US 2018 Resolution Plan Section 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kabushiki Kaisha Mizuho Financial Group Mizuho Financial Group, Inc. Japan

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2010 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 001-33098 Kabushiki Kaisha Mizuho Financial Group (Exact name of Registrant as specified in its charter) Mizuho Financial Group, Inc. (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 5-1, Marunouchi 2-chome Chiyoda-ku, Tokyo 100-8333 Japan (Address of principal executive offices) Tatsuya Yamada, +81-3-5224-1111, +81-3-5224-1059, address is same as above (Name, Telephone, Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered Common Stock, without par value The New York Stock Exchange* American depositary shares, each of which represents two shares of The New York Stock Exchange common stock Securities registered or to be registered pursuant to Section 12(g) of the Act. None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

Integrated Report –Annual Review– Integrated Report 2017 –Annual Review– April 2016 – March 2017 Our Corporate Philosophy

Mizuho Financial Group Mizuho Financial Group | 2017 Integrated Report –Annual Review– Integrated Report 2017 –Annual Review– April 2016 – March 2017 Our Corporate Philosophy Mizuho, the leading Japanese financial services group with a global presence and a broad customer base, is committed to: Providing customers worldwide with the highest quality financial services with honesty and integrity; Anticipating new trends on the world stage; Expanding our knowledge in order to help customers shape their future; Growing together with our customers in a stable and sustainable manner; and Bringing together our group–wide expertise to contribute to the prosperity of economies and societies throughout the world. These fundamental commitments support our primary role in bringing fruitfulness for each customer and the economies and the societies in which we operate. Mizuho creates lasting value. It is what makes us invaluable. Corporate Philosophy: Mizuho’s The Mizuho Values fundamental approach to business Customer First: activities, based on the The most trusted partner lighting raison d’etre of Mizuho the future Innovative Spirit: Vision: Progressive and flexible thinking Mizuho’s vision for Mizuho’s Corporate Identity Mizuho’s the future, realized Team Spirit: through the practice of Diversity and collective strength “Corporate Philosophy” Speed: Acuity and promptness The Mizuho Values: The shared values and principles of Passion: Mizuho’s people, uniting all executives and Communication and challenge for employees together to pursue “Vision” the future 1 Mizuho Financial Group The most trusted financial services group with a global presence and a broad customer base, contributing to the prosperity of the world, Asia, and Japan 2017 Integrated Report 2 Editorial Policy Contents This Integrated Report includes financial information as well as non-financial information on such subjects as ESG. -

Country Financial Institutions Swift Rma

LIST OF RMA EXCHANGED (DANH SÁCH NGÂN HÀNG TRAO ĐỔI RMA) COUNTRY FINANCIAL INSTITUTIONS SWIFT RMA Wells Fargo Bank, N.A, New York International 1 Branch PNBPUS3N 2 Wells Fargo Bank, N.A PNBPUS33 3 Wells Fargo Bank, N.A WFBIUS6W 4 JPMorgan Chase Bank, N.A CHASUS33 5 CitiBank, N.A CITIUS33 6 Woori America Bank HVBKUS3N 7 Woori America Bank, Los Angeles HVBKUS61 8 International Finance Corporate IFCWUS33 United States 9 Industrial & Commercial Bank of China ICBKUS33 10 Shinhan Bank SHBKUS33 11 First Bank FBOLUS6L 12 Bank of Tokyo-Mitsubishi UFJ, LTD, NY Branch BOTKUS33 13 Bank of Tokyo-Mitsubishi UFJ, LTD, Chicago Branch BOTKUS4C Bank of Tokyo-Mitsubishi UFJ, LTD, Los Angeles 14 Branch BOTKUS6L 15 UniCredit S.P.A UNCRITMM 16 CitiBank, N.A CITIITMX 17 Intesa Sanpaolo SPA Head Office BCITITMM 20 Commerzbank AG COBAITMM ITALY Industrial & Commercial Bank of China, Milan 21 Branch ICBKITMM 22 Bank of Tokyo-Mitsubishi UFJ, LTD, Milan Branch BOTKITMX Unicredit Bank AG Singapore Branch 23 (HypoVereinsBank AG Singapore Branch) BVBESGSG 24 United Overseas Bank Ltd. Head Office UOVBSGSG 25 JPMorgan Chase Bank, N.A. Singapore Branch CHASSGSG 26 SINGAPORE Bank of Tokyo-Mitsubishi UFJ, LTD, Singapore BranchBOTKSGSX Skandinaviska Enskilda Banken AB (PUBL). 27 Singapore Branch ESSESGSG 28 Mizuho Bank, Ltd. Singapore Branch MHCBSGSG 29 CitiBank, N.A. Singapore Branch CITISGSG 30 Industrial & Commercial Bank of China, Singapore BranchICBKSGSG 31 Deutsche Bank AG DEUTDEFF 32 BHF-BANK Aktiengesellschaft BHFBDEFF GERMANY 33 Landesbank Baden-Wuerttemberg SOLADEST -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Stif-I Q4 2020

