DNC Destination Management Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Regional Development Australia Mid North Coast

Mid North Coast [Connected] 14 Prospectus Contents Mid North Coast 3 The Regional Economy 5 Workforce 6 Health and Aged Care 8 Manufacturing 10 Retail 12 Construction 13 Education and Training 14 The Visitor Economy 16 Lord Howe Island 18 Financial and Insurance Services 19 Emerging Industries 20 Sustainability 22 Commercial Land 23 Transport Options 24 Digitally Connected 26 Lifestyle and Housing 28 Glossary of Terms 30 Research Sources 30 How can you connect ? 32 Cover image: Birdon Group Image courtesy of Port Macquarie Hastings Council Graphic Design: Revive Graphics The Mid North Coast prospectus was prepared by Regional Development Australia Mid North Coast. Content by: Justyn Walker, Communications Officer Dr Todd Green, Research & Project Officer We wish to thank the six councils of the Mid North Coast and all the contributors who provided images and information for this publication. MID NORTH COAST NSW RDA Mid North Coast is a not for profit organisation funded by the Federal Government and the NSW State Government. We are made up of local people, developing local solutions for the Mid North Coast. Birdon boat building Image2 Mid cou Northrtesy of PortCoast Macquarie Prospectus Hastings Council Mid North Coast The Mid North Coast is the half-way point connecting Sydney and Brisbane. It comprises an area of 15,070 square kilometres between the Great Divide and the east coast. Our region is made up of six local government areas: Coffs Harbour, Bellingen, Nambucca, Kempsey, Port Macquarie – Hastings and Greater Taree. It also includes the World Heritage Area of Lord Howe Island. It is home to an array of vibrant, modern and sometimes eclectic townships that attract over COFFS 4.9 million visitors each year. -

A List of Australia's Big Things

A List of Australia's big Things Drawn from the Wikipedia article Australia's Big Things Australian Capital New South Wales Victoria Territory Western Australia South Australia Tasmania Northern Territory Australian Capital Territory Name Location Notes Located in the Belconnen Fresh Food Giant Markets, the Giant Mushroom shelters a Mushroom Belconnen children's playground. It was officially launched in 1998 by the ACT Chief Minister. Located at the main entrance to Giant Owl Belconnen town centre, the statue cost Belconnen $400,000 and was built by Melbourne sculptor Bruce Armstrong.[3] New South Wales Name Location Notes A bull ant sculpture designed by artist Pro Hart, which was erected in 1980 and originally stood at the Stephens Creek Hotel. It was moved to its current location, Big Ant Broken Hill next to the Tourist Information Centre in Broken Hill, after being donated to the city in 1990. Located in the middle of an orchard about 3km north of Batlow, without public Big Apple Batlow access. Only its top is visible from Batlow- Tumut Road, as it is largely blocked by apple trees. Big Apple Yerrinbool Visible from the Hume Highway Big Avocado Duranbah Located at Tropical Fruit World. Located alongside the Kew Visitor Information Centre. The original sculpture The Big Axe Kew was replaced in 2002 as a result of ant induced damage. This 1/40 scale model of Uluru was formerly an attraction at Leyland Brothers World, and now forms the roof of the Rock Restaurant. Technically not a "Big Big Ayers North Arm Cove Thing" (as it is substantially smaller than Rock the item it is modelled on), the Rock Restaurant is loosely grouped with the big things as an object of roadside art. -

