Dolphin Digital Media Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DISTINGUISHED ALUMNI As of 3/1/2017

University of Northern Colorado School of Theatre Arts and Dance DISTINGUISHED ALUMNI as of 3/1/2017 Broadway – 25 Performers (55 Productions) Josh Buscher – West Side Story 2009 (OC), Pricilla Queen of the Desert (OC), Big Fish (OC) Ryan Dinning – Machinal (OC) Jenny Fellner – Wicked, Mamma Mia, The Boyfriend, Pal Joey (OC) Scott Foster – Forbidden Broadway (Alive and Kicking) 2013, Brooklyn (OC), Forbidden Broadway (Alive and Kicking) 2014 Greg German – Assassins (OC), Biloxi Blues (OC), Boeing/Boeing Patty Goble – Bye Bye Birdie 2009 (OC), Curtains (OC), The Woman in White (OC), La Cage Aux Follies 2004 (OC), Kiss Me Kate 1999 (OC), Ragtime (OC), Phantom of the Opera Derek Hanson – Anything Goes (Sutton Foster), Side Show (2014 Revival), An American in Paris (2016), Tamara Hayden – Les Miz, Cabaret Autumn Hulbert – Legally Blonde Aisha Jackson – Beautiful: The Carol King Musical, Waitress (OC) Ryan Jesse – Jersey Boys Patricia Jones – Buried Child (OC), Indiscretions (w/Kathleen Turner) Andy Kelso – Mamma Mia, Kinky Boots (OC) Beth Malone – Ring of Fire (OC), Fun Home (OC)+ Victoria Matlock – Million Dollar Quartet (OC) Jason Olazabal – Julius Caesar (OC) (w/Denzel Washington) Laura Ryan – Country Roads The John Denver Musical (OC) Lisa Simms – A Chorus Line Andrea Dora Smith – Tarzan, Motown (OC) Erica Sweany – Honeymoon in Vegas – The Musical (OC) Jason Veasey – The Lion King Jason Watson – Mamma Mia Aléna Watters – Sister Act (OC), Adams Family Musical (OC), West Side Story 2009, Wysandria Woolsey – Chess, Parade, Beauty and the -

B4 the MESSENGER, Friday, March 9, 2012 6:30 7:30 8:30 9:30

B4 B4 THE MESSENGER, Friday, March 9, 2012 03/9 6AM 6:30 7AM 7:30 8AM 8:30 9AM 9:30 10AM 10:30 11AM 11:30 WBKO ^ 5:30 AM Kentucky (N) Good Morning America Andrew Garfield; Richard Blais. (N) Å Live! With Kelly (N) Å The View (N) Å WBKO at Midday (N) % Today Kathy Bates; Elizabeth Olsen. (N) Å The 700 Club (N) Å WHAG News at 12:00PM (N) _ _ Paid Program Storm Stories Å Eyewitness News Daybreak (N) Local 7 News Lifestyles Family Feud Å Family Feud Å Animal Adv Å Swift Justice Å Judge Mathis Å 3 ( 5:00 The Daily Buzz Å Better (N) Å Cash Cab Å Cash Cab Å The Cosby Show Å The Cosby Show Å Law & Order: Criminal Intent Å C ) 5:00 QVC This Morning Perricone MD Cosmeceuticals Kitchen Innovations LizClaiborne New York Fashion. Q Check Style Edition . * 14 News Sunrise (N) Å Today Kathy Bates; Elizabeth Olsen. (N) Å Today (N) Å Today (N) Å :15 Midday With Mike (N) Å 9 + 5:00 Eyewitness News Daybreak (N) Å Good Morning America Andrew Garfield; Richard Blais. (N) Å Live! With Kelly (N) Å The View (N) Å FreeCruise Paid Program ) , Arthur (EI) Å Martha Speaks Å Curious George Å Cat in the Hat Å Super Why! Å Dinosaur Train Å Sesame Street (EI) Å Sid the Science Å WordWorld (EI) Å Super Why! Å Barney & Friends Å L ` Morning News Å Morning News Å CBS This Morning Ewan McGregor; Grant Hill. (N) Å The Doctors (N) Å The Price Is Right (N) Å The Young and the Restless (N) Å & 2 BBC World News Å Kentucky Health Å Body Electric Å TV 411 Å GED Connection Å GED Connection Å Paint This-Jerry Å Quilt in a Day Å Knitting Daily Å Beads, Baubles Å Charlie Rose Å WGN / Paid Program Paid Program Bewitched Å Dream of Jeannie Å Matlock “The Ghost” Å Matlock “The Class” Å In the Heat of the Night “Discovery” Å In the Heat of the Night Å INSP 1 Int’nl Fellowship Life Today Å Creflo Dollar Å Feed the Children Victory Today Life Today Å Joseph Prince Å Joyce Meyer Å Humanitarian Int’nl Fellowship The Waltons “The Idol” TBN 5 Spring Praise-A-Thon Spring Praise-A-Thon HGTV 7 Destination De Marriage/Const. -

