Housing Market Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How to Sell Your House Online Online Sites Offer Virtually All the Services Of

How to sell your house online Online sites offer virtually all the services of a traditional estate agent – and their fees can be thousands of pounds lower Sunday 7 July 2013 Online seller Ron Houston: 'They did everything I would expect from a traditional estate agent, with the exception that I had to conduct viewings myself, but I actually enjoyed that side of it.' Photograph: Antonio Olmos for the Observer As the housing market gathers momentum, one group of people hoping to rake in the cash will be estate agents. But a growing number of house sellers are shunning the traditional approach and marketing their properties online, saving thousands of pounds in the process. While high-street estate agents charge between 1.5% and 2% of the sale price, or up to a whopping £6,000 on a £300,000 property, online rivals offer a flat fee of between £250 and £1,000. This breed of private-sale sites and low-cost online agents now accounts for around 5% of completed sales, according to the Royal Institute of Chartered Surveyors. The biggest sites all report a rising number of property listings and sales, and the ability to save sellers a chunk of cash, as the sites do not need to fund a chain of offices and company cars. For example, eMoov, which sold 520 properties worth a combined £170m in 2012, has 850 properties for sale, says founder Russell Quirk. "We will sell your property for a flat fee of £395 plus VAT," he says, adding that eMoov saved its average customer £3,846 last year. -

Rightmove Plc, Winterhill (RMV:LN)

Rightmove Plc, Winterhill (RMV:LN) Real Estate/Real Estate Services Price: 737.40 GBX Report Date: September 22, 2021 Business Description and Key Statistics Rightmove operates as an online property portal. Co.'s segments Current YTY % Chg include The Agency, which includes resale and lettings property advertising services provided on Co.'s platforms and tenant Revenue LFY (M) 289 8.0 referencing and insurance products sold by Van Mildert Landlord EPS Diluted LFY 0.19 10.2 and Tenant Protection Limited; and The New Homes, which provides property advertising services to new home developers Market Value (M) 6,453 and housing associations on Co.'s platforms. Co.'s customers are primarily estate agents, lettings agents and new homes developers Shares Outstanding LFY (000) 875,062 advertising properties for sale and to rent in the United Kingdom. Book Value Per Share 0.05 EBITDA Margin % 75.10 Net Margin % 60.8 Website: www.rightmove.co.uk Long-Term Debt / Capital % 20.3 ICB Industry: Real Estate Dividends and Yield TTM 0.04 - 0.61% ICB Subsector: Real Estate Services Payout Ratio TTM % 34.9 Address: 2 Caldecotte Lake;Business Park;Caldecotte Lake Drive 60-Day Average Volume (000) 1,679 Milton Keynes 52-Week High & Low 746.80 - 555.80 GBR Employees: 538 Price / 52-Week High & Low 0.99 - 1.33 Price, Moving Averages & Volume 756.4 756.4 Rightmove Plc, Winterhill is currently trading at 737.40 which is 4.4% above its 50 day 730.1 730.1 moving average price of 706.13 and 15.3% above its 703.8 703.8 200 day moving average price of 639.56. -

FT UK 500 2011 A-Z Company UK Rank 2011 3I Group 94 888 Holdings 485 Abcam 250 Aberdeen Asset Management 109 Admiral Group 72 A

