BCE 2015 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2011 BCE Annual Information Form

Annual Information Form BCE Inc. For the year ended December 31, 2011 March 8, 2012 In this Annual Information Form, Bell Canada is, unless otherwise indicated, referred to as Bell, and comprises our Bell Wireline, Bell Wireless and Bell Media segments. Bell Aliant means, collectively, Bell Aliant Inc. and its subsidiaries. All dollar figures are in Canadian dollars, unless stated otherwise. The information in this Annual Information Form is as of March 8, 2012, unless stated otherwise, and except for information in documents incorporated by reference that have a different date. TABLE OF CONTENTS PARTS OF MANAGEMENT’S DISCUSSION & ANALYSIS AND FINANCIAL STATEMENTS ANNUAL INCORPORATED BY REFERENCE INFORMATION (REFERENCE TO PAGES OF THE BCE INC. FORM 2011 ANNUAL REPORT) Caution Regarding Forward-Looking Statements 2 32-34; 54-69 Corporate Structure 4 Incorporation and Registered Offices 4 Subsidiaries 4 Description of Our Business 5 General Summary 5 23-28; 32-36; 41-47 Strategic Imperatives 6 29-31 Our Competitive Strengths 6 Marketing and Distribution Channels 8 Our Networks 9 32-34; 54-69 Our Employees 12 Corporate Responsibility 13 Competitive Environment 15 54-57 Regulatory Environment 15 58-61 Intangible Properties 15 General Development of Our Business 17 Three-Year History (1) 17 Our Capital Structure 20 BCE Inc. Securities 20 112-114 Bell Canada Debt Securities 21 Ratings for BCE Inc. and Bell Canada Securities 21 Ratings for Bell Canada Debt Securities 22 Ratings for BCE Inc. Preferred Shares 22 Outlook 22 General Explanation 22 Explanation of Rating Categories Received for our Securities 24 Market for our Securities 24 Trading of our Securities 25 Our Dividend Policy 27 Our Directors and Executive Officers 28 Directors 28 Executive Officers 30 Directors’ and Executive Officers’ Share Ownership 30 Legal Proceedings 31 Lawsuits Instituted by BCE Inc. -

Management's Discussion and Analysis

Management’s Discussion and Analysis Table of Contents 4 At a Glance The following Management’s Discussion and Analysis (“MD&A”) for George Weston 5 Our Business Limited (“GWL” or the “Company”) should be read in conjunction with the audited annual consolidated financial statements and the accompanying notes on pages 89 8 Key Performance Indicators to 171 of this Annual Report. The Company’s audited annual consolidated financial Operating Segments statements and the accompanying notes for the year ended December 31, 2019 have 12 Loblaw been prepared in accordance with International Financial Reporting Standards (“IFRS” or “GAAP”) as issued by the International Accounting Standards Board (“IASB”). 14 Choice Properties The audited annual consolidated financial statements include the accounts of 16 Weston Foods the Company and other entities that the Company controls and are reported in 19 Financial Results Canadian dollars, except where otherwise noted. 76 Outlook Under GAAP, certain expenses and income must be recognized that are not necessarily reflective of the Company’s underlying operating performance. Non-GAAP financial 77 Non-GAAP Financial Measures measures exclude the impact of certain items and are used internally when analyzing 87 Forward-Looking Statements consolidated and segment underlying operating performance. These non-GAAP 88 Additional Information financial measures are also helpful in assessing underlying operating performance on a consistent basis. See Section 14, “Non-GAAP Financial Measures”, of this MD&A for more information on the Company’s non-GAAP financial measures. The Company operates through its three reportable operating segments, Loblaw Companies Limited (“Loblaw”), Choice Properties Real Estate Investment Trust (“Choice Properties”) and Weston Foods. -

47058.00 BCE Eng Cover

Bell Canada Enterprises Annual Report 1999 say hello to the internet economy Who could have predicted this? Not just the exhilarating vistas unfolding on the Internet, but the speed with which it’s changed how we live, work and play. But wait... there’s more on the way. And BCE is at the centre of it all. We’re Canada’s leading communications services company, at the crossroads where information, e-commerce and entertainment intersect. Through Bell Canada, we help to shape how Canadians access, view and use the Internet. 4 report to shareholders We do this through Bell Nexxia, our national fibre optic backbone; Bell ActiMedia with Sympatico-Lycos, the 16 chairman’s message leading source of Internet content and high-speed access; 18 management’s discussion Bell Mobility, Canada’s foremost wireless company; and and analysis Bell ExpressVu, the leading satellite-TV service. We’re also 37 consolidated financial statements the country’s leading provider of e-commerce solutions, 62 board of directors and delivered by BCE Emergis and CGI. And now, through corporate officers Teleglobe, our business services are also going global. 63 committees of the board 64 shareholder information key indicators ($ millions, except per share amounts) 1999 1998 Revenues 14,214 27,207 Revenues excluding Nortel Networks 14,214 13,579 Net earnings 5,459 4,598 Baseline earnings(1) 1,936 1,592 Baseline earnings per common share (before goodwill expense)(1) 3.26 2.65 1 Excluding special items price range of common shares 1999 1998 High Low Close High Low Close Toronto -

