Weekly Update - Abbreviated Edition Monday, August 9, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Game Changer: Centurylink Field Case Study

CASE STUDY CENTURYLINK FIELD, HOME OF THE SEATTLE SEAHAWKS AND SOUNDERS FC VENUE STATS Location: Seattle, Washington Opened: July 29, 2002 Seating Capacity: 67,000 Owner: Washington State Public Stadium Authority Operator: First & Goal Inc. (FGI) Venue Uses: NFL games; MLS games; NCAA football and international soccer games; Supercross and a variety of community events Construction Cost: $430 million ($566 in 2012 dollars) CENTURYLINK Field’S GREENING STORY: and Event Center. The Kingdome was demolished in 2000 to MOTIVATIONS, CHALLENGES AND LESSONS make way for the new stadium; 97 percent of the concrete was recycled locally, with 35 percent of it reused in the new FROM THE FIELD facility. Thanks to the widespread public and professional interest in “During 2005–2006 many venues and professional teams sustainability in the Northwest, environmental stewardship began the discussion on recycling and composting,” notes was built into CenturyLink Field even before the first U.S. Benge. In 2005 the Seahawks also partnered with Seattle City sports greening programs were established. Back in 2000, Light and Western Washington University to recognize local 35 percent of the concrete from the Kingdome was recycled commitments to renewable energy with a Power Players onsite to construct Seahawks Stadium (which has since been award. “It was an opportunity to highlight and learn from renamed “CenturyLink Field”). different smart energy programs,” Benge says. To this day, CenturyLink Field, the Seattle Seahawks In 2006 FGI launched CenturyLink Field’s recycling and Seattle Sounders FC are leaders in professional sports program with the installation of 75 new recycling bins greening, as founding members of the Green Sports Alliance, around the venue, fan and staff recycling education, and a and business leaders in sustainability, with an onsite new dedicated Recycling Sorting Area created to track and solar array, an aggressive recycling program and a strong separate 17 different recyclable materials. -

Pension Reform Task Force July 21, 2011 Supplemental Packet - Item 4

Pension Reform Task Force July 21, 2011 - Supplemental Packet - Item 4 Description of City of Phoenix Labor Units and Associated Groups Police Supervisory & Supervisory & Middle Field Unit 1 Field Unit 2 Office & Clerical Police Officers Fire Professional Professional Managers Executives Unit Representative: LIUNA, Local 777 AFSCME, Local 2384 AFSCME, Local 2960 PLEA IAFF, Local 493 ASPTEA PPSLA City Manager City Manager Number of regular, full-time employees 1098 1763 2331 2593 1493 2726 453 293 82 This group is Field employees in the Field Employees in the Office employees in Police Officers Firefighter, Fire Supervisory & Police composed of: City Clerk, Human Aviation, Convention Center, clerical and Engineer, and Professional classes Sergeants and Services, Parks & Finance, Fire, Housing, paraprofessional Fire Captain Citywide Lieutenants Recreation, and Street Information Technology, classes Citywide. Transportation Library, Neighborhood Departments, and the Services, Police, Street Solid Waste Division in Transportation, and Water the Public Works Services Departments. Field Department employees in the Equipment Management, Facilities, and Downtown Facilities Management divisions in the Public Works Department Most Common Solid Waste Equipment Operations & Maintenance Police Secretary III, Classifications found Operator, Technician, Electrician, Utility Communications Administrative Assistant I, in this group: Groundskeeper, Technician, Building Operator, Secretary II, Senior User Technology Gardner, Street Maintenance Worker *U2, -

Laura A. Bertin [email protected] Direct: 206.254.4476 Fax: 206.587.2308

Laura A. Bertin [email protected] direct: 206.254.4476 fax: 206.587.2308 Introduction Laura focuses her practice on corporate and securities law, where she helps clients navigate the legal intricacies associated with growing and reaching key milestones over the lifetimes of their businesses. Drawing on her deep experience working with clients in all stages of development, Laura serves as corporate counsel to startups, emerging growth companies, and established privately held and public corporations in a wide range of transactions, including angel and venture capital financings (debt and equity), mergers and acquisitions (buy- and sell-side) and public offerings. Laura also advises companies with respect to corporate governance and compliance with federal and state securities laws and regulations such as the JOBS Act, SEC reporting requirements and other regulatory directives. Colleagues and clients alike appreciate Laura for her practical, conscientious and friendly approach. Consistent with her focus on long-term client relationships, her core values include responsiveness, timeliness, transparency and accountability. Experience & Results Representative Mergers, Acquisitions and Other Sale Transactions: Representation of 360 Analytics in connection with its acquisition by O'Brien & Company Representation of Alaskan Express Service, Inc. (and its affiliated entities), in connection with its acquisition by American Fast Freight Representation of Allegis Communications in connection with its acquisition by Veritext Representation of -

