FTSE Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How to Sell Your House Online Online Sites Offer Virtually All the Services Of

How to sell your house online Online sites offer virtually all the services of a traditional estate agent – and their fees can be thousands of pounds lower Sunday 7 July 2013 Online seller Ron Houston: 'They did everything I would expect from a traditional estate agent, with the exception that I had to conduct viewings myself, but I actually enjoyed that side of it.' Photograph: Antonio Olmos for the Observer As the housing market gathers momentum, one group of people hoping to rake in the cash will be estate agents. But a growing number of house sellers are shunning the traditional approach and marketing their properties online, saving thousands of pounds in the process. While high-street estate agents charge between 1.5% and 2% of the sale price, or up to a whopping £6,000 on a £300,000 property, online rivals offer a flat fee of between £250 and £1,000. This breed of private-sale sites and low-cost online agents now accounts for around 5% of completed sales, according to the Royal Institute of Chartered Surveyors. The biggest sites all report a rising number of property listings and sales, and the ability to save sellers a chunk of cash, as the sites do not need to fund a chain of offices and company cars. For example, eMoov, which sold 520 properties worth a combined £170m in 2012, has 850 properties for sale, says founder Russell Quirk. "We will sell your property for a flat fee of £395 plus VAT," he says, adding that eMoov saved its average customer £3,846 last year. -

Rightmove Plc, Winterhill (RMV:LN)

Rightmove Plc, Winterhill (RMV:LN) Real Estate/Real Estate Services Price: 737.40 GBX Report Date: September 22, 2021 Business Description and Key Statistics Rightmove operates as an online property portal. Co.'s segments Current YTY % Chg include The Agency, which includes resale and lettings property advertising services provided on Co.'s platforms and tenant Revenue LFY (M) 289 8.0 referencing and insurance products sold by Van Mildert Landlord EPS Diluted LFY 0.19 10.2 and Tenant Protection Limited; and The New Homes, which provides property advertising services to new home developers Market Value (M) 6,453 and housing associations on Co.'s platforms. Co.'s customers are primarily estate agents, lettings agents and new homes developers Shares Outstanding LFY (000) 875,062 advertising properties for sale and to rent in the United Kingdom. Book Value Per Share 0.05 EBITDA Margin % 75.10 Net Margin % 60.8 Website: www.rightmove.co.uk Long-Term Debt / Capital % 20.3 ICB Industry: Real Estate Dividends and Yield TTM 0.04 - 0.61% ICB Subsector: Real Estate Services Payout Ratio TTM % 34.9 Address: 2 Caldecotte Lake;Business Park;Caldecotte Lake Drive 60-Day Average Volume (000) 1,679 Milton Keynes 52-Week High & Low 746.80 - 555.80 GBR Employees: 538 Price / 52-Week High & Low 0.99 - 1.33 Price, Moving Averages & Volume 756.4 756.4 Rightmove Plc, Winterhill is currently trading at 737.40 which is 4.4% above its 50 day 730.1 730.1 moving average price of 706.13 and 15.3% above its 703.8 703.8 200 day moving average price of 639.56. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

FT UK 500 2011 A-Z Company UK Rank 2011 3I Group 94 888 Holdings 485 Abcam 250 Aberdeen Asset Management 109 Admiral Group 72 A

FT UK 500 2011 A-Z UK rank Company 2011 3I Group 94 888 Holdings 485 Abcam 250 Aberdeen Asset Management 109 Admiral Group 72 Advanced Medical Solutions 488 Aegis Group 127 Afren 138 African Barrick Gold 118 African Minerals 131 Aggreko 69 Albemarle & Bond 460 Allied Gold 306 Amec 75 Amerisur Resources 426 Amlin 124 Anglo American 11 Anglo Pacific Group 327 Anglo-Eastern Plantations 370 Anite 445 Antofagasta 29 Aquarius Platinum 136 Archipelago Resources 346 Arm Holdings 42 Ashley (Laura) 476 Ashmore 112 Ashtead Group 206 Asian Citrus 263 Asos 171 Associated British Foods 41 Assura 449 Astrazeneca 12 Atkins (WS) 240 Aurelian Oil & Gas 334 Autonomy 76 Avanti Communications 324 Aveva 192 Avis Europe 326 Aviva 31 Avocet Mining 287 Axis-Shield 469 AZ Electronic Materials 199 Babcock International 117 Bae Systems 35 Bahamas Petroleum 397 Balfour Beatty 111 Barclays 16 Barr (AG) 289 Barratt Developments 197 BBA Aviation 209 Beazley 257 Bellway 216 Bellzone Mining 292 Berendsen 222 Berkeley 160 Betfair Group 202 BG Group 8 BHP Billiton 7 Big Yellow Group 308 Blinkx 344 Bodycote 259 Booker 213 Boot (Henry) 478 Borders & Southern Petroleum 378 Bovis Homes Group 268 Bowleven 220 BP 4 Brammer 351 Brewin Dolphin 319 British American Tobacco 9 British Land 61 British Sky Broadcasting 27 Britvic 210 Brown (N) 237 BT Group 28 BTG 235 Bunzl 107 Burberry 59 Bwin Party Digital Entertainment 223 Cable & Wireless Communications 181 Cable & Wireless Worldwide 158 Cairn Energy 49 Caledon Resources 380 Camellia 389 Cape 270 Capita 66 Capital & Counties Properties -

