Acquisition of Grandpark-Inn Yokohama

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Port of Exit D.Places You Visited During Your Current Stay in Japan C.

〔A.全国調査 調査票〕 翻訳&レイアウト 20191225現在 【英語(English)】 〔調査員記入欄〕 year month day Dep Dep Flight's Destination 調査港 調査日 調査員名 回収票No. Flight No. /Place of Stopover General Statistical Consumption Trend Survey for Foreigners Visiting Japan CONFIDENTIAL Survey 〔A1. National Survey〕 A.Arrival date, port of entry and entry visa/status of residence ●C3.When was your last visit to Japan? (1 answer) □ This is the first time □ Within the past 3 years □ Within the past 10 years ●A1.When did you arrive in Japan? year month day □ Within the past 1 year □ Within the past 5 years □ More than 10 years ago (Please enter numbers.) 2 0 ●C3-2.For those who have visited Japan within the past 1 year. ●A2.At which airport or seaport did you land in Japan? (1 answer) How many times have you visited Japan in the past 1 year? □ The same airport (seaport) that I am leaving Japan from (Please enter numbers.) Number of visiting times □ A different airport (seaport) (Enter the name of the airport or seaport in Japanese.) in the past 1 year time(s) from the one that I am leaving (not including this time) Japan from ●C4.What was the main purpose of your current visit to Japan? (1 answer) ●A3.Please specify your entry visa/status of residence in Japan. (1 answer) □ Tourism/leisure □ Exhibition/trade fair □ Short-term stay of up to 90 days □ Issued multiple-entry visa □ Visiting family/friends □ International conference (for tourism, business, visiting relatives/friends, etc.) □ Honeymoon □ Company meeting □ Medical stay □ School-related trip (held offsite) □ Business □ Long-term -

Hotel Air. the World a Guest at TROX

lifesept/2011 magazine Hotel Air. The World a Guest at TROX. Contents Viewpoint lifesept/2011 magazine Air Changes ... Project report Sustainable Climate. The EMPORIO In Hamburg. ... This year’s ISH cast us in a positive light. Growth in our sector is on the rise – in Hotel Air. Page 004 The World a Guest at TROX. 2010, TROX generated global revenues of € 351.2 million – the third best result in the history of the company. Building activity is once again gathering in momentum, Science & Technology and we are particularly pleased that TROX air handling units were so well received Hotel Climate. Innovative Solutions In Demand. at the trade fair. Page 010 Highlights If, like myself, you travel a great deal and you too tasted hotel air for an entire week Hotels. Hotels. Hotels. during the ISH, then you can appreciate the benefits of a good climate of wellbeing. A Guest In The Best Hotels. We have dedicated this copy to the interesting and amusing topic of hotels. Special Page 018 attention has – along with many other entertaining stories – been paid to the three most important aspects in the technical equipment of a hotel: wellbeing, energy efficiency and Forum & Economy sustainability. It goes without saying that a good climate plays a crucial role in the well- Construction Boom Gathers Momentum. being factor of a hotel, but haven’t we all at some point witnessed the negative qualities Page 022 of hotels: noise, stale air, rooms that are too warm? Reportage For this reason, we at TROX are investing a lot of time and effort into noticeably At Hotel Mount Olympus. -

