Hong Kong and the Context of Laissez-Faire: Myths and Truths About a 'Free Market Paradise'

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Icons, Culture and Collective Identity of Postwar Hong Kong

Intercultural Communication Studies XXII: 1 (2013) R. MAK & C. CHAN Icons, Culture and Collective Identity of Postwar Hong Kong Ricardo K. S. MAK & Catherine S. CHAN Hong Kong Baptist University, Hong Kong S.A.R., China Abstract: Icons, which take the form of images, artifacts, landmarks, or fictional figures, represent mounds of meaning stuck in the collective unconsciousness of different communities. Icons are shortcuts to values, identity or feelings that their users collectively share and treasure. Through the concrete identification and analysis of icons of post-war Hong Kong, this paper attempts to highlight not only Hong Kong people’s changing collective needs and mental or material hunger, but also their continuous search for identity. Keywords: Icons, Hong Kong, Hong Kong Chinese, 1997, values, identity, lifestyle, business, popular culture, fusion, hybridity, colonialism, economic takeoff, consumerism, show business 1. Introduction: Telling Hong Kong’s Story through Icons It seems easy to tell the story of post-war Hong Kong. If merely delineating the sky-high synopsis of the city, the ups and downs, high highs and low lows are at once evidently remarkable: a collective struggle for survival in the post-war years, tremendous social instability in the 1960s, industrial take-off in the 1970s, a growth in economic confidence and cultural arrogance in the 1980s and a rich cultural upheaval in search of locality before the handover. The early 21st century might as well sum up the development of Hong Kong, whose history is long yet surprisingly short- propelled by capitalism, gnawing away at globalization and living off its elastic schizophrenia. -

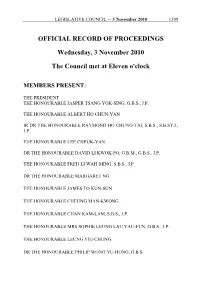

Official Record of Proceedings

LEGISLATIVE COUNCIL ─ 3 November 2010 1399 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 3 November 2010 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN IR DR THE HONOURABLE RAYMOND HO CHUNG-TAI, S.B.S., S.B.ST.J., J.P. THE HONOURABLE LEE CHEUK-YAN DR THE HONOURABLE DAVID LI KWOK-PO, G.B.M., G.B.S., J.P. THE HONOURABLE FRED LI WAH-MING, S.B.S., J.P. DR THE HONOURABLE MARGARET NG THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHEUNG MAN-KWONG THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE MRS SOPHIE LEUNG LAU YAU-FUN, G.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG DR THE HONOURABLE PHILIP WONG YU-HONG, G.B.S. 1400 LEGISLATIVE COUNCIL ─ 3 November 2010 THE HONOURABLE WONG YUNG-KAN, S.B.S., J.P. THE HONOURABLE LAU KONG-WAH, J.P. THE HONOURABLE LAU WONG-FAT, G.B.M., G.B.S., J.P. THE HONOURABLE MIRIAM LAU KIN-YEE, G.B.S., J.P. THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE ANDREW CHENG KAR-FOO THE HONOURABLE TIMOTHY FOK TSUN-TING, G.B.S., J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, S.B.S., J.P. THE HONOURABLE LI FUNG-YING, S.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. -

Modern Hong Kong

Modern Hong Kong Oxford Research Encyclopedia of Asian History Modern Hong Kong Steve Tsang Subject: China, Hong Kong, Macao, and/or Taiwan Online Publication Date: Feb 2017 DOI: 10.1093/acrefore/9780190277727.013.280 Abstract and Keywords Hong Kong entered its modern era when it became a British overseas territory in 1841. In its early years as a Crown Colony, it suffered from corruption and racial segregation but grew rapidly as a free port that supported trade with China. It took about two decades before Hong Kong established a genuinely independent judiciary and introduced the Cadet Scheme to select and train senior officials, which dramatically improved the quality of governance. Until the Pacific War (1941–1945), the colonial government focused its attention and resources on the small expatriate community and largely left the overwhelming majority of the population, the Chinese community, to manage themselves, through voluntary organizations such as the Tung Wah Group of Hospitals. The 1940s was a watershed decade in Hong Kong’s history. The fall of Hong Kong and other European colonies to the Japanese at the start of the Pacific War shattered the myth of the superiority of white men and the invincibility of the British Empire. When the war ended the British realized that they could not restore the status quo ante. They thus put an end to racial segregation, removed the glass ceiling that prevented a Chinese person from becoming a Cadet or Administrative Officer or rising to become the Senior Member of the Legislative or the Executive Council, and looked into the possibility of introducing municipal self-government. -

