United States Securities and Exchange Commission Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Simon Property Group, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 04-6268599 (State or other jurisdiction of (Commission File No.) (I.R.S. Employer incorporation or organization) Identification No.) 225 West Washington Street Indianapolis, Indiana 46204 (Address of principal executive offices) (ZIP Code) (317) 636-1600 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12 (b) of the Act: Name of each exchange Title of each class on which registered Common stock, $0.0001 par value New York Stock Exchange 6% Series I Convertible Perpetual Preferred Stock, $0.0001 par value New York Stock Exchange 83⁄8% Series J Cumulative Redeemable Preferred Stock, $0.0001 par value New York Stock Exchange Securities registered pursuant to Section 12 (g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ፤ No អ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes អ No ፤ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

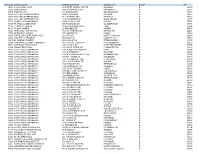

Agtnum Agent Name

AGTNUM AGENT_NAME AGENT_ADDRESS AGENT_CITY STATE ZIP 19348 CHECK N GO #1315 22 E WEST NEWELL RD STE DANVILLE IL 61834 23563 KROGER #531 1405 W GARFIELD AVE BARTONVILLE IL 61607 23575 KROGER #984 633 ARMOUR RD BOURBONNAIS IL 60914 26836 ACE CASH EXPRESS #9309 1690 E JACKSON MACOMB IL 61455 26837 ACE CASH EXPRESS #9308 4111 N VERMILION DANVILLE IL 61832 26838 ACE CASH EXPRESS #9307 1145 W SPRINGS ST SOUTH ELGIN IL 60177 31025 TA #030 CHICAGO NORTH 16650 RUSSELL RD RUSSELL IL 60075 31059 TA #092 BLOOMINGTON 505 TRUCKERS LN BLOOMINGTON IL 61701 31140 TA #199 ST LOUIS E 819 EDWARDSVILLE RD TROY IL 62294 31184 TA #236 MORRIS 21 ROMINES DR MORRIS IL 60450 31225 PETRO #321 EFFINGHAM 1805 W FAYETTE AVE EFFINGHAM IL 62401 32594 PETRO #367 MONEE 5915 MONEE RD MONEE IL 60449 34609 TORTILLERIA/SUPERMERCADO 821 10TH ST NORTH CHICAGO IL 60064 35653 FARMER CITY MARKET 404 S MAIN ST FARMER CITY IL 61842 35875 EL GORDO GROCERY 5032 VALLEY LN STREAMWOOD IL 60107 35908 TOM'S PRICED RIGHT FOODS #53 HWY 14 E RT 5 BOX 347 MCLEANSBORO IL 62859 35910 TOM'S MAD PRICE #5326 1000 W MAIN ST WEST FRANKFORT IL 62896 37954 WOODFIELD PAWN 7201 OLDE SALEM CIR HANOVER PARK IL 60133 38723 CHECK INTO CASH #04001 1002 SHOOTING PARK RD PERU IL 61354 38799 CHECK INTO CASH #04003 4274 N PROSPECT DECATUR IL 62526 38801 CHECK INTO CASH #04004 2303 E WASHINGTON ST STE BLOOMINGTON IL 61704 38802 CHECK INTO CASH #04005 3437-39 N MAIN ST ROCKFORD IL 61103 38803 CHECK INTO CASH #04007 1507 N PROSPECT AVE CHAMPAIGN IL 61820 38804 CHECK INTO CASH #04008 3923 41ST AVENUE DR MOLINE IL 61265 -

American Customer Satisfaction Index Methodology Report

American Customer Satisfaction Index Methodology Report June 2008 Methodology American Customer Satisfaction Index Methodology Report June 2008 © Copyright 2008, The Regents of the University of Michigan PREFACE ACSI is designed, conducted, and analyzed by the National Quality Research Center (NQRC), Stephen M. Ross School of Business at the University of Michigan. The ACSI technical staff includes: • Professor Claes Fornell, Donald C. Cook Professor of Business Administration, and Director, National Quality Research Center • David VanAmburg, Managing Director, ACSI • Forrest Morgeson, Ph.D., Research Scientist & Lead Statistician • Barbara Everitt Bryant, Ph.D., Research Scientist • Lifang Vanderwill, Research Associate • Kimberly J. Ward, Administrative Assistant • Julie M. Trombly, Editor and Graphic Production ACSI Methodology Report prepared by: Barbara Everitt Bryant; Chapter II prepared by Professor Claes Fornell and Forrest Morgeson For questions on research or an interpretation of this report, contact: National Quality Research Center Stephen M. Ross School of Business University of Michigan Ann Arbor, MI 48109-1234 Telephone: 734-763-9767; Fax: 734-763-9768 Web: www.theacsi.org ii National Update reports on customer satisfaction are produced quarterly and delivered electronically on request. To order reports, visit the ACSI Bookstore on the Web at: www.theacsi.org. iii CONTENTS I. INTRODUCTION.......................................................................................................................1 A. HISTORY ..............................................................................................................................2 -

