Australian Stocks: What Happened Today?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Orpheus Cover Cover Concepts

(ACN 121 257 412) PROSPECTUS for the offer by Orpheus Energy Limited of up to 50,000,000 Shares at 25 cents each with oversubscriptions of up to a further 10,000,000 Shares including the Rights Issue to existing Shareholders as at the Record Date Lead Manager BBY Limited IMPORTANT NOTICE ASX Code to be OEG. This document is important and should be read in its entirety. If you are in any doubt as to the course you should follow you should consult your stockbroker, solicitor, accountant or other professional adviser. This is a speculative investment.. Corporate Directory Directors Independent Geologist – Indonesia Mr Wayne Douglas Mitchell, Chairman, Ravensgate CEO & Managing Director Level 3, 44 Parliament Place Mr Wesley Harder, Director – Exploration West Perth WA 6005 Mr Anthony Meacham King, Director Independent Geologist – Australia Proposed Directors Minarco-MineConsult Mr Nugroho Suksmanto Level 16, Australia Square Mr Michael Rhodes (alternate director to Nugroho 264-278 George St Suksmanto) Sydney NSW 2000 Company Secretary Auditor Mr Nathan Bartrop Bentleys Melbourne Audit Pty Ltd Level 7 114 William Street Registered Office Melbourne VIC 3000 Level 5, 44 Miller St North Sydney NSW 2060 Independent Accountant Stantons International Securities Share Registry Level 1 Security Transfer Registrars Pty Ltd 1 Havelock Street 770 Canning Highway West Perth WA 6000 Applecross WA 6953 Title Report – Indonesia Lead Manager Hadiputranto, Hadinoto & Partners BBY Limited The Indonesia Stock Exchange Building Level 17, 60 Margaret Street Tower II, 21st Floor Sydney NSW 2000 JI. Jend. Sudirman Kav.52-53 Jakarta 12190 Indonesia Sponsoring Broker Centre Capital Securities Pty Ltd Title Report – Australia 14 Macquarie Street Hetherington Exploration & Belmont NSW 2280 Mining Title Services Pty Limited Level 1, 503 Willoughby Rd Solicitors Willoughby NSW 2068 Whitttens Lawyers and Consultants Level 5 137 Bathurst Street Sydney NSW 2000 i CORPORATE DIRECTORY Indicative Timetable Rights Issue Timetable Lodgment of Prospectus with ASIC and Announcement to ASX . -

Market Insight – August 2015 Welcome to “The Baader-Meinhof Phenomena”… by Jon Michel

SYDNEY MELBOURNE Level 24 Level 5 400 George Street 189 Flinders Lane SYDNEY NSW 2000 MELBOURNE VIC 3000 Tel 61 2 9235 9400 Tel 61 3 9653 8600 Market Insight – August 2015 Welcome to “The Baader-Meinhof Phenomena”… By Jon Michel I recently had the pleasure of working on a really interesting role for one of our clients. Having presented a particularly cracking shortlist, I noticed that three of the top four candidates had ended up on our shores in similar circumstances. They (guys) were all here as a result of meeting and marrying Australian girls who had been travelling overseas… think Contiki tours got a mention at least once! Each couple had initially settled and had children abroad (Europe/US) and then, largely due to those Aussie girls wanting to be closer to family and bring up the kids here, they had relocated to Australia. Put it this way, the move was not driven by career priorities but instead by family and lifestyle considerations. Anyway, since that shortlist construction, I seem to keep bumping into people who have ended up here through the same scenario. Now, I’d always called this the ‘Pink VW’ syndrome: i.e. you see one pink Volkswagen, then as it sits in the forefront of your consciousness, you continually seem to register them as you go. Well, it does exist but it’s actually called the Baader-Meinhof phenomena. Seriously, Google it. A bizarre choice, referencing it to an urban German terrorist gang of the 1970’s... go figure. Apart from you now being prepared when this topic inevitably comes up in your next Trivial Pursuit quiz, I also wanted to highlight the excellent talent pool that us recruiters get to tap into as a result of such offshore unions and subsequent relocations down under. -