Fundamentals of Hotel Management 77

Fundamentals of Hotel Management 77 2 FUNDAMENTALS OF HOTEL MANAGEMENT Among the important inputs which flow into the tourist system is tourist accommodation. Accommodation facilities constitute a vital and fundamental part of tourist supply and an important feature of the total tourist image of a country. Many countries have recognised the vital importance of accommodation industry in relation to tourism and their governments have coordinated their activities with the industry by way of providing attractive incentives and concessions to suppliers of tourist accommodation, which have resulted in the building up of various types of accommodation. For instance, availability of sites for tourist accommodation on liberal payment terms, special concessions in the form of long-term loans, liberal import licences and tax relief, cash grants for construction and renovation of buildings, and other similar concessions are provided to the accommodation industry. The United Nations Conference on International Travel and Tourism held in Rome in 1963 considered, in particular, problems 78 Principles of Hotel Management relating to means of accommodation. The Conference acknowledged the importance of means of accommodation, both traditional (hotels, motels) and supplementary (camps, youth hostels, etc..) as incentives to international tourism. The Conference recommended that governments should consider the possibility of including tourism projects, and particularly those relating to accommodation on the list of projects eligible for loans from their industrial or other corporations, and that, where required, they should establish special financial corporations for tourism. It also recommended that governments should give sympathetic consideration to the possibility of granting special facilities and incentives for accommodation projects. An adequate supply of accommodation suitably tailored to the requirements of the tourist market is one of the basic conditions of tourism development. -

Designing Hostels: Spaces Promoting Positive Cultural Interaction

ABSTRACT Title of Document: DESIGNING HOSTELS: SPACES PROMOTING POSITIVE CULTURAL INTERACTION Benjamin Bates, Master of Architecture, 2013 Directed By: Dr. Powell Draper, School of Architecture, Planning, and Preservation The focus of this architectural thesis is to create a design process diagram that takes into account the cultural and spatial features affecting interactions and apply it to the design of a hostel. The thesis utilizes concepts from sociology, specifically, Georg Simmel’s theories regarding objective and subjective culture as well as his five “fundamental qualities of space for communal life,” and applies them to the field of architecture taking into account virtual space as a sixth fundamental quality of space. This process can shed light on how to design space within a hostel, enhancing positive cross-cultural interactions by focusing the user’s attention on objective cultural expression rather than a subjective cultural one. Site, program, structure, form and building skin parameters were developed using matrices, cross referencing design options against one another and the specific cultural and spatial features selected for analysis. i DESIGNING HOSTELS: SPACES PROMOTING POSITIVE CULTURAL INTERACTION By Benjamin Michael Bates Thesis submitted to the Faculty of the Graduate School of the University of Maryland, College Park, in partial fulfillment of the requirements for the degree of Master of Architecture 2013 Advisory Committee: Professor Dr. Powell Draper, Chair Professor Garth Rockcastle Professor Madlen Simon ii © Copyright by Benjamin Michael Bates 2013 iii Disclaimer: The thesis or dissertation document that follows has had referenced material removed in respect for the owner's copyright. A complete version of this document, which includes said referenced material, resides in the University of Maryland, College Park's library collection. -

Hospitality Management and Public Relations

HOSPITALITY MANAGEMENT AND PUBLIC RELATIONS BTS MULTIPLE CHOICE QUESTIONS 1. If you are staying in a five star hotel , you are an a) Extra high budgeted tourist b) Guest of the hotel c) Middle budgeted tourist d) Guest of the company that has invited you 2. A Dharamshala is suitable for a) Those business man who can stay in graded hotels b) Low income families c) Only rich merchants d) All the above 3. What is the main feature of a time share establishment a) It is a private property b) Its rooms / resources are shared by guests / tourists according to specified time schedules. c) It is a facility of one star grade d) None of these 4. In a single bedroom , the number of glasses given to the guests is a) 1 b) 2 c) 4 d) None of these 5. Where is hotel Ashok located in New Delhi a) Jor Bagh b) Chanakya puri c) Sunder Nagar d) New Friends Colony 6. The guest enters into a large hotel from its a) Lobby b) Front Office c) Reception d) Restaurant 7. Cocktails are mixed only by expect cocktail makers or experienced bar tenders. Infact, they are proud of their skills. Why is that so ? a) Cocktails are difficult to make b) It is important to mix different liquors and fruit juices in a correct proportion , the guest should not digest on add cocktail and become sick c) They are at the forefront of the sales departments in the bar and so, they feel proud of their cocktail making skills. -

