Welcome to Vaud Canton Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Canton of Vaud: a Drone Industry Booster

Credit photo: senseFly Canton of Vaud: a drone industry booster “We now Engineering Quality, Trusted Applications & Neutral Services practically cover Switzerland offers a unique multicultural and multidisciplinary drone ecosystem ideally the entire located in the centre of Europe. Swiss drone stakeholders have the expertise and spectrum of experience that can be leveraged by those looking to invest in a high growth industry, technology for develop their own business or hire talent of this new era for aviation. Foreign small drones: companies, like Parrot and GoPro, have already started to invest in Switzerland. sensors and control, Team of teams mechatronics, Swiss academia, government agencies, established companies, startups and industry mechanical associations have a proven track record of collaborating in the field of flying robotics design, and unmanned systems. Case in point: the mapping solution proposed by senseFly communication, (hardware) and Pix4D (software). Both are EPFL spin-offs, respectively from the and human Intelligent Systems Lab & and the Computer Vision Labs. They offer a good example of interaction.” how proximity to universities and the Swiss aviation regulator (FOCA) gave them a competitive and market entry advantage. Within three years the two companies have Prof. Dario Floreano, collectively created 200 jobs in the region and sell their products and services Director, Swiss worldwide. Another EPFL spin-off, Flyability, was able to leverage know-how of National Centre of regionally strong, robust and lightweight structure specialists, Décision and North TPT Competence and to produce their collision tolerant drone that won The UAE Drones for Good Award of Research Robotics USD One Million in 2015. -

Canton of Basel-Stadt

Canton of Basel-Stadt Welcome. VARIED CITY OF THE ARTS Basel’s innumerable historical buildings form a picturesque setting for its vibrant cultural scene, which is surprisingly rich for THRIVING BUSINESS LOCATION CENTRE OF EUROPE, TRINATIONAL such a small canton: around 40 museums, AND COSMOPOLITAN some of them world-renowned, such as the Basel is Switzerland’s most dynamic busi- Fondation Beyeler and the Kunstmuseum ness centre. The city built its success on There is a point in Basel, in the Swiss Rhine Basel, the Theater Basel, where opera, the global achievements of its pharmaceut- Ports, where the borders of Switzerland, drama and ballet are performed, as well as ical and chemical companies. Roche, No- France and Germany meet. Basel works 25 smaller theatres, a musical stage, and vartis, Syngenta, Lonza Group, Clariant and closely together with its neighbours Ger- countless galleries and cinemas. The city others have raised Basel’s profile around many and France in the fields of educa- ranks with the European elite in the field of the world. Thanks to the extensive logis- tion, culture, transport and the environment. fine arts, and hosts the world’s leading con- tics know-how that has been established Residents of Basel enjoy the superb recre- temporary art fair, Art Basel. In addition to over the centuries, a number of leading in- ational opportunities in French Alsace as its prominent classical orchestras and over ternational logistics service providers are well as in Germany’s Black Forest. And the 1000 concerts per year, numerous high- also based here. Basel is a successful ex- trinational EuroAirport Basel-Mulhouse- profile events make Basel a veritable city hibition and congress city, profiting from an Freiburg is a key transport hub, linking the of the arts. -