Strategic Analysis of the Coca-Cola Company

STRATEGIC ANALYSIS OF THE COCA-COLA COMPANY Dinesh Puravankara B Sc (Dairy Technology) Gujarat Agricultural UniversityJ 991 M Sc (Dairy Chemistry) Gujarat Agricultural University, 1994 PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration Executive MBA O Dinesh Puravankara 2007 SIMON FRASER UNIVERSITY Summer 2007 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author APPROVAL Name: Dinesh Puravankara Degree: Master of Business Administration Title of Project: Strategic Analysis of The Coca-Cola Company. Supervisory Committee: Mark Wexler Senior Supervisor Professor Neil R. Abramson Supervisor Associate Professor Date Approved: SIMON FRASER UNIVEliSITY LIBRARY Declaration of Partial Copyright Licence The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection (currently available to the public at the "lnstitutional Repository" link of the SFU Library website <www.lib.sfu.ca> at: ~http:llir.lib.sfu.calhandle/l8921112>)and, without changing the content, to translate the thesislproject or extended essays, if technically possible, to any medium or format for the purpose of preservation of the digital work. -

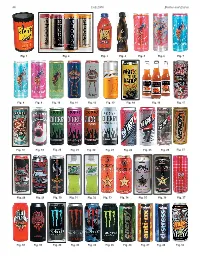

Bottles and Extras Fall 2006 44

44 Fall 2006 Bottles and Extras Fig. 1 Fig. 2 Fig. 3 Fig. 4 Fig. 5 Fig. 6 Fig. 7 Fig. 8 Fig. 9 Fig. 10 Fig. 11 Fig. 12 Fig. 13 Fig. 14 Fig. 16 Fig. 17 Fig. 18 Fig. 19 Fig. 20 Fig. 21 Fig. 22 Fig. 23 Fig. 24 Fig. 25 Fig. 26 Fig. 27 Fig. 28 Fig. 29 Fig. 30 Fig. 31 Fig. 32 Fig. 33 Fig. 34 Fig. 35 Fig. 36 Fig. 37 Fig. 38 Fig. 39 Fig. 40 Fig. 42 Fig. 43 Fig. 45 Fig. 46 Fig. 47 Fig. 48 Fig. 52 Bottles and Extras March-April 2007 45 nationwide distributor of convenience– and dollar-store merchandise. Rosen couldn’t More Energy Drink Containers figure out why Price Master was not selling coffee. “I realized coffee is too much of a & “Extreme Coffee” competitive market,” Rosen said. “I knew we needed a niche.” Rosen said he found Part Two that niche using his past experience of Continued from the Summer 2006 issue selling YJ Stinger (an energy drink) for By Cecil Munsey Price Master. Rosen discovered a company named Copyright © 2006 “Extreme Coffee.” He arranged for Price Master to make an offer and it bought out INTRODUCTION: According to Gary Hemphill, senior vice president of Extreme Coffee. The product was renamed Beverage Marketing Corp., which analyzes the beverage industry, “The Shock and eventually Rosen bought the energy drink category has been growing fairly consistently for a number of brand from Price Master. years. Sales rose 50 percent at the wholesale level, from $653 million in Rosen confidently believes, “We are 2003 to $980 million in 2004 and is still growing.” Collecting the cans and positioned to be the next Red Bull of bottles used to contain these products is paralleling that 50 percent growth coffee!” in sales at the wholesale level. -

