March 31, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kabushiki Kaisha Mizuho Financial Group Mizuho Financial Group, Inc. Japan

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2010 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 001-33098 Kabushiki Kaisha Mizuho Financial Group (Exact name of Registrant as specified in its charter) Mizuho Financial Group, Inc. (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 5-1, Marunouchi 2-chome Chiyoda-ku, Tokyo 100-8333 Japan (Address of principal executive offices) Tatsuya Yamada, +81-3-5224-1111, +81-3-5224-1059, address is same as above (Name, Telephone, Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered Common Stock, without par value The New York Stock Exchange* American depositary shares, each of which represents two shares of The New York Stock Exchange common stock Securities registered or to be registered pursuant to Section 12(g) of the Act. None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

Integrated Report –Annual Review– Integrated Report 2017 –Annual Review– April 2016 – March 2017 Our Corporate Philosophy

Mizuho Financial Group Mizuho Financial Group | 2017 Integrated Report –Annual Review– Integrated Report 2017 –Annual Review– April 2016 – March 2017 Our Corporate Philosophy Mizuho, the leading Japanese financial services group with a global presence and a broad customer base, is committed to: Providing customers worldwide with the highest quality financial services with honesty and integrity; Anticipating new trends on the world stage; Expanding our knowledge in order to help customers shape their future; Growing together with our customers in a stable and sustainable manner; and Bringing together our group–wide expertise to contribute to the prosperity of economies and societies throughout the world. These fundamental commitments support our primary role in bringing fruitfulness for each customer and the economies and the societies in which we operate. Mizuho creates lasting value. It is what makes us invaluable. Corporate Philosophy: Mizuho’s The Mizuho Values fundamental approach to business Customer First: activities, based on the The most trusted partner lighting raison d’etre of Mizuho the future Innovative Spirit: Vision: Progressive and flexible thinking Mizuho’s vision for Mizuho’s Corporate Identity Mizuho’s the future, realized Team Spirit: through the practice of Diversity and collective strength “Corporate Philosophy” Speed: Acuity and promptness The Mizuho Values: The shared values and principles of Passion: Mizuho’s people, uniting all executives and Communication and challenge for employees together to pursue “Vision” the future 1 Mizuho Financial Group The most trusted financial services group with a global presence and a broad customer base, contributing to the prosperity of the world, Asia, and Japan 2017 Integrated Report 2 Editorial Policy Contents This Integrated Report includes financial information as well as non-financial information on such subjects as ESG. -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Stif-I Q4 2020

Coupon Units Cost Market Value SHORT TERM INVESTMENT FUND-I Domestic Fixed Income Securities 15.99% Domestic Corporate & Other Bonds AMERICAN CREDIT ACCEP 3 A 144A 0.6200 42,183 42,183 42,232 AMERICAN HONDA FINANCE CORP 0.4236 85,460 85,533 85,480 AMERICAN HONDA FINANCE CORP 0.3286 54,694 54,694 54,723 AMERICREDIT AUTOMOBILE RE 3 A2 0.4200 27,347 27,346 27,376 APPLE INC 2.5000 110,073 109,953 112,578 BANK OF AMERICA CORP 5.8750 136,736 140,191 136,736 CATERPILLAR FINANCIAL SERVICES 0.4465 102,552 102,682 102,584 CATERPILLAR FINANCIAL SERVICES 0.4136 54,421 54,510 54,496 CISCO SYSTEMS INC 1.8500 115,542 112,721 116,707 CPS AUTO RECEIVABLES C A 144A 0.6300 42,202 42,200 42,242 DT AUTO OWNER TRUST 3A A 144A 0.5400 50,582 50,581 50,674 DUKE ENERGY PROGRESS LLC 0.4004 58,113 58,113 58,123 ENTERPRISE FLEET FIN 2 A1 144A 0.2399 62,000 62,000 62,002 ENTERPRISE FLEET FIN 3 A2 144A 2.0600 81,499 82,929 82,870 EXETER AUTOMOBILE RECEIV 3A A1 0.2183 694 694 694 FLAGSHIP CREDIT AUTO 3 A 144A 0.7000 22,958 22,956 22,982 FLAGSHIP CREDIT AUTO 4 A 144A 0.5300 95,666 95,663 95,733 FORD CREDIT AUTO OWNER T C A2A 1.8800 18,939 18,937 19,010 FORD CREDIT AUTO OWNER TR C A1 0.1744 53,228 53,228 53,223 FORD CREDIT AUTO OWNER TR C A2 0.2500 15,725 15,724 15,730 GLS AUTO RECEIVABLES 4A A 144A 0.5200 54,011 54,010 54,029 GM FINANCIAL AUTOMOBILE L 3 A1 0.1781 43,244 43,244 43,244 GM FINANCIAL CONSUMER AUT 4 A1 0.1854 34,234 34,234 34,234 HONDA AUTO RECEIVABLES 20 3 A1 0.1888 50,372 50,372 50,372 HONDA AUTO RECEIVABLES 20 4 A2 1.8600 57,124 57,120 57,418 HUNTINGTON -