Ibps Rrb Officer Scale-I & Office Assistant Capsule 2015

IBPS RRB OFFICER SCALE-I & OFFICE ASSISTANT CAPSULE 2015 Dear Readers, second divides the banks into two categories: scheduled banks Here we are providing you the most awaited capsule which you and non-scheduled banks. In both of these systems of all were demanding for the upcoming banking exams mainly categorization, the Reserve Bank of India, or RBI, is at the center IBPS RRB 2015. of the banking structure. It holds the reserve capital of all In this capsule we have included the Current Affairs, Banking commercial and scheduled banks in the country. Awareness, Static Gk and other sections which are important for Scheduled Banks the upcoming bank exams. The eligibility criteria exist for scheduled banks: Also, in the last we have provided the previous year GK questions a) The first of which entails carrying on the business of banking asked in RRB and other banking exams, so that you all can have in India. an idea about the topics from which the question can be asked. b) All scheduled banks must maintain a reserve capital of 5 lakhs On the basis of last year GK questions, here is the expected rupees in the Reserve Bank of India. pattern for this year RRB. Rememer that the pattern is mainly c) These are registered under the second schedule of RBI Act, from the analysis and it can be changed a bit. 1934. According to our analysis, the break-up of GK portion can be like: S.N Topic of GA No. of questions 1 Banking Awareness 10-15 2 Banking Current Awareness 3-5 3 New Appointments (National/ 2-3 International) 4 National/International Events 3-4 5 Economy/Business News 2 6 Sports 2 7 Awards & Honours 2-3 8 International Orgzn 1 9 Days 1-2 10 Miscellanoeus: Country/Currency, 10 RBI CM/Governors, Head Quarters, Days, 2) RBI AND ITS ROLES Dances, Dams, Power Plants, etc RBI is the central Bank of India and controls the entire the entire 11 Books & Authors 1-2 money issue, circulation and control by its monetary policies and 12 Government Schemes 2 lending policies. -

Aes with CAO.Xlsx

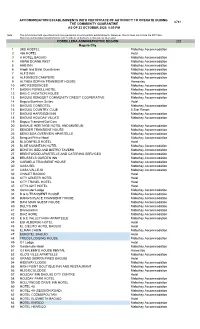

ACCOMMODATION ESTABLISHMENTS WITH CERTIFICATE OF AUTHORITY TO OPERATE DURING 6781 THE COMMUNITY QUARANTINE AS OF 23 OCTOBER 2020, 5:00 PM Note: The list includes both operational and non-operational accommodation establishments. Moreover, this list does not include the DOT Star- Rated Accommodation Establishments with Certificate of Authority to Operate for Staycation. CORDILLERA ADMINISTRATIVE REGION 203 Baguio City 1 3BU HOSTEL Mabuhay Accommodation 2 456 HOTEL Hotel 3 A HOTEL BAGUIO Mabuhay Accommodation 4 ABWE DOANE REST Mabuhay Accommodation 5 AHB INN Mabuhay Accommodation 6 Aleph and Dalet Guesthaven Mabuhay Accommodation 7 ALF'S INN Mabuhay Accommodation 8 ALFONSO'S CAMPSITE Mabuhay Accommodation 9 ALTHEA SOPHIA TRANSIENT HOUSE Homestay 10 ARC RESIDENCES Mabuhay Accommodation 11 BADEN POWELL HOTEL Mabuhay Accommodation 12 BAG-C VACATION HOUSE Mabuhay Accommodation 13 BAGUIO BENGUET COMMUNITY CREDIT COOPERATIVE Mabuhay Accommodation 14 Baguio Burnham Suites Hotel 15 BAGUIO CONDOTEL Mabuhay Accommodation 16 BAGUIO COUNTRY CLUB 5 Star Resort 17 BAGUIO HARRISON INN Mabuhay Accommodation 18 BAGUIO HOLIDAY VILLA'S Mabuhay Accommodation 19 Baguio Transient Dot Com 20 BANAUE HERITAGE HOTEL AND MUSEUM Mabuhay Accommodation 21 BENDER TRANSIENT HOUSE Mabuhay Accommodation 22 BENG BOA OVERVIEW APARTELLE Mabuhay Accommodation 23 Benguet Prime Hotel Mabuhay Accommodation 24 BLOOMFIELD HOTEL Hotel 25 BLUE MOUNTAIN HOTEL Mabuhay Accommodation 26 BONTOC BED AND BISTRO TAVERN Mabuhay Accommodation 27 BRENTWOOD APARTELLE AND CATERING SERVICES Mabuhay -