BBY Client Monies Investigation Report: 22 December 2015

+ BBY Limited (Receivers and Managers Appointed) (In Liquidation) ACN 006 707 777 Client monies investigations Liquidators’ Report Stephen Vaughan and Ian Hall Joint and Several Liquidators KPMG 10 Shelley Street Sydney 22 December 2015 2 © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. The KPMG name, logo and "cutting through complexity" are registered trademarks or trademarks of KPMG International. Liability limited by a scheme approved under Professional Standards Legislation. Glossary ABN ABN Amro, Futures clearing house AC Account Number ACN Australian Company Number Act Corporations Act 2001 (Cth) ACH ASX Clearing House ADM ADM Investor Services International Administrators Stephen Vaughan and Ian Hall of KPMG AFSL Australian Financial Services Licence AIMS AIMS Financial Group Agility Agility Applications Pty Ltd ANZ Australia and New Zealand Banking Group APX Asia Pacific Stock Exchange AQA Aquila Resources Limited ARITA Australian Restructuring, Insolvency and Turnaround Association ARCC Audit, Risk and Compliance Committee ASIC Australian Securities and Investments Commission ASX Australia Stock Exchange ATO Australian Taxation Office BAU Business as Usual BBO Business Banking Online BBYAS BBY Advisory Services Pty Ltd BBYH BBY Holdings BBYHT BBY Hometrader Pty Ltd BBYN BBY Nominees Pty Ltd BBYPN BBY Protection Nominees Pty Ltd BBY Companies BBY Limited and each of -

The Australian National Registry of Emissions Units

The Australian National Registry of Emissions Units ANREU - Authorised Entities Report 13/CMP.1 Paragraph 48 Report Generated: 24/07/20 1:55:26 AM Total Number of Authorised Entities: 1122 List of Legal Entities Authorised to hold ERUs, CERs, AAUs, and/or RMUs 1st Energy Pty Ltd A. A. Company Pty. Ltd. A.B.C. Paper & Paper Mills Pty. Limited A.J. BUSH & SONS (MANUFACTURES) PTY LTD Aak Puul Ngantam Ltd. Aboriginal Carbon Fund Limited ACCU Asset Management Pty Ltd Adam John Robinson Adam Richard Nixon Adelaide Brighton Cement Limited ADELAIDE BRIGHTON MANAGEMENT LTD Adrian Lewis Schmidt Advanced Energy Centre Pty. Ltd. AEDP CARBON PTE LTD AETV PTY LTD Agasco Limited AGL ACT Retail Investments Pty Limited AGL Energy Limited AGL Energy Sales & Marketing Limited AGL Energy Services Pty Limited AGL HP1 Pty Limited AGL HP2 Pty Limited AGL HP3 Pty Limited AGL Hydro Partnership AGL Macquarie Pty Limited AGL POWER GENERATION PTY LIMITED AGL Retail Energy Limited AGL SALES (QUEENSLAND) PTY LIMITED AGL Sales Pty Limited AGL SOUTH AUSTRALIA PTY LIMITED AGL Torrens Island Pty Limited AGL Wholesale Gas Limited Agriprove Pty Ltd Agriprove Solutions Pty Ltd Alan Carl Pulsford Alan Peter Cole Alan Stuart John Lawson Albury City Council 1 ALCOA AUSTRALIA ROLLED PRODUCTS PTY LIMITED Alcoa of Australia Limited Alfa (NT) Limited Alfred James Clark ALINTA COGENERATION (PINJARRA) PTY LTD Alinta Cogeneration (Wagerup) Pty Ltd ALINTA ENERGY CEA PTY LTD ALINTA ENERGY RETAIL SALES PTY. LTD. ALINTA SALES PTY LTD Allgas Energy Pty Limited Alpine MDF Industries Pty -