Coupon Units Cost Market Value SHORT TERM INVESTMENT FUND-I Domestic Fixed Income Securities 15.99% Domestic Corporate & Other Bonds AMERICAN CREDIT ACCEP 3 A 144A 0.6200 42,183 42,183 42,232 AMERICAN HONDA FINANCE CORP 0.4236 85,460 85,533 85,480 AMERICAN HONDA FINANCE CORP 0.3286 54,694 54,694 54,723 AMERICREDIT AUTOMOBILE RE 3 A2 0.4200 27,347 27,346 27,376 APPLE INC 2.5000 110,073 109,953 112,578 BANK OF AMERICA CORP 5.8750 136,736 140,191 136,736 CATERPILLAR FINANCIAL SERVICES 0.4465 102,552 102,682 102,584 CATERPILLAR FINANCIAL SERVICES 0.4136 54,421 54,510 54,496 CISCO SYSTEMS INC 1.8500 115,542 112,721 116,707 CPS AUTO RECEIVABLES C A 144A 0.6300 42,202 42,200 42,242 DT AUTO OWNER TRUST 3A A 144A 0.5400 50,582 50,581 50,674 DUKE ENERGY PROGRESS LLC 0.4004 58,113 58,113 58,123 ENTERPRISE FLEET FIN 2 A1 144A 0.2399 62,000 62,000 62,002 ENTERPRISE FLEET FIN 3 A2 144A 2.0600 81,499 82,929 82,870 EXETER AUTOMOBILE RECEIV 3A A1 0.2183 694 694 694 FLAGSHIP CREDIT AUTO 3 A 144A 0.7000 22,958 22,956 22,982 FLAGSHIP CREDIT AUTO 4 A 144A 0.5300 95,666 95,663 95,733 FORD CREDIT AUTO OWNER T C A2A 1.8800 18,939 18,937 19,010 FORD CREDIT AUTO OWNER TR C A1 0.1744 53,228 53,228 53,223 FORD CREDIT AUTO OWNER TR C A2 0.2500 15,725 15,724 15,730 GLS AUTO RECEIVABLES 4A A 144A 0.5200 54,011 54,010 54,029 GM FINANCIAL AUTOMOBILE L 3 A1 0.1781 43,244 43,244 43,244 GM FINANCIAL CONSUMER AUT 4 A1 0.1854 34,234 34,234 34,234 HONDA AUTO RECEIVABLES 20 3 A1 0.1888 50,372 50,372 50,372 HONDA AUTO RECEIVABLES 20 4 A2 1.8600 57,124 57,120 57,418 HUNTINGTON -

Nber Working Paper Series Did Mergers Help Japanese

NBER WORKING PAPER SERIES DID MERGERS HELP JAPANESE MEGA-BANKS AVOID FAILURE? ANALYSIS OF THE DISTANCE TO DEFAULT OF BANKS Kimie Harada Takatoshi Ito Working Paper 14518 http://www.nber.org/papers/w14518 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 December 2008 The paper started as a joint project with Dr. Kelly Wang when she was Assistant Professor at University of Tokyo. The authors are grateful to her for her help in providing us with computer programs and in discussion the ways to apply her methods to the Japanese banking data. Upon Dr. Wang's departure from the University of Tokyo, the project was carried on by the current two authors with full consent from Dr. Wang. The current two authors take responsibility for any remaining errors. Mr. Shuhei Takahashi provided us with superb research assistance. We are grateful for financial support from Nomura foundation for social science and Chuo University for Special Research. We are also grateful for helpful discussions with Masaya Sakuragawa, Naohiko Baba, Satoshi Koibuchi, Woo Joong Kim, Joe Peek, Kazuo Kato and for insigutful comments from participants in Asia pacific Economic Association in Hong Kong in 2007, Japan Economic Association in 2008, NBER Japan Group Meeting in 2008 and Asian FA-NFA 2008 International Conference. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. -

