ISG Providerlens™ Quadrant Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Microsoft Partner of the Year Award Winners and Finalists

2021 Microsoft Partner of the Year Award Winners and Finalists The Microsoft Partner of the Year Awards acknowledge outstanding achievements and innovations from across our global partner ecosystem. This impressive group of partners and their solutions demonstrates amazing agility and creativity in building new technologies across the intelligent cloud to edge, all with the goal of exceeding customer expectations by bringing technology to life in meaningful ways. This year’s group of winners and finalists is an inspiring reflection of the impact our partner ecosystem enables through the innovative technologies they continue to build for our mutual customers. Across categories including Azure, Modern Work & Security, and Social Impact, our partners are dedicated to helping customers solve challenges and truly work to support our mission to empower every person and every organization on the planet to achieve more. Congratulations to this year’s winners and finalists, which have shown exceptional expertise, dedication to our customers, and care for our world through a year of change. Table of contents Partner of the Year Awards: Category Winners • Azure • Business Applications • Modern Work & Security • Industry • Social Impact • Business Excellence Category Finalists Country/Region Winners 2021 Microsoft Partner of the Year Award Winners – Category Azure 2021 Microsoft Partner of the Year Award Winners – Category 2021 Microsoft Partner of the Year Award Winners – Category Azure AI Icertis United States www.icertis.com Icertis’ strategic bet with Microsoft on Azure AI is delivering strong customer success and leadership positioning in the contract lifecycle management market. Hundreds of customers have been empowered through over 10 million contracts valued at more than $1 trillion, and in 40+ languages across 90+ countries. -

Financial Review 2020 TIETOEVRY 2020 GOVERNANCE and REMUNERATION FINANCIALS

Financial Review 2020 TIETOEVRY 2020 GOVERNANCE AND REMUNERATION FINANCIALS Table of contents TietoEVRY 2020 3 Governance 7 Financials 33 CEO review 4 Corporate Governance Report by the Board of Statement 8 Directors 34 Annual General Meeting 9 Consolidated financial Shareholders' statements 77 Nomination Board 10 Parent company's The Board of Directors 12 financial statements 143 The President and CEO Dividend proposals, signatures and operative management 18 for the Board of Directors' report and Financial Internal control and risk Statement and Auditor's note 157 management 21 Auditor's report 158 Related-party transactions 24 Insider administration 25 Auditors 26 Remuneration Remuneration report 27 FINANCIAL REVIEW 2020 2 TIETOEVRY 2020 GOVERNANCE AND REMUNERATION FINANCIALS TietoEVRY 2020 CEO review 4 FINANCIAL REVIEW 2020 3 TIETOEVRY 2020 GOVERNANCE AND REMUNERATION FINANCIALS CEO REVIEW 2020: The year of integration - building a foundation for the future 2020 will stand out as one of the most unusual years ever. Extraordinary circumstances brought by the global pandemic led us to reassess our values and priorities on both an individual and organizational level. Employee safety and the continuity of customers’ operations have been the leading themes for us at TietoEVRY during a time when some 96% of our 24 000 employees globally have worked remotely. Simultaneously, we have been taking the first steps on our journey as a strong integrated company, aiming to create digital advantage for businesses and societies. Progress impacted by our digital platforms and core processes, as integration and Covid-19 well as started to build a unified company We started the operational and cultural culture and renewed identity. -

2018 Performance Related Share Grant

October 3, 2018 Grant of performance shares to Corporate executive officers The Board of Directors of Capgemini SE, upon recommendation of the Compensation Committee, has decided during its meeting on October 3, 2018, to grant a total of 1 384 530 performance shares of the company Capgemini SE to employees and corporate officers of the Company and its French and foreign subsidiaries. Out of this total, reduced versus last year due to the share price evolution, 61 000 performance shares have been granted to Mr. Paul Hermelin, Chairman and CEO, and to Messrs. Thierry Delaporte and Aiman Ezzat, Chief Operating Officers, as follows: Board of Directors decision on As a reminder 03.10.2018 2018 % of the total 2017 % of the (total number of authorized (total number of shares total shares granted) amount * granted) authorized amount Mr. P. Hermelin 28 000 35,000 2.07% Chairman and CEO Mr. T. Delaporte 16 500 3,62% n/a n/a Chief Operating Officer Mr. A. Ezzat 16 500 n/a n/a Chief Operating Officer * Ceiling of 10% of the maximum allocation authorized by the Shareholders' Meeting of May 23, 2018 (23rd resolution) for the total allocation to Corporate executive officers For each of the Corporate executive officers, the final vesting of the shares, after a three-years acquisition period, is subject to the completion of the following performance conditions: • A market performance condition (35%) based on the comparative performance of the Capgemini SE share against the average performance of a basket of eight comparable companies in the same business -