Upper Rhine Valley: a Migration Crossroads of Middle European Oaks

Upper Rhine Valley: A migration crossroads of middle European oaks Authors: Charalambos Neophytou & Hans-Gerhard Michiels Authors’ affiliation: Forest Research Institute (FVA) Baden-Württemberg Wonnhaldestr. 4 79100 Freiburg Germany Author for correspondence: Charalambos Neophytou Postal address: Forest Research Institute (FVA) Baden-Württemberg Wonnhaldestr. 4 79100 Freiburg Germany Telephone number: +49 761 4018184 Fax number: +49 761 4018333 E-mail address: [email protected] Short running head: Upper Rhine oak phylogeography 1 ABSTRACT 2 The indigenous oak species (Quercus spp.) of the Upper Rhine Valley have migrated to their 3 current distribution range in the area after the transition to the Holocene interglacial. Since 4 post-glacial recolonization, they have been subjected to ecological changes and human 5 impact. By using chloroplast microsatellite markers (cpSSRs), we provide detailed 6 phylogeographic information and we address the contribution of natural and human-related 7 factors to the current pattern of chloroplast DNA (cpDNA) variation. 626 individual trees 8 from 86 oak stands including all three indigenous oak species of the region were sampled. In 9 order to verify the refugial origin, reference samples from refugial areas and DNA samples 10 from previous studies with known cpDNA haplotypes (chlorotypes) were used. Chlorotypes 11 belonging to three different maternal lineages, corresponding to the three main glacial 12 refugia, were found in the area. These were spatially structured and highly introgressed 13 among species, reflecting past hybridization which involved all three indigenous oak species. 14 Site condition heterogeneity was found among groups of populations which differed in 15 terms of cpDNA variation. This suggests that different biogeographic subregions within the 16 Upper Rhine Valley were colonized during separate post-glacial migration waves. -

Insights Into the Thermal History of North-Eastern Switzerland—Apatite

geosciences Article Insights into the Thermal History of North-Eastern Switzerland—Apatite Fission Track Dating of Deep Drill Core Samples from the Swiss Jura Mountains and the Swiss Molasse Basin Diego Villagómez Díaz 1,2,* , Silvia Omodeo-Salé 1 , Alexey Ulyanov 3 and Andrea Moscariello 1 1 Department of Earth Sciences, University of Geneva, 13 rue des Maraîchers, 1205 Geneva, Switzerland; [email protected] (S.O.-S.); [email protected] (A.M.) 2 Tectonic Analysis Ltd., Chestnut House, Duncton, West Sussex GU28 0LH, UK 3 Institut des sciences de la Terre, University of Lausanne, Géopolis, 1015 Lausanne, Switzerland; [email protected] * Correspondence: [email protected] Abstract: This work presents new apatite fission track LA–ICP–MS (Laser Ablation Inductively Cou- pled Plasma Mass Spectrometry) data from Mid–Late Paleozoic rocks, which form the substratum of the Swiss Jura mountains (the Tabular Jura and the Jura fold-and-thrust belt) and the northern margin of the Swiss Molasse Basin. Samples were collected from cores of deep boreholes drilled in North Switzerland in the 1980s, which reached the crystalline basement. Our thermochronological data show that the region experienced a multi-cycle history of heating and cooling that we ascribe to burial and exhumation, respectively. Sedimentation in the Swiss Jura Mountains occurred continuously from Early Triassic to Early Cretaceous, leading to the deposition of maximum 2 km of sediments. Subsequently, less than 1 km of Lower Cretaceous and Upper Jurassic sediments were slowly eroded during the Late Cretaceous, plausibly as a consequence of the northward migration of the forebulge Citation: Villagómez Díaz, D.; Omodeo-Salé, S.; Ulyanov, A.; of the neo-forming North Alpine Foreland Basin. -

Clarity on Swiss Taxes 2019

Clarity on Swiss Taxes Playing to natural strengths 4 16 Corporate taxation Individual taxation Clarity on Swiss Taxes EDITORIAL Welcome Switzerland remains competitive on the global tax stage according to KPMG’s “Swiss Tax Report 2019”. This annual study analyzes corporate and individual tax rates in Switzerland and internationally, analyzing data to draw comparisons between locations. After a long and drawn-out reform process, the Swiss Federal Act on Tax Reform and AHV Financing (TRAF) is reaching the final stages of maturity. Some cantons have already responded by adjusting their corporate tax rates, and others are sure to follow in 2019 and 2020. These steps towards lower tax rates confirm that the Swiss cantons are committed to competitive taxation. This will be welcomed by companies as they seek stability amid the turbulence of global protectionist trends, like tariffs, Brexit and digital service tax. It’s not just in Switzerland that tax laws are being revised. The national reforms of recent years are part of a global shift towards international harmonization but also increased legislation. For tax departments, these regulatory developments mean increased pressure. Their challenge is to safeguard compliance, while also managing the risk of double or over-taxation. In our fast-paced world, data-driven technology and digital enablers will play an increasingly important role in achieving these aims. Peter Uebelhart Head of Tax & Legal, KPMG Switzerland Going forward, it’s important that Switzerland continues to play to its natural strengths to remain an attractive business location and global trading partner. That means creating certainty by finalizing the corporate tax reform, building further on its network of FTAs, delivering its “open for business” message and pressing ahead with the Digital Switzerland strategy. -

