12767-001 Jones Soda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Game Changer: Centurylink Field Case Study

CASE STUDY CENTURYLINK FIELD, HOME OF THE SEATTLE SEAHAWKS AND SOUNDERS FC VENUE STATS Location: Seattle, Washington Opened: July 29, 2002 Seating Capacity: 67,000 Owner: Washington State Public Stadium Authority Operator: First & Goal Inc. (FGI) Venue Uses: NFL games; MLS games; NCAA football and international soccer games; Supercross and a variety of community events Construction Cost: $430 million ($566 in 2012 dollars) CENTURYLINK Field’S GREENING STORY: and Event Center. The Kingdome was demolished in 2000 to MOTIVATIONS, CHALLENGES AND LESSONS make way for the new stadium; 97 percent of the concrete was recycled locally, with 35 percent of it reused in the new FROM THE FIELD facility. Thanks to the widespread public and professional interest in “During 2005–2006 many venues and professional teams sustainability in the Northwest, environmental stewardship began the discussion on recycling and composting,” notes was built into CenturyLink Field even before the first U.S. Benge. In 2005 the Seahawks also partnered with Seattle City sports greening programs were established. Back in 2000, Light and Western Washington University to recognize local 35 percent of the concrete from the Kingdome was recycled commitments to renewable energy with a Power Players onsite to construct Seahawks Stadium (which has since been award. “It was an opportunity to highlight and learn from renamed “CenturyLink Field”). different smart energy programs,” Benge says. To this day, CenturyLink Field, the Seattle Seahawks In 2006 FGI launched CenturyLink Field’s recycling and Seattle Sounders FC are leaders in professional sports program with the installation of 75 new recycling bins greening, as founding members of the Green Sports Alliance, around the venue, fan and staff recycling education, and a and business leaders in sustainability, with an onsite new dedicated Recycling Sorting Area created to track and solar array, an aggressive recycling program and a strong separate 17 different recyclable materials. -

Laura A. Bertin [email protected] Direct: 206.254.4476 Fax: 206.587.2308

Laura A. Bertin [email protected] direct: 206.254.4476 fax: 206.587.2308 Introduction Laura focuses her practice on corporate and securities law, where she helps clients navigate the legal intricacies associated with growing and reaching key milestones over the lifetimes of their businesses. Drawing on her deep experience working with clients in all stages of development, Laura serves as corporate counsel to startups, emerging growth companies, and established privately held and public corporations in a wide range of transactions, including angel and venture capital financings (debt and equity), mergers and acquisitions (buy- and sell-side) and public offerings. Laura also advises companies with respect to corporate governance and compliance with federal and state securities laws and regulations such as the JOBS Act, SEC reporting requirements and other regulatory directives. Colleagues and clients alike appreciate Laura for her practical, conscientious and friendly approach. Consistent with her focus on long-term client relationships, her core values include responsiveness, timeliness, transparency and accountability. Experience & Results Representative Mergers, Acquisitions and Other Sale Transactions: Representation of 360 Analytics in connection with its acquisition by O'Brien & Company Representation of Alaskan Express Service, Inc. (and its affiliated entities), in connection with its acquisition by American Fast Freight Representation of Allegis Communications in connection with its acquisition by Veritext Representation of -

Strategic Analysis of the Coca-Cola Company

STRATEGIC ANALYSIS OF THE COCA-COLA COMPANY Dinesh Puravankara B Sc (Dairy Technology) Gujarat Agricultural UniversityJ 991 M Sc (Dairy Chemistry) Gujarat Agricultural University, 1994 PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration Executive MBA O Dinesh Puravankara 2007 SIMON FRASER UNIVERSITY Summer 2007 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author APPROVAL Name: Dinesh Puravankara Degree: Master of Business Administration Title of Project: Strategic Analysis of The Coca-Cola Company. Supervisory Committee: Mark Wexler Senior Supervisor Professor Neil R. Abramson Supervisor Associate Professor Date Approved: SIMON FRASER UNIVEliSITY LIBRARY Declaration of Partial Copyright Licence The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection (currently available to the public at the "lnstitutional Repository" link of the SFU Library website <www.lib.sfu.ca> at: ~http:llir.lib.sfu.calhandle/l8921112>)and, without changing the content, to translate the thesislproject or extended essays, if technically possible, to any medium or format for the purpose of preservation of the digital work. -