2014 Registration Document Annual Financial Report Contents

2014 REGISTRATION DOCUMENT ANNUAL FINANCIAL REPORT CONTENTS 1 4 Presentation of the Company Financial Information 129 and its activities 5 4.1 Analysis on Capgemini 2014 Group consolidated 1.1 Milestones in the Group’s history and its values 6 results AFR 130 1.2 The Group’s activities 8 4.2 Consolidated accounts AFR 136 1.3 Main Group subsidiaries and simplified 4.3 Comments on the Cap Gemini S.A. Financial organization chart 13 Statements AFR 195 1.4 The market and the competitive environment 15 4.4 Cap Gemini S.A. financial statements AFR 197 1.5 2014, a year of strong growth 17 4.5 Other financial and accounting information AFR 221 1.6 The Group’s investment policy, financing policy and market risks AFR 25 1.7 Risk analysis AFR 26 5 CAP GEMINI and its shareholders 223 2 5.1 Cap Gemini S.A. Share Capital AFR 224 5.2 Cap Gemini S.A. and the stock market 229 Corporate governance 5.3 Current ownership structure 233 and Internal control 33 5.4 Share buyback program AFR 235 2.1 Organization and activities of the Board of Directors AFR 35 6 2.2 General organization of the Group AFR 54 2.3 Compensation of executive corporate officers AFR 58 2.4 Internal control and risk management Report of the Board of Directors procedures AFR 70 and draft resolutions 2.5 Statutory Auditors’ report prepared in accordance with Article L.225-235 of the French Commercial of the Combined Shareholders’ Code on the report prepared by the Chairman Meeting of May 6, 2015 237 of the Board of Directors AFR 79 6.1 Resolutions presented at the Ordinary Shareholders’ -

Joining Forces for Digital Advantage Table of Contents

Financial Review 2019 Joining forces for digital advantage Table of contents TIETOEVRY 2019 3 GOVERNANCE 7 FINANCIALS 37 CEO statement 4 Corporate Governance Report by the Board of Statement 8 Directors 39 Annual General Meeting 10 Calculation of Key Figures 70 Shareholders' Nomination Consolidated Financial Board 10 Statement 72 The Board of Directors 12 Parent company's Financial Statement 145 The President and CEO and operative management 18 Dividend proposal, signatures for the Board of Directors' Internal control and risk report and Financial Statement 21 management and Auditor's note 161 24 Major risks Auditor's report 162 27 Related-party transactions Information for shareholders 168 Insider administration 28 Auditors 28 Remuneration statement 29 Letter from the Chairman of the Remuneration Committee 36 Annual report 2019 2 Tieto and EVRY 2019 Governance Financials TietoEVRY 2019 The non-financial disclosures in the annual report 2019 covers only Tieto. Financial reporting for 2019 covers TietoEVRY with EVRY consolidated as from 5 December. CEO statement 4 Annual report 2019 3 Tieto and EVRY 2019 Governance Financials CEO STATEMENT An exceptional year of transformation and exciting new opportunities 2019 was a historic year for Tieto. We joined forces with EVRY, the Norway- based consulting and technology company, to create TietoEVRY, a leading Nordic digital services and software company and the largest community for business and technology professionals. Together, we will accelerate digitalization and create digital advantage for our customers and society as a whole. 2019 was an extraordinary year for us at increased agility and collaboration. This Tieto. We started the year by taking the enables us to serve our customers with next big leap in the company renewal to the best possible solutions that integrate enhance the competitiveness of customers our expertise, software and services. -