Response of Drainage Systems to Neogene Evolution of the Jura Fold-Thrust Belt and Upper Rhine Graben

1661-8726/09/010057-19 Swiss J. Geosci. 102 (2009) 57–75 DOI 10.1007/s00015-009-1306-4 Birkhäuser Verlag, Basel, 2009 Response of drainage systems to Neogene evolution of the Jura fold-thrust belt and Upper Rhine Graben PETER A. ZIEGLER* & MARIELLE FRAEFEL Key words: Neotectonics, Northern Switzerland, Upper Rhine Graben, Jura Mountains ABSTRACT The eastern Jura Mountains consist of the Jura fold-thrust belt and the late Pliocene to early Quaternary (2.9–1.7 Ma) Aare-Rhine and Doubs stage autochthonous Tabular Jura and Vesoul-Montbéliard Plateau. They are and 5) Quaternary (1.7–0 Ma) Alpine-Rhine and Doubs stage. drained by the river Rhine, which flows into the North Sea, and the river Development of the thin-skinned Jura fold-thrust belt controlled the first Doubs, which flows into the Mediterranean. The internal drainage systems three stages of this drainage system evolution, whilst the last two stages were of the Jura fold-thrust belt consist of rivers flowing in synclinal valleys that essentially governed by the subsidence of the Upper Rhine Graben, which are linked by river segments cutting orthogonally through anticlines. The lat- resumed during the late Pliocene. Late Pliocene and Quaternary deep incision ter appear to employ parts of the antecedent Jura Nagelfluh drainage system of the Aare-Rhine/Alpine-Rhine and its tributaries in the Jura Mountains and that had developed in response to Late Burdigalian uplift of the Vosges- Black Forest is mainly attributed to lowering of the erosional base level in the Back Forest Arch, prior to Late Miocene-Pliocene deformation of the Jura continuously subsiding Upper Rhine Graben. -

PARLIAMENT of CANTON VAUD LAUSANNE, SWITZERLAND a BONELL I GIL + ATELIER CUBE ARCHITECTS 1 /4

PARLIAMENT OF CANTON VAUD LAUSANNE, SWITZERLAND A BONELL i GIL + ATELIER CUBE ARCHITECTS 1 /4 Site plan Befor the fire Fire 2002 The Parliament of Lausanne, originally built by Alexandre Perregaux in 1803 rebuilt by Viollet-le-Duc in the 1800s) and the The façade of Rue Cité-Devant, a grand opening that acts as the new on the occasion of the foundation of the Canton of Vaud, was destroyed by Saint-Maire Castle (built in the fourteenth cen- access to the building. Crossing the threshold means entering into a parti- a fire in 2002. tury) provides a setting that rebalances the cular atmosphere, a space that fuses the past and the present. presence of the religious and military institu- Its reconstruction presented the opportunity to reassess the criteria that tions. The reconstruction of the Salle Perregaux, with its neoclassical façade saved would allow to solve both the parliamentary seat and the revitalization of the from the fire, is another of the attractions of the project. The old entrance to neighbouring buildings. In closer view, the project presents itself as a unitary ensemble, formally the Parliament is now used as a Salle des pas perdus, a hall for gatherings. autonomous, containing all part of the programme and where the Great As- The project proposed an architecture capable of restoring the continuity and sembly Hall assumes its prominent role both spatially and functionally. The new Parliament headquarters has been erected on top of historical ves- atmosphere of the historical city. An architecture that would be the synthesis tiges and wants to present itself as an efficient and modern building, cons- between old and new, between traditional construction and new technolo- The three-storey high foyer unites and separates the diverse spaces, but it tructed using innovative techniques but offering an image of timelessness. -

