Bank of Baroda Speech

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wings Unfold ABBREVIATIONS

SBM HOLDINGS LTD Wings Unfold ABBREVIATIONS REFERENCE Also referred as: SBM Holdings Ltd including its subsidiaries SBM Group or The Group SBMH or The Holding Company or The Bank Investment Holding SBM Holdings Ltd Company SBM (Bank) Holdings Ltd including its subsidiaries SBM Bank Group SBM Bank (Mauritius) Ltd SBM Bank (Mauritius) Ltd or The Bank SBM (NBFC) Holdings Ltd including its subsidiaries SBM Non-Bank Group SBM (NFC) Holdings Ltd SBM Non-Financial Investment Holding Company Bank of Mauritius BOM Financial Services Commission FSC Reserve Bank of India RBI Wholly Owned Subsidiary WOS Special Purpose Vehicle SPV Basel Committee on Banking Supervision BCBS African Currency Unit AfCU Stock Exchange of Mauritius SEM Capital Adequacy Ratio CAR Caution regarding forward-looking statements Within this report, SBM Holdings Ltd (SBMH) has made various forward-looking statements with respect to its financial position, business strategy and objectives of management. Such forward-looking statements are identified by the use of words such as ‘expects’, ‘estimates’, ‘anticipates’, ‘believes’, ‘intends’, ‘plans’, ‘forecasts’, ‘projects’ or words or phrases of a similar nature. By their nature, forward-looking statements require SBMH to make assumptions and are subject to inherent risks and uncertainties. There is a significant risk that predictions and other forward-looking statements may not prove to be accurate. Readers of this report are thus cautioned not to place undue reliance on forward-looking statements as a number of factors could cause -

1 Executive Summary Mauritius Is an Upper Middle-Income Island Nation

Executive Summary Mauritius is an upper middle-income island nation of 1.2 million people and one of the most competitive, stable, and successful economies in Africa, with a Gross Domestic Product (GDP) of USD 11.9 billion and per capita GDP of over USD 9,000. Mauritius’ small land area of only 2,040 square kilometers understates its importance to the Indian Ocean region as it controls an Exclusive Economic Zone of more than 2 million square kilometers, one of the largest in the world. Emerging from the British colonial period in 1968 with a monoculture economy based on sugar production, Mauritius has since successfully diversified its economy into manufacturing and services, with a vibrant export sector focused on textiles, apparel, and jewelry as well as a growing, modern, and well-regulated offshore financial sector. Recently, the government of Mauritius has focused its attention on opportunities in three areas: serving as a platform for investment into Africa, moving the country towards renewable sources of energy, and developing economic activity related to the country’s vast oceanic resources. Mauritius actively seeks investment and seeks to service investment in the region, having signed more than forty Double Taxation Avoidance Agreements and maintaining a legal and regulatory framework that keeps Mauritius highly-ranked on “ease of doing business” and good governance indices. 1. Openness To, and Restrictions Upon, Foreign Investment Attitude Toward FDI Mauritius actively seeks and prides itself on being open to foreign investment. According to the World Bank report “Investing Across Borders,” Mauritius has one of the world’s most open economies to foreign ownership and is one of the highest recipients of FDI per capita. -

State Bank of Mauritius (Sbm) Holdings Limited Analysis: Is Investors Cash Safe with Sbm?

STATE BANK OF MAURITIUS (SBM) HOLDINGS LIMITED ANALYSIS: IS INVESTORS CASH SAFE WITH SBM? January 2018 i List of Abbreviations: BOM – Bank of Mauritius CBK – Central bank of Kenya EOI – Expression of Interest KDIC – Kenya Deposit Insurance Corporation Kes – Kenya Shillings NAV – Net Assets Value SEMTRI - Stock Exchange of Mauritius Total Return Index SEM – Stock Exchange of Mauritius SBM – State bank of Mauritius ROE – Return on Equity USD – United States Dollar ii Table of Contents Executive Summary ........................................................ 1 Bank Overview.............................................................. 2 Ownership and Governance .............................................. 2 Corporate Governance .................................................... 3 SBM Stock Performance ................................................... 5 SBMH Acquisition of Fidelity Commercial Bank (Kenya) ............. 5 SBM Financial Performance ............................................... 6 SBM Holding Comparison with some selected Kenyan Banks ........ 9 SBM’s Binding Offer on Chase Bank ................................... 10 Chase Bank Acquisition Terms ......................................... 10 Fusion’s View on the terms of this deal .............................. 11 Fusion’s View on SBM Bank acquiring Chase Bank .................. 12 iii Executive Summary SBM Holdings ‘SBM’ was founded in 1973 by the Government of Mauritius and was listed in the Stock Exchange of Mauritius ‘SEM’ in 1995. The Bank is engaged in banking, non-banking -