Show Programs

~ 52ND STREET PROJECT SHOW PROGRAMS 1996-2000 r JJj!J~f~Fffr!JFIEJ!fJE~JJf~fJ!iJrJtrJffffllj'friJfJj[IlJ'JiJJif~ i i fiiii 1 t!~~~~fi Jf~[fi~~~r~j (rjl 1 rjfi{Jij(fr; 1 !liirl~iJJ[~JJJf J Jl rJ I frJf' I j tlti I ''f '!j!Udfl r r.~~~.tJI i ~Hi 'fH '~ r !!'!f'il~ [ Uffllfr:pllfr!l(f[J'l!'Jlfl! U!! ~~frh:t- G 1 1 lr iJ!•f Hlih rfiJ aflfiJ'jrti lf!liJhi!rHdiHIIf!ff tl~

2013 Annual Donor Report Thank You for Your Partnership and Support During the Past Year!

2013 Annual Donor Report Thank you for your partnership and support during the past year! Gifts to Membership, Research and Education $100,000 + William R. Lewis, III, M.D. Mohammad Ehteshami Duncan & Dr. William R. Lewis, Sr. Virginia & William Michael Christopher S. Eklund Michelle & David Mackay Josephine Morrison FSHD Global Research Foundation Susan Nordeen The Geraldi Norton Foundation $50,000 - 99,999 Edward Norris, M.D. Eugene & Emily Grant Delta Railroad Construction, Inc. Jane & Paul Rittmaster Monica Herzberg Grand Rapids Community Marsha & Jerry Seslowe William Herzberg & Judy Marantz- Foundation Erin & Clint Shack Herzberg Ida Laurello Pauli Overdorff & Allan C. Helen Klaben Kahn S & L Marx Foundation Silverstein, D.D.S. Robert & Cathy Kahn New York Community Trust Dr. Gracia Toubia-Stucky Tonia Kalleward $10,000 - 49,999 Helen & Marc Younger Paul & Stacey Laurello Adveq Management AG David & Nancy Lokerson $5,000 - 9,999 Anonymous Mindy Mackenzie AFM - French Muscular Dystrophy Sanford Batkin Sonia & Paul Norman Association Barbara & James Chin, Sr. Petro Capital Advisors Lesley & Mark Baynes William J. Conners III and Barbara Quest Diagnostics, Inc. Amy Bekier & Alan Schreer S. Conners Charitable Foundation Regeneron Pharmaceuticals, Inc. Paula Birnbaum & Neil Solomon Michael Finkelstein & Sue-ann Richards Family Charitable Trust Peter H. Catterall & Kim Toskey Friedman Elysa & Robert Roskam Combined Federal Campaign FSHD Canada Foundation Beverly & Mike Rowlett National Capital Area - Global Goldman, Sachs & Co. Joan & Alan Safir Impact Leslie & Roslyn Goldstein Judith & Kenneth Seslowe Community Foundation of Abilene Foundation The Herbert & Nell Singer Grace Corradino & Brian Kerr Kay Kitagawa & Andy Johnson-Laird Foundation, Inc. CPMAK Investments Stuart Lai Howard Solomon Joseph Drown Foundation Largotex Resources, LLC Madeline & Dr. -