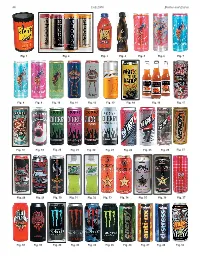

Bottles and Extras Fall 2006 44

44 Fall 2006 Bottles and Extras Fig. 1 Fig. 2 Fig. 3 Fig. 4 Fig. 5 Fig. 6 Fig. 7 Fig. 8 Fig. 9 Fig. 10 Fig. 11 Fig. 12 Fig. 13 Fig. 14 Fig. 16 Fig. 17 Fig. 18 Fig. 19 Fig. 20 Fig. 21 Fig. 22 Fig. 23 Fig. 24 Fig. 25 Fig. 26 Fig. 27 Fig. 28 Fig. 29 Fig. 30 Fig. 31 Fig. 32 Fig. 33 Fig. 34 Fig. 35 Fig. 36 Fig. 37 Fig. 38 Fig. 39 Fig. 40 Fig. 42 Fig. 43 Fig. 45 Fig. 46 Fig. 47 Fig. 48 Fig. 52 Bottles and Extras March-April 2007 45 nationwide distributor of convenience– and dollar-store merchandise. Rosen couldn’t More Energy Drink Containers figure out why Price Master was not selling coffee. “I realized coffee is too much of a & “Extreme Coffee” competitive market,” Rosen said. “I knew we needed a niche.” Rosen said he found Part Two that niche using his past experience of Continued from the Summer 2006 issue selling YJ Stinger (an energy drink) for By Cecil Munsey Price Master. Rosen discovered a company named Copyright © 2006 “Extreme Coffee.” He arranged for Price Master to make an offer and it bought out INTRODUCTION: According to Gary Hemphill, senior vice president of Extreme Coffee. The product was renamed Beverage Marketing Corp., which analyzes the beverage industry, “The Shock and eventually Rosen bought the energy drink category has been growing fairly consistently for a number of brand from Price Master. years. Sales rose 50 percent at the wholesale level, from $653 million in Rosen confidently believes, “We are 2003 to $980 million in 2004 and is still growing.” Collecting the cans and positioned to be the next Red Bull of bottles used to contain these products is paralleling that 50 percent growth coffee!” in sales at the wholesale level. -

Albers Students Shine on the Hardwood Page 5

A PUBLICATION OF NEWS AND CURRENT EVENTS FROM THE ALBERS SCHOOL OF BUSINESS AND ECONOMICS SPRING 2010 Albers Students Shine on the Hardwood Page 5 Albers Joins PRME, Page 3 (Principles for Responsible Management Education) Albers Executive Speaker Series, Page 6 WHAT’S INSIDE? Albers Joins PRME ...............3 Red Winged .........................4 Leadership Award Albers Faculty .......................4 Research News ith this generation of students, business schools are finding Student Profile: ....................5 Albers Students Shine on that initiatives and projects can Wliterally be turned over to the students to the Hardwood Albers Executive ..................6 manage and organize. Whereas in the past, Speaker Series we assumed that faculty and staff were the Faculty Profile: .....................8 resources to turn to for new initiatives, Fiona Robertson today our students are ready and anxious to 2009 Donors .........................9 take on important responsibilities. The Red Winged Leadership Award is a great example Alumni Profile: ...................10 Message Brian Webster of this new trend. Under the guidance of Dr. Jennifer Marrone, a group of our graduate Alumni Events ....................11 students is organizing a very complex project to recognize ‘under the radar’ socially responsible leadership in our community. ON THE COVER: Dean’s INTERNATIONAL BUSINESS More information about the award can be MAJOR CHRIS GWETH, #15, found on page 4. SCORED 17 POINTS DURING THE Since the last issue of the Brief, we have been fortunate to see our programs ALBERS-SPONSORED SU MEN’S BASKETBALL gaME agaINST recognized by BusinessWeek. First, our Part-time MBA program was ranked 25th HaRVARD ON JaN. 2. in the nation. More recently, our undergraduate program was ranked 46th in the US, putting us in the Top 25 among private schools. -