BMO Low Volatility Canadian Equity ETF (ZLB) Summary of Investment Portfolio • As at September 30, 2016

Quarterly portfolio disclosure BMO Low Volatility Canadian Equity ETF (ZLB) summary of investment portfolio • as at september 30, 2016 % of Net Asset % of Net Asset Portfolio Allocation Value Top 25 Holdings Value Financials ......................................................................25.4 Fairfax Financial Holdings Limited ............................................ 5.0 Consumer Staples .............................................................15.4 Dollarama Inc. ................................................................. 4.1 Real Estate ....................................................................12.0 Waste Connection, Inc. ........................................................ 3.7 Utilities ........................................................................11.7 Intact Financial Corporation ................................................... 3.6 Consumer Discretionary ......................................................10.3 Canadian REIT .................................................................. 3.6 Telecommunication Services .................................................. 8.1 BCE Inc. ......................................................................... 3.0 Information Technology ....................................................... 6.9 RioCan REIT ..................................................................... 2.9 Industrials ...................................................................... 3.7 Empire Company Limited, Class A ........................................... -

Court File No. CV-15-10832-00CL ONTARIO

Court File No. CV-15-10832-00CLCV-l5-10832-00CL ONTARIO SUPERIOR COURT OFOF' JUSTICE [COMMERCIALICOMMERCTAL LIST]LrSTI IN THE MATTER OF THE COMPANIES' CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c.C-36, AS AMENDED AND IN THE MATTER OFOF A PLANPLAN OFOF'COMPROMISE COMPROMISE AND ARRANGEMENT OFOF' TARGET CANADA CO., TARGET CANADACANADA HEALTH CO., TARGET CANADA MOBILE GP CO., TARGET CANADACANADA PHARMACYPHARMACY (BC)(BC) CORP.,CORP., TARGETTARGET CANADACANADA PHARMACY (ONTARIO) CORP.,CORP., TARGETTARGET CANADACANADA PHARMACY CORP.,CORP., TARGETTARGET CANADA PHARMACY (SK)(sK) CORP.,coRP., and TARGET CANADA PROPERTY LLCLLc Applicants RESPONDING MOTION RECORD OF FAUBOURGF'AUBOURG BOISBRIAND SHOPPING CENTRE HOLDINGS INC. (Motion to Accept Filing ofof aa Plan andand Authorize Creditors'Creditorso MeetingMeeting toto VoteVote onon thethe Plan) (Returnable(Returnable DecemberDecemb er 21, 2015)201 5) Date: December 8,8,2015 2015 DE GRANDPRÉ CHAIT LLP Lawyers 10001000 DeDe.La La Gauchetière Street West Suite 2900 Montréal (Québec) H3B 4W5 Telephone: 514514 878-431187 8-4311 Fax:Fax:514 514 878-4333878-4333 Stephen M. Raicek [email protected]@,dgclex.com Matthew Maloley mmalole)¡@declex.commmaroleyedgclex.com Lawyers for FaubourgFaubourg Boisbriand Boisbriand Shopping Shopping Centre Holdings Inc. TO: SERVICE LIST CCAA Proceedings ofof TargetTarget CanadaCanada Co.etCo.et al,al, CourtCourt File No. CV-15-10832-00CLCV-l5-10832-00CL Main Service List (as(as atatDecember7,2015) December 7, 2015) PARTY CONTACTcqNTACT • OSLER,osLER, HOSKIN & HARCOURT -

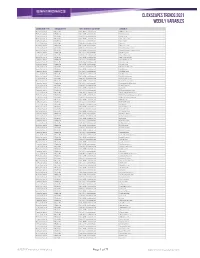

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Broadcasting and Telecommunications Legislative Review