COVERAGE LIST GEO Group, Inc

UNITED STATES: REIT/REOC cont’d. UNITED STATES: REIT/REOC cont’d. UNITED STATES: NON-TRADED REITS cont’d. COVERAGE LIST GEO Group, Inc. GEO Sabra Health Care REIT, Inc. SBRA KBS Strategic Opportunity REIT, Inc. Getty Realty Corp. GTY Saul Centers, Inc. BFS Landmark Apartment Trust, Inc. Gladstone Commercial Corporation GOOD Select Income REIT SIR Lightstone Value Plus Real Estate Investment Trust II, Inc. Gladstone Land Corporation LAND Senior Housing Properties Trust SNH Lightstone Value Plus Real Estate Investment Trust III, Inc. WINTER 2015/2016 • DEVELOPED & EMERGING MARKETS Global Healthcare REIT, Inc. GBCS Seritage Growth Properties SRG Lightstone Value Plus Real Estate Investment Trust, Inc. Global Net Lease, Inc. GNL Silver Bay Realty Trust Corp. SBY Moody National REIT I, Inc. Government Properties Income Trust GOV Simon Property Group, Inc. SPG Moody National REIT II, Inc. EUROPE | AFRICA | ASIA-PACIFIC | MIDDLE EAST | SOUTH AMERICA | NORTH AMERICA Gramercy Property Trust Inc. GPT SL Green Realty Corp. SLG MVP REIT, Inc. Gyrodyne, LLC GYRO SoTHERLY Hotels Inc. SOHO NetREIT, Inc. HCP, Inc. HCP Sovran Self Storage, Inc. SSS NorthStar Healthcare Income, Inc. UNITED KINGDOM cont’d. Healthcare Realty Trust Incorporated HR Spirit Realty Capital, Inc. SRC O’Donnell Strategic Industrial REIT, Inc. EUROPE Healthcare Trust of America, Inc. HTA St. Joe Company JOE Phillips Edison Grocery Center REIT I, Inc. GREECE: Athens Stock Exchange (ATH) AFI Development Plc AFRB Hersha Hospitality Trust HT STAG Industrial, Inc. STAG Phillips Edison Grocery Center REIT II, Inc. AUSTRIA: Vienna Stock Exchange (WBO) Babis Vovos International Construction S.A. VOVOS Alpha Pyrenees Trust Limited ALPH Highwoods Properties, Inc. -

Marten & Co / Quoted Data Word Template

Monthly roundup | Real estate August 2020 Kindly sponsored by Aberdeen Standard Investments Winners and losers in July Best performing companies in price terms in July Worst performing companies in price terms in July (%) (%) AEW UK REIT 18.9 Hammerson (20.0) UK Commercial Property REIT 14.9 Countryside Properties (14.4) Schroder REIT 14.5 U and I Group (14.0) Empiric Student Property 11.4 Real Estate Investors (13.4) Palace Capital 10.6 Tritax EuroBox (11.8) LondonMetric Property 9.7 St Modwen Properties (10.9) Triple Point Social Housing REIT 9.2 Drum Income Plus REIT (10.0) RDI REIT 8.5 Alternative Income REIT (8.4) SEGRO 8.3 Panther Securities (8.2) CLS Holdings 5.5 BMO Commercial Property Trust (7.1) Source: Bloomberg, Marten & Co Source: Bloomberg, Marten & Co. AEW UK REIT share price YTD A number of REITs Hammerson share price YTD Retail landlord and property Hammerson continued 110 companies saw big 300 to see its share price 95 255 share price gains 210 fall during July and has 80 over the month of 165 now lost 79.2% of its 120 65 July as covid-19 value in the year to 75 50 restrictions started to 30 date – the worst in the Dec Jan Feb Mar Apr May Jun Jul ease across the UK Dec Jan Feb Mar Apr May Jun Jul real estate sector. The Source: Bloomberg, Marten & Co and greater Source: Bloomberg, Marten & Co company, which owns economic stimulus shopping centres, retail was revealed. The biggest mover was AEW UK REIT. -