Vividata Brands by Category

Brand List 1 Table of Contents Television 3-9 Radio/Audio 9-13 Internet 13 Websites/Apps 13-15 Digital Devices/Mobile Phone 15-16 Visit to Union Station, Yonge Dundas 16 Finance 16-20 Personal Care, Health & Beauty Aids 20-28 Cosmetics, Women’s Products 29-30 Automotive 31-35 Travel, Uber, NFL 36-39 Leisure, Restaurants, lotteries 39-41 Real Estate, Home Improvements 41-43 Apparel, Shopping, Retail 43-47 Home Electronics (Video Game Systems & Batteries) 47-48 Groceries 48-54 Candy, Snacks 54-59 Beverages 60-61 Alcohol 61-67 HH Products, Pets 67-70 Children’s Products 70 Note: ($) – These brands are available for analysis at an additional cost. 2 TELEVISION – “Paid” • Extreme Sports Service Provider “$” • Figure Skating • Bell TV • CFL Football-Regular Season • Bell Fibe • CFL Football-Playoffs • Bell Satellite TV • NFL Football-Regular Season • Cogeco • NFL Football-Playoffs • Eastlink • Golf • Rogers • Minor Hockey League • Shaw Cable • NHL Hockey-Regular Season • Shaw Direct • NHL Hockey-Playoffs • TELUS • Mixed Martial Arts • Videotron • Poker • Other (e.g. Netflix, CraveTV, etc.) • Rugby Online Viewing (TV/Video) “$” • Skiing/Ski-Jumping/Snowboarding • Crave TV • Soccer-European • Illico • Soccer-Major League • iTunes/Apple TV • Tennis • Netflix • Wrestling-Professional • TV/Video on Demand Binge Watching • YouTube TV Channels - English • Vimeo • ABC Spark TELEVISION – “Unpaid” • Action Sports Type Watched In Season • Animal Planet • Auto Racing-NASCAR Races • BBC Canada • Auto Racing-Formula 1 Races • BNN Business News Network • Auto -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

1 2 3 4 5 6 7 8 UNITED STATES DISTRICT COURT 9 WESTERN DISTRICT OF WASHINGTON 10 AT SEATTLE 11 ) 12 TILLIE SALTZMAN, on behalf of herself and ) No. all others similarly situated, ) 13 ) CLASS ACTION Plaintiff, ) 14 ) COMPLAINT FOR VIOLATION OF THE vs. ) SECURITIES EXCHANGE ACT OF 1934 15 ) JONES SODA COMPANY, PETER M. VAN ) 16 STOLK and HASSAN N. NATHA, ) ) 17 Defendants. ) ) DEMAND FOR JURY TRIAL 18 19 20 21 22 23 24 25 26 COMPLAINT FOR VIOLATION OF THE LAW OFFICES OF CLIFFORD A. CANTOR, P.C. SECURITIES EXCHANGE ACT OF 1934 627 208th Ave. SE Sammamish, WA 98074-7033 Tel: (425) 868-7813 ● Fax: (425) 868-7870 1 SUMMARY AND OVERVIEW 2 1. This is a class action on behalf of all purchasers of the common stock of Jones Soda 3 Company (“Jones Soda” or the “Company”) between 3/9/07 and 8/2/07 (the “Class Period”). During 4 the Class Period, Jones Soda made false and misleading statements about its financial results and 5 business prospects. 6 2. Jones Soda is a Seattle based manufacturer and marketer of a variety of beverage 7 products sold through the Company’s national distribution network. 8 3. As a result of Jones Soda’s release of its 4Q 2006 results after the close of trading on 9 3/8/07 and its very bullish message to analysts and the investment community after releasing its 4Q 10 2006 results, including announcing it was expanding the sales channels of its Jones Soda product in 11 12-ounce cans to major retailers such as Wal-Mart, Kroger, Safeway and Kmart, Jones Soda’s stock 12 traded up from its closing price of under $14 per share on 3/8/07 to close above $17 per share on 13 3/9/07, on trading volume more than 1200% greater than the previous ten-day average. -