Futures Terms and Conditions

Futures Terms JULY 2014 http://www.bby.com.au BBY FUTURES TERMS BBY FUTURES CLIENT AGREEMENT Market Participant with ASX Clear (Futures), neither BBY BETWEEN nor the Client has any rights whether by way of subrogation THE CLIENT AND BBY LTD ABN 80 006 707 777 AFSL NO. or otherwise, against any person or corporation other than, 238095 (BBY) in the case of BBY, the Market Participant or, in the case of the Client, BBY. PART A 4. CLIENTS THAT TRADE IN OTHER PRODUCTS OFFERED BY BBY FUTURES CLIENT AGREEMENT If the Client trades in other products offered by BBY, then The following terms and conditions (Terms) apply if the Client is the Client may have one or more Trading Accounts with to trade in Futures and future options with BBY acting as order BBY. Since the method of dealing may differ significantly placement agent (including, but not limited to, ASX 24 Futures with little interaction among those Trading Accounts, with Market Participants ABN AMRO Clearing Sydney Pty Ltd the calculations, reporting and administration may be and ADM Investor Services International Limited, as Executing performed by BBY separately for each Trading Account, and Clearing Broker’s for those trades). If the Client wishes to so that (among other things, without limitation): engage in “Give- Up” arrangements, then Part B of these terms (a) Margin calculations are managed and enforcement will apply to the clients’ trading. action is taken for each Trading Account separately; The Client and the BBY agree and acknowledge as follows: and 1. INSTRUCTIONS (b) BBY may at any time aggregate one or more Trading Accounts (for reporting or managing Margins or The Client may from time to time instruct BBY to deal otherwise for the purposes of these Terms). -

BBY Nominees Annual Creditors Report

BBY Nominees Pty Ltd (In Liquidation) ACN 007 001 443 Liquidators’ annual report 25 November 2016 Stephen Vaughan KPMG BBY Nominee Client and and Ian Hall Restructuring Services Creditor Enquiries Tower Three, E [email protected] Joint and Several International Towers Sydney W www.kpmg.com/AU/bby Liquidators 300 Barangaroo Avenue Sydney NSW 2000 BBY Nominees Liquidators’ annual report to creditors 25 November 2016 Executive summary BBY Nominees acted as a bare trustee and nominated custodian for clients of the BBY business providing nominee services in respect of securities and other financial products, both domestic and international. BBY Nominees was part of the wider BBY Group and failed as a consequence of the collapse and insolvency of BBY Limited and the other BBY Companies. Purpose of this report Each year during the winding up of a company liquidators are required to convene an annual meeting of creditors (or lodge an annual report with ASIC), providing an account of the conduct of the winding up. This is the first annual report by the Liquidators to the former clients and creditors of BBY Nominees and accompanies notice of a meeting of creditors to be held on 15 December 2016. Appointment details Stephen Vaughan and Ian Hall of KPMG were appointed as Administrators of ten BBY group companies on 17 May 2015 including BBY Nominees. At a meeting of creditors held on 8 October 2015 BBY Nominees was placed into liquidation and we became the Liquidators. Clients At the time of or appointment, the accounts of BBY Nominees were inadequate to determine the identity of all clients, the extent of assets held and whether assets were owned or held on trust for others. -

Australian Stocks: What Happened Today?

Australian Stocks: What Happened Today? Mar 19, 2014 By Henry Jennings, Private Client Advisor, BBY Ltd The ASX200 closed up for the second day in succession, today rising 11pts thanks to a decent late rally over the last few hours of trading. Volume was solid at around $5.5b. The market is again closing in on that crucial 5400pt level, as opinion remains divided as to where we trade next. The market remains in a 100pt trading range, as investors remain cautious ahead in light of the recent Ukraine crisis, and the crucial Fed meeting to follow later in the week. All eyes continue to be focused offshore, with this week’s macro developments likely to be pivotal in dictating any short term momentum. The share market has edged higher as investors wait to see how quickly the United States will continue to wind back its economic stimulus measures. Investors are looking past developments in Ukraine’s Crimea region and are waiting on comments to be made by the US Federal Reserve on Thursday, Australian time, at the conclusion of its two-day policy meeting. The Westpac Melbourne Institute Leading Index which indicates the likely pace of economic growth three to nine months into the future fell from 0.53% in January to –0.19% in February, continuing a sharp loss of momentum since late 2013. The February result marks the first sub-trend reading since December 2012. Wotif.com Holdings Limited (A$3.00, +23.0%) continued on its positive run from yesterday, following a pre-market trade of around 3.5% of the company shares at $2.40. -

