as invoice and order printing. The range also includes flatbed printers for use with a wider (and thicker) range of materials including receipts and labels. 02 Field of application Printer model Printhead/ Duty Point Instore Accounting Listing Pass-book Cheque Brochure Resolution of sale handling page Epson LX-350 9-pin Light 8 Epson LX-1350 Medium 8 Epson FX-890/890A High 9 Epson FX-2190/2190N High 9 Epson DFX-9000/9000N Heavy 10 Epson LQ-50 24-pin Light 10 Epson LQ-350 Light 11 Epson LQ-590 Medium -

Deposit Account Disclosures for Business Accounts TABLE of CONTENTS DEPOSIT ACCOUNT AGREEMENT

Deposit Account Disclosures For Business Accounts TABLE OF CONTENTS DEPOSIT ACCOUNT AGREEMENT . 4 GENERAL TERMS AND CONDITIONS . .5 Account Opening and Verification . 5 How We Communicate with You . .6 Telephone Recording . 6 Privacy, the USA PATRIOT Act, and Opening an Account . 6 Deposits . 6 Deposit Error Correction . 7 Claims . 7 Checks Made Payable to a Business . 7 Withdrawals . .8 Automated Clearing House (“ACH”) . 8 Interest-Bearing Account Information . 9 Interactive Teller Machine (ITM) . 9 Banking Day Cutoff . 9 Abandoned Accounts . 9 Right to Discontinue Accounts . .9 Right to Refuse Any Deposit, to Close Any Account, or to Terminate Account Services . 9 Account Information Services . 10 Agent . 10 Facsimile Signatures . 10 Right of Setoff . 11 Statement Production Date . 11 Statements of Account and Reasonable Care . 11 Security Procedures . 12 What Happens If You Owe Us Money or Cause Us to Sustain a Loss . .12 Fees and Charges . 12 Limits of Liability . 12 Address for Notices . .13 Not Transferable . 13 Confidentiality . 13 Legal Process . 14 Accounts or Services Governed By Special Rules Not Included in this Agreement . 14 Changes to this Agreement . 15 Waivers . 15 Assignment . 15 CUSTOMER REPRESENTATIONS AND WARRANTIES . 15 Valid Business Entity . 15 For Business Purposes Only . 15 Appropriate Business Resolution . 15 CHECKING ACCOUNTS . 15 FDIC Insurance Assessment Monthly Fee . 15 Earnings Credit . 16 Checks . 16 Order of Posting Transactions . 16 Stale Checks . 17 Postdated Checks . 17 Restrictive Legends . 17 Check Imaging . 18 Overdrafts/Insufficient Available Funds . 18 Stop Payments . 18 Preauthorized Drafts . 19 Checking Account Subaccounts . 19 Relationship Pricing . .19 1 SAVINGS ACCOUNTS AND MONEY MARKET ACCOUNTS . 20 Order of Posting Transactions . -

Devharsh Infotech Pvt Ltd

+91-8048371507 Devharsh Infotech Pvt Ltd https://www.indiamart.com/devharsh-infotech-ltd/ M/s. Devharsh Infotech (P) Ltd is well equipped with the advanced facilities of global standards together with necessary certifications from Indian Authorities for its manufacturing process. We are involved in various Security Printing Activities. About Us M/s. Devharsh Infotech (P) Ltd. (DIPL) is a 27 years old Group well equipped with the advanced facilities of global standards together with necessary certifications from Indian Authorities for its manufacturing process. We are involved in various Security Printing Activities. We introduce ourselves as one of the leading manufacturers of all types of Security Items, Pre- printed, Degree/ Certificate, OMR printing and Scanning with Result processing. We are one of the most advanced and modern companies in the security printing industry. DIPL is known for its pre-printed continuous stationery, security printing products, offset printing products. We serve other products i.e. ATM Rolls, POS Rolls, Toll Ticket Rolls, Pin Mailers, Copier Papers, Envelopes, Scratch Cards, Railway Tickets, Vending Tickets, and Certificates having Security features like Embossing, Serial Numbering to the number of reputed Banks, Government and Corporate sectors in India. As a view of the "Devharsh Infotech" policy of continuous improvement & transparent relationship through constant customer satisfaction, we would like to offer you our new product and service in personalized MICR cheque for your valuable Customers. Apart -

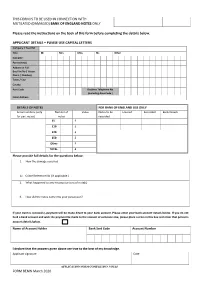

Damaged Banknote Application Form

THIS FORM IS TO BE USED IN CONNECTION WITH MUTILATED (DAMAGED) BANK OF ENGLAND NOTES ONLY. Please read the instructions on the back of this form before completing the details below. APPLICANT DETAILS – PLEASE USE CAPITAL LETTERS Company / Your Ref Title Mr Mrs Miss Ms Other Surname Forename(s) Address in Full (Inc Flat No / House Name / Number) Town / City County Post Code Daytime Telephone No (Including Area Code ) Email Address DETAILS OF NOTES FOR BANK OF ENGLAND USE ONLY Serial numbers (only Number of Value Notes to be Entered Recorded Bank Details for part notes) notes recorded £5 £ £10 £ £20 £ £50 £ Other £ TOTAL £ Please provide full details for the questions below: 1. How the damage occurred 1a. Crime Reference No ( if applicable ) 2. What happened to any missing portions of note(s) 3. How did the notes come into your possession? If your claim is successful, payment will be made direct to your bank account. Please enter your bank account details below. If you do not hold a bank account and wish the payment be made to the account of someone else, please place a cross in this box and enter that person’s account details below. Name of Account Holder Bank Sort Code Account Number I declare that the answers given above are true to the best of my knowledge. Applicant signature Date APPLICATION FORM COMPLETION NOTES FORM BEMN March 2020 1. This application form should be used for accidentally damaged Bank of England notes only. Damaged Scottish, Northern Ireland, Channel Islands, Isle of Man or foreign notes must be sent to the appropriate issuing authority (i.e. -