FT UK 500 2011 A-Z UK rank Company 2011 3I Group 94 888 Holdings 485 Abcam 250 Aberdeen Asset Management 109 Admiral Group 72 Advanced Medical Solutions 488 Aegis Group 127 Afren 138 African Barrick Gold 118 African Minerals 131 Aggreko 69 Albemarle & Bond 460 Allied Gold 306 Amec 75 Amerisur Resources 426 Amlin 124 Anglo American 11 Anglo Pacific Group 327 Anglo-Eastern Plantations 370 Anite 445 Antofagasta 29 Aquarius Platinum 136 Archipelago Resources 346 Arm Holdings 42 Ashley (Laura) 476 Ashmore 112 Ashtead Group 206 Asian Citrus 263 Asos 171 Associated British Foods 41 Assura 449 Astrazeneca 12 Atkins (WS) 240 Aurelian Oil & Gas 334 Autonomy 76 Avanti Communications 324 Aveva 192 Avis Europe 326 Aviva 31 Avocet Mining 287 Axis-Shield 469 AZ Electronic Materials 199 Babcock International 117 Bae Systems 35 Bahamas Petroleum 397 Balfour Beatty 111 Barclays 16 Barr (AG) 289 Barratt Developments 197 BBA Aviation 209 Beazley 257 Bellway 216 Bellzone Mining 292 Berendsen 222 Berkeley 160 Betfair Group 202 BG Group 8 BHP Billiton 7 Big Yellow Group 308 Blinkx 344 Bodycote 259 Booker 213 Boot (Henry) 478 Borders & Southern Petroleum 378 Bovis Homes Group 268 Bowleven 220 BP 4 Brammer 351 Brewin Dolphin 319 British American Tobacco 9 British Land 61 British Sky Broadcasting 27 Britvic 210 Brown (N) 237 BT Group 28 BTG 235 Bunzl 107 Burberry 59 Bwin Party Digital Entertainment 223 Cable & Wireless Communications 181 Cable & Wireless Worldwide 158 Cairn Energy 49 Caledon Resources 380 Camellia 389 Cape 270 Capita 66 Capital & Counties Properties -

State Street AUT UK Screened (Ex Controversies and CW) Index

Report and Financial Statements For the year ended 31st December 2020 State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund (formerly State Street UK Equity Tracker Fund) State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund Contents Page Manager's Report* 1 Portfolio Statement* 9 Director's Report to Unitholders* 27 Manager's Statement of Responsibilities 28 Statement of the Depositary’s Responsibilities 29 Report of the Depositary to the Unitholders 29 Independent Auditors’ Report 30 Comparative Table* 33 Financial statements: 34 Statement of Total Return 34 Statement of Change in Net Assets Attributable to Unitholders 34 Balance Sheet 35 Notes to the Financial Statements 36 Distribution Tables 48 Directory* 49 Appendix I – Remuneration Policy (Unaudited) 50 Appendix II – Assessment of Value (Unaudited) 52 * These collectively comprise the Manager’s Report. State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund Manager’s Report For the year ended 31st December 2020 Authorised Status The State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund (the “Fund”) is an Authorised Unit Trust Scheme as defined in section 243 of the Financial Services and Markets Act 2000 and it is a UCITS Retail Scheme within the meaning of the FCA Collective Investment Schemes sourcebook. The unitholders are not liable for the debts of the Fund. The Fund's name was changed to State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund on 18th December 2020 (formerly State Street UK Equity Tracker Fund). Investment Objective and Policy The objective of the Fund is to replicate, as closely as possible and on a “gross of fees” basis, the return of the United Kingdom equity market as represented by the FTSE All-Share ex Controversies ex CW Index (the “Index”), net of withholding taxes. -

Housing Market Overview

Housing market overview Produced 05 February 2021 This document provides the latest information available from various sources, with dates varying from November 2020 – January 2021 Contents Market overview 3 Summary of published price indices 4 UK annual house prices – rate of change 5 Regional all-dwellings annual house price – 12-month % change 6 UK house-price rates of change: types of buyer 7 UK house-price rates of change: types of dwelling 8 Number of housing transactions per month 9 Monthly asking-price trend 10 Home asking-price trend (England & Wales) 11 Average-time-on-market indicator (National) 12 Asking-price fluctuation percentage 13 UK sales volumes by funding status 14 UK house-price-to-earnings ratio 15 Average properties for sale per estate agent 16 2 Market overview Half of our sources continue to report house price growth, with month-on-month rises ranging from 0.1% to 1.2%. Halifax, Nationwide and Rightmove are conversely reporting monthly price falls in the range of 0.3% to 0.9%. All sources continue to report year-on-year increases in the range 3.3% to 7.8%. LSL tell us that prices rose rapidly over much of England and Wales in 2020, with the average house price in December up 7.8% on the previous year. They say this is the highest annual increase since 2016, though it is worth noting that most of this growth took place in the last six months of the year as pent-up demand was released by more relaxed coronavirus restrictions. The NHBC say that new home registrations across the UK fell 23% in 2020 against the previous year, but with figures recovering close to pre- pandemic levels in the final quarter, down just 2% year-on-year. -