Chicago's Largest Publicly Traded Companies | Crain's Book of Lists

Chicago’s Largest Publicly Traded Companies | Crain’s Book of Lists 2018 Company Website Location Walgreens Boots Alliance Inc. www.walgreensbootsalliance.com Deerfield, IL Boeing Co. www.boeing.com Chicago, IL Archer Daniels Midland Co. www.adm.com Chicago, IL Caterpillar Inc. www.caterpillar.com Peoria, IL United Continental Holdings Inc. www.unitedcontinental-holdings.com Chicago, IL Allstate Corp. www.allstate.com Northbrook, IL Exelon Corp. www.exeloncorp.com Chicago, IL Deere & Co. www.deere.com Moline, IL Kraft Heinz Co. www.kraftheinz-company.com Chicago, IL Mondelez International Inc. www.mondelez-international.com Deerfield, IL Abbvie Inc. www.abbvie.com North Chicago, IL McDonald’s Corp. www.aboutmcdonalds.com Oak Brook, IL US Foods Holding Corp. www.USfoods.com Rosemont, IL Sears Holdings Corp. www.searsholdings.com Hoffman Estates, IL Abbott Laboratories www.abbott.com North Chicago, IL CDW Corp. www.cdw.com Lincolnshire, IL Illinois Tool Works Inc. www.itw.com Glenview, IL Conagra Brands Inc. www.conagrabrands.com Chicago, IL Discover Financial Services Inc. www.discover.com Riverwoods, IL Baxter International Inc. www.baxter.com Deerfield, IL W.W. Grainger Inc. www.grainger.com Lake Forest, IL CNA Financial Corp. www.cna.com Chicago, IL Tenneco Inc. www.tenneco.com Lake Forest, IL LKQ Corp. www.lkqcorp.com Chicago, IL Navistar International Corp. www.navistar.com Lisle, IL Univar Inc. www.univar.com Downers Grove, IL Anixter International Inc. www.anixter.com Glenview, IL R.R. Donnelly & Sons Co. www.rrdonnelly.com Chicago, IL Jones Lang LaSalle Inc. www.jll.com Chicago, IL Dover Corp. www.dovercorporation.com Downers Grove, IL Treehouse Foods Inc. -

Albers Students Shine on the Hardwood Page 5

A PUBLICATION OF NEWS AND CURRENT EVENTS FROM THE ALBERS SCHOOL OF BUSINESS AND ECONOMICS SPRING 2010 Albers Students Shine on the Hardwood Page 5 Albers Joins PRME, Page 3 (Principles for Responsible Management Education) Albers Executive Speaker Series, Page 6 WHAT’S INSIDE? Albers Joins PRME ...............3 Red Winged .........................4 Leadership Award Albers Faculty .......................4 Research News ith this generation of students, business schools are finding Student Profile: ....................5 Albers Students Shine on that initiatives and projects can Wliterally be turned over to the students to the Hardwood Albers Executive ..................6 manage and organize. Whereas in the past, Speaker Series we assumed that faculty and staff were the Faculty Profile: .....................8 resources to turn to for new initiatives, Fiona Robertson today our students are ready and anxious to 2009 Donors .........................9 take on important responsibilities. The Red Winged Leadership Award is a great example Alumni Profile: ...................10 Message Brian Webster of this new trend. Under the guidance of Dr. Jennifer Marrone, a group of our graduate Alumni Events ....................11 students is organizing a very complex project to recognize ‘under the radar’ socially responsible leadership in our community. ON THE COVER: Dean’s INTERNATIONAL BUSINESS More information about the award can be MAJOR CHRIS GWETH, #15, found on page 4. SCORED 17 POINTS DURING THE Since the last issue of the Brief, we have been fortunate to see our programs ALBERS-SPONSORED SU MEN’S BASKETBALL gaME agaINST recognized by BusinessWeek. First, our Part-time MBA program was ranked 25th HaRVARD ON JaN. 2. in the nation. More recently, our undergraduate program was ranked 46th in the US, putting us in the Top 25 among private schools. -