Nber Working Paper Series Did Mergers Help Japanese

NBER WORKING PAPER SERIES DID MERGERS HELP JAPANESE MEGA-BANKS AVOID FAILURE? ANALYSIS OF THE DISTANCE TO DEFAULT OF BANKS Kimie Harada Takatoshi Ito Working Paper 14518 http://www.nber.org/papers/w14518 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 December 2008 The paper started as a joint project with Dr. Kelly Wang when she was Assistant Professor at University of Tokyo. The authors are grateful to her for her help in providing us with computer programs and in discussion the ways to apply her methods to the Japanese banking data. Upon Dr. Wang's departure from the University of Tokyo, the project was carried on by the current two authors with full consent from Dr. Wang. The current two authors take responsibility for any remaining errors. Mr. Shuhei Takahashi provided us with superb research assistance. We are grateful for financial support from Nomura foundation for social science and Chuo University for Special Research. We are also grateful for helpful discussions with Masaya Sakuragawa, Naohiko Baba, Satoshi Koibuchi, Woo Joong Kim, Joe Peek, Kazuo Kato and for insigutful comments from participants in Asia pacific Economic Association in Hong Kong in 2007, Japan Economic Association in 2008, NBER Japan Group Meeting in 2008 and Asian FA-NFA 2008 International Conference. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. -

Changes of Directors and Executive Officers

March 22, 2021 Mizuho Financial Group, Inc. Changes of Directors and Executive Officers Mizuho Financial Group, Inc. hereby announces changes of Member of the Board of Directors and Executive Officers (including changes in their areas of responsibility, etc.) of the following entities within the Group : Mizuho Financial Group, Inc. (MHFG) Mizuho Bank, Ltd. (MHBK) Mizuho Trust & Banking Co., Ltd. (MHTB) Mizuho Securities Co., Ltd. (MHSC) Mizuho Research & Technologies, Ltd. (MHRT) 1 Contents Mizuho Financial Group, Inc. (MHFG) .......................................................................................................... 3 1. Changes of Member of the Board of Directors ..................................................................................... 3 2. Changes of Executive Officers .............................................................................................................. 3 3. Directors and Executive Officers as of April 1, 2021 .......................................................................... 5 Mizuho Bank, Ltd. (MHBK) ............................................................................................................................ 8 1. Changes of Directors and Executive Officers ...................................................................................... 8 2. Directors and Executive Officers as of April 1, 2021 ......................................................................... 12 Mizuho Trust & Banking Co., Ltd. (MHTB) ............................................................................................... -

Takahiro Saito Partner

Takahiro Saito Partner 41st Floor 9-10, Roppongi 1-Chome Ark Hills Sengokuyama Mori Tower Minato-Ku, Tokyo 106-0032 JP [email protected] Phone: +81-3-5562-6214 Fax: +81-3-5562-6202 Takahiro Saito is a Partner in the Firm’s Corporate Department. PRACTICE FOCUS His practice focuses mainly on capital markets and merger and acquisition transactions. Taki regularly advises issuers and Initial Public Offerings underwriters on global securities offerings by Japanese issuers, Debt including Rule 144A/Regulation S offerings and U.S.-registered Capital Markets offerings, as well as listings by Japanese issuers on U.S. Mergers and Acquisitions securities exchanges. The global initial public offerings by Corporate – M&A Corporate Japanese issuers that he has handled include representing: Recruit Holdings Co., Ltd. in its $1.8 billion IPO and listing on the Tokyo Stock Exchange and Regulation S/Rule 144A offering of common stock Skylark Co., Ltd. in its $698 million IPO and listing on the Tokyo Stock Exchange and Regulation S/Rule 144A offering of common stock Seibu Holdings Inc. in its $438 million IPO and listing on the Tokyo Stock Exchange and Regulation S/Rule 144A offering of common stock Otsuka Holdings Co., Ltd. in its $2.4 billion IPO and listing on the Tokyo Stock Exchange and Regulation S/Rule 144A offering of common stock. The IPO was the largest equity deal in the world for a pharmaceutical company Underwriters led by Daiwa Securities SMBC and UBS Limited in the ¥110 billion IPO and listing on the Tokyo Stock Exchange and Regulation S/Rule 144A offering of common stock by Idemitsu Kosan Co. -