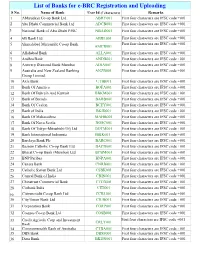

List of Bank Names

List of Banks for e-BRC Registration and Uploading S No. Name of Bank User Id (7 characters) Remarks 1 Abhyudaya Co-op Bank Ltd ABHY001 First four characters are IFSC code +001 2 Abu Dhabi Commercial Bank Ltd ADCB001 First four characters are IFSC code +001 3 National Bank of Abu Dhabi PJSC NBAD001 First four characters are IFSC code +001 4 AB Bank Ltd. ABBL001 First four characters are IFSC code +001 5 Ahmedabad Mercantile Co-op Bank First four characters are IFSC code +001 AMCB001 6 Allahabad Bank ALLA001 First four characters are IFSC code +001 7 Andhra Bank ANDB001 First four characters are IFSC code +001 8 Antwerp Diamond Bank Mumbai ADIA001 First four characters are IFSC code +001 9 Australia and New Zealand Banking ANZB001 First four characters are IFSC code +001 Group Limited 10 Axis Bank UTIB001 First four characters are IFSC code +001 11 Bank Of America BOFA001 First four characters are IFSC code +001 12 Bank Of Bahrain And Kuwait BBKM001 First four characters are IFSC code +001 13 Bank of Baroda BARB001 First four characters are IFSC code +001 14 Bank Of Ceylon BCEY001 First four characters are IFSC code +001 15 Bank of India BKID001 First four characters are IFSC code +001 16 Bank Of Maharashtra MAHB001 First four characters are IFSC code +001 Bank Of Nova Scotia NOSC001 First four characters are IFSC code +001 17 18 Bank Of Tokyo-Mitsubishi Ufj Ltd BOTM001 First four characters are IFSC code +001 19 Bank Internasional Indonesia IBBK001 First four characters are IFSC code +001 20 Barclays Bank Plc BARC001 First four characters -

List of Bank Names

List of Banks for e-BRC Registration and Uploading S No. Name of Bank User Id (7 characters) Remarks 1 Abhyudaya Co-op Bank Ltd ABHY001 First four characters are IFSC code +001 2 Abu Dhabi Commercial Bank Ltd ADCB001 First four characters are IFSC code +001 3 National Bank of Abu Dhabi PJSC NBAD001 First four characters are IFSC code +001 4 AB Bank Ltd. ABBL001 First four characters are IFSC code +001 5 Ahmedabad Mercantile Co-op Bank First four characters are IFSC code +001 AMCB001 6 Allahabad Bank ALLA001 First four characters are IFSC code +001 7 Andhra Bank ANDB001 First four characters are IFSC code +001 8 Antwerp Diamond Bank Mumbai ADIA001 First four characters are IFSC code +001 9 Australia and New Zealand Banking ANZB001 First four characters are IFSC code +001 Group Limited 10 Axis Bank UTIB001 First four characters are IFSC code +001 11 Bank Of America BOFA001 First four characters are IFSC code +001 12 Bank Of Bahrain And Kuwait BBKM001 First four characters are IFSC code +001 13 Bank of Baroda BARB001 First four characters are IFSC code +001 14 Bank Of Ceylon BCEY001 First four characters are IFSC code +001 15 Bank of India BKID001 First four characters are IFSC code +001 16 Bank Of Maharashtra MAHB001 First four characters are IFSC code +001 17 Bank Of Nova Scotia NOSC001 First four characters are IFSC code +001 18 Bank Of Tokyo-Mitsubishi Ufj Ltd BOTM001 First four characters are IFSC code +001 19 Bank Internasional Indonesia IBBK001 First four characters are IFSC code +001 20 Barclays Bank Plc BARC001 First four characters -