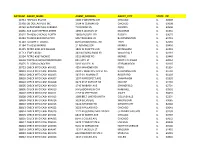

Your Benefits Card Merchant List

Your Benefits Card Merchant List ¾ Use your benefits card at these stores that can identify FSA/HRA eligible expenses. ¾ Check the list to find your store before you order prescriptions or shop for over-the- counter (OTC) items. ¾ Swipe your benefits card first and only your FSA/HRA eligible purchases will be deducted from your account. ¾ You won’t have to submit receipts to verify purchases from these stores, but you should still save your receipts for easy reference. ¾ Merchants have the option of accepting MasterCard and/or Visa for payment. Before making a purchase with your benefits card, please make sure you know which cards are accepted. Ist America Prescription Drugs* Albertville Discount Pharmacy* AmiCare Pharmacy Inc* 3C Healthcare Inc, dba Medicap Alden Pharmacy* Anderson and Haile Drug Store* Pharmacy* Alert Pharmacy Services-Mt Anderson County Discount 50 Plus Pharmacy* Holly* Pharmacy* A & P* Alexandria Drugs Inc* Anderson Drug-Athens TX* Aasen Drug* Alfor’s Pharmacy* Anderson Pharmacy-Denver PA Abeldt’s Gaslight Pharmacy* Allcare Pharmacy* Anderson Pharmacy/John M* ACME * Allen Drug* Anderson’s Pharmacy* Acres Market (UT) * Allen’s Discount Pharmacy* Andrews Pharmacy* Acton Pharmacy Allen Family Drug* Anthony Brown Pharmacy Inc* Adams Pharmacy* Allen’s Foodmart* Antwerp Pharmacy* Adams Pharmacy Inc* Allen’s of Hastings, Inc.* Apotek Inc. Adams Pharmacy and Home Allen's Super Save #1 Provo Apotek Pharmacy* Care* UT* Apoteka Compounding LLC* Adamsville Pharmacy* Allen's Super Save #2 Orem UT* Apothecare Pharmacy* Adrien Pharmacy* -

Agtnum Agent Name Agent Address Agent City

AGTNUM AGENT_NAME AGENT_ADDRESS AGENT_CITY STATE ZIP 21931 HISPANO ENVIOS 5000 S WESTERN AVE CHICAGO IL 60609 21938 OB DOLLAR PLUS INC 1704 W CERMAK RD CHICAGO IL 60608 21969 SUPERMERCADO CARRERA 710 FORAN LN AURORA IL 60506 26836 ACE CASH EXPRESS #9309 1690 E JACKSON ST MACOMB IL 61455 31025 TA #030 CHICAGO NORTH 16650 RUSSELL RD RUSSELL IL 60075 31059 TA #092 BLOOMINGTON 505 TRUCKERS LN BLOOMINGTON IL 61701 31140 TA #199 ST LOUIS E 819 EDWARDSVILLE RD TROY IL 62294 31184 TA #236 MORRIS 21 ROMINES DR MORRIS IL 60450 31225 PETRO #321 EFFINGHAM 1805 W FAYETTE AVE EFFINGHAM IL 62401 31713 JEWEL #3341 343 W IRVING PARK RD WOOD DALE IL 60191 32594 PETRO #367 MONEE 5915 MONEE RD MONEE IL 60449 34609 TORTILLERIA/SUPERMERCADO 821 10TH ST NORTH CHICAGO IL 60064 35875 EL GORDO GROCERY 5032 VALLEY LN STREAMWOOD IL 60107 38723 CHECK INTO CASH #04001 4254 MAHONEY DR PERU IL 61354 38801 CHECK INTO CASH #04004 2303 E WASHINGTON ST STE BLOOMINGTON IL 61704 38802 CHECK INTO CASH #04005 3437-39 N MAIN ST ROCKFORD IL 61103 38803 CHECK INTO CASH #04007 1507 N PROSPECT AVE CHAMPAIGN IL 61820 38804 CHECK INTO CASH #04008 3923 41ST AVENUE DR MOLINE IL 61265 38805 CHECK INTO CASH #04009 1740 WABASH AVE SPRINGFIELD IL 62704 38806 CHECK INTO CASH #04010 9 MEADOWVIEW CTR KANKAKEE IL 60901 38807 CHECK INTO CASH #04011 2157 W JEFFERSON JOLIET IL 60435 38808 CHECK INTO CASH #04013 1099 BELT LINE RD UNIT H COLLINSVILLE IL 62234 38809 CHECK INTO CASH #04014 3024 BELVIDERE WAUKEGAN IL 60085 38810 CHECK INTO CASH #04015 3224 NAMEOKI RD GRANITE CITY IL 62040 38813 CHECK -