Lazard Japanese Strategic Equity Fund Monthly Commentary

Lazard Japanese Strategic Equity Fund AUG Commentary 2021 Market Overview Markets were on the weak side for the rst few weeks of the month due to concerns that rapidly increasing delta variant cases around the world would side-track the current global economic recovery following pandemic period lows. However, the market made a strong recovery in the last week-and-a-half, with the TOPIX Total Return index nishing the month up a solid 3.2% in yen terms. Tokyo managed to host a reasonably successful Olympics and Japan even produced a strong showing in the medal count, particularly in gold medals. Portfolio Review During the month, the portfolio underperformed the TOPIX Total Return Index which returned 3.2% in yen terms. Being underweight and stock selection in consumer discretionary, and stock selection in the materials and utilities sectors were top contributors to performance. Being underweight and stock selection in health care, stock selection in communication services, and being underweight and stock selection in information technology sectors were negative. During the month, the top positive contributors to relative performance included: • Nippon Steel, Japan’s largest steel manufacturer, was strong after reporting better-than-expected rst-quarter earnings and raising its full-year guidance. • Mitsui O.S.K.Lines, a leading shipping company, continued to rise due to stronger-than-expected earnings and a better-than- expected dividend increase. • Makita, a leading global manufacturer of power tools, raised full-year guidance as its rst-quarter saw continued strong demand globally. • Dai-ichi Life Holdings, a leading life insurance company, rose as the yield on 10-year U.S. -

International Value Fund Q3 Portfolio Holdings

Putnam International Value Fund The fund's portfolio 3/31/21 (Unaudited) COMMON STOCKS (96.1%)(a) Shares Value Aerospace and defense (0.7%) BAE Systems PLC (United Kingdom) 137,249 $955,517 955,517 Airlines (1.2%) Qantas Airways, Ltd. (voting rights) (Australia)(NON) 437,675 1,698,172 1,698,172 Auto components (1.5%) Magna International, Inc. (Canada) 23,813 2,097,257 2,097,257 Automobiles (1.2%) Yamaha Motor Co., Ltd. (Japan) 70,500 1,742,181 1,742,181 Banks (14.7%) AIB Group PLC (Ireland)(NON) 708,124 1,861,795 Australia & New Zealand Banking Group, Ltd. (Australia) 165,820 3,561,114 BNP Paribas SA (France)(NON) 28,336 1,723,953 CaixaBank SA (Spain) 295,756 915,292 DBS Group Holdings, Ltd. (Singapore) 60,800 1,311,573 DNB ASA (Norway) 71,016 1,511,129 Hana Financial Group, Inc. (South Korea) 38,370 1,447,668 ING Groep NV (Netherlands) 362,345 4,432,786 Lloyds Banking Group PLC (United Kingdom)(NON) 1,014,265 594,752 Mizuho Financial Group, Inc. (Japan) 73,920 1,066,055 Skandinaviska Enskilda Banken AB (Sweden)(NON) 30,210 368,223 Sumitomo Mitsui Financial Group, Inc. (Japan) 67,400 2,450,864 21,245,204 Beverages (1.0%) Asahi Group Holdings, Ltd. (Japan) 33,700 1,426,966 1,426,966 Building products (1.1%) Compagnie De Saint-Gobain (France)(NON) 27,404 1,617,117 1,617,117 Capital markets (3.6%) Partners Group Holding AG (Switzerland) 1,115 1,423,906 Quilter PLC (United Kingdom) 798,526 1,759,704 UBS Group AG (Switzerland)(NON) 132,852 2,057,122 5,240,732 Chemicals (1.1%) LANXESS AG (Germany) 21,951 1,618,138 1,618,138 Construction and engineering (2.5%) Vinci SA (France) 35,382 3,624,782 3,624,782 Construction materials (1.2%) CRH PLC (Ireland) 38,290 1,794,760 1,794,760 Containers and packaging (0.8%) SIG Combibloc Group AG (Switzerland) 51,554 1,192,372 1,192,372 Diversified financial services (2.1%) Eurazeo SA (France)(NON) 20,542 1,563,415 ORIX Corp. -

Hitachi and the Mizuho Financial Group to Begin Proof of Concept Regarding the Utilization of Blockchain Technology in the Supply Chain Management Field