March Current Affairs

1 March Current Affairs 1. Name the 2021 United Nations World Water 5) Manikarnika: The Queen of Jhansi Development Report, that reported on the Answer- 2) Marakkar: Arabikadalinte Simham decreasing per capita water capacity in the world’s reservoirs? 4. Which organisation recorded India’s 1st successful demonstration of free-space Quantum 1) Leaving no one behind Communication over a distance of 300m? 2) Valuing Water 1) DRDO s 3) Nature for Water 2) IISC, Bangalore 4) Water and Climate Change 3) ISRO 5) Wastewater 4) IIT-Madras e Answer- 2) Valuing Water 5) IIT-Delhi According to the 2021 edition of the United Nations Answer- 3) ISRO World Water Development Report (UN WWDR 2021) For the 1st time in India, Indian Space Research titled ‘Valuing Water’, Each person on the planet s Organisation (ISRO) successfully demonstrated may have to live on less Water as the per capita reservoir free-space Quantum Communication over a distance of capacity is decreasing. 300 Metres. The free-space QKD (Quantum Key • The World population is set to increase to 9 Billion s Distribution) was demonstrated at Space Applications by 2040, but the projected reservoir volume is Centre (SAC), Ahmedabad, Gujarat. It is a major stabilising around 7, 000 billion cubic metre. milestone achievement for unconditionally secured • This report was published by the United Nations satellite dataa communication using quantum Educational, Scientific, and Cultural Organization technologies.l (UNESCO) on behalf of UN-Water. 5. When is the World Tuberculosis Day annually 2. In March 2021, SEBI amended the valuation rule of observed by the World Health Organisation (WHO)? Perpetual Bonds. -

Key Financial Indicators

Key financial indicators ---------------------------Restateda----------------------------- 2006 2005 2004 2003 2002 Earnings per Share (Cents) 406 366 346 284 262 Net Income before Tax (Rs M) 1,524 1,489 1,360 1,176 1,022 Net Income available to Shareholders (Rs M) 1,319 1,191 1,127 1,018 952 Economic Value Added (Rs M) 392 304 338 286 247 Capital to Risk Weighted Assets (%)b 20.77 21.78 17.79 18.16 20.55 Return on Average Risk Weighted Assets (%)c 4.22 4.01 4.11 4.23 4.46 Return on Average Assets (%)d 2.61 2.64 2.90 2.93 2.94 Return on Average Shareholders’ Funds (%)d 15.62 15.45 19.29 19.65 20.31 Return on Average Tier 1 Capital (%)d 22.36 22.41 24.13 20.29 21.34 Risk Adjusted Return on Capital (RAROC) (%)e 41.38 39.37 39.87 N/A N/A Cost to Income (%)f 41.11 38.91 40.15 39.17 38.24 Cost to Income excluding depreciation (%)f 30.94 28.55 31.55 28.88 27.01 Electronic to Total Transactions (%) 83.00 82.00 80.00 76.00 72.00 a Restated wherever applicable for comparative purposes. b Capital adequacy is computed as per regulatory requirement, based on credit as well as operational risks of the Group in line with Basel II Accord. c Average Risk Weighted Assets are calculated using year end balances. d Averages are based on daily balances as from 2003. 2002 average is based on monthly balances. -