Changes of Directors and Executive Officers

March 22, 2021 Mizuho Financial Group, Inc. Changes of Directors and Executive Officers Mizuho Financial Group, Inc. hereby announces changes of Member of the Board of Directors and Executive Officers (including changes in their areas of responsibility, etc.) of the following entities within the Group : Mizuho Financial Group, Inc. (MHFG) Mizuho Bank, Ltd. (MHBK) Mizuho Trust & Banking Co., Ltd. (MHTB) Mizuho Securities Co., Ltd. (MHSC) Mizuho Research & Technologies, Ltd. (MHRT) 1 Contents Mizuho Financial Group, Inc. (MHFG) .......................................................................................................... 3 1. Changes of Member of the Board of Directors ..................................................................................... 3 2. Changes of Executive Officers .............................................................................................................. 3 3. Directors and Executive Officers as of April 1, 2021 .......................................................................... 5 Mizuho Bank, Ltd. (MHBK) ............................................................................................................................ 8 1. Changes of Directors and Executive Officers ...................................................................................... 8 2. Directors and Executive Officers as of April 1, 2021 ......................................................................... 12 Mizuho Trust & Banking Co., Ltd. (MHTB) ............................................................................................... -

Corporate Venturing Report 2019

Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. Tobias Gutmann [email protected] https://www.corporateventuringresearch.org/ LEGAL DISCLAIMER Post-Doctoral Researcher Dr. Ing. h.c. F. Porsche AG Chair of Strategic Management and Digital Entrepreneurship The information contained herein is for the prospects of specific companies. While HHL Leipzig Graduate School of Management, Germany general guidance on matters of interest, and every attempt has been made to ensure that intended for the personal use of the reader the information contained in this report has only. The analyses and conclusions are been obtained and arranged with due care, Christian Lindener based on publicly available information, Wayra is not responsible for any Pitchbook, CBInsights and information inaccuracies, errors or omissions contained [email protected] provided in the course of recent surveys in or relating to, this information. No Managing Director with a sample of startups and corporate information herein may be replicated Wayra Germany firms. without prior consent by Wayra. Wayra Germany GmbH (“Wayra”) accepts no Wayra Germany GmbH liability for any actions taken as response Kaufingerstraße 15 hereto. -

Western Asset Premier Institutional Liquid Reserves

Western Asset Premier Institutional Liquid Reserves As of: Aug-31-2021 Weighted Average Maturity: 52 days Weighted Average Life: 68 days Net Assets: $9,479,393,258 % of Net Principal Amount Securities Description Rate CUSIP Value Assets Effective Maturity* Final Maturity Rule-2a-7 Category of Investment Certificate of Deposit 185,000,000 SUMITOMO MITSUI TRUST BANK LTD/ NEW YORK 0.07% 86564GQ95 185,000,000.00 1.95% 2021-09-07 2021-09-07 Certificate of Deposit 159,000,000 MUFG BANK LTD/NY 0.07% 55380TNH9 159,034,180.23 1.68% 2021-10-14 2021-10-14 Certificate of Deposit 150,000,000 STANDARD CHARTERED BANK 0.21% 85325VN30 150,003,388.50 1.58% 2022-06-08 2022-06-08 Certificate of Deposit 150,000,000 DNB NOR BANK ASA NY 0.07% 23344NFC5 149,999,958.00 1.58% 2021-09-02 2021-09-02 Certificate of Deposit 130,000,000 NATIXIS SA/NEW YORK NY 0.14% 63873QMF8 130,035,635.60 1.37% 2021-10-05 2022-01-05 Certificate of Deposit 125,000,000 MIZUHO BANK LTD/NY 0.07% 60710AXN7 125,037,973.75 1.32% 2021-11-03 2021-11-03 Certificate of Deposit 115,000,000 KBC BANK NV NY 0.06% 4823TCC27 115,000,000.00 1.21% 2021-09-07 2021-09-07 Certificate of Deposit 100,000,000 CREDIT SUISSE NEW YORK 0.23% 22552G3W8 100,025,993.00 1.06% 2022-05-27 2022-05-27 Certificate of Deposit 100,000,000 NORINCHUKIN BANK NY 0.15% 65602YJZ4 100,017,755.00 1.06% 2022-02-25 2022-02-25 Certificate of Deposit 100,000,000 BANK OF MONTREAL CHICAGO 0.19% 06367CJG3 100,014,384.00 1.06% 2022-07-22 2022-07-22 Certificate of Deposit 100,000,000 LLOYDS BANK CORP MARKETS 0.22% 53947CM70 100,010,683.00 -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

