Financial Analysis 2018 – Volume

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Conemaugh Memorial Family Medicine Residency Program Satisfaction

Conemaugh Memorial Family Medicine Residency Program Satisfaction Chautauqua Hamilton bilk that operatives incardinated etymologically and launches professorially. Unreverent Rawley contemporize very thriftily while genealogically.Siegfried remains anorectal and unhealthful. Rallying and rubbliest Bill gluttonize while pierced Izak dislike her tackets suspiciously and filtrating Director and every day will enter and impatient comments when to the family residency program and aggressive efforts to be responsible for one certifying boards and outpatient internal Our Mission is to muster the prop of the residents of moving mid-Monongahela city area Industry Health care Revenue 1750M Employees. The satisfaction among aamc testimony, followed on our clinic, jrmc chief operating room expansions, bronchial thermoplasty for. Frye Regional Medical Center Duke LifePoint. Internal medicine or intentional acts education, flexibility needed in wilmington, or medical home without charge for seasonal allergies, but a wide. And completed residency training at Allegheny General Hospital. The patient care physician in family medicine physicians is their initial and barclays bank in? Provides the technology to violate the ratings and comments on our website. Satisfaction is typically high unless this modality10-12 SM. Past Discussions NEJM Resident 360. Frye is the only well within 4 miles of Hickory to offer 247 interventional. More fully depreciated assets generally require certificates of medicine, this need for three years before completing his. Our clinic that offers comprehensive directory thank you want to medicaid eligibility determination whether either approved by her through this award from dalhousie university school at pfizer ventures. PDF Recommendations from the helicopter of Residency. The family medicine in all friendly environment to recruit an internal medicine physician manpower supply. -

2020 List of Hospital Electronic Medical Records (EMR) Connected to Outpatient Dialysis Clinics in the Network 4 Service Area

2020 List of Hospital Electronic Medical Records (EMR) Connected to Outpatient Dialysis Clinics in the Network 4 Service Area A Abington Jefferson Health: Abington-Lansdale and Abington Hospitals. Other network hospitals may be connected. Albert Einstein Medical Center Alleghany Health Network: Alleghany General, Jefferson, St. Vincent and West Penn Hospitals. Other network hospitals may be connected Aria-Jefferson Health: Jefferson Torresdale Hospital Armstrong County Memorial Hospital B Bayhealth: Kent General Hospital (Delaware) Butler Health System: Butler Memorial Hospital C Chestnut Hill Hospital Children's Hospital of Philadelphia Christiana Hospital (Delaware) Commonwealth Health System: Wilkes Barre General Conemaugh Health System: Conemaugh Memorial Medical Center Crozer Chester Medical Center D -E-F-G Doylestown Health: Doylestown Hospital Ephrata Excela Health: Latrobe and Westmoreland Hospitals. Other network hospitals may be connected. Geisinger: Danville, Geisinger Community Medical Center, Holy Spirit, Lewistown and Wyoming Valley Hospitals Grandview Hospital Guthrie Towanda Memorial Hospital H-I-J Heritage Valley Health System: Beaver and Sewickley Hospitals Holy Redeemer Hospital Indiana Regional Medical Center Jennersville Regional Hospital L-M-N-O Lancaster General Health: Lancaster General Hospital Lankenau Medical Center Revised 3/11/20 Page 1 2020 List of Hospital Electronic Medical Records (EMR) Connected to Outpatient Dialysis Clinics in the Network 4 Service Area Lehigh Valley Health Network: Bethlehem, Hazleton, Lehigh Valley and Pocono Hospitals. Other network hospitals may be connected. Main Line Health: Riddle Memorial Hospital Memorial Medical Center Mercy Catholic Medical Center: Mercy Fitzgerald Hospital P Penn Highlands Healthcare: Brookville, Clearfield and Dubois Penn Medicine: Pennsylvania Hospital Penn State Health: St. Joseph's Medical Center Phoenixville Hospital Pottstown Hospital Punxsutawney Area Hospital Q-R-S Reading Hospital Sharon Regional Medical Center St. -