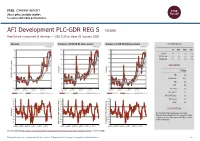

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 30 January 2020 AFI Development PLC-GDR REG S TICKER Real Estate Investment & Services — USD 0.36 at close 30 January 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 30-Jan-2020 30-Jan-2020 30-Jan-2020 0.4 150 160 1D WTD MTD YTD Absolute -1.6 -5.3 -6.3 -6.3 140 150 Rel.Sector -1.4 -3.8 -5.7 -5.7 0.35 140 Rel.Market -0.4 -2.8 -4.2 -4.2 130 130 120 0.3 VALUATION 120 110 110 Trailing RelativePrice 0.25 RelativePrice 100 100 PE 6.3 Absolute(localPrice currency) 90 EV/EBITDA 11.6 90 0.2 PB 0.2 80 80 PCF 5.8 0.15 70 70 Div Yield 0.0 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Price/Sales 1.2 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.7 100 100 100 Div Payout 0.0 90 90 90 ROE 4.1 80 80 80 70 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 The Company's main activities are real estate 40 40 40 RSI RSI (Absolute) development and investment. -

November 2020

November 2020 Monthly roundup | Real estate Kindly sponsored by Aberdeen Standard Investments Winners and losers in October Best performing funds in price terms Worst performing funds in price terms (%) (%) NewRiver REIT 28.7 Panther Securities (28.6) Schroder European REIT 27.4 Raven Property Group (20.3) Helical 15.1 Grit Real Estate Income Group (11.5) Workspace Group 14.6 Empiric Student Property (11.5) Standard Life Inv. Property Income 14.1 Ground Rents Income Fund (10.2) Alternative Income REIT 12.2 Secure Income REIT (9.4) CEIBA Investments 9.3 PRS REIT (9.3) BMO Real Estate Investments 7.8 GCP Student Living (9.2) Inland Homes 6.8 Sigma Capital Group (7.8) Real Estate Investors 6.3 Alpha Real Trust (7.2) Source: Bloomberg, Marten & Co Source: Bloomberg, Marten & Co kjjjj October finished with the threat of a second lockdown The heaviest share price faller in October – Panther looming over the UK as COVID-19 cases continued to rise. Securities – is very illiquid so its share price can be However, this did not dampen demand for shares in some distorted with one big transaction. Of the rest, Grit Real of the companies that have already been battered during Estate Income saw a double-digit fall in its share price after the pandemic, even before news of a potential vaccine reporting a big drop in NAV. Student accommodation breakthrough broke in early November. Successful sales specialists Empiric Student Property and GCP Student of retail assets by NewRiver REIT saw its share price Living both continue to be impacted by COVID-19, with bounce 28.7% in the month to top the table. -