FT UK 500 2012 A-Z Company UK Rank 2012 3I Group 114 888 Holdings 401 Abcam 261 Aberdeen Asset Management 93 Admiral Group 88 A

FT UK 500 2012 A-Z UK rank Company 2012 3I Group 114 888 Holdings 401 Abcam 261 Aberdeen Asset Management 93 Admiral Group 88 Advanced Medical Solutions 458 Aegis Group 111 Afren 163 African Barrick Gold 148 African Minerals 128 Aggreko 55 Albemarle & Bond 423 Allied Gold 383 Alternative Networks 490 Amec 79 Amerisur Resources 388 Amlin 143 Andor Technology 459 Anglo American 15 Anglo Pacific Group 333 Anglo-Eastern Plantations 346 Anite 316 Antofagasta 36 Aquarius Platinum 256 Archipelago Resources 322 Arm Holdings 45 Ashley (Laura) 445 Ashmore 102 Ashtead Group 171 Asian Citrus 281 Asian Plantations 487 Asos 166 Associated British Foods 40 Assura 452 Astrazeneca 13 Atkins (WS) 244 Avanti Communications 357 Aveva 191 Aviva 41 Avocet Mining 326 AZ Electronic Materials 195 Babcock International 94 Bae Systems 39 Bahamas Petroleum 483 Balfour Beatty 120 Barclays 16 Barr (AG) 297 Barratt Developments 167 Bayfield Energy 478 BBA Aviation 206 Beazley 246 Bellway 211 Bellzone Mining 386 Berendsen 220 Berkeley 138 Betfair Group 223 BG Group 7 BHP Billiton 9 FT UK 500 2012 A-Z UK rank Company 2012 Big Yellow Group 325 Blinkx 402 Bodycote 243 Booker 169 Boot (Henry) 438 Borders & Southern Petroleum 353 Bovis Homes Group 260 Bowleven 350 BP 3 Brammer 311 Breedon Aggregates 497 Brewin Dolphin 303 British American Tobacco 6 British Land 67 British Sky Broadcasting 33 Britvic 218 Brooks Macdonald 473 Brown (N) 257 BT Group 26 BTG 196 Bumi 189 Bunzl 84 Burberry 52 Bwin Party Digital Entertainment 174 Cable & Wireless Communications 233 Cable & Wireless -

LSL Property Services/Acadata

LSL Property Services/Acadata Wales House Price Index OCTOBER 2013 STRICTLY UNDER EMBARGO UNTIL 00.01 WEDNESDAY 18TH DECEMBER 2013 Welsh house prices rise by £1,125 in October Average house prices up £3,137 since start of 2013 Sales at highest level since December 2007 New record average price in Cardiff, up 7.4% annually House Price Index Monthly Change % Annual Change % £154,696 240.0 0.7 1.4 Oliver Blake, Managing Director of Reeds Rains estate agents, who has branches in Wales comments: “The housing market in Wales has turned over a new leaf and is clearly entering a new phase, with pent up demand and strong competition driving house price growth and rising sales. The market is moving ahead, with prices increasing by £1,125 compared to September - this represents the third consecutive monthly price rise, and prices are up by £3,137 since January 2013. New buyer enquiries, sales and price expectations are all above the three-month average, illustrating the strong headway being made. “Sales in particular are now standing at the highest level since December 2007, and momentum is building further - thanks to the boost in consumer confidence and the improving economic picture. Now that mortgage rates have dropped to record lows, aspiring homeowners have more chance to put together the money required for a deposit. As a result, first-time buyers are entering the market more enthusiastically, and with Wales seeing a higher loan-to-value ratio than elsewhere in the UK. There is also an improvement in the home movers sector of the market. -