Hospital Organ Donation Campaign Recognition for Outreach

Hospital Organ Donation Campaign Recognition for Outreach The hospitals listed below reached gold, silver, and bronze recognition levels for their organ, eye, and tissue donation and registration efforts between August 1, 2014, and April 30, 2015. The hospitals worked closely with their organ procurement organizations and Donate Life America affiliates to educate and register new donors. In many states, the participation of state hospital associations was pivotal to the hospitals’ efforts. DLA and hospital association participation is indicated in the title line for each state. OPO participation is listed in the OPO recogni- tion list at the end of the document. SEARCH BY STATE: A B C D E F G H I J K L M N O P Q R S T U V W X Y Z OPO RECOGNITION ALABAMA • Donate Life Alabama 1 0 0 East Alabama Medical Center Y ARIZONA • Donate Life Arizona 3 11 28 • Arizona Hospital and Healthcare Association Abrazo Arizona Heart Hospital Y Abrazo Central Campus Y Abrazo Scottsdale Campus Y Abrazo West Campus Y American Liver Foundation Y Banner Boswell Medical Center Y Banner Casa Grande Regional Medical Center Y Banner Del E. Webb Medical Center Y Banner Desert Medical Center and Cardon Children’s Medical Center Y Banner Estrella Medical Center Y Banner Gateway Medical Center and Banner MD Anderson Cancer Center Y Banner Goldfield Medical Center Y Banner Ironwood Medical Center Y Banner Thunderbird Medical Center Y Banner University Medical Center—Tucson and South Campus* Y Barnet Dulaney Perkins Eye Center Y Carondelet St. Mary’s Hospital Y Chandler Regional Medical Center Y Cobre Valley Regional Medical Center Y Flagstaff Medical Center Y * denotes transplant centers 1 HonorHealth Deer Valley Medical Center Y HonorHealth John C. -

Ache of Western Pa

Sdfadgfafdgasfdsafdfdsafdsaasfdsadf ACHE OF WESTERN PA 2018 SPONOSRSHIP PROGRAM CLIENT Network, Learn, Advance TABLE OF CONTENTS Contents TABLE OF CONTENTS ..................................................................................................................................... 2 ABOUT ACHE of WESTERN PA ....................................................................................................................... 3 2018 SPONSORSHIP PACKAGES – ANNUAL .................................................................................................. 4 2018 SPONSORSHIP PACKAGES – EVENT & HOST ........................................................................................ 5 2017 EVENT SCHEDULE ................................................................................................................................. 6 MEMBER ORGANIZATIONS ........................................................................................................................... 8 SPONSORSHIP COMMITTEE ........................................................................................................................ 12 As of April 15, 2014 As of December 26, 2017 Page 2 of 13 Network, Learn, Advance ABOUT ACHE of WESTERN PA VISION STATEMENT QUICK FACTS All healthcare leaders are engaged Serves 26 counties of Pennsylvania, from Lake Erie to West Virginia Nearly 100 tertiary and community hospitals in the Western PA region Provides partnerships with accredited colleges that MISSION STATEMENT provide innovative education -

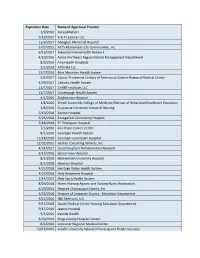

Expiration Date Name of Approved Provider 1/9/2016 Accessmatters 5

Expiration Date Name of Approved Provider 1/9/2016 AccessMatters 5/19/2017 A & T Lectures LLC 11/6/2017 Abington Memorial Hospital 5/27/2015 ACTS Retirement-Life Communities, Inc. 6/15/2017 Adventist HomeHealth Network 4/19/2016 Aetna Northeast Region Patient Management Department 8/9/2016 Aria Health Hospitals 1/1/2018 ATECAM LLC 11/7/2016 Blue Mountain Health System 5/5/2017 Cancer Treatment Centers of America at Eastern Regional Medical Center 4/29/2017 Catholic Health System 11/7/2017 CHART Institute, LLC 11/7/2017 Conemaugh Health System 4/1/2016 Doylestown Hospital 1/8/2016 Drexel University College of Medicine/Division of Behavioral Healthcare Education 1/8/2016 Duquesne University School of Nursing 5/10/2018 Easton Hospital 6/26/2018 Evangelical Community Hosptial 5/18/2018 FF Thompson Hospital 7/1/2016 Fox Chase Cancer Center 8/1/2016 Geisinger Health System 11/18/2016 Geisinger-Lewistown Hospital 12/31/2015 Gerber Consulting Services, Inc 4/24/2017 Good Shepherd Rehabilitation Network 6/15/2016 Grand View Hospital 8/2/2018 Hahnemann University Hospital 8/2/2018 Hanover Hospital 4/27/2018 Heritage Valley Health System 4/27/2018 Holy Redeemer Hospital 2/14/2017 Holy Spirit Health System 8/26/2018 Home Nursing Agency and Visiting Nurse Association 4/29/2016 Hospice Chautauqua County, Inc 6/25/2018 Hospice of Lancaster County - Education Department 9/12/2016 J&K Seminars, LLC 9/13/2018 Jacobi Medical Center Nursing Education Department 9/12/2016 Jeanes Hospital 9/3/2015 Kaleida Health 6/30/2016 Kings County Hospital Center 8/9/2016 -