Schroder UK Mid Cap Fund Plc Unaudited Portfolio Holdings at 31St July 2020

Schroder UK Mid Cap Fund plc Unaudited portfolio holdings at 31st July 2020 The investments listed below have been valued on a fair value basis using closing bid prices. Market Nominal value Investment SEDOL ISIN holding £ 4Imprint Group Ord GBP0.385 664097 GB0006640972 105,000 2,493,750 A G Barr Ord GBP0.04167 B6XZKY7 GB00B6XZKY75 700,000 2,999,500 Anglo Pacific Group Ord GBP0.02 644936 GB0006449366 2,050,000 2,423,100 Bodycote PLC Ord GBP0.173 B3FLWH9 GB00B3FLWH99 800,000 4,504,000 Brewin Dolphin Ord GBP0.01 176581 GB0001765816 1,610,000 4,218,200 Cairn Energy Ord GBP0.0136686 B74CDH8 GB00B74CDH82 2,300,000 2,748,500 Capita Plc B23K0M2 GB00B23K0M20 2,700,000 924,210 CLS Holdings Plc Ord GBP0.025 BF04459 GB00BF044593 1,749,950 3,415,902 Computacenter Plc Ord 0.075555 BV9FP30 GB00BV9FP302 300,000 5,943,000 Cranswick Ord GBP0.10 231888 GB0002318888 114,000 4,078,920 Crest Nicholson Holdings Ltd Ord GBP0.05 B8VZXT9 GB00B8VZXT93 800,000 1,496,000 Dechra Pharmaceuticals Ord GBP0.01 963318 GB0009633180 143,310 4,087,201 Diploma Ord GBP0.05 182663 GB0001826634 320,000 5,801,600 Dunelm Group GBP.01 B1CKQ73 GB00B1CKQ739 790,000 9,709,100 Fisher (James) Ord GBP0.25 339500 GB0003395000 266,000 3,037,720 Future PLC Ord GBP0.15 BYZN904 GB00BYZN9041 212,000 2,925,600 Games Workshop Ord GBP0.05 371847 GB0003718474 80,000 7,024,000 Gamesys Group Plc Ord NPV BZ14BX5 GB00BZ14BX56 132,072 1,226,949 Genus Ord GBP0.10 207458 GB0002074580 80,000 2,716,800 Grafton Group New Units B00MZ44 IE00B00MZ448 530,000 3,407,900 Grainger Ord GBP0.05 B04V127 GB00B04V1276 -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Housing Market Overview

Housing market overview Produced 05 September 2019 This document provides the latest information available from various sources, with dates varying from June - August 2019 Contents Market overview 3 Summary of published price indices 4 UK annual house prices – rate of change 5 Regional all-dwellings annual house price – 12-month % change 6 UK house-price rates of change: types of buyer 7 UK house-price rates of change: type of dwelling 8 Number of housing transactions per month 9 Monthly asking-price trend 10 Home asking-price trend (England & Wales) 11 Average-time-on-market indicator (National) 12 Asking-price fluctuation percentage 13 UK sales volumes by funding status 14 UK house-price-to-earnings ratio 15 Average properties for sale per estate agent 16 2 Market overview All but three of our available sources are reporting month-on-month increases in house prices in the range of 0.2% to 0.7%. Nationwide show zero change and home.co.uk and Rightmove report decreases of 0.1% and 1.0% respectively. All of our sources are reporting annual increases. The number of new UK homes registered to be built in July fell 9% year-on-year, according to the latest figures from NHBC. They say during the month, 14,262 new homes were registered. Of these, 10,398 were for the private sector, down 12% against July 2018. Meanwhile, registrations in the affordable and rental sector were marginally up, from 3,842 in 2018 to 3,864. Barratt Developments has seen another strong year, they said on 4th September, achieving their highest number of completions in 11 years and “record” pre-tax profit. -

CLS Holdings Plc Annual Report and Accounts 2020

CLS Holdings plc Annual Report and Accounts 2020 Well placed for the future Our business CLS is a London-based FTSE 250 office investment Through our business model, we seek to be company with a £2.2 billion portfolio of 97 properties a responsible business by employing sustainable comprising 6.4m sq. ft (over 597,000 sqm) in the long-term thinking with the environment in mind. UK, Germany and France. We provide workspaces As well as benefiting our own business and shareholders, for over 740 tenants including leading blue-chip this supports other key stakeholders like our tenants companies and government bodies. in their efforts to reduce their environmental impacts and achieve their sustainability objectives. We actively manage our portfolio with in-house teams across all functions of the business. This allows us to engage with our tenants to build long-term relationships and develop a detailed understanding of their needs. It also allows us to embed sustainable behaviours throughout the business which support and drive our progress towards our commitments. Who we are and what we believe Statutory and alternative performance measures Throughout the strategic report we use a range of financial and non-financial measures to assess our performance. The majority of those are European Public Real Estate Association (EPRA) measures. EPRA is a recognised body in the property industry which is involved in the formulation of accounting metrics and sustainability reporting, which give the European listed real estate sector greater transparency and consistency. These standards also provide visibility and comparability to industry stakeholders in addition to being appreciated by the investment community.