Premium Listed Companies Are Subject to the UK's Super-Equivalent Rules Which Are Higher Than the EU Minimum "Standard Listing" Requirements

List of Premium Equity Comercial Companies - 29th April 2020 Definition: Premium listed companies are subject to the UK's super-equivalent rules which are higher than the EU minimum "standard listing" requirements. Company Name Country of Inc. Description of Listed Security Listing Category Market Status Trading Venue Home Member State ISIN(S) 4IMPRINT GROUP PLC United Kingdom Ordinary Shares of 38 6/13p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB0006640972 888 Holdings Plc Gibraltar Ordinary Shares of 0.5p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GI000A0F6407 AA plc United Kingdom Ordinary Shares of 0.1p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BMSKPJ95 Admiral Group PLC United Kingdom Ordinary Shares of 0.1p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00B02J6398 AGGREKO PLC United Kingdom Ordinary Shares of 4 329/395p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BK1PTB77 AIB Group Plc Ireland Ordinary Shares of EUR0.625 each; fully paid Premium Equity Commercial Companies RM LSE Ireland IE00BF0L3536 Air Partner PLC United Kingdom Ordinary Shares of 1p each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BD736828 Airtel Africa plc United Kingdom Ordinary Shares of USD0.50 each; fully paid Premium Equity Commercial Companies RM LSE United Kingdom GB00BKDRYJ47 AJ Bell plc United Kingdom Ordinary Shares of GBP0.000125 each; fully paid Premium -

Broker Upgrades and Downgrades & Key Uk

Shard Capital Stockbrokers T +44 (0) 207 186 9950 rd 23 Floor, F +44 (0) 207 186 9979 20Fenchurch St, E [email protected] London, EC3M 3BY W shardcapitalstockbrokers.com BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS 27 September 2017 UK Broker Upgrades / Downgrades Please contact us for more information Code Company Broker Recomm. From Recomm. To Price From Price To Upgrades BDEV Barratt Developments Plc Peel Hunt Hold Add 670 670 BKG Berkeley Group Holdings Plc Peel Hunt Buy Buy 4390 4660 BVS Bovis Homes Group Plc Peel Hunt Hold Add 1180 BWY Bellway Plc Peel Hunt Add Add 3435 3545 CIU Cape Plc Macquarie Neutral Neutral 235 265 CSP Countryside Properties Plc Peel Hunt Add Buy 395 420 HOTC Hotel Chocolat Group Plc finnCap Hold Hold 270 280 Jefferies LLOY Lloyds Banking Group Plc Buy Buy 87 91 International PSON Pearson Plc Exane BNP Paribas Underperform Outperform 600 700 Jefferies RBS Royal Bank of Scotland Group Plc Hold Buy 262 306 International SVS Savills Plc Peel Hunt Hold Hold 910 940 TW. Taylor Wimpey Plc Peel Hunt Hold Add 210 210 WJG Watkin Jones Plc Peel Hunt Buy Buy 225 230 https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS Code Company Broker Recomm. From Recomm. To Price From Price To Downgrades Jefferies -