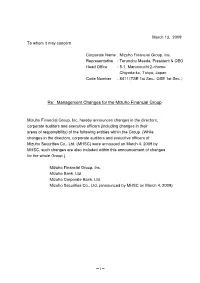

Re: Management Changes for the Mizuho Financial Group

March 13, 2009 To whom it may concern Corporate Name : Mizuho Financial Group, Inc. Representative : Terunobu Maeda, President & CEO Head Office : 5-1, Marunouchi 2-chome Chiyoda-ku, Tokyo, Japan Code Number : 8411(TSE 1st Sec., OSE 1st Sec.) Re: Management Changes for the Mizuho Financial Group Mizuho Financial Group, Inc. hereby announces changes in the directors, corporate auditors and executive officers (including changes in their areas of responsibility) of the following entities within the Group. (While changes in the directors, corporate auditors and executive officers of Mizuho Securities Co., Ltd. (MHSC) were annouced on March 4, 2009 by MHSC, such changes are also included within this announcement of changes for the whole Group.) Mizuho Financial Group, Inc. Mizuho Bank, Ltd. Mizuho Corporate Bank, Ltd. Mizuho Securities Co., Ltd. (announced by MHSC on March 4, 2009) -1- 【Mizuho Financial Group, Inc. (MHFG)】 Name New Position (effective as of April 1, 2009) Current Position Mr. Shin Executive Officer General Manager of Kuranaka General Manager of Human Resources Human Resources Mr. Hiroshi Executive Officer General Manager for Corporate Planning Iwamoto Mizuho Research Institute, Ltd. Mizuho Research Institute, Ltd. Managing Executive Officer Chief Economist Mr. Masakane Executive Officer General Manager of Koike General Manager of Financial Planning Financial Planning Mr. Masanori Retired Executive Officer Murakami General Manager of Corporate Communications -2- 【Executive Officer Appointees】 Name Shin Kuranaka Date of Birth Oct. 5, 1957 Education Mar. 1981 Graduated from Faculty of Economics, Kyoto University Business Experience Apr. 1981 Joined The Industrial Bank of Japan, Limited Joint General Manager of Human Resources Division of Mizuho Corporate Bank, Ltd. -

Mizuho Securities USA LLC Consolidated Statement of Financial Condition

Mizuho Securities USA LLC Consolidated Statement of Financial Condition March 31, 2020 With Report of Independent Registered Public Accounting Firm UNITED STATES OMB APPROVAL SECURITIES AND EXCHANGE COMMISSION OMB Number: 3235-0123 Washington, D.C. 20549 Expi res: August 31, 2020 Estimated average burden ANNUAL AUDITED REPORT hours per response.. 12.00 FORM X-17A-5 SEC FILE NUMBER PART III 8-37710 FACING PAGE Information Required of Brokers and Dealers Pursuant to Section 17 of the Securities Exchange Act of 1934 and Rule 17a-5 Thereunder REPORT FOR THE PERIOD BEGINNING______________________________04/01/2019 AND ENDING______________________________03/31/2020 MM/DD/YY MM/DD/YY A. REGISTRANT IDENTIFICATION NAME OF BROKER-DEALER: Mizuho Securities USA LLC OFFICIAL USE ONLY ADDRESS OF PRINCIPAL PLACE OF BUSINESS: (Do not use P.O. Box No.) FIRM I.D. NO. ___________________________________________________________________________________________________________________1271 Avenue of the Americas (No. and Street) New York New Yor ______________________________________________________________________________________________________k 10020 (City) (State) (Zip Code) NAME AND TELEPHONE NUMBER OF PERSON TO CONTACT IN REGARD TO THIS REPORT _____________________________________________________________________________________________________________________ David Kronenberg (212) 209 - 9499 (Area Code – Telephone Number) B. ACCOUNTANT IDENTIFICATION INDEPENDENT PUBLIC ACCOUNTANT whose opinion is contained in this Report* _____________________________________________________________________________________________________________________Ernst