September 21, 2017 Hitachi, Ltd. Mizuho Financial Group, Inc. Mizuho Bank, Ltd. Hitachi and the Mizuho Financial Group to Begin Proof of Concept Regarding the Utilization of Blockchain Technology in the Supply Chain management Field Tokyo, September 21, 2017 --- Hitachi, Ltd. (TSE: 6501, Hitachi), the Mizuho Financial Group, Inc., (TSE: 8411) and Mizuho Bank, Ltd. will begin proof of concept (PoC) in October 2017, with the goal of advancing the utilization of blockchain technology1 in the supply chain field. Through this PoC, Hitachi and Mizuho hope to work toward the implementation of blockchain technology in supply chain management systems, while also examining the future implementation of supply chain finance2. International procurement operations that span multiple countries involve the complicated task of managing information (ledgers) related to ordering and deadlines at each entity and for each business. Because it takes a long time to register orders, to reconcile order forms and invoices against each other for verification purposes, and to manage overall costs, these tasks have become an issue for many companies which procure internationally. By utilizing blockchain technology for procurement operations, ordering and credit data can be shared among sites and businesses, making it easy to understand the overall state of the supply chain. In addition, by recording information such as the supplier of each part, highly reliable traceability management can be achieved. In this PoC, Hitachi and Mizuho will work together to implement blockchain technology for part of the Hitachi Group’s global supply chain, and to verify the results. Specifically, in October 2017, they will begin development of a prototype application that will utilize blockchain technology to manage the supply chains for devices and parts for which global materials procurement is necessary. -

Kabushiki Kaisha Mizuho Financial Group Mizuho Financial Group, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2018 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 001-33098 Kabushiki Kaisha Mizuho Financial Group (Exact name of Registrant as specified in its charter) Mizuho Financial Group, Inc. (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 1-5-5 Otemachi Chiyoda-ku, Tokyo 100-8176 Japan (Address of principal executive offices) Masahiro Kosugi, +81-3-5224-1111, +81-3-5224-1059, address is same as above (Name, Telephone, Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered Common Stock, without par value The New York Stock Exchange* American depositary shares, each of which represents two shares of The New York Stock Exchange common stock Securities registered or to be registered pursuant to Section 12(g) of the Act. None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

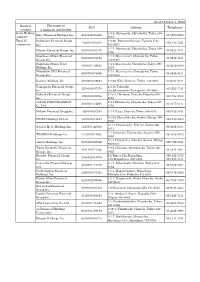

The Name of a Financial Institution JCN Address Telephone As of October

As of October 1, 2020 Business The name of JCN Address Telephone category a financial institution Bank Holding 1-9-2, Ohtemachi, Chiyoda-ku, Tokyo 100- Sony Financial Holdings Inc. 4010401053410 03-5290-6500 company 0004 Total 25 Hokuhoku Financial Group, 1-2-26 Tsutsumicho-dori, Toyama City 1230001004554 076-423-7331 companies Inc. 930-8637 1-5-5, Ohtemachi, Chiyoda-ku, Tokyo 100- Mizuho Financial Group, Inc. 9010001081419 03-5224-1111 8176 Sumitomo Mitsui Financial 1-1-2, Marunouchi, Chiyoda-ku, Tokyo 2010001081053 03-3282-8111 Group, Inc. 100-0005 Sumitomo Mitsui Trust 1-4-1,Marunouchi,Chiyoda-ku,Tokyo 100- 9010001139555 03-6256-6000 Holding, Inc. 8233 Mitsubishi UFJ Financial 2-7-1, Marunouchi, Chiyoda-ku, Tokyo 4010001073486 03-3240-8111 Group, Inc. 100-8330 Resona Holdings, Inc. 5010601039654 1-5-65, Kiba, Koto-ku, Tokyo 135-8581 03-6704-3111 Yamaguchi Financial Group, 4-2-36,Takezaki- 5250001007270 083-223-5511 Inc. cho,Shimonoseki,Yamaguchi 750-8603 Fukuoka Financial Group, 2-13-1, Ohtemon, Chuo-ku,Fukuoka,810- 9290001028986 092-723-2502 Inc. 8693 JAPAN POST HOLDINGS 2-3-1 Ohtemachi, Chiyoda-ku, Tokyo 100- 5010001112697 03-3477-0111 Co, Ltd 8791 Mebuki Financial Group,Inc. 1060001007582 2-7-2,Yaesu,Chuo-ku,Tokyo 104-0028 029-233-1151 3-1-24 Chuo Aoba-ku, Sendai, Miyagi 980- FIDEA Holdings Co.Ltd 4370001018694 022-290-8800 8800 18-14 Chayamachi, Kita-ku, Osaka 530- Senshu Ikeda Holdings,Inc 1120001140303 06-4802-0181 0013 7-1 Kameicho, Takamatsu, Kagawa 760- TOMONY Holdings, Inc. 5470001011928 087-812-0102 0050 2-1-1 Ichibancho, Aoba-ku, Sendai, Miyagi Jimoto Holdings, Inc.