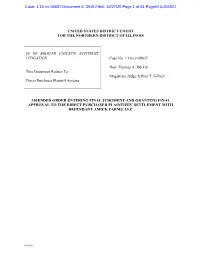

Amended Final Approval Order: Amick

Case: 1:16-cv-08637 Document #: 3945 Filed: 10/27/20 Page 1 of 61 PageID #:265921 UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF ILLINOIS IN RE BROILER CHICKEN ANTITRUST LITIGATION Case No. 1:16-cv-08637 Hon. Thomas A. Durkin This Document Relates To: Magistrate Judge Jeffrey T. Gilbert Direct Purchaser Plaintiff Actions AMENDED ORDER ENTERING FINAL JUDGMENT AND GRANTING FINAL APPROVAL TO THE DIRECT PURCHASER PLAINTIFFS’ SETTLEMENT WITH DEFENDANT AMICK FARMS, LLC 943169.1 Case: 1:16-cv-08637 Document #: 3945 Filed: 10/27/20 Page 2 of 61 PageID #:265922 The Court has considered the Direct Purchaser Plaintiffs’ (“DPPs”) motion for final approval of their class action settlement with Defendant Amick Farms, LLC (“Settling Defendant”), and has conducted a fairness hearing in connection with that motion. The Court also has reviewed the Settlement Agreement between the DPPs and Amick Farms, LLC (“Amick”) (the “Settlement” or “Settlement Agreement”), the pleadings and other papers on file in this action, and the statements of counsel and the parties. The Court now hereby finds that the motion should be GRANTED as to the Settlement with Settling Defendant. NOW, THEREFORE, IT IS HEREBY ORDERED THAT: 1. The Court has jurisdiction over the subject matter of this litigation, including the actions within this litigation, and over the parties to the Settlement Agreement, including all members of the Settlement Class (also referred to herein as the “Class”) and the Settling Defendant. 2. For purposes of this Order, except as otherwise set forth herein, the Court adopts and incorporates the definitions contained in the Settlement Agreement. -

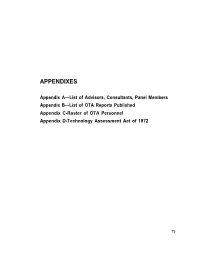

Annual Report to the Congress for 1977 (Part 9 Of

APPENDIXES Appendix A—List of Advisors, Consultants, Panel Members Appendix B—List of OTA Reports Published Appendix C-Roster of OTA Personnel Appendix D-Technology Assessment Act of 1972 73 Appendix A List of Advisors, Consultants, Panel Members ENERGY ADVISORY COMMITTEE Milton Katz. Chairman Director, International Legal Studies, Harvard Law School Thomas G Ayers Wassily Leontief John Redmond President and Chairman of the Board Department of Economics Executive Vice President (Retired) Commonwealth Edison Company New York University Shell Oil Company Kenneth E Boulding George E. Mueller John C Sawhill Institute of Behavioral Science President and Chairman of the Board President University of Colorado Systems Development Corporation New York University Eugene G Fubini Gerard Piel Chauncey Starr Fubini Consultants, Ltd Publisher President Electric Power Research Institute John M Leathers Scientific American Executive Vice President Dow Chemical USA Direct Coal Utilization Panel Ed Light Larry Williams West Virginia Citizens Action Group Electric Power Research Institute Harry Perry, Chairman Robert Lundberg Joseph Yancik Resources for the Future, Inc Commonwealth Edison National Coal Association David Comey Paul Martinka Executive Director American Electric Power Corp. Citizens for a Better Environment A W Deurbrouck David Mastbaum Residential Energy Conservation Coal Preparation and Analysis Staff Counsel Advisory Panel Laboratory Environmental Defense Fund Department of Energy John H. Gibbons, Chairman Ken Mills Director. Environment Center Michael Enzi Tug Valley Recovery Center University of Tennessee Mayor, City of Gillette. Wyo Ralph Perhac John Richards Andrews Don Gasper Electric Power Research institute Architect Director. Economic Studies Michael Rieber Consolidation Coal Co Robert E. Ashburn Center for Advanced Computation Manager, Economic Research D W Hallman University of Illinois at Urbana Department Engineering Department Steve Shapiro Long Island Lighting Company E. -