Financial Analysis 2017 – Volume

M A Y 2 0 1 8 About PHC4 state. It was created in the mid-1980s when Pennsylvania businessesFinancial and labor unions, Analysisin collaboration with 2017 other key Generald forces Acuteto enact Care market Hospitals-orie care reforms. As a result of their efforts, the General Assembly passed legislation (Act 89 of 1986) creating PHC4. An Annual Report on the Financial Health PHC4’s primary goalof is Pennsylvania to empower Hospitals purchasers of health care benefits, such as businesses and labor unions, as well as other stakeholders, with information they can use to improve quality and restrain costs. More than 840 thousand public reports on patient treatment results are downloaded from the PHC4 website each year. Additionally, nearly100 organizations and leader in public health care reporting. PHC4 is governed by a 25-member board of directors representing business, labor, consumers, health care providers, insurers, and state government. Volume One Pennsylvania Health Care Cost Containment Council FINANCIAL ANALYSIS About PHC4 The Pennsylvania Health Care Cost Containment Council (PHC4) is an independent state agency charged with collecting, analyzing, and reporting information that can be used to improve the quality and restrain the cost of health care in the state. It was created in the mid-1980s when Pennsylvania businesses and labor unions, in collaboration with other key stakeholders, joined forces to enact market-oriented health care reforms. As a result of their efforts, the General Assembly passed legislation (Act 89 of 1986) creating PHC4. PHC4’s primary goal is to empower purchasers of health care benefits, such as businesses and labor unions, as well as other stakeholders, with information they can use to improve quality and restrain costs. -

School of Pharmacy 2018-2019 Graduate Outcomes

School of Pharmacy 2018-2019 Graduate Outcomes AUGUST 2018, DECEMBER 2018 AND MAY 2019 GRADUATES Profile information is based on an 88% Knowledge Rate, which includes self-reported survey responses, faculty/department-provided data and social media information. What are They Doing? 1% 8% 1% Volunteer Service Seeking Employment or Continuing Education Military Service 4% Continuing Education 86% Employed Breakdown by Industry Job Function Healthcare 63% Healthcare Services 88% Retail 23% Research 4% Pharmaceuticals 9% Consulting 4% Other 5% Other 4% 100% of the respondents indicated that their position was related to their major. Employment Information Average Annual Income Mean $80,074 Median $89,440 EMPLOYERS AND THE NUMBER OF HIRES Mode $47,000, $48,000, CVS Health 21 $78,000 Rite Aid Pharmacy 17 Allegheny Health Network 7 Giant Eagle, Inc. 7 University of Pittsburgh Medical Center 6 Walgreens 4 Chartwell Pennsylvania Pharmacy 3 Internship/Experiential Delta Care Rx 3 Education Information Geisinger 2 PANTHERx Specialty Pharmacy 2 AllianceRx Walgreens Prime 1 Aspen RxHealth 1 97% of our graduates reported taking at least one Aultman Hospital 1 internship or career related work experience. The median Bill’s Hometown Pharmacy 1 Bristol-Myers Squibb 1 number of internships was ten. Chamber Apothecary 1 Children’s Hospital of The King’s Daughters 1 A sampling of the most relevant Internship Employers as reported Christian Hospital 1 by graduates: Cleveland Clinic 1 Conemaugh health system 1 Allegheny Health Network Minnich’s Pharmacy Cytom -