Carbon Footprint & Energy Transition Report

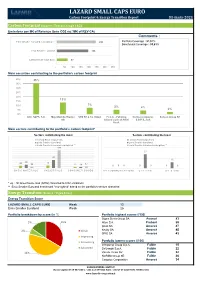

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

AGM 2020 Notice

Notice to the Annual General Meeting of TietoEVRY Corporation TietoEVRY Corporation STOCK EXCHANGE RELEASE 8 April 2020 8.00 am EEST Notice is hereby given to the shareholders of TietoEVRY Corporation to the Annual General Meeting to be held on 29 April 2020 at 4.00 p.m. EET at TietoEVRY’s premises, address Keilalahdentie 2-4, 02150 Espoo, Finland. TietoEVRY takes the coronavirus pandemic very seriously and will impose several precautionary measures to be able to hold the Annual General Meeting and to ensure the safety of the persons who have to be present at the meeting. The Annual General Meeting can be held only if the number of shareholders attending the meeting can be kept limited and the Finnish authorities’ instructions be fulfilled. Due to the coronavirus pandemic and risk of spreading the virus, TietoEVRY strongly encourages all shareholders to follow the Annual General Meeting this year through a live webcast and exercise their voting rights by using the proxy service provided by the company instead of attending the meeting in person. Further information on these measures is available in section C of this notice below and at www.tietoevry.com/agm. The reception of persons who have registered for the meeting and the distribution of voting tickets will commence at 3.30 pm EEST. A. Matters on the agenda of the Annual General Meeting At the Annual General Meeting, the following matters will be considered: 1. Opening of the meeting 2. Calling the meeting to order 3. Election of persons to scrutinize the minutes and to supervise the counting of votes 4. -

Proposals of the Board of Directors of Tieto Corporation to the Annual General Meeting to Be Held on 21 March 2019

Proposals of the Board of Directors of Tieto Corporation to the Annual General Meeting to be held on 21 March 2019 Tieto Corporation STOCK EXCHANGE RELEASE 6 February 2019 9.00 a.m. EET Payment of dividend The Board of Directors proposes to the Annual General Meeting that, for the financial year that ended on 31 December 2018, a dividend of EUR 1.25 per share and an additional dividend of EUR 0.20 be paid from the distributable profits of the company. The dividend shall be paid to shareholders who on the record date for the dividend payment on 25 March 2019 are recorded in the shareholders’ register held by Euroclear Finland Oy or the register of Euroclear Sweden AB. The dividend shall be paid as from 9 April 2019. Remuneration of the auditor The Board of Directors proposes to the Annual General Meeting, in accordance with the recommendation of the Audit and Risk Committee of the Board of Directors, that the auditor to be elected at the Annual General Meeting be reimbursed according to the auditor's invoice and in compliance with the purchase principles approved by the Committee. Election of the auditor The Board of Directors proposes to the Annual General Meeting, in accordance with the recommendation of the Audit and Risk Committee of the Board of Directors, that the firm of authorized public accountants Deloitte Oy be elected as the company's auditor for the financial year 2019. The firm of authorized public accountants Deloitte Oy has notified that APA Jukka Vattulainen will act as the auditor with principal responsibility. -

Tech Procurement in the UK Justice Sector

Tech Procurement in the UK Justice Sector December 2020 Trusted Insight on Government Contracts and Spend Trusted by suppliers, the public sector, and the media — Corporate Government Media 550+ Press citations since Jan 2019 “Serious-minded business data provider Tussell” Matthew Vincent 22nd September 2018 2 | Trends and Opportunities in the Justice Sector We transform open data into useful data – so you don’t have to — Open data Third party data Useful data Use cases CONTRACT DATA Public Sector Aggregate Get better value from TED (EU) suppliers Companies House Contracts Finder (UK), Sell2Wales, PCS Match Digital Marketplace Suppliers Normalise Win government Circa 70 local portals contracts Cleanse SPEND DATA Moody’s Analytics 6800+ Central Gov’t, Press Local Gov’t & NHS Machine Scrutinise public bodies learn spending 3 | Trends and Opportunities in the Justice Sector Total data coverage: Justice — Spend Contracts Q1 2016 – Q2 2020 Q1 2015 – Q3 2020 864,000 invoices 7,000 contracts £28bn spend value £17bn contract value 43 buyers 100 buyers 31,000 suppliers 2,600 suppliers 4 | Trends and Opportunities in the Justice Sector Questions Tussell will answer — 1. How big is the market? 2. What’s the breakdown by sub-sector? 3. Can new entrants break through? 4. Has demand recovered from Covid? 5. How can I position my firm for future rebids? 5 | Procurement in the UK EdTech market Technology spend in the justice sector in the five years from 2016-2020 was £3bn in total, an average of £597m per annum Spend data £728M £710M Average: £597M £578M -