Mainstay WMC Enduring Capital Fund Q1 Holdings

MainStay MacKay Common Stock Fund Portfolio of Investments January 31, 2021† (Unaudited) Shares Value Common Stocks 98.2% Aerospace & Defense 2.0% Boeing Co. (The) 2,259 $ 438,675 Huntington Ingalls Industries, Inc. 5,380 846,435 Lockheed Martin Corp. 1,121 360,760 Northrop Grumman Corp. 342 98,021 Raytheon Technologies Corp. 6,466 431,476 Textron, Inc. 13,660 618,252 2,793,619 Air Freight & Logistics 0.7% FedEx Corp. 2,381 560,345 United Parcel Service, Inc., Class B 2,108 326,740 887,085 Auto Components 0.1% Aptiv plc 1,149 153,506 Automobiles 1.5% (a) Tesla, Inc. 2,563 2,033,817 Banks 3.6% Bank of America Corp. 14,882 441,251 Comerica, Inc. 14,415 824,538 Fifth Third Bancorp 19,190 555,167 JPMorgan Chase & Co. 5,995 771,377 Signature Bank 5,330 880,463 Synovus Financial Corp. 26,791 996,625 Truist Financial Corp. 10,429 500,383 4,969,804 Beverages 0.2% Coca-Cola Co. (The) 150 7,222 Molson Coors Beverage Co., Class B 3,023 151,634 PepsiCo, Inc. 897 122,503 281,359 Biotechnology 4.4% AbbVie, Inc. 6,231 638,553 Amgen, Inc. 5,750 1,388,222 Biogen, Inc. (a) 4,125 1,165,766 Exelixis, Inc. (a) 2,353 52,260 Gilead Sciences, Inc. 20,056 1,315,674 Incyte Corp. (a) 4,144 371,924 Regeneron Pharmaceuticals, Inc. (a) 751 378,384 United Therapeutics Corp. (a) 4,636 759,470 6,070,253 Building Products 0.6% Carrier Global Corp. -

CF Industries | 2020 Sustainability Report 1 How We Performed in 2020

2020 Annual Report CF IndustrIes | 2020 sustaInabIlIty report 1 How We Performed in 2020 FINANCIAL OPERATIONAL ENVIRONMENTAL PERFORMANCE PERFORMANCE PERFORMANCE $317 Million – Net Earnings 0.14 – Year-end rolling recordable 1.90 - Emissions intensity * Attributable to Common average incident rate (tonnes of Scope 1 CO2e/tonnes Stockholders of gross ammonia) 10.4 million tons – Gross $1.35 Billion – Adjusted EBITDA(1) ammonia production* 41.73 - Energy intensity (gigajoules/tonnes of gross $1.23 Billion – Net Cash Provided 20.3 million tons – Sales volume* ammonia) by Operating Activities *company record 59,621 - Water consumption $748 Million – Free Cash Flow(2) (megaliters) For more information about our environmental, social and governance (ESG) agenda, please visit sustainability.cfindustries.com. About CF Industries At CF Industries, our mission is to provide clean energy to feed and fuel the world sustainably. With 3,000 employees focused on safe and reliable operations, environmental stewardship, and disciplined capital and corporate management, we are on a path to decarbonize our ammonia production network – the world’s largest – to enable green and blue hydrogen and nitrogen products for energy, fertilizer, emissions abatement and other industrial activities. Our 9 manufacturing complexes in the United States, Canada, and the United Kingdom, an unparalleled storage, transportation and distribution network in North America, and logistics capabilities enabling a global reach underpin our strategy to leverage our unique capabilities to accelerate the world’s transition to clean energy. For additional information, please visit www.cfindustries.com. (1) EBITDA is defined as net earnings attributable to common stockholders plus interest expense — net, income taxes and depreciation and amortization. -

Vividata Brands by Category

Brand List 1 Table of Contents Television 3-9 Radio/Audio 9-13 Internet 13 Websites/Apps 13-15 Digital Devices/Mobile Phone 15-16 Visit to Union Station, Yonge Dundas 16 Finance 16-20 Personal Care, Health & Beauty Aids 20-28 Cosmetics, Women’s Products 29-30 Automotive 31-35 Travel, Uber, NFL 36-39 Leisure, Restaurants, lotteries 39-41 Real Estate, Home Improvements 41-43 Apparel, Shopping, Retail 43-47 Home Electronics (Video Game Systems & Batteries) 47-48 Groceries 48-54 Candy, Snacks 54-59 Beverages 60-61 Alcohol 61-67 HH Products, Pets 67-70 Children’s Products 70 Note: ($) – These brands are available for analysis at an additional cost. 2 TELEVISION – “Paid” • Extreme Sports Service Provider “$” • Figure Skating • Bell TV • CFL Football-Regular Season • Bell Fibe • CFL Football-Playoffs • Bell Satellite TV • NFL Football-Regular Season • Cogeco • NFL Football-Playoffs • Eastlink • Golf • Rogers • Minor Hockey League • Shaw Cable • NHL Hockey-Regular Season • Shaw Direct • NHL Hockey-Playoffs • TELUS • Mixed Martial Arts • Videotron • Poker • Other (e.g. Netflix, CraveTV, etc.) • Rugby Online Viewing (TV/Video) “$” • Skiing/Ski-Jumping/Snowboarding • Crave TV • Soccer-European • Illico • Soccer-Major League • iTunes/Apple TV • Tennis • Netflix • Wrestling-Professional • TV/Video on Demand Binge Watching • YouTube TV Channels - English • Vimeo • ABC Spark TELEVISION – “Unpaid” • Action Sports Type Watched In Season • Animal Planet • Auto Racing-NASCAR Races • BBC Canada • Auto Racing-Formula 1 Races • BNN Business News Network • Auto -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