Mark Wagner's Stunt Resume

Mark Aaron Wagner HEIGHT: 5’10” Weight: 165 lbs. Stuntman / Stunt Coordinator/ Actor S.A.G./ A.F.T.R.A./ U.B.C.P./ A.C.T.R.A Suit- 38-40R, Shirt- 16x34 International Stunt Association- 818-501-5225 Waist- 32, Inseem- 31 KMR (agent)- (818) 755-7534 Shoe: 10 www.MarkAaronWagner.com (Online Demo) Current Resume on IMDB.com Feature Films (Full List Upon Request) Once Upon a Time in Hollywood Zoë Bell/ Rob Alonzo Captain Marvel (driver) Hank Amos/ Jeff Habberstad Ant-Man and The Wasp (dbl. Paul Rudd) Brycen Counts Peppermint (stunt dbl.) Keith Woulard Deadpool 2 (driver) Owen Walstrom/ Darrin Prescott Bright Rob Alonzo Predator Marny Eng/ Lance Gilbert Captain America: Civil War (dbl.- Paul Rudd) Sam Hargrave/ Doug Coleman Three Billboards (dbl.- Sam Rockwell) Doug Coleman PeeWee’s Big Holiday (dbl.- Paul Reubens) Mark Rayner Maze Runner: Scorch Trials ND George Cottle Ant-Man (dbl.- Paul Rudd) Jeff Habberstad Stretch (dbl.- Patrick Wilson) Ben Bray Captain America: Winter Soldier Strike Agent Tom Harper/ Casey O’Neil 300: Rise of an Empire Artemisia Father Damon Caro Iron Man 3 Extremis Soldier Markos Rounthwaite/ Mike Justus/ Jeff Habberstad Secret Life of Walter Mitty (dbl.- Adam Scott) Tim Trella/ Clay Cullen Dark Knight Rises ND/ Driving Tom Struthers/ George Cottle Gangster Squad (dbl.-Frank Grillo) Doug Coleman Men in Black 3 ND Wade Eastwood/ Simon Crane X-Men: First Class MIB Jeff Habberstad/ Brian Smrz Girl with the Dragon Tattoo Drving Jeff Habberstad This Is 40 (dbl.- Paul Rudd) Joel Kramer The Master (dbl.- Joaquin Phoenix) Garrett -

Lynn Council Candidates Square up in Round Two

DEALS OF THE $DAY$ PG. 3 THURSDAY, OCTOBER 17, 2019 DEALS OF THE Peabody’s Kidney getting$DAY$ used to her new heartPG. 3 By Thomas Grillo a new heart she may not reach her 50th ITEM STAFF birthday. Last spring, she joined the near- ly 3,800 patients nationwideDEALS waiting for a PEABODY — One month after Sharon new heart. Doctors said there was no way Kidney received a life saving heart trans- of knowing when a heartOF wouldTHE become plant, the 49-year-old Lynn native is in no available. Sharon Kidney hurry to make plans for her new life. With that, she wrote $herDA willY and$ made relaxes in her “I’m taking one day at a time,”she said nal arrangements. PG. 3 reclining chair as from the comfort of a reclining chair in her “Even with the surgery, there’s always a she recovers from downtown home. “I’m hoping for another chance for death, so I had to be prepared,” life-saving heart 20 years, but how I will spend them is a she said. “It was, like everything is right transplant surgery. mystery for now.” now, a little surreal.” Earlier this year, her doctors at Massa- ITEM PHOTO | THOMAS GRILLO chusetts General Hospital said without DEALSKIDNEY, A3 OF THE GAYLA CAWLEY $DAY$ COMMENTARY Lynn council candidates PG. 3 Commuter square up in round two rail needs DEALS OF THE to get on $DAY$ right track PG. 3 I had heard taking the commut- er rail to Boston distressing, but there’s nothing like experiencing something rst-hand. -

Programming; Providing an Environment for the Growth and Education of Theatre Professionals, Audiences, and the Community at Large