The ALM Vanguard: Strategic Risk Management Consulting2019

Source: ALM Intelligence's Strategic Risk Management Consulting (c) 2019; used by licensing permissions Buyer Ratings Guide The ALM Vanguard: Strategic Risk Management Consulting 2019 March 2019 Source: ALM Intelligence's Strategic Risk Management Consulting (c) 2019; used by licensing permissions Buyer Ratings Guide Contents Overview 3 ALM Vanguard of Strategic Risk Management Consulting Providers 5 Competitive Landscape 6 Provider Capability Rankings 7 Rating Level Summaries 8 Leader Assessments 9 Provider Capability Ratings 10 Best in Class Providers 11 Provider Briefs 12 Definitions 20 Methodology 22 About ALM Intelligence 24 Author Naima Hoque Essing Senior Research Analyst, Management Consulting Research T +1 212-457-9174 [email protected] For more information, visit the ALM Intelligence website at www.alm.com/intelligence/industries-we-serve/consulting-industry/ © 2019 ALM Media Properties, LLC 2 Source: ALM Intelligence's Strategic Risk Management Consulting (c) 2019; used by licensing permissions Buyer Ratings Guide Overview Capability Drivers Risk is finally making it onto the formal agenda of boards and senior leadership. With the risk environment more complex than ever and with the frequency and impact of disruption rising due to the confluence of changing geopolitical trends, technology disruption and rising stakeholder expectations, boards are looking for better ways to stay abreast of change or to get ahead of it. At the same time, while many companies have invested in basic internal risk controls, they are still blindsided by risk. These trends are creating tension among companies for the need to do something. Boards are increasingly questioning consultants on how to incorporate risk into the strategic agenda and make risk management more relevant and connected to the actual needs of the business in making decisive, bigger and faster bets on the future. -

Everest Group PEAK Matrix™ for Devops Service Providers 2019

® Everest Group PEAK Matrix™ for DevOps Service Providers 2019 Focus on Capgemini September 2019 ® ™ Copyright © 2019 Everest Global, Inc. This document has been licensed for exclusive use and distribution by Capgemini EGR-2019-32-E-3316 Introduction and scope Everest Group recently released its report titled “DevOps Services PEAK Matrix™ Assessment and Market Trends 2019 – Siloed DevOps is No DevOps! ” This report analyzes the changing dynamics of the DevOps services landscape and assesses service providers across several key dimensions. As a part of this report, Everest Group updated its classification of 20 service providers on the Everest Group PEAK Matrix™ for DevOps services into Leaders, Major Contenders, and Aspirants. The PEAK Matrix is a framework that provides an objective, data-driven, and comparative assessment of DevOps service providers based on their absolute market success and delivery capability. Based on the analysis, Capgemini emerged as a Leader. This document focuses on Capgemini’s DevOps services experience and capabilities and includes: ⚫ Capgemini’s position on the DevOps PEAK Matrix ⚫ Detailed DevOps services profile of Capgemini Buyers can use the PEAK Matrix to identify and evaluate different service providers. It helps them understand the service providers’ relative strengths and gaps. However, it is also important to note that while the PEAK Matrix is a useful starting point, the results from the assessment may not be directly prescriptive for each buyer. Buyers will have to consider their unique situation and requirements, and match them against service provider capability for an ideal fit. Source: Everest Group (2019) unless cited otherwise ® Copyright © 2019, Everest Global, Inc. -

Annual & Sustainability Report

Smart solutions out of fibers Annual2020 & Sustainability Report 1 / ANNUAL & SUSTAINABILITY REPORT 2020 Contents YEAR IN BRIEF ........................................................................3 Abrasive ................................................................................52 THE FINANCIAL YEAR 2020........................................96 CSR DATA ..............................................................................184 Highlights of 2020 ................................................................4 Medical ..................................................................................53 Board of Directors’ report ...........................................97 Reporting principles ..................................................... 185 CEO word ....................................................................................5 Liquid Technologies ........................................................54 Key figures .............................................................................112 GRI content index ............................................................ 193 Beverage & Casing ..........................................................55 Consolidated financial statements, IFRS ........ 118 UN Global Compact........................................................ 198 THE COMPANY .......................................................................7 Tape .........................................................................................56 Income statement ..........................................................