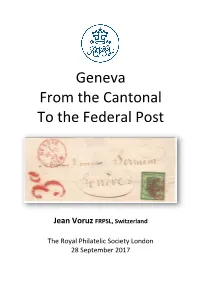

Geneva from the Cantonal to the Federal Post

Geneva From the Cantonal To the Federal Post Jean Voruz FRPSL, Switzerland The Royal Philatelic Society London 28 September 2017 Front cover illustration On 1 st October 1849, the cantonal posts are reorganized and the federal post is created. The Geneva cantonal stamps are still valid, but the rate for local letters is increased from 5 to 7 cents. As the "Large Eagle" with a face value of 5c is sold at the promotional price of 4c, additional 3c is required, materialized here by the old newspapers stamp. One of the two covers being known dated on the First Day of the establishment of the Federal Service. 2 Contents Frames 1 - 2 Cantonal Post Local Mail Frame 2 Cantonal Post Distant Mail Frame 3 Cantonal Post Sardinian & French Mail Frame 4 Transition Period Nearest Cent Frames 4 - 6 Transition Period Other Phases Frame 7 Federal Post Local Mail Frame 8 Federal Post Distant Mail Frames 9 - 10 Federal Post Sardinian & French Mail Background Although I started collecting stamps in 1967 like most of my classmates, I really entered the structured philately in 2005. That year I decided to display a few sheets of Genevan covers at the local philatelic society I joined one year before. Supported by my new friends - especially Henri Grand FRPSL who was one of the very best specialists of Geneva - I went further and got my first FIP Large Gold medal at London 2010 for the postal history collection "Geneva Postal Services". Since then the collection received the FIP Grand Prix International at Philakorea 2014 and the FEPA Grand Prix Finlandia 2017. -

Lump-Sum Taxation Regime for Individuals in Switzerland by End of 2014, Swiss Voters Decided by a Clear Majority to Maintain the Lump-Sum Taxation Regime

Lump-Sum Taxation Regime for Individuals in Switzerland By end of 2014, Swiss voters decided by a clear majority to maintain the lump-sum taxation regime. At federal level the requirements to qualify for being taxed under the lump-sum regime will be slightly amended. Cantonal regulations also consider adjustments to ensure an attractive and pragmatic lump-sum taxation regime for selected individual tax payers. Background is then subject to ordinary tax rates the Lump-sum taxation are Schwyz, Under the lump-sum tax regime, applicable at the place of residence. As Zug, Vaud, Grisons, Lucerne and Valais. foreign nationals taking residence a consequence, it is not necessary to In autumn 2012, more stringent rules in Switzerland who do not engage in report effective earnings and wealth. to tighten the lump-sum taxation were gainful employment in Switzerland may The lump-sum taxation regime may be approved by the Swiss parliament to choose to pay an expense-based tax attractive to wealthy foreigners given strengthen its acceptance. The revised instead of ordinary income and wealth the fact that the ordinary tax rates only legislation will be effective on federal tax. Typically, the annual living expenses apply to a portion of the taxpayer’s and cantonal level as of 1 January 2016. of the tax payer and his family, which worldwide income and assets. are considered to be the tax base, are Current legislation and rulings in disclosed and agreed on in a ruling Over the last years this taxation regime place continue to be applicable for a signed and confirmed by the competent has come under some pressure in transitional period of five years from cantonal tax authority prior to relocating Switzerland. -

Precision Industry Cluster

Precision industry cluster Facts and figures Leading companies Technology transfer Research and development Education Official bodies and associations Networking and trade fairs Our services Facts and fi gures: precision industry in Switzerland Facts and fi gures: precision industry in the Canton of Bern Swiss precision industry includes machine-building, electrical Precision industry in Switzerland The long tradition in the watchmaking industry has driven forward The Federal Institute of Metrology and the offi cialSwiss Chrono- industry and metal industry (MEM) and the watchmaking industry. know-how used in precision industry work. It is a major advantage meter Testing Institute have their head offi ces in the Canton of Bern. Share in Swiss Number of Number of It is characterised by a large number of SMEs that perform at the value added employees companies for the successful development of precision industry in the Canton of The Federation of the Swiss Watch Industry has its head offi ce in top level in the world market. As part of this, nanotechnology is Bern. Many well-known watch manufacturers are benefi ting from the Biel. The Swissmechanic federation, uniting SME employers, profes- opening up new opportunities for traditional microengineering and MEM industry 9 % 358,400 14,500 close proximity of suppliers in the Jura region. The supplier industry has sionals and specialists, has representative sections in Biel and Bern. electrical engineering, and in surface treatments. In Switzerland, Watchmaking 8.5 % 59,100 650 developed strongly and diversifi ed. Its businesses are not only working around 358,000 people work in precision industry and around industry in the watchmaking industry, but also in automotive engineering, med- Precision industry in the Canton of Bern 14,500 companies operate in this area of industry. -