News Release Circle Ten Council, Boy Scouts of America 8605 Harry Hines • Dallas, TX 75235 • (214) 902-6700

FOR IMMEDIATE RELEASE News Release Circle Ten Council, Boy Scouts of America 8605 Harry Hines • Dallas, TX 75235 www.circle10.org • (214) 902-6700 MEDIA CONTACT: Wendy Kurten Office: 214-902-6794 Mobile: 214-232-9574 Email: [email protected] Boy Scouts Launch Annual Food Drive Scouting for Food Scheduled for February 9-16, 2008 DALLAS – On February 9, 2008 Circle Ten Council, Boy Scouts of America will kick off its 21st annual Scouting for Food drive collecting food donations for the needy across Dallas and surrounding areas. Scouting for Food is Circle Ten Council’s largest service project involving thousands of Scouts and volunteers across 12 counties in North Texas and Oklahoma. Since 2000, Scouts in Circle Ten Council, their families and volunteer leaders have collected over 3.5 million food items for our neighbors living with hunger. The council’s goal this year is 500,000 items. On Saturday, February 9, Cub Scouts, Boy Scouts and Venturers from across Circle Ten Council will be placing bright yellow plastic bags on door steps across Dallas and surrounding areas. Scouts will return to pick these bags up on Saturday morning, February 16. Donations should be placed on doorsteps for pick up before 10 AM that morning. Food donations needed include canned items such as vegetables, meats, chili, soups or juices, and baby formula. Boxed or bagged meals and pastas are also welcome. The ideal food donation bag would include one of each. Please—nothing perishable, frozen or in glass. Monetary donations cannot be accepted. This year’s food drive is generously sponsored by Tom Thumb Food and Pharmacy, The Dallas Morning News, and WFAA-Channel 8. -

Amended Final Approval Order: Peco and George's

Case: 1:16-cv-08637 Document #: 3944 Filed: 10/27/20 Page 1 of 73 PageID #:265848 UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF ILLINOIS IN RE BROILER CHICKEN ANTITRUST LITIGATION Case No. 1:16-cv-08637 Hon. Thomas A. Durkin This Document Relates To: Magistrate Judge Jeffrey T. Gilbert Direct Purchaser Plaintiff Actions AMENDED ORDER ENTERING FINAL JUDGMENT AND GRANTING FINAL APPROVAL TO THE DIRECT PURCHASER PLAINTIFFS’ SETTLEMENTS WITH DEFENDANTS PECO FOODS, INC., GEORGE’S, INC., GEORGE’S FARMS, INC. 943139.2 Case: 1:16-cv-08637 Document #: 3944 Filed: 10/27/20 Page 2 of 73 PageID #:265849 The Court has considered the Direct Purchaser Plaintiffs’ (“DPPs”) motion for final approval of their class action settlements with Defendants Peco Foods, Inc., George’s, Inc., and George’s Farms, Inc. (“Settling Defendants”), and has conducted a fairness hearing in connection with that motion. The Court also has reviewed the Settlement Agreements between the DPPs and Peco Foods, Inc. (“Peco”) and the DPPs and George’s, Inc., George’s Farms, Inc. (“George’s”) (collectively the “Settlements” or “Settlement Agreements”), the pleadings and other papers on file in this action, and the statements of counsel and the parties. The Court now hereby finds that the motion should be GRANTED as to the Settlements with the Settling Defendants. NOW, THEREFORE, IT IS HEREBY ORDERED THAT: 1. The Court has jurisdiction over the subject matter of this litigation, including the actions within this litigation, and over the parties to the Settlement Agreements, including all members of the Settlement Class (also referred to herein as the “Class”) and the Settling Defendants. -