The RTHK Coverage of the 2004 Legislative Council Election Compared with the Commercial Broadcaster

Mainstream or Alternative? The RTHK Coverage of the 2004 Legislative Council Election Compared with the Commercial Broadcaster so Ming Hang A Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Philosophy in Government and Public Administration © The Chinese University of Hong Kong June 2005 The Chinese University of Hong Kong holds the copyright of this thesis. Any person(s) intending to use a part or whole of the materials in the thesis in a proposed publication must seek copyright release from the Dean of the Graduate School. 卜二,A館書圆^^ m 18 1 KK j|| Abstract Theoretically, public broadcaster and commercial broadcaster are set up and run by two different mechanisms. Commercial broadcaster, as a proprietary organization, is believed to emphasize on maximizing the profit while the public broadcaster, without commercial considerations, is usually expected to achieve some objectives or goals instead of making profits. Therefore, the contribution by public broadcaster to the society is usually expected to be different from those by commercial broadcaster. However, the public broadcasters are in crisis around the world because of their unclear role in actual practice. Many politicians claim that they cannot find any difference between the public broadcasters and the commercial broadcasters and thus they asserted to cut the budget of public broadcasters or even privatize all public broadcasters. Having this unstable situation of the public broadcasting, the role or performance of the public broadcasters in actual practice has drawn much attention from both policy-makers and scholars. Empirical studies are divergent on whether there is difference between public and commercial broadcaster in actual practice. -

Hong Kong Walkability Analysis IQP Project Proposal

Hong Kong Walkability Analysis IQP Project Proposal Sponsoring Agencies: Designing Hong Kong and Harbour Business Forum Submitted to: Project Advisor: Zhikun Hou, WPI Professor Project Co‐advisor: Robert Kinicki, WPI Professor On‐Site Liaison: Paul Zimmerman, Designing Hong Kong On‐Site Co‐Liaison: Dr. Sujata S. Govada, Harbour Business Forum Submitted by: Michael Audi Kathryn Byorkman Alison Couture Suzanne Najem Date Submitted: 15 December 2010 Creighton Peet ID 2050 Instructor Table of Contents Title Page .............................................................................................................................................. i Table of Contents ................................................................................................................................. ii Table of Figures .................................................................................................................................. iv Table of Tables ..................................................................................................................................... v Executive Summary ............................................................................................................................ vi 1.0 Introduction ................................................................................................................................... 1 2.0 Background .................................................................................................................................... 4 -

The Globalization of Chinese Food ANTHROPOLOGY of ASIA SERIES Series Editor: Grant Evans, University Ofhong Kong

The Globalization of Chinese Food ANTHROPOLOGY OF ASIA SERIES Series Editor: Grant Evans, University ofHong Kong Asia today is one ofthe most dynamic regions ofthe world. The previously predominant image of 'timeless peasants' has given way to the image of fast-paced business people, mass consumerism and high-rise urban conglomerations. Yet much discourse remains entrenched in the polarities of 'East vs. West', 'Tradition vs. Change'. This series hopes to provide a forum for anthropological studies which break with such polarities. It will publish titles dealing with cosmopolitanism, cultural identity, representa tions, arts and performance. The complexities of urban Asia, its elites, its political rituals, and its families will also be explored. Dangerous Blood, Refined Souls Death Rituals among the Chinese in Singapore Tong Chee Kiong Folk Art Potters ofJapan Beyond an Anthropology of Aesthetics Brian Moeran Hong Kong The Anthropology of a Chinese Metropolis Edited by Grant Evans and Maria Tam Anthropology and Colonialism in Asia and Oceania Jan van Bremen and Akitoshi Shimizu Japanese Bosses, Chinese Workers Power and Control in a Hong Kong Megastore WOng Heung wah The Legend ofthe Golden Boat Regulation, Trade and Traders in the Borderlands of Laos, Thailand, China and Burma Andrew walker Cultural Crisis and Social Memory Politics of the Past in the Thai World Edited by Shigeharu Tanabe and Charles R Keyes The Globalization of Chinese Food Edited by David Y. H. Wu and Sidney C. H. Cheung The Globalization of Chinese Food Edited by David Y. H. Wu and Sidney C. H. Cheung UNIVERSITY OF HAWAI'I PRESS HONOLULU Editorial Matter © 2002 David Y. -

The Diminishing Power and Democracy of Hong Kong: an Analysis of Hong Kong's Umbrella Movement and the Anti-Extradition Law Amendment Bill Movement