The Australian National Registry of Emissions Units

The Australian National Registry of Emissions Units ANREU - Authorised Entities Report 13/CMP.1 Paragraph 48 Report Generated: 8/09/17 4:37:44 AM Total Number of Authorised Entities: 992 List of Legal Entities Authorised to hold ERUs, CERs, AAUs, and/or RMUs 1st Energy Pty Ltd A.B.C. Paper & Paper Mills Pty. Limited A.J. BUSH & SONS (MANUFACTURES) PTY LTD Aak Puul Ngantam Ltd. Aboriginal Carbon Fund Limited ACI OPERATIONS PTY. LTD. Adam John Robinson Adelaide Brighton Cement Limited ADELAIDE BRIGHTON MANAGEMENT LTD Adrian Lewis Schmidt Advanced Energy Centre Pty. Ltd. AEDP CARBON PTE LTD AETV PTY LTD AGL ACT Retail Investments Pty Limited AGL Energy Limited AGL Energy Sales & Marketing Limited AGL Energy Services Pty Limited AGL HP1 Pty Limited AGL HP2 Pty Limited AGL HP3 Pty Limited AGL Hydro Partnership AGL Macquarie Pty Limited AGL POWER GENERATION PTY LIMITED AGL Retail Energy Limited AGL SALES (QUEENSLAND) PTY LIMITED AGL Sales Pty Limited AGL SOUTH AUSTRALIA PTY LIMITED AGL Torrens Island Pty Limited AGL Wholesale Gas Limited Alan Carl Pulsford Alan Peter Cole Alan Stuart John Lawson Albury City Council ALCAN GOVE PTY LIMITED ALCOA AUSTRALIA ROLLED PRODUCTS PTY LIMITED Alcoa of Australia Limited Alfa (NT) Limited Alfred James Clark 1 ALINTA COGENERATION (PINJARRA) PTY LTD Alinta Cogeneration (Wagerup) Pty Ltd ALINTA ENERGY CEA PTY LTD ALINTA ENERGY RETAIL SALES PTY. LTD. ALINTA SALES PTY LTD Allgas Energy Pty Limited Alpine MDF Industries Pty Ltd Alterra Limited Amaral Pastoral Pty Limited Amiterre Ag Solutions Pty Ltd Andrew Crawford -

BBY Group – Notice to Clients

Australia and New Zealand’s Largest Independent Stockbroker NOTICE TO CLIENTS 20 May 2015 Dear Sir/Madam, BBY Ltd (Administrators Appointed) (Receivers and Managers Appointed) ACN 006 707 777 Broker Services Australia Pty Ltd (Administrators Appointed) (Receivers and Managers Appointed) ACN 074 976 364 BBY Holdings Pty Limited (Administrators Appointed) (Receivers and Managers Appointed) ACN 075 187 432 BBY Nominees Pty. Ltd. (Administrators Appointed) ACN 007 001 443 BBY Protection Nominees Pty. Ltd. (Administrators Appointed) ACN 007 001 710 Options Research Pty. Ltd. (Administrators Appointed) ACN 006 770 627 Tilbia Nominees Pty Ltd (Administrators Appointed) ACN 007 001 578 BBY Advisory Services Pty Ltd (Administrators Appointed) (Receivers and Managers Appointed) ACN 102 761 008 BBY Hometrader Pty Ltd (Administrators Appointed) ACN 134 838 207 SmarTrader Limited (Administrators Appointed) ACN 115 752 102 (“the Companies”) BACKGROUND On 17 May 2015 at 11.03pm Stephen Ernest Vaughan and Ian Richard Hall ("Administrators") of KPMG were appointed joint and several administrators of the above companies. Following that appointment, on 18 May 2015 Stephen Parbery and Brett Lord ("Receivers") were appointed receivers and managers to each of BBY, BBY Holdings, BBY Advisory and Broker Services (“the Receivership Companies”). The Receivers and Managers have taken control of the Receivership Companies and their operations from the date of their appointment, in accordance with the terms of the Corporations Act 2001 (Cth) (“the Act”). The remaining Companies listed above are subject to the control of the Administrators. At around 7:53am on 20 May 2015, the Administrators received notice that the Receivers had retired as receivers and managers of BBY Advisory, which is a related company of BBY that employs staff and contracts with advisers. -

BBY Limited (Receivers and Managers Appointed) (Administrators Appointed) ACN 006 707 777 and Associated Companies (See Over Page)