Local and Regional Democracy in Switzerland

33 SESSION Report CG33(2017)14final 20 October 2017 Local and regional democracy in Switzerland Monitoring Committee Rapporteurs:1 Marc COOLS, Belgium (L, ILDG) Dorin CHIRTOACA, Republic of Moldova (R, EPP/CCE) Recommendation 407 (2017) .................................................................................................................2 Explanatory memorandum .....................................................................................................................5 Summary This particularly positive report is based on the second monitoring visit to Switzerland since the country ratified the European Charter of Local Self-Government in 2005. It shows that municipal self- government is particularly deeply rooted in Switzerland. All municipalities possess a wide range of powers and responsibilities and substantial rights of self-government. The financial situation of Swiss municipalities appears generally healthy, with a relatively low debt ratio. Direct-democracy procedures are highly developed at all levels of governance. Furthermore, the rapporteurs very much welcome the Swiss parliament’s decision to authorise the ratification of the Additional Protocol to the European Charter of Local Self-Government on the right to participate in the affairs of a local authority. The report draws attention to the need for improved direct involvement of municipalities, especially the large cities, in decision-making procedures and with regard to the question of the sustainability of resources in connection with the needs of municipalities to enable them to discharge their growing responsibilities. Finally, it highlights the importance of determining, through legislation, a framework and arrangements regarding financing for the city of Bern, taking due account of its specific situation. The Congress encourages the authorities to guarantee that the administrative bodies belonging to intermunicipal structures are made up of a minimum percentage of directly elected representatives so as to safeguard their democratic nature. -

Bernese Anabaptist History: a Short Chronological Outline (Jura Infos in Blue!)

Bernese Anabaptist History: a short chronological outline (Jura infos in blue!) 1525ff Throughout Europe: Emergence of various Anabaptist groups from a radical reformation context. Gradual diversification and development in different directions: Swiss Brethren (Switzerland, Germany, France, Austria), Hutterites (Moravia), Mennonites [Doopsgezinde] (Netherlands, Northern Germany), etc. First appearance of Anabaptists in Bern soon after 1525. Anabaptists emphasized increasingly: Freedom of choice concerning beliefs and church membership: Rejection of infant baptism, and practice of “believers baptism” (baptism upon confession of faith) Founding of congregations independent of civil authority Refusal to swear oaths and to do military service “Fruits of repentance”—visible evidence of beliefs 1528 Coinciding with the establishment of the Reformation in Bern, a systematic persecution of Anabaptists begins, which leads to their flight and migration into rural areas. Immediate execution ordered for re-baptized Anabaptists who will not recant (Jan. 1528). 1529 First executions in Bern (Hans Seckler and Hans Treyer from Lausen [Basel] and Heini Seiler from Aarau) 1530 First execution of a native Bernese Anabaptist: Konrad Eichacher of Steffisburg. 1531 After a first official 3-day Disputation in Bern with reformed theologians, well-known and successful Anabaptist minister Hans Pfistermeyer recants. New mandate moderates punishment to banishment rather than immediate execution. An expelled person who returns faces first dunking, and if returning a second time, death by drowning . 1532 Anabaptist and Reformed theologians meet for several days in Zofingen: Second Disputation. Both sides declare a victory. 1533 Further temporary moderation of anti-Anabaptist measures: Anabaptists who keep quiet are tolerated, and even if they do not, they no longer face banishment, dunking or execution, but are imprisoned for life at their own expense.