Honeymoon Barefoot

LUXURY LODGES OF AUSTRALIA SUGGESTED ITINERARIES 1 Darwin 2 Kununurra HONEYMOON Alice Springs Ayers Rock (Uluru) 3 4 BAREFOOT Lord Howe Sydney Island TOTAL SUGGESTED NIGHTS: 12 nights Plus a night or two en route where desired or required. Australia’s luxury barefoot paradises are exclusive by virtue of their remoteness, their special location and the small number of guests they accommodate at any one time. They offer privacy, outstanding experiences and a sense of understated luxury and romance to ensure your honeymoon is the most memorable holiday of a lifetime. FROM DARWIN AIRPORT GENERAL AVIATION TAKE A PRIVATE 20MIN FLIGHT TO PRIVATE AIRSTRIP, THEN 15MIN HOSTED DRIVE TO BAMURRU PLAINS. 1 Bamurru Plains Top End, Northern Territory (3 Nights) This nine room camp exudes ‘Wild Bush Luxury’ ensuring that guests are introduced to the sights and sounds of this spectacular environment in style. On the edge of Kakadu National Park, Bamurru Plains, its facilities and 300km² of country are exclusively for the use of its guests - a romantic, privileged outback experience. A selection of must do’s • Airboat tour - A trip out on the floodplain wetlands is utterly exhilarating and the only way to truly experience this key natural environment. Cut the engine and float amongst mangroves and waterlilies which create one of the most romantic natural sceneries possible. • 4WD safaris - An afternoon out with one of the guides will provide a insight to this fragile yet very important environment. • Enjoy the thrill of a helicopter flight and an exclusive aerial experience over the spectacular floodplains and coastline of Northern Australia. -

And Grey Duck (A

Notornis, 2008, Vol. 55: 1-7 1 0029-4470 © The Ornithological Society of New Zealand, Inc. Hybridisation between mallard (Anas platyrhynchos) and grey duck (A. superciliosa) on Lord Howe Island and management options JOHN P. TRACEY* Vertebrate Pest Research Unit, NSW Department of Primary Industries Orange Agricultural Institute, Forest Rd., Orange, NSW 2800, Australia [email protected] BRIAN S. LUKINS Vertebrate Pest Research Unit, NSW Department of Primary Industries Orange Agricultural Institute, Forest Rd., Orange, NSW 2800, Australia CHRIS HASELDEN World Heritage Unit, Lord Howe Island Board, Lord Howe Island Abstract Introduced mallards (Anas platyrhynchos) occur on many islands of the South Pacific, where they hybridise with the resident grey duck (A. superciliosa). In October 2007, we conducted systematic surveys of Lord Howe Island to estimate the abundance and distribution of grey ducks, mallards, and their hybrids. Hybrids were common in areas of high public use, particularly where there was mown or grazed grass. Phenotypic characteristics suggest that mallards are now dominant and have supplanted the native grey duck, with 81% of birds classified as mallard or mallard-like hybrids, 17% as intermediate hybrids and only 2% as grey duck-like hybrids. No pure grey duck were observed. These hybrids pose direct and indirect economic, social and environmental impacts to Lord Howe Island. A management program to remove mallards using trapping, shooting and opportunistic capture by hand was conducted in October 2007. Standardised indices of duck abundance before and after management indicates that the total population was reduced by 71.7%. Eradication of mallard and hybrids from Lord Howe Island is considered achievable with a program of education, monitoring, and continued control to prevent re-establishment. -

Results from Public Consultation

1 Regional Plan (Update) 2016-2020 Results from Public Consultation 169 survey respondents: Which industry do you represent? Transport, logistics and warehousing 0.0% Tourism, accommodation and food services 11.8% Retail 2.4% Public services 8.3% Professional, scientific and technical services 14.8% Other 5.9% Not for profit 21.9% Media and telecommunications 1.8% Manufacturing 2.4% Health care, aged care and social assistance 8.3% Food growers and producers 4.1% Financial and insurance services 3.6% Electricity, gas, water and waste services 1.2% Education and training 8.9% Construction 0.6% Arts 4.1% 0% 20% 40% 60% 80% 100% Which local government area do you live in? Outside the region 3.0% Coffs Harbour 35.5% Bellingen 8.3% Nambucca 13.6% Kempsey 14.8% Port Macquarie -… 18.9% Greater Taree 5.9% 0% 20% 40% 60% 80% 100% 2 Careers advice linked to traineeships and apprenticeships Issue: Youth unemployment is high and large numbers of young people leave the region after high school seeking career opportunities, however, skills gaps currently exist in many fields suited to traineeships and apprenticeships. Target outcome: To foster employment and retention of more young people by providing careers advice on local industries with employment potential, linked with more available traineeships and apprenticeships. Key points: - Our region’s youth unemployment rate is 50% higher than the NSW state average. - There is a decline in the number of apprenticeships being offered in the region. - The current school based traineeship process is overly complicated for students, teachers and employers. -