+ BBY Limited (Receivers and Managers Appointed) (Administrators Appointed) ACN 006 707 777 And associated companies (see over page) Administrators’ report to creditors Section 439A of the Corporations Act 2001 12 June 2015 BBY Holdings Pty Limited (Receivers and Managers Appointed) ACN 075 187 432 BBY Limited (Receivers and Managers Appointed) ACN 006 707 777 Broker Services Australia Pty Ltd (formerly Receivers and Managers Appointed) ACN 074 976 364 BBY Advisory Services Pty Ltd (Receivers and Managers Appointed) ACN 102 761 008 SmarTrader Limited ACN 115 752 102 BBY Hometrader Pty Ltd ACN 134 838 207 (All Administrators Appointed) (“BBY Companies”) Stephen Vaughan and Ian Hall Joint and Several Administrators KPMG 10 Shelley Street Sydney 2 © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. The KPMG name, logo and "cutting through complexity" are registered trademarks or trademarks of KPMG International. Liability limited by a scheme approved under Professional Standards Legislation. Glossary ACN Australian Company Number Act Corporations Act 2001 (Commonwealth) Administrators Stephen Vaughan and Ian Hall of KPMG AEST Australian Eastern Daylight Time AFSL Australian Financial Services Licence AIMS AIMS Financial Group Agility Agility Applications Pty Ltd AMEX American Express ANZ Australia and New Zealand Banking Corporation AQA Aquila Resources Limited ARITA Australian Restructuring, -

Factset Exchange Datafeed Data Model Version 2.0J

FactSet Exchange DataFeed Data Model Version 2.0J Last Updated: 18th August 2020 Copyright © 2020 FactSet Research Systems Inc. All rights reserved. FactSet Research Systems Inc. | www.factset.com 1 Notice This manual contains confidential information of FactSet Research Systems Inc. or its affiliates ("FactSet"). All proprietary rights, including intellectual property rights, in the Licensed Materials will remain property of FactSet or its Suppliers, as applicable. The information in this document is subject to change without notice and does not represent a commitment on the part of FactSet. FactSet assumes no responsibility for any errors that may appear in this document. Revision History Effective Date Version Number Description Changes made 18/08/2020 2.0J FactSet Exchange Updated Template DataFeed Data Model 2.0I Section 5.3.2 Added Indicative Intraday Nav and NAV for ETF’s Section 5.8.3 Added Market Statistics Appendix C Added Mapping table for Market Makers Appendix C Remove ISO table 1.2R Section 3.2 Mapping tables have been updated Copyright © 2020 FactSet Research Systems Inc. All rights reserved. FactSet Research Systems Inc. | www.factset.com 2 Table of Contents Notice ................................................................................................................................... 2 Revision History .................................................................................................................... 2 Document Organization and Audience ................................................................................. -

Rcd.0015.0003.0208

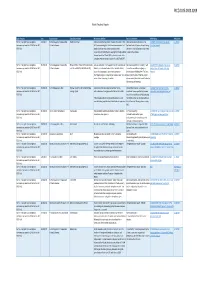

RCD.0015.0003.0208 Public Results & Reports Type of Inquiry Date Industry Sector Entity/Subject Name Misconduct identified Actions or outcomes MR Heading MR number Formal investigation (an investigation 2/11/2011 Funds Management - Responsible Equititrust Limited ASIC concerned that Equititrust in breach of a condition of its Obtained various interim orders in the 11-238AD ASIC obtains orders against 11-238AD commenced pursuant to s13 ASIC Act or s247 Entities & schemes AFS licence requiring that it hold a minimum amount of net Supreme Court of Queensland constraining Equititrust Limited NCCP Act) tangible assets and has breached provisions of the the manner in which Equititrust is permitted Corporations Act 2001 (the Act) requiring that it lodge audited to operate the schemes. financial reports for EIF and EPCIF and audited reports of its compliance with the compliance plans for both EIF and EPCIF. Formal investigation (an investigation 31/07/2015 Funds management - Responsible Mr David Anthony Ross, Mr Richard Albarran ASIC was concerned that the appointment of Messrs Ross and ASIC was successful in its proceeding, with 15-203MR ASIC takes action to remove 15-203MR commenced pursuant to s13 ASIC Act or s247 Entities & schemes and Midland HWY Pty Ltd (Midland HWY) Albarran, as replacement administrators to Midland HWY, Messrs Ross and Albaran resigning as administrators of failed land banking NCCP Act) occurred in circumstances where many investors in administrators of Midland HWY. The Court company Hermitage Bendigo, who may also be creditors, were not given made orders by consent that the original notice of the first meeting of creditors.