Portland State University PDXScholar University Honors Theses University Honors College Summer 2021 The Diminishing Power and Democracy of Hong Kong: An Analysis of Hong Kong's Umbrella Movement and the Anti-Extradition Law Amendment Bill Movement Xiao Lin Kuang Portland State University Follow this and additional works at: https://pdxscholar.library.pdx.edu/honorstheses Part of the Asian Studies Commons, and the Other International and Area Studies Commons Let us know how access to this document benefits ou.y Recommended Citation Kuang, Xiao Lin, "The Diminishing Power and Democracy of Hong Kong: An Analysis of Hong Kong's Umbrella Movement and the Anti-Extradition Law Amendment Bill Movement" (2021). University Honors Theses. Paper 1126. https://doi.org/10.15760/honors.1157 This Thesis is brought to you for free and open access. It has been accepted for inclusion in University Honors Theses by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. The diminishing power and democracy of Hong Kong: an analysis of Hong Kong’s Umbrella Movement and the Anti-extradition Law Amendment Bill Movement by Xiao Lin Kuang An undergraduate honors thesis submitted in partial fulfillment of the Requirements for the degree of Bachelor of Arts In University Honors And International Development Studies And Chinese Thesis Adviser Maureen Hickey Portland State University 2021 The diminishing power and democracy of Hong Kong Kuang 1 Abstract The future of Hong Kong – one of the most valuable economic port cities in the world – has been a key political issue since the Opium Wars (1839—1860). -

Capital As Process and the History of Capitalism

Jonathan Levy Capital as Process and the History of Capitalism In the wake of the Great Recession, a new cycle of scholarship opened on the history of American capitalism. This occurred, however, without much specification of the subject at hand. In this essay, I offer a conceptualization of capitalism, by focus- ing on its root—capital. Much historical writing has treated capital as a physical factor of production. Against such a “mate- rialist” capital concept, I define capital as a pecuniary process of forward-looking valuation, associated with investment. Engag- ing recent work across literatures, I try to show how this con- ceptualization of capital and capitalism helps illuminate many core dynamics of modern economic life. Keywords: capitalism, capital theory, economic thought, finance, Industrial Revolution, Keynes, money, slavery, Veblen ecently, the so-called new history of capitalism has helped bring Reconomic life back closer to the center of the professional historical agenda. But what further point might it now serve—especially for schol- ars toiling in the fields of business and economic history all the while independent of historiographical fashion and trend? In the wake of the U.S. financial panic of 2008 and the Great Reces- sion that followed, in the field of U.S. history a new cycle of scholarship on the history of American capitalism opened, but without all that much conceptualization of the subject at hand—capitalism. If there has been one shared impulse, it is probably the study of commodification. Follow the commodity wherever it may lead, across thresholds of space, time, and the ever-expanding boundaries of the market. -

UC Riverside Cliodynamics

UC Riverside Cliodynamics Title Capitalist Systems are Societal Constructs: Not “Clouds” or “Clocks,” but “City States”: A Review of Does Capitalism Have a Future? by Immanuel Wallerstein, Randall Collins, Michael Mann, Georgi Derluguian, and Craig Calhoun (Oxford University Press,... Permalink https://escholarship.org/uc/item/7z63z6jt Journal Cliodynamics, 6(2) Author Scott, Bruce Publication Date 2015 DOI 10.21237/C7clio6229140 License https://creativecommons.org/licenses/by/4.0/ 4.0 eScholarship.org Powered by the California Digital Library University of California Cliodynamics: The Journal of Quantitative History and Cultural Evolution Capitalist Systems are Societal Constructs: Not “Clouds” or “Clocks,” but “City States” A Review of Does Capitalism Have a Future? by Immanuel Wallerstein, Randall Collins, Michael Mann, Georgi Derluguian, and Craig Calhoun (Oxford University Press, 2013) Bruce Scott Harvard University Does Capitalism Have a Future? is the work of five distinguished senior authors addressing the future of capitalism and its recent past. Their book warns that “something big looms on the horizon: a structural crisis much bigger than the recent great recession. Over the next three or four decades, capitalists of the world may simply find it impossible to make their usual investment decisions due to overcrowding of world markets and inadequate accounting for rising social costs. In this situation, capitalism would end in the frustration of the capitalists themselves.” The authors have chosen a very broad and important topic -