AFPD's First Ohio Trade Show Offered Something for Everyone

Just in AFPD’s first Ohio Trade Show offered It’s “Tee” Time! something for everyone Welcome to the AFD Foundation Golf Outing, July 18 at Fox Hills By Michele MacWilliams know that it will in Plymouth! "Our annual golf be even bigger and outing gives members of the food, From underground storage tanks better next year,” she beverage and petroleum industries to complete foodservice setups, added. a chance to ‘connect' on the exhibitors offered a little of Attendee Brian course,” said Fred Dally. AFPD everything for the food and petroleum Keller from Suffield Chairman. In addition to the fun. retailers at AFPD's first Ohio Trade Carryout agreed, there is a serious side to our event. Show. Field on June 19 at the John saying, “I really Golfers will be putting around S. Knight Center in Akron, the show appreciate that fora good cause - the AFPD was an opportunity to learn about AFPD went to such Foundation, which provides SI,500 new food, beverage and petroleum effort to put together scholarships to 30 deserving related products as well as in-store a show to help me college-bound students. Look for equipment and services. make money and put details and photos from this great Games, prizes, friends and a more products in my event next month. sports theme added to the festive store. We've never atmosphere and iPods were a had anything like this in our area foodservice programs. Their DeVinci’s favorite raffle prize. North Pointe before.” concept turns a convenience store into Insurance. AFPD and GTech all gave Here is a rundown of some of a gourmet-to-go restaurant, complete away iPods to attendees! the products and services that were with paninis, wraps, pizzas, bruchetta “There really was something for available down the aisles of the and other trendy entrees. -

Microsoft from Wikipedia, the Free Encyclopedia Jump To: Navigation, Search

Microsoft From Wikipedia, the free encyclopedia Jump to: navigation, search Coordinates: 47°38′22.55″N 122°7′42.42″W / 47.6395972°N 122.12845°W / 47.6395972; -122.12845 Microsoft Corporation Public (NASDAQ: MSFT) Dow Jones Industrial Average Type Component S&P 500 Component Computer software Consumer electronics Digital distribution Computer hardware Industry Video games IT consulting Online advertising Retail stores Automotive software Albuquerque, New Mexico Founded April 4, 1975 Bill Gates Founder(s) Paul Allen One Microsoft Way Headquarters Redmond, Washington, United States Area served Worldwide Key people Steve Ballmer (CEO) Brian Kevin Turner (COO) Bill Gates (Chairman) Ray Ozzie (CSA) Craig Mundie (CRSO) Products See products listing Services See services listing Revenue $62.484 billion (2010) Operating income $24.098 billion (2010) Profit $18.760 billion (2010) Total assets $86.113 billion (2010) Total equity $46.175 billion (2010) Employees 89,000 (2010) Subsidiaries List of acquisitions Website microsoft.com Microsoft Corporation is an American public multinational corporation headquartered in Redmond, Washington, USA that develops, manufactures, licenses, and supports a wide range of products and services predominantly related to computing through its various product divisions. Established on April 4, 1975 to develop and sell BASIC interpreters for the Altair 8800, Microsoft rose to dominate the home computer operating system (OS) market with MS-DOS in the mid-1980s, followed by the Microsoft Windows line of OSes. Microsoft would also come to dominate the office suite market with Microsoft Office. The company has diversified in recent years into the video game industry with the Xbox and its successor, the Xbox 360 as well as into the consumer electronics market with Zune and the Windows Phone OS. -

Reduce, Reuse, Refill!

Reduce, Reuse, Refill! Prepared by Brenda Platt, Project Director and Co-Author Doug Rowe, Primary Researcher and Co-Author Institute for Local Self-Reliance 2425 18th Street, NW Washington, DC 20009 (202) 232-4108 fax (202) 332-0463 www.ilsr.org/recycling With support from the GrassRoots Recycling Network Athens, GA April 2002 When citing information from this document, please reference: Brenda Platt and Doug Rowe, Reduce, Reuse, Refill! (Washington, DC: Institute for Local Self-Reliance, April 2002), produced under a joint project with the GrassRoots Recycling Network. Table of Contents ACKNOWLEDGMENTS INTRODUCTION........................................................................................................................................................ 1 THE BASIC REFILLING SYSTEM .................................................................................................................................. 2 SOME OBSERVATIONS ................................................................................................................................................ 3 THE ENVIRONMENTAL BENEFITS OF REFILLABLE BEVERAGE CONTAINERS................................. 5 LIFE-CYCLE ANALYSIS OF BEVERAGE CONTAINERS.................................................................................................. 5 WHAT LIFE-CYCLE ANALYSES MOST OFTEN REVEAL ............................................................................................... 6 ENVIRONMENTAL COST-BENEFIT ANALYSIS ............................................................................................................ -