(Iii) Airport Runway Extension Feasibility Study Update

Board Meeting: May 2018 Agenda Number: 12 (iii) Record No: ED18/3501 LORD HOWE ISLAND BOARD Business Paper OPEN SESSION ITEM Airport Runway Extension Feasibility Study Update RECOMMENDATION It is recommended that the Board note this report and endorse further investigation of the ‘570m runway extension’ option to the NW. BACKGROUND Lord Howe Island’s restricted runway length of 888 metres limits the type of commercial aircrafts that can operate on the Island. While other options have been considered such as leasing or hiring other aircrafts to operate on Lord Howe Island or to get other airlines to operate; without extending the runway, airlines will be restricted in the types of aircrafts that can service the Island. A sustainable and viable long-term solution is therefore needed to secure the provision of air services to Lord Howe Island. In late November 2017, AECOM Australia Pty Ltd was contracted to undertake the Lord Howe Island Airport Runway Extension Feasibility. The scope of the study includes the future aircraft requirements for the island, plane characteristics, existing runway/site limitations, CASA requirements, conceptual design, geotechnical investigation, environmental assessment, community consultation and economic impacts/costs. The project is broken down into a number of milestones. Milestone Description Anticipated time Completion of detailed assessment of extended runway and 1. March 2018 suitable aircraft options 2. Completion of preliminary geotechnical investigation June 2018 3. Completion of conceptual engineering design August 2018 4. Completion of preliminary environmental assessment September 2018 5. Undertake economical assessment and preliminary business case October 2018 6. Final presentation and report December 2018 The funding for the project comes predominately from a Restart NSW grant through Infrastructure NSW with a small amount of Board staff wages for project management as shown below: 1. -

Premium Location Surcharge

Premium Location Surcharge The Premium Location Surcharge (PLS) is a levy applied on all rentals commencing at any Airport location throughout Australia. These charges are controlled by the Airport Authorities and are subject to change without notice. LOCATION PREMIUM LOCATION SURCHARGE Adelaide Airport 14% on all rental charges except fuel costs Alice Springs Airport 14.5% on time and kilometre charges Armidale Airport 9.5% on all rental charges except fuel costs Avalon Airport 12% on all rental charges except fuel costs Ayers Rock Airport & City 17.5% on time and kilometre charges Ballina Airport 11% on all rental charges except fuel costs Bathurst Airport 5% on all rental charges except fuel costs Brisbane Airport 14% on all rental charges except fuel costs Broome Airport 10% on time and kilometre charges Bundaberg Airport 10% on all rental charges except fuel costs Cairns Airport 14% on all rental charges except fuel costs Canberra Airport 18% on time and kilometre charges Coffs Harbour Airport 8% on all rental charges except fuel costs Coolangatta Airport 13.5% on all rental charges except fuel costs Darwin Airport 14.5% on time and kilometre charges Emerald Airport 10% on all rental charges except fuel costs Geraldton Airport 5% on all rental charges Gladstone Airport 10% on all rental charges except fuel costs Grafton Airport 10% on all rental charges except fuel costs Hervey Bay Airport 8.5% on all rental charges except fuel costs Hobart Airport 12% on all rental charges except fuel costs Kalgoorlie Airport 11.5% on all rental -

Cycling Routes Coffs Harbour Bellingen Nambucca

Explore Our Living Coast POPULAR Cycling Routes Coffs Harbour Bellingen Nambucca FREE CYCLING GUIDE www.ourlivingcoast.com.au A B Funding for this booklet Exploring OU T This booklet has been funded through OUR LIVING COAST No matter what your skill level, there and ‘Get Healthy NSW’. It was inspired by the completion of are many opportunities for exploring the introduction the Coffs Creek Cycleway upgrade, a project funded by the Coffs, Bellingen and Nambucca regions Australian Government and Barbara and Allen Hogbin. on two wheels – from dedicated, shared off-road bike paths, to informal bike routes between towns and villages. this booklet Our Living Coast is an alliance of Coffs Harbour City Council, Bellingen Using Shire Council and Nambucca Shire Council and is assisted by the This booklet contains a series of maps, displaying New South Wales Government through its Environmental Trust. a selection of popular cycling routes enjoyed by local cyclists. Each of these maps are followed by a short description of each of the routes. It has been presented in six regions, to enable you to explore at your own pace. Pick a ride route as described, or use the booklet to plot your own ride within or across each region. Select routes that match your skill, confidence Gumbaynggirr Nation and fitness level. The Our Living Coast region encompasses the traditional This is in no way a comprehensive list of every possible homelands of the Gumbaynggirr people. We respect and ride throughout Coffs, Bellingen and Nambucca. For more fully acknowledge the Gumbaynggirr Aboriginal people as ideas on favourite riding routes, ask at one of the local bike traditional custodians of this land. -