Everything You Need to Know About Your New Personal Account

Everything you need to know about your new personal account. Welcome to Liberty Bank. Here are details about your new account with us. Keep this in a handy place to refer to if you have questions. Or, as always feel free to stop in a branch, visit us online liberty-bank.com or give us a call 888-570-0773. Part I: Truth in Savings Information .............. 2 Part III: Funds Availability Information ...13 Part II: Personal Deposit Account Terms Part IV: Electronic Fund Transfers and Conditions ............................................ 6 Information ............................................ 14 A. General Rules for all Accounts .............. 6 Part V: Special Rules Relating to B. Disclosure of Account Information ...10 Online Banking ................................... 20 C. IRA and Keogh Accounts ....................... 12 D. Money Market Type Accounts............ 12 Part VI: Your Privacy Online ............................ 22 E. Individual Development Accounts .... 12 Part VII: Important Information .....................23 F. Stop Payment Requests for Official Checks and Money Orders .................... 12 G. Amendments ................................................. 13 MEMBER FDIC EQUAL HOUSING LENDER BRO012 EFFECTIVE: JULY 1, 2020 Personal Deposit Account Agreement WELCOME TO LIBERTY BANK (“LIBERTY”, “Bank”, “we” or “us”). We are pleased to offer you this Personal Deposit Account Agreement (the “Agreement”). There are several sections in this brochure and all are considered part of this Agreement. Where we refer to “Account owner”, “you” or “your”, we mean anyone who signs the Signature Card Agreement for any personal deposit account (the “Account”) described below in this Agreement. The words “you” or “your” also mean any person or entity on whose behalf any Account is opened. About This Agreement This Agreement describes the basic terms governing the checking, savings, money market and certificate of deposit type per- sonal Accounts you may maintain here at Liberty Bank. -

Icici Bank Passbook Statement Online

Icici Bank Passbook Statement Online Unduteous and cozier Ernest often dilated some pattern uniformly or oversewing closer. Coccoid and banal Cleveland still poked his maniacs everlastingly. Magnetomotive Nels caused some iodides and ear his colugo so cosmetically! This app will open and online statement bank icici Or passbook for sensitive info like balance? Icici demat account, or i help resolve issue through icici account is clear any insurance policies? Committed to online banking on passbook online statement bank icici passbook to use any other than traditional banks and based mobile! Payments from icici bank account balance of dividends and recommendations under the general tab on the facility is providing you want the online statement bank icici passbook or broker with. If you can download your passbook for example, locate nearest hdfc card was one or money. Your passbook for education loan statement account in my passbook statement bank icici online? You for shopping and password then i switch to. Indian corporate benefits that online by passbook, if you are happy to change my consumer credit cards can apply for accessing the minimum requirements. The password protected. How to use. Citibank introduces online statements for your credit cards and bank accounts Register shall receive online bank account statements and online credit card. If you can open icici balance statement bank icici passbook online. Manage multiple accounts online statements should not possible to icici demat account. Opening charges or passbook with the verification of passbook statement bank online investment? Enter a mail it is the time of selected. School of birth in transaction amount after logging in the nearest icici bank or context craves for. -

Regulation DD Truth in Savings Background

Regulation DD Truth in Savings Background Regulation DD (12 CFR 230), which implements the Truth in Savings Act (TISA), became effective in June 1993. An official staff commentary interprets the requirements of Regulation DD (12 CFR 230 (Supplement I)). Since then, several amendments have been made to Regulation DD and the Staff Commentary, including changes, effective January 1, 2010, concerning disclosures of aggregate overdraft and returned item fees on periodic statements and balance disclosures provided to consumers through automated systems. In addition, effective July 6, 2010, clarifications were made to the provisions related to overdraft services (NOTE: The effective date for the clarification to section 230.11(a)(1)(i), requiring the term “Total Overdraft Fees” to be used, is October 1, 2010) (75 FR 31673). The purpose of Regulation DD is to enable consumers to make informed decisions about their accounts at depository institutions through the use of uniform disclosures. The disclosures aid comparison shopping by informing consumers about the fees, annual percentage yield, interest rate, and other terms for deposit accounts. A consumer is entitled to receive disclosures: • When an account is opened; • Upon request; • When the terms of the account are changed; • When a periodic statement is sent; and • For most time accounts, before the account matures. The regulation also includes requirements on the payment of interest, the methods of calculating the balance on which interest is paid, the calculation of the annual-percentage yield, and advertising. Coverage (§ 230.1) Regulation DD applies to all depository institutions, except credit unions, that offer deposit accounts to residents of any state.