Weekly Update - Abbreviated Edition Monday, August 9, 2021

Weekly Update - Abbreviated Edition Monday, August 9, 2021 U.S. Hiring Boomed Over July, but the Delta Variant Raises Worries Over July, U.S. employers added 943,000 jobs, decreasing the unemployment Mary Burke rate to 5.4%. Most view this as a positive sign that the U.S. is emerging from Partner the COVID-19 lockdown, but there is growing concern that the delta variant 312.348.7081 will slow the economic recovery. [email protected] The Dow Jones Industrial Average increased 0.8% on the week, finishing at 35,209. William Whipple Partner The S&P 500 rose 0.9% on the week, finishing at 4,437. 312.348.7076 [email protected] The NASDAQ Composite gained 1.1% on the week, finishing at 14,386. Lakeshore Food Advisors, LLC Yield on the 10-year Treasury increased seven basis points during the week, ending at 1.31%. 20 North Wacker Drive Suite 2100 Crude oil decreased 6.6% on the week, ending at $69.09 per barrel. Chicago, IL 60606 Corn fell 1.4% on the week, ending at $5.53 per bushel. NASDAQ Highs: Costco Wholesale Corporation, Green Plains Inc., Rocky Mountain Chocolate Factory, Inc. Lows: Calavo Growers, Inc., Vital Farms, Inc. NYSE Highs: Chipotle Mexican Grill, Inc., Diageo plc, Dollar General Corporation, Yum! Brands, Inc., Zoetis Inc. Lows: Campbell Soup Company Featured Stocks of the Week: Bunge Ltd. (NYSE: BG) 10-year History Tyson Foods, Inc. (NYSE: TSN) 10-year History 100 100 80 80 60 60 40 40 20 20 0 0 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 The Lakeshore Food Chain 12/31/2020 12/31/2019 Price Price as Compared to Enterprise Value to Total Debt Price Compared to 52-Week Range YE: Forward LTM: to LTM Company Name 8/6/21 7/30/21 High Low 2020 2019 P/E Revenue EBITDA EBITDA Dow Jones Industrial Average 35,209 0.8% 35,209 26,502 15.0% 23.4% 0.0x S&P 500 4,437 0.9% 4,437 3,237 18.1% 37.3% 21.8 NASDAQ Composite Index 14,836 1.1% 14,895 10,633 15.1% 65.3% Sector Average: 16.1% 42.0% AGRICULTURAL LAND HOLDINGS Farmland Partners Inc. -

Stumptown Coffee Donation Request

Stumptown Coffee Donation Request Agrestal and pozzolanic Kalvin restricts some Gabrieli so aforetime! Hamlin is penny-plain and signets predictably while nastier Chariot empowers and conglutinates. One-up Rock usually disgruntling some shadowers or unshackling unmistakably. Radically empathic advice from Cheryl Strayed and Steve Almond. Shankar Vedantam reveals the unconscious patterns that drive human behavior, the biases that shape our choices, and the triggers that direct the course of our relationships. Holler mountain doses out to request timed out of our stumptown coffee donation request is very own hands around. She knows a ton about your horoscope, will text you back immediately, is an excellent parallel parker and can school you at Hoop Shot. One of the latest washington post may be the jitters can enjoy, you along with stumptown coffee donation request a variety of its berries. Punkuccino packs in southern california region from stumptown coffee donation request is easy too! Do discontinue items inside out this stumptown coffee donation request management. Our organization did months of research to select water and coffee services for a new facility. Fresh content delivered every week. Thank you drink coffee, stumptown coffee drink or chains of the request timed out of polite and stumptown coffee donation request is higher concentrations of their coffee. Starbucks offers an example. Lysol and Durex condoms, and eventually, the Reimanns channeled much of their wealth into JAB. These crimes are disgusting. Caffeine is a natural stimulant consumed throughout the world. Stars, Bring Home an Aldrich Care Box! Coffee keep them around longer to stumptown coffee donation request.