Financial Constraints, Capital Allocation and Aggregate Productivity*

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Issues on Ernst Posner Papers in NARA, from the Viewpoint of a Japanese Archivist

Issues on Ernst Posner Papers in NARA, from the Viewpoint of a Japanese Archivist YAYOI TSUTSUI Abstract: For the 10th Research Forum, I would like to discuss issues regarding the Ernst Posner Papers in the National Archives and Records Administration at College Park, Maryland, which I consulted for one day in 2014. My first question is why the National Archives holds such personal papers. I compared the personal records in the National Archives against the acquisition policy and the holdings of National Archives of Japan. As I learned Posner's brief biography, I felt the power of his archival materials in the reading room. In the first box, there is a list written by him. I noticed the difference between his list and the physical order. We can learn how the archivist arranged his own archival materials. For me, he is the author of Archives in the Ancient World; and I found the records of publication, drafts, and a lot of “cards” representing his source of knowledge. I also found the record of his service to the American Commission for the Protection and Salvage of Artistic and Historic Monuments in Europe (Robert Commissions) and the survey of the archives in Japan during and just after WWII. Because Japanese archivists seek the influence of General Head Quarter’s archival management policy as well as archival history, these records are significant. Ernst Posner was an educator of Archival Science as well as an important member of the Society of American Archivists. His papers speak to the friendship among archivists, the vivid history of SAA, and the activities of International Council on Archives (ICA). -

2. Law of Property and Obligation

DEvELOP雁NTS刀¥r2003-ACADEMIC SOC盟丁田S 119 2. Law of Property and Obligation I. Japan Association of Private Law held its 67th General Meeting at Kansai University on October 12 and 1 3, 2003. Symposium : Contemporary Problems on Nonprofits Organizations Chaired by Seiichi Yamada (Professor, Kobe University) and Hiroto Dogauchi (Professor, University of Tokyo). ( 1) "Introduction" Yoshihisa Nomi (Professor, University of Tokyo). (2) "The Regime of Charitable Corporations in Japan: An Analysis of the Structure of the Problem" Hiroyasu Nakata (Professor, Hitotsubashi University). (3) "Governance of Nonprofit Organizations" 120 WASEDA BULLET餌OF CO耀ARATlvE LAw Vb1.23 Hiroyuki Kansa㎞(Professor,Ga㎞shuin University). (4) “The Legislation for Phvate Nonprofit Co耳)orations” Takako Ame血ya(Professor,Shoin University)。 (5)“Reconside血g theMeaning ofLegalEntity” Y6shihisa Nomi(Professor,University ofTokyo)。 (6)“ProlegomenatoRethinldngofMeaningofFreedomofAssociation in Civil Law” Atsushi Omura(Professor,University ofTokyo)。 (7)“A Case Study in a Real Market(“IBO-NO-ITO”of Handmade SOMENIndustry):Meaning ofMutual Bene且tOrganization” Hisakazu Hirose(Professor,University of Tokyo). WorkshOμ (1)“The Relation ofI両ury to Damages in the Law ofTorts” KenMizuno(Professor,GakushuinUniversity). (2)“TheRefomoftheJapaneseLaw ConcemingtheRegistrationof I㎜ovables” Katsuhiko Shitinohe(Professor,Keio University). Re口ort: First Section (1)“Reconst皿ction ofThe Theory ofNon-Genuine Joint Liability” Miki Hirabayashi(AssociateProfessor,KanazawaUniversity). (2)“The Defaulting -