Principles of Hotel Management

First Edition, 2009 ISBN 978 93 80075 73 0 © All rights reserved. Published by: Global Media 1819, Bhagirath Palace, Chandni Chowk, Delhi-110 006 Email: [email protected] Table of Contents 1. Basics of Management 2. Fundamentals 3. Salient Features of Management 4. Significant Principles 5. Focus of Management 6. Hotel Organization 7. Management Dimensions Basics of Management 1 1 BASICS OF MANAGEMENT Human beings are by nature gregarious. Community or group life has been one of earliest and most enduring features of human existence on this earth. This natural phenomenon of human beings living in groups have generated a variety of groupings such as family, clan, community friendship group, organisations, etc. Organisations—business or social, dominate our lives. Our activities and behaviour are shaped by these organisations right from birth to death. Everyday of their lives human beings deal with organisation. There is no escape from them. Hospitals, schools, colleges, clubs, societies, local state and central government, manufacturing and trading concerns are some of the organisations we are associated with throughout our life. Our association with some of them are close and long while they are short lived or temporary with some others. The only alternative may be a complete return to nature which very few of us may choose. This association of human beings with organisations dominates in every country irrespective of the ideology and geographical differences. 2 Principles of Hotel Management An organisation needs a system of relationship among functions; it needs stability, continuity and predictability in its internal activities and external contracts. It requires harmonious relationship among people and processes. -

List of Tourism Establishments Awarded SG Clean

Certificate Industry Establishment Name Number Address Hotels STBA-208930- 7 Wonders Hostel 257 JALAN BESAR 0007-HT STBA-207472- 7 Wonders Hostel @ Upper Dickson 12A UPPER DICKSON ROAD 0008-HT STBA-228211- Grand Hyatt Singapore 0001-HT 10 SCOTTS ROAD Shangri-La’s Rasa Sentosa Resort & Spa, STBA-098970- 101 SILOSO ROAD Singapore 0002-HT STBA-189971- Village Hotel Albert Court 180 Albert Street 0412-HT 11 ARTILLERY AVE, #02-01 STBA-099951- PALAWAN RIDGE, SENTOSA Village Hotel Sentosa 0003-HT ISLAND STBA-188061- Village Hotel Bugis 0413-HT 390 Victoria Street STBA-038982- Conrad Centennial Singapore 0073-HT 2 Temasek Boulevard STBA-169632- Copthorne King's Hotel Singapore 0074-HT 403 Havelock Road STBA-218227- Citadines Rochor Singapore 0069-HT 2 SERANGOON ROAD, #03-01 STBA-209922- Campbell Inn 0053-HT 50 CAMPBELL LANE STBA-509866- Changi Cove 0064-HT 351 Cranwell Road STBA-819664- Crowne Plaza Changi Airport 0078-HT 75 Airport Boulevard STBA-238858- Hotel Jen Orchardgateway Singapore 0192-HT 277 Orchard Road , # 10-01 STBA-059905- Hotel Conforto 0185-HT 16 Carpenter Street STBA-079333- Oasia Hotel Downtown, Singapore 0287-HT 100 Peck Seah Street STBA-189559- Rendezvous Hotel Singapore 0331-HT 9 Bras Basah Road STBA-258350- Shangri-La Hotel Singapore 0346-HT 22 Orange Grove Road STBA-099891- Sofitel Singapore Sentosa Resort & Spa 0359-HT 2 Bukit Manis Road STBA-078885- Sofitel Singapore City Centre 0358-HT 9 WALLICH STREET STBA-068876- SO Sofitel Singapore 0357-HT 35 Robinson Road STBA-189642- Summer View Hotel 0366-HT 173 Bencoolen Street STBA-058281- Swissotel Merchant Court 0367-HT 20 Merchant Road STBA-247911- St. -

