2019 Investment Stewardship

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

The Report from Passenger Transport Magazine

MAKinG TRAVEL SiMpLe apps Wide variations in journey planners quality of apps four stars Moovit For the first time, we have researched which apps are currently Combined rating: 4.5 (785k ratings) Operator: Moovit available to public transport users and how highly they are rated Developer: Moovit App Global LtD Why can’t using public which have been consistent table-toppers in CityMApper transport be as easy as Transport Focus’s National Rail Passenger Combined rating: 4.5 (78.6k ratings) ordering pizza? Speaking Survey, have not transferred their passion for Operator: Citymapper at an event in Glasgow customer service to their respective apps. Developer: Citymapper Limited earlier this year (PT208), First UK Bus was also among the 18 four-star robert jack Louise Coward, the acting rated bus operator apps, ahead of rivals Arriva trAinLine Managing Editor head of insight at passenger (which has different apps for information and Combined rating: 4.5 (69.4k ratings) watchdog Transport Focus, revealed research m-tickets) and Stagecoach. The 11 highest Operator: trainline which showed that young people want an rated bus operator apps were all developed Developer: trainline experience that is as easy to navigate as the one by Bournemouth-based Passenger, with provided by other retailers. Blackpool Transport, Warrington’s Own Buses, three stars She explained: “Young people challenged Borders Buses and Nottingham City Transport us with things like, ‘if I want to order a pizza all possessing apps with a 4.8-star rating - a trAveLine SW or I want to go and see a film, all I need to result that exceeds the 4.7-star rating achieved Combined rating: 3.4 (218 ratings) do is get my phone out go into an app’ .. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 30 January 2020 Celtic CCP Travel & Leisure — GBP 1.425 at close 30 January 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 30-Jan-2020 30-Jan-2020 30-Jan-2020 1.7 105 100 1D WTD MTD YTD Absolute 0.0 2.2 -12.3 -12.3 1.65 100 95 Rel.Sector 1.6 4.7 -7.7 -7.7 Rel.Market 1.3 4.8 -10.4 -10.4 1.6 95 90 1.55 VALUATION 90 1.5 85 Trailing 85 RelativePrice RelativePrice 1.45 80 PE 17.5 Absolute(localPrice currency) 80 1.4 EV/EBITDA -ve 75 PB 1.9 1.35 75 PCF -ve 1.3 70 70 Div Yield 0.0 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Price/Sales 1.8 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.1 100 80 80 Div Payout 0.0 90 70 70 ROE 12.9 80 60 60 70 Index) Share Share Sector) Share - - 50 DESCRIPTION 60 50 50 40 40 The principal activity of the Group is the operation of 40 30 RSI RSI (Absolute) a professional football club, with related and ancillary 30 30 activities. -

Reducing the Risk of Covid-19 Transmission on Trains.Pdf

V-KEMS Study Group Report Reducing the Risk of Covid-19 Transmission on Trains Report Authors and Contributors: Simone Appella (University of Bath), Eldad Avital (Queen Mary University of London), Tosin Babasola (University of Bath), Thanos Bantis (Connected Places Catapult), Alexandra Brintrup (University of Cambridge), Chris Budd OBE (University of Bath), Radu Cimpeanu (University of Warwick), Philippe De Wilde (University of Kent), Jess Enright (University of Glasgow), Akshay Gupte (University of Edinburgh), Peter Hicks (OpenTrainTimes Ltd.), Andrew Lacey (Heriot-Watt University), William Lee (University of Huddersfield), Antonio Martinez-Sykora (University of Southampton), Amjad Natour (RDG), Simon Noel (QinetiQ Ltd.), Sophie Peachey (Iotics), Eileen Russell (University of Bath), Dipak Sarker (University of Brighton), Lars Schewe (University of Edinburgh), Yang Zhou (University of Bath) Our thanks also to useful contributions from: Jonathan Bridgewood (FirstGroup Rail), Ben Ford (Network Rail), Matt Hunt (RSSB) WARNING: this report contains preliminary findings that have not been peer reviewed. The findings are intended to provoke further study and policy discussion and should not be treated as definitive scientific advice in response to the SARS-CoV-2 epidemic. Whilst we expect these principles to help others formulate coherent and consistent guidelines, time has prevented any quantitative study of their eectiveness. This could be undertaken, but would require real data and time to build more detailed simulation tools. Thus, we are not able to make specific recommendations from the principles, e.g. we cannot infer that it is safe to do X if you follow principle Y. Additionally, this report has been assembled in a short time frame, we have made every eort to ensure references and links are present. -

Firstgroup Plc Annual Report and Accounts 2015 Contents

FirstGroup plc Annual Report and Accounts 2015 Contents Strategic report Summary of the year and financial highlights 02 Chairman’s statement 04 Group overview 06 Chief Executive’s strategic review 08 The world we live in 10 Business model 12 Strategic objectives 14 Key performance indicators 16 Business review 20 Corporate responsibility 40 Principal risks and uncertainties 44 Operating and financial review 50 Governance Board of Directors 56 Corporate governance report 58 Directors’ remuneration report 76 Other statutory information 101 Financial statements Consolidated income statement 106 Consolidated statement of comprehensive income 107 Consolidated balance sheet 108 Consolidated statement of changes in equity 109 Consolidated cash flow statement 110 Notes to the consolidated financial statements 111 Independent auditor’s report 160 Group financial summary 164 Company balance sheet 165 Notes to the Company financial statements 166 Shareholder information 174 Financial calendar 175 Glossary 176 FirstGroup plc is the leading transport operator in the UK and North America. With approximately £6 billion in revenues and around 110,000 employees, we transported around 2.4 billion passengers last year. In this Annual Report for the year to 31 March 2015 we review our performance and plans in line with our strategic objectives, focusing on the progress we have made with our multi-year transformation programme, which will deliver sustainable improvements in shareholder value. FirstGroup Annual Report and Accounts 2015 01 Summary of the year and -

ASSET ALLOCATION RISK GRADE Fixed Interest 44.97

COMPLETE FINANCIAL SOLUTIONS INTRODUCING THE PARTNERSHIP 02 03 Our Philosophy The Marlborough Funds As our client, you are the one and only Marlborough’s Irish-domiciled fund priority. Our advisors are dedicated to of funds range provides you with providing an unparalleled service that comprehensive risk-graded investment puts you, your needs and your ambitions solutions in a UCITS structure. at the forefront of every stage of They are expertly managed ‘all-in-one’ decision-making. portfolios constructed using a blend Our common aim is to secure a of active and passive funds. We use prosperous future for you and your actively managed funds in areas where family. By combining our expertise with a we believe they can add real value personalised approach to your finances, and select managers with exceptional we can help you to achieve your goals. track records, including those running Marlborough’s award-winning single- Our Commitment strategy funds. We are committed to developing As stablemates in the Marlborough lifelong relationships with our clients Group, we can access the expertise – ones based on integrity, trust and a and resources of these highly respected clear understanding of your personal managers at institutional rates, which circumstances. We believe this is the key helps to keep costs for our investors as to successful financial planning. low as possible. We work exclusively for and with our clients and so all consultations are treated in the strictest confidence between you and your advisor. As our client, you can count on us to keep to our commitment. Fund performance and awards 60 % Marlborough 55 % 50 % CAUTIOUS 45 % Investment Growth 40 % 01/07/2016 to 30/06/2021 35 % Marlborough 38.4% 30 % Cautious Fund Z 25 % Source: Morningstar Direct, mid-mid, 20 % net income reinvested. -

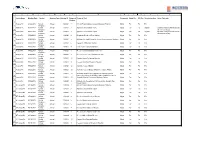

Vote Summary Report

A B C D E F G H I J K L 1 Issuer Name Meeting Date Country Meeting Type Meeting ID Proposal Proposal Text Proponent Mgmt Rec ISS Rec Vote Instruction Voter Rationale Number 2 Assura Plc 07/02/2019 United Annual 1341821 1 Accept Financial Statements and Statutory Reports Mgmt For For For 3 Kingdom Assura Plc 07/02/2019 United Annual 1341821 2 Approve Remuneration Policy Mgmt For For Against Quantum being increased across 4 Kingdom all elements of pay. Assura Plc 07/02/2019 United Annual 1341821 3 Approve Remuneration Report Mgmt For For Against Quantum being increased across 5 Kingdom all elements of pay. Assura Plc 07/02/2019 United Annual 1341821 4 Reappoint Deloitte LLP as Auditors Mgmt For For For 6 Kingdom Assura Plc 07/02/2019 United Annual 1341821 5 Authorise the Audit Committee to Fix Remuneration of Auditors Mgmt For For For 7 Kingdom Assura Plc 07/02/2019 United Annual 1341821 6 Re-elect Ed Smith as Director Mgmt For For For 8 Kingdom Assura Plc 07/02/2019 United Annual 1341821 7 Elect Louise Fowler as Director Mgmt For For For 9 Kingdom Assura Plc 07/02/2019 United Annual 1341821 8 Re-elect Jonathan Murphy as Director Mgmt For For For 10 Kingdom Assura Plc 07/02/2019 United Annual 1341821 9 Re-elect Jenefer Greenwood as Director Mgmt For For For 11 Kingdom Assura Plc 07/02/2019 United Annual 1341821 10 Re-elect Jayne Cottam as Director Mgmt For For For 12 Kingdom Assura Plc 07/02/2019 United Annual 1341821 11 Re-elect Jonathan Davies as Director Mgmt For For For 13 Kingdom Assura Plc 07/02/2019 United Annual 1341821 12 Authorise -

First Student

Business review First Student Year to 31 March 2020 2019 costs. We attribute this continuing retention success to our excellent safety track record Revenue $2,474.9m $2,424.9m and consistent focus on building sustained customer relationships over many years, Adjusted operating profit $205.9m $227.1m resulting in this year’s record-breaking willingness to recommend and satisfaction Adjusted scores, which saw fully 75% of our customers operating margin 8.3% 9.4% rating us nine or ten on a ten-point scale for overall satisfaction. Average number of employees 48,000 48,000 Our retention success was supplemented with organic growth, continuing conversions from Paul Osland First Student revenue was $2,474.9m or in-house to private provision and good net President, First Student £1,940.4m (2019: $2,424.9m or £1,845.9m), market share gains from our larger competitors, representing growth in constant currency in several cases at higher pricing than ■■ Sustainable and resilient of 2.2%. This comprised growth of 4.1% in proposed by the incumbent. returns from our market constant currency to the end of February We also continued to build out our ability 2020, benefiting from the pricing and contract leading multi-year contract to supplement growth and expand our wins we achieved in the summer 2019 bid portfolio in the home-to- addressable market via acquisitions in this season as well as from acquisitions made school market fragmented segment of the mobility services in the year. This was partially offset in March industry. Since the start of the financial year we ■■ Opportunities for organic when substantially all North American schools have closed three transactions adding a total had closed by the end of the month due to the and M&A-led growth, of 850 buses. -

Fiscal Quarter-End Holdings (Pdf)

Quarterly Schedules of Portfolio Holdings International & Global Funds July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class Harbor Diversified International All Cap Fund HNIDX HAIDX HRIDX HIIDX Harbor Emerging Markets Equity Fund HNEMX HAEMX HREMX HIEEX Harbor Focused International Fund HNFRX HNFSX HNFDX HNFIX Harbor Global Leaders Fund HNGIX HGGAX HRGAX HGGIX Harbor International Fund HNINX HAINX HRINX HIINX Harbor International Growth Fund HNGFX HAIGX HRIGX HIIGX Harbor International Small Cap Fund HNISX HAISX HRISX HIISX Harbor Overseas Fund HAORX HAOSX HAOAX HAONX Table of Contents Portfolios of Investments HARBOR DIVERSIFIED INTERNATIONAL ALL CAP FUND. ..... 1 HARBOR EMERGING MARKETS EQUITY FUND . .......... 8 HARBOR FOCUSED INTERNATIONAL FUND. ................................. 11 HARBOR GLOBAL LEADERS FUND. ................. 13 HARBOR INTERNATIONAL FUND . 15 HARBOR INTERNATIONAL GROWTH FUND . ........................ 21 HARBOR INTERNATIONAL SMALL CAP FUND. ................. 24 HARBOR OVERSEAS FUND . ............................................ 26 Notes to Portfolios of Investments ..................................... 31 Harbor Diversified International All Cap Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost, and Principal Amounts in Thousands COMMON STOCKS—96.4% COMMON STOCKS—Continued Shares Value Shares Value AEROSPACE & DEFENSE—0.7% BANKS—Continued 28,553 Airbus SE (France)* .............................. $ 2,090 236,142 Svenska Handelsbanken AB (Sweden) ............... $ -

Virtus Allianzgi International Small-Cap Fund

Virtus AllianzGI International Small-Cap Fund as of : 08/31/2021 (Unaudited) SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO ASMedia Technology Inc 23,000 $1,722,085 2.04 % Unimicron Technology Corp 319,000 $1,697,819 2.01 % Evotec SE 33,494 $1,664,973 1.97 % Georg Fischer AG 954 $1,565,779 1.85 % Grafton Group PLC 80,693 $1,549,843 1.83 % Elkem ASA 361,810 $1,541,414 1.82 % Genus PLC 18,880 $1,540,558 1.82 % Howden Joinery Group PLC 118,070 $1,534,979 1.82 % Interroll Holding AG 340 $1,511,111 1.79 % Cancom SE 22,963 $1,510,768 1.79 % Spectris PLC 27,520 $1,490,733 1.76 % ASM International NV 3,841 $1,490,287 1.76 % Soitec 6,191 $1,479,549 1.75 % Intermediate Capital Group PLC 48,932 $1,478,686 1.75 % Aperam SA 23,199 $1,423,300 1.68 % Fuji Electric Co Ltd 32,600 $1,411,980 1.67 % Wienerberger AG 35,448 $1,391,268 1.65 % Bechtle AG 19,089 $1,379,858 1.63 % Jungheinrich AG Pref 24,964 $1,348,243 1.60 % Storebrand ASA 151,651 $1,346,924 1.59 % JMDC Inc 19,500 $1,336,454 1.58 % 1 SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO Industrial & Infrastructure Fund Investment Corp 653 $1,312,945 1.55 % ValueCommerce Co Ltd 31,900 $1,309,171 1.55 % Jeol Ltd 17,700 $1,308,013 1.55 % Tokyu Fudosan Holdings Corp 225,200 $1,303,935 1.54 % ASR Nederland NV 28,191 $1,288,854 1.53 % Huhtamaki Oyj 24,096 $1,286,286 1.52 % Crest Nicholson Holdings plc 221,947 $1,280,994 1.52 % Aak Ab 53,435 $1,278,063 1.51 % Jenoptik AG 35,252 $1,272,856 1.51 % Auto Trader Group PLC 146,909 $1,270,441 1.50 % Elis SA 71,514 $1,264,914 1.50 % Sojitz Corp 415,100 $1,218,718