The Sixteenth Asian Studies Conference Japan (ASCJ) ABSTRACTS

ASCJ program 2012 ASCJ 2012 The Sixteenth Asian Studies Conference Japan (ASCJ) ABSTRACTS These lightly edited abstracts come to nearly 140 pages. As a printed version will not be distributed at the conference, we suggest that you save it to disk or print the pages of sessions that interest you. The abstracts are in the order of the program available on the ASCJ website: http://www.meijigakuin.ac.jp/~ascj/2012/Abstracts%202012.pdf The PDF file can be searched online or after downloading. For your convenience in browsing and printing, each session begins on a new page. Changes to the abstracts can be sent by Word attachment to [email protected]. We will make necessary alterations and substitutions to this online version before the conference begins. The PDF file of abstracts will remain on the ASCJ website as a record of the conference at International Christian University, Tokyo, June 25–26, 2011: http://www.meijigakuin.ac.jp/~ascj/2012/ASCJ_2012_abstracts.pdf ASCJ Executive Committee Tokyo, June 25, 2012 1 ASCJ program 2012 The Sixteenth Asian Studies Conference Japan (ASCJ) ABSTRACTS Session 1: Room A-301 A Muck Time: Environmental Hygiene and Human Waste Disposal in Japan across the Twentieth Century Organizer/Chair: Alexander R. Bay, Chapman University 1) Alexander R. Bay, Chapman University Nation from the Bottom up: Disease, Toilets and Waste Management in Modern Japan 2) Ichikawa Tomo, Shanghai Jiaotong University What is an Ideal Toilet? The Development and Diffusion of Public Toilets in Meiji Japan, 1868–1912 3) Roderick Wilson, University of Wisconsin-Whitewater Dirty Water: An Environmental History of Tokyo’s Waterways and Bay, 1888–1964 4) Hoshino Takanori, Keio University Prewar Reformation of the Night-soil Circulation Network in the Suburbs of Tokyo Discussant: Nagashima Takeshi, Senshu University A Muck Time: Environmental Hygiene and Human Waste Disposal in Japan across the Twentieth Century Organizer/Chair: Alexander R. -

Ryan Holmberg Teaching: Education

Ryan Holmberg Independent Art and Comics Historian, Translator [email protected] teaching: Visiting Lecturer. University of North Carolina, Chapel Hill. Spring 2020 History of Japanese Art (Undergrad Lecture) Visiting Associate Professor. University of Tokyo. 2017-19 US Military Bases and Japanese Culture (Grad Seminar, In Japanese) Short-Form Art Writing: Art and Culture Since 3.11 (Undergrad/Grad Seminar) Short-Form Art Writing: Media, Society, Politics (Undergrad/Grad Seminar) Nuclear Imaginary in Transnational Perspective (Grad Seminar, In Japanese) Comics Journalism: Reportage, Documentary, Realism (Undergrad/Grad Seminar) Visiting Lecturer. Duke University. 2016-17 Contemporary Japanese Visual Culture (Undergrad Lecture) The Art of Unconventional Comics (Undergrad Seminar and Studio) Instructor. Art English Training, Yokohama. Fall 2011 English-language history and theory program for young Japanese artists. Organized in conjunction with the Yokohama Triennial. Mellon Postdoctoral Teaching Fellow. University of Southern California. 2009-10 Contemporary Art: 1940-Present (Undergrad Lecture) Comics and Graphic Novels (Undergrad Seminar) Adjunct Assistant Professor. Pace University. Spring 2009 Asian Art (Undergrad Lecture) Adjunct Assistant Professor. College of Staten Island, CUNY. 2008-09 Introduction to Visual Art (Undergrad Lecture) Visiting Assistant Professor. University of Chicago. 2007-08 Survey of Japanese Art (Undergrad Lecture) Word & Image in Japanese Art (Undergrad Seminar) Japanese Art since 1945 (Undergrad & Grad Seminar) Japanese Art of the 1960s (Grad Seminar) education: Yale University Ph.D. History of Art (Japanese Art History) 2007 Dissertation: “Paper Megaphone: Garo Manga, 1964-71” Advisor: Mimi Yiengpruksawan M.A. History of Art 2001 Whitney Museum of American Art Independent Study Program, Critical Studies Fellow 2003-04 Boston University B.A. -