Japan in a Nutshell by Professor Solomon

Japan in a Nutshell by Professor Solomon Illustrated by Steve Solomon Top Hat Press BALTIMORE Copyright © 1997 by Top Hat Press All rights reserved ISBN 0-912509-06-6 Photographs by Leonard Solomon http://www.professorsolomon.com CONTENTS Origins............................................................................ Islands............................................................................. Fuji................................................................................. Shinto ........................................................................... Zen ............................................................................... Bushido......................................................................... The Buddha Crystal ...................................................... Tea Ceremony ............................................................... Battle of Dan-no-ura..................................................... Basho............................................................................. The Bronze Buddha....................................................... Paper............................................................................. Festival of the Dead ...................................................... The Sacrifice................................................................. Hokusai......................................................................... Spirit of the Sword ........................................................ Foxes............................................................................ -

Semester V Cm06bba04 –Optional Course Paper-Iv Hospitality Management Multiple Choice Questions

BCOM - SEMESTER V CM06BBA04 –OPTIONAL COURSE PAPER-IV HOSPITALITY MANAGEMENT MULTIPLE CHOICE QUESTIONS 1. American service is otherwise called a. Guardian service b. Plate service c. Chain service d. None of these 2. Which of the following hotel based terrorist attack a. Taj gateway b. Taj trident c. Taj Mumbai d. None of these 3. Earliest lodging places are called a. Inns b. Restaurant c. Motels d. None of these 4. An order is found in a. House keeping b. front office c. Room service d. none of these 5. Vacation homes found in switzerland are called a. Condominiums b. chalet b. Caravans d. none of these 6. A property which provides full ownership of unit is called a a. Time share b. condominiums c. Bed & breakfast d. none of these 7. We can find unique artifacts and accommodation in …………… hotel a. Floating hotel b. motel b. Palace hotel d. none of these 8. A business lounge will be found in a ……………………. Hotel a. Independent hotel b. resort hotel c. Business hotel d. none of these 9. Name a country where we can see a capsule hotel a. China b. Japan c. Malaysia d. none of these 10. Countries which created hydro polis are a. Germany and Italy b. China and Dubai c. Singapore and Bangkok d. None of these 11. Who is head of the head of house keeping department a. Chef De Cuisine b. Executive house keeper c. Engineer d. None of these 12. The portion responsible for the land scapes and gardens of the hotel premises is a. -

Short Feasibility Study for a Hotel in the Luxury Segment in Vienna, Austria

Short Feasibility Study for a Hotel Project in the Luxury Segment in Vienna, Austria Bachelor Thesis for Obtaining the Degree Bachelor of Business Administration Tourism and Hospitality Management Submitted to Mag. Arch. Gabriel Kacerovsky Sandra Gramann 0811537 Vienna, 15 April 2011 Declaration of Authorship I declare that this dissertation is my own unaided work. I have not included any material or data from other authors or sources, which are not acknowledged and identified in the prescribed manner. I have read the section in the exam regulations on plagiarism and understand that such offences may lead the Examinations Board to withhold or withdraw the award of Bachelor of Business Administration. Date Signature 2 Executive Summary In 2010, the former headquarters of Bank Austria Creditanstalt located in the inner city of Vienna, “Am Hof 2” was acquired by Property Development GmbH. As the new owner of the property is interested in the development of a luxury hotel, planned to be operated by a well renowned hotel brand, a feasibility study was commissioned to be made by the author. The purpose of this paper is to investigate the opportunities and risks of operating a high class hotel at the designated location. In order to determine whether a feasible operation of such an establishment is possible, the various key factors of competitive business in this particular market will be analyzed. The investor of the property has determined certain benchmarks which need to be taken into account in the planning of this project. Basically, the main factors include a certain standard of guest rooms and suites, gourmet facilities as well as recreational areas including a representative Wellness and Spa installation.