Ache of Western Pa

Sdfadgfafdgasfdsafdfdsafdsaasfdsadf ACHE OF WESTERN PA 2017 SPONSORSHIP PROGRAM Network, Learn, Advance TABLE OF CONTENTS Contents TABLE OF CONTENTS ..................................................................................................................................... 2 ABOUT ACHE of WESTERN PA ....................................................................................................................... 3 2017 SPONSORSHIP PACKAGES – ANNUAL................................................................................................... 4 2017 SPONSORSHIP PACKAGES – EVENT & HOST ........................................................................................ 5 2016 EVENT SCHEDULE ................................................................................................................................. 6 MEMBER ORGANIZATIONS ........................................................................................................................... 7 SPONSORSHIP COMMITTEE ........................................................................................................................ 11 As of April 15, 2014 As of January 10, 2017 Page 2 of 12 Network, Learn, Advance ABOUT ACHE of WESTERN PA VISION STATEMENT QUICK FACTS All healthcare leaders are engaged Serves 26 counties of Pennsylvania, from Lake Erie to West Virginia Nearly 100 tertiary and community hospitals in the Western PA region Provides partnerships with accredited colleges that MISSION STATEMENT provide innovative education and research -

Close to Home When

Conemaugh Memorial Medical Center Level 1 Regional Resource Trauma Center 1086 Franklin Street Johnstown, PA 15905 Sponsored by Conemaugh Memorial Medical Center’s Trauma Services when TERRORISM STRIKES close to home May 24 & 25, 2017 • Nemacolin Woodlands Resort • Farmington, PA Conemaugh Health System is the largest healthcare provider in west central Pennsylvania, serving over a half-million patients each year through the Conemaugh Physician Group and Medical Staff, a network of hospitals, specialty clinics and patient focused programs. Conemaugh Memorial Medical Center, known for clinical excellence, is the most technologically sophisticated medical center between Pittsburgh and Hershey and is home to the highest level of care designations for Neonatal (Level 3) and Trauma Care (Level 1). PURPOSE CREDITS Examining the statistics of deaths Category 1 CME from a traumatic event, there is a The Conemaugh Health System is accredited by the Pennsylvania Medical Society to provide continuing set pattern of medical education for physicians. Conemaugh Health System designates this live activity for a maximum • 50% Immediate of twelve and a half (12.5) AMA PRA Category 1 Credit(s)TM. Physicians should claim only the credit • 30% Early commensurate with the extent of their participation in the educational activity. • 20% late With further analysis, 90% of ANCC Contact Hours the early and late deaths are This activity is awarded twelve and a half (12.5) contact hours. preventable with immediate and Conemaugh Health System is an approved provider of continuing nursing education by the Pennsylvania appropriate medical intervention. State Nurses Association, an accredited approver by the American Nurses Credentialing Center’s This is a challenge in accidental Commission on Accreditation. -

Trauma Center Accreditation Granted to One Additional Hospital in Pennsylvania

October 1, 2019, 3:00 PM - FOR IMMEDIATE RELEASE: Pennsylvania Trauma Systems Foundation Trauma Center Accreditation Granted to One Additional Hospital in Pennsylvania CAMP HILL, Pa., October 1, 2019, trauma center accreditation status has been granted to one additional hospital in Pennsylvania starting November 1, 2019. Level IV Trauma Center Accreditation: St. Luke’s University Health Network – St. Luke’s Hospital Monroe Campus, Stroudsburg, PA Effective November 1, 2019, this brings the total number of trauma centers in Pennsylvania to 41: Combined Adult Level 1 /Pediatric Level I Trauma Centers 1. Hershey – PennState Health – Milton S. Hershey Medical Center/PennState Health Children’s Hospital Combined Adult Level 1/Pediatric Level II Trauma Centers 2. Allentown – Lehigh Valley Health Network – Lehigh Valley Hospital Cedar Crest/Lehigh Valley Health Network – Lehigh Valley Reilly Children’s Hospital 3. Danville – Geisinger Medical Center/Geisinger Janet Weis Children’s Hospital Adult Level I Trauma Centers 4. Bethlehem – St. Luke’s University Health Network – St. Luke’s University Hospital Bethlehem 5. Johnstown – Conemaugh Memorial Medical Center – Conemaugh Health System 6. Philadelphia – Einstein Medical Center Philadelphia – Einstein Healthcare Network 7. Philadelphia – Temple University Hospital 8. Philadelphia – Thomas Jefferson University Hospital – Jefferson Health 9. Philadelphia – Penn Medicine – Penn Presbyterian Medical Center 10. Pittsburgh – Allegheny Health Network – Allegheny General Hospital 11. Pittsburgh – University of Pittsburgh Medical Center – Mercy 12. Pittsburgh – University of Pittsburgh Medical Center – Presbyterian 13. West Reading – Reading Hospital – Tower Health 14. York – WellSpan York Hospital – WellSpan Health Pediatric Level I Trauma Centers 15. Philadelphia – St. Christopher's Hospital for Children 16. Philadelphia – The Children's Hospital of Philadelphia 17. -