Current Affairs August-2018 National News

CURRENT AFFAIRS AUGUST-2018 Visit us @ Sehpaathi.in NATIONAL NEWS To showcase Buddhist Heritage in India and boost tourism to the Buddhist sites, the International Buddhist Conclave was inaugurated by President Ram Nath Kovind in New Delhi. theme: - 'Buddha Path – The Living Heritage'. The Centre unveiled The Draft International Air Connectivity (IAC) scheme, for extending the affordable air travel programme UDAN to international circuits. The Food Safety and Standards Authority of India (FSSAI) constituted B Sesikeran Committee to Review Food Labelling Standards AIBD India has been elected as the President of the Asia-Pacific Institute for Broadcasting Development (AIBD) for two years. To create awareness about Intellectual Property Rights (IPRs), Commerce and Industry Minister Suresh Prabhu launched logo and tagline for Geographical Indications (GI) GI tag: Invaluable Treasures of Incredible India Government Approves 122 New Research Projects Under ‘IMPRINT-2’ Scheme to advance research in energy, security and healthcare domains in the high education institutions. Committee Formed to Address Issues of Stressed Thermal Power Projects headed by Cabinet Secretary, Pradeep Kumar Sinha. 2nd Conference of Young Superintendent of Police held in New Delhi, Theme: “Predictive Policing and Contemporary Challenges for Indian Police Forces”. Union Government Provides Rs 66,000 crore green funds to increase the country’s forest cover. For monitoring the rejuvenation project of Ganga, National Green Tribunal constituted a committee headed by former Allahabad High Court judge. Under the Impacting Research Innovation and Technology ‘IMPRINT-2’ scheme, Government has approved 122 new research projects of 112 crore rupees. 1 CURRENT AFFAIRS AUGUST-2018 Visit us @ Sehpaathi.in NITI Aayog Identified 117 Districts as Aspirational Districts for ashtriya Uchchatar Shiksha Abhiyan (RUSA) Scheme. -

FOREX ASSOCIATION of INDIA (Affiliated to ACI) 55-C, 5Th Floor, Mittal Tower, C Wing, Nariman Point, Mumbai - 400 021

FOREX ASSOCIATION OF INDIA (Affiliated to ACI) 55-C, 5th Floor, Mittal Tower, C Wing, Nariman Point, Mumbai - 400 021. FOREWORD At the outset, we thank the Forex Fraternity for their unstinted co-operation in all endeavours of Forex Association of India. We are delighted to bring out the “Dealing Room Directory - 2012.” The earlier edition of the directory was brought out in 2010. The Directory contains among other things, present address of the dealing rooms, names of the dealers, the telephone numbers etc. We place the directory in the hands of the “Forex Dealers”, who are associated with movement of “Foreign Exchange” of the country day in and day out. We hope the directory will be of immense help to all the Forex Dealers. While we have made all out efforts to provide error free and updated details of the member banks and dealers, members are requested to bring to the notice of the Managing Committee any errors/printing mistakes which could be communicated to the members through e-mail. The Managing Committee of Forex Association of India appreciates the efforts put in by some dealers and brokers in bringing out this directory. We also welcome suggestions, if any, for further improvement of future editions of the directory. Sanjay Grover B. Raghavendra Rao Secretary Chairman Asst. General Manager & Asst. General Manager & Chief Dealer Chief Dealer Bank of Baroda State Bank of India MANAGING COMMITTEE OF THE FOREX ASSOCIATION OF INDIA (2011-2012) Position Name Bank Phone Chairman Mr. B. Raghavendra Rao State Bank of India 2289 1401 [email protected] Vice Chairman Mr. -

Bank of Mauritius. Offshore Accounts in Mauritius

Private Banking Mauritius has a developed banking sector, has 11 domestic and 12 offshore banks. Of the 11 domestic banks five - local, but two - are owned by foreign capital, but are registered on the island. T he remaining four banks are branches of foreign banks. Two Mauritian banks, namely: Mauritius Commercial Bank Limited. and State Bank of Mauritius Ltd s. cover about 75% of the market. Both banks are among the ten largest banks in Africa. Among the major foreign banks in Mauritius include EychEsBiSi and Barclays Bank. S Bank of Mauritius, the Central Bank, supervise and regulate banks and nonbank financial institutions authorized to accept deposits. Banks are engaged in, mainly trade financing and provision of working capital. Account be opened in all major currencies, as well as in Mauritian rupees. Several commercial banks offer debit and credit cards for payment and direct debit accounts. Other banks have established a banking over the phone, online banking at home, on the Internet and using a personal computer. Commercial banks offer deals "spot" and "forward" in all major currencies. A number of commercial banks expanded their activities to non-banking operations, which they exercise through its subsidiaries and affiliates. Banks engaged in the provision of leasing, brokerage on the stock market, asset management and funds, investment and private banking, insurance, portfolio management and deposit of valuables. As of October 2004 the aggregate amount of assets of commercial banks amounted to nearly 6.2 billion U.S. dollars. Bank of Mauritius started licensing offshore banks in the early 1990's. -

Good Luck with Your Exams!!!