CASE 0:18-Cv-01776-JRT-HB Doc. 827-1 Filed 07/12/21 Page 1 of 25

CASE 0:18-cv-01776-JRT-HB Doc. 827-1 Filed 07/12/21 Page 1 of 25 EXHIBIT A CASE 0:18-cv-01776-JRT-HB Doc. 827-1 Filed 07/12/21 Page 2 of 25 In re Pork Antitrust Litigation (Direct Purchaser Action), Case No. 0:18-cv-01776-JRT-HB Exhibit A - Exclusion Report # Name 1 Postmark Date Assigned Claims 1 Harvest Donut & Bakery 4/4/2021 2 Eickhoff Enterprises, Inc. 4/7/2021 3Vogel's Party Store 4/5/2021 4 Northwestern Selecta, Inc. 4/8/2021 5 E & S Sales 4/9/2021 6 Plunkett's Pest Control 4/12/2021 7 Belstra Milling Company 4/15/2021 8 Cascade Meats, Inc 4/20/2021 8-1 Bruce Packing Company 4/20/2021 9 Cheney Bros., Inc. 4/22/2021 9-1 Bari Importing Corp 4/22/2021 9-2 Bari Italian Foods 4/22/2021 9-3 Cheney Brother, Inc.- Autofax 4/22/2021 9-4 Cheney Brothers 4/22/2021 9-5 Cheney Brothers Inc 4/22/2021 9-6 Cheney Brothers Inc N Carolina 4/22/2021 9-7 Cheney Brothers Inc. 4/22/2021 9-8 Cheney Brothers Inc. Ocala 4/22/2021 9-9 Cheney Brothers Inc. Riviera 4/22/2021 9-10 Cheney Brothers Punta Gorda 4/22/2021 9-11 Cheney Brothers, Inc. 4/22/2021 9-12 Cheney Brothers- Ocala 4/22/2021 9-13 Cheney Brothers- Punta Gord 4/22/2021 9-14 Cheney Brothers- Riviera BE 4/22/2021 9-15 Grand Western 4/22/2021 9-16 Grand Western Brands Inc 4/22/2021 9-17 Grand Western Brands, Inc. -

1 United States District Court in the Eastern District Of

Case 2:08-md-02002-GP Document 1036 Filed 08/15/14 Page 1 of 3 UNITED STATES DISTRICT COURT IN THE EASTERN DISTRICT OF PENNSYLVANIA IN RE: PROCESSED EGG PRODUCTS : ANTITRUST LITIGATION : MDL No. 2002 _______________________________________ : 08-md-02002 : THIS DOCUMENT APPLIES TO: : All Direct Purchaser Class Actions : PLAINTIFFS’ MOTION FOR FINAL APPROVAL OF THE CLASS ACTION SETTLEMENT BETWEEN PLAINTIFFS AND DEFENDANT CAL-MAINE FOODS, INC. Pursuant to Rule 23(e) of the Federal Rules of Civil Procedure, Plaintiffs move the Court for final approval of the settlement between the Direct Purchaser Class Plaintiffs (“Plaintiffs”) and Defendant Cal-Maine Foods, Inc. (“Cal-Maine”) on the terms and conditions set forth in the Settlement Agreement Between Plaintiffs and Cal-Maine (“Settlement” or “Settlement Agreement”), and to certify the Class for the purpose of Settlement pursuant to Federal Rules 23(a) and 23(b)(3). This Motion is based upon Plaintiffs’ Memorandum of Law, Declaration of James J. Pizzirusso, and Supplemental Affidavit of Jennifer M. Keough submitted herewith, and is made on the following grounds: 1. The Settlement is entitled to an initial presumption of fairness, because the settlement negotiations were undertaken at arm’s-length over a period spanning approximately a year and four months by experienced antitrust counsel who entered the negotiations with sufficient background in the facts of the case, and no members of the class have objected. See In re Cendant Corp. Litig., 264 F.3d 201, 232 n.18 (3d Cir. 2001) 2. The Settlement is fair, reasonable, and adequate, and the nine Girsh factors strongly support approval. -

2005 Form 10-K

QuickLinks -- Click here to rapidly navigate through this document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2005 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 04-6268599 (State or other jurisdiction (Commission File No.) (I.R.S. Employer of incorporation or organization) Identification No.) 115 West Washington Street, Suite 15 East Indianapolis, Indiana 46204 (Address of principal executive offices) (ZIP Code) (317) 636-1600 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12 (b) of the Act: Name of each exchange Title of each class on which registered Common stock, $0.0001 par value New York Stock Exchange 8.75% Series F Cumulative Redeemable Preferred Stock, $.0001 par value New York Stock Exchange 7.89% Series G Cumulative Step-Up Premium Rate Preferred Stock, $.0001 par value New York Stock Exchange 6% Series I Convertible Perpetual Preferred Stock, $.0001 par value New York Stock Exchange 3 8 /8% Series J Cumulative Redeemable Preferred Stock, $.0001 par value New York Stock Exchange Securities registered pursuant to Section 12 (g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). YES NO o Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.