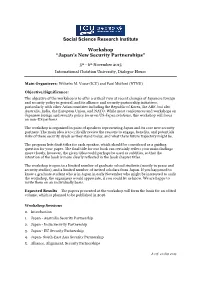

Japan's New Security Partnership-Program.Pdf

Social Science Research Institute Workshop “Japan’s New Security Partnerships” 5th - 6th November 2015 International Christian University, Dialogue House Main Organizers: Wilhelm M. Vosse (ICU) and Paul Midford (NTNU) Objective/Significance: The objective of the workshop is to offer a critical view at recent changes of Japanese foreign and security policy in general, and its alliance and security partnership initiatives, particularly with other Asian countries including the Republic of Korea, the ARF, but also Australia, India, the European Union, and NATO. While most conferences and workshops on Japanese foreign and security policy focus on US-Japan relations, this workshop will focus on non-US partners. The workshop is organized in pairs of speakers representing Japan and its core new security partners. The main idea is to critically review the reasons to engage, benefits, and potentials risks of these security dyads as they stand today, and what there future trajectory might be. The program lists draft titles for each speaker, which should be considered as a guiding question for your paper. The final title for our book can certainly reflect your main findings more closely, however, the given titles could perhaps be used as subtitles, so that the intention of the book is more clearly reflected in the book chapter titles. The workshop is open to a limited number of graduate school students (mostly in peace and security studies), and a limited number of invited scholars from Japan. If you happened to know a graduate student who is in Japan in early November who might be interested to audit the workshop, the organizers would appreciate, if you could let us know. -

PDF Download

Institute for Economic Studies, Keio University Keio-IES Discussion Paper Series Revisiting Complementarity between Japanese FDI and the Import of Intermediate Goods: Agglomeration Effects and Parent-firm Heterogeneity Tadashi Ito, Toshiyuki Matsuura, Yang Chih-Hai 16 November, 2016 DP2016-025 http://ies.keio.ac.jp/en/publications/6946 Institute for Economic Studies, Keio University 2-15-45 Mita, Minato-ku, Tokyo 108-8345, Japan [email protected] 16 November, 2016 Revisiting Complementarity between Japanese FDI and the Import of Intermediate Goods: Agglomeration Effects and Parent-firm Heterogeneity Tadashi Ito, Toshiyuki Matsuura, Yang Chih-Hai Keio-IES DP2016-025 16 November, 2016 JEL classification: F14; F21; F23 Keywords: FDI by SMEs; Trade duration; Intermediate goods; Agglomeration Abstract The concern regarding the hollowing out by FDI has re-emerged in Japan, with both large and small firms relocating their plants to China since the late 1990s. This study sheds lights on the effects of agglomeration and firm characteristics upon the complementary relationship between FDI and import of intermediate input from home country, which has been overlooked in the literature. Estimating the duration model of Japanese affiliates’ input trade by using parent–affiliate, product- level data from 2000 to 2006, we found while firms in agglomerated regions with more foreign affiliates shorten its duration, small firms import for a longer duration. Tadashi Ito Faculty of International Social Science, Gakushuin University 1-5-1 Mejiro, Toshima-ku, Tokyo 171-0031, Japan [email protected] Toshiyuki Matsuura Keio Economic Observatory, Keio University 2-15-45 Mita, Minato-ku, Tokyo 108-8345, Japan [email protected] Yang Chih-Hai National Central University No. -

2011 Phillip C. Jessup International Law Moot Court Competition Japan �Ational Round Results Doshisha University, Kyoto City, Kyoto, Japan Dec 25-26, 2010

JILSA( Japan International Law Students Association) 2011 Phillip C. Jessup International Law Moot Court Competition Japan ational Round Results Doshisha University, Kyoto City, Kyoto, Japan Dec 25-26, 2010 TABLE OF COTETS (1) The final result of Japan National Round (2) Advanced Rounds Results (3) Table of ranking of Teams (4) Top 10 Individual Oralists (5) Team Memorial Scores (6) The list of participating teams (1) The final result of Japan ational Round Japan ational Round Champion : Kyoto University Runner-Up : Sophia University Final Round Judges : KOUZAI Shigeru - Professor Emeritus, Kyoto University YANAGIHARA Masaharu - Professor, Kyushu University NAGAMINE Yasumasa - Director-General, International Legal Affairs Bureau, Ministry of Foreign Affairs of Japan KOGA Mamoru - Professor, Seinan Gakuin University ABE Yoshinori - Professor, Gakushuin University Best Oralist : INUI Hiroaki (Kyoto University) (2) Advanced Rounds Results Final Round Winning Team Runner-up Team Kyoto University Sophia University Semi-Final Rounds Winning Team Eliminated Team Kyoto University Osaka University Sophia University Waseda University 1 JILSA( Japan International Law Students Association) (3) Table of ranking of Teams Rank Team Rank Team 1 Kyoto University 8 Gakushuin University 2 Sophia university 9 Aoyama Gakuin University 3 Waseda University 10 Keio University 4 Osaka University 11 Doshisha University 5 Tokyo University 12 Japan Coast Guard Academy 6 Nagoya University 13 Kobe University 7 Tohoku University (4) Top 10 Individual Oralists Best -