WILDLIFE 5 TOTAL SUGGESTED NIGHTS: 15 Nights Plus a Night on Route Where Required

LUXURY LODGES OF AUSTRALIA SUGGESTED ITINERARIES 51 Darwin UNIQUELY AUSTRALIAN 4 3 2 Adelaide Lord Howe Sydney Island Kangaroo Island WILDLIFE 5 TOTAL SUGGESTED NIGHTS: 15 nights Plus a night on route where required. Australia is a place of exceptional natural beauty where ancient rainforests and vast national parks, rugged mountain ranges and reefs, beaches and waterways, provide sanctuary for Australia’s wondrous wildlife. With the continent accommodating more than 20,000 plant species and 2,300 animal and bird species, many of these endemic, this itinerary encourages complete immersion themselves in Australia’s pristine natural environments and the ability to get up close and personal with our unique wildlife. FROM DARWIN AIRPORT, PRIVATE 20MIN FLIGHT TO PRIVATE AIRSTRIP, 15MIN HOSTED DRIVE TO BAMURRU PLAINS. 1 Bamurru Plains Top End, Northern Territory (3 Nights) Bamurru Plains is an extraordinary safari-style bush experience on the edge of Kakadu National Park in Australia’s Northern Territory. The coastal floodplains of northern Australia are home to prolific bird and wildlife (Australia’s answer to the Okavango Delta) whilst Kakadu and Arnhem Land are the heartland of the country’s indigenous culture. *Bamurru Plains is open from 1 May to 31 October. A selection of must do’s • Airboat safari - A morning trip out on the floodplain wetlands of the Mary River catchment in an airboat is utterly exhilarating and the only way to truly experience this achingly beautiful natural environment and the prolific bird and wildlife it hosts. • 4WD safari - With the recession of the waters from much of the floodplain in the dry season, the plains become accessible to 4WD vehicles and an afternoon out with one of the guides will provide a unique insight to this fragile yet very important environment. -

AECOM Lord Howe Island Airport Runway Extension Feasibility Study Lord Howe Island Preliminary Business Case

RUNWAY EXTENSION FEASIBILITY STUDY PRELIMINARY BUSINESS CASE 3 Lord Howe Island Board | 1 December 2018 AECOM Lord Howe Island Airport Runway Extension Feasibility Study Lord Howe Island Preliminary Business Case Lord Howe Island Preliminary Business Case Client: Lord Howe Island Board Co No.: N/A Prepared by AECOM Australia Pty Ltd Level 21, 420 George Street, Sydney NSW 2000, PO Box Q410, QVB Post Office NSW 1230, Australia T +61 2 8934 0000 F +61 2 8934 0001 www.aecom.com ABN 20 093 846 925 13-Dec-2018 Job No.: 60559990 AECOM in Australia and New Zealand is certified to ISO9001, ISO14001 AS/NZS4801 and OHSAS18001. © AECOM Australia Pty Ltd (AECOM). All rights reserved. AECOM has prepared this document for the sole use of the Client and for a specific purpose, each as expressly stated in the document. No other party should rely on this document without the prior written consent of AECOM. AECOM undertakes no duty, nor accepts any responsibility, to any third party who may rely upon or use this document. This document has been prepared based on the Client’s description of its requirements and AECOM’s experience, having regard to assumptions that AECOM can reasonably be expected to make in accordance with sound professional principles. AECOM may also have relied upon information provided by the Client and other third parties to prepare this document, some of which may not have been verified. Subject to the above conditions, this document may be transmitted, reproduced or disseminated only in its entirety. \\ausyd1fp001\Projects\605X\60559990\6. -