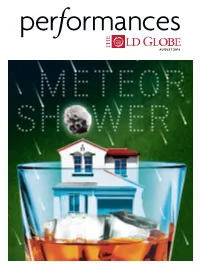

AUGUST 2016 WELCOME Welcome to the funny, unexpected, and delightfully off-kilter world of Meteor Shower. With this world premiere production, we’re thrilled to continue our ongoing relationship with the brilliant artist Steve Martin. The Globe’s production of Bright Star, Steve and Edie Brickell’s new musical that premiered here in 2014, transferred to Broadway earlier this year, where it was nominated for an impressive five Tony Awards, including Best Musical. Next season, the Globe will mount a major revival of Steve’s 1993 play Picasso at the Lapin Agile. We’re glad Steve has found a new artistic home here in San Diego. The Globe is an especially fitting place to premiere Meteor Shower because it is a DOUGLAS GATES California story. Set in Ojai in the 1990s, Managing Director Michael G. Murphy and Erna Finci Viterbi Artistic Director Barry Edelstein. the play examines a specific moment in the life of our state. It’s a theatrical snapshot of the mores and (kooky) ways of society in Southern California, and though it’s set in the past, it’s eminently recognizable to Californians today. It’s also a pleasure to welcome yet another artistic director of a major regional theatre here at the Globe. Gordon Edelstein is the Artistic Director of Long Wharf Theatre in Connecticut, the great company we’re partnering with to co-produce this show, and the fifth artistic director to helm a show at the Globe this year. And because we know you’re wondering: no, Gordon and Barry are not related, except in their devotion to the wonders of theatre. -

LGBTQ Episodic Television Study Guide

Archive Study Guide: LESBIAN, GAY, BISEXUAL AND TRANSGENDER TELEVISION: SITCOMS AND EPISODIC DRAMAS ARCHIVE STUDY GUIDE The representation of Lesbian, Gay, Bisexual and Transgender (LGBT) communities on television is marked by a history of stereotypes and inexplicable invisibility. By the 1970s, gay media-watch groups communicated their concerns to the television industry and a sense of cooperation began to emerge between the LG BT community and broadcasters. During the 1980s, the AIDS crisis and resulting prejudices ushered in a new era of problematic and offensive portrayals. In the late 1990s, Ellen Degeneres' landmark coming out, (both in real- life, and through the character she portrayed in her sitcom), generated much controversy and discussion, ultimately paving the way for well -developed gay characters in prominent primetime TV roles. Despite such advances, stereotypes continue to resurface and perpetuate, and the full diversity of the LGBT community is more often than not underrepresented in the mass media. This is only a partial list – consult the Archive Research and Study Center for additional titles, including relevant materials held in the Outfest Legacy Collection. HEARST NEWSREEL Hearst Newsreel Footage. Movie Stars Join Circus for Charity! Los Angeles, California (1948-09-04). Wrestling telecasts of the late 1940s and early 1950s often featured flamboyant characters with (implied) gay personas. Features Bob Hope acting as manager of outlandish TV wrestler Gorgeous George, who faces actor Burt Lancaster in a match. Study Copy: VA6581 M Hearst Newsreel Footage. Wrestling from Montreal, Quebec, Canada (1948-10-22). Gorgeous George vs. Pete Petersen. Study Copy: VA8312 M TELEVISION (Please note some titles may require additional lead-time to make available for viewing) 1950s Western Main Event Wrestling. -