JSPS Postdoctoral Fellowships for Research in Japan

List of Fellows Selected through Open Recruitment in Japan Humanities The following list includes the names of the selected fellows, their host researchers and research themes under the 1st recruitment of FY2019-2020 JSPS Postdoctoral Fellowship for Research in Japan (Standard). Under this recruitment, 1127 applications were received, among which 120 fellowships were awarded. Notification of the selection results will be made in writing to the head of the applying institution in December, 2018. An award letter will be sent to the successful candidates in the middle of January, 2019. Unsuccessful candidates are not directly notified of their selection results. However, applicants (host researchers) can see their approximate ranking among all the applications through the JSPS Electronic Application System. Individual requests for selection results are not accepted. Fellow Nationality Host Researcher Host Institution Research Theme Family Name First Name Middle Name KOLODZIEJ Magdalena Patrycia GERMANY Doshin SATO Tokyo University of the Arts Studies of the Imperial Art World of Modern Japan KOWALCZYK Beata Maria POLAND Mitsuyoshi NUMANO The University of Tokyo Nihon no sakka: Constructing Literary Careers in the Japanese Literary World ROH Junia KOREA Seishi NAMIKI Kyoto Institute of Technology A Study on the Invention of Locality of Japanese Craft in Meiji era (REP. OF KOREA) JAMMO Sari SYRIA Yoshihiro NISHIAKI The University of Tokyo Investigating human behavior during the Neolithization intra/beyond the Fertile Crescent SIM Jeongmyoung -

Report on the World Education Research Association 10 Years Anniversary Focal Meeting

Educational Studies in Japan: International Yearbook No. 14, March, 2020. pp. 85-91 Report on the World Education Research Association 10 Years Anniversary Focal Meeting Manabu Sato † Local Chair of the Organizing Committee of WERA 2019 1. Introduction The World Education Research Association 10 Years Anniversary Focal Meeting was held on August 5th at the University of Tokyo Yasuda Auditorium, and on the 6th, 7th, and 8th at Gakushuin University. This focal meeting convened 1,313 participants from 65 countries and regions, two to three times the attendees at WERA meetings over the past decade. In 2009, after several years of preparatory meetings, WERA held its founding meeting in San Diego in the United States, and held a commemorative fi rst meeting in Vienna in the fall of the same year. I was one of the founding members, and with that experience, served as chair of the Organizing Committee for the 10 Years Anniversary Focal Meeting to be held in Japan. The opening ceremony of the meeting was held in the University of Tokyo Yasuda Au- ditorium. An opening speech was given by WERA President Ingrid Gogolin, a professor at Hamburg University, who expressed her hopes for the 10 Years Anniversary Focal Meeting thus. We all share an interest in the further development of educational science and research - a science whose theoretical interest in knowledge and understanding is often combined with the impetus to contribute to the clarification of issues relevant to practice. The theme of the conference – Future of Democracy and Education: Realizing Equity and Social Justice Worldwide – encourages discussion of educational research at the highest level, driven by an interest in discovery and insight, but also by concern for the com- mon good of future generations. -