In Hong Kong the Political Economy of the Asia Pacific

The Political Economy of the Asia Pacific Fujio Mizuoka Contrived Laissez- Faireism The Politico-Economic Structure of British Colonialism in Hong Kong The Political Economy of the Asia Pacific Series editor Vinod K. Aggarwal More information about this series at http://www.springer.com/series/7840 Fujio Mizuoka Contrived Laissez-Faireism The Politico-Economic Structure of British Colonialism in Hong Kong Fujio Mizuoka Professor Emeritus Hitotsubashi University Kunitachi, Tokyo, Japan ISSN 1866-6507 ISSN 1866-6515 (electronic) The Political Economy of the Asia Pacific ISBN 978-3-319-69792-5 ISBN 978-3-319-69793-2 (eBook) https://doi.org/10.1007/978-3-319-69793-2 Library of Congress Control Number: 2017956132 © Springer International Publishing AG, part of Springer Nature 2018 This work is subject to copyright. All rights are reserved by the Publisher, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfilms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed. The use of general descriptive names, registered names, trademarks, service marks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use. The publisher, the authors and the editors are safe to assume that the advice and information in this book are believed to be true and accurate at the date of publication. -

Civil Society and Democratization in Hong Kong Paradox and Duality

Taiwan Journal of Democracy, Volume 4, No.2: 155-175 Civil Society and Democratization in Hong Kong Paradox and Duality Ma Ngok Abstract Hong Kong is a paradox in democratization and modernization theory: it has a vibrant civil society and high level of economic development, but very slow democratization. Hong Kong’s status as a hybrid regime and its power dependence on China shape the dynamics of civil society in Hong Kong. The ideological orientations and organizational form of its civil society, and its detachment from the political society, prevent civil society in Hong Kong from engineering a formidable territory-wide movement to push for institutional reforms. The high level of civil liberties has reduced the sense of urgency, and the protracted transition has led to transition fatigue, making it difficult to sustain popular mobilization. Years of persistent civil society movements, however, have created a perennial legitimacy problem for the government, and drove Beijing to try to set a timetable for full democracy to solve the legitimacy and governance problems of Hong Kong. Key words: Civil society, democratization in Hong Kong, dual structure, hybrid regime, protracted transition, transition fatigue. For many a democratization theorist, the slow democratization of Hong Kong is anomalous. As one of the most advanced cities in the world, by as early as the 1980s, Hong Kong had passed the “zone of transition” postulated by the modernization theorists. Hong Kong also had a vibrant civil society, a sizeable middle class, many civil liberties that rivaled Western democracies, one of the freest presses in Asia, and independent courts. -

Strategies for Optimizing Hong Kong's Living Environment Beyond 2030

SHAPING HONG KONG: STRATEGIES FOR OPTIMIZING HONG KONG’S LIVING ENVIRONMENT BEYOND 2030 PRINCIPLES, DIRECTIONS, PARAMETERS AND STRATEGY Research Team: Mee Kam NG Yee LEUNG Ka Ling CHEUNG Kam Yee YIP Institute of Future Cities The Chinese University of Hong Kong SHAPING HONG KONG: STRATEGIES FOR OPTIMIZING HONG KONG’S LIVING ENVIRONMENT BEYOND 2030 PRINCIPLES, DIRECTIONS, PARAMETERS AND STRATEGY September 2015 Shaping Hong Kong—Strategies for optimising Hong Kong’s living environment beyond 2030 PRINCIPLES, DIRECTIONS, PARAMETERS & STRATEGY OF LOW-CARBON INFRASTRUCTURE DEVELOPMENT Table of Contents Page Executive Summary 1 1. Introduction 3 2. Research Methodology 5 3. The Need to Move Beyond 2030 6 4. Guiding Principles for Low-Carbon Infrastructure Development 13 5. Overall Parameters of Low-Carbon Infrastructure Development in Hong 19 Kong beyond 2030 6. Low-Carbon Infrastructure Development Strategy: City-level Priorities 23 7. Low-Carbon Infrastructure Development Strategy: Sector-level Priorities 29 8. Possible Infrastructure Investment Priorities 51 9. Conclusion 52 References 55 List of Figures 1. Greenhouse Gas Emissions in Hong Kong from 1990 -2012 10 2 Greenhouse Gas Emission Trends of Hong Kong by Sector from 1990-2012 11 3 Five Tracks of Low Carbon Green Growth 13 4 Key Areas of Concern of Civil Engineers 18 5 Integrated and Holistic Considerations of Infrastructure Systems 23 6 Smart Grid 41 7 Hong Kong Energy Consumption by Sector 41 8 Waste Management Structure in Hong Kong and other Asian Areas 46 9 Towards Low-Carbon