Your Guide to May – December 2014

YOUR GUIDE TO REGIONAL NSW MAY – DECEMBER 2014 REGIONAL NSW THE BEST OF NEW SOUTH WALES An exciting season of events, thrilling adventures, and standout food and wine experiences await you in NSW. From May to December, you’ll also find some of Australia’s very best short break experiences right here. With five World Heritage areas, 14 official wine regions, 867 national parks and reserves, and a coastline of stunning beaches, there’s a long list of possibilities for fun, adventure and relaxation. Bar Beach, Newcastle CONNECT WITH REGIONAL NSW CONTENTS facebook.com/visitnsw The Best of NSW 3 Northern Rivers 23 twitter.com/nswtips @visitnsw New South Wales Regions 4 South Coast 24 #NewSouthWales Did You Know...? 5 Southern Highlands and Tablelands 25 plus.google.com/+visitnsw Food & Wine 6 -7 Mid North Coast 26 visitnsw.com FLAVOURS OF NSW EATING OUT IN NSW HANDS-ON EXPERIENCES Oyster Trails 8 The Murray 27 Get some insider tips on the food and Discover where to find the State’s best Whether you’re keen to know more about CONNECT WITH SYDNEY Farm Gates & Picnics 9 New England North West 28 wine that NSW is really famous for, find craft brews, pubs serving great food, wine varieties, cheese-making, where to facebook.com/seesydney out about the best paddock-to-plate luxury escapes along the coast, country learn about rainforests or marine life, Country Pubs 10 Central Coast 29 experiences, farmers markets and dining at its best and cooking schools NSW has the right experience for you. twitter.com/sydney_sider much, much more. -

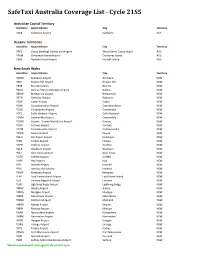

Safetaxi Australia Coverage List - Cycle 21S5

SafeTaxi Australia Coverage List - Cycle 21S5 Australian Capital Territory Identifier Airport Name City Territory YSCB Canberra Airport Canberra ACT Oceanic Territories Identifier Airport Name City Territory YPCC Cocos (Keeling) Islands Intl Airport West Island, Cocos Island AUS YPXM Christmas Island Airport Christmas Island AUS YSNF Norfolk Island Airport Norfolk Island AUS New South Wales Identifier Airport Name City Territory YARM Armidale Airport Armidale NSW YBHI Broken Hill Airport Broken Hill NSW YBKE Bourke Airport Bourke NSW YBNA Ballina / Byron Gateway Airport Ballina NSW YBRW Brewarrina Airport Brewarrina NSW YBTH Bathurst Airport Bathurst NSW YCBA Cobar Airport Cobar NSW YCBB Coonabarabran Airport Coonabarabran NSW YCDO Condobolin Airport Condobolin NSW YCFS Coffs Harbour Airport Coffs Harbour NSW YCNM Coonamble Airport Coonamble NSW YCOM Cooma - Snowy Mountains Airport Cooma NSW YCOR Corowa Airport Corowa NSW YCTM Cootamundra Airport Cootamundra NSW YCWR Cowra Airport Cowra NSW YDLQ Deniliquin Airport Deniliquin NSW YFBS Forbes Airport Forbes NSW YGFN Grafton Airport Grafton NSW YGLB Goulburn Airport Goulburn NSW YGLI Glen Innes Airport Glen Innes NSW YGTH Griffith Airport Griffith NSW YHAY Hay Airport Hay NSW YIVL Inverell Airport Inverell NSW YIVO Ivanhoe Aerodrome Ivanhoe NSW YKMP Kempsey Airport Kempsey NSW YLHI Lord Howe Island Airport Lord Howe Island NSW YLIS Lismore Regional Airport Lismore NSW YLRD Lightning Ridge Airport Lightning Ridge NSW YMAY Albury Airport Albury NSW YMDG Mudgee Airport Mudgee NSW YMER Merimbula