Jay O'connell

JAY O’CONNELL Producer / UPM I MOM SO HARD (multi-cam pilot; UPM) – CBS/WBTV; Prods: Michelle Nader, Rob Thomas, Kristin Hensley, Jen Smedley; Dir: Don Scardino; w/ Freddie Prinze, Jr, David Fynn LIVING BIBLICALLY (multi-cam series; UPM) – CBS/WBTV; Prods: Patrick Walsh, Johnny Galecki, Spencer Medof, Andrew Haas; Dir: Andy Ackerman; w/ Jay Ferguson, Ian Gomez, David Krumholtz RELATIVELY HAPPY (multi-cam pilot; UPM) – CBS/WBTV; Prods: Max Mutchnick, Jeff Astrof; Dir: James Burrows; w/ Jane Lynch, Genevieve Angelson, Jon Rudnitsky, Stephen Guarino TWO BROKE GIRLS (multi-cam pilot and series, Co-Producer/UPM) – CBS / WBTV; Prods: Michael Patrick King, Whitney Cummings; Dir: Jim Burrows, Ted Wass, Scott Ellis, John Fortenberry, Fred Savage, Julie Anne Robinson, Thomas Kail, Michael McDonald, Don Scardino; w/ Kat Dennings, Beth Behrs MAN WITH A PLAN (multi-cam pilot; UPM) – CBS/CBSP; Prods: Jackie Filgo, Jeff Filgo, Michael Rotenberg, Matt LeBlanc; Dir: James Burrows; w/ Matt LeBlanc, Jenna Fischer, Grace Kaufman HAPPY LIFE (multi-cam pilot, UPM) – CBS / WBTV; Prods: Bill Wrubel; Dir: James Burrows; w/ Steven Weber, Duane Martin, Eric Petersen, Rita Moreno, Bill Smitrovich, Minnie Driver ONE BIG HAPPY (multi-cam pilot and series, UPM) – NBC/WBTV; Prods: Ellen DeGeneres, Liz Feldman, Jeff Kleeman; Dir: Scott Ellis; w/ Nick Zano, Elisha Cuthbert BIG BANG THEORY (multi-cam series, UPM) – CBS/WBTV; Prods: Chuck Lorre, Lee Aronsohn, Bill Prady; Dir: Mark Cendrowski; w/ Johnny Galecki, Jim Parsons, Kaley Cuoco, Simon Helberg, Kunal Nayyar PARTNERS -

87Th Academy Awards Reminder List

REMINDER LIST OF PRODUCTIONS ELIGIBLE FOR THE 87TH ACADEMY AWARDS ABOUT LAST NIGHT Actors: Kevin Hart. Michael Ealy. Christopher McDonald. Adam Rodriguez. Joe Lo Truglio. Terrell Owens. David Greenman. Bryan Callen. Paul Quinn. James McAndrew. Actresses: Regina Hall. Joy Bryant. Paula Patton. Catherine Shu. Hailey Boyle. Selita Ebanks. Jessica Lu. Krystal Harris. Kristin Slaysman. Tracey Graves. ABUSE OF WEAKNESS Actors: Kool Shen. Christophe Sermet. Ronald Leclercq. Actresses: Isabelle Huppert. Laurence Ursino. ADDICTED Actors: Boris Kodjoe. Tyson Beckford. William Levy. Actresses: Sharon Leal. Tasha Smith. Emayatzy Corinealdi. Kat Graham. AGE OF UPRISING: THE LEGEND OF MICHAEL KOHLHAAS Actors: Mads Mikkelsen. David Kross. Bruno Ganz. Denis Lavant. Paul Bartel. David Bennent. Swann Arlaud. Actresses: Mélusine Mayance. Delphine Chuillot. Roxane Duran. ALEXANDER AND THE TERRIBLE, HORRIBLE, NO GOOD, VERY BAD DAY Actors: Steve Carell. Ed Oxenbould. Dylan Minnette. Mekai Matthew Curtis. Lincoln Melcher. Reese Hartwig. Alex Desert. Rizwan Manji. Burn Gorman. Eric Edelstein. Actresses: Jennifer Garner. Kerris Dorsey. Jennifer Coolidge. Megan Mullally. Bella Thorne. Mary Mouser. Sidney Fullmer. Elise Vargas. Zoey Vargas. Toni Trucks. THE AMAZING CATFISH Actors: Alejandro Ramírez-Muñoz. Actresses: Ximena Ayala. Lisa Owen. Sonia Franco. Wendy Guillén. Andrea Baeza. THE AMAZING SPIDER-MAN 2 Actors: Andrew Garfield. Jamie Foxx. Dane DeHaan. Colm Feore. Paul Giamatti. Campbell Scott. Marton Csokas. Louis Cancelmi. Max Charles. Actresses: Emma Stone. Felicity Jones. Sally Field. Embeth Davidtz. AMERICAN REVOLUTIONARY: THE EVOLUTION OF GRACE LEE BOGGS 87th Academy Awards Page 1 of 34 AMERICAN SNIPER Actors: Bradley Cooper. Luke Grimes. Jake McDorman. Cory Hardrict. Kevin Lacz. Navid Negahban. Keir O'Donnell. Troy Vincent. Brandon Salgado-Telis. -

Opens April 15Th in Theatres Nationwide!