BROADCASTING AND TELECOMMUNICATIONS LEGISLATIVE REVIEW APPENDIX 4 TO SUBMISSION OF CANADIAN NETWORK OPERATORS CONSORTIUM INC. TO THE BROADCASTING AND TELECOMMUNICATIONS LEGISLATIVE REVIEW PANEL 11 JANUARY 2019 BEFORE THE CANADIAN RADIO-TELEVISION AND TELECOMMUNICATIONS COMMISSION IN THE MATTER OF RECONSIDERATION OF TELECOM DECISION 2017-56 REGARDING FINAL TERMS AND CONDITIONS FOR WHOLESALE MOBILE WIRELESS ROAMING SERVICE, TELECOM NOTICE OF CONSULTATION CRTC 2017-259, 20 JULY 2017 SUPPLEMENTAL INTERVENTION OF ICE WIRELESS INC. 27 OCTOBER 2017 TABLE OF CONTENTS EXECUTIVE SUMMARY ...................................................................................................................... 1 1.0 INTRODUCTION .......................................................................................................................... 8 1.1 A note on terminology ................................................................................................................ 9 2.0 SUMMARY OF DR. VON WARTBURG’S REPORT ............................................................... 10 3.0 CANADA’S MOBILE WIRELESS MARKET IS NOT COMPETITIVE .................................. 13 3.1 Canada’s mobile wireless market is extremely concentrated in the hands of the three national wireless carriers ........................................................................................................................ 14 3.2 Mobile wireless penetration rates and mobile data usage indicate that the mobile wireless market is not sufficiently competitive...................................................................................... -

Growth Potential of Stocks: Security of a GIC

BMO Financial Group BMO Growth GIC Growth potential of Stocks: Security of a GIC This medium term GIC allows you to participate in the growth of Canadian stocks with no risk to your principal investment. It offers the potential to generate returns based on the performance of a basket of 15 large Canadian companies. Is this GIC right for you? Product Features This GIC may be right for you if you: Term • are looking to diversify your portfolio with a medium term investment Minimum Investment • would like principal protection Maximum Rate of Return • are willing to forego a guaranteed return for the potential for the Term to earn higher market linked returns • can keep your money invested until the end of the term 100 % Principal protected Reference Portfolio Key Benefits This GIC is an excellent way for you to gain access to the Company (equally weighted) returns on a portfolio of 15 large Canadian companies with • Toronto-Dominion Bank (The) (TD) • Royal Bank of Canada (RY) the security of principal protection. • Canadian Imperial Bank of • George Weston Limited (WN) Commerce (CM) • Principal protection 100% of your original investment is • Nutrien Ltd. (NTR) returned to you at maturity • Bank of Nova Scotia (The) (BNS) • Canadian Tire Corp Ltd (CTC.A) • BCE Inc. (BCE) • Higher return potential based on the performance of a • Suncor Energy Inc. (SU) portfolio of Canadian stocks • Saputo Inc. (SAP) • Enbridge Inc. (ENB) • Designed in partnership with BMO Capital Markets®, a • National Bank of Canada (NA) • TransCanada Corporation (TRP) market -

Blg.Com Mergers & Acquisitions Mining United States United Kingdom Agribusiness

Steve Suarez Partner T 416.367.6702 Business Tax F 416.367.6749 International Tax Toronto Tax Disputes & Litigation [email protected] Mergers & Acquisitions Mining United States United Kingdom Agribusiness Steve works exclusively on income tax matters, focusing on mergers and acquisitions, inbound and outbound investment, corporate restructurings and audit management, and tax dispute resolution. He is the founder of Mining Tax Canada website, a website devoted to mining-related taxation issues. Experience Sterling Capital Brokers in its merger with Luedey Consultants Inc. to become one of the largest independent employee-owned benefit consulting firms in Canada. Epiroc Canada Holding Inc., a subsidiary of Epiroc Rock Drills AB, in its acquisition of 100% of MineRP Holdings Inc. from Dundee Precious Metals Inc. (TSX: DPM). BNY Mellon Wealth Management, Advisory Services, Inc. in its sale to Guardian Capital Group (TSX: GCG). SterlingCapitalBrokers Ltd. acquired all of the issued and outstanding shares of Riverview Insurance Solutions Inc. Virtu Financial (NASDAQ: VIRT), a leading provider of financial services and products that leverages cutting-edge technology, in its sale of MATCHNow marketplace to Cboe Global Markets. Canadian Premier Life Insurance Company in its acquisition of Gerber Life Insurance Company's Canadian insurance business from U.S.-based Western & Southern Financial Group. Berkshire Hathaway Energy Company ("BHE"), in its indirect share purchase acquisition of the Montana Alberta Tie-Line from Enbridge Inc. for an approximate purchase price of $200M. Atlas Copco AB on its divisive reorganization and spin-out of Epiroc AB. HollyFrontier Corporation in connection with its acquisition of Petro-Canada Lubricants Inc. from Suncor Energy. -