Companies That Have Either Cut, Cancelled Or Postponed Dividends This Year

COMPANIES THAT HAVE EITHER CUT, CANCELLED OR POSTPONED DIVIDENDS THIS YEAR 1pm Clarkson Hunting Morgan Sindall ScS 4imprint Close Brothers Hydrogen Morses Club Secure Trust Bank AA Coats Hyve Mortgage Advice Senior Bureau Abbey Colefax Ibstock Shaftesbury Mpac AdEPT Technology Costain IMI Shoe Zone N Brown Adnams Crest Nicholson Ince SIG NewRiver Reit AG Barr Dalata Hotels Inchcape Signature Aviation Next Fifteen Aggreko DFS Furniture Inland Homes Smiths Group Nichols Alliance Pharma Dignity InterContinental Hotels Softcat Non-Standard Alpha FX Direct Line International Somero Enterprises Finance Consolidated Airlines Alumasc Domino's Pizza Spectris Norish International Amedeo Air Four Plus DP Group Springfield Personal Finance Nucleus Financial Properties Amino DS Smith INTU Ocean Wilsons Technologies SSP Group Dunelm ITV OneSavings Bank Anexo St Modwen Elecosoft IWG On The Beach Properties Animalcare Elementis James Cropper Oxford Instruments Stagecoach Applegreen Empiric Student James Fisher Palace Capital Standard Chartered Appreciate Properties James Halstead Page Group SThree Aquila Services Epwin JD Wetherspoon Persimmon STV Arbuthnot Banking Essentra John Menzies Petrofac Synectics Arrow Global FDM Group Johnson Service Photo-Me Taylor Wimpey ASA International FIH International K3 BusinessTech The Works Ascential Filta Playtech Keystone Law Topps Tiles Avation FinnCap Polypipe Kin & Carta Tracsis Aviva Finsbury Foods Portmieirion Kingfisher Travis Perkins BAE Systems Flowtech Fluidpower PPHE Hotel Land Securities Tribal Bakkavor -

TDS Report Asset Pack

Report 9 Has the private rented sector grown because people want to rent, or because they cannot afford to buy? Image: Andersastphoto | Dreamstime About this report This report has been created thanks to the support of the TDS Charitable Foundation. The Foundation “works to advance education about housing rights and obligations in general”. In particular, the charity focuses on: ● Best practice in the management of private rented housing; ● Legal rights and obligations of those involved in the provision or management of private rented housing; ● Using alternative dispute resolution for more efficient and effective resolution of disputes between landlords and tenants. The charity has provided a grant to Kate Faulkner who runs Designs on Property Ltd (designsonproperty.co.uk), to produce a series of reports and surveys on the private rented sector which are designed to increase knowledge on the private rented sector in England and to promote best practice. Opinions expressed in this report are those of Kate Faulkner and do not necessarily reflect the views of Tenancy Deposit Scheme (TDS) or The TDS Foundation. TDS Charitable Foundation Registration number: 1154321 2 About the authors Kate Faulkner Bsc (Econ) MBA CIM DipM was originally a consumer in the residential property market, buying, selling, renovating and renting property for many years. At that time she was a sales and marketing professional working with major brands such as PG Tips. Having enjoyed working in her spare time in residential property, she went on to set up one of the UK’s first property portals prior to the advent of Rightmove, then used her experience to help create on- and off-line tools designed to take the stress out of corporate relocations for employees. -

FTSE Factsheet

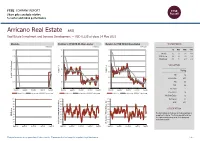

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Arricano Real Estate ARO Real Estate Investment and Services Development — USD 0.325 at close 14 May 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-May-2021 14-May-2021 14-May-2021 0.36 110 115 1D WTD MTD YTD Absolute 0.0 0.0 0.0 8.3 110 0.35 105 Rel.Sector -0.8 3.6 1.7 5.3 Rel.Market -1.1 1.3 -0.7 -0.8 105 0.34 100 VALUATION 100 0.33 95 Trailing 95 Relative Price Relative Price Relative 0.32 90 PE 1.6 Absolute Price (local (local currency) AbsolutePrice 90 EV/EBITDA 15.7 0.31 85 85 PB 0.3 PCF 2.8 0.3 80 80 Div Yield - May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Price/Sales 1.0 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 1.2 100 100 100 Div Payout 0.0 90 90 90 ROE 17.0 80 80 80 70 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 The main activity of the Group is the development of 40 40 40 RSI RSI (Absolute) properties in Ukraine.