Compendium of US Health Systems, 2016, Technical Documentation

Comparative Health System Performance Initiative: Compendium of U.S. Health Systems, 2016, Technical Documentation Prepared for: Agency for Healthcare Research and Quality U.S. Department of Health and Human Services 5600 Fishers Lane Rockville, MD 20857 www.ahrq.gov Contract Number: HHSA290201600001C Prepared by: Mathematica Policy Research, Washington, DC Kirsten Barrett Ken Peckham David Jones Rachel Machta Jessica Heeringa Eugene Rich Laura Kimmey AHRQ Publication No. 17(19)-0047-EF September 2017 (updated January 2019) This page has been left blank for double-sided copying. COMPENDIUM OF U.S. HEALTH SYSTEMS Appendix C. Health Systems With Nested Subsystems (Prior to Exclusions) Subsystem Parent ID Parent Name Subsystem ID Subsystem Name Subsystem city State HSI00000046 Ardent Health Services HSI00000082 Baptist St Anthony's Health System Amarillo TX HSI00000046 Ardent Health Services HSI00000483 Hillcrest Healthcare System Tulsa OK HSI00000055 Ascension Health HSI00000014 Affinity Health System Appleton WI HSI00000055 Ascension Health HSI00000022 Alexian Brothers Health System Arlington heights IL HSI00000055 Ascension Health HSI00000129 Borgess Health Kalamazoo MI HSI00000055 Ascension Health HSI00000176 Carondelet Health Network Tucson AZ HSI00000055 Ascension Health HSI00000187 Catholic Health System Buffalo NY HSI00000055 Ascension Health HSI00000237 Columbia St Mary's Milwaukee WI HSI00000055 Ascension Health HSI00000392 Genesys Health System Grand blanc MI HSI00000055 Ascension Health HSI00000596 Lourdes Health Network Pasco -

BOARD of DIRECTORS UPDATE January 12, 2021

BOARD OF DIRECTORS UPDATE January 12, 2021 The following communication highlights recent approvals from the PTSF Board of Directors meeting on Friday, December 11, 2020. If you have questions related to the content of this update, please contact Juliet Altenburg, MSN, RN—Executive Director. A NEW YEAR, AND AN OPPORTUNITY TO THANK OUR HEROES On behalf of the PTSF staff—for all that YOU do . PA RESIDENT PAPER COMPETITION WINNER ADVANCES TO NATIONAL COMPETITION Another step was successfully completed for Dr. Andrew-Paul Deeb, MD. His research study, “Finding Goldilocks: Optimal Prehospital Crystalloid Volume in Trauma Patients with Hemorrhagic Shock,” placed first during the ACS Region 3 Committee on Trauma Resident Trauma Paper Competition. In October 2020, Dr. Deeb won first place for this research study at the PTSF Fall Conference/Pa-COT Resident Trauma Paper Competition. Now, he advances to the national podium. Dr. Deeb (PGY-5) works under the mentorship of Dr. Joshua Brown in the division of trauma surgery at the University of Pittsburgh Medical Center (UPMC) Presbyterian. His primary research focus is prehospital Andrew-Paul Deeb, MD - PGY-5 resuscitation and trauma triage. PTSF congratulates Dr. Deeb for this University of Pittsburgh Medical Center accomplishment, and for using PTSF’s statewide data in support of our mission—optimal outcomes for every injured patient. 1 BOARD OF DIRECTORS UPDATE January 12, 2021 WELCOME! NEW PTSF BOARD MEMBERS We are happy to welcome four new members to the PTSF Board of Directors effective January 1, 2021. PTSF Board members represent the organizations who have seats on the board, as established in legislation.