Stonehaven Media and First in Flight Media presents the biggest race of your (dad's) life! starring Greg Germann, Lauren Holly and Pat Morita A new family comedy about a long-time American tradition — the Pinewood Derby! • Over 100 million derby cars handmade and raced since its creation in 1953 • Annual event among Cub Scouts, YMCA youth groups and church communities • Released in celebration of the 75th Anniversary of Cub Scouts (founded in 1930) Opens April 15th in Theatres Nationwide! 94 minutes – PG Press Downloads available at www.downandderby.com National PR Contact: Distribution Contact: Susan Steeno John Stone GS Entertainment Stonehaven Media 615.279.5629 916.834.3417 [email protected] [email protected] DOWN AND DERBY Short Synopsis Down and Derby is a family comedy about a small-town Pinewood Derby competition that transforms an average group of dads into an awkward bunch of competitors. The parental pursuit of first place – in a race intended for 7-10 year olds – gets the best of them as they all disregard the event's ideals and completely take over the design, planning and construction of the cars. In the crazed world of derby fever, the kids are lucky if they get to pick the paint color or attach a decal! Hilarity builds as the dads teeter on the edge of insanity and resort to backstabbing, cover-ups and sabotage. The farce reaches comical and outrageous levels when in the end, a surprise twist reminds us to never take ourselves too seriously or underestimate what kids can do. This comedy satirizes the desperate behavior of parents who compete with one another through their children, a social dynamic seen in everyday activities ranging from little league to beauty pageants to science fairs. -

Show Programs 1982-1990 D(.{~ :Pal ~

~ 52ND STREET PROJECT SHOW PROGRAMS 1982-1990 D(.{~ :PAL ~..... a~d~le-s -f{.,e 5.\ ffOrl- of £.. S I . :Pov-h'~ lev- ~ k..:s +o (Art· Te""'f'~r , ~~·~ ( Dl~ov- c:W'ld. D CJ.o,'<d. 'J?o~a,k.. 1 -:p¢~c4.., Dn-eo 1:>r. ~I --rt-a"'k.s +o 11-eteso 8~ I ~vie. -Ut~~"', a .... d N8Yl~ L_c,l.)Yenc:e.. ~1--o proua'ckd LV~ ~a.) -space t<>~ JA,can :P-AL had ho~ • ( AT - ( ( ... ,, "'' DANC.£:S OF Tt-l E. ANClt..NI £A;:::.-r-H C+l JGI'SI /ViAs i . ~n·}.fe "' ~ d\rs.ded. hi r W ILU E f::.E:ALE. ~ :Je..,"'~ sf-o""' M ,•cJ..e.lle Oar-.~ ~~ Cos-t- M\\ldV'd. ~ tut91\"" ~.5 ki~ ~a.cc.1'or.p\ ~\"non d.. 'Ra-~ .5 CQ.mt9- Gro+e. ~e ~~ves E:Pel ~ ~-~ ~e-s . ~Vl ;~ Ft \ ~"'"' 1 1 M f~ le.. ACoa.ve..<:.. ~~~05 ~e, l A I ~ a ""'de.v- ~ At L'>a,v-e.. c:.. qoi-a~l ~~\ea M~a. ~le;s A~ ,'ltla, ~z.a,1en:.. -Hema."'do Cov-el-rev-a 5 ~Wll\o 1:-oj a..s tfo~d.a GoYl~le~ ~ l"'s~~c..-1-o....- ( t-le,Y\\ 1Co ~~ ..)~Je. Mot==a"'\10 ~~orr\ ~ ~op~o ·· D,Ve.c.+ov- .<.ui l\ te 'Rea.le CavLa 15u i Z-cl. ~a..e-1 .Atex~d.eY As51-. Da'vev+Ov ....)8'\e. i?er ka'n :> ~~~ l:e.:s/1n~ S""'k.J Aro n.o ..f~ Lt<=thf'f\ ~ ''\ n ~ 'D-t""ba.r 5 psc-''~ I A~tCV"'c.e.S b\ Li \h-1-1 \ T echn,'c..~ d.'r'\ +'aM\ ~&.le.