Bce Inc. 2013 Annual Report

BCE INC. 2013 ANNUAL REPORT We’re the same company… WorldReginfo - 45aa5ca7-6679-44ab-8e49-81ca5bf5fe10 … just totally different. Bell has connected Canadians since 1880, leading the innovation and investment in our nation’s communications networks and services. We have successfully embraced the rapid changes in communications technology, competition and opportunity, building on our 134-year record of service to Canadians with a clear goal, and the strategy and team execution required to achieve it. WorldReginfo - 45aa5ca7-6679-44ab-8e49-81ca5bf5fe10 WorldReginfo - 45aa5ca7-6679-44ab-8e49-81ca5bf5fe10 Our goal: To be recognized by customers as Canada’s leading communications company. Our 6 strategic imperatives 1. Accelerate wireless 10 2. Leverage wireline momentum 12 3. Expand media leadership 14 4. Invest in broadband networks and services 16 5. Achieve a competitive cost structure 17 6. Improve customer service 18 Bell is delivering the next generation of communications and an enhanced service experience to our customers across Canada. In the last five years, our industry-leading investments in world-class networks and communications services like Fibe and LTE, coupled with strong execution by the national team, have re-energized Bell as a nimble competitor setting the pace in TV, Internet, Wireless and Media growth services. We achieved all financial targets in 2013, delivering for our customers and shareholders and giving us strong momentum going into 2014. Financial and operational highlights 4 Letters to shareholders 6 Strategic imperatives 10 Community investment 20 Bell archives 22 Management’s discussion and analysis (MD&A) 24 Reports on internal control 106 Consolidated financial statements 110 Notes to consolidated financial statements 114 WorldReginfo - 45aa5ca7-6679-44ab-8e49-81ca5bf5fe10 Successfully executing our strategic imperatives in a competitive marketplace, Bell achieved all 2013 financial targets and continued to deliver value to shareholders. -

An Introduction to Telecommunications Policy in Canada

Australian Journal of Telecommunications and the Digital Economy An Introduction to Telecommunications Policy in Canada Catherine Middleton Ryerson University Abstract: This paper provides an introduction to telecommunications policy in Canada, outlining the regulatory and legislative environment governing the provision of telecommunications services in the country and describing basic characteristics of its retail telecommunications services market. It was written in 2017 as one in a series of papers describing international telecommunications policies and markets published in the Australian Journal of Telecommunications and the Digital Economy in 2016 and 2017. Drawing primarily from regulatory and policy documents, the discussion focuses on broad trends, central policy objectives and major players involved in building and operating Canada’s telecommunications infrastructure. The paper is descriptive rather than evaluative, and does not offer an exhaustive discussion of all telecommunications policy issues, markets and providers in Canada. Keywords: Policy; Telecommunications; Canada Introduction In 2017, Canada’s population was estimated to be above 36.5 million people (Statistics Canada, 2017). Although Canada has a large land mass and low population density, more than 80% of Canadiansi live in urban areas, the majority in close proximity to the border with the United States (Central Intelligence Agency, 2017). Telecommunications services are easily accessible for most, but not all, Canadians. Those in lower-income brackets and/or living in rural and remote areas are less likely to subscribe to telecommunications services than people in urban areas or with higher incomes, and high-quality mobile and Internet services are simply not available in some parts of the country (CRTC, 2017a). On average, Canadian households spend more than $200 (CAD)ii per month to access mobile phone, Internet, television and landline phone services (2015 data, cited in CRTC, 2017a). -

BCE Inc. 2015 Annual Report

Leading the way in communications BCE INC. 2015 ANNUAL REPORT for 135 years BELL LEADERSHIP AND INNOVATION PAST, PRESENT AND FUTURE OUR GOAL For Bell to be recognized by customers as Canada’s leading communications company OUR STRATEGIC IMPERATIVES Invest in broadband networks and services 11 Accelerate wireless 12 Leverage wireline momentum 14 Expand media leadership 16 Improve customer service 18 Achieve a competitive cost structure 20 Bell is leading Canada’s broadband communications revolution, investing more than any other communications company in the fibre networks that carry advanced services, in the products and content that make the most of the power of those networks, and in the customer service that makes all of it accessible. Through the rigorous execution of our 6 Strategic Imperatives, we gained further ground in the marketplace and delivered financial results that enable us to continue to invest in growth services that now account for 81% of revenue. Financial and operational highlights 4 Letters to shareholders 6 Strategic imperatives 11 Community investment 22 Bell archives 24 Management’s discussion and analysis (MD&A) 28 Reports on internal control 112 Consolidated financial statements 116 Notes to consolidated financial statements 120 2 We have re-energized one of Canada’s most respected brands, transforming Bell into a competitive force in every communications segment. Achieving all our financial targets for 2015, we strengthened our financial position and continued to create value for shareholders. DELIVERING INCREASED