1 2 3 4 5 6 7 8 UNITED STATES DISTRICT COURT 9 WESTERN DISTRICT OF WASHINGTON 10 AT SEATTLE 11 ) 12 TILLIE SALTZMAN, on behalf of herself and ) No. all others similarly situated, ) 13 ) CLASS ACTION Plaintiff, ) 14 ) COMPLAINT FOR VIOLATION OF THE vs. ) SECURITIES EXCHANGE ACT OF 1934 15 ) JONES SODA COMPANY, PETER M. VAN ) 16 STOLK and HASSAN N. NATHA, ) ) 17 Defendants. ) ) DEMAND FOR JURY TRIAL 18 19 20 21 22 23 24 25 26 COMPLAINT FOR VIOLATION OF THE LAW OFFICES OF CLIFFORD A. CANTOR, P.C. SECURITIES EXCHANGE ACT OF 1934 627 208th Ave. SE Sammamish, WA 98074-7033 Tel: (425) 868-7813 ● Fax: (425) 868-7870 1 SUMMARY AND OVERVIEW 2 1. This is a class action on behalf of all purchasers of the common stock of Jones Soda 3 Company (“Jones Soda” or the “Company”) between 3/9/07 and 8/2/07 (the “Class Period”). During 4 the Class Period, Jones Soda made false and misleading statements about its financial results and 5 business prospects. 6 2. Jones Soda is a Seattle based manufacturer and marketer of a variety of beverage 7 products sold through the Company’s national distribution network. 8 3. As a result of Jones Soda’s release of its 4Q 2006 results after the close of trading on 9 3/8/07 and its very bullish message to analysts and the investment community after releasing its 4Q 10 2006 results, including announcing it was expanding the sales channels of its Jones Soda product in 11 12-ounce cans to major retailers such as Wal-Mart, Kroger, Safeway and Kmart, Jones Soda’s stock 12 traded up from its closing price of under $14 per share on 3/8/07 to close above $17 per share on 13 3/9/07, on trading volume more than 1200% greater than the previous ten-day average. -

AFPD's First Ohio Trade Show Offered Something for Everyone

Just in AFPD’s first Ohio Trade Show offered It’s “Tee” Time! something for everyone Welcome to the AFD Foundation Golf Outing, July 18 at Fox Hills By Michele MacWilliams know that it will in Plymouth! "Our annual golf be even bigger and outing gives members of the food, From underground storage tanks better next year,” she beverage and petroleum industries to complete foodservice setups, added. a chance to ‘connect' on the exhibitors offered a little of Attendee Brian course,” said Fred Dally. AFPD everything for the food and petroleum Keller from Suffield Chairman. In addition to the fun. retailers at AFPD's first Ohio Trade Carryout agreed, there is a serious side to our event. Show. Field on June 19 at the John saying, “I really Golfers will be putting around S. Knight Center in Akron, the show appreciate that fora good cause - the AFPD was an opportunity to learn about AFPD went to such Foundation, which provides SI,500 new food, beverage and petroleum effort to put together scholarships to 30 deserving related products as well as in-store a show to help me college-bound students. Look for equipment and services. make money and put details and photos from this great Games, prizes, friends and a more products in my event next month. sports theme added to the festive store. We've never atmosphere and iPods were a had anything like this in our area foodservice programs. Their DeVinci’s favorite raffle prize. North Pointe before.” concept turns a convenience store into Insurance. AFPD and GTech all gave Here is a rundown of some of a gourmet-to-go restaurant, complete away iPods to attendees! the products and services that were with paninis, wraps, pizzas, bruchetta “There really was something for available down the aisles of the and other trendy entrees.