Current Affairs Q&A PDF Current Affairs Questions &Answer PDF 2018 AffairsCloud Recommends Oliveboard Mock Test IBPS PO Prelims 2018: Take 20 Tests, 3 Free IBPS RRB Assistant 2018: Take 40 Tests, 1 Free IBPS RRB Officer Scale I 2018: Take 40 Tests, 1 Free RBI Grade B 2018: Take 10 Phase I + 25 Phase II Tests, 1 Free Indian Bank PO 2018: Take 15 Tests, 1 Free NIACL Assistant 2018: Take 20 Tests, 1 Free SSC CGL 2018: 50 Tests (30 Tier I + 20 Tier II) Good Luck with Your Exams!!! Suggestions are welcomed; Contact us any time at [email protected] If You Satisfied with our Content mean kindly donate some amount to BoscoBan.org (Facebook.com/boscobengaluru ) or Kindly Suggest this site to your family members & friends !!! -------------- > http://boscoban.org/page/donate/ Try WPS Office + PDF APP Reader for Mobile 1 | Page Follow Us - FB.com/AffairsCloudOfficialPage Copyright 2018 @ AffairsCloud.Com Current Affairs Q&A PDF Current Affairs Q&A PDF August 2018 1. On August 1,2018, the Union Cabinet, chaired by Prime Minister Narendra Modi, cleared the purchase of 51 % controlling stake in IDBI bank by which entity? 1.Life Insurance Corporation (LIC) 2.State Bank of India 3.Reserve Bank of India 4.Aditya Birla Insurance 5.None of these Answer - 1.Life Insurance Corporation (LIC) Explanation: On August 1,2018, The Union Cabinet, chaired by Prime Minister Narendra Modi , cleared the purchase of 51 per cent controlling stake in IDBI bank by state-run insurer Life Insurance Corporation (LIC). According to the deal the bank will get Rs 10,000 crore to Rs 13,000 crore depending on the share price. -

Foreign Banks

Foreign Banks Sr No Bank's Name Address City State Citi India, Citi Centre, First International Financial Centre,Bandra Kurla 1 CITI BANK Mumbai Maharashtra Complex, Bandra East, The Royal Bank of Scotland N.V. “Brady House”, 14, Veer Nariman Road, 2 NatWest Markets Plc Mumbai Maharashtra Fort BANK OF AMERICA, NATIONAL 3 ‘A’ Wing, One BKC, ‘G’ Block, Bandra-Kurla Complex, Bandra-East, Mumbai Maharashtra ASSOCIATION. BNP Paribas House, 1 North Avenue, Maker Maxity, Bandra Kurla Complex, 4 B N P PARIBAS Mumbai Maharashtra Bandra East, 5 SONALI BANK LIMITED WATCHEL MOLLA BUILDING, 1ST FLOOR, 8, LENIN SARANI Kolkata West Bengal 14-15TH FLOOR, THE CAPITAL, PLOT NOE. C-70, BANDRA KURLA 6 DEUTSCHE BANK (ASIA) Mumbai Maharashtra COMPLEX, BANDRA (EAST). 7 ABU DHABI COMMERCIAL BANK LTD. 75, Rehmat Manzil, Veer Nariman Road, Churchgate Mumbai Maharashtra 8 MASHREQ BANK LTD Mashreq bank, 1305 Raheja Centre , Free press journal Marg, Nariman Point Mumbai Maharashtra CREDIT AGRICOLE CORPORATE AND 9 11th, 12th & 14th Floor, Hoechst House, Nariman Point, Mumbai Maharashtra INVESTMENT BANK 10 THE HSBC LTD. 52/60 M.G Road, P.O. Box 128, Fort, Mumbai- 400 001 Mumbai Maharashtra B-Wing, Mittal Tower, Ground Floor, Nariman Point, Mumbai, Maharashtra, 11 THE BANK OF NOVA SCOTIA Mumbai Maharashtra India - 400021 19th Floor, Peninsula Business Park, 12 SOCIETE GENERALE PARIS(FRANCE) Mumbai Maharashtra Tower A, G. K. Marg, Lower Parel, BANK OF BAHRAIN AND KUWAIT B.S.C JOLLY MAKER CHAMBERS 13 BANK OF BAHRAIN AND KUWAIT B. S. C Mumbai Maharashtra II,GROUND FLOOR, 225, NARIMAN POINT, 14 BARCLAYS BANK P.