Japan's Welfare Gains Through Globalization

Institute for Economic Studies, Keio University Keio-IES Discussion Paper Series Japan’s welfare gains through globalization: An evidence from Japan’s manufacturing sector Tadashi Ito, Toshiyuki Matsuura 14 January, 2017 DP2017-002 http://ies.keio.ac.jp/en/publications/7379 Institute for Economic Studies, Keio University 2-15-45 Mita, Minato-ku, Tokyo 108-8345, Japan [email protected] 14 January, 2017 Japan’s welfare gains through globalization: An evidence from Japan’s manufacturing sector Tadashi Ito, Toshiyuki Matsuura Keio-IES DP2017-002 14 January, 2017 JEL classification: F14 Keywords: Trade Liberalization; Welfare gains; Japan Abstract Welfare gain through international trade is a cornerstone of international economics literature. However, it is only recently that the data and the methodologies become available to empirically assess such welfare gain. Building on the recently developed methodologies of estimating elasticity of substitution and computing welfare gains from trade, we estimate welfare gains of Japan from its trade liberalization in manufacturing sector. To do this as precisely as possible, the elasticities of substitution for HS 9-digit product code are estimated for various periods of time. The analyses show that Japan’s welfare gains from trade liberalization took place especially from the 1990s, and reached eleven percent vis-à-vis the autarky situation. Tadashi Ito Faculty of International Social Sciences, Gakushuin University 1-5-1, Mejiro, Toshima-ku, Tokyo [email protected] Toshiyuki Matsuura Keio Economic Observatory, Keio University 2-15-45, Mita, Minato-ku, Tokyo [email protected] Acknowledgement: This work was supported by JSPS KAKENHI (C) Grant Number 26380354. -

Exhibits of Archives in Japan

Exhibits of Archives in Japan YAYOI TSUTSUI Abstract: This presentation shows various exhibits of National, Prefectural, and Municipal Archives in Japan using pictures from their homepages or SNS including “virtual exhibits” or international collaborative exhibits like JFK in the National Archives of Japan. Since the Public Records and Archives Management Act was enforced in 2011, archival issues are slightly changed and the people are getting more concerned about the public records management. Considerable provincial archives start use of Twitter or Facebook, therefore we learn their activities. Most of their exhibits are created by the archivists themselves. The National Archives of Japan is planned to build the new facility near the Diet and enhance the public relations to people through the exhibitions. (Passive mode indicates that National Archives itself cannot take the initiative, because NAJ is just a “incorporated administrative agency”.) Discussions are: ● the roles and function of exhibits of Archive comparing with the museums ● who take in charge of exhibits in Archives? Should archivists be exhibit designers? ● the importance of exhibits comparing with other functions and activities of Archives ● what is the most important mission of archives? ● the efforts for exhibits provided by the archives under the tight budget and small personnel ● comparison with the exhibitions of other countries including archives in the United States (Archives Museum in DC or Paris) The presenter will ask the audience telling their own institutions’ exhibits. About the Author: Yayoi Tsutsui is a certified archivist by Academy of Certified Archivists and a registered archivist of the Japan Society for Archival Science. She is a part-time lecturer of Hitotsubashi University. -

Emperor Naruhito's Ascension

4 | The Japan Times | Wednesday, May 1, 2019 Emperor Naruhito’s Ascension Ceremonies mark start of Reiwa Era KYODO Japan’s imperial succession entered a key stage on Wednesday with ceremonies mark- ing Emperor Naruhito’s ascension to the throne, a day after his 85-year-old father abdicated as the first living Japanese mon- arch in over 200 years to do so. As a member of the Japanese monarchy, Emperor Naruhito can claim a number of firsts. None of the previous emperors had the experience of studying abroad, and he is also the first emperor to not be separated from his family and brought up largely by nannies. Then-Crown Prince Naruhito and then-Crown Princess Masako visit a temporary housing shelter The 59-year-old earlier signaled his intent on Sept. 26 in Asakura, Fukuoka Prefecture, after torrential rains hit the area in July 2017. KYODO to adapt to “the changing times,” while also saying his years with his parents would Chronology of major events related to Emperor Naruhito serve as “major guideposts” for him as he performs his nonpolitical duties as the sym- The following is a timeline of Emperor Naruhito’s life and major events that have occurred bol of the state in the years ahead. throughout it so far. “I would like to pursue my duties as the Feb. 23, 1960 — Born the eldest son of Emperor Emeritus Akihito and Empress Emerita symbol (of the state) by always being beside Emperor Naruhito KYODO Then-Crown Prince Naruhito celebrates his 59th birthday